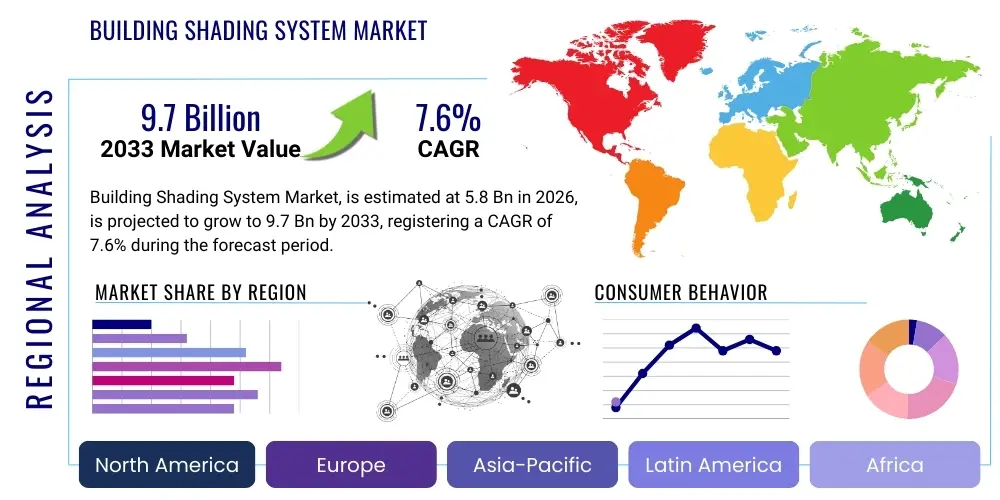

Building Shading System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441191 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Building Shading System Market Size

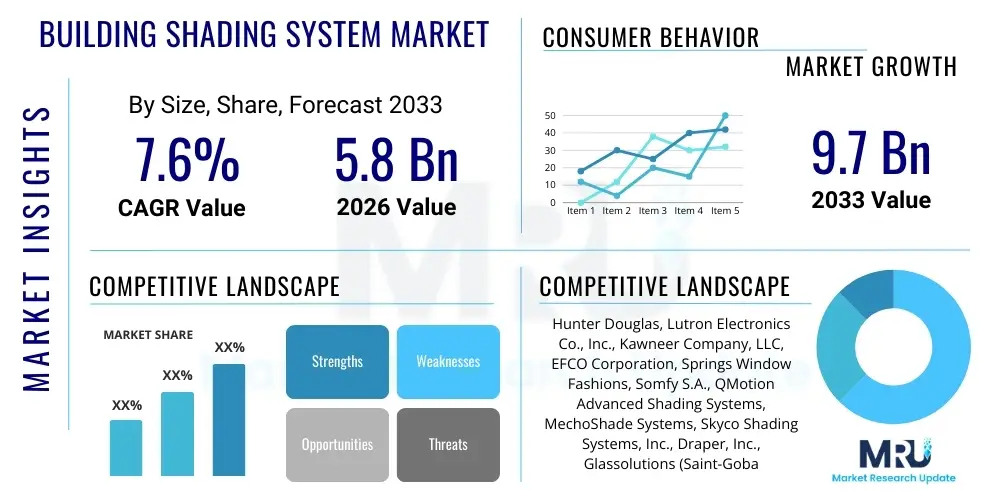

The Building Shading System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.6% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.7 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by global mandates toward energy efficiency in the construction sector, increasing adoption of smart building technologies, and the necessity to comply with stringent green building certifications such as LEED and BREEAM. The integration of advanced materials and automation features, particularly in the commercial and institutional sectors, contributes significantly to this upward trajectory, positioning building shading as a critical component of modern facade engineering designed for thermal comfort and daylight optimization.

Market valuation growth reflects the paradigm shift from static shading solutions to dynamic, responsive systems. While initially adopted for aesthetic purposes, building shading systems are now recognized as essential components for mitigating solar heat gain, thus reducing reliance on HVAC systems. The high demand for sophisticated external shading solutions, which are significantly more effective at blocking solar radiation before it enters the building envelope compared to internal systems, further fuels the market expansion. Furthermore, continuous product innovation, including the development of photovoltaic-integrated shading and electrochromic glass technologies, provides premium value offerings that bolster average selling prices and market revenue over the forecast period.

Building Shading System Market introduction

The Building Shading System Market encompasses a diverse range of architectural elements designed to control the amount of solar radiation and daylight entering a structure, thereby managing interior thermal conditions and visual comfort. These systems are categorized broadly into internal and external solutions, utilizing materials such as advanced fabrics, aluminum, wood, and glass composites. Major applications span commercial infrastructure (offices, hotels, healthcare facilities), institutional buildings (schools, government complexes), and increasingly, high-end residential properties seeking improved energy performance and sophisticated aesthetics. Building shading systems are instrumental in achieving net-zero energy goals by substantially reducing cooling loads, minimizing glare, and optimizing the diffusion of natural light, which collectively enhances occupant well-being and productivity while providing substantial operational cost benefits.

Products within this market range from conventional vertical and horizontal louvers, fixed architectural fins, and retractable awnings to sophisticated dynamic systems like automated blinds and electrochromic windows. The central benefit of these systems is passive climate control; they act as a crucial buffer zone regulating energy exchange between the interior and exterior environments. The market’s growth trajectory is strongly influenced by driving factors suchating government incentives for energy-efficient construction, rising global awareness concerning climate change mitigation, and the rapid pace of urbanization in emerging economies, necessitating high-performance building envelopes that adhere to modern energy codes and standards.

The technological advancement in shading systems includes integration with Building Management Systems (BMS) and IoT platforms, allowing real-time adjustments based on factors like sun angle, outdoor temperature, and internal occupancy. This smart integration shifts shading from a static architectural feature to a dynamic energy management tool. The versatility and customization options available across materials and operational mechanisms ensure that these systems are adaptable to various architectural styles and climatic zones, reinforcing their indispensable role in sustainable building design and construction globally. This technological convergence ensures higher efficiency and personalized comfort, making shading solutions a core focus area for architects and engineers worldwide.

Building Shading System Market Executive Summary

The Building Shading System Market is characterized by robust business trends emphasizing automation, sustainable material usage, and integration with intelligent facade systems. The primary business driver is the push towards high-performance green buildings, where shading is viewed as a foundational element for achieving strict thermal efficiency targets. Key market players are investing heavily in R&D to develop lightweight, durable, and aesthetically appealing materials, alongside sophisticated control electronics that enable predictive and responsive shading operations. A major trend involves the increased market penetration of external shading solutions, particularly motorized louvers and retractable screens, due to their superior solar heat gain mitigation capabilities compared to traditional internal blinds. The competitive landscape is evolving rapidly, seeing convergence between traditional construction component manufacturers and high-tech sensor/software providers.

Regionally, the market exhibits varied maturity levels, with Europe leading in the implementation of stringent energy performance directives (EPD) that mandate the use of high-efficiency shading systems, thereby ensuring sustained, high-value growth in the region. Asia Pacific (APAC) represents the fastest-growing market, propelled by massive commercial construction booms, rapid infrastructure development, and increasing awareness regarding the long-term operational cost savings associated with energy-efficient envelopes. North America demonstrates strong growth centered on the integration of complex, fully automated systems within large corporate campuses and institutional buildings, driven by corporate sustainability goals and federal tax incentives. The Middle East and Africa (MEA) are also emerging as significant consumers, especially for external systems designed to manage extreme solar irradiance and high ambient temperatures.

Segmentation trends indicate a strong shift towards the automated and motorized segments across product types, reflecting the demand for convenience, precision, and integration with smart home or smart office environments. While traditional materials like aluminum remain prevalent for durability and structural integrity, the use of specialized high-performance fabrics (e.g., fiberglass, polyester) is escalating, particularly in roller shade and screen applications due to their thermal properties and aesthetic versatility. Commercial application remains the dominant segment by revenue, given the large glass surface areas in modern commercial architecture and the critical need to maintain thermal comfort and daylighting levels for large numbers of occupants, leading to larger project sizes and higher system complexity requirements.

AI Impact Analysis on Building Shading System Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Building Shading System Market predominantly center around optimizing energy consumption, predictive maintenance capabilities, and achieving hyper-personalized internal comfort levels. Users frequently ask how AI can move shading control beyond simple sun tracking to encompass real-time weather predictions, internal occupancy detection, and integration with dynamic HVAC load balancing. Key themes that emerge include the desire for automated systems that self-learn and adjust to optimize contradictory goals—maximizing daylight penetration while minimizing glare and heat gain—and concerns about the interoperability challenges when integrating complex AI algorithms into existing legacy Building Management Systems (BMS). Expectations are high for AI-driven systems to deliver demonstrable reductions in energy usage (beyond basic automation) and to offer superior resilience through predictive fault detection of motorized components.

- Predictive Energy Optimization: AI algorithms analyze historical data (weather, occupancy, HVAC performance) to proactively adjust shading angles and positions, minimizing solar heat gain before it impacts cooling loads.

- Occupancy-Based Control: Integration with internal sensor networks allows shading systems to adjust zones based on real-time room occupancy, ensuring localized comfort and energy savings in unoccupied areas.

- Glaze and Daylight Harvesting Management: AI optimizes blind retraction and slat angles to maximize the penetration of diffuse natural light deeper into the floorplate while avoiding direct, harsh solar glare that impairs visual comfort.

- Fault Detection and Predictive Maintenance: Machine learning models analyze motor performance data (current draw, speed, cycle frequency) to predict potential mechanical failures in motorized components, reducing downtime and maintenance costs.

- Dynamic Interoperability: AI acts as a sophisticated middleware layer, ensuring seamless communication and coordinated action between the shading system, lighting controls, and the central HVAC system for holistic climate management.

DRO & Impact Forces Of Building Shading System Market

The Building Shading System Market is shaped by significant Drivers promoting adoption, certain Restraints hindering growth, and substantial Opportunities for future expansion, all culminating in powerful Impact Forces that influence investment and technological development. The primary driver is the accelerating focus on energy efficiency in commercial real estate, mandated by increasingly strict government regulations worldwide, coupled with the rising cost of electricity. These factors create an indisputable business case for investing in shading systems that drastically cut down HVAC energy consumption. Conversely, a major restraint is the high initial capital expenditure associated with advanced, motorized, and integrated external shading systems, particularly when compared to simpler, static architectural elements or internal blinds. This cost barrier often proves prohibitive for smaller construction projects or budget-sensitive residential retrofits, slowing mass market adoption.

Significant opportunities exist in the burgeoning retrofit market, where existing buildings must be upgraded to meet contemporary energy standards, providing a continuous stream of demand for specialized, customizable shading solutions. Furthermore, the convergence of shading technology with renewable energy generation, such as BIPV (Building-Integrated Photovoltaics) shading elements, offers a potent opportunity to transform facades into active energy generators. The impact forces are predominantly environmental and economic: the undeniable link between building envelopes and global energy consumption places political and public pressure on the construction industry to implement effective solar control. Economic forces, driven by the desire for long-term operational savings and higher asset valuation (green premium), further accelerate the demand for high-performance shading solutions, overriding the initial investment hurdles for many large-scale commercial developers.

The market also faces restraints related to complex installation and maintenance requirements for intricate external systems, especially on high-rise structures, requiring specialized skills and increasing overall project complexity. Design integration challenges, ensuring shading systems harmonize aesthetically and structurally with diverse architectural visions, also pose a constraint. Despite these challenges, the prevailing market trend is toward sophisticated, digitally controlled, and sustainable solutions. Opportunities arising from product differentiation, such as self-cleaning coatings or ultra-lightweight composite materials, further enhance market attractiveness. These market dynamics collectively ensure that the demand for smart, high-efficiency shading systems will continue to grow, solidifying their role as essential components in the future of sustainable architecture and urban development.

Segmentation Analysis

The Building Shading System Market is comprehensively segmented based on product type, mechanism, material, application, and operation type to provide granular insights into market dynamics and growth pockets. Product segmentation differentiates between interior and exterior solutions, recognizing that exterior systems generally offer superior thermal performance but higher installation complexity. Mechanism segmentation highlights the shift from fixed to dynamic systems, while material segmentation identifies trends towards sustainable and high-durability composites. Application analysis confirms the dominance of the commercial sector, though residential adoption of automated systems is growing rapidly. Understanding these segmentations is crucial for manufacturers to tailor their product offerings, sales strategies, and supply chain logistics to capitalize on areas exhibiting the highest growth potential, particularly the smart and external shading sub-segments that align closely with energy efficiency mandates and smart building infrastructure.

The detailed segmentation structure reflects the technological diversity and functional specialization within the market. For instance, the transition from manually operated shading to fully automated, sensor-driven systems represents a significant value addition and market premium, especially in large-scale commercial deployments where centralized control is essential for energy management. Similarly, material choices are increasingly influenced by regulatory requirements concerning fire resistance, durability, and recyclable content, pushing manufacturers toward advanced polymers, reinforced fabrics, and recycled aluminum. The segmentation analysis thus serves as a map for strategic market entry and competitive positioning, indicating where innovation in materials, mechanics, and control systems will yield the highest returns.

- By Product Type:

- Interior Shading Systems (Blinds, Shades, Curtains, Interior Louvers)

- Exterior Shading Systems (Awnings, Exterior Blinds, Exterior Louvers/Fins, Shutters, Screens)

- By Mechanism/Technology:

- Fixed Shading Systems

- Dynamic/Adjustable Shading Systems (Motorized, Manual)

- Smart/Automated Systems (Integrated with BMS/IoT)

- Electrochromic and Thermochromic Glazing

- By Material:

- Metal (Aluminum, Steel)

- Glass (Clear, Tinted, Insulated)

- Fabric/Textile (Polyester, Fiberglass, Specialized UV-resistant materials)

- Wood and Composites

- By Application/End-Use:

- Commercial Buildings (Offices, Retail, Hospitality)

- Residential Buildings (Single-family, Multi-family)

- Industrial and Institutional Buildings (Hospitals, Schools, Government)

- By Control System:

- Manual Operation

- Motorized Operation (Wired, Wireless)

- Centralized Control (BMS Integration)

- Decentralized Control (Local Sensors)

Value Chain Analysis For Building Shading System Market

The Value Chain for the Building Shading System Market begins with the upstream sourcing of raw materials, involving key inputs like aluminum billets, specialty polymers for fabrics and coatings, and electronic components such as motors, sensors, and microcontrollers. High-quality raw material suppliers are crucial, as the performance and longevity of shading systems depend heavily on corrosion resistance, UV stability, and mechanical strength. Component manufacturing, including the production of specialized actuators, framing elements, and control boards, represents the next critical step. This stage requires precision engineering and quality control, especially for motorized and dynamic systems, where reliability is paramount for integration into complex building management infrastructures. Technological advancement often dictates the choice of upstream partners, favoring those who can supply sustainable, lightweight, and durable inputs.

Mid-stream activities involve the design, fabrication, and assembly of the final shading system. System integrators and dedicated manufacturers take standardized components and customize them based on specific architectural drawings and performance requirements (e.g., wind load specifications, thermal transmittance targets). This process often requires high levels of customization and specialized welding, coating, or textile processing. Direct distribution channels often involve close collaboration between the manufacturer and architectural firms or large construction contractors (B2B model), particularly for high-value commercial projects. Indirect distribution routes utilize established networks of specialized distributors, dealers, and installers who handle sales, integration, and post-installation support for smaller commercial or residential projects, providing regional market penetration and logistical efficiency.

The downstream analysis focuses on the final installation, commissioning, and subsequent maintenance activities. Installation complexity varies greatly; static internal blinds are straightforward, while large, exterior motorized facades require specialized rigging and electrical expertise. End-users (building owners and facility managers) rely heavily on reliable after-sales service and scheduled maintenance to ensure the continued optimal performance of integrated shading and control systems. The direct channel offers greater control over installation quality and direct feedback, crucial for high-tech systems, while indirect channels provide scale. The evolving landscape sees a growing emphasis on software services and data analytics derived from BMS integration, adding a recurring revenue stream to the traditional component sales model, thereby extending the value chain beyond the initial purchase and installation phase.

Building Shading System Market Potential Customers

The primary potential customers and buyers in the Building Shading System Market are categorized by their role in the construction and facility management lifecycle, spanning from initial design conception to ongoing building operation. Architects and facade consultants represent a key customer group, as they specify the type, material, and integration level of the shading system during the preliminary design phase, prioritizing aesthetic compatibility and thermal performance compliance. Large-scale general contractors and specialized glazing contractors are direct buyers who procure and install the systems according to architectural specifications, focusing on cost-efficiency, reliability, and ease of installation within tight project timelines.

Crucially, commercial building owners, real estate developers, and large institutional bodies (e.g., universities, government agencies) are the ultimate end-users, driven by the need for regulatory compliance, reduced operating expenses (HVAC costs), and higher tenant satisfaction. These entities increasingly favor advanced, automated systems that integrate seamlessly with existing smart building infrastructure to provide long-term operational data and performance optimization. For the residential segment, high-net-worth individuals and developers of luxury multi-family units constitute the main buyer base, prioritizing convenience, aesthetic appeal, and smart home integration.

Facility managers represent another critical customer segment, especially in the maintenance and retrofit markets. They are responsible for the ongoing efficiency and functionality of installed systems. Their purchasing decisions are heavily influenced by the reliability, ease of maintenance, and the total cost of ownership (TCO) of the shading systems. As regulatory pressure increases, governmental bodies are also significant buyers, often specifying standardized, high-efficiency shading solutions for public infrastructure projects, adhering strictly to energy conservation codes, thus making public sector procurement a stable and volume-driven revenue stream for specialized manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.7 Billion |

| Growth Rate | CAGR 7.6% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hunter Douglas, Lutron Electronics Co., Inc., Kawneer Company, LLC, EFCO Corporation, Springs Window Fashions, Somfy S.A., QMotion Advanced Shading Systems, MechoShade Systems, Skyco Shading Systems, Inc., Draper, Inc., Glassolutions (Saint-Gobain), Insolroll, Inc., Colt International, Warema International GmbH, Alutech Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Building Shading System Market Key Technology Landscape

The technology landscape for the Building Shading System Market is rapidly evolving, driven primarily by the pursuit of passive energy optimization and enhanced user experience through automation. A foundational shift involves the transition toward sophisticated Dynamic Facade Technology, which utilizes integrated sensors and algorithmic control to automatically adjust shading elements (such as louvers, blinds, or screens) based on real-time external conditions (sun position, intensity, wind speed) and internal demands (temperature, occupancy). Key technological advancements include the miniaturization and increased reliability of specialized, low-power motors (DC and stepping motors) that enable silent, precise, and high-speed operation for large facade elements, critical for maintaining occupant comfort and structural integrity during high winds.

Furthermore, the development and commercialization of Smart Glass technologies, particularly Electrochromic (EC) and Thermochromic (TC) glass, represent a major disruption. EC glass allows the optical properties (tint level) to be adjusted electrically, effectively acting as a dynamic, solid-state shade without moving parts. While initial costs remain high, their aesthetic appeal and seamless integration are highly valued in premium architectural projects. IoT integration is paramount, facilitated by wireless communication protocols (like Zigbee, Z-Wave, and dedicated RF systems) that allow shading devices to be networked with centralized Building Management Systems (BMS). This connectivity enables complex control strategies, energy data logging, and remote diagnostics, moving shading systems into the realm of intelligent climate control devices rather than simple mechanical components.

Advanced material science also plays a significant role, particularly in the development of specialized solar control fabrics with high solar reflectance (Rs) and low solar heat gain coefficients (SHGC). These materials provide optimal balance between daylight transmission (Visual Light Transmittance - VLT) and thermal blocking. The integration of Building Information Modeling (BIM) tools is also critical in the technology stack, allowing architects and engineers to accurately simulate the solar performance and long-term energy savings of specific shading designs before construction begins. This predictive capability reduces design risk and validates the investment in higher-cost, high-performance shading solutions, ensuring the technological implementation directly meets performance targets.

Regional Highlights

- Europe: Europe maintains market leadership, largely driven by the stringent Energy Performance of Buildings Directive (EPBD) and regional commitments to decarbonization and net-zero construction goals. Countries like Germany, France, and the UK exhibit high adoption rates for advanced, external shading solutions and smart glass integration. The focus is on robust, long-lasting products that comply with high regulatory standards, fostering innovation in passive solar design and control system interoperability. The well-established renovation market further contributes substantial demand for high-efficiency retrofits.

- North America: The market in North America, particularly the U.S. and Canada, is characterized by rapid adoption of IoT-enabled and centralized shading controls, driven by large commercial and technology campus projects prioritizing sophisticated BMS integration and corporate sustainability initiatives. While regulatory mandates are less uniform than in Europe, strong economic incentives and green building movements (e.g., LEED certification) push developers toward high-performance facades. The region exhibits high demand for aesthetically pleasing interior and exterior systems that deliver energy savings without compromising modern architectural transparency.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by unprecedented urbanization, massive infrastructural investments (especially in China, India, and Southeast Asia), and a high concentration of new commercial and mixed-use construction. Although market maturity varies, increasing energy costs and rising middle-class disposable incomes are accelerating the demand for both functional and high-end automated shading systems. The intense solar exposure in many parts of the region makes external shading and highly durable materials mandatory for managing heat load, driving substantial volume growth in the next decade.

- Latin America (LATAM): Growth in LATAM is concentrated in key urban centers like Brazil and Mexico, driven by sustainable development projects and growing international investment in commercial real estate. The market often favors locally manufactured or imported standardized systems, although there is a slowly growing appetite for smart, motorized solutions, particularly in high-rise residential and upscale hospitality projects aimed at energy conservation and improved occupant amenity.

- Middle East and Africa (MEA): The MEA region is a critical market for robust external shading systems due to extreme heat and solar irradiance. Demand is driven by major giga-projects and governmental investments in resilient, high-efficiency infrastructure (e.g., UAE, Saudi Arabia). The focus is overwhelmingly on external systems designed for high wind loads, high temperatures, and dust resistance, requiring durable metal and composite materials, ensuring specialized market requirements are met.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Building Shading System Market.- Hunter Douglas

- Lutron Electronics Co., Inc.

- Somfy S.A.

- Kawneer Company, LLC (Arconic)

- EFCO Corporation

- Springs Window Fashions

- QMotion Advanced Shading Systems

- MechoShade Systems

- Draper, Inc.

- Skyco Shading Systems, Inc.

- Glassolutions (Saint-Gobain)

- Insolroll, Inc.

- Colt International

- Warema International GmbH

- Alutech Group

- Rockwell Automation (Control Systems)

- Elero GmbH

- Sefar AG

- Verosol

- Architectural Shading Systems, Inc.

Frequently Asked Questions

Analyze common user questions about the Building Shading System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between interior and exterior shading systems in terms of energy performance?

Exterior shading systems provide superior thermal performance because they intercept and reflect solar radiation before it passes through the glazing and converts to heat inside the building envelope, potentially reducing cooling loads by up to 80%. Interior systems are effective for glare control and diffused light but are less efficient at mitigating solar heat gain.

How do smart shading systems contribute to a building’s overall energy efficiency and BMS integration?

Smart shading systems utilize sensors and AI/algorithms to dynamically adjust in real time based on sun angle, exterior temperature, and occupancy. This automation optimizes daylight harvesting while minimizing solar heat gain, ensuring coordination with the HVAC and lighting systems via the Building Management System (BMS) to achieve maximal passive cooling savings and comfort.

Which material segments are expected to drive the highest growth in the dynamic shading market?

The metal (primarily aluminum) and high-performance technical fabric segments are expected to drive the highest growth. Aluminum is preferred for durable external louvers and fins due to its light weight and corrosion resistance, while specialized technical fabrics offer superior optical and thermal properties essential for roller shades and screens, balancing transparency and heat blocking effectively.

What is the main restraining factor affecting the mass adoption of high-end shading systems?

The primary restraining factor is the high initial capital expenditure (CapEx) associated with fully automated, integrated, and exterior-grade systems, including complex motors, sensors, and installation costs. While the long-term operational savings (OpEx) are substantial, this upfront investment often presents a financial barrier for smaller projects or existing building retrofits.

How does the Building Shading System Market align with global green building standards like LEED and BREEAM?

Shading systems are fundamental to achieving points in LEED and BREEAM certifications, particularly within the Energy and Atmosphere (EA) and Indoor Environmental Quality (EQ) categories. They directly demonstrate performance in reducing energy demand, managing solar heat gain, and providing high levels of occupant visual and thermal comfort, making them essential components for certified green buildings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager