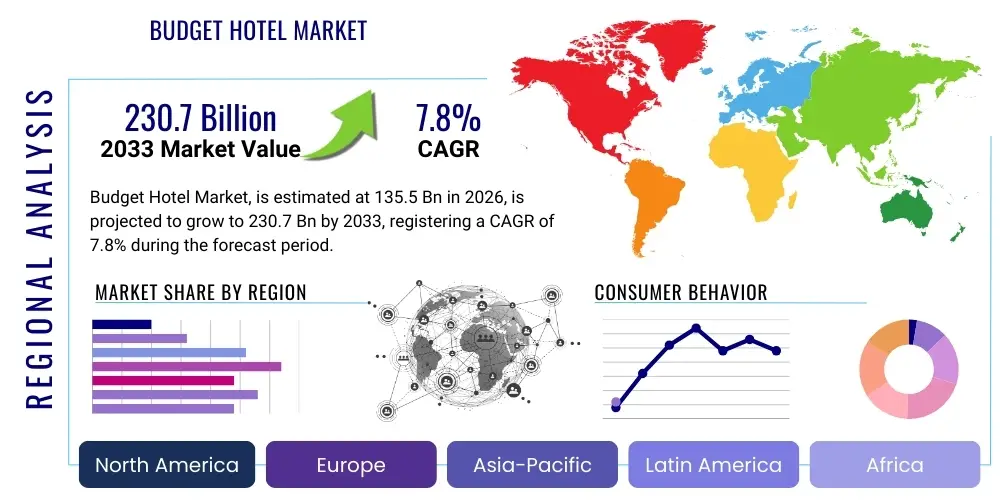

Budget Hotel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443632 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Budget Hotel Market Size

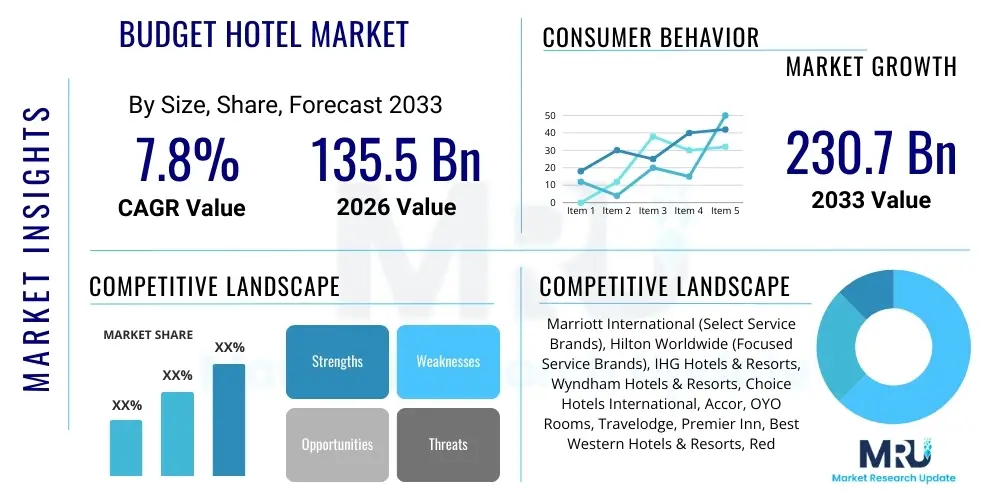

The Budget Hotel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. This robust growth trajectory is fueled by increasing globalization, the expanding middle-class population globally, and the consistent consumer preference for value-driven accommodation solutions. The resilience of the budget segment, particularly during periods of economic uncertainty, further stabilizes its market performance and attracts continued investment for portfolio expansion, especially in high-growth urban centers and emerging tourist corridors.

The market is estimated at $135.5 Billion in 2026 and is projected to reach $230.7 Billion by the end of the forecast period in 2033. This significant increase reflects not only rising occupancy rates but also a strategic evolution within the sector, where budget hotels are increasingly incorporating advanced technology and streamlined services to optimize operational efficiency and enhance the guest experience without dramatically inflating average daily rates (ADR). The segment is moving beyond mere cost minimization to focus on delivering essential quality and reliable service.

Budget Hotel Market introduction

The Budget Hotel Market encompasses accommodation services designed to offer essential lodging amenities at a significantly lower price point compared to full-service or luxury hotels. These establishments typically feature standardized rooms, limited on-site services—often focusing purely on accommodation and basic connectivity—and operational efficiencies that minimize overhead. Major applications include serving independent leisure travelers, business commuters requiring short-term functional lodging, and tour groups seeking cost-effective accommodation solutions. The primary benefits driving market demand are affordability, predictability of service quality across chains, and strategic locations near transport hubs or secondary city centers. Key driving factors include the proliferation of low-cost carriers (LCCs) fueling global travel accessibility, the digitization of booking platforms enabling easy price comparison, and the continuous innovation in operational models such as modular construction and simplified staffing structures, which allow for rapid expansion and sustained profitability within tight margins.

Budget Hotel Market Executive Summary

The Budget Hotel Market is characterized by intense competition driven by both established global chains and disruptive regional players focusing on asset-light models. Current business trends heavily favor technological integration, specifically mobile check-in/out, automated guest services, and sophisticated revenue management systems tailored to dynamic pricing strategies. The market is witnessing a major shift toward improved design standards, where budget brands are investing in aesthetics and functional common areas to dispel the traditional stigma associated with 'cheap' lodging, thereby appealing to younger, value-conscious demographics who prioritize experience alongside cost savings. Furthermore, sustainability and environmental practices are emerging as critical competitive differentiators, influencing consumer choice even in the budget segment.

Regionally, Asia Pacific (APAC) stands as the dominant growth engine, propelled by rapidly increasing disposable incomes, urbanization, and domestic tourism in countries like India, China, and Southeast Asian nations. North America and Europe remain mature markets, focusing on revitalization and standardization, particularly through franchising models that ensure brand consistency. Segmentation trends indicate a strong rise in the 'Extended Stay Budget' category, catering to project-based workers and digital nomads requiring reliable, affordable long-term lodging. Additionally, there is a clear trend toward diversifying booking channels, although direct bookings are strategically prioritized by major operators to circumvent high commission rates charged by Online Travel Agencies (OTAs).

AI Impact Analysis on Budget Hotel Market

Common user inquiries concerning AI integration in budget hotels often revolve around whether automation will significantly reduce service quality, how AI can justify slightly higher budget prices through enhanced personalization, and the potential for AI-driven revenue management to stabilize or increase room rates. Users are keenly interested in contactless operations, AI-powered multilingual customer support, and the speed of resolution for common issues like check-in delays or billing discrepancies. The underlying themes center on achieving a balance: utilizing AI to drive cost efficiency (a core budget hotel tenet) while simultaneously using AI to deliver a perceived increase in value and responsiveness, mitigating the traditional limitations of low staffing levels. The expectation is that AI will be the primary lever for competitive differentiation and operational optimization.

- AI-driven Revenue Management Systems (RMS) optimize dynamic pricing strategies, maximizing occupancy and yield based on real-time demand fluctuations.

- Implementation of AI-powered chatbots and virtual assistants for instant customer service, booking modifications, and addressing common queries 24/7, reducing reliance on front-desk personnel.

- Contactless check-in/out processes utilizing facial recognition or mobile apps, significantly enhancing operational speed and guest convenience (a key AEO driver).

- Predictive maintenance analytics, leveraging machine learning to anticipate equipment failures (HVAC, plumbing) before they impact guest experience, minimizing costly reactive repairs.

- Personalized marketing and recommendation engines, analyzing guest data to offer tailored upsells (e.g., late check-out, enhanced Wi-Fi) without excessive human intervention.

- Optimization of staff scheduling and housekeeping routes using algorithms to increase labor efficiency across multiple budget properties.

DRO & Impact Forces Of Budget Hotel Market

The growth dynamics of the Budget Hotel Market are primarily driven by the expanding global middle class, particularly in emerging economies, coupled with the increasing accessibility of travel facilitated by low-cost airlines and affordable digital booking platforms. However, the market faces significant restraints, chiefly intense price competition that continually pressures profit margins and operational costs that fluctuate widely, including labor shortages and rising energy expenses. The major opportunities lie in geographical expansion into underserved secondary and tertiary markets, alongside the adoption of standardized, modular construction techniques that accelerate time-to-market and reduce capital expenditure. The collective impact forces shaping the market include ongoing digital transformation, demanding high investment in technology infrastructure; evolving sustainability regulations requiring resource-efficient operations; and macroeconomic volatility, which paradoxically boosts the budget segment's demand as consumers trade down from mid-scale options.

Segmentation Analysis

The Budget Hotel Market is highly segmented, reflecting diverse consumer needs and operational models. Segmentation by Type focuses on the level of service standardization, ranging from basic economy motels offering minimum essentials to mid-scale budget hotels that include enhanced amenities like complimentary breakfast or small business centers. By Location, the market is primarily divided between high-traffic urban centers where land costs necessitate vertical efficiency, and suburban or highway locations where accessibility and parking are critical differentiators. Furthermore, the segmentation by Booking Channel highlights the ongoing battle between proprietary direct booking platforms, which offer loyalty rewards, and third-party Online Travel Agencies (OTAs) that dominate discovery and initial conversion. Analyzing these segments is crucial for brands to strategically allocate resources and tailor their value proposition to specific traveler demographics, ensuring maximized RevPAR (Revenue Per Available Room) within the constrained budget environment.

- By Type:

- Economy (Minimal Service)

- Mid-scale Budget (Standardized Amenities)

- Extended Stay Budget

- By Location:

- Urban/City Center

- Suburban/Highway

- Airport

- Tourist Destinations

- By Booking Channel:

- Direct Booking (Brand Website/App)

- Online Travel Agencies (OTAs)

- Global Distribution Systems (GDS)

- Travel Management Companies (TMCs)

- By Target Consumer:

- Leisure Travelers (Individual & Family)

- Business Travelers (Corporate & Small Business)

- Backpackers/Youth Travelers

- Groups and Tours

Value Chain Analysis For Budget Hotel Market

The value chain for the Budget Hotel Market starts with upstream activities focused heavily on site selection, standardized architectural design, and highly efficient procurement of construction materials and essential furnishings (e.g., bedding, fixtures). Due to the emphasis on cost control, budget operators prioritize bulk purchasing and long-term contracts with specialized suppliers who can guarantee uniformity and durability. Technology providers, especially those offering Property Management Systems (PMS) and cloud-based revenue management tools, form a critical upstream component, allowing operators to scale efficiently without localized IT infrastructure burdens. Upstream management is heavily influenced by franchising models, where the franchisor provides brand standards and centralized procurement power to individual owners.

Downstream activities center on operational execution and distribution. Operations involve minimal staffing models supported by automated processes for guest interactions, housekeeping, and light maintenance. Distribution is complex; while direct bookings (via owned brand websites and apps) are financially preferred due to zero commission, a significant portion of bookings originates through indirect channels, primarily OTAs (like Booking.com and Expedia). Effective yield management and channel management systems are vital downstream elements to ensure optimal room rate distribution and maintain rate parity across all sales platforms. The balance between maximizing direct bookings for loyalty and utilizing OTAs for visibility is a constant strategic consideration for sustaining high occupancy rates.

The distribution channel for budget hotels is primarily bifurcated. Direct channels build customer loyalty and provide superior data insights, often incentivized through proprietary loyalty programs offering incremental discounts or perks. Indirect channels provide unparalleled market reach and demand aggregation, particularly useful for filling capacity during low season or penetrating new geographic markets quickly. The efficiency of the reservation process, whether direct or indirect, is a key determinant of competitive success, emphasizing the need for robust, mobile-optimized booking engines and seamless integration with aggregators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $135.5 Billion |

| Market Forecast in 2033 | $230.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marriott International (Select Service Brands), Hilton Worldwide (Focused Service Brands), IHG Hotels & Resorts, Wyndham Hotels & Resorts, Choice Hotels International, Accor, OYO Rooms, Travelodge, Premier Inn, Best Western Hotels & Resorts, Red Roof Inn, Motel 6, Extended Stay America, G6 Hospitality, Econo Lodge, Super 8, Jin Jiang International, Huazhu Group, GreenTree Hospitality, Magnuson Hotels |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Budget Hotel Market Potential Customers

The primary customer base for the Budget Hotel Market is broad but fundamentally unified by a strong value-consciousness and a preference for functionality over luxury amenities. This cohort includes general leisure travelers who prioritize spending on experiences rather than accommodation, utilizing budget hotels as essential base camps for exploration. A significant segment consists of small business owners and corporate travelers operating on strict travel policies, requiring clean, safe, and efficiently located lodging for short durations. Furthermore, the rising demographic of digital nomads and young professionals, who value connectivity and consistency over extensive in-house services, represents a growing niche. These customers are typically highly proficient in digital booking and rely heavily on aggregated online reviews to make purchasing decisions, emphasizing the importance of online reputation management for budget brands.

Budget Hotel Market Key Technology Landscape

The technological landscape within the Budget Hotel Market is rapidly evolving, moving from basic Property Management Systems (PMS) to integrated, cloud-based operational platforms that support minimal staffing models. Central to this transformation is the widespread deployment of Mobile Key and Digital Check-in/out technologies, which significantly improve guest flow and reduce the need for constant front-desk presence. Revenue Management Systems (RMS) are critical, utilizing predictive analytics and AI algorithms to optimize occupancy rates and room pricing in real time, ensuring that budget constraints do not compromise yield. Furthermore, high-speed, reliable Wi-Fi connectivity is no longer an optional amenity but a mandatory utility, supported by robust network infrastructure designed for simultaneous heavy usage by multiple devices. Operational technologies also include centralized, IoT-enabled building management systems for energy efficiency, allowing remote monitoring and automated adjustments to lighting, heating, and cooling, directly impacting the bottom line of cost-sensitive budget operations.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region globally, driven by massive increases in domestic tourism and the emergence of a burgeoning middle class in India, China, and Southeast Asia. Governments in these regions are actively investing in transportation infrastructure, further stimulating regional travel. Localization is key here, with major international brands competing fiercely with localized, high-volume players like OYO and Huazhu Group, focusing on hyper-efficient, density-optimized property models tailored to metropolitan areas.

- North America: This is a highly mature market characterized by extensive franchise operations and strong brand standardization. Growth is focused on renovating existing properties, expanding the Extended Stay Budget segment to capture long-term travelers, and integrating technology to manage high labor costs. The focus remains on strategic highway locations and primary transportation corridors, where brand recognition drives consistent traveler trust.

- Europe: The European market displays heterogeneity, with strong growth in Western European urban hubs (driven by LCC tourism) and emerging Eastern European markets. Operators here must navigate diverse regulatory environments, often leading to a focus on sustainable and culturally sensitive designs. Key trends include the integration of budget hotels into mixed-use developments and highly competitive pricing strategies against alternative accommodation providers.

- Latin America (LATAM): Growth is concentrated in key commercial centers and popular tourist destinations, driven by regional economic stability and increased intra-regional travel. The market structure is less saturated than APAC or Europe, presenting significant opportunities for standardized international budget chains to establish early market dominance through strategic partnerships and localized operational strategies.

- Middle East and Africa (MEA): Growth is primarily concentrated in major Gulf Cooperation Council (GCC) nations, often tied to government visions for diversifying away from oil dependence through tourism and major event hosting. Africa presents long-term potential, though development is challenged by infrastructure gaps; here, localized, highly essential service models are gaining traction to cater to both commercial travelers and nascent tourism sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Budget Hotel Market.- Wyndham Hotels & Resorts

- Choice Hotels International

- IHG Hotels & Resorts (Holiday Inn Express, Staybridge Suites)

- Marriott International (Fairfield Inn, Courtyard by Marriott)

- Hilton Worldwide (Hampton by Hilton, Tru by Hilton)

- Accor (ibis, greet)

- OYO Rooms

- Travelodge

- Premier Inn (Whitbread PLC)

- Best Western Hotels & Resorts

- Red Roof Inn

- Motel 6 (G6 Hospitality)

- Extended Stay America

- Econo Lodge

- Super 8

- Jin Jiang International

- Huazhu Group

- GreenTree Hospitality

- Magnuson Hotels

- Radisson Hotel Group (Country Inn & Suites)

Frequently Asked Questions

Analyze common user questions about the Budget Hotel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the current growth of the Budget Hotel Market?

The primary drivers are the expanding global middle class seeking affordable travel options, the proliferation of low-cost air travel, and the operational efficiencies achieved by major chains through technology adoption (AEO Focus: market drivers, LCC influence, operational efficiency).

How is technology, specifically AI, changing the guest experience in budget hotels?

AI is primarily enhancing operational efficiency and speed through automated revenue management, contactless check-in systems, and AI-powered virtual assistants for quick query resolution, minimizing staff interaction while maintaining service quality (AEO Focus: AI application, contactless service, operational benefits).

Which geographic region is expected to lead the future growth of the budget accommodation sector?

Asia Pacific (APAC) is projected to lead future growth, driven by rapid urbanization, substantial growth in domestic and regional tourism, and the massive scaling capabilities demonstrated by major Asian hospitality groups (AEO Focus: APAC growth forecast, regional market dominance, urbanization impact).

What is the most significant operational challenge facing budget hotel operators today?

The most significant challenge is balancing intense price competition—which limits pricing power—with rising operational expenses, particularly fluctuating labor costs and the necessary capital investment in foundational digital technologies (AEO Focus: profitability challenges, cost management, competitive pricing).

What is the 'Extended Stay Budget' segment and why is it gaining popularity?

The Extended Stay Budget segment offers rooms designed for longer stays (e.g., 5+ nights) with basic kitchenettes and increased storage space. Its popularity stems from catering to project-based workers, contract employees, and relocating families seeking cost-effective, apartment-like functionality (AEO Focus: Extended Stay definition, target audience, long-term accommodation trends).

The increasing consumer focus on experiential travel, where accommodation serves as a functional necessity rather than a destination in itself, further bolsters the budget segment’s appeal. This philosophical shift, combined with robust digital infrastructure supporting price transparency and instant booking, dictates that competitive success relies heavily on delivering a consistent, value-driven offering. Operators are constantly refining their core product—a clean room, comfortable bed, and fast Wi-Fi—while minimizing all non-essential costs. This disciplined approach ensures margins remain viable despite the aggressively competitive pricing structures prevalent across global markets. Furthermore, the standardization of processes facilitated by centralized management systems allows budget brands to scale rapidly and maintain high operational consistency across diverse geographical locations, which is a major advantage over fragmented independent operators. The introduction of loyalty programs tailored to budget travelers, such as offering free upgrades or points toward future stays, is another strategic effort to shift booking reliance from OTAs back to direct channels, securing long-term customer value.

In analyzing the Budget Hotel Market's trajectory, it is imperative to note the dual challenge posed by both mid-scale brands trading down services to compete on price, and the rise of short-term rental platforms (like Airbnb), which offer localized, often comparable, cost structures. Budget hotels respond to this pressure by emphasizing professional management, stringent safety standards, and predictable service reliability—attributes often inconsistent in the unregulated short-term rental space. The market's resilience, even during economic downturns, is a testament to its inelastic demand base. When corporate and leisure budgets shrink, travelers tend to opt for budget hotels instead of canceling trips, securing the segment's steady market share and underpinning the forecast growth rate, even amid global economic fluctuations. The strategic placement of new properties, often focusing on high-density areas that are underserved by higher-tier hotels, also plays a crucial role in sustained revenue growth.

The evolution of budget hotel infrastructure involves a significant architectural shift towards pre-fabricated and modular construction methods. These techniques dramatically reduce construction time and cost, allowing chains to deploy new properties rapidly in response to immediate market demand. This efficiency is critical for meeting expansion targets, particularly in fast-growing urban fringes or newly developed commercial zones where speed-to-market is a significant competitive differentiator. Additionally, the interior design philosophy has undergone modernization; contemporary budget hotels prioritize efficient use of space, multi-functional furniture, and bold, simplified aesthetics that appeal to younger demographics, effectively rebranding the segment from 'basic' to 'smart' or 'essential.' This focus on streamlined design extends to public areas, often transforming what was once a simple lobby into a vibrant, yet minimally staffed, social or co-working space, maximizing the utility of the limited physical footprint.

Technological refinement also plays a pivotal role in the maintenance and sustainability profiles of budget hotels. Sophisticated Building Management Systems (BMS) integrate heating, ventilation, air conditioning (HVAC), and lighting controls, utilizing occupancy sensors and weather predictions to minimize energy expenditure without sacrificing basic guest comfort. This not only fulfills emerging environmental mandates but also provides a quantifiable reduction in utility costs, which are substantial fixed operating expenses for any hotel. Furthermore, digital housekeeping management systems ensure staff time is optimized, prioritizing rooms based on check-out times or guest requests, leading to increased productivity per employee—an essential factor in markets facing acute labor shortages. The successful implementation of these lean operational technologies is intrinsically linked to the market’s ability to achieve the forecasted high growth rates while maintaining attractive investor returns.

The competitive landscape remains fragmented, dominated by large global franchises that maintain multiple budget brands under their umbrella (e.g., Wyndham and Choice Hotels) and regional powerhouse groups with dense portfolios (e.g., OYO and Huazhu). These players leverage their brand strength and centralized procurement to negotiate better supplier terms and achieve economies of scale unmatched by independent budget properties. Future market consolidation is expected, driven by larger entities acquiring regional chains to instantly gain established footholds in new or strategically important geographies. Mergers and acquisitions will likely focus on entities that have demonstrated superior technological integration or possess valuable real estate in key secondary cities, allowing the acquiring entity to expand its asset-light franchising model. The ability to standardize and integrate acquired properties quickly will be a key driver for successful consolidation within the budget segment.

The influence of Gen Z and Millennial travelers cannot be overstated; these generations represent a core demographic for the Budget Hotel Market. Their expectations are centered around digital functionality, social consciousness, and authentic, localized experiences. Budget hotels are adapting by partnering with local businesses, utilizing social media heavily for marketing and customer engagement, and ensuring their value proposition is clearly communicated across all digital touchpoints. The preference for mobile interaction means that a seamless mobile booking and check-in experience is now table stakes, influencing how technology budgets are allocated. As these digital natives become the majority of the traveling public, brands that successfully integrate transparent pricing, high-quality connectivity, and effortless digital interaction will significantly outperform competitors still relying on older, analogue operational models. The investment in robust mobile applications capable of handling everything from booking to room control is paramount for securing future market relevance.

Specific market dynamics related to the Extended Stay Budget segment are particularly interesting. This segment provides tailored services that bridge the gap between traditional hotels and residential rentals. Guests often include medical professionals on rotation, construction crews on long-term projects, and military personnel, all requiring reliable, cost-controlled lodging for weeks or months. The operational model for extended stay properties differs significantly, focusing less on daily turnover and more on reduced service frequency (e.g., weekly housekeeping) and the provision of in-room conveniences like larger refrigerators and dedicated workspaces. The financial stability of this segment is high, characterized by lower customer acquisition costs and higher predictable occupancy rates, making it an attractive investment category, especially for real estate trusts focused on stable long-term yields. The demand here is relatively insulated from short-term leisure travel trends, providing a stabilizing factor for the overall budget market.

Furthermore, sustainability is transitioning from a fringe consideration to a core operational mandate, even within the budget segment. While guests prioritize cost, they are increasingly aware of a brand's environmental footprint. Budget hotels are focusing on low-flow plumbing fixtures, energy-efficient LED lighting, minimal water usage in laundry, and waste reduction programs. Communicating these efforts transparently through digital channels helps build brand reputation and aligns with the values of the target demographic without dramatically increasing room rates. Government regulations across Europe and parts of North America are enforcing stricter energy performance standards for commercial buildings, meaning investment in smart building technology is becoming mandatory rather than optional, compelling budget operators to innovate in resource management to maintain compliance and profitability. The long-term cost savings associated with reduced energy and water consumption eventually justify the initial capital expenditure on these sustainable technologies.

The concept of 'bleisure' travel—combining business and leisure—further expands the potential customer base. Business travelers are increasingly extending their stays into the weekend for personal enjoyment, driving demand for strategically located budget hotels that offer easy access to both commercial districts and tourist attractions. This requires budget properties to evolve their service offering to cater to both corporate efficiency (fast Wi-Fi, easy invoicing) and leisure comfort (local area guides, proximity to dining and entertainment). The segmentation of the market by consumer type, therefore, requires a flexible operational approach capable of satisfying diverse needs within a standardized, cost-controlled environment. The ability of a budget chain to successfully market its properties as 'dual-purpose' assets significantly enhances its RevPAR performance, particularly in urban and secondary city markets that host significant corporate activity.

Channel distribution strategy remains a dynamic battleground. While OTAs offer extensive visibility, they erode profit margins. Consequently, major budget chains are heavily investing in loyalty program upgrades and direct booking incentives to shift market share. These investments include dedicated mobile apps that serve as the primary point of contact for the entire guest journey—from initial booking to check-out and future re-booking. Successful direct booking strategies rely on providing the lowest price guarantee and exclusive benefits, thereby justifying the customer bypassing the aggregator platforms. Data gathered through direct interaction also enables hyper-personalized marketing and service optimization, giving budget operators a distinct advantage in understanding and responding quickly to evolving guest preferences, ensuring that they maintain their competitive edge through superior customer relationship management and data-driven decision-making.

The role of regulatory compliance, especially concerning safety and accessibility standards, continues to impact capital expenditure in established markets. Budget hotels, being high-volume, standardized operations, must ensure strict adherence to local building codes, fire safety regulations, and accessibility mandates (such as ADA compliance in the US). These mandatory compliance costs can be significant, especially during renovation cycles of older properties. However, adherence to high standards of safety and cleanliness serves as a core trust-builder for the budget traveler, differentiating legitimate chain operations from less regulated alternatives. The operational excellence demonstrated through consistent safety protocols is a silent yet powerful marketing tool that reinforces the perceived reliability and quality of the value proposition offered by leading budget hotel brands globally. This formal commitment to compliance is fundamental to long-term brand equity and sustainable market presence across diverse international jurisdictions.

The impact of economic volatility cannot be underestimated. While budget hotels often benefit from trade-down effects during recessions, they are simultaneously vulnerable to external cost shocks, such as spikes in energy prices or inflation in construction materials. Effective risk mitigation requires sophisticated hedging strategies and flexible supply chain management. Furthermore, the reliance on franchising models, prevalent in this sector, transfers much of the operational risk to the independent franchisee, but also requires the franchisor to maintain strong brand support and operational standardization to protect the brand's overall integrity. The formal agreements governing these franchising relationships are increasingly detailed, focusing on technology adoption mandates, quality assurance audits, and standardized training protocols to ensure that the core value promise—consistent quality at a low price—is never compromised, regardless of individual ownership variations. This complex interplay of macroeconomic forces and franchising strategy defines much of the strategic decision-making in the competitive Budget Hotel Market environment.

Finally, the focus on urban expansion into secondary and tertiary cities represents a significant untapped market opportunity. As urbanization continues globally, major corporate activities and government hubs are increasingly decentralizing, creating demand for reliable, affordable accommodation outside the highly saturated Tier 1 metropolitan areas. Budget hotels are ideally positioned to capitalize on this trend due to their lower land acquisition costs compared to mid-to-high scale hotels, and their standardized, replicable operational blueprint. Expanding into these markets provides first-mover advantages, establishing brand loyalty and market share before competitors follow. Success in these new frontiers depends heavily on robust market intelligence, localized pricing strategies, and strategic partnerships with regional developers who possess deep knowledge of the local regulatory environment and consumer preferences, ensuring the budget hotel offering is appropriately tailored to regional demands while maintaining global brand consistency.

The market also witnesses increasing adoption of flexible hotel models, such as hybrid concepts that incorporate co-working spaces and micro-rooms. These models maximize revenue generation per square foot, a crucial metric in high-cost urban environments. By blending traditional lodging with integrated workspaces and social hubs, budget hotels are attracting the growing demographic of remote workers and entrepreneurs who require reliable infrastructure outside a traditional office setting. This evolution transforms the budget hotel from a mere sleeping facility into a multi-functional hub, increasing its utility and potential revenue streams throughout the day, rather than just during nighttime occupancy. This innovative use of physical space, supported by flexible pricing structures for day use or common area access, represents a key strategic direction for budget operators aiming to enhance overall profitability without resorting to significant increases in room rates, thereby maintaining their core value proposition.

The convergence of hospitality and technology vendors is another defining trend. Budget hotel chains are forming tighter partnerships with tech providers to co-develop proprietary operational software, ensuring seamless integration of PMS, RMS, and guest-facing technologies. This approach allows brands to customize solutions to their specific lean operating models, rather than relying on generic, costly enterprise solutions designed for full-service hotels. The emphasis is on scalable, cloud-native platforms that can be rapidly deployed across a global portfolio of franchised and managed properties. This proprietary technological advantage becomes a critical barrier to entry for smaller or independent competitors and significantly enhances the efficiency with which corporate headquarters can manage and monitor thousands of distributed budget hotel assets, guaranteeing operational rigor and financial oversight across the entire ecosystem.

The final consideration is the role of global events, such as major sporting tournaments, cultural festivals, and large-scale conventions, which temporarily spike demand for affordable accommodation. While short-lived, these events provide significant revenue injections. Budget hotels near such venues leverage dynamic, event-based pricing models enabled by their advanced RMS technology to maximize yield during peak periods. Strategic planning around these events, including temporary staffing adjustments and targeted marketing campaigns, is a vital component of the annual revenue strategy for budget hotel operators. The flexibility inherent in the lean operational model allows these hotels to quickly scale their services to meet intense, short-term demand surges more effectively than high-end properties constrained by fixed service staff requirements. This agility contributes substantially to the overall high growth potential projected for the market in the coming years.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager