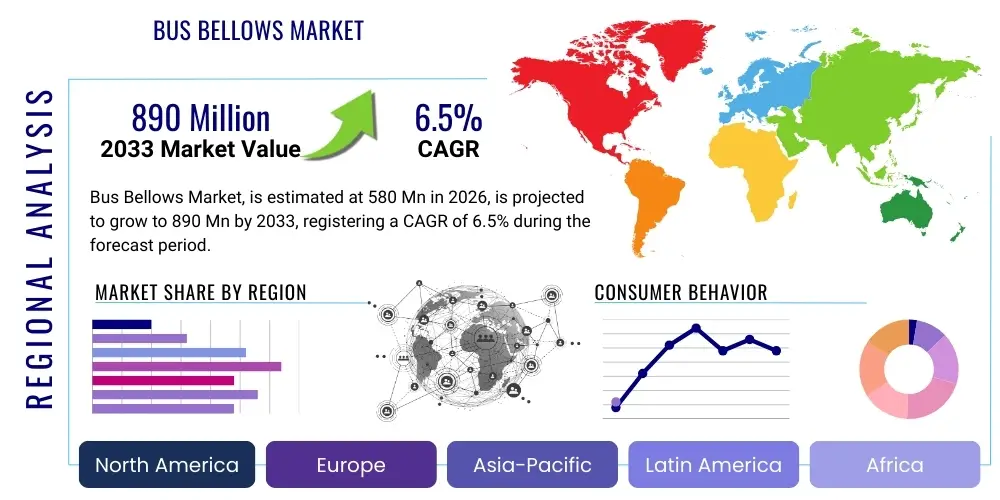

Bus Bellows Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442453 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Bus Bellows Market Size

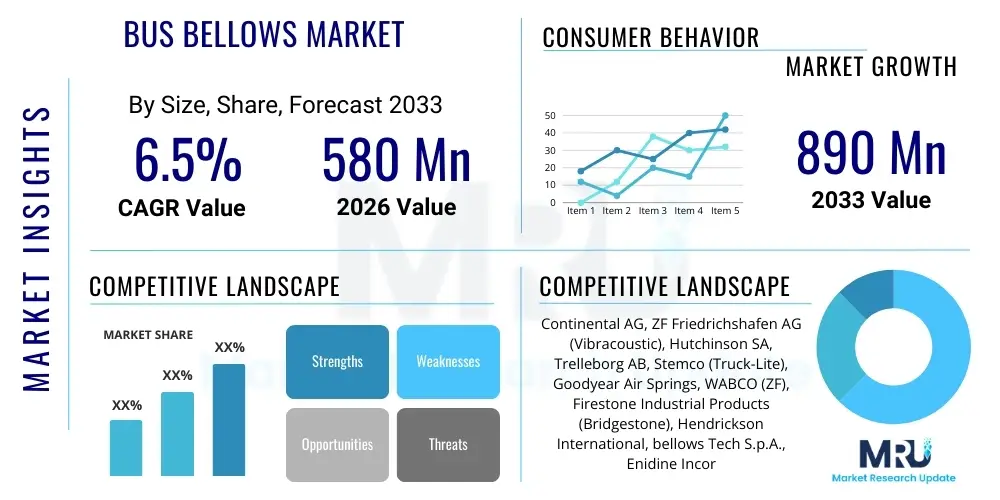

The Bus Bellows Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $890 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating global focus on urban public transportation infrastructure development, coupled with the increasing production and deployment of articulated and low-floor buses, particularly in emerging economies and established European markets.

Bus Bellows Market introduction

The Bus Bellows Market encompasses the manufacturing, distribution, and maintenance of flexible air suspension components critical for the safe and comfortable operation of modern articulated and transit buses. Bus bellows, often referred to as air springs or convoluted air bags, are indispensable elastomeric components used primarily in air suspension systems to absorb road shock, maintain ride height regardless of passenger load, and facilitate the articulation joint movement in extra-long buses. The primary function involves isolating the chassis from axle movements, thereby enhancing passenger comfort, vehicle stability, and reducing structural fatigue over the lifespan of the bus fleet.

Major applications for bus bellows extend across various segments of public transport, including city buses, long-distance coaches, and highly specialized articulated buses utilized for high-capacity Bus Rapid Transit (BRT) systems. The market is characterized by stringent quality standards owing to the critical safety function these components fulfill, demanding high durability against temperature fluctuations, chemical exposure, and mechanical stress. The shift towards electric and hybrid buses introduces new requirements regarding component weight reduction and enhanced vibrational damping characteristics, propelling continuous innovation in material science and design methodologies within the sector.

Driving factors for market growth include favorable government policies supporting green transportation initiatives, rapid global urbanization leading to increased demand for high-capacity public transport solutions like articulated buses, and technological advancements in suspension system design. Benefits derived from utilizing high-performance bus bellows include superior ride quality, extended tire life, minimized wear and tear on bus chassis components, and improved fuel efficiency due to consistent ride height control. Furthermore, the robust aftermarket demand, fueled by routine maintenance cycles and replacement requirements, ensures a stable revenue stream for market participants.

Bus Bellows Market Executive Summary

The Bus Bellows Market is currently experiencing robust business trends characterized by significant technological convergence, focusing on integrating smart suspension components capable of real-time diagnostics and adaptive response. Global original equipment manufacturers (OEMs) are increasingly demanding bespoke bellows solutions that offer superior resilience and compatibility with lighter, more advanced bus platforms, especially those powered by alternative fuels. The competition remains intense, centered around material durability (e.g., advanced polymers and reinforced synthetic rubber) and optimizing manufacturing precision to minimize failure rates under extreme operating conditions. Furthermore, strategic mergers, acquisitions, and long-term supply agreements between component manufacturers and major bus builders are defining the market structure.

Regionally, the market dynamics are highly fragmented yet promising. Asia Pacific (APAC) stands out as the fastest-growing region, driven primarily by massive investments in public infrastructure in China, India, and Southeast Asian nations, coupled with aggressive mandates for fleet modernization and the adoption of electric articulated buses. Europe maintains a mature, yet highly innovative market, characterized by stringent emission standards and a high proliferation of premium articulated buses in major urban centers. North America shows stable growth, primarily driven by the replacement cycle of aging transit fleets and incremental adoption of BRT systems, requiring reliable, heavy-duty suspension components suitable for diverse climatic conditions.

Segment-wise, the market is shifting towards Rolling Lobe Bellows, favored for their design simplicity, superior load-bearing capabilities, and suitability for complex electronic air management systems (EAMS). In terms of material, hybrid compositions combining high-performance synthetic rubbers with advanced textile reinforcement layers are gaining prominence, offering an optimal balance between low weight, high strength, and extended service life. The City Bus application segment continues to dominate market share due to the sheer volume of municipal transit operations worldwide, but the Coach Bus segment is exhibiting strong growth, propelled by the luxury and intercity travel sectors demanding maximum comfort and stability.

AI Impact Analysis on Bus Bellows Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Bus Bellows Market frequently focus on predictive failure analysis, optimization of manufacturing processes, and AI-driven supply chain resilience. Key concerns revolve around how machine learning algorithms can accurately forecast the remaining useful life (RUL) of bellows based on real-time operational data (load cycles, temperature, pressure changes), thereby minimizing unexpected vehicle downtime. Users also express interest in AI's role in optimizing the complex rubber compounding and molding processes to eliminate defects and ensure uniform material properties across large production batches. Expectations center on AI enabling a shift from scheduled maintenance to condition-based monitoring, leading to significant reductions in operational costs and enhancement of overall fleet safety metrics.

The application of AI in predictive maintenance for bus bellows is fundamentally transforming aftermarket services. Sensor data collected from air suspension systems—including pressure fluctuations, temperature, and vibration patterns—is fed into machine learning models. These models are trained to detect subtle anomalies that precede component failure, offering precise alerts to fleet managers. This shift not only optimizes inventory management by accurately predicting replacement needs but also substantially improves vehicle uptime, a critical metric for public transit operators. The high-stress nature of articulated bus operations makes such predictive capabilities invaluable, extending the operational life of the components beyond traditional maintenance schedules.

Furthermore, AI is being leveraged extensively in the design and manufacturing phases. Generative design algorithms, powered by AI, can rapidly iterate on bellows geometries to optimize stress distribution and material usage, leading to lighter yet more durable components. In the production facility, computer vision systems combined with machine learning are employed for highly precise quality control, instantly identifying microscopic defects or inconsistencies in the elastomeric structure during vulcanization and assembly. This enhances the overall reliability and reduces waste, ultimately lowering the total cost of ownership for transit authorities procuring buses equipped with these components. The integration of AI tools ensures that the mass production of specialized bellows adheres to the tightest tolerances required for modern, integrated suspension management systems.

- AI-driven Predictive Maintenance (PdM) reduces unplanned downtime by forecasting component failure.

- Machine Learning (ML) algorithms optimize elastomeric material compounding for superior fatigue resistance.

- Computer Vision systems ensure high-precision quality control during the manufacturing and assembly process.

- AI enhances supply chain resilience by optimizing raw material procurement and inventory levels based on global demand forecasts.

- Generative Design facilitates the rapid development of lightweight and stress-optimized bellows geometries.

DRO & Impact Forces Of Bus Bellows Market

The Bus Bellows Market is significantly influenced by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces shaping its trajectory. The primary driver is the global commitment to sustainable urban mobility, manifesting as governmental mandates favoring low-emission and electric bus fleets, many of which utilize air suspension systems to compensate for battery weight and enhance passenger experience. This is powerfully complemented by rapid global urbanization, necessitating high-capacity transport solutions like articulated buses, which are inherently reliant on sophisticated bellows systems for safe articulation. Restraints predominantly stem from the volatility in raw material prices, particularly specialized synthetic rubber and polymer composites, which directly impact manufacturing costs and profitability. Additionally, the high precision required in manufacturing, coupled with extended certification cycles, acts as a barrier to entry for smaller players.

The core opportunities in this market lie in technological innovation, specifically the development of smart, sensor-integrated bellows capable of communicating real-time performance data to the vehicle's electronic control unit (ECU). This integration facilitates true condition-based monitoring and adaptive suspension adjustments. Furthermore, the growing focus on lightweighting vehicles to maximize efficiency in electric buses provides an opportunity for manufacturers to develop hybrid or composite material bellows that offer the required strength and flexibility at a fraction of the traditional weight. The expansion of Bus Rapid Transit (BRT) networks worldwide presents a continuous, robust demand channel for articulated bus components, ensuring sustained growth, particularly in emerging markets where infrastructure investments are paramount.

These forces generate significant market impact. The push towards electrification accelerates demand for advanced materials and sensor integration (Opportunity & Driver impact), while geopolitical stability affecting the supply chain of elastomers and reinforcing fabrics introduces cost pressures (Restraint impact). The need for enhanced passenger safety and comfort remains a non-negotiable driver, compelling manufacturers to adhere to increasingly stringent performance and durability standards. The net effect is a market characterized by high investment in R&D, strategic partnerships focused on material science, and a continuous requirement for manufacturers to demonstrate component longevity and reliability under diverse operational stress profiles.

Segmentation Analysis

The Bus Bellows Market is meticulously segmented based on Type, Application, Material, and Distribution Channel, allowing for granular analysis of demand patterns and strategic focus areas. Understanding these segments is crucial for manufacturers to tailor their product offerings, optimize supply chain logistics, and prioritize R&D efforts. The technological distinctions between bellow types often dictate the appropriate application and performance envelope, while material science innovations are continually challenging established norms regarding weight, durability, and cost efficiency. The evolving global bus fleet composition, particularly the rise of electric articulated models, necessitates flexible segmentation strategies to capture nascent market opportunities effectively.

The segmentation by Type primarily differentiates between Rolling Lobe and Convoluted designs, each offering distinct advantages in load capacity, travel stroke, and packaging constraints relevant to specific bus axle designs. Application segmentation highlights the diverse operational requirements of city transit (frequent stops, high loads), intercity coaches (high speeds, comfort focus), and highly specialized transit systems like BRT. Material segmentation reflects the ongoing drive towards performance enhancement, moving beyond traditional rubber formulations to sophisticated polyurethane (PU) blends and hybrid elastomeric composites reinforced with high-strength synthetic fibers. Finally, the distribution channel breakdown analyzes the crucial distinction between OEM supply (initial fitment) and the lucrative, yet highly competitive, aftermarket segment (replacement and maintenance), essential for long-term revenue stability.

- By Type:

- Rolling Lobe Bellows

- Convoluted Bellows

- By Application:

- City Bus/Transit Bus

- Coach Bus/Intercity Bus

- Articulated Bus (BRT)

- By Material:

- Natural Rubber

- Synthetic Rubber (e.g., Chloroprene, EPDM)

- Polyurethane (PU) and Hybrid Composites

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

Value Chain Analysis For Bus Bellows Market

The value chain for the Bus Bellows Market begins with extensive upstream analysis focused on the procurement of specialized raw materials, primarily high-grade elastomeric compounds, textile reinforcement cords (e.g., nylon, aramid), and high-strength metal or plastic components for end closures and pistons. Raw material cost volatility and supply chain stability are critical determinants of profitability. Key manufacturers engage in long-term contracts with specialized chemical and polymer suppliers to ensure consistent quality and availability. The upstream phase also includes significant investment in R&D for material compounding, aiming to optimize characteristics such as ozone resistance, fatigue life, and operational temperature tolerance, which are prerequisites for meeting rigorous automotive standards.

The manufacturing process, which constitutes the core of the value chain, involves specialized techniques such as calendering, cutting, assembly, and vulcanization (curing). This is a highly capital-intensive stage, requiring precise molding equipment and sophisticated quality control systems, often utilizing automated or robotic assembly to ensure dimensional accuracy. Midstream activities are focused on efficiency, waste reduction, and continuous product testing. Once manufactured, the bellows transition to downstream distribution. The downstream analysis encompasses two primary pathways: direct sales channels to major global bus OEMs for integration into new vehicle production lines, and indirect sales channels targeting the expansive global aftermarket through independent distributors, authorized service centers, and fleet maintenance providers.

The dominance of the indirect channel in the aftermarket segment necessitates a robust and geographically extensive network to ensure timely availability of replacement parts across diverse operating regions. Direct distribution channels, while securing large-volume contracts, often require extensive technical collaboration and adherence to proprietary standards set by the bus manufacturers. Effective management of this dual distribution strategy—balancing high technical demands of OEM supply with the logistical complexity of aftermarket coverage—is a critical success factor. Furthermore, digitalization of the supply chain, incorporating technologies for tracking and managing inventory across these diverse channels, is becoming increasingly essential to maintaining market competitiveness and responsiveness.

Bus Bellows Market Potential Customers

The primary potential customers and end-users of bus bellows are segmented into three major categories, all characterized by the need for high reliability, durability, and compliance with strict regulatory standards. These include Global Bus and Coach Original Equipment Manufacturers (OEMs), large-scale Municipal Transit Authorities and Government Agencies, and Independent Aftermarket Service Providers and Fleet Owners. OEMs, such as Daimler Buses, Volvo, Scania, and BYD, represent the largest initial purchase volume, demanding components tailored precisely to their vehicle platforms and integrated suspension systems. For these customers, factors like product customization, just-in-time delivery, and proven track record of durability are paramount in the selection process.

Municipal Transit Authorities and government-owned BRT operators constitute a critical end-user group, directly influencing purchasing decisions based on operational lifespan, maintenance frequency, and compliance with local public safety regulations. These organizations often manage large, diverse fleets that experience extreme duty cycles, making the total cost of ownership (TCO) a crucial decision criterion. They typically source replacement parts either directly through established contracts or via tenders managed by national or regional procurement agencies. The demand from this segment is non-cyclical and driven by mandatory replacement schedules and fleet expansion, providing stable long-term demand.

Finally, the independent aftermarket, comprising vehicle repair garages, specialized suspension service centers, and independent fleet maintenance organizations, represents a high-volume, price-sensitive segment. These customers require widely available, interchangeable, and cost-effective replacement parts. While they prioritize immediate availability, quality and certification standards remain important to minimize liability and ensure vehicle safety. Targeting this customer base requires strong brand recognition, expansive distribution networks, and competitive pricing strategies, making the aftermarket vital for realizing sustained revenue growth across diverse geographical locations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $890 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, ZF Friedrichshafen AG (Vibracoustic), Hutchinson SA, Trelleborg AB, Stemco (Truck-Lite), Goodyear Air Springs, WABCO (ZF), Firestone Industrial Products (Bridgestone), Hendrickson International, bellows Tech S.p.A., Enidine Incorporated (ITT), Goma Juntas Industriales, Triangle Suspension Systems, Sumitomo Riko Co., Ltd., Vibracoustic GmbH, Air Lift Company, Dunlop Systems and Components, S&W Manufacturing, Knorr-Bremse AG, and PACCAR Parts. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bus Bellows Market Key Technology Landscape

The technological landscape of the Bus Bellows Market is characterized by a strong emphasis on material science innovation, precision engineering, and the integration of electronic control systems. Modern bellows manufacturing relies heavily on advanced elastomers, specifically formulations of EPDM (Ethylene Propylene Diene Monomer) or synthetic rubber compounds tailored for extreme resistance to ozone, UV degradation, and chemical exposure common in urban environments. The use of Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD) software is standard practice, enabling engineers to accurately simulate stress distributions under dynamic loading conditions, optimizing the profile and wall thickness of the bellows to maximize lifespan and minimize material use. This predictive modeling capability reduces physical prototyping cycles and significantly improves product launch efficiency.

A major technological frontier involves the transition to "smart" bellows systems, integrating micro-sensors (such as pressure, temperature, or strain gauges) directly into the component structure or adjacent mounting hardware. These sensors continuously monitor the operational health of the bellow, transmitting data wirelessly to the vehicle's electronic air management system (EAMS) and, potentially, to cloud-based fleet management platforms. This integration supports adaptive suspension control, where stiffness and damping characteristics are adjusted in real-time based on road conditions, speed, and load, dramatically improving vehicle handling and comfort. Furthermore, these smart systems are the foundation for predictive maintenance programs, allowing fleet operators to replace components proactively before catastrophic failure occurs, thereby maintaining high service levels.

Manufacturing technology also plays a crucial role. Modern facilities utilize high-precision injection molding and specialized vulcanization techniques to achieve highly repeatable material integrity and dimensional stability. Automation is increasingly employed in the assembly of the end closures (bead plates) onto the rubber sleeve to ensure a perfectly hermetic seal under high internal pressure. Furthermore, the development of lightweight components is driving the adoption of advanced thermoplastic polyurethanes (TPU) and hybrid structures reinforced with high-modulus fibers. These materials offer comparable durability to traditional rubber while achieving substantial weight reduction, a critical factor for extending the range and efficiency of electric and fuel cell buses currently entering global service fleets.

Regional Highlights

- Asia Pacific (APAC): APAC represents the most dynamic and fastest-growing region, primarily fueled by the massive governmental investment in public transit infrastructure, particularly in China and India. China's dominance in the global electric bus manufacturing sector means it is a colossal consumer of specialized air suspension components. Regional growth is also bolstered by stringent air pollution regulations that necessitate fleet modernization and the adoption of high-capacity articulated buses in rapidly expanding megacities. Local manufacturing capacity is also expanding rapidly, although reliance on specialized material imports remains a key concern.

- Europe: Europe is a mature market characterized by high regulatory standards, strong emphasis on passenger comfort, and a dense network of city and intercity bus routes. The region is a leader in implementing Bus Rapid Transit (BRT) systems and electric bus deployment, driving demand for technologically advanced, high-durability bellows, often featuring smart sensor integration. Germany, France, and the Nordic countries are major consumers, driven by continuous innovation cycles and demanding technical specifications from established European OEMs.

- North America: The North American market is stable, driven mainly by fleet replacement cycles and incremental adoption of high-capacity public transport solutions. Demand is concentrated in major metropolitan areas for transit buses and coaches. The market is characterized by a preference for heavy-duty components designed to withstand challenging road conditions and wide temperature variations. Regulatory mandates related to accessibility (low-floor buses) necessitate advanced air suspension solutions that maintain consistent kneeling and ride height features.

- Latin America (LATAM): LATAM exhibits significant potential, linked to large-scale BRT implementations in major cities like Bogota, Mexico City, and Rio de Janeiro. The market is highly price-sensitive but demands robustness due to often challenging road quality. Investments in fleet modernization are often tied to national infrastructure projects and foreign investment, leading to fluctuating but potentially high-volume demand spikes.

- Middle East and Africa (MEA): This region is an emerging market, driven by urbanization in Gulf Cooperation Council (GCC) states and infrastructure development in South Africa and North African nations. Demand is heavily influenced by climatic factors, necessitating bellows components engineered for extreme heat and high-dust environments. Market growth is primarily concentrated in luxury coach segment and new public transit initiatives in developing economic hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bus Bellows Market.- Continental AG

- ZF Friedrichshafen AG (Vibracoustic)

- Hutchinson SA

- Trelleborg AB

- Firestone Industrial Products (Bridgestone)

- WABCO (ZF)

- Goodyear Air Springs

- Hendrickson International

- Stemco (Truck-Lite)

- Knorr-Bremse AG

- Dunlop Systems and Components

- Triangle Suspension Systems

- Sumitomo Riko Co., Ltd.

- Air Lift Company

- S&W Manufacturing

- Enidine Incorporated (ITT)

- Goma Juntas Industriales

- bellows Tech S.p.A.

- PACCAR Parts

- MecAir s.r.l.

Frequently Asked Questions

Analyze common user questions about the Bus Bellows market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Bus Bellows Market?

Market growth is primarily driven by accelerating global urbanization, increased governmental investment in high-capacity public transport (especially articulated buses and BRT systems), and the widespread adoption of electric and low-emission buses requiring advanced, weight-optimized air suspension components for superior load management and ride comfort.

How does the shift to electric buses impact the demand and design requirements for bus bellows?

The transition to electric buses increases demand for lightweight, high-durability bellows, as the heavy battery packs necessitate sophisticated air suspension systems to maintain optimal ride height and stability. Designs must often accommodate higher loads while minimizing overall component weight through the use of hybrid and composite materials.

Which geographical region dominates the Bus Bellows Market in terms of volume and growth potential?

Asia Pacific (APAC), particularly China, dominates the market in terms of volume and exhibits the highest growth potential. This dominance is due to extensive government-led infrastructure projects, rapid expansion of metropolitan transit networks, and China's leading position in global electric bus manufacturing and deployment.

What is the role of AI and sensor integration in the Bus Bellows Market?

AI facilitates predictive maintenance (PdM) by analyzing sensor data (pressure, temperature) from smart bellows to accurately forecast component failure, thereby minimizing vehicle downtime. Sensor integration enables real-time monitoring and adaptive suspension adjustment, optimizing performance and increasing component lifespan.

What are the key material trends influencing the production of modern bus bellows?

The key material trends involve moving away from traditional natural rubber toward advanced synthetic elastomers like EPDM and innovative hybrid composites, often incorporating high-strength fibers or specialized polyurethanes. This shift aims to enhance fatigue resistance, thermal stability, ozone resistance, and achieve crucial weight reduction necessary for modern bus applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager