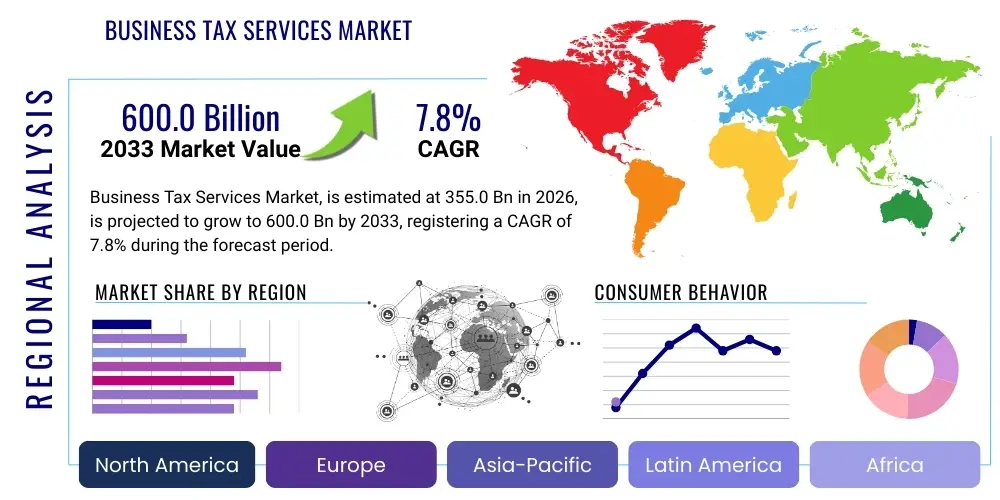

Business Tax Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442322 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Business Tax Services Market Size

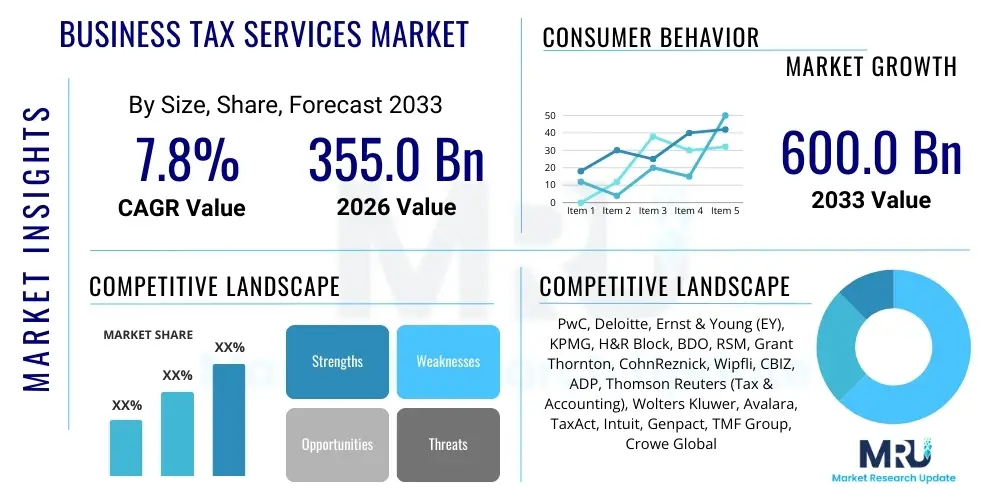

The Business Tax Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 355.0 Billion in 2026 and is projected to reach USD 600.0 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the increasing globalization of trade, necessitating cross-border tax expertise, coupled with the relentless complexity and frequency of regulatory changes across major economic zones. Businesses, regardless of size, are increasingly dependent on sophisticated external advisory and compliance services to mitigate risk and optimize their tax positions.

Business Tax Services Market introduction

The Business Tax Services Market encompasses a comprehensive range of financial and advisory services focused on helping commercial entities comply with tax laws, manage liabilities, and strategically plan for future tax obligations. These services span corporate tax planning, compliance and preparation, indirect tax handling (such as VAT/GST), international tax consulting, and specialized regulatory reporting. The core product offering is expertise and assurance, enabling businesses to navigate intricate national and international fiscal landscapes effectively.

Major applications of business tax services include managing annual tax filings for domestic operations, restructuring tax obligations following mergers and acquisitions (M&A), and establishing transfer pricing mechanisms for multinational corporations (MNCs). The primary benefits derived are risk mitigation concerning regulatory penalties, efficiency gains through outsourcing complex processes, and strategic optimization of cash flow by leveraging tax incentives and credits. The increasing pace of digitalization across governmental tax authorities also drives demand, as businesses require integrated solutions to meet digital reporting mandates.

Key driving factors accelerating the market include continuous legislative shifts (e.g., changes stemming from the OECD’s BEPS initiative), the expansion of e-commerce necessitating expertise in digital service taxes, and the severe penalties associated with non-compliance. Furthermore, the persistent shortage of in-house tax expertise, particularly within Small and Medium-sized Enterprises (SMEs), solidifies the reliance on external professional services firms, sustaining robust demand for specialized tax preparation and advisory functions globally.

Business Tax Services Market Executive Summary

The Business Tax Services Market is undergoing rapid transformation, characterized by significant shifts towards technology-enabled solutions and a heightened focus on advisory services rather than mere compliance. Current business trends indicate a strong move toward cloud-based tax platforms, which allow for real-time data integration and continuous monitoring, thereby improving the efficiency and accuracy of compliance tasks. The necessity for complex international tax planning, spurred by increased cross-border investment and stricter transfer pricing regulations, is elevating the value proposition of specialized advisory firms. Digital transformation is not just streamlining processes; it is fundamentally altering service delivery models, favoring providers who integrate advanced data analytics and Artificial Intelligence (AI) into their offerings.

Regional trends highlight North America and Europe as the dominant revenue generators, primarily due to their large base of multinational corporations and mature, highly regulated tax environments. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by rapid economic expansion in emerging economies like India and China, coupled with ongoing efforts to modernize and standardize tax regimes across ASEAN countries. These developing markets present a dual opportunity: substantial compliance workload due to shifting domestic laws and high demand for international tax structuring advice.

Segment trends underscore the burgeoning demand for specialized Consulting Services, particularly in areas like Environmental, Social, and Governance (ESG) tax compliance and digital tax reporting. While compliance services remain the foundational revenue stream, the Advisory segment is growing faster, reflecting the shift in business needs from reaction to proactive planning. Large Enterprises continue to be the primary clients for high-value strategic consulting, while Small and Medium Enterprises (SMEs) increasingly adopt automated software solutions and bundled compliance packages, recognizing the cost-efficiency and reduced complexity these modern tools provide in navigating local tax intricacies.

AI Impact Analysis on Business Tax Services Market

User inquiries regarding the impact of Artificial Intelligence on Business Tax Services predominantly center around the automation potential for routine tasks, the reliability and accuracy of AI-driven compliance checks, and the subsequent implications for the tax professional workforce. Common questions address whether AI can handle complex jurisdictional rules, what level of data security is maintained by AI platforms, and how firms are retraining their personnel to transition from data processing to high-value strategic consulting. Key concerns revolve around the initial investment costs, the transparency of algorithmic decision-making (explainability), and the ethical governance needed when relying on machine learning for sensitive financial operations.

The consensus emerging from user expectations is that AI will be a disruptive but ultimately essential force. It is expected to liberate human expertise from tedious data entry, reconciliation, and basic compliance form preparation. This shift allows tax analysts to dedicate time to strategic planning, interpreting new legislation, and providing bespoke advisory services, thereby increasing the overall value delivered to clients. The market anticipates significant investments in platforms utilizing Natural Language Processing (NLP) to interpret legal documents and Machine Learning (ML) algorithms to identify tax optimization opportunities and compliance risks far quicker than traditional methods.

- AI enables automated data extraction and classification from diverse financial documents, significantly reducing manual errors.

- Predictive analytics powered by ML algorithms enhances tax planning by modeling various future legislative scenarios.

- AI-driven tools facilitate continuous tax monitoring and real-time compliance checks, moving beyond annual or quarterly reporting cycles.

- Intelligent chatbots and virtual assistants provide immediate answers to basic regulatory queries, improving client service efficiency.

- RPA (Robotic Process Automation) handles repetitive data input and report generation, reducing operational costs for service providers.

- The technology supports enhanced fraud detection and risk assessment by analyzing transactional patterns against known compliance deviations.

DRO & Impact Forces Of Business Tax Services Market

The Business Tax Services Market dynamics are shaped by powerful Drivers, structural Restraints, strategic Opportunities, and overarching Impact Forces. The primary drivers include the escalating global regulatory complexity, especially concerning digital taxes and cross-border transactions; the mandatory digitalization of tax administration worldwide (e.g., e-invoicing and real-time reporting); and the persistent focus of corporate governance on minimizing tax risk exposure and ensuring transparency. These factors compel businesses to seek external specialized assistance to maintain compliance and avoid hefty penalties.

However, the market faces significant restraints, notably the intense concern over data privacy and the security risks associated with cloud-based financial data storage. The high cost of implementing sophisticated tax technology platforms, especially for smaller service providers or SMEs, acts as a barrier to entry for full digital transformation. Furthermore, the global shortage of highly skilled tax professionals proficient in both tax law and advanced technology represents a crucial human capital constraint limiting the capacity of the industry to scale rapidly and efficiently meet demand for niche advisory services.

Opportunities abound in leveraging Artificial Intelligence and Blockchain technology to offer advanced, immutable audit trails and hyper-efficient compliance services. Specialized consulting in emerging areas such as ESG tax reporting, carbon credit valuation, and digital asset taxation presents new high-margin revenue streams. Impact Forces, primarily technological acceleration and geopolitical instability affecting international tax treaties, ensure that the market remains highly dynamic and requires continuous adaptation from both service providers and regulatory bodies to maintain relevance and effectiveness.

Segmentation Analysis

The Business Tax Services Market is analyzed through several critical segmentation dimensions, reflecting the diverse needs of the commercial landscape. Segmentation by Service Type differentiates between the foundational requirements of Compliance and Preparation services—which form the market's backbone—and the higher-value strategic inputs offered by Consulting and Advisory services, which focus on optimization and future planning. Analyzing the market based on Organization Size is crucial, distinguishing the standardized, scalable needs of Small and Medium Enterprises (SMEs) from the highly customized, multinational requirements of Large Enterprises.

Further segmentation by Industry Vertical (e.g., Banking, Financial Services, and Insurance (BFSI); Manufacturing; Retail; Technology) recognizes that tax obligations and challenges are unique to specific sectors, requiring specialized domain knowledge (e.g., complex depreciation rules in manufacturing or specific regulatory compliance in BFSI). Deployment Model segmentation is becoming increasingly relevant, classifying service delivery based on whether it is fully managed (outsourced), co-sourced (in-house team supported by external tools/experts), or purely technology-driven (software-as-a-service or on-premise solutions). This structural breakdown allows market participants to tailor their offerings precisely to distinct client profiles and regulatory environments.

- By Service Type:

- Compliance and Preparation

- Consulting and Advisory

- Tax Litigation and Representation

- International Tax Services (Transfer Pricing, BEPS compliance)

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- IT and Telecommunications

- Retail and E-commerce

- Healthcare and Life Sciences

- Energy and Utilities

- By Deployment Model:

- Managed Services (Outsourced)

- Co-sourced/Hybrid

- Software/Platform-as-a-Service (SaaS)

Value Chain Analysis For Business Tax Services Market

The value chain for the Business Tax Services Market begins with Upstream Activities, primarily involving technology and infrastructure providers. This includes developers of specialized tax software, regulatory database aggregators, cloud computing services, and providers of data management and security solutions. These upstream elements ensure that tax service providers have access to the necessary tools for real-time compliance monitoring, large-scale data processing, and secure client information handling, forming the critical foundation for service delivery.

Midstream (Core Activities) involve the actual provision of services. This stage covers the technical execution of tax preparation, sophisticated tax advisory, and strategic planning. Key processes include jurisdictional analysis, risk assessment, transfer pricing documentation, litigation support, and audit defense. Service delivery is executed through various channels: Direct engagement, where the client works immediately with the provider’s specialized tax team (common for large consulting projects), and Indirect methods, often facilitated by integrated digital platforms or reseller partnerships, particularly targeting the standardized compliance needs of smaller businesses.

Downstream Activities focus on final client delivery, implementation of tax strategies, and continuous client relationship management. This involves ensuring the seamless integration of tax advice into the client's financial operations, providing ongoing technical support for compliance software, and proactive communication regarding upcoming legislative changes. The distribution channel is predominantly based on professional services networks—the Big Four and specialized regional firms—who maintain global reach through direct physical presence or strong affiliation networks to service multinational corporations.

Business Tax Services Market Potential Customers

Potential customers for Business Tax Services span the entire spectrum of the commercial landscape, necessitating a highly tailored approach based on organizational size, geographical presence, and industry-specific regulatory needs. Large Multinational Corporations (MNCs) constitute a vital customer segment, demanding high-value international tax planning, intricate transfer pricing studies, and sophisticated advice concerning cross-border M&A activities and regulatory frameworks like BEPS. These entities require comprehensive, globally coordinated service packages to ensure uniformity and compliance across numerous jurisdictions.

Small and Medium Enterprises (SMEs) represent a massive volume segment, characterized by their need for cost-effective, standardized compliance services, particularly local and national tax preparation. SMEs often lack dedicated in-house tax expertise and rely heavily on external providers for basic filing, payroll tax management, and leveraging local tax incentives. The growing segment of technology startups and e-commerce companies also forms a significant client base, driven by challenges related to digital service taxes and navigating tax obligations in multiple end-user markets without physical presence.

Furthermore, specialized industry verticals like Financial Institutions (Banks, Asset Managers), Manufacturing firms, and Energy companies require highly specialized expertise due to their unique capitalization rules, depreciation schedules, and industry-specific taxes (e.g., excise duties or environmental taxes). End-users within these sectors seek providers who not only manage compliance but also understand the specific operational and financial nuances that define their tax optimization opportunities and regulatory exposure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 355.0 Billion |

| Market Forecast in 2033 | USD 600.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PwC, Deloitte, Ernst & Young (EY), KPMG, H&R Block, BDO, RSM, Grant Thornton, CohnReznick, Wipfli, CBIZ, ADP, Thomson Reuters (Tax & Accounting), Wolters Kluwer, Avalara, TaxAct, Intuit, Genpact, TMF Group, Crowe Global |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Business Tax Services Market Key Technology Landscape

The technology landscape underpinning the Business Tax Services Market is rapidly migrating towards advanced digitalization to enhance efficiency, accuracy, and compliance speed. Cloud Computing represents the foundational technology, providing scalable infrastructure necessary for handling massive datasets, facilitating collaborative work across geographically dispersed teams, and enabling the timely deployment of software updates reflecting immediate regulatory changes. This shift to the cloud is crucial for accommodating real-time tax calculation and reporting mandates prevalent in modern tax regimes globally.

Advanced data analytics and Machine Learning (ML) algorithms are pivotal in driving predictive insights and identifying potential tax risks or optimization opportunities that traditional methods often overlook. ML is used for pattern recognition in large transaction volumes, significantly improving the accuracy of indirect tax determination (VAT/GST) and enhancing transfer pricing documentation review. Furthermore, Robotic Process Automation (RPA) is widely deployed within compliance teams to automate high-volume, repetitive tasks such as data aggregation from Enterprise Resource Planning (ERP) systems, report generation, and form filing, drastically cutting down the time spent on routine administration.

Finally, emerging technologies such as Blockchain are being explored, particularly for creating immutable, transparent records of cross-border transactions, which is highly relevant for establishing irrefutable audit trails and simplifying supply chain tax verification. The integration of these disparate technologies—from foundational cloud services to cutting-edge AI—is creating comprehensive, end-to-end tax lifecycle management platforms, transforming the role of tax professionals from data processors to strategic technology interpreters and advisors.

Regional Highlights

The global Business Tax Services Market exhibits distinct dynamics across key geographical regions, dictated by varying economic maturity, regulatory complexity, and technological adoption rates. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to the presence of a vast number of multinational corporations (MNCs), a highly sophisticated but intricate federal and state tax structure, and the rapid adoption of advanced tax technology solutions. The U.S. market, in particular, is characterized by the high demand for specialized advisory services concerning corporate restructuring, intellectual property tax management, and continuous lobbying efforts related to tax legislative changes.

Europe represents a highly fragmented yet significant market due to the multiplicity of tax systems within the European Union (EU) and the resulting challenges in cross-border compliance. Key growth factors include the mandatory implementation of e-invoicing and digital reporting across many member states, coupled with intense regulatory focus on tax avoidance measures following EU directives. Countries like Germany, the UK, and France are primary contributors, demanding expertise in VAT/GST management, Pillar One and Pillar Two implementation (global minimum tax), and robust data privacy compliance (GDPR) related to tax data handling. The European market emphasizes harmonization efforts while simultaneously grappling with localized complexities.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, driven by significant economic expansion, industrialization, and ongoing tax system reforms in populous economies such as China, India, and Southeast Asian nations. The region is seeing rapid modernization of tax authorities, leading to a surge in demand for compliance digitization services. Multinational expansion into APAC necessitates complex international tax advice, particularly in navigating diverse withholding tax regimes and transfer pricing rules. Finally, Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions, where growth is primarily fueled by structural economic diversification, implementation of new taxation systems (e.g., VAT introduction in the GCC states), and the general need for international tax expertise to attract foreign direct investment.

- North America: Market leader driven by large MNC base, complex federal and state taxation, and high adoption rate of integrated tax technology platforms.

- Europe: High-value market characterized by intense regulatory diversity (EU directives vs. local laws), strong demand for VAT/GST expertise, and focus on BEPS implementation.

- Asia Pacific (APAC): Fastest-growing region, fueled by economic boom, mass digitalization of compliance (e-invoicing), and burgeoning need for cross-border structuring advice in emerging markets.

- Latin America (LATAM): Growth propelled by continuous regulatory instability, high demand for tax planning to mitigate currency risks, and managing complex indirect tax requirements.

- Middle East and Africa (MEA): Emerging market focused on tax system establishment (e.g., introduction of corporate tax/VAT), driven by government diversification strategies and foreign investment protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Business Tax Services Market.- PwC (PricewaterhouseCoopers)

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited (EY)

- KPMG International Limited

- H&R Block Inc.

- BDO Global

- RSM International

- Grant Thornton International Ltd

- CohnReznick LLP

- CBIZ Inc.

- Wipfli LLP

- ADP (Automatic Data Processing)

- Thomson Reuters (Tax & Accounting segment)

- Wolters Kluwer N.V.

- Avalara Inc.

- TaxAct Holdings, Inc.

- Intuit Inc. (ProConnect)

- Genpact Ltd.

- TMF Group B.V.

- Crowe Global

Frequently Asked Questions

What are the primary drivers of growth in the Business Tax Services Market?

The key drivers are the increasing complexity of international tax laws, the mandatory digitalization of tax reporting by governmental agencies (such as e-invoicing), and the growing necessity for businesses to mitigate severe financial penalties associated with non-compliance across multiple jurisdictions.

How is technology reshaping the delivery of tax compliance services?

Technology, particularly Artificial Intelligence (AI) and Robotic Process Automation (RPA), is automating routine compliance tasks like data entry and reconciliation, shifting service providers' focus towards higher-value strategic tax advisory, real-time risk assessment, and predictive planning.

Which segment holds the highest growth potential in the next seven years?

The Consulting and Advisory service segment is anticipated to exhibit the highest growth rate, fueled by the demand for highly specialized expertise in emerging areas such as international transfer pricing, digital service taxes, and corporate ESG (Environmental, Social, and Governance) tax reporting.

What is the main challenge facing multinational corporations regarding tax services?

The primary challenge for MNCs is navigating the patchwork of global tax regulations, especially the changes resulting from the OECD's BEPS (Base Erosion and Profit Shifting) framework, necessitating sophisticated international tax planning and rigorous, consistent transfer pricing documentation across all operational locations.

Why is the Asia Pacific (APAC) market expected to grow the fastest?

APAC growth is driven by accelerated industrialization, widespread economic reforms in countries like China and India, and government initiatives to modernize and digitalize existing tax systems, creating immense opportunities for both domestic compliance services and international advisory support.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager