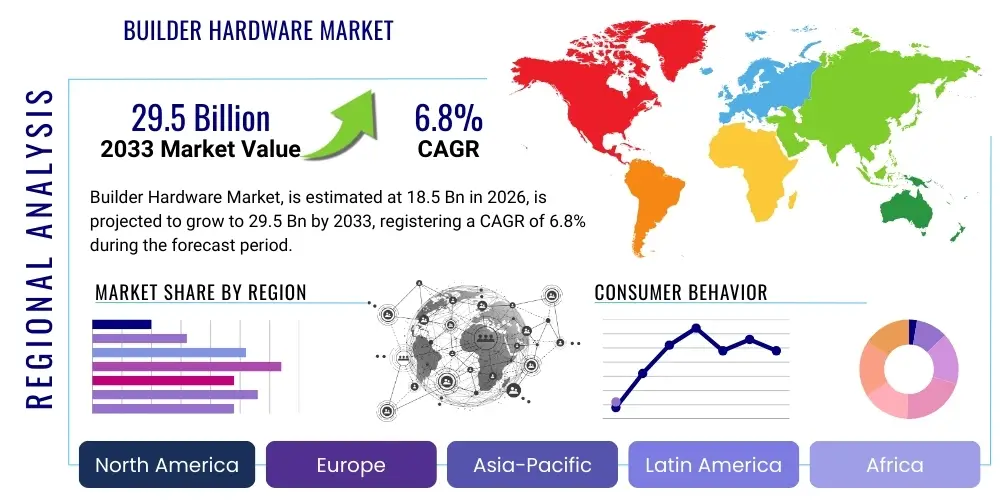

Builder Hardware Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442579 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Builder Hardware Market Size

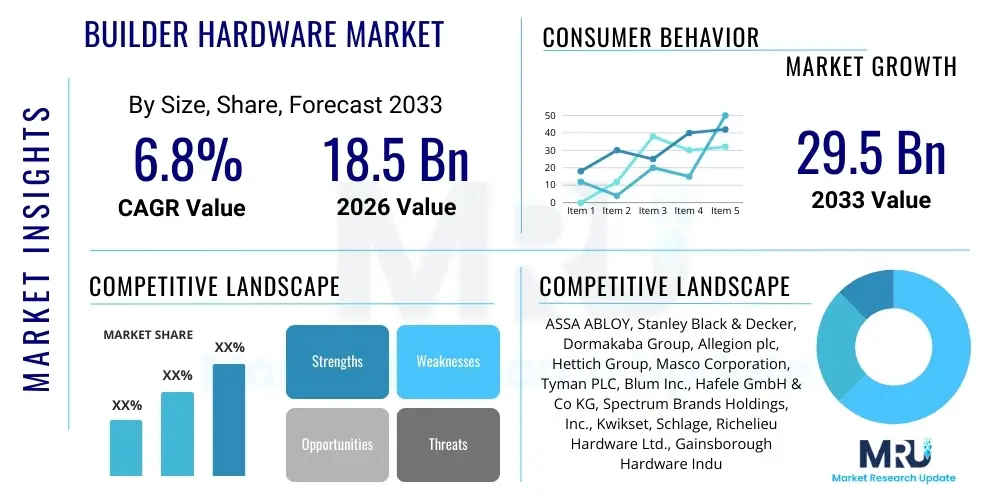

The Builder Hardware Market is a crucial segment within the construction and renovation industry, encompassing essential components required for securing, operating, and finishing structures. This market is projected to demonstrate robust expansion, driven by global urbanization trends and increasing infrastructure spending, alongside growing consumer demand for advanced security and aesthetic hardware solutions. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 29.5 Billion by the end of the forecast period in 2033.

The valuation reflects sustained momentum across both residential and commercial construction sectors globally. While mature markets focus on high-end, smart, and sustainable hardware replacements, emerging economies are fueling demand through massive new construction projects. This dichotomy ensures steady growth, with technological integration, particularly in access control systems and automated components, acting as a significant value accelerator.

Builder Hardware Market introduction

The Builder Hardware Market encompasses mechanical components, fittings, and accessories used in the construction and finishing of buildings. Key product categories include architectural hardware (e.g., door and window fittings, hinges, locks, handles, latches), cabinet hardware (e.g., drawer slides, knobs, pulls), and functional hardware (e.g., fasteners, connectors, specialized mounting brackets). These products are indispensable across all phases of building construction, from structural completion to final aesthetic detailing, ensuring functionality, safety, security, and ease of use.

Major applications span residential buildings (new homes, apartments, renovations), commercial structures (offices, retail spaces, hotels), and institutional facilities (hospitals, schools). The primary benefits derived from high-quality builder hardware include enhanced physical security through robust locking mechanisms, improved operational efficiency through smooth-running drawers and doors, and significant aesthetic value that complements interior and exterior architectural designs. Moreover, modern hardware increasingly incorporates features like fire resistance, ADA compliance, and low environmental impact materials, meeting stringent regulatory requirements and consumer preferences for sustainability.

Driving factors for market growth include rapid global urbanization leading to increased construction activities, substantial investments in smart home and commercial building technologies demanding connected hardware, rising disposable incomes in developing nations fueling home renovation projects, and stringent building codes mandating higher standards for safety and quality in hardware components. The continuous innovation in materials, such as lightweight alloys and durable composites, alongside miniaturization of electronic components, further sustains the market's positive trajectory.

Builder Hardware Market Executive Summary

The global Builder Hardware Market is characterized by intense competition and rapid innovation, shifting towards connected, aesthetically superior, and environmentally compliant products. Business trends indicate a strong move toward digitalization of supply chains, allowing for better inventory management and customized product offerings. Manufacturers are increasingly adopting modular designs and lean manufacturing processes to handle raw material price volatility and meet diverse regional standards efficiently. Strategic mergers and acquisitions remain a core strategy for leading players seeking to expand geographical reach, integrate specialized technologies (like biometric locks), and consolidate market share in highly fragmented segments such as cabinet hardware.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure projects, rapid residential construction, and burgeoning middle-class populations in India and China. North America and Europe, while mature, maintain leadership in revenue due to high adoption rates of premium, smart hardware, and ongoing renovation activities focused on energy efficiency and enhanced security standards. The Middle East and Africa (MEA) are emerging as significant growth pockets, bolstered by substantial government investments in luxury commercial and residential development, particularly in the Gulf Cooperation Council (GCC) countries.

Segment trends highlight the significant growth of the functional hardware and architectural hardware segments, particularly those incorporating IoT capabilities. Smart locks and integrated access control systems are transitioning from niche luxury items to mainstream requirements, driving demand for electronic builder hardware. Material trends show a persistent shift away from traditional brass and zinc toward stainless steel and aluminum, favored for their durability, anti-corrosion properties, and suitability for modern, minimalist designs. Furthermore, distribution channels are evolving, with e-commerce platforms gaining substantial traction, especially among professional contractors and DIY enthusiasts seeking convenience and competitive pricing.

AI Impact Analysis on Builder Hardware Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Builder Hardware Market reveals key themes centered around operational efficiency, design customization, and the evolution of smart hardware. Users frequently inquire about how AI can optimize hardware design for performance and material usage, predict supply chain disruptions affecting raw material availability, and enhance the functionality of smart locks and access systems through better pattern recognition and anomaly detection. There is also significant curiosity about AI-driven predictive maintenance for commercial hardware, reducing downtime and operational costs.

The immediate influence of AI is most visible in streamlining complex manufacturing processes and improving quality control. AI-powered machine vision systems are being deployed on production lines to detect minute defects in finishes or dimensional inconsistencies faster and more accurately than human inspectors, significantly reducing waste and enhancing product reliability. Furthermore, generative design algorithms are assisting architects and hardware engineers in creating optimized hardware shapes that utilize less material while maximizing structural integrity, particularly critical for specialized hinges and brackets.

From a consumer interaction standpoint, AI is enhancing the user experience of smart builder hardware. For instance, integration with existing smart home ecosystems (like voice assistants) is managed through sophisticated AI algorithms that ensure seamless interoperability and personalized security protocols. In logistics, machine learning models forecast demand fluctuations with higher precision, allowing manufacturers to adjust production schedules and maintain optimal stock levels across varied product lines, addressing concerns about lead times and product availability during peak construction seasons.

- AI optimizes factory floor efficiency, using machine vision for precision quality control and defect reduction.

- Generative design AI aids in creating resource-efficient and structurally optimized hardware components.

- Machine learning algorithms enhance supply chain resilience by predicting demand and material price volatility.

- AI powers advanced analytics in smart hardware, improving biometric recognition accuracy and adaptive security features in locks.

- Predictive maintenance schedules for large commercial installations are optimized by AI, minimizing system failure and ensuring compliance.

- AI-driven chatbot support provides quick, technical assistance to installers and DIY consumers, improving post-sales service.

DRO & Impact Forces Of Builder Hardware Market

The Builder Hardware Market's trajectory is determined by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping industry strategy. Primary drivers include the massive global push toward urbanization, which necessitates continuous construction of new infrastructure and housing, especially in APAC and parts of Africa. Concurrent with this physical expansion is the exponential growth of the smart building industry, compelling hardware manufacturers to integrate IoT, biometrics, and electronic access capabilities into traditional mechanical components, raising the average selling price and value proposition of hardware products.

However, the market faces significant restraints, notably the volatile pricing and supply disruptions of critical raw materials such as steel, zinc, aluminum, and copper, which directly impact manufacturing costs and profit margins. Furthermore, the market is highly susceptible to the cyclical nature of the construction industry; economic downturns or regulatory freezes on housing projects can swiftly dampen demand. Counterfeiting and the prevalence of low-quality, inexpensive imports, particularly in emerging markets, also restrain the growth potential for established premium brands, forcing difficult choices regarding pricing and standardization.

Opportunities for expansion are abundant, centered primarily around the accelerating renovation and retrofitting trend in mature economies, where older buildings require upgrades to meet modern energy, safety, and aesthetic standards. The development of sustainable and ‘green’ hardware, manufactured using recycled materials or processes that minimize carbon footprint, presents a critical differentiation opportunity. Furthermore, expanding distribution networks, particularly leveraging digital platforms for direct-to-consumer and business-to-business sales, offers a pathway for smaller innovators to bypass traditional, often complex, distribution bottlenecks. The cumulative impact forces thus favor technologically advanced, high-quality, and efficiently distributed hardware solutions.

Segmentation Analysis

The Builder Hardware Market is extensively segmented based on product type, material, application, and distribution channel, reflecting the diversity of uses and functional requirements within the construction sector. Product segmentation is crucial, distinguishing between high-security architectural hardware (locks, hinges) and aesthetic or functional components (cabinet pulls, shelf supports). Material choice dictates durability, finish, and cost, influencing selection based on environment—stainless steel for high-humidity areas, versus brass for internal aesthetic components.

Application segmentation reveals the varying performance demands across sectors; commercial buildings require highly durable, fire-rated, and access-controlled hardware suitable for high traffic volumes, contrasting with residential applications that prioritize security, design, and ease of installation. Distribution analysis highlights the ongoing shift, with professional contractors relying heavily on specialized distributors and wholesalers, while the DIY segment increasingly utilizes retail chains and expansive e-commerce platforms for convenience and price comparison.

- By Product Type:

- Architectural Hardware (Door Fittings, Window Fittings, Hinges, Locks, Handles)

- Cabinet Hardware (Knobs, Pulls, Drawer Slides, Catches)

- Functional Hardware (Fasteners, Connectors, Brackets, Structural Components)

- Others (Railings, Specialty Fixtures)

- By Material:

- Metal (Stainless Steel, Brass, Aluminum, Zinc Alloy, Iron)

- Plastics and Composites

- Other Materials (Ceramics, Glass)

- By Application:

- Residential (Single-family, Multi-family)

- Commercial (Office Buildings, Retail, Hospitality)

- Industrial and Institutional (Hospitals, Schools, Factories)

- By Distribution Channel:

- Wholesalers and Distributors

- Retail Stores and Home Improvement Centers (DIY)

- Online Channels (E-commerce)

- Direct Sales to Builders/OEMs

Value Chain Analysis For Builder Hardware Market

The Value Chain of the Builder Hardware Market begins with upstream activities, dominated by the sourcing and refinement of raw materials—primarily metals like steel, zinc, brass, and aluminum. This stage is critical as material costs and quality directly influence the final product price and performance. Key upstream players include specialized metal foundries and alloy suppliers. Manufacturers often establish long-term contracts or vertical integration strategies to mitigate volatility in commodity markets, ensuring a stable supply of high-grade inputs necessary for precision engineering of components like lock cylinders and drawer slides.

The midstream phase involves manufacturing, characterized by stamping, casting, machining, finishing (plating, coating), and assembly. Differentiation at this stage relies heavily on adopting advanced production techniques such as automated CNC machining and robotic assembly to maintain tight tolerances and achieve high throughput. Downstream analysis focuses on product distribution and end-user engagement. Due to the diverse nature of hardware, distribution is highly fragmented, utilizing a mix of channels to reach varying customer bases.

The distribution channel landscape distinguishes between direct and indirect routes. Direct sales are often preferred for large commercial projects and Original Equipment Manufacturers (OEMs), where high volumes and custom specifications require close collaboration between the manufacturer and the builder or architect. Indirect distribution, which accounts for the majority of residential and renovation sales, flows through multi-step channels: from the manufacturer to national and regional wholesalers, then to retail outlets (e.g., Lowe’s, Home Depot), and finally to contractors or DIY consumers. E-commerce platforms are increasingly blurring these lines, offering a highly efficient indirect route that bypasses intermediate distributors for certain standard products, catering directly to both professional and retail buyers.

Builder Hardware Market Potential Customers

Potential customers for the Builder Hardware Market are broadly categorized into professional users, institutional buyers, and individual consumers, all demanding products tailored to specific application requirements, security levels, and aesthetic criteria. Professional customers, who represent the highest volume segment, include large-scale residential and commercial General Contractors (GCs) responsible for new builds and extensive renovations. These buyers prioritize product certifications, bulk pricing, supply reliability, and adherence to specific building codes, often selecting established brands with comprehensive product lines and strong after-sales support.

A second critical customer group is Architects and Interior Designers, who act as powerful specifiers. While they may not directly purchase the hardware, their influence determines brand and product selection, driven by factors like design aesthetics, material quality, and compatibility with overall architectural concepts. This group demands high-end, innovative, and customizable finishes, making them key targets for manufacturers seeking to launch premium or signature collections, such as advanced biometric locks or unique artisanal door handles.

Finally, the individual consumer and smaller trade professionals (e.g., carpenters, locksmiths) form the substantial end-user base, primarily accessing products via retail and online channels. This segment includes homeowners undertaking DIY projects, property managers replacing worn-out hardware, and small-scale renovation contractors. Their purchasing decisions are highly sensitive to ease of installation, perceived value (durability vs. cost), and immediate availability. The growing smart home market is specifically expanding this customer base, as technologically inclined homeowners seek connected, app-controlled builder hardware.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 29.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASSA ABLOY, Stanley Black & Decker, Dormakaba Group, Allegion plc, Hettich Group, Masco Corporation, Tyman PLC, Blum Inc., Hafele GmbH & Co KG, Spectrum Brands Holdings, Inc., Kwikset, Schlage, Richelieu Hardware Ltd., Gainsborough Hardware Industries, Sobinco NV, Valli&Valli, Rocky Mountain Hardware, Salice America, Hager Companies, CompX International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Builder Hardware Market Key Technology Landscape

The technological landscape of the Builder Hardware Market is undergoing a fundamental transformation driven primarily by the integration of IoT (Internet of Things) and advanced manufacturing techniques. The shift is most pronounced in the architectural hardware segment, where traditional mechanical components are being augmented or replaced by electronic and smart devices. Smart locks featuring connectivity protocols such as Wi-Fi, Bluetooth, and Z-Wave are now standard requirements in high-end residential and modern commercial constructions, offering keyless entry, remote access control, and integration with broader building management systems (BMS). This technological evolution necessitates specialized electronic components and sophisticated firmware development expertise from hardware manufacturers.

Beyond smart connectivity, the industry is witnessing significant advancements in material science and production methodologies. The adoption of Additive Manufacturing (3D Printing) is revolutionizing prototyping and low-volume production of highly customized hardware components, especially complex geometries required for specialized hinges or unique designer handles. Furthermore, sustainability is driving innovation in surface treatments and finishes. Manufacturers are increasingly utilizing Physical Vapor Deposition (PVD) coatings, which offer exceptional durability, corrosion resistance, and aesthetic finishes without the harmful environmental byproducts associated with traditional electroplating processes.

Moreover, the integration of specialized software for design and installation is becoming a critical technological differentiator. Building Information Modeling (BIM) platforms now require manufacturers to provide detailed digital twins of their hardware products, enabling architects and builders to precisely integrate components into the digital building model, ensuring compatibility and optimizing placement before physical installation begins. This trend of digital integration across the entire product lifecycle—from design simulation using Finite Element Analysis (FEA) to final maintenance alerts delivered via embedded sensors—underscores the hardware industry's move toward being a high-tech manufacturing sector.

Regional Highlights

The regional dynamics of the Builder Hardware Market are highly diverse, reflecting varying stages of economic development, construction activity levels, and regulatory environments. North America, encompassing the United States and Canada, represents a high-value, mature market characterized by stringent building codes, high consumer expectations for security, and a strong propensity for adopting smart home technology. The region's growth is predominantly fueled by continuous renovation projects and the demand for premium, branded hardware. Manufacturers here focus heavily on compliance (e.g., ADA standards) and developing innovative electronic access solutions that cater to both the residential luxury segment and high-security commercial installations.

Europe, driven by Western economies like Germany, France, and the UK, exhibits a strong preference for high-quality, precision-engineered hardware, emphasizing durability and aesthetic integration within heritage and modern architecture. Sustainability mandates are particularly rigorous in this region, favoring manufacturers who utilize environmentally sound processes and materials. Eastern European markets offer higher growth potential due to ongoing infrastructure modernization and increasing foreign direct investment in real estate. The market in Europe is also characterized by strong specialization, with several players dominating niche segments like specialized fittings for high-performance windows and doors.

Asia Pacific (APAC) stands out as the engine of global market growth. Countries such as China, India, and Southeast Asian nations are undergoing unprecedented rates of urbanization, leading to massive new construction volume across residential, commercial, and industrial sectors. While the region is price-sensitive, there is a rapidly expanding segment demanding premium hardware due to rising middle-class incomes and international architectural influence. Local production capabilities are highly competitive, though dependency on raw material imports and adherence to diverse regional standards present ongoing challenges. Investments in affordable housing and smart city projects further solidify APAC’s dominance in market volume.

Latin America presents a market with significant untapped potential, though growth can be intermittent due to economic instability and high levels of informal construction in some areas. Brazil and Mexico are the largest contributors, where demand is spurred by large-scale public infrastructure projects and a growing formal housing sector. The emphasis in this region is often on robust, high-security hardware that can withstand varied climate conditions. The Middle East and Africa (MEA) are marked by substantial investment in luxury hospitality, retail, and commercial complexes, particularly in the UAE, Saudi Arabia, and Qatar. This sector demands ultra-high-end, custom-designed hardware and advanced access control systems, often imported from leading global manufacturers. African nations are focusing on basic, functional hardware driven by large-scale affordable housing initiatives.

- North America: High penetration of smart locks; strong renovation market; strict regulatory environment (ADA compliance).

- Europe: Focus on sustainable manufacturing; demand for high-precision, aesthetic fittings; strong emphasis on energy-efficient building hardware.

- Asia Pacific (APAC): Highest volume growth due to rapid urbanization in China and India; price-sensitive market with emerging luxury segments; high investment in new infrastructure.

- Latin America: Growth tied to economic stability; demand for durable and secure hardware; strong regional manufacturing presence in large economies like Brazil.

- Middle East & Africa (MEA): Demand concentrated in high-value commercial and hospitality projects; substantial government spending driving construction; reliance on imported high-end products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Builder Hardware Market, analyzing their product portfolios, geographical presence, strategic initiatives, and recent financial performance.- ASSA ABLOY

- Stanley Black & Decker

- Dormakaba Group

- Allegion plc

- Hettich Group

- Masco Corporation

- Tyman PLC

- Blum Inc.

- Hafele GmbH & Co KG

- Spectrum Brands Holdings, Inc.

- Kwikset

- Schlage

- Richelieu Hardware Ltd.

- Gainsborough Hardware Industries

- Sobinco NV

- Valli&Valli

- Rocky Mountain Hardware

- Salice America

- Hager Companies

- CompX International

Frequently Asked Questions

Analyze common user questions about the Builder Hardware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Builder Hardware Market?

Market growth is primarily driven by accelerating global urbanization, which necessitates new construction; rising adoption of smart home technology demanding connected hardware; and increased government and private spending on infrastructure and renovation projects globally. The shift towards aesthetic, high-quality architectural components also contributes significantly.

How is smart technology transforming traditional builder hardware components?

Smart technology, including IoT and biometrics, is transforming hardware by integrating electronic access control (smart locks), remote operation, and seamless compatibility with building management systems (BMS). This shifts hardware functionality from purely mechanical to digitally managed security and convenience systems, increasing product value.

Which geographical region holds the highest growth potential for builder hardware manufacturers?

The Asia Pacific (APAC) region is projected to hold the highest growth potential, largely due to unprecedented rates of urbanization and massive construction investments in developing economies like India and China. While North America and Europe lead in premium market value, APAC leads in volume and growth trajectory.

What challenges are restraining market expansion in the short to mid-term forecast?

Key challenges include high volatility and supply chain instability for essential raw materials (steel, zinc, aluminum), which directly affects manufacturing costs. Additionally, the fragmented market structure and intense competition from low-cost generic products present barriers to entry and pricing pressures for premium brands.

What is the role of sustainable materials in the future development of builder hardware?

Sustainable materials and processes are becoming crucial, particularly in mature markets like Europe. The future role involves using recycled content, minimizing waste in manufacturing (e.g., through Additive Manufacturing), and employing environmentally friendly surface finishes (e.g., PVD coatings) to meet increasing regulatory requirements and consumer demand for 'green' building solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager