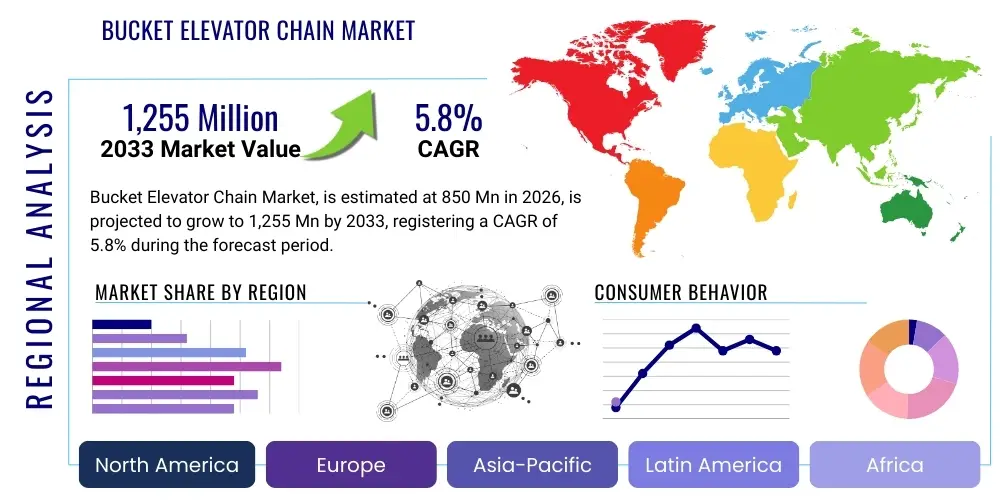

Bucket Elevator Chain Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443124 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Bucket Elevator Chain Market Size

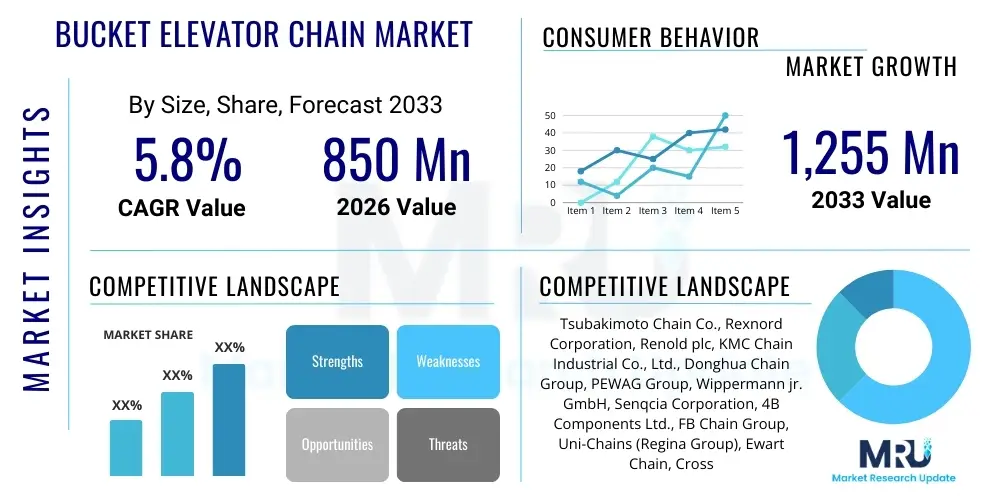

The Bucket Elevator Chain Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1,255 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by accelerated industrialization in developing economies, coupled with significant modernization and capacity expansion in heavy industries such as cement, mining, and grain processing across established markets. The indispensable role of bucket elevator chains in high-capacity vertical material handling ensures their steady demand, positioning the market for stable growth.

Bucket Elevator Chain Market introduction

The Bucket Elevator Chain Market encompasses the manufacturing, distribution, and utilization of specialized conveyance chains designed specifically for vertical material transport systems, known as bucket elevators. These systems are critical components in heavy-duty industrial applications where bulk solids, powders, or granular materials must be lifted efficiently and reliably to significant heights. The chains themselves are engineered for high tensile strength, resistance to abrasion, and durability under varying environmental conditions, often featuring precision-machined links to accommodate continuous, high-speed operation. Key product types include central chain systems, utilizing a single robust chain, and double-strand chain systems, offering increased stability and capacity, catering to diverse industrial requirements.

Major applications of bucket elevator chains span vital industrial sectors, including cement production, where they handle raw meal, clinker, and finished cement; mining operations, facilitating the vertical transport of ores and crushed minerals; agriculture and grain handling, moving crops and seeds efficiently; and power generation, managing coal and ash handling. The intrinsic benefits of using these specialized chains lie in their superior vertical conveying capabilities, minimizing floor space requirements while maximizing throughput. They offer enhanced operational efficiency and significantly reduced manual handling costs compared to alternative conveyance methods, making them essential assets in large-scale processing facilities globally. Furthermore, advancements in chain metallurgy and design, focusing on extended wear life and reduced maintenance downtime, continue to bolster their adoption across demanding environments.

Driving factors for this market include the global rebound in infrastructure development projects, necessitating increased production of cement and construction materials. Furthermore, the rising demand for bulk commodities and raw materials, particularly in the Asia Pacific region, mandates expanded capacity in mining and processing plants. The constant need for upgrading and replacement of existing aging equipment, particularly in mature markets like North America and Europe, also contributes substantially to market growth. The robustness, longevity, and high load-bearing capacity of these chains, combined with innovations aimed at improving resistance to corrosive and abrasive media, cement the foundational demand for bucket elevator chain systems across the industrial landscape.

Bucket Elevator Chain Market Executive Summary

The global Bucket Elevator Chain Market exhibits robust business trends characterized by a decisive shift toward high-performance materials and integrated condition monitoring solutions. Key manufacturers are focusing intensely on developing chains with superior corrosion and abrasion resistance, primarily leveraging advanced alloy steels and specialized heat treatments to extend mean time between failures (MTBF). Digitalization trends are influencing product development, with IoT-enabled chains featuring embedded sensors for real-time monitoring of tension, vibration, and temperature, enabling predictive maintenance strategies and reducing unplanned downtime, which is a major operational concern for end-users. The market structure remains moderately consolidated, dominated by a few global players who invest heavily in R&D, while regional players capitalize on customized and lower-cost solutions for localized industrial needs.

Regionally, the Asia Pacific (APAC) stands out as the epicenter of growth, driven by massive investments in infrastructure development, rapid urbanization, and expansion of cement and power generation sectors, particularly in China, India, and Southeast Asian countries. North America and Europe, characterized by highly mature industrial bases, demonstrate stable demand, focusing primarily on maintenance, repair, and overhaul (MRO) activities and the replacement of older systems with energy-efficient, high-durability chains compliant with stringent safety and environmental regulations. Latin America and the Middle East & Africa (MEA) represent emerging growth pockets, fueled by new mining projects and expansion of agricultural processing facilities, though market penetration rates remain highly dependent on stable foreign direct investment and commodity price volatility.

Segment trends confirm that the Cement Industry application dominates the market due to the extremely abrasive nature of materials handled (clinker, raw meal) and the continuous operation requirements of cement kilns, necessitating frequent chain replacement and specialized designs. By material, Carbon Steel chains remain the volume leader due offering a balance of cost-effectiveness and sufficient strength for standard applications, however, demand for specialized alloy steels and stainless steel is increasing rapidly in sectors like chemical processing and food handling, where resistance to corrosion and high temperatures is paramount. The Central Chain segment generally leads by type, favored in deep, high-capacity installations, though the Double Strand Chain system holds significant ground in applications requiring wider buckets and enhanced stability.

AI Impact Analysis on Bucket Elevator Chain Market

Analysis of common user questions regarding the interaction between Artificial Intelligence (AI) and the Bucket Elevator Chain Market reveals key themes centered around operational longevity, preventative maintenance efficacy, and system optimization. Users frequently inquire about how AI can predict chain failure before it occurs, questioning the feasibility and accuracy of deploying machine learning algorithms on real-time sensor data gathered from chains operating in harsh environments. A major concern revolves around the required infrastructure investment for data collection (e.g., retrofitting existing chains with sensors) and the ROI derived from reduced downtime. Expectations are high regarding AI’s potential to optimize energy consumption by modulating elevator speeds based on throughput demand and material characteristics, moving beyond traditional scheduled maintenance to truly condition-based monitoring, thus maximizing asset utilization and minimizing catastrophic failures.

The primary influence of AI is manifested through predictive maintenance platforms integrated with Industrial Internet of Things (IIoT) sensors attached to or monitoring the bucket elevator system. AI algorithms process vibration analysis, acoustic emission data, temperature fluctuations, and chain tension measurements collected over time. By establishing baseline operational signatures and recognizing subtle anomalies that precede mechanical failure, the system can issue highly accurate warnings, allowing maintenance teams to schedule targeted repairs rather than relying on time-based schedules. This shift not only significantly extends the lifespan of the costly chain components but also drastically improves plant safety and operational continuity, directly addressing the core concerns of plant managers regarding unpredictable downtime events in 24/7 operations.

Furthermore, AI is instrumental in optimizing chain design and material selection. Manufacturers are leveraging generative design and simulation software powered by AI to model complex stress distributions under various loads and abrasive conditions. This allows for the creation of new chain geometries and material compositions that offer superior resistance to specific application challenges (e.g., highly corrosive environments in chemical plants or extreme abrasion in mining). Over the long term, AI-driven feedback loops, utilizing aggregated field performance data, will accelerate the iteration cycle for new product development, ensuring that next-generation bucket elevator chains are intrinsically more durable, lighter, and more efficient, profoundly transforming manufacturing standards and maintenance practices within the market.

- Deployment of AI-powered predictive maintenance (PdM) systems to forecast chain fatigue and potential failure points.

- Optimization of lubrication schedules and monitoring parameters using machine learning models based on environmental variables.

- Enhanced inventory management through AI forecasting of necessary spare parts (links, buckets) based on wear rates.

- Integration of machine vision systems to continuously inspect chain links for micro-cracks and structural damage during operation.

- AI-driven simulation and generative design optimizing chain material composition for specific harsh environments (e.g., high heat or extreme abrasion).

- Automated anomaly detection in operational acoustics and vibration profiles, minimizing human error in condition monitoring.

DRO & Impact Forces Of Bucket Elevator Chain Market

The Bucket Elevator Chain Market is shaped by a complex interplay of internal and external forces categorized as Drivers, Restraints, and Opportunities. A primary driver is the global escalation in infrastructure and construction activities, particularly in emerging economies, which directly boosts demand for bulk handling equipment used in cement, steel, and utility sectors. Simultaneously, the persistent trend of industrial automation across mature economies compels manufacturers to adopt high-capacity, highly durable vertical conveying systems to achieve operational efficiency targets. The inherent reliability and high throughput capacity of bucket elevator systems, coupled with manufacturers' efforts to develop chains with longer service lives through material advancements, ensure stable market momentum, especially in heavy industries where system reliability is non-negotiable.

However, the market faces significant restraints, notably the high initial investment required for specialized, heavy-duty chain systems and the substantial ongoing maintenance costs associated with chains operating in highly abrasive environments, such as those found in mining and cement production. Furthermore, intense competition from alternative conveying technologies, such as belt conveyors and pneumatic systems, particularly for specific low-capacity or horizontal transport applications, places limitations on market expansion. Economic volatility, especially fluctuations in the cost of raw materials like steel and alloy metals, introduces pricing instability, potentially eroding profit margins for manufacturers and raising procurement costs for end-users, thus slightly tempering overall market growth rates.

Opportunities for growth are concentrated in the adoption of smart, IoT-enabled chain technologies and the expansion of the retrofit and replacement market in developed regions. The integration of sensors for condition monitoring, allowing for predictive maintenance, represents a lucrative avenue for vendors to offer value-added services and command premium pricing. Furthermore, the increasing global emphasis on sustainable industrial practices and energy efficiency is driving demand for lighter, yet equally strong, chains that reduce operational energy consumption. Penetration into niche, high-value applications such as specialized chemical processing, food and beverage handling (requiring stainless steel and hygienic designs), and advanced recycling facilities offers diversification potential away from traditional heavy industry dependence. The impact forces are generally positive, leaning towards accelerated adoption in industrializing regions offset slightly by high operational expenditure concerns in mature markets.

Segmentation Analysis

The segmentation of the Bucket Elevator Chain Market is critical for understanding specific demand characteristics and targeting tailored solutions across diverse industrial applications. The market is primarily broken down based on Type (Central Chain, Double Strand Chain, Flat Link Chain), Material (Carbon Steel, Stainless Steel, Alloy Steel), and Application (Cement Industry, Mining, Grain Handling, Chemical Processing, Power Generation). This detailed breakdown allows stakeholders to analyze product performance requirements, cost sensitivity, and environmental compatibility across different end-user verticals. The type segmentation reflects load capacity and elevator configuration, with central chains dominating high-lift, deep-bucket installations, while double-strand chains are preferred for wider, high-stability conveyance systems. Understanding these segments is vital for supply chain planning and product differentiation strategies.

The material segmentation directly dictates the chain’s resilience and lifespan in harsh operating environments. Carbon steel remains the economical choice for standard, non-corrosive applications, capturing the largest market share by volume. However, the rapidly expanding need for superior resistance to heat, moisture, and chemical exposure, particularly in power generation (ash handling) and chemical plants, is driving the growth of the alloy steel and stainless steel segments. These premium materials, though higher in cost, offer significantly extended wear life, justifying the investment through reduced maintenance downtime and fewer replacement cycles. Therefore, manufacturers must continuously invest in metallurgy R&D to optimize material properties for extreme conditions.

Application-based segmentation highlights the cement industry as the key revenue generator, characterized by continuous operation and extremely abrasive material flows, leading to high chain consumption rates for MRO activities. The Grain Handling and Mining segments also exhibit substantial demand, driven by increasing global food production requirements and steady extraction rates of bulk minerals. The nuances in each application, such as the need for hygienic chains in food processing versus high tensile strength in deep mining, dictate specific design modifications and material choices, enabling focused marketing and technical support efforts tailored to the operational demands of each major industrial vertical.

- By Type:

- Central Chain

- Double Strand Chain

- Flat Link Chain

- By Material:

- Carbon Steel

- Stainless Steel

- Manganese Steel

- Alloy Steel

- By Application:

- Cement Industry

- Mining and Metallurgy

- Grain Handling and Agriculture

- Chemical Processing

- Power Generation (Coal and Ash Handling)

- Pulp and Paper

Value Chain Analysis For Bucket Elevator Chain Market

The value chain for the Bucket Elevator Chain Market begins intensely at the upstream segment, dominated by raw material suppliers providing high-grade steel, specialized alloys, and raw components necessary for manufacturing. Key raw inputs include high-carbon steel rods, manganese, chromium, and nickel, whose price volatility significantly impacts the final product cost and market pricing stability. Manufacturers rely heavily on consistent sourcing of quality materials to meet the rigorous tensile strength and abrasion resistance specifications demanded by industrial end-users. Strong relationships with reliable metal processors and forging companies are crucial, as the quality of the raw material directly dictates the performance and lifespan of the manufactured chain links, pins, bushings, and rollers, necessitating stringent quality control protocols at this foundational stage.

The core manufacturing and assembly stage involves complex processes such as precision forging, heat treatment, machining, and surface hardening (e.g., induction hardening or case carburizing) to impart maximum wear resistance. This stage is capital-intensive and requires significant technical expertise to achieve the tight tolerances required for smooth, high-speed operation within the elevator system. Distribution channels are varied, incorporating direct sales for major industrial clients and complex, specialized distributor networks and technical service providers for smaller MRO needs and regional markets. Indirect channels often include large industrial supply houses that stock common chain types and provide localized technical support and installation services, which are critical given the specialized nature of installation and maintenance procedures.

The downstream segment involves the integration of the chains into complete bucket elevator systems, typically sold to large industrial end-users in the cement, mining, and agricultural sectors. Post-sale services, including installation oversight, predictive maintenance contracts (increasingly incorporating AI/IoT diagnostics), and replacement parts provision, form a significant part of the value capture. The longevity of the chain system is paramount; thus, the quality of post-installation support and timely availability of spare parts heavily influence customer loyalty and repeat business. The entire value chain emphasizes durability and total cost of ownership (TCO) over mere initial purchase price, distinguishing high-quality specialized manufacturers from general industrial suppliers in a highly competitive technical market.

Bucket Elevator Chain Market Potential Customers

The primary customers for specialized bucket elevator chains are large-scale industrial operators whose core processes rely on continuous, vertical bulk material handling. The most significant end-user segment is the Cement Industry, encompassing cement manufacturers and clinker grinding units, which require heavy-duty, abrasion-resistant chains capable of operating reliably in high-temperature, dusty environments for materials like raw meal, fly ash, and clinker. These entities prioritize chain systems that offer maximized operational uptime and minimum maintenance intervention, leading them to favor high-alloy, precision-machined chain products despite the higher upfront investment cost.

Another major buying segment includes Mining and Metallurgy companies involved in the extraction and primary processing of ores (e.g., iron ore, coal, potash). These buyers require chains with exceptional tensile strength and impact resistance to handle large volumes of heavy, abrasive minerals. Procurement decisions in this sector are driven by safety standards, load-bearing capacity, and resilience against highly corrosive or wet mining environments. Similarly, the Power Generation sector, particularly facilities utilizing coal-fired boilers, represents substantial recurring demand for specialized chains used in handling coal supply and disposing of highly abrasive ash products, requiring chains that resist both heat and abrasion effectively.

Furthermore, the Grain Handling and Agricultural sector, including large co-operatives, grain terminals, and processing plants, constitutes a steady customer base. Although the chains used here may not face the same extreme temperatures as cement plants, they require designs that minimize material spillage, are easy to clean (in food-grade applications), and maintain structural integrity under continuous, high-speed operation. Buyers in this segment often look for corrosion-resistant coatings or stainless steel variants, especially in environments exposed to moisture or specific agricultural chemicals, prioritizing cleanliness and compliance with sanitary regulations alongside operational efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1,255 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tsubakimoto Chain Co., Rexnord Corporation, Renold plc, KMC Chain Industrial Co., Ltd., Donghua Chain Group, PEWAG Group, Wippermann jr. GmbH, Senqcia Corporation, 4B Components Ltd., FB Chain Group, Uni-Chains (Regina Group), Ewart Chain, Cross+Morse, Elite Chain International, SKF (Chain Products), A&S Chain. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bucket Elevator Chain Market Key Technology Landscape

The key technological advancements shaping the Bucket Elevator Chain Market center on material science innovation and the integration of digital monitoring capabilities. Manufacturers are continuously researching advanced alloy compositions, particularly focusing on micro-structures and surface treatments that drastically enhance resistance to wear, fatigue, and corrosion. Techniques such as plasma nitriding, advanced case hardening, and proprietary heat treatment protocols are being utilized to create chains with significantly extended operational lifecycles, thereby addressing the crucial end-user demand for reduced maintenance frequency. These metallurgical enhancements are essential, especially for operations in highly abrasive or high-temperature environments like clinker cooling systems in cement plants, ensuring the chains maintain structural integrity under extreme thermal and mechanical stress. The development of modular, quick-link assembly technologies also represents a design innovation, simplifying field installation and maintenance procedures, further contributing to reduced system downtime.

Digitalization represents the second major technological frontier, driven by the adoption of IIoT. This involves embedding or attaching sophisticated sensor technology—including accelerometers, strain gauges, and temperature sensors—onto critical points of the elevator chain system. These sensors generate high-frequency data used for real-time condition monitoring. The data is transmitted to centralized processing units where AI and machine learning algorithms interpret operational parameters to identify early signs of chain link elongation, excessive vibration, or bearing wear, leading directly to the implementation of predictive maintenance strategies. This shift from reactive or time-based maintenance to true condition-based monitoring is revolutionizing how operators manage these assets, ensuring maximized throughput and preventing catastrophic failures, which can be immensely costly in large industrial setups.

Furthermore, technology is being applied to improve manufacturing precision and quality assurance. Utilizing advanced CNC machining and robotic welding ensures tighter dimensional tolerances for components like pins and bushings, which is critical for smooth engagement with sprockets and minimizing stress concentration points. Precision engineering reduces the initial break-in period and significantly contributes to overall system efficiency and noise reduction. Furthermore, there is an increasing focus on developing specialized coatings and polymer-based components for specific applications, such as lightweight buckets or anti-corrosion treatments for the pins and links used in chemical or food processing, demonstrating a commitment to application-specific technological solutions rather than a one-size-fits-all approach.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Drivers: APAC is the fastest-growing and largest market for bucket elevator chains, driven primarily by extensive infrastructure development across China, India, and Southeast Asia. The continuous expansion of the cement, mining, and power generation industries to support rapid urbanization and industrialization dictates substantial demand for both new installations and replacement chains. Government initiatives promoting domestic manufacturing and rising foreign direct investment in core industrial sectors contribute significantly to market buoyancy. Companies often prioritize cost-effectiveness alongside robust performance due to the sheer volume of projects undertaken, leading to high utilization rates for carbon steel chains, while demand for specialized alloy chains is growing steadily in large-scale resource extraction projects.

- North America (NA) Focus on Modernization and Compliance: The North American market is characterized by maturity, with growth primarily stemming from the modernization and replacement of aging infrastructure, coupled with stringent safety and environmental regulations. End-users in the US and Canada focus heavily on adopting high-durability, premium chains that minimize environmental risks and operational downtime. The market shows a strong inclination toward integrating IIoT solutions and predictive maintenance capabilities, driven by high labor costs and the necessity of optimizing asset performance. Key drivers include stable activity in the grain handling sector and ongoing investment in the refurbishment of existing power plants and mineral processing facilities.

- Europe (EU) Emphasis on Efficiency and Premium Quality: Europe maintains a stable market, characterized by demand for high-quality, engineered chains that emphasize energy efficiency and adherence to strict European machinery directives. European manufacturers often lead in metallurgical innovation, providing highly durable, specialized chains, particularly for chemical, pharmaceutical, and specialized mining applications. MRO activities form the backbone of the market, with end-users prioritizing TCO over initial purchase price. Sustainability goals also drive the selection of longer-lasting components that reduce waste and operational footprint, favoring specialized alloy and stainless steel solutions.

- Latin America (LATAM) Commodity-Driven Demand: The LATAM market growth is heavily correlated with the fluctuating prices of bulk commodities, primarily driven by investments in the mining sector (e.g., copper, iron ore in Chile, Brazil, and Peru) and the agricultural sector (grain and sugar processing). While market entry can be complex due to economic volatility, major project announcements create spikes in demand for heavy-duty, robust chains. Buyers in this region often seek cost-effective yet reliable solutions, positioning it as a competitive ground for both global and regional suppliers.

- Middle East and Africa (MEA) Emerging Industrialization: The MEA region is showing promising growth, particularly in the Middle East due to massive infrastructure projects and cement production expansions, supported by oil revenues. In Africa, growth is tied to new mining exploration and expansion projects. Challenges include complex logistics and the need for chains specifically designed to withstand extreme desert heat and high dust environments. The region offers significant long-term potential as industrial diversification progresses across key economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bucket Elevator Chain Market.- Tsubakimoto Chain Co.

- Rexnord Corporation

- Renold plc

- KMC Chain Industrial Co., Ltd.

- Donghua Chain Group

- PEWAG Group

- Wippermann jr. GmbH

- Senqcia Corporation

- 4B Components Ltd.

- FB Chain Group

- Uni-Chains (Regina Group)

- Ewart Chain

- Cross+Morse

- Elite Chain International

- SKF (Chain Products)

- A&S Chain

- Moorhemp Ltd.

- Diamond Chain Company

- Hitachi Metals, Ltd.

- Iwis drive systems

Frequently Asked Questions

Analyze common user questions about the Bucket Elevator Chain market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for high-performance bucket elevator chains?

The increasing global emphasis on industrial uptime and efficiency in heavy sectors like cement and mining is the primary driver. These industries require chains with superior tensile strength and abrasion resistance to minimize system failures and costly unplanned downtime associated with continuous 24/7 operations, favoring specialized alloy steels and robust designs.

How does the material of the chain impact its application and cost?

Chain material directly determines durability and application suitability. Carbon steel is cost-effective for standard use. However, applications involving extreme heat, moisture, or corrosives (e.g., chemical processing or ash handling) necessitate premium materials like stainless steel or alloy steel, which significantly increase the lifespan and lower TCO, despite higher initial procurement costs.

What role does IoT play in modern bucket elevator chain maintenance?

IoT enables real-time condition monitoring through embedded sensors that track parameters like vibration, tension, and temperature. This data is fed into AI-powered predictive maintenance (PdM) systems, allowing operators to detect nascent failures and schedule maintenance proactively, thereby maximizing operational lifespan and reducing the reliance on fixed maintenance schedules.

Which geographical region exhibits the highest growth potential for this market?

The Asia Pacific (APAC) region, specifically emerging economies like India and Southeast Asia, exhibits the highest growth potential. This growth is fueled by massive infrastructure investments, rapid industrialization, and continuous expansion in the local cement, construction, and power generation sectors, demanding extensive new elevator chain installations.

What are the main alternatives to bucket elevator chains, and how do they compare?

Primary alternatives include deep-troughed belt conveyors and pneumatic conveying systems. Belt conveyors are often preferred for higher volumes and less vertical lift, offering lower noise but potentially higher floor space requirements. Pneumatic systems are used for fine powders where cleanliness and sealing are critical, though they are generally less efficient and higher in energy consumption than mechanical chains for heavy, coarse bulk materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager