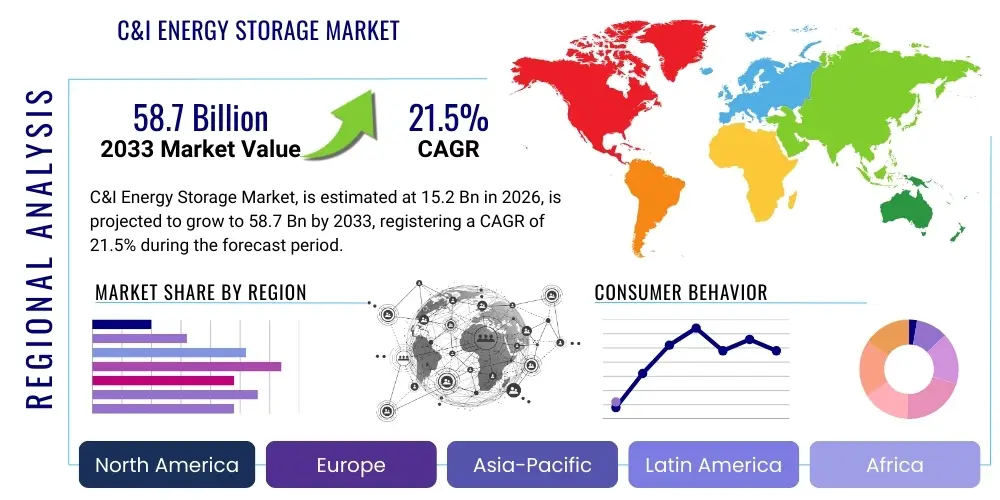

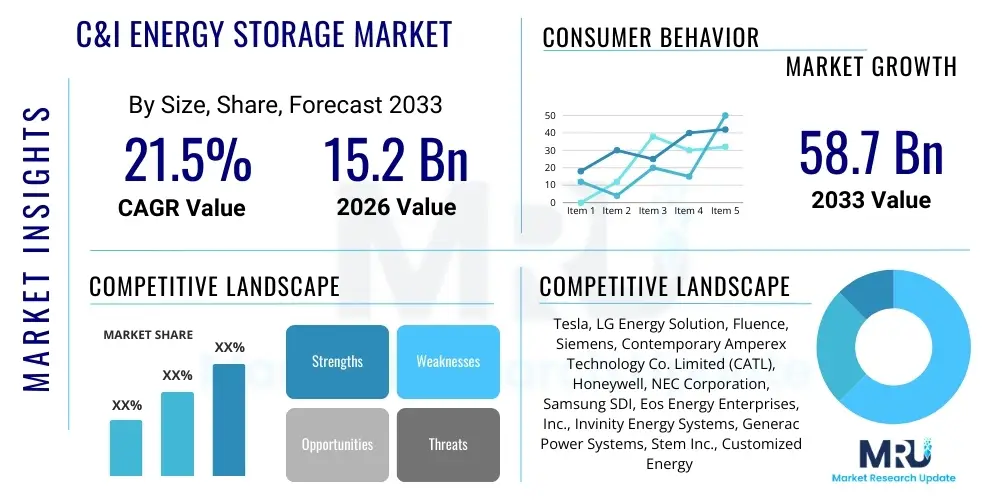

C&I Energy Storage Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441716 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

C&I Energy Storage Market Size

The C&I Energy Storage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 58.7 Billion by the end of the forecast period in 2033.

C&I Energy Storage Market introduction

The Commercial and Industrial (C&I) Energy Storage Market encompasses battery energy storage systems (BESS) deployed at business premises, manufacturing facilities, data centers, and institutional buildings, primarily designed to optimize energy consumption, reduce operating costs, and enhance power resilience. These systems typically range from 50 kW to several megawatts and are crucial components of decentralized energy infrastructure, enabling businesses to manage high demand charges, utilize cheaper off-peak electricity, and participate in grid services. The fundamental value proposition of C&I energy storage lies in its ability to provide flexible, on-demand power, insulating commercial operations from increasing utility tariffs and grid instabilities, thereby establishing itself as a vital tool for modern corporate sustainability and operational efficiency goals globally.

Product descriptions within this market are diverse, encompassing various battery chemistries, sophisticated Power Conversion Systems (PCS), and advanced Energy Management Systems (EMS) which act as the intelligence layer, orchestrating charging and discharging cycles based on complex algorithms and real-time energy price signals. Major applications driving installation include peak shaving, where the system discharges during periods of highest demand to reduce consumption from the grid; demand charge management, which significantly lowers fixed utility fees based on peak usage; and backup power provision, ensuring continuity of critical operations during grid outages. Furthermore, C&I systems are increasingly integrated with renewable sources like rooftop solar photovoltaic (PV) installations, maximizing self-consumption and enabling businesses to achieve higher levels of energy independence and carbon neutrality.

The market is predominantly driven by the sharp decline in battery costs, particularly for lithium-ion technology, coupled with favorable regulatory incentives such as federal tax credits in the US and specific capacity market mechanisms in Europe and Asia Pacific, which monetize storage capacity for grid support. The key benefits realized by end-users include substantial cost savings, enhanced energy security, and improved sustainability profiles, making energy storage a strategically sound investment. These systems also allow facility managers greater control over energy assets and consumption patterns, which is critical in an era of fluctuating energy prices and increased regulatory scrutiny regarding emissions.

- Major Applications: Peak shaving, demand charge reduction, load shifting, backup power, integration with renewables (solar PV optimization).

- Key Benefits: Operational cost reduction, enhanced energy resilience, improved sustainability metrics, participation in ancillary services, grid support optimization.

- Driving Factors: Declining battery hardware costs, escalating utility demand charges, supportive government policies and financial incentives (tax credits, rebates), corporate mandates for decarbonization.

C&I Energy Storage Market Executive Summary

The C&I Energy Storage Market is undergoing rapid transformation, characterized by aggressive deployment, technological diversification, and increasing standardization of system integration, reflecting a global shift toward decentralized energy management. Business trends indicate a move from simple demand-charge reduction applications to complex, stacked revenue streams, where a single battery asset provides multiple services, including firming intermittent renewables and offering fast frequency response to the grid, thereby maximizing Return on Investment (ROI) for asset owners. Furthermore, partnerships between established energy infrastructure players and innovative software providers are defining the competitive landscape, emphasizing the growing importance of the software layer (EMS/VPP) over the hardware component alone. The market structure is consolidating, yet niche players focused on specific chemistries (e.g., flow batteries for long duration) or specialized integration services continue to find viable opportunities.

Regional trends reveal significant polarization in growth drivers. North America, particularly the US states like California and Massachusetts, leads in adoption, largely due to high retail electricity prices and state-level incentives targeting grid reliability and resilience. The Asia Pacific region, spearheaded by China, Japan, and Australia, is experiencing explosive growth driven by robust manufacturing capabilities, mandatory renewable energy integration targets, and the necessity to stabilize burgeoning smart grids supporting high industrial loads. Conversely, Europe’s growth is steadier, centered around energy transition mandates, particularly in Germany and the UK, where storage is valued for supporting local distribution grids and enabling greater penetration of intermittent wind and solar resources, requiring robust storage solutions for stability and efficient grid operation.

Segment trends underscore the dominance of lithium-ion batteries due to their energy density, maturity, and established supply chains, though non-Li-ion chemistries are gaining traction for long-duration applications (over four hours). The software segment, encompassing controls, monitoring, and optimization platforms, is exhibiting the highest growth rate, reflecting the increased complexity required to manage stacked services and integrate storage with distributed energy resources (DERs). Within the application segment, manufacturing and heavy industry sectors represent the largest volume, primarily driven by the imperative to ensure power quality and minimize operational downtime, while data centers and commercial buildings are rapidly adopting storage for guaranteed reliability and substantial demand charge savings, cementing the market’s multifaceted growth trajectory.

AI Impact Analysis on C&I Energy Storage Market

Common user questions regarding AI's impact on the C&I Energy Storage Market often revolve around how artificial intelligence can significantly enhance system profitability, reliability, and lifespan. Users are primarily concerned with predictive maintenance capabilities—seeking to understand how AI algorithms can anticipate battery degradation or failures to minimize downtime and avoid costly repairs. A second major theme focuses on optimization: users want to know how AI-driven Energy Management Systems (EMS) can optimize charging and discharging schedules in real-time by analyzing fluctuating electricity prices, weather forecasts, and facility load profiles to maximize financial returns through sophisticated arbitrage and demand response participation. Finally, there is significant interest in how AI facilitates seamless integration with Virtual Power Plants (VPPs) and the broader grid, enabling C&I assets to provide high-value ancillary services efficiently and reliably without manual human intervention.

The key themes emerging from user inquiries highlight an expectation that AI will transition C&I energy storage from a reactive asset (used primarily for backup) to a proactive, highly intelligent financial asset that autonomously generates revenue. Users expect AI to handle the complexity inherent in stacking multiple revenue streams—a process currently limited by basic rule-based controls—by leveraging machine learning models to continuously refine operational strategies against dynamic utility tariffs and grid operator requirements. This capability is paramount because the profitability of a C&I BESS often depends entirely on its ability to react instantly and accurately to second-by-second grid signals and fluctuating market prices.

AI's influence extends deeply into lifecycle management and regulatory compliance. By applying machine learning to massive datasets derived from system performance, AI can accurately model the degradation curve of specific battery installations under various stress conditions, allowing operators to adjust usage patterns to extend asset life while adhering to performance guarantees. This not only improves the business case for investors but also standardizes the process of validating performance claims, easing regulatory burdens and insurance assessments. The integration of AI tools is thus viewed not merely as a technological enhancement but as an essential element for scaling the deployment of C&I storage systems across diverse regulatory and economic environments.

- AI optimizes dynamic dispatch strategies based on predictive modeling of energy prices and consumption patterns, maximizing arbitrage profits.

- Predictive maintenance algorithms use sensor data to identify anomalies, forecasting potential equipment failures and extending the operational lifespan of battery packs.

- AI-driven EMS facilitates sophisticated stacking of revenue streams, allowing the C&I asset to simultaneously participate in demand response, frequency regulation, and peak shaving.

- Machine learning improves forecasting accuracy for renewable generation (e.g., rooftop solar output), enabling better coordination between storage and generation assets.

- AI enhances cybersecurity by detecting abnormal network traffic and operational behaviors, protecting critical energy infrastructure assets.

- Automated compliance reporting and performance verification are streamlined using AI tools, reducing operational overhead and accelerating regulatory approval.

- AI enables seamless aggregation of individual C&I storage units into large-scale Virtual Power Plants (VPPs) for bulk participation in wholesale energy markets.

DRO & Impact Forces Of C&I Energy Storage Market

The C&I Energy Storage Market is profoundly shaped by a powerful interplay of Drivers (D), Restraints (R), Opportunities (O), and resulting Impact Forces. The primary drivers include the escalating volatility and costs of commercial electricity, particularly punitive demand charges, which provide a compelling economic justification for investment, coupled with strong government incentives like tax credits and capital subsidies aimed at accelerating decarbonization goals. These drivers establish a foundation for sustained, robust market expansion, especially in jurisdictions with deregulated or high-cost energy markets. However, market acceptance and scale are moderated by significant restraints, primarily the high initial capital expenditure associated with purchasing and installing sophisticated BESS hardware, which can present substantial financial hurdles for small and medium-sized enterprises (SMEs). Furthermore, the complexity of integrating these systems with existing facility infrastructure and the variability in interconnection standards across different utility service territories pose technical challenges that slow deployment velocity and increase soft costs.

Significant opportunities are emerging from the evolution of the energy sector, particularly the growing demand for Long-Duration Energy Storage (LDES) solutions, which extends the applicability of storage beyond basic load shifting to critical functions like seasonal reliability and prolonged backup power for essential services. The integration of C&I assets into Virtual Power Plants (VPPs) represents another crucial opportunity, allowing asset owners to generate additional revenue streams by providing ancillary services and capacity to grid operators, thereby improving the investment payback period dramatically. Moreover, technological advancements, specifically the maturation of non-Li-ion chemistries such as flow batteries and solid-state batteries, promise to deliver safer, more scalable, and environmentally sustainable storage options that can address growing concerns about battery supply chain reliance and environmental impact, further diversifying market penetration.

These internal market dynamics translate into powerful impact forces on the broader energy ecosystem. The most prominent force is the accelerated decentralization of energy infrastructure, shifting power generation and management responsibility closer to the point of consumption, which inherently improves local grid resilience and reduces dependence on centralized power stations. This shift is fueling fierce competition among utilities, independent power producers (IPPs), and technology providers, driving innovation in system integration and optimization software. Ultimately, the cumulative effect of these forces is the transformation of the C&I sector into a crucial component of modern grid stability and flexibility, compelling regulatory bodies to continuously adapt market structures and pricing mechanisms to fairly value the contributions of distributed energy storage assets to the overall energy security framework.

- Drivers: High and volatile electricity prices, stringent demand charges, corporate net-zero commitments, regulatory support and financial incentives (e.g., ITC), need for operational resilience.

- Restraints: High upfront capital costs, complexity and duration of interconnection processes, regulatory hurdles regarding dual use (on-grid/off-grid), public perception of battery safety (fire risks).

- Opportunities: Expansion into Long-Duration Energy Storage (LDES), integration with Virtual Power Plants (VPPs) for new revenue streams, technological innovation in battery chemistries (sodium-ion, flow), global expansion into emerging markets with poor grid infrastructure.

- Impact Forces: Accelerated decentralization of power generation, increased grid resilience at the distribution level, standardization of communication protocols (e.g., IEEE 2030.5), disruption of traditional utility revenue models, enhanced energy autonomy for large commercial consumers.

Segmentation Analysis

The C&I Energy Storage Market is meticulously segmented based on several critical dimensions, including technology, application, connectivity, power rating, and end-user industry, enabling targeted analysis of growth vectors and competitive positioning. Understanding these segments is crucial for stakeholders to tailor product offerings and strategic investments. The technology segmentation is dominated by Li-ion but is broadening to include emerging chemistries that offer improved safety and longer cycling capabilities, catering to different operational profiles. Application segmentation highlights the primary use cases, with demand charge management remaining the foundational driver of investment due to its direct and measurable financial benefits. The market’s segmentation reveals a high degree of maturity and specialization, requiring nuanced marketing strategies tailored to specific industry needs, whether it be the high-reliability demands of the healthcare sector or the high-power requirements of heavy manufacturing.

- By Technology:

- Lithium-ion Batteries (Li-NMC, Li-LFP)

- Flow Batteries (Vanadium Redox, Zinc-Bromine)

- Lead-Acid Batteries (Advanced VRLA)

- Other Technologies (Solid-State, Compressed Air Energy Storage)

- By Application:

- Demand Charge Management

- Peak Shaving

- Load Shifting/Energy Arbitrage

- Backup Power/Uninterruptible Power Supply (UPS)

- Renewable Integration and Firming

- By Connectivity:

- On-Grid Systems (Grid-Tied)

- Off-Grid Systems (Stand-Alone)

- By Power Rating:

- Less than 250 kW

- 250 kW to 500 kW

- Above 500 kW

- By End-User Industry:

- Manufacturing (Light and Heavy)

- Commercial Buildings (Offices, Retail, Hospitality)

- Healthcare and Data Centers

- Educational and Institutional Campuses

- Utilities and Grid Services (Front-of-the-Meter components used by C&I assets)

Value Chain Analysis For C&I Energy Storage Market

The C&I Energy Storage value chain begins with the Upstream Analysis, which focuses on the sourcing and processing of critical raw materials, predominantly lithium, cobalt, nickel, and manganese for Li-ion batteries, alongside steel and electronics components for the balance of system (BOS). This segment is characterized by complex global supply chains, significant geopolitical risks associated with material extraction and processing, and intense price volatility, particularly for key battery minerals. Manufacturing of the core battery cells and modules is highly concentrated in Asia, setting the initial cost basis and technological trajectory for the entire downstream market. Key players at this stage include global chemical processors and specialized cell manufacturers, whose capacity expansion and technological breakthroughs directly determine system performance and cost reductions, emphasizing the dependence of the C&I market on advancements in large-scale automotive and grid battery manufacturing sectors.

The midstream component of the value chain involves system integration, encompassing the design, assembly, and packaging of battery modules, Power Conversion Systems (PCS), thermal management systems, and the crucial Energy Management System (EMS) software. Integrators take the core battery technology and customize it into deployable, certified C&I solutions suitable for specific environments, addressing factors like fire safety, regulatory compliance (UL standards), and optimizing system longevity. This stage also involves the development of proprietary software algorithms that dictate the financial performance of the asset, transforming raw hardware into a profitable service. Differentiation often occurs here, with companies offering superior software capabilities and optimized integration services gaining a significant competitive edge over purely hardware-focused competitors, reflecting a shift in value from cells to intelligence.

Downstream analysis covers distribution channels, installation, commissioning, and long-term operations & maintenance (O&M) and end-of-life management (recycling). Distribution channels are bifurcated into Direct and Indirect models. Direct sales involve large utility customers or sophisticated corporate clients purchasing directly from integrators or large EPC firms. Indirect channels rely on established electrical wholesalers, specialized energy service companies (ESCOs), and solar installers who bundle storage with solar installations, particularly targeting smaller C&I customers. O&M contracts, often utilizing data analytics and remote diagnostics, are becoming significant long-term revenue streams. Crucially, the increasing focus on the circular economy introduces the challenge and opportunity of battery repurposing and specialized recycling infrastructure development, which will be essential for the sustainable scaling of the C&I sector.

C&I Energy Storage Market Potential Customers

The potential customer base for C&I Energy Storage is extremely broad, encompassing any entity with high operational criticality, substantial and volatile electricity usage, or strong environmental, social, and governance (ESG) commitments. End-users fall primarily into sectors where minimizing operational downtime is paramount or where electricity expenses form a disproportionately large component of operating budgets. Heavy manufacturing facilities, such as automotive assembly plants, semiconductor fabrication plants, and chemical processing sites, represent prime buyers. These sectors often face intense scrutiny over power quality issues, which can damage sensitive equipment or halt production lines, making reliable backup power and voltage support provided by BESS invaluable. Their high, intermittent power demands also make them ideal candidates for maximizing savings through aggressive demand charge reduction strategies.

Another rapidly expanding segment of buyers includes data centers, telecommunications infrastructure, and healthcare facilities (hospitals and specialized clinics). For these customers, the primary driver is absolute energy resilience and continuity of service, making the Uninterruptible Power Supply (UPS) function of BESS critical. Modern data centers, in particular, require massive, instantaneous power reserves to bridge the gap between grid failure and generator start-up, a role perfectly suited to high-power Li-ion systems. The high density of these facilities and their 24/7 operational profile also allows them to leverage storage for continuous energy arbitrage, provided they operate in favorable regulatory environments, thereby justifying the significant capital outlay necessary for resilient energy infrastructure.

Furthermore, commercial real estate developers, large retail chains, and university campuses represent significant potential customers driven by sustainability targets and the desire to monetize underutilized space via onsite generation and storage. These institutions often integrate storage to maximize the value of large rooftop solar arrays, manage large campus-wide loads, and participate in local utility demand response programs, turning their energy infrastructure into a source of passive income. As ESG reporting becomes standardized and mandatory across global financial markets, the attractiveness of C&I storage as a quantifiable measure of commitment to decarbonization and resilience continues to pull in a diverse range of institutional and corporate buyers globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 58.7 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla, LG Energy Solution, Fluence, Siemens, Contemporary Amperex Technology Co. Limited (CATL), Honeywell, NEC Corporation, Samsung SDI, Eos Energy Enterprises, Inc., Invinity Energy Systems, Generac Power Systems, Stem Inc., Customized Energy Solutions, ABB, Eaton, Hitachi Energy, Enphase Energy, BYD, SMA Solar Technology AG, Nidec Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

C&I Energy Storage Market Key Technology Landscape

The C&I Energy Storage technology landscape is primarily defined by the robust dominance of Lithium-ion (Li-ion) batteries, specifically Nickel Manganese Cobalt (NMC) and Lithium Iron Phosphate (LFP) chemistries. LFP is gaining substantial traction in the stationary C&I market due to its inherently greater thermal stability, longer cycle life, and lower manufacturing cost compared to NMC, making it the preferred choice despite its marginally lower energy density. Continuous improvements in Li-ion cell packaging, module design, and advanced Battery Management Systems (BMS) are enhancing energy efficiency and reducing the footprint, making Li-ion systems highly adaptable for installation in diverse urban and industrial environments. This technological standardization is contributing significantly to supply chain predictability and driving down installation soft costs, solidifying Li-ion’s position as the mainstream technology for short- to medium-duration (2-4 hour) applications in the C&I sector.

Beyond the Li-ion sphere, significant innovation is focused on developing commercial-scale Long-Duration Energy Storage (LDES) solutions, which are crucial for enabling deeper penetration of intermittent renewable energy and securing multi-hour industrial reliability. Flow batteries, such as Vanadium Redox (VRFB) and Zinc-Bromine, represent the most mature alternative LDES technologies. Flow batteries decouple power capacity (determined by the stack size) from energy capacity (determined by the electrolyte volume), offering exceptional scalability and cycle life (often exceeding 10,000 cycles) without significant degradation over long periods. While current capital costs per kilowatt-hour remain generally higher than Li-ion, their non-flammable nature and superior suitability for high-utilization, long-duration applications (6+ hours) are creating specialized market niches, particularly for large industrial campuses and remote mining operations that require extended resilience.

The technological ecosystem is equally reliant on the Balance of System (BOS) components and software innovation. High-efficiency bidirectional Power Conversion Systems (PCS) are vital for minimizing energy losses during charging and discharging, ensuring efficient conversion between AC and DC power. Furthermore, thermal management systems are critical, particularly in high-density Li-ion installations, to maintain optimal operating temperatures, which directly impacts safety and battery lifespan. Most critically, the transition to sophisticated, cloud-based Energy Management Systems (EMS) utilizing Artificial Intelligence (AI) and machine learning for predictive optimization is transforming the performance of all battery chemistries. This software layer is increasingly viewed as the primary differentiator, determining the financial viability and maximizing the stacked revenue potential of the entire C&I BESS investment, regardless of the underlying hardware technology employed.

Regional Highlights

The global C&I Energy Storage market exhibits varied growth trajectories shaped by local regulatory frameworks, utility rate structures, and renewable energy penetration rates. North America, especially the United States, stands as a primary growth engine, largely due to high retail electricity rates and substantial federal and state incentives. The Investment Tax Credit (ITC) in the US has dramatically improved the economics of solar-plus-storage projects, specifically benefitting C&I customers seeking tax deductions. California, the leading state, mandates high penetration of renewables and enforces strict demand charge policies, making energy storage a financial necessity. This region is characterized by high adoption rates in commercial real estate and major data center hubs, focusing on both economic arbitrage and resilience against increasing weather-related power outages.

Asia Pacific (APAC) represents the fastest-growing region, driven by explosive industrialization, robust government support for grid modernization, and the presence of major battery manufacturing giants like China and South Korea. China’s centralized planning mandates for pairing solar and wind projects with dedicated storage capacity are creating immense market demand for C&I-scale projects. Furthermore, Australia’s high solar penetration and the subsequent grid congestion issues are compelling commercial entities to install storage for grid firming and maximizing self-consumption. Japan and South Korea, facing high energy import costs, prioritize storage for enhanced national energy security and efficiency, creating a highly competitive market where system cost and operational efficiency are key determining factors for success and large-scale deployment.

Europe’s C&I market growth is driven by the European Union’s ambitious decarbonization targets and the necessity to manage fluctuating power flows generated by extensive wind and solar farms integrated into distribution grids. Countries like Germany and the United Kingdom focus on local grid stability and maximizing the value of ancillary services provided by distributed assets. Regulatory frameworks are evolving rapidly to allow C&I assets to participate actively in energy markets through aggregation via Virtual Power Plants (VPPs). While overall electricity prices are often high, the availability and structure of demand charges differ from the US, leading to a slightly slower, but more quality-driven adoption focused on sophisticated, long-term grid service contracts, primarily favoring high-efficiency and certified compliant energy storage solutions.

- North America (US & Canada): Dominant market share due to high demand charges, federal incentives (ITC), and focus on resilience for data centers and critical infrastructure.

- Asia Pacific (China, Australia, Japan): Fastest growth driven by manufacturing scale, government-mandated renewable integration targets, and rapid build-out of smart grid infrastructure.

- Europe (Germany, UK, Italy): Steady growth fueled by EU decarbonization policies, focus on VPP integration, and providing local grid balancing services in congested distribution networks.

- Latin America & MEA: Emerging markets driven primarily by poor grid reliability (need for backup power) and integration of storage with new renewable projects in resource-rich but grid-poor areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the C&I Energy Storage Market.- Tesla

- LG Energy Solution

- Fluence

- Siemens

- Contemporary Amperex Technology Co. Limited (CATL)

- Honeywell

- NEC Corporation

- Samsung SDI

- Eos Energy Enterprises, Inc.

- Invinity Energy Systems

- Generac Power Systems

- Stem Inc.

- Customized Energy Solutions

- ABB

- Eaton

- Hitachi Energy

- Enphase Energy

- BYD

- SMA Solar Technology AG

- Nidec Corporation

Frequently Asked Questions

Analyze common user questions about the C&I Energy Storage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary financial benefit of installing C&I energy storage?

The primary financial benefit is achieved through demand charge management (peak shaving), which significantly reduces the highest electricity fees levied by utilities based on a facility's maximum power usage during a billing cycle, leading to substantial operational cost savings.

Which battery technology dominates the C&I energy storage sector?

Lithium-ion batteries, specifically the Lithium Iron Phosphate (LFP) chemistry, dominate the C&I sector due to their superior cycle life, enhanced safety profile, and continuous cost reductions, making them ideal for short-to-medium duration applications (2-4 hours).

How do C&I energy storage systems contribute to grid stability?

C&I systems contribute to grid stability by participating in ancillary services, such as frequency regulation and voltage support, and by aggregating into Virtual Power Plants (VPPs) to provide responsive capacity during high-demand periods or unexpected generation shortfalls.

What is the typical Return on Investment (ROI) period for a C&I BESS?

The typical ROI period varies significantly based on local utility rates and incentive structures, but well-optimized C&I BESS installations targeting high demand charges often achieve payback periods ranging from 4 to 7 years, especially when coupled with renewable generation.

What role does AI play in optimizing C&I energy storage operations?

AI-driven Energy Management Systems (EMS) use machine learning to predict energy prices and facility loads in real-time, optimizing charging and discharging schedules to maximize financial returns through arbitrage, efficient demand response participation, and predictive maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager