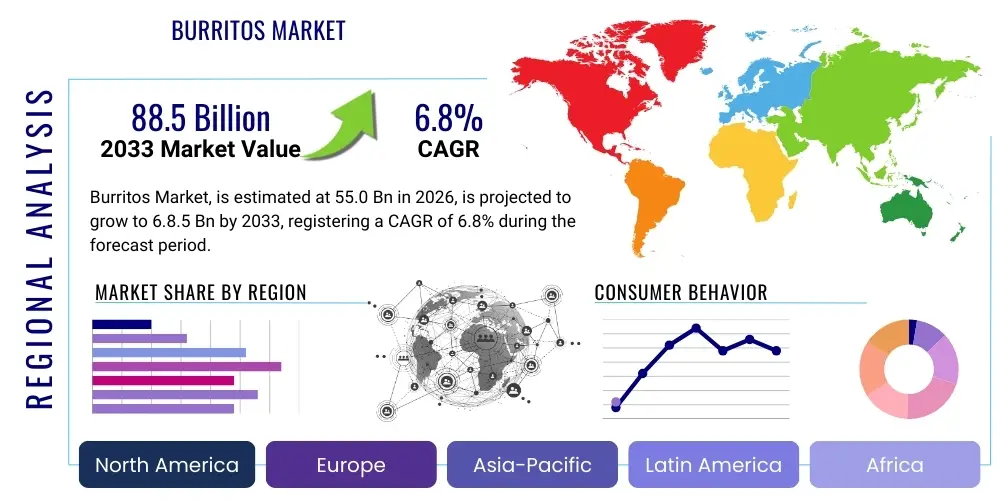

Burritos Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442304 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Burritos Market Size

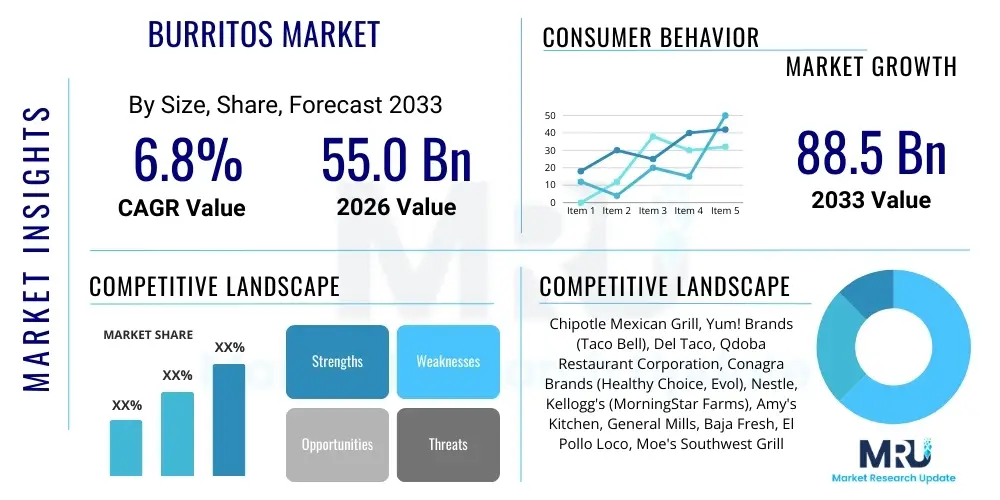

The Burritos Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 55.0 Billion in 2026 and is projected to reach USD 88.5 Billion by the end of the forecast period in 2033. This significant growth trajectory is primarily fueled by the increasing consumer demand for convenient, customizable, and globally inspired fast-casual food options. The burrito, being a highly versatile platform allowing for diverse dietary specifications—including vegan, keto, and high-protein content—is strategically positioned to capitalize on modern nutritional trends.

The valuation reflects global consumption across both foodservice channels, dominated by Quick Service Restaurants (QSRs) and fast-casual dining, and retail channels, featuring frozen and refrigerated ready-to-eat products. Expansion in emerging economies, coupled with sophisticated marketing efforts emphasizing fresh ingredients and ethical sourcing, contribute substantially to market acceleration. Furthermore, innovation in packaging and delivery logistics ensures sustained market penetration, particularly within urban and densely populated areas where meal preparation time is often limited. Investment in sustainable ingredients and reduced sodium options are also crucial factors differentiating key players.

Burritos Market introduction

The Burritos Market encompasses the global production, distribution, and consumption of burritos, defined as a versatile Mexican and Tex-Mex food item consisting of a tortilla wrapped around various fillings such as meat, beans, rice, vegetables, and condiments. This market segment has evolved significantly beyond traditional forms, embracing global fusion cuisine and tailored dietary options to meet diverse consumer preferences. Major applications span quick meal solutions, catering services, and packaged retail offerings, providing convenience and nutritional flexibility to consumers across all demographics. The primary benefits driving market traction include rapid consumption time, ease of portability, and high customizability, allowing consumers to adjust ingredients based on taste, caloric intake, or specific dietary restrictions, such as gluten-free tortillas or plant-based protein alternatives.

Driving factors for the market include the accelerating urbanization rate globally, which increases reliance on convenient, ready-to-eat meals, and the strong influence of Mexican and Tex-Mex culinary trends in Western and Asian markets. Furthermore, the rise of the fast-casual dining segment, spearheaded by large multinational chains, emphasizes ingredient quality, transparency, and consumer-centric service models, making burritos an appealing, higher-quality alternative to traditional fast food. Increased disposable income in developing regions also contributes to greater expenditure on international and prepared foods, cementing the burrito's position as a staple in the modern quick-service landscape.

Burritos Market Executive Summary

The Burritos Market is characterized by robust growth, driven by key business trends emphasizing menu customization, supply chain transparency, and digital integration. Business trends are dominated by strategic expansion in fast-casual chains, intense competition in the frozen food aisle through product innovation (e.g., sustainable packaging and ethnic flavor profiles), and the proliferation of virtual brands operating solely through delivery platforms. Regional trends show North America maintaining market leadership due to established cultural acceptance and high QSR density, while Asia Pacific exhibits the highest growth potential, fueled by increasing Westernization of diets and rising middle-class income. Latin America remains a foundational market, influencing authentic ingredient sourcing and flavor innovation globally.

Segment trends highlight the significant surge in demand for the Plant-Based Protein segment, responding directly to ethical and health-conscious consumer mandates. The Fresh/Ready-to-Eat category within the Product Type segment retains the largest market share, bolstered by consumer preference for perceived freshness and immediate consumption, facilitated by efficient last-mile delivery services. Distribution channel trends indicate that online delivery and mobile ordering platforms are increasingly critical, blurring the lines between traditional brick-and-mortar restaurants and purely digital food service models, thereby optimizing throughput and customer reach across geographical boundaries. These converging trends underscore a market that is highly responsive to health, convenience, and technological integration.

AI Impact Analysis on Burritos Market

User inquiries regarding AI's impact on the Burritos Market typically revolve around operational efficiency, personalization, and supply chain optimization. Key themes concern how AI can streamline order processing in high-volume fast-casual environments, whether personalized ingredient recommendations can boost customer loyalty and average transaction value, and the application of predictive analytics to minimize food waste and optimize inventory management, particularly for perishable components like fresh produce and prepared proteins. Consumers and stakeholders are keenly interested in automated quality control systems, robotic food assembly (especially for tedious tasks like wrapping and preparation), and sophisticated demand forecasting that adapts rapidly to localized events and weather patterns, ensuring optimal stock levels and ingredient freshness across thousands of franchise locations. The general expectation is that AI will drive down operational costs while significantly enhancing the consistency and speed of service, translating into a superior customer experience and higher profitability margins for leading market players.

- Supply Chain Prediction: Utilizing machine learning algorithms to forecast demand for specific ingredients, minimizing spoilage and optimizing procurement cycles, crucial for perishable items like avocados and fresh dairy.

- Personalized Ordering: AI-driven recommendation engines that analyze past purchase history and dietary preferences to suggest customized burrito compositions, enhancing customer engagement and upselling opportunities.

- Robotic Food Preparation: Implementation of automated robotic arms for precise ingredient dispensing, assembly, and wrapping, ensuring consistency and speed in high-throughput kitchen environments.

- Dynamic Pricing: AI systems adjusting menu pricing in real-time based on local demand, ingredient cost fluctuations, and competitor analysis to maximize revenue per order.

- Quality Control and Auditing: Computer vision systems monitoring the visual appearance and temperature compliance of prepared burritos, ensuring adherence to strict food safety and brand standards.

- Customer Service Automation: Use of chatbots and virtual assistants for handling common ordering inquiries, tracking delivery status, and managing loyalty programs, reducing labor costs in customer support.

- Operational Efficiency Mapping: Analyzing kitchen workflow data to identify bottlenecks and suggest layout or procedural modifications, optimizing the overall speed of service (throughput).

DRO & Impact Forces Of Burritos Market

The Burritos Market is dynamically influenced by a synergistic combination of Driving factors, operational Restraints, and strategic Opportunities, collectively constituting the critical Impact Forces shaping its competitive landscape. The primary drivers include robust consumer demand for convenient and portable meals, coupled with the increasing global popularity and acceptance of Mexican cuisine beyond its traditional geographies. Opportunities arise notably from the burgeoning health and wellness trend, encouraging the expansion of customized, plant-based, and functional ingredient options, alongside leveraging digital transformation for order efficiency and delivery expansion. However, the market faces significant restraints, principally the volatility of agricultural commodity prices (e.g., avocado, beef, rice), which impacts profitability margins, and persistent food safety concerns related to large-scale handling of fresh ingredients.

Impact forces are currently favoring rapid technological adoption and strategic diversification. The market benefits from strong consumer affinity towards customization, allowing brands like Chipotle and Qdoba to thrive on their build-your-own model. This customization ability mitigates the risk of menu stagnation and ensures responsiveness to fleeting dietary trends, such as the high-protein or low-carb movements. The inherent structural flexibility of the burrito as a product—capable of being adapted to breakfast, lunch, or dinner—provides year-round revenue stability. Furthermore, advancements in cryogenic freezing and packaging technology are significantly extending the shelf life and quality of retail-packaged burritos, widening their geographic reach and appeal in supermarket environments where convenience is paramount.

Conversely, the impact of labor costs, particularly in developed economies, remains a critical restraint, pushing operators towards automation solutions. Supply chain risks related to climate change and geopolitical instability affecting key sourcing regions necessitate significant investment in localized or alternative supply chains, which can inflate input costs. Successfully navigating these forces requires a dual strategy: aggressive investment in efficiency technologies to curb labor and operational costs, coupled with innovation in plant-based and premium offerings to maintain high average order values and appeal to affluent, health-conscious segments.

Segmentation Analysis

The Burritos Market is segmented comprehensively based on Product Type, Protein Type, Distribution Channel, and End-User, providing granular insights into consumer preferences and market dynamics. The segmentation reflects the diverse consumption patterns globally, ranging from quick-service restaurant dining to at-home preparation of frozen products. Analyzing these segments is essential for stakeholders to tailor product development, pricing strategies, and marketing campaigns effectively. The major segmentation axis centers on the readiness of the product—Fresh/Ready-to-Eat versus Frozen/Refrigerated—which dictates the primary distribution channel, whether through foodservice establishments or retail grocery environments. This structure allows for precise measurement of growth within the highly competitive fast-casual sector versus the steady-state packaged goods sector, highlighting where investment should be strategically deployed to capture maximum market share.

- By Product Type:

- Fresh/Ready-to-Eat Burritos

- Frozen Burritos

- Refrigerated Burritos

- By Protein Type:

- Beef Burritos

- Chicken Burritos

- Pork Burritos

- Plant-Based Burritos (Vegan/Vegetarian)

- Other Protein (Fish, Turkey, Specialty Meats)

- By Distribution Channel:

- Food Service (QSRs, Fast Casual, Full-Service Restaurants, Cafes)

- Retail (Supermarkets/Hypermarkets, Convenience Stores, Online Retail)

- By End-User:

- Adults

- Children/Families

- Institutions (Schools, Hospitals, Corporate Catering)

- By Size:

- Standard Size

- Snack Size/Mini

- Jumbo/XL Size

Value Chain Analysis For Burritos Market

The Burritos Market value chain is complex, spanning agricultural production, processing, assembly, distribution, and final consumption, highlighting critical dependency on upstream activities. Upstream analysis begins with the sourcing of agricultural commodities—tortillas (wheat/corn), proteins (meat and dairy farming), rice, beans, and fresh produce. Quality control and ethical sourcing at this stage are paramount, as ingredient integrity directly influences the final product’s perceived value and compliance with sustainability goals. Challenges include price volatility and the logistical complexity of managing fresh produce supply chains across large multinational operations. Key players often engage in vertical integration or long-term contracts with regional suppliers to mitigate these risks and ensure consistent ingredient quality, especially for signature items like grass-fed beef or specific pepper varieties, thereby maintaining brand identity and premium positioning.

Midstream activities involve processing and manufacturing, including the preparation of pre-cooked proteins, batch production of sauces and salsas, and the assembly/packaging of frozen or ready-to-eat burritos in centralized facilities. The efficiency of food processing technology, specifically continuous cooking lines and high-speed wrapping machinery, significantly impacts economies of scale. Downstream analysis focuses heavily on distribution channels, which are bifurcated between direct sales (QSRs/Fast Casual) and indirect retail sales (supermarkets). The direct channel relies heavily on robust logistics for daily replenishment and temperature control, while the indirect channel requires extensive cold chain management and strategic shelf placement in grocery stores.

The distribution network relies on both direct distribution, where large chains manage their own fleet and distribution centers for optimal control over ingredient freshness and delivery scheduling, and indirect distribution through third-party logistics (3PL) providers and wholesale distributors, especially for reaching remote or institutional customers. The rise of digital platforms has created a significant shift in the consumer interface, positioning delivery aggregators (DoorDash, Uber Eats) as critical intermediaries, influencing pricing and market access. Understanding this value chain asymmetry—where farm-to-table traceability meets last-mile delivery technology—is vital for optimizing cost structure and maximizing market reach while preserving ingredient quality until the point of consumption.

Burritos Market Potential Customers

The potential customer base for the Burritos Market is highly diversified, encompassing a broad demographic spectrum united by the need for convenience, affordability, and customization in meal solutions. Primary end-users include young professionals and urban populations (aged 20–45) who frequently rely on fast-casual dining and quick delivery options due to demanding work schedules and limited time for meal preparation. This group highly values ingredient quality, transparency, and the ability to tailor their order to specific health goals (e.g., high protein, low carbohydrate, or vegetarian), making them the core demographic for customized fast-casual chains. College students and budgetary consumers also form a crucial segment, attracted by the perceived value and substantial caloric content of a single burrito, often favoring cheaper QSR options or bulk purchases of frozen varieties for cost-effective eating.

Furthermore, families represent a significant and expanding segment, utilizing burritos as a convenient, quick dinner solution, particularly when purchasing multi-packs of frozen products from retail outlets. The increasing awareness and demand for international flavors also position immigrants and ethnic food enthusiasts as key buyers, seeking authentic or globally fusion interpretations of the dish. Finally, the growing cohort of health-conscious and ethical consumers (including flexitarians, vegans, and those with specific allergies) represents a high-growth customer segment. These buyers actively seek plant-based burritos, clean-label ingredients, and ethically sourced meats, driving innovation in ingredient technology and compelling manufacturers to offer validated nutritional information and transparency in sourcing practices to secure their patronage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 55.0 Billion |

| Market Forecast in 2033 | USD 88.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chipotle Mexican Grill, Yum! Brands (Taco Bell), Del Taco, Qdoba Restaurant Corporation, Conagra Brands (Healthy Choice, Evol), Nestle, Kellogg's (MorningStar Farms), Amy's Kitchen, General Mills, Baja Fresh, El Pollo Loco, Moe's Southwest Grill, Rubio's Coastal Grill, Jimboy's Tacos, Taco John's, Saffron Road, Trader Joe's, Puesto, Wahoo's Fish Taco, Freebirds World Burrito. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Burritos Market Key Technology Landscape

The technological landscape within the Burritos Market is characterized by innovations focused on enhancing operational efficiency, maintaining product quality across the cold chain, and improving customer engagement through digital interfaces. In-store technology adoption centers heavily on advanced Point-of-Sale (POS) systems integrated with kitchen display systems (KDS) to streamline order flow, manage customization requests accurately, and minimize preparation errors, particularly during peak hours. Furthermore, robotics and automation are gaining traction, moving beyond simple kitchen tasks to encompass automated ingredient dispensing and, in some pilot projects, full burrito assembly and wrapping, addressing high labor costs and ensuring product consistency across franchised locations. Investment in predictive maintenance for cooking and refrigeration equipment is also crucial to prevent costly downtime in high-volume settings.

In the packaged goods segment (frozen and refrigerated), technology is driven by materials science and food preservation techniques. Modified Atmosphere Packaging (MAP) and advanced freezing methods (e.g., cryogenic freezing) are vital for extending shelf life while preserving the texture and flavor profile of ingredients like rice, beans, and fillings upon reheating. Traceability technology, utilizing blockchain and QR codes, is being implemented to provide consumers with transparent information regarding the origin of key ingredients, responding directly to the growing demand for food safety and ethical sourcing validation. This level of technological integration ensures brand trust and supports premium pricing strategies for high-quality, pre-packaged burritos.

Digital technology forms the backbone of the customer-facing experience. Mobile ordering applications, integrated loyalty programs, and geo-fencing technologies enable highly efficient order placement and pickup/delivery management. Data analytics generated by these digital platforms provide comprehensive insights into consumer purchasing habits, allowing companies to dynamically manage promotions, test new menu items regionally, and forecast daily demand with high accuracy. This strategic use of data allows for optimal inventory management and targeted marketing, ensuring maximum return on investment and a personalized consumer journey from digital interaction to physical consumption.

Regional Highlights

- North America (Market Leader): The region, particularly the United States and Canada, dominates the global Burritos Market due to the established presence of major Tex-Mex and fast-casual chains, high consumer acceptance, and significant disposable income dedicated to convenience food. Innovation in plant-based proteins and aggressive expansion of digital ordering infrastructure continue to solidify its leading position. The US market dictates global trends in speed of service and menu customization.

- Europe (High Potential Growth): Growth is accelerating across Western European countries (UK, Germany, France) driven by increasing exposure to international cuisine and the demand for fast, lunch-time solutions. While traditionally slower to adopt QSR models than North America, European consumers show a strong preference for perceived quality and sustainability, driving demand for premium ingredients and non-GMO options in the burrito segment.

- Asia Pacific (Fastest Growing Region): This region is poised for the highest growth rate, fueled by rapid urbanization, Westernization of dietary habits, and the rise of the middle class in economies like China, India, and Southeast Asian nations. Market expansion here is largely focused on adapting flavor profiles to local palates (e.g., utilizing local spices or less spicy heat levels) and leveraging strong e-commerce and delivery platforms to penetrate dense urban centers.

- Latin America (Foundational Market): While deeply rooted in traditional Mexican cuisine, the market growth focuses on the modernization of delivery and QSR concepts, moving beyond street food vendors to formalized fast-casual settings. Local market dynamics influence global ingredient sourcing, particularly for authentic chili peppers, avocados, and beans, maintaining regional relevance and high consumption frequency.

- Middle East and Africa (Emerging Opportunities): Growth is nascent but promising, driven by expatriate populations and increasing international tourism, which introduces Tex-Mex concepts. Challenges include adherence to strict Halal dietary restrictions and localized supply chain constraints, necessitating adaptation in protein sourcing and preparation methods, primarily focusing on poultry and specific beef products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Burritos Market.- Chipotle Mexican Grill

- Yum! Brands (Taco Bell)

- Del Taco Restaurants, Inc.

- Qdoba Restaurant Corporation

- Conagra Brands (Healthy Choice, Evol)

- Nestle S.A.

- Kellogg's Company (MorningStar Farms)

- Amy's Kitchen Inc.

- General Mills (Old El Paso)

- Baja Fresh Mexican Grill

- El Pollo Loco Holdings, Inc.

- Moe's Southwest Grill (Focus Brands)

- Rubio's Coastal Grill

- Jimboy's Tacos

- Taco John's International, Inc.

- Saffron Road Food, Inc.

- Tyson Foods, Inc. (Prepared Foods Division)

- Puesto Holdings LLC

- Wahoo's Fish Taco

- Freebirds World Burrito

Frequently Asked Questions

Analyze common user questions about the Burritos market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the global Burritos Market?

The global Burritos Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven by increasing demand for convenient and customizable fast-casual food options worldwide.

Which segment is leading the growth in the Burritos Market based on protein type?

The Plant-Based Protein segment is currently leading market growth, reflecting a significant consumer shift towards vegetarian, vegan, and flexitarian diets due to health and environmental consciousness, fostering substantial innovation in meat alternatives.

How is technology impacting operational efficiency in the Burritos Market?

Technology is enhancing efficiency through AI-powered demand forecasting to minimize food waste, sophisticated mobile ordering platforms for quicker service, and robotic automation in food preparation to ensure product consistency and reduce escalating labor costs in foodservice operations.

What are the primary restraints affecting the profitability of burrito manufacturers and QSRs?

The primary restraints include high volatility in the pricing of essential agricultural commodities (e.g., beef, avocados, and grains) and rising operational costs associated with labor, stringent food safety regulations, and complex cold chain logistics required for fresh ingredients.

Which geographic region demonstrates the fastest expansion potential for burrito consumption?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, propelled by rapid urbanization, adoption of Western dietary habits among the expanding middle class, and aggressive market entry strategies by major global fast-casual brands.

The Burritos Market, valued at USD 55.0 Billion in 2026, is fundamentally characterized by its adaptability to consumer desires for speed, nutrition, and flavor diversity, establishing itself as a resilient and high-growth sector within the global prepared foods industry. The strategic emphasis on menu transparency, ethical sourcing, and omnichannel distribution—integrating high-street restaurants with sophisticated digital delivery platforms—is pivotal to maintaining competitive advantage. Leading players are heavily investing in supply chain resilience to mitigate commodity price risks and technological advancements, such as predictive analytics, to perfect inventory management for perishable ingredients, which is critical to profitability. Furthermore, the market's trajectory is increasingly defined by sustainable innovation; consumers are willing to pay a premium for burritos that offer certified organic ingredients, low-sodium options, and environmentally friendly packaging solutions, compelling manufacturers to recalibrate production and sourcing practices to align with these evolving ethical mandates. The differentiation between the Fresh/Ready-to-Eat category, focused on rapid throughput and ingredient customization, and the Frozen category, prioritizing shelf stability and convenience for at-home consumption, drives distinct investment strategies across the value chain, ensuring comprehensive market coverage across diverse consumer lifestyles and consumption occasions. This robust dual-channel strategy, backed by advanced logistics and data science, positions the Burritos Market for sustained and substantial expansion toward the USD 88.5 Billion projection by 2033. The competitive landscape requires continuous adaptation, focusing particularly on maximizing digital presence and leveraging consumer data to personalize marketing efforts and new product introductions, ensuring the longevity and relevance of the burrito format in the intensely dynamic global food industry.

The convergence of foodservice and retail channels, particularly through grocery delivery services that stock both QSR-branded meal kits and traditional frozen burritos, further complicates the competitive analysis. Companies are increasingly forging strategic partnerships with meal kit providers and dark kitchens to expand their geographic reach without significant capital expenditure on physical locations. This decentralized model allows for targeted market penetration in densely populated urban cores where real estate costs are prohibitive. Ingredient innovation extends beyond protein substitutes to include specialty tortillas (e.g., cauliflower, sweet potato) and functional fillings fortified with vitamins or gut-healthy fibers, directly appealing to the bio-hacking and wellness segment. Regulatory challenges, especially concerning nutritional labeling and trans-fat restrictions in various countries, necessitate proactive formulation adjustments by multinational corporations. The successful navigation of these regulatory environments, coupled with operational excellence driven by AI and automation, will be the defining factor distinguishing market leaders from regional competitors over the forecast period. The global footprint of Tex-Mex cuisine ensures that the fundamental appeal of the burrito remains strong, providing a consistent base for further, highly customized market expansion.

In terms of geographical dominance, while North America remains the revenue powerhouse, responsible for the vast majority of consumption value and menu innovation, the growth story is centered in APAC and parts of Europe, where the market is less saturated. European expansion is often led by domestic restaurant groups integrating high-quality, regionally sourced ingredients into the burrito format, resonating with local food culture that prioritizes provenance. Meanwhile, in APAC, the challenge is cultural adaptation—making the product appealing to palates less accustomed to heavy dairy or intensely spicy flavors, leading to lighter, customizable versions that incorporate local vegetables and seasoning. This regional divergence in strategy—optimization in saturated markets versus adaptation in emerging ones—is a hallmark of the current global burrito market structure. Capital expenditure is increasingly directed towards digitizing customer journeys, from AI-driven menu boards that suggest pairings to fully automated pickup lockers, cementing the burrito's status as a leader in food technology integration within the fast-casual space. Furthermore, sustainability reporting and ethical sourcing credentials are now non-negotiable requirements, particularly when targeting the influential Gen Z and Millennial consumer cohorts, compelling all major companies to establish clear, verifiable goals for reducing carbon footprint and improving labor practices across their expansive supply chains.

The market also faces constant innovation pressure from adjacent food categories, such as gourmet sandwiches, complex bowls, and various street food imports, necessitating continual refreshment of the product offering. Burrito chains frequently introduce limited-time offerings (LTOs) and seasonal ingredients to maintain consumer interest and test market viability for new flavor profiles without committing to permanent menu changes. For instance, the seasonal use of ingredients like pumpkin spice or unique regional chili peppers keeps the menu dynamic and engages consumer enthusiasm. Financial performance across the segment is closely tied to managing labor turnover; high staff retention through improved working conditions and training programs directly correlates with lower food waste and higher customer satisfaction scores due to consistent product quality. Thus, human capital management is increasingly viewed as a crucial competitive differentiator, alongside technological supremacy. The strong performance of the drive-thru and mobile order pickup channels, accelerated significantly by recent global events, underscores the lasting consumer preference for minimal contact and maximum speed, reinforcing the investment case for dedicated off-premise fulfillment infrastructure. The future competitive environment will reward organizations that can master the complex balance between rapid digital scaling, supply chain ethics, and maintaining an authentic, high-quality food experience across thousands of touchpoints globally.

The expansion into institutional settings, such as corporate cafeterias, university dining halls, and hospital food services, represents a substantial, yet often overlooked, growth vector. These settings require scalable, standardized solutions, which frozen or large-batch ready-to-eat burritos can easily fulfill, offering bulk purchasing advantages. The focus here shifts slightly from customization to nutritional compliance and regulatory adherence, particularly concerning allergen control and sodium levels. Companies targeting this institutional market must invest heavily in certified production facilities and robust quality assurance protocols to meet institutional standards. This B2B segment provides a stable, high-volume revenue stream, balancing the inherent volatility and marketing costs associated with the competitive consumer-facing fast-casual sector. Moreover, the development of specialty burritos designed for specific dietary needs, such as diabetic-friendly or low-carb options, opens up niche medical and therapeutic markets, further diversifying the application of the product. The ability to cater to such precise, high-stakes requirements validates the technological sophistication and supply chain control of the leading market players, solidifying the burrito's evolution from a simple street food item to a highly engineered, customizable meal solution capable of serving diverse segments from mass market consumers to specialized institutional clients.

The penetration of the market by non-traditional players, including major coffee chains and large packaged goods conglomerates leveraging their existing distribution networks, introduces intense cross-industry competition. These new entrants often possess superior logistical efficiency and capital resources, allowing them to quickly capture shelf space in convenience stores and quick-service gas stations, targeting the 'on-the-go' breakfast and lunch segments. To counter this, established fast-casual chains are increasingly developing branded retail products (e.g., proprietary salsas or packaged tortilla chips) and pre-packaged burritos for grocery sales, creating a virtuous cycle where the restaurant experience drives retail demand and vice versa. This blurring of lines requires a cohesive brand strategy that maintains quality perception across disparate consumer environments. Furthermore, the role of sustainability extends to waste management; restaurants are adopting innovative packaging solutions (e.g., compostable wrappers and biodegradable containers) to appeal to environmentally conscious consumers, especially in regions with strict municipal waste mandates. The long-term success of stakeholders will hinge on their agility in leveraging data science for hyper-local marketing, maintaining a diverse and ethically sound supply chain, and consistently delivering high perceived value relative to the cost of consumption, whether that consumption takes place in a dining room, a car, or at home.

Technological advancement is also observable in kitchen management systems that optimize the cooking process, ensuring ingredients are prepared perfectly to maintain moisture and texture, which is critical for the final product's quality, particularly when dealing with large volumes of rice and beans. Sophisticated temperature control logistics are employed not just during distribution but also during in-store holding times, guaranteeing food safety and taste consistency from the moment of assembly until the customer takes the first bite. The rise of cloud kitchens, or ghost kitchens, specifically dedicated to high-volume burrito delivery without a storefront, represents a significant operational innovation, lowering fixed costs and enabling rapid expansion into new geographic zones based purely on delivery radius modeling. These facilities utilize AI-optimized layouts and precise inventory tracking to maximize order throughput, achieving delivery speeds competitive with or superior to traditional QSRs. This model’s efficiency is transforming how fast food reaches the consumer, making the burrito even more accessible. Additionally, intellectual property development around unique flavor combinations, specialized ingredient processing (e.g., slow-cooked meats or innovative vegan cheeses), and patented wrapping techniques provides long-term competitive moats for key players, protecting their distinct product offerings from easy replication and sustaining premium market positioning based on proprietary formulations and methodologies.

The consumer electronics and digital integration landscape also profoundly influences the market dynamics. Wearable technology and smart home assistants are becoming new ordering channels, allowing consumers to place voice commands for their favorite burrito customized orders, further simplifying the purchasing process. This shift towards frictionless ordering requires significant backend investment in highly robust and scalable application programming interfaces (APIs) capable of integrating seamlessly with disparate technologies. Furthermore, augmented reality (AR) technology is being explored for marketing purposes, allowing consumers to visualize burrito customization options or track the journey of ingredients on their mobile devices, providing an interactive and transparent brand experience. The ability of major chains to aggregate and effectively analyze the vast quantities of data generated by these digital interactions—from click-through rates on promotions to real-time feedback on ingredient shortages—provides an unparalleled operational advantage, enabling proactive adjustments to menu items, staffing levels, and localized marketing efforts. This data-centric operational model underscores the transformation of the Burritos Market from a purely culinary field into a high-tech logistics and personalization sector, where the efficiency of the software is almost as critical as the quality of the salsa. Maintaining competitive edge requires continuous, high-level investment in cybersecurity to protect sensitive customer data collected through loyalty programs and mobile transactions, ensuring consumer trust in the digital ordering ecosystem. This confluence of culinary tradition and digital innovation defines the modern market structure.

The financial health of the Burritos Market is generally robust, characterized by strong margins in the fast-casual segment where average transaction value is significantly higher due to upselling opportunities (guacamole, premium proteins, beverages) and lower dine-in service costs compared to full-service restaurants. However, the frozen segment operates on tighter margins, relying heavily on efficient, large-scale manufacturing processes and favorable raw material costs to achieve profitability at retail price points. Investment strategy is therefore bifurcated: maximizing experiential value and customization in the QSR space, and achieving economies of scale and packaging innovation in the retail space. Merger and Acquisition (M&A) activities are frequent, often seeing large food conglomerates acquire smaller, innovative fast-casual chains or specialized plant-based burrito companies to quickly gain market share in high-growth niches and incorporate novel intellectual property. This pattern of strategic consolidation reflects the intense competition for novel flavor profiles and established brand loyalty, particularly among younger, affluent consumers. Transparency in corporate social responsibility (CSR) reporting—detailing efforts in minimizing food waste, promoting ethical labor practices, and sourcing sustainable palm oil or conflict-free ingredients—is now mandatory for maintaining investor confidence and appealing to the rising demographic of socially conscious investment funds, further integrating ethical considerations into the core market strategy and financial valuation of key stakeholders.

The regulatory environment across various operational geographies imposes distinct challenges and compliance costs. In the European Union, stricter regulations regarding food labeling, additive usage, and country-of-origin declarations necessitate complex supply chain management and documentation. Similarly, in parts of North America, regulations governing sodium content and calorie counts require continuous product reformulation, impacting flavor profiles and ingredient choices. The implementation of hazard analysis and critical control points (HACCP) systems across all production and preparation facilities is non-negotiable, particularly for fresh ingredients like unpasteurized cheeses, raw vegetables, and salsas, which pose higher microbiological risks. Companies that invest proactively in advanced food safety technologies—such as rapid pathogen testing and predictive risk modeling based on ingredient supply data—gain a significant reputational advantage and mitigate the high financial and brand damage associated with foodborne illness outbreaks. The market’s operational maturity is increasingly judged not just on speed and flavor, but on its verifiable commitment to public health and regulatory compliance on a global scale. This regulatory complexity acts as a barrier to entry for smaller, less-resourced competitors, ultimately favoring large, multinational corporations with established compliance infrastructures and global sourcing networks.

Finally, market dynamics are strongly influenced by demographic shifts, notably the increasing diversity of populations in major consumption hubs. This necessitates a continuous evolution of menu offerings to cater to nuanced cultural tastes, moving beyond generic Tex-Mex to incorporate regional Mexican cuisine variations (e.g., Oaxaca, Puebla) and even broader Latin American influences, such as Peruvian or Colombian flavors. The popularity of specialty diets—Keto, Paleo, Whole30—requires menu flexibility, offering options like "burrito bowls" without the tortilla or substitutions for rice, transforming the traditional burrito concept into a customizable, bowl-based platform. This flexibility is key to maximizing addressable market size. Furthermore, the role of social media influencers and culinary trends propagated via platforms like TikTok and Instagram cannot be overstated; these platforms rapidly disseminate new flavor combinations and drive localized spikes in demand, requiring rapid response capability from supply chain and marketing teams. The Burritos Market thrives on this confluence of culinary tradition, technological innovation, and acute responsiveness to fast-moving consumer trends, ensuring its relevance as a staple in the global diet and a sustained investment opportunity across the forecast period. The ability to quickly pivot menu composition and marketing narratives in response to digital trends is paramount for competitive differentiation and consumer loyalty in this high-velocity sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager