Bruton Tyrosine Kinase (BTK) Inhibitor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442154 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Bruton Tyrosine Kinase (BTK) Inhibitor Market Size

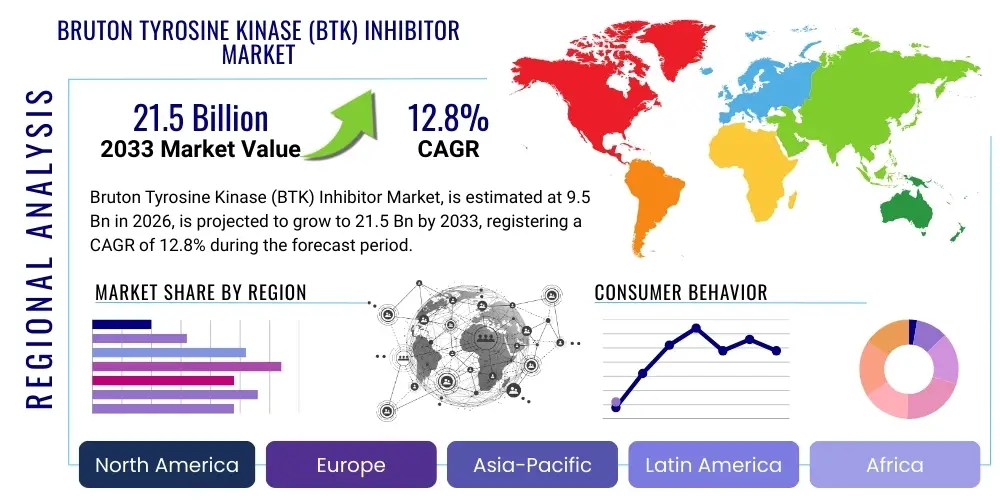

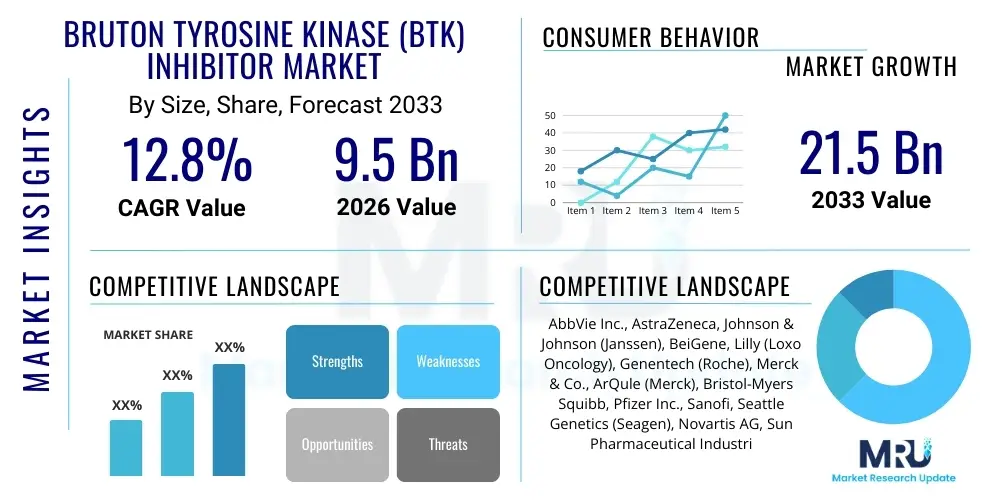

The Bruton Tyrosine Kinase (BTK) Inhibitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 21.5 Billion by the end of the forecast period in 2033.

Bruton Tyrosine Kinase (BTK) Inhibitor Market introduction

The Bruton Tyrosine Kinase (BTK) Inhibitor Market encompasses a class of targeted therapy drugs primarily used in the treatment of various B-cell malignancies, notably Chronic Lymphocytic Leukemia (CLL), Mantle Cell Lymphoma (MCL), and Waldenström’s Macroglobulinemia (WM). BTK is a critical enzyme in the B-cell receptor signaling pathway, crucial for B-cell maturation, survival, and proliferation. Inhibiting this enzyme disrupts malignant B-cell signaling, leading to apoptosis and reduced disease progression. The first-generation BTK inhibitor, Ibrutinib (Imbruvica), revolutionized the treatment landscape for these hematological cancers, offering oral administration and significantly improved response rates compared to traditional chemotherapy regimens. Subsequent development has focused on second and third-generation inhibitors designed to address limitations such as off-target effects and acquired resistance mutations, particularly the C481S mutation.

Key applications of BTK inhibitors extend beyond oncology, increasingly finding use in autoimmune diseases such as Rheumatoid Arthritis (RA) and Systemic Lupus Erythematosus (SLE), where aberrant B-cell activity contributes significantly to pathogenesis. The robust clinical pipeline, focusing on both covalent and non-covalent (reversible) inhibitors, is driving market expansion. Non-covalent inhibitors, such as pirtobrutinib, are particularly important as they offer effective treatment options for patients who have failed prior BTK inhibitor therapies due to mutation or intolerance. Market growth is further fueled by increased patient awareness, rising incidence of hematological cancers globally, and favorable regulatory approvals allowing for earlier-line use and combination therapies. These drugs offer patients a less toxic, targeted therapeutic option, solidifying their position as backbone therapies in B-cell driven diseases.

The major market drivers include the documented superior efficacy and improved overall survival rates associated with BTK inhibitors in comparison to older standards of care. Furthermore, the shift towards personalized medicine and biomarker-driven treatment strategies strongly favors targeted therapies like BTK inhibitors. The introduction of fixed-duration regimens, especially in combination with BCL-2 inhibitors (e.g., Venetoclax), is also transforming the treatment paradigm, offering patients the possibility of treatment breaks. These advancements necessitate continuous R&D investment from major pharmaceutical players focusing on developing best-in-class molecules with enhanced selectivity and reduced toxicity profiles to maintain competitive advantage in this rapidly evolving therapeutic area.

Bruton Tyrosine Kinase (BTK) Inhibitor Market Executive Summary

The Bruton Tyrosine Kinase (BTK) Inhibitor Market is characterized by intense competition, rapid technological advancements focused on overcoming drug resistance, and a significant expansion into autoimmune indications. Business trends indicate a strategic focus among pharmaceutical companies on securing first-to-market advantage with novel non-covalent inhibitors, which promise efficacy in relapsed/refractory settings. Major players are increasingly pursuing combination therapy clinical trials to maximize efficacy and minimize the risk of developing resistance, establishing BTK inhibitors as foundational agents in multi-drug regimens. Furthermore, patent expiration of first-generation inhibitors is prompting shifts in market dynamics, though the complexity of biosimilar development for these targeted oral agents presents unique market entry challenges. Investment in robust Phase III trials demonstrating superiority over existing covalent inhibitors is a key strategy for pipeline assets aiming for market leadership.

Regionally, North America maintains market dominance due to high incidence rates of hematological malignancies, established healthcare infrastructure, high reimbursement rates for innovative therapies, and the presence of leading pharmaceutical headquarters. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, driven by increasing awareness, improving access to advanced cancer treatments, and significant government investments in healthcare infrastructure in countries such as China and India. European markets remain strong, underpinned by structured regulatory frameworks and robust public health spending, though pricing pressures and Health Technology Assessment (HTA) requirements can influence market uptake rates. Global expansion strategies emphasize regulatory filing synchronization across major jurisdictions to capture peak market share quickly.

In terms of segmentation, the market is primarily segmented by drug type (Covalent vs. Non-Covalent/Reversible), indication (CLL, MCL, WM, etc.), and route of administration (primarily oral). The non-covalent segment is emerging as the pivotal growth driver, specifically addressing the unmet need posed by Ibrutinib and Acalabrutinib failure. Chronic Lymphocytic Leukemia (CLL) remains the largest application segment globally, driven by the high prevalence and established first-line use of these agents. However, expansion into non-oncology applications, such as multiple sclerosis and severe asthma, represents a significant untapped opportunity that promises diversification and sustained long-term revenue growth beyond the established hematology segment, further segmenting the application landscape.

AI Impact Analysis on Bruton Tyrosine Kinase (BTK) Inhibitor Market

User inquiries regarding Artificial Intelligence (AI) in the BTK inhibitor space frequently center on accelerating drug discovery timelines, predicting patient response and resistance mechanisms, and optimizing personalized dosing strategies. Key themes revolve around how AI can enhance the selectivity of novel BTK candidates, moving beyond current generation limitations, and whether machine learning algorithms can accurately predict the onset of the common C481S resistance mutation before clinical failure. There is significant user expectation that AI will streamline clinical trials by identifying optimal patient cohorts and rapidly analyzing complex biomarker data, thereby reducing the cost and duration of bringing advanced third-generation inhibitors to market. Concerns often relate to data privacy, validation of AI models in diverse patient populations, and ensuring regulatory bodies are equipped to evaluate AI-assisted drug development submissions, recognizing that successful integration hinges on robust, high-quality real-world data feeds.

The application of sophisticated AI algorithms, particularly deep learning models, is revolutionizing the identification of new druggable targets and accelerating the structural optimization of BTK inhibitor candidates. By analyzing massive chemical libraries and predicting pharmacokinetic and pharmacodynamic properties, AI can filter out compounds with undesirable off-target activity early in the preclinical phase, leading to highly selective molecules. This predictive capability significantly reduces the attrition rate in drug development. Furthermore, AI tools are employed to analyze genetic sequencing data from patient tumors, correlating specific mutations or gene expression profiles with treatment efficacy, thereby enhancing patient stratification and ensuring that the right inhibitor is matched to the right patient, maximizing clinical benefit and improving resource allocation.

In the clinical setting, AI is instrumental in monitoring patient adherence, predicting severe adverse events, and optimizing individualized treatment modifications. Continuous monitoring through wearable technology, combined with AI-driven analysis of patient-reported outcomes (PROs) and electronic health record (EHR) data, allows clinicians to detect subtle signs of drug intolerance or impending relapse much faster than traditional methods. This proactive approach improves patient safety and maximizes the durability of the response to BTK inhibition. The integration of AI into companion diagnostics is a critical area, where machine learning models analyze complex pathology images or liquid biopsy results to identify minimal residual disease (MRD) with greater sensitivity and precision, providing valuable insights into treatment endpoints and subsequent intervention strategies.

- AI accelerates target identification and structural optimization for novel, selective BTK inhibitors.

- Machine learning predicts patient response and resistance mechanisms (e.g., C481S mutation) using genomic data.

- AI optimizes clinical trial design by selecting optimal patient cohorts and synthetic control arms.

- Deep learning enhances biomarker discovery, linking specific molecular signatures to drug efficacy.

- Natural Language Processing (NLP) speeds up the analysis of large volumes of preclinical and clinical literature.

- AI-driven tools facilitate personalized dosing and toxicity monitoring based on real-time patient health data.

DRO & Impact Forces Of Bruton Tyrosine Kinase (BTK) Inhibitor Market

The BTK Inhibitor market is significantly influenced by powerful market dynamics, categorized into Drivers, Restraints, and Opportunities (DRO). Major drivers include the increasing global prevalence of B-cell malignancies, particularly CLL and MCL, coupled with overwhelming clinical evidence supporting the use of BTK inhibitors as superior first-line therapy options, replacing traditional chemo-immunotherapy. The development of next-generation, more selective and potent inhibitors (like zanubrutinib and non-covalent agents) that offer better tolerability and circumvent acquired resistance is a crucial driving force. Regulatory support, evidenced by rapid approvals and designation as breakthrough therapies, further accelerates market penetration. The established oral route of administration significantly enhances patient quality of life and compliance compared to intravenous treatments, bolstering market acceptance across diverse geographical regions.

However, significant restraints temper market expansion. The high cost associated with these targeted therapies poses a substantial access barrier, particularly in developing economies and challenging reimbursement negotiations in established markets. Furthermore, adverse events, including cardiac toxicities (e.g., atrial fibrillation associated with first-generation inhibitors) and bleeding risks, necessitate careful patient management and sometimes lead to treatment discontinuation, creating market churn. The emergence of acquired resistance, notably the C481S mutation in the BTK binding site, remains a persistent pharmacological challenge, limiting long-term efficacy and demanding continuous R&D investment into resistance-overcoming mechanisms. Fierce competition from emerging alternative targeted agents, such as BCL-2 inhibitors and CAR T-cell therapies, also acts as a competitive restraint, forcing companies to continually demonstrate superior patient outcomes.

Opportunities for explosive market growth lie in the successful expansion of BTK inhibitors into significant non-oncology indications, particularly large autoimmune markets like multiple sclerosis, lupus, and Sjogren’s syndrome, where the mechanism of action—modulating B-cell and myeloid cell activity—holds substantial promise. The focus on developing combination therapies, particularly fixed-duration regimens utilizing synergistic agents, represents a major commercial opportunity as it addresses the need for finite treatment periods, which is highly appealing to patients and payers alike. Geographical expansion into high-growth emerging economies in APAC and Latin America, where oncology markets are rapidly maturing, provides substantial untapped patient pools. Finally, the successful introduction of oral, highly selective, reversible inhibitors that demonstrate curative potential in specific subsets of patients without the toxicity profile of older drugs represents the pinnacle opportunity for future market dominance.

Segmentation Analysis

The Bruton Tyrosine Kinase (BTK) Inhibitor Market is systematically segmented based on Type of Drug, Application/Indication, and Geography, providing granular insights into demand patterns and competitive landscapes. Segmentation by drug type distinguishes between covalent (irreversible) inhibitors, which form a permanent bond with BTK, and non-covalent (reversible) inhibitors, which bind transiently and are crucial for treating patients resistant to first-generation drugs. The application segment reflects the therapeutic focus, with hematological malignancies constituting the largest share, although the growing pipeline in autoimmune diseases signifies future diversification. Understanding these segments is vital for strategic market positioning, resource allocation, and identifying key investment areas, particularly favoring the development of next-generation drugs that address current clinical limitations.

The segmentation based on indication emphasizes Chronic Lymphocytic Leukemia (CLL) and Small Lymphocytic Lymphoma (SLL) as the primary revenue generators globally due to high prevalence and established first-line use protocols. Mantle Cell Lymphoma (MCL) and Waldenström’s Macroglobulinemia (WM) also represent significant, albeit smaller, revenue streams where BTK inhibitors are standard of care. The growing segment of autoimmune diseases, currently nascent but holding enormous potential, is being closely monitored by major biopharmaceutical firms. Geographic segmentation highlights the disparity in adoption rates and regulatory environments, with North America and Europe defining the standards of care, while APAC serves as the future engine of volumetric growth, driven by sheer population size and increasing affordability of advanced treatments. This multi-faceted segmentation allows stakeholders to accurately project regional growth trajectories and tailor marketing efforts.

Further segmentation includes distribution channels, distinguishing between hospital pharmacies, retail pharmacies, and online channels, reflecting patient access points. As BTK inhibitors are high-cost, specialized drugs, hospital pharmacies and specialized oncology centers traditionally dominate distribution, particularly during the initiation of treatment. However, increased use in maintenance therapy and oral administration facilitates greater reliance on specialized retail pharmacies. The ongoing trend toward combination therapy also influences segmentation, as drugs are increasingly studied and marketed as part of defined therapeutic regimens rather than monotherapies, potentially leading to future segmentation based on fixed-duration versus continuous treatment approaches, impacting revenue stability and patient management protocols.

- By Drug Type:

- Covalent (Irreversible) BTK Inhibitors (e.g., Ibrutinib, Acalabrutinib, Zanubrutinib)

- Non-Covalent (Reversible) BTK Inhibitors (e.g., Pirtobrutinib, Vecabrutinib, Fenebrutinib)

- By Application/Indication:

- Chronic Lymphocytic Leukemia (CLL)

- Mantle Cell Lymphoma (MCL)

- Waldenström’s Macroglobulinemia (WM)

- Marginal Zone Lymphoma (MZL)

- Chronic Graft-versus-Host Disease (cGVHD)

- Autoimmune Diseases (e.g., Rheumatoid Arthritis, Systemic Lupus Erythematosus)

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies and Drug Stores

- Online Pharmacies

Value Chain Analysis For Bruton Tyrosine Kinase (BTK) Inhibitor Market

The value chain for the Bruton Tyrosine Kinase (BTK) Inhibitor Market begins with upstream activities focused heavily on R&D, encompassing drug discovery, target validation, and sophisticated chemical synthesis of the active pharmaceutical ingredients (APIs). Due to the complexity and high intellectual property value associated with novel kinase inhibitors, this initial phase requires substantial investment in specialized expertise, advanced computational chemistry, and early-stage clinical trials. Key upstream suppliers include specialized fine chemical manufacturers, contract research organizations (CROs) providing preclinical testing services, and academic research institutions where foundational discoveries often originate. The quality and purity of the API are paramount, ensuring efficacy and safety profiles are maintained throughout the supply chain, emphasizing stringent regulatory compliance.

Midstream processes involve large-scale manufacturing, formulation into oral dosage forms (typically tablets or capsules), and quality control testing, often performed by in-house pharmaceutical manufacturing facilities or specialized Contract Manufacturing Organizations (CMOs). The manufacturing stage must comply with rigorous Good Manufacturing Practice (GMP) standards globally, given the high value and sensitive nature of these oncological treatments. Downstream activities involve distribution, marketing, and sales, where established, globally integrated pharmaceutical companies leverage extensive networks. Distribution channels are specialized, relying heavily on cold chain logistics and secure storage to reach specialized oncology hospitals and treatment centers. Direct distribution to hospital pharmacies is common for initial patient loading doses, ensuring controlled access and dispensing.

The distribution network relies on both direct and indirect channels. Direct sales forces and medical science liaisons (MSLs) are crucial for educating oncologists, hematologists, and specialists about the clinical benefits, dosing, and management of potential side effects, thus driving prescription volume. Indirect channels involve wholesalers and specialty distributors who manage the complex logistics and inventory management required for high-value drugs before they reach the specialized retail or hospital pharmacies. Since BTK inhibitors are often covered under complex specialty pharmacy programs and payer agreements, managing reimbursement pathways and patient access programs forms a critical, late-stage component of the value chain, ensuring patients overcome financial barriers to access this life-saving medication.

Bruton Tyrosine Kinase (BTK) Inhibitor Market Potential Customers

The primary customers and end-users of Bruton Tyrosine Kinase (BTK) Inhibitors are highly specialized, focusing mainly on the treatment of B-cell lymphomas and leukemias. This core customer base includes academic medical centers and specialized oncology hospitals that manage complex hematological malignancies and conduct advanced clinical trials. These institutions utilize BTK inhibitors as standard-of-care treatments, often integrating them into multi-modal therapy regimens. Oncologists and hematologists specializing in lymphoid malignancies are the key decision-makers who prescribe these targeted agents, relying heavily on guidelines from organizations such as the National Comprehensive Cancer Network (NCCN) and European Society for Medical Oncology (ESMO) to guide their therapeutic choices and drive product adoption.

Secondary, yet rapidly expanding, customer segments include clinics specializing in autoimmune disorders, such as rheumatology and dermatology clinics, particularly as non-oncology applications for BTK inhibitors progress through clinical development. Patients suffering from severe, refractory autoimmune conditions like Rheumatoid Arthritis, Lupus, and Multiple Sclerosis may eventually constitute a significant patient pool, shifting the purchasing power slightly toward general hospitals and outpatient specialty clinics. Furthermore, governmental health agencies and third-party payers, including private insurance companies and national health services (e.g., NHS in the UK, Centers for Medicare & Medicaid Services in the US), function as critical gatekeepers, determining reimbursement status and formulary placement, thereby dictating patient accessibility and ultimately, market volume.

Finally, specialized compounding pharmacies and specialty drug wholesalers act as crucial intermediaries, ensuring the safe and timely delivery of these high-value, temperature-sensitive oral treatments to the end-user. Research institutions and pharmaceutical companies themselves also act as customers when purchasing these compounds as reference materials or comparators for ongoing drug discovery and competitive pipeline analysis. The shift towards personalized medicine increasingly necessitates that end-users possess the capability for advanced molecular diagnostics, making specialized diagnostic laboratories integral partners in the delivery process, influencing which patients are deemed eligible for BTK inhibitor treatment based on genetic profiles or specific disease markers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 21.5 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AbbVie Inc., AstraZeneca, Johnson & Johnson (Janssen), BeiGene, Lilly (Loxo Oncology), Genentech (Roche), Merck & Co., ArQule (Merck), Bristol-Myers Squibb, Pfizer Inc., Sanofi, Seattle Genetics (Seagen), Novartis AG, Sun Pharmaceutical Industries Ltd., Hutchison Medipharma, Incyte Corporation, TG Therapeutics, Epizyme Inc., Acerta Pharma, Zai Lab. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bruton Tyrosine Kinase (BTK) Inhibitor Market Key Technology Landscape

The technological landscape of the BTK Inhibitor market is defined by continuous innovation aimed at enhancing selectivity, potency, and overcoming resistance mechanisms. The transition from first-generation covalent inhibitors, exemplified by Ibrutinib, to second-generation agents like Acalabrutinib and Zanubrutinib—which offer greater specificity and reduced off-target effects—represents a core technological advancement. These second-generation molecules leverage refined chemical structures to minimize binding to other kinases (e.g., EGFR, TEC), thereby reducing systemic toxicity, notably cardiac issues. The key technological focus remains on improving the therapeutic index through precise targeting of the Cys481 residue in the BTK active site, ensuring durable efficacy while minimizing undesirable side effects that often lead to dose reduction or discontinuation.

The most recent technological breakthroughs center on the development of non-covalent or reversible BTK inhibitors, such as Pirtobrutinib. This third-generation approach uses molecular docking techniques to bind to BTK at sites other than the C481 residue, effectively bypassing the C481S resistance mutation—the primary mechanism of acquired resistance to first and second-generation drugs. This represents a significant technological leap, providing a viable salvage therapy option for patients who have relapsed after initial BTK treatment. Furthermore, technology is leveraged in combination strategies, where inhibitors are co-developed with other targeted agents (like BCL-2 inhibitors or PI3K delta inhibitors) based on rational drug design to achieve deeper, more durable responses and potentially finite treatment regimens, moving beyond continuous dosing models.

Advanced pharmaceutical technologies are also crucial in formulation and drug delivery. Enhanced bioavailability and reduced pill burden are achieved through sophisticated formulation techniques, improving patient adherence and overall convenience, which is vital for chronic oral treatments. Moreover, the integration of advanced molecular diagnostics and liquid biopsy technologies is inseparable from the successful application of these drugs. These technologies allow for the high-sensitivity detection of minimal residual disease (MRD) and early identification of resistance mutations, enabling clinicians to make timely therapeutic switches, a practice heavily reliant on precise, cutting-edge sequencing and PCR technologies to guide the use of next-generation BTK inhibitors effectively within stratified patient populations.

Regional Highlights

North America, particularly the United States, commands the largest share of the Bruton Tyrosine Kinase (BTK) Inhibitor Market revenue. This dominance is attributed to several factors including the high prevalence of hematological malignancies, the robust presence of key pharmaceutical manufacturers driving R&D and launching novel therapies, and favorable reimbursement policies through private and public payers like Medicare. The rapid adoption of new, expensive, targeted therapies is facilitated by a well-established healthcare infrastructure and high levels of specialist penetration in oncology. Clinical trial activity for second and third-generation BTK inhibitors is concentrated here, driving immediate market uptake upon regulatory approval, establishing North America as the benchmark for clinical integration and commercial success.

Europe represents the second-largest market, characterized by stringent regulatory processes led by the European Medicines Agency (EMA) and complex market access hurdles due to country-specific Health Technology Assessments (HTAs). Despite these challenges, major European countries (Germany, France, UK, Italy, and Spain) show high adoption rates, especially for approved first and second-line treatments in CLL and MCL. The market dynamics in Europe are influenced by efforts to manage healthcare expenditures, often leading to competitive pricing negotiations, but the demand remains robust due to an aging population and increasing incidence rates of chronic diseases, ensuring sustained, albeit moderated, growth throughout the forecast period.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally. This accelerated growth is primarily driven by rapidly improving healthcare infrastructure, rising disposable incomes, and increasing awareness and acceptance of targeted oncology treatments across major economies like China, Japan, and India. While regulatory approval timelines can sometimes lag compared to Western markets, the sheer volume of the patient population and government initiatives aimed at improving cancer care accessibility represent immense untapped potential. Japan and South Korea are key markets due to their advanced regulatory framework and high adoption of novel therapeutics, whereas emerging markets like China and India are focuses for strategic investment and localized clinical development programs aimed at capturing future market leadership.

- North America (US & Canada): Dominant market share due to high R&D investment, favorable reimbursement, and established standard of care in oncology.

- Europe (Germany, UK, France): High adoption rates but constrained by strict HTA processes and pricing pressures; strong market for established BTK inhibitors.

- Asia Pacific (China, Japan, India): Fastest growth rate, driven by improving healthcare access, large patient pool, and increasing pharmaceutical expenditure.

- Latin America & MEA: Emerging markets characterized by increasing awareness and improving, though fragmented, access to specialty oncology drugs, offering long-term growth potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bruton Tyrosine Kinase (BTK) Inhibitor Market.- AbbVie Inc.

- AstraZeneca

- Johnson & Johnson (Janssen)

- BeiGene

- Eli Lilly and Company (Loxo Oncology)

- Genentech (Roche)

- Merck & Co.

- Bristol-Myers Squibb (BMS)

- Pfizer Inc.

- Sanofi

- Seattle Genetics (Seagen/Pfizer)

- Novartis AG

- Sun Pharmaceutical Industries Ltd.

- Hutchison Medipharma (HUTCHMED)

- Incyte Corporation

- TG Therapeutics

- Acerta Pharma (AstraZeneca)

- Ono Pharmaceutical Co., Ltd.

- Zai Lab

- ArQule (Merck)

Frequently Asked Questions

Analyze common user questions about the Bruton Tyrosine Kinase (BTK) Inhibitor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between covalent and non-covalent BTK inhibitors?

Covalent inhibitors (like Ibrutinib) form an irreversible chemical bond with the BTK protein's Cys481 residue, offering durable inhibition but risking off-target effects and resistance via the C481S mutation. Non-covalent inhibitors (like Pirtobrutinib) bind reversibly to a different site, making them effective against the C481S mutation and generally leading to higher selectivity and lower toxicity profiles, thus providing crucial options for relapsed/refractory patients.

Which indications drive the highest revenue in the BTK Inhibitor Market?

Chronic Lymphocytic Leukemia (CLL) is the dominant revenue driver globally due to its high prevalence and the established use of BTK inhibitors as a preferred first-line and subsequent-line treatment option. Mantle Cell Lymphoma (MCL) and Waldenström’s Macroglobulinemia (WM) also contribute significantly, with a growing segment being the utilization of these agents in chronic Graft-versus-Host Disease (cGVHD).

What is the primary factor limiting the long-term effectiveness of first-generation BTK inhibitors?

The primary limiting factor is the development of acquired resistance, predominantly through the C481S mutation in the BTK gene. This mutation prevents the covalent binding of drugs like Ibrutinib, leading to disease progression and necessitating a switch to non-covalent, third-generation BTK inhibitors that can bypass this specific resistance mechanism effectively.

How is the adoption of BTK inhibitors evolving in autoimmune disease treatment?

BTK inhibitors are showing significant promise in treating autoimmune diseases such as Rheumatoid Arthritis (RA) and Systemic Lupus Erythematosus (SLE) by suppressing aberrant B-cell activation and inflammation. This expansion represents a major growth opportunity, moving these drugs beyond oncology into large, previously untapped inflammatory disease markets, contingent upon positive late-stage clinical trial data demonstrating efficacy and long-term safety.

Which geographical region is expected to show the fastest market growth rate?

The Asia Pacific (APAC) region, driven by expanding healthcare access, increasing awareness of advanced oncology treatments, and significant government investment in countries like China and India, is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period from 2026 to 2033, positioning it as the future engine for volumetric market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager