Bulb Sockets Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441194 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Bulb Sockets Market Size

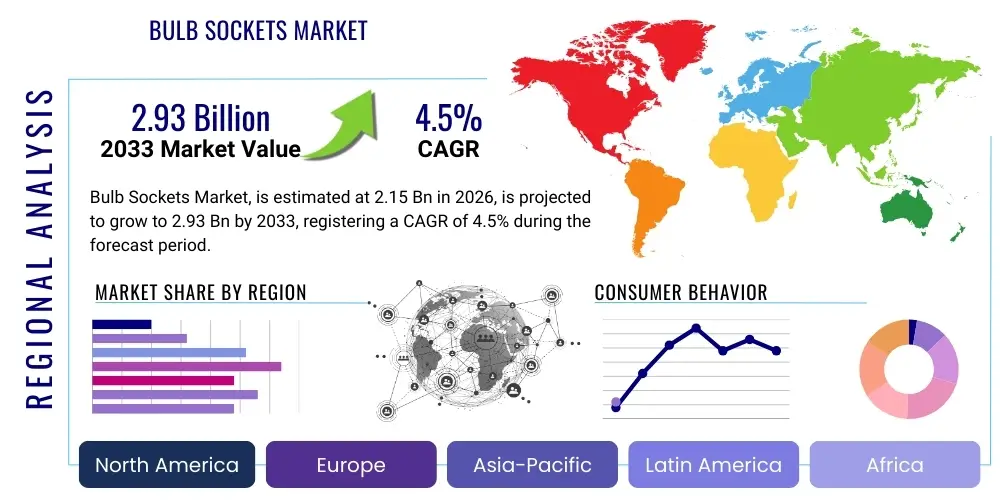

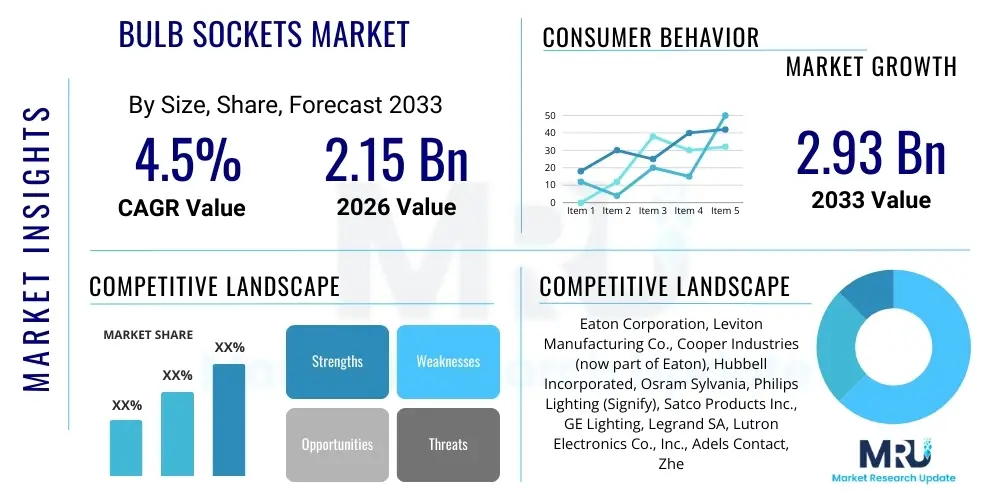

The Bulb Sockets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $2.15 Billion in 2026 and is projected to reach $2.93 Billion by the end of the forecast period in 2033.

Bulb Sockets Market introduction

The Bulb Sockets Market encompasses the global trade and utilization of devices designed to mechanically and electrically connect lamps or light bulbs to a power source. These essential components, often standardized (such as E26, E27, GU10, B22), are critical for ensuring safety, thermal dissipation, and optimal electrical contact within lighting fixtures. The foundational role of bulb sockets in both residential and commercial infrastructure makes their demand intrinsically linked to construction activity, urbanization rates, and the continuous retrofitting and upgrade cycle of existing lighting systems globally. Recent market dynamics are heavily influenced by the transition from traditional incandescent lighting toward highly efficient LED technology, requiring specialized or optimized socket designs that handle lower heat loads and provide robust electrical stability for advanced driver electronics.

Product diversity within the market is substantial, spanning ceramic, plastic, and metallic materials, catering to diverse environments ranging from high-temperature industrial settings to moisture-resistant outdoor applications. Key applications include general lighting systems in architectural, automotive, and theatrical sectors. The driving forces behind market expansion are multifaceted, primarily centered on stringent global energy efficiency mandates, which necessitate the replacement of outdated fixtures with modern, socket-compatible solutions. Furthermore, the rising adoption of smart lighting systems, which integrate control electronics directly into the fixture or the bulb base, places greater demands on socket reliability and integration capabilities.

The core benefit of modern bulb sockets lies in their adherence to international safety standards (like UL, CE, RoHS), minimizing electrical hazards and ensuring consistent performance over the lifespan of the lighting installation. Growth is particularly robust in developing economies, fueled by rapid infrastructural development, and in mature markets, driven by the replacement of aging infrastructure and the deployment of advanced, connected lighting ecosystems. Manufacturers are constantly innovating materials and mechanical designs to reduce installation complexity, enhance thermal management properties, and improve durability, thereby extending the replacement cycle of the sockets themselves and ensuring compatibility across a wide spectrum of lamp types.

Bulb Sockets Market Executive Summary

The Bulb Sockets Market is experiencing a pivotal transformation driven by profound shifts in lighting technology and regulatory landscapes. Business trends are characterized by consolidation among major manufacturers focusing on intellectual property related to LED compatibility and smart fixture integration. There is a strong emphasis on developing highly durable, cost-effective thermoplastic and ceramic composite sockets that meet enhanced fire safety standards, particularly for use in commercial and high-density residential buildings. The competitive landscape is intensely focused on supply chain optimization, addressing geopolitical disruptions, and ensuring compliance with regional standards, which differ significantly across North America, Europe, and Asia Pacific. Strategic partnerships between socket manufacturers and smart lighting control companies are becoming increasingly common to offer integrated solutions that simplify installation for electricians and end-users.

Regionally, the Asia Pacific (APAC) market maintains dominance in terms of volume, attributed to high population density, rapid infrastructural expansion, and robust manufacturing bases in countries like China and India. However, North America and Europe lead in terms of value growth, primarily fueled by the premium pricing associated with certified, high-efficiency, and smart-enabled sockets required for sophisticated retrofitting projects and adherence to strict building codes. Emerging markets in Latin America and the Middle East and Africa (MEA) demonstrate significant growth potential, driven by national energy access initiatives and large-scale public infrastructure projects requiring standardized and ruggedized lighting solutions. Investment in automated manufacturing processes in these regions is also a nascent trend designed to reduce labor costs and improve production consistency.

Segment trends highlight a noticeable migration towards the E27/E26 and GU10 socket standards due to the pervasive adoption of screw-in and twist-and-lock LED bulbs. The material segmentation indicates an increasing preference for engineered plastics and high-grade ceramics over traditional brass and standard thermoplastics, owing to superior dielectric properties and heat resistance required for higher wattage industrial LED systems. Furthermore, the market for specialty sockets—such as those used in automotive or medical applications—is exhibiting stable, high-margin growth, driven by stringent quality requirements and specialized form factors. The ongoing standardization efforts by international bodies are streamlining production processes but simultaneously intensifying price competition within the mass-market, commodity segment.

AI Impact Analysis on Bulb Sockets Market

User queries regarding the impact of Artificial Intelligence (AI) on the Bulb Sockets Market primarily revolve around themes of manufacturing efficiency, predictive maintenance integration, and the role of the socket within a broader smart home ecosystem. Users seek clarification on whether AI will lead to the obsolescence of traditional sockets or if it will primarily serve to optimize their production and deployment. Key concerns focus on the integration complexity of smart sockets (sockets embedded with sensors and connectivity modules) and the security implications of networking basic lighting components. Expectations center on AI-driven supply chain transparency, improved quality control through machine vision, and the capability of AI models to forecast demand for specific socket standards based on macro-economic indicators and regional construction trends.

While the bulb socket itself remains a passive electromechanical component, AI significantly influences the processes surrounding its production and application. In manufacturing, AI and machine learning algorithms are utilized for real-time monitoring of injection molding parameters, precision component assembly, and defect detection using advanced optical inspection systems, leading to minimized tolerances and improved product reliability. This optimization reduces material waste and increases throughput, directly impacting profitability. Furthermore, AI-powered demand forecasting integrates complex variables—such as climate data, energy policy changes, and housing starts—to provide manufacturers with highly accurate production schedules, minimizing inventory holding costs and ensuring timely supply of specific socket standards.

In the application phase, while the physical socket is not "intelligent," the fixtures incorporating them are increasingly part of IoT networks managed by AI. AI algorithms manage smart lighting loads, optimize energy consumption based on occupancy and daylight harvesting data, and perform predictive maintenance on entire lighting circuits. Smart sockets, which integrate microcontrollers for remote control and sensing (e.g., monitoring current draw or temperature), leverage AI backend processing to detect anomalies, identify faulty bulbs or fixtures, and trigger maintenance alerts, enhancing the overall system longevity and operational efficiency of large commercial installations.

- AI-driven Quality Control: Implementation of machine vision and deep learning models for automated, high-precision defect detection during assembly, reducing failure rates.

- Predictive Maintenance Integration: Utilization of AI to analyze data streams from smart fixtures (current, temperature) to predict socket or bulb failure, minimizing downtime in industrial settings.

- Optimized Manufacturing: Machine learning algorithms fine-tuning production parameters (e.g., injection pressure, curing time) for ceramic and plastic components, improving material integrity.

- Supply Chain Forecasting: AI models analyzing global construction trends, energy mandates, and inventory levels to optimize the sourcing and distribution of specific socket types.

- Smart System Management: AI acts as the central intelligence governing interconnected lighting systems, using the passive socket as a critical node in an energy management network.

DRO & Impact Forces Of Bulb Sockets Market

The Bulb Sockets Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces determining future growth trajectories. The primary Driver is the global regulatory push toward energy-efficient lighting, mandating the replacement of older, less efficient incandescent and fluorescent fixtures with modern LED solutions. This replacement cycle necessitates compatible, high-quality sockets, especially standardized fittings like E27/E26 and GU10, which are globally adopted for LEDs. Concurrently, the proliferation of smart home technology and building automation systems acts as a strong driver, encouraging the adoption of sophisticated fixtures that require robust, connected socket infrastructure. Infrastructure development in emerging economies also fuels volume demand for basic, cost-effective socket types.

Key Restraints challenge the market’s linear progression. The primary restraint is the increased lifespan of LED bulbs, which dramatically reduces the frequency of replacement demand for both bulbs and associated sockets, dampening the replacement cycle revenues. Furthermore, intense price competition, particularly within the mass-produced plastic segment, compresses profit margins for standard socket manufacturers. Material volatility, especially concerning copper, brass, and specialized engineering plastics, introduces instability in manufacturing costs. Regulatory complexity, where different regions maintain slightly varied, non-interchangeable standards (e.g., North American vs. European threading specifications), also hinders global production scale efficiencies.

Opportunities for growth are significant, particularly in the niche markets of specialized industrial and high-heat applications, where high-performance ceramic sockets command premium pricing due to enhanced safety requirements. The rising trend of modular and track lighting systems presents an opportunity for innovative, tool-less connection sockets and proprietary track systems. Moreover, manufacturers have an opportunity to integrate sensors (temperature, ambient light) directly into the socket housing, transforming the component from a passive connector into an active data node within the Internet of Things (IoT) ecosystem, thereby generating value beyond simple electrical connection and capturing market share in the smart building sector. Overall, the dominant Impact Force is technological convergence, where the necessity for interoperability between physical lighting components and digital control systems dictates product development.

Segmentation Analysis

The Bulb Sockets Market is comprehensively segmented based on Type, Application, Material, and Standard, reflecting the diverse requirements of the global lighting industry. This granular segmentation is essential for understanding consumption patterns, technological evolution, and regional supply chain specialization. The Type segmentation distinguishes between highly durable, heavy-duty industrial sockets and standard residential or decorative sockets, reflecting significant differences in manufacturing complexity, material choice, and pricing structure. The application environment dictates material selection, ranging from moisture-resistant sockets for outdoor use to high-temperature ceramic sockets required in heat-intensive fixtures such as certain commercial downlights or stage lighting.

Material segmentation reveals a critical dichotomy: cost-sensitive mass production relies heavily on engineered plastics (such as polycarbonate or PBT), favored for their dielectric properties and ease of molding. Conversely, specialized high-reliability applications, including industrial facilities, specialized baking ovens, or historical preservation lighting, maintain demand for ceramic (porcelain) sockets due to their unparalleled heat resistance and fire safety characteristics. The Standard segmentation—the most influential factor for interoperability—is dominated by global conventions, primarily the Edison screw base (E series) and bayonet systems (B series), with increasing traction seen in GU-type pin bases optimized for modern LED spotlights.

This detailed segmentation allows market players to focus their research and development efforts. For instance, companies targeting the retrofit market prioritize E26/E27 thermoplastic sockets with superior thermal management properties, ensuring compatibility with existing fixtures while safely accommodating modern LED drivers. Meanwhile, firms targeting new construction in Europe often focus on B22 and GU10 standards, adhering to local architectural and electrical specifications. The segmentation clearly outlines where value concentration lies: generally higher margins are associated with specialized, high-specification sockets (e.g., weatherproof, marine-grade, or high-temperature ceramic), whereas standard thermoplastic sockets represent the largest volume but operate under tighter margins due to intense commodity competition.

- By Type:

- Standard Sockets (Edison Screw, Bayonet)

- Specialty Sockets (Candelabra, Intermediate)

- Fluorescent Sockets (T-Series)

- Halogen Sockets (GU/GZ Series)

- Smart/Connected Sockets (Integrated connectivity)

- By Material:

- Ceramic (Porcelain) Sockets

- Plastic (PBT, Polycarbonate) Sockets

- Metallic/Brass Sockets

- By Application:

- Residential Lighting

- Commercial Lighting (Office, Retail)

- Industrial Lighting (Warehouses, Factories)

- Outdoor & Street Lighting

- Automotive Lighting

- By Standard:

- Edison Screw Base (E26, E27, E14, E12)

- Bayonet Base (B22, B15)

- Pin Base (GU10, G9, GX53)

- Proprietary and Specialty Bases

Value Chain Analysis For Bulb Sockets Market

The Value Chain for the Bulb Sockets Market begins with upstream analysis, focusing on the procurement of critical raw materials. This includes high-grade ceramic compounds (porcelain, steatite), specialized engineering plastics (Polybutylene Terephthalate or PBT, and Polycarbonate), and conductive metals like copper, brass, and zinc alloys used for contacts and terminals. Raw material sourcing is critical; price volatility in commodities directly impacts manufacturing costs. Suppliers of these primary materials hold moderate bargaining power, especially for specialized plastics and high-purity ceramic powders required for UL/CE certified products. Successful upstream integration involves securing long-term supply contracts and implementing advanced inventory management to mitigate price fluctuations and ensure material quality compliance.

The midstream stage involves manufacturing and assembly. This phase is capital-intensive, requiring specialized machinery for injection molding (for plastic sockets), pressing and firing (for ceramic sockets), and automated high-speed assembly processes for securing conductive contacts. Key activities here include precision tooling, quality control (CQ) testing for dielectric strength and thermal resistance, and final packaging. Geographic concentration of manufacturing, particularly in Asian countries, allows for lower operating costs, but necessitates high investment in automation to maintain competitive advantage and consistent quality standards necessary for export to highly regulated markets like North America and Europe. Certification and regulatory adherence (UL, CE, VDE) constitute major value additions at this stage.

Downstream analysis covers distribution channels and end-user engagement. Distribution is multifaceted, involving both direct and indirect channels. Direct sales often target large Original Equipment Manufacturers (OEMs) who integrate sockets into lighting fixtures, or major infrastructural projects (e.g., street lighting installation). Indirect channels utilize a robust network of electrical wholesalers, hardware distributors, large retail chains, and increasingly, e-commerce platforms. The trend towards B2C and D2C sales via online marketplaces is growing, facilitating market access but intensifying price transparency and requiring robust logistics. Wholesalers and distributors play a critical role in inventory holding and providing localized technical support, essential for the fragmented market of electricians and small contractors who constitute the primary installers of replacement sockets.

Bulb Sockets Market Potential Customers

Potential customers for bulb sockets are broadly categorized across residential, commercial, and industrial segments, with specific buyers determined by the volume and type of socket required. The largest segment of buyers, in terms of sheer volume, comprises lighting fixture manufacturers (OEMs). These companies purchase sockets in massive quantities, requiring deep customization, strict dimensional tolerances, and high levels of compliance documentation for integration into their final products (e.g., chandeliers, recessed lighting, track lights). OEMs are highly price-sensitive but prioritize supplier reliability and certification status above all else, ensuring that the integrated socket does not compromise the final fixture's safety rating.

A second major customer base includes electrical wholesalers, distributors, and large retail hardware chains (B2B and B2C sales). These entities purchase sockets for the replacement and retrofit market. Their procurement decisions are driven by inventory diversity (stocking all major standards like E26, E27, GU10), packaging suitability for shelf display, and margin potential. The professional electrical contractor, who procures sockets through these distributors, acts as the ultimate decision-maker regarding installation volume, favoring products that offer ease of installation, high durability, and strong warranty support. This customer group values accessibility and immediate availability of products.

Finally, specialized procurement bodies, such as governmental agencies, municipal infrastructure departments, and large industrial corporations (e.g., manufacturing plants, shipping ports), represent high-value, niche customers. These buyers often require highly specialized, ruggedized, or certified sockets—such as marine-grade, explosion-proof, or high-voltage sockets—often purchased directly from specialized manufacturers. Their buying criteria prioritize performance specifications, regulatory compliance in harsh environments, and long-term reliability over initial cost, leading to higher average selling prices in this market segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion |

| Market Forecast in 2033 | $2.93 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, Leviton Manufacturing Co., Cooper Industries (now part of Eaton), Hubbell Incorporated, Osram Sylvania, Philips Lighting (Signify), Satco Products Inc., GE Lighting, Legrand SA, Lutron Electronics Co., Inc., Adels Contact, Zhejiang Light Holdings, NINGBO ZHONGLI LIGHTING, JINXU Electrical, Wenzhou Huaou Electric, Mersen, Schurter Holding AG, Phoenix Contact, WAGO Kontakttechnik, IDEAL Industries, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bulb Sockets Market Key Technology Landscape

The technology landscape for the Bulb Sockets Market, while seemingly mature, is undergoing evolutionary changes driven by the demands of smart lighting and LED integration. Traditional socket technology focused on simple mechanical integrity and electrical conductivity, utilizing standardized contact mechanisms like screw-in threads or bayonet pins. The key technological shift now centers on thermal management and dielectric performance. Modern LED drivers are sensitive to temperature fluctuations; thus, sockets must be designed with materials (high-PBT compounds or specialized ceramics) that facilitate heat dissipation while maintaining structural integrity under continuous load. Manufacturing technology is highly advanced, utilizing high-precision robotic assembly and automated inspection systems to ensure stringent dimensional accuracy, crucial for reliable contact connection and adherence to safety standards.

A significant area of technological innovation is the development of ‘tool-less’ or rapid connection systems, moving beyond traditional screw terminals toward push-in or lever-operated terminals (often utilizing WAGO or Phoenix Contact technology principles adapted for socket bases). These innovations dramatically reduce installation time and potential wiring errors in large-scale commercial deployments, providing a distinct competitive advantage in the contractor market. Furthermore, smart socket technology integrates connectivity modules (Wi-Fi, Zigbee, Bluetooth mesh) and microcontrollers directly into the base unit. This integration allows the socket to function as a gateway or sensing node, collecting data on current draw, temperature, and supporting remote control functionality, fundamentally changing the socket’s utility from a simple conductor to an IoT device enabler.

Material science remains at the core of technological advancement. Research is heavily focused on developing halogen-free, flame-retardant thermoplastics that offer superior tracking resistance and high Comparative Tracking Index (CTI) values, exceeding basic safety requirements, particularly for fire-safety critical installations in public infrastructure. Advanced stamping and plating technologies are also utilized to create highly resilient and low-resistance contacts, ensuring reliable power transfer to sophisticated LED drivers, which are more susceptible to poor contact quality than legacy incandescent bulbs. The pursuit of robust, standardized, and yet cost-effective socket designs that universally accommodate the variability in global bulb standards and power requirements remains a constant technological challenge.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: The APAC region commands the largest market share globally, driven by two primary factors: massive volume consumption in new construction and infrastructure projects, particularly in China, India, and Southeast Asian nations; and the presence of the world’s largest manufacturing base for lighting fixtures and components. The market here is highly price-sensitive, leading to intense competition in the standard plastic socket segment (E27 and B22). Regulatory harmonization efforts, particularly driven by regional trade blocs, are gradually standardizing technical specifications, although local variance remains significant. The rapid adoption of LED street lighting programs across major metropolitan areas in China and India is a critical driver for high-specification outdoor sockets.

- North America (NA) Market Maturity and Value Focus: North America, comprising the United States and Canada, is characterized by stringent safety and quality standards (UL, ETL listings), leading to a higher average selling price for sockets. Growth is primarily driven by retrofitting older commercial buildings to meet modern energy codes and the strong consumer demand for smart lighting solutions, particularly in the residential sector. The market strongly favors the E26 Edison screw base standard. Technological innovation, especially in integrating sockets with smart home platforms (Z-Wave, Zigbee), originates frequently from this region, focusing on value-added features like energy monitoring capabilities integrated into the socket unit.

- European Market Standardization and Regulatory Stringency: Europe is highly standardized under CE directives and focuses heavily on energy efficiency and environmental compliance (RoHS). The market is diversified, with significant demand for GU10 pin bases and B22 bayonet fittings, reflecting historical architectural norms. Germany, France, and the UK are key markets, emphasizing high-quality, durable materials, often leading to a greater demand for specialized ceramic and high-grade plastic sockets that comply with VDE and related European norms. The emphasis on sustainable building practices, such as nearly zero-energy buildings (NZEB), drives demand for highly efficient, tightly integrated fixture components.

- Latin America (LATAM) Infrastructural Growth: The LATAM region represents a high-potential, developing market, characterized by significant governmental investment in public infrastructure modernization and expansion of electricity access. Countries like Brazil and Mexico are undergoing mass transitions to LED lighting, creating steady demand for affordable, yet reliable, standard sockets (primarily E27). Market growth is often volatile, tied closely to national economic stability and large-scale public sector tenders. Manufacturers often compete on durability against common power instability issues, leading to a focus on products with enhanced surge protection compatibility.

- Middle East and Africa (MEA) Project-Driven Demand: Growth in the MEA market is largely project-driven, fueled by massive construction booms in the Gulf Cooperation Council (GCC) states (e.g., Saudi Arabia, UAE) and urbanization in major African economies (e.g., South Africa, Nigeria). Demand is typically high-specification in the GCC due to luxury construction requirements, often favoring sockets certified for extreme temperatures and desert environments. Conversely, the African market focuses on robust, affordable solutions for rural electrification and basic housing projects. The adoption of smart city concepts in places like Dubai and Riyadh further accelerates demand for advanced, networked lighting components, including high-tech smart sockets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bulb Sockets Market.- Eaton Corporation

- Leviton Manufacturing Co.

- Cooper Industries (now part of Eaton)

- Hubbell Incorporated

- Signify (Philips Lighting)

- Osram Sylvania

- Satco Products Inc.

- GE Lighting

- Legrand SA

- Lutron Electronics Co., Inc.

- Adels Contact

- Zhejiang Light Holdings

- NINGBO ZHONGLI LIGHTING

- JINXU Electrical

- Wenzhou Huaou Electric

- Mersen

- Schurter Holding AG

- Phoenix Contact

- WAGO Kontakttechnik

- IDEAL Industries, Inc.

Frequently Asked Questions

Analyze common user questions about the Bulb Sockets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth trajectory of the Bulb Sockets Market?

The primary driver is the mandated global transition from traditional incandescent and fluorescent lighting to highly energy-efficient LED technology, which requires compliant, modern socket designs capable of supporting advanced electrical loads and thermal requirements across both new construction and extensive retrofitting projects worldwide.

How do global standardization efforts impact manufacturers in the Bulb Sockets Market?

Standardization, particularly around the E series (Edison) and GU series (Pin bases), simplifies international trade and allows manufacturers to achieve economies of scale. However, regional variations in standards (e.g., voltage and specific safety certifications like UL vs. VDE) necessitate localized production or significant customization, adding complexity to the global supply chain management.

What role do ceramics and specialized plastics play in material segmentation?

Ceramics (Porcelain) are utilized predominantly in high-heat and industrial applications where superior thermal resistance and fire safety are non-negotiable, commanding premium pricing. Specialized engineering plastics like PBT are favored for mass-market residential and commercial sockets due to their excellent dielectric properties, moldability, and cost efficiency for LED integration.

Is the integration of smart home technology creating new market segments for bulb sockets?

Yes, the integration of smart home technology is generating the 'Smart Socket' segment. These sockets are embedded with Wi-Fi/Bluetooth modules and microcontrollers, allowing them to function as active data nodes for remote control, energy monitoring, and integration into IoT-managed lighting systems, moving beyond the traditional role of a passive connector.

Which geographical region holds the highest growth potential for high-value bulb sockets?

While Asia Pacific dominates in volume, North America and Europe demonstrate the highest growth potential in terms of value. This is driven by high regulatory compliance costs, significant demand for certified smart sockets, and ongoing sophisticated retrofitting projects that require premium, high-specification, and technologically integrated components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager