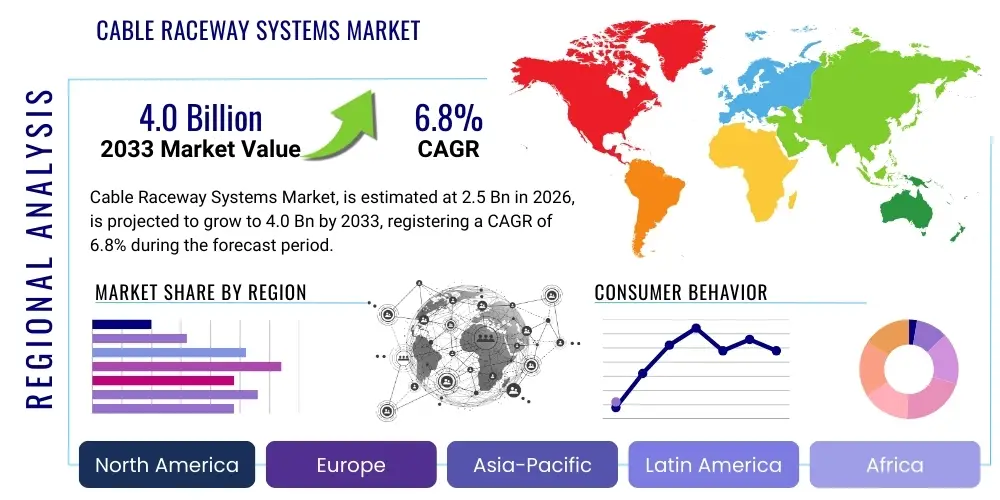

Cable Raceway Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442710 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Cable Raceway Systems Market Size

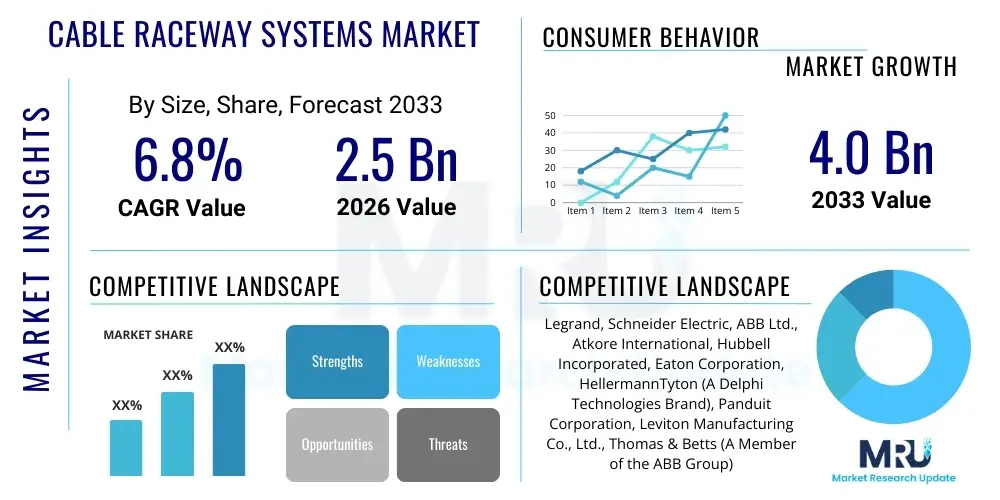

The Cable Raceway Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.0 Billion by the end of the forecast period in 2033.

Cable Raceway Systems Market introduction

The Cable Raceway Systems Market encompasses the manufacturing, distribution, and utilization of enclosed channels designed to house and protect electrical wires and cables. These systems, crucial components of modern infrastructure across commercial, industrial, and residential sectors, provide mechanical protection, safeguard against environmental factors, and ensure effective management and organization of complex wiring layouts. Key products include surface-mounted raceways, slotted wiring ducts, solid wall ducts, and specialized perimeter trunking systems, fabricated from materials such as Polyvinyl Chloride (PVC), galvanized steel, aluminum, and fiberglass, depending on the required application and environmental demands, such as flame retardancy or corrosion resistance. The primary function of these systems is to adhere to stringent electrical and safety codes while improving the aesthetics and accessibility of installations for future maintenance and expansion, thereby mitigating risks associated with exposed wiring, including fire hazards and physical damage.

The widespread adoption of cable raceway systems is intrinsically linked to the global expansion in critical infrastructure development, specifically in data centers, smart buildings, industrial automation facilities, and renewable energy projects. As data transmission requirements intensify and the complexity of Building Management Systems (BMS) increases, the need for high-density, high-performance cable management solutions becomes paramount. Benefits derived from deploying advanced raceway systems include enhanced system uptime, simplified retrofitting of legacy systems, superior protection against electromagnetic interference (EMI), and reduced installation time and labor costs. Furthermore, raceway systems contribute significantly to regulatory compliance, particularly standards set by bodies like the National Electrical Code (NEC) and International Electrotechnical Commission (IEC), ensuring electrical safety and operational reliability across various geographical jurisdictions.

Driving factors sustaining market growth include robust investments in digitalization initiatives worldwide, increasing urbanization leading to commercial construction booms, and the modernization of aging electrical grids and manufacturing plants. The shift toward modular construction and prefabricated wiring solutions also favors the deployment of standardized, easy-to-install raceway segments. Technological advancements, such as the integration of antimicrobial materials for healthcare settings and fire-rated compounds for critical safety zones, continue to expand the scope and applicability of these cable containment solutions. The confluence of safety imperatives, aesthetic demands, and regulatory requirements positions the Cable Raceway Systems Market for sustained and robust growth throughout the forecast period.

Cable Raceway Systems Market Executive Summary

The Cable Raceway Systems Market is undergoing a significant transformative phase, driven by accelerated digital infrastructure expansion and stricter regulatory frameworks concerning electrical safety. Key business trends indicate a strong move toward lightweight, durable, and environmentally sustainable materials, with PVC and halogen-free plastic raceways gaining substantial traction over traditional metallic systems in specific commercial and residential applications due to ease of installation and cost-effectiveness. Furthermore, manufacturers are increasingly focusing on modular and pre-wired raceway solutions that minimize on-site labor and accelerate project timelines, appealing directly to large-scale construction and data center operators who prioritize speed of deployment and standardization across multiple sites. Mergers, acquisitions, and strategic partnerships aimed at broadening product portfolios, particularly those integrating smart features like embedded sensors for temperature monitoring, are defining the competitive landscape.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure investments in emerging economies like China, India, and Southeast Asian nations, supporting rapid urbanization and the proliferation of 5G networks and associated fiber optic installations. North America and Europe, while mature, maintain dominance in terms of technological adoption and demand for high-end, specialized raceway systems tailored for sensitive environments such as pharmaceuticals, aerospace, and advanced manufacturing. These regions are witnessing increased replacement demand as older systems are upgraded to comply with modern fire safety and bandwidth requirements. Government stimulus packages focused on digital transformation and green building mandates further stimulate demand across mature geographies, pushing innovation toward recycled and energy-efficient manufacturing processes.

Segment trends underscore the rising prominence of the surface-mounted raceway segment, particularly in retrofitting existing buildings where embedded wiring is impractical or cost-prohibitive. Application-wise, the IT & Telecom sector remains the dominant consumer, driven by continuous data center construction and the rollout of edge computing facilities necessitating complex, compartmentalized cable management for power, data, and cooling lines. The industrial automation segment is projected to exhibit the highest CAGR, spurred by Industry 4.0 initiatives that require highly protected and robust metallic raceway systems capable of withstanding harsh operating conditions, including vibration, extreme temperatures, and chemical exposure. Overall, the market trajectory is characterized by a dual focus: minimizing material cost and installation complexity while maximizing safety compliance and long-term durability in increasingly demanding environments.

AI Impact Analysis on Cable Raceway Systems Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Cable Raceway Systems Market generally center on several critical areas: whether AI-driven design tools can optimize raceway layout and sizing, the impact of AI infrastructure (such as hyper-scale data centers and edge nodes) on demand patterns, and how AI can improve predictive maintenance and efficiency in existing raceway installations. Users are keen to understand if AI can automate the compliance checking process for complex cable routes, thereby reducing engineering time and potential human error. A key concern revolves around the physical demands placed on raceway systems by future AI hardware, which generates greater heat density and necessitates specialized compartmentalization for power and high-speed data cables to prevent thermal issues and crosstalk. The summarized themes indicate a strong expectation that AI will primarily act as an accelerator of demand through supporting infrastructure expansion and an enabler of efficiency improvements across the design, manufacturing, and operational lifespan of cable raceway systems.

The integration of AI tools, specifically machine learning algorithms, into the design phase is revolutionizing how architects and electrical engineers plan cable routes within large facilities. These tools can analyze complex floor plans, capacity requirements, and regulatory constraints simultaneously, generating optimal raceway paths that minimize material use, maximize accessibility, and ensure code compliance automatically. This paradigm shift from manual, heuristic-based design to data-driven optimization is expected to significantly reduce both the time required for design iterations and the likelihood of costly on-site modifications. Furthermore, the ability of AI to simulate various stress scenarios, including heat dissipation and load balancing within confined spaces, ensures that the specified raceway system is perfectly matched to the operational demands of the housed cabling, especially relevant in high-performance computing environments.

Beyond design and planning, AI’s primary physical impact stems from the exponential demand generated by AI processing infrastructure. The deployment of large-scale GPU clusters and specialized AI hardware requires unprecedented levels of power delivery and cooling, demanding larger, more robust, and often customized cable raceways. The need for precise separation of fiber optic, copper data, and high-voltage power cables to maintain signal integrity in AI environments is non-negotiable, driving demand for multi-compartment and specialized metallic raceway systems that offer superior shielding capabilities. Moreover, future smart raceway systems may incorporate miniature embedded sensors monitored by AI, enabling real-time diagnostics of cable temperature, potential insulation degradation, or unauthorized access, thereby enhancing the overall security and longevity of the physical layer infrastructure supporting AI operations.

- AI-driven generative design optimizes raceway routing, reducing material waste and installation time in large-scale projects.

- Increased construction of AI-focused data centers (hyper-scale and edge) drives robust demand for high-capacity, shielded metallic raceways.

- Predictive maintenance platforms utilizing AI analyze sensor data from smart raceways to anticipate cable stress, heat issues, and potential failures.

- AI automation in manufacturing processes improves the precision and material efficiency of molded plastic and fabricated metal raceway components.

- Requirement for compartmentalization of high-speed data and power cables in AI environments necessitates specialized, multi-channel raceway designs for EMI mitigation.

DRO & Impact Forces Of Cable Raceway Systems Market

The dynamics of the Cable Raceway Systems Market are heavily influenced by a confluence of powerful drivers, structural restraints, and emerging opportunities, all interacting as critical impact forces. The primary driver is the accelerating global investment in infrastructure, particularly centered around digital transformation, smart cities, and the massive build-out of 5G and fiber-to-the-home (FTTH) networks, which inherently require sophisticated physical layer management. Regulatory mandates demanding enhanced electrical safety and fire protection standards across commercial and public buildings globally further compel the adoption of compliant raceway systems. Opportunities are chiefly concentrated in innovation related to sustainable materials, modular systems designed for rapid deployment in prefabricated construction, and the integration of specialized functions, such as built-in thermal management or sensor integration for IoT applications. These forces collectively dictate the market’s growth trajectory and shape competitive strategies among key industry participants.

Key drivers include the burgeoning data center industry, where cable density and heat management necessitate superior raceway performance, and the rapid expansion of industrial automation (Industry 4.0), demanding robust, chemically resistant containment for machine wiring. Furthermore, the inherent benefits of raceway systems—such as organization, aesthetics, and ease of future cable additions or changes—make them indispensable in modern commercial office spaces and institutional facilities seeking long-term operational flexibility. The move towards decentralized energy systems and electric vehicle (EV) charging infrastructure also provides a significant niche market for heavy-duty, weather-resistant outdoor raceway solutions. These market pull factors are creating consistent, high-volume demand across both developed and developing economies, prioritizing raceways that offer standardization and long-term asset protection.

Conversely, the market faces significant restraints, including the high initial cost associated with complex, fire-rated, or specialized metallic raceway installations compared to simpler, often non-compliant, alternatives like exposed conduits in certain low-cost regions. Volatility in raw material prices, specifically plastics (PVC resin) and metals (steel, aluminum), poses a persistent challenge to stable pricing and profit margins for manufacturers. An additional restraint is the lack of standardized installation practices or skilled labor in some emerging markets, potentially leading to incorrect system deployment, which undermines the intended safety benefits. Opportunities, however, exist in utilizing advanced manufacturing techniques, such as additive manufacturing for custom fittings, and penetrating the retrofit market by offering sleek, non-intrusive surface raceway solutions that minimize disruption during installation in occupied buildings, allowing companies to overcome these restraints through strategic product differentiation and value-added services.

Segmentation Analysis

The Cable Raceway Systems Market is segmented based on several crucial parameters, offering manufacturers and strategists a granular view of market dynamics and specialized demand areas. The primary axes of segmentation include material type, which critically affects durability, cost, and safety ratings; product type, defining the physical form and installation method (e.g., trunking, ducts, conduits); and application, identifying the end-use environment such as commercial, industrial, or IT and telecommunications. This structured classification helps in understanding shifts in consumer preference, such as the increasing demand for halogen-free plastic raceways driven by fire safety concerns in Europe, versus the persistent need for heavy-gauge metallic raceways in demanding industrial sectors like oil and gas or manufacturing plants where physical protection is paramount. Analyzing these segments is essential for targeting marketing efforts and allocating research and development resources toward high-growth areas.

Further segmentation delves into the degree of protection and installation configuration. For instance, classifying raceways based on their sealing capability (e.g., dust-tight, waterproof) dictates their suitability for harsh environments, while differentiating between perimeter, ceiling-mounted, and underfloor ducting addresses specific architectural requirements. The rise of modular data centers and prefabricated construction techniques has spurred the need for highly adaptable, interconnected raceway components that can be assembled quickly and efficiently on-site. The comprehensive segmentation analysis reveals that while volume growth is often found in the plastic/PVC segments due to cost and ease of use, the highest value and margin opportunities reside in the specialized metallic and fiberglass reinforced plastic (FRP) systems designed for environments with stringent regulatory and performance mandates, such as clean rooms, transportation, and power generation facilities.

- Material Type

- Metallic Raceways (Steel, Aluminum, Galvanized)

- Non-Metallic Raceways (PVC, Halogen-Free Plastics, ABS)

- Fiberglass Reinforced Plastic (FRP)

- Product Type

- Slotted Wiring Ducts

- Solid Wall Ducts (Trunking)

- Surface Mounted Raceways

- Perimeter Trunking Systems

- Flexible Raceway Systems

- Application

- IT & Telecommunication (Data Centers, Network Rooms)

- Commercial Construction (Offices, Retail, Hospitality)

- Industrial (Manufacturing, Oil & Gas, Power Generation)

- Residential

- Infrastructure (Transportation, Utilities)

- End-User

- Contractors and Electricians

- Original Equipment Manufacturers (OEMs)

- System Integrators

- Infrastructure Developers

Value Chain Analysis For Cable Raceway Systems Market

The value chain for the Cable Raceway Systems Market commences with the upstream supply of fundamental raw materials, primarily steel, aluminum, and various polymers such as PVC resin and ABS plastics. Upstream analysis focuses on securing stable, cost-effective, and quality-assured material inputs, as price volatility directly impacts manufacturing costs and final product margins. Key upstream activities involve processing these raw materials, including metal forming, extrusion, and injection molding, which demand significant capital expenditure and adherence to environmental standards. Strategic vertical integration or long-term supply agreements with raw material producers are critical for mitigating supply chain risks and maintaining competitive pricing, especially for metallic raceways where global commodity pricing is a defining factor. Manufacturers must also invest in quality control to ensure raw materials meet specific fire, mechanical, and electrical resistance standards mandated by regional codes.

The mid-stream encompasses the core manufacturing processes: design, fabrication, finishing, and assembly of the raceway components and complementary accessories (fittings, connectors, mounting hardware). This stage involves high technical complexity, especially in producing specialized systems like high-shielding electromagnetic compatibility (EMC) raceways or modular snap-together systems. Distribution channels are highly fragmented yet specialized; direct sales are common for large industrial or infrastructure projects where customization and technical support are required. However, the majority of volume moves through indirect channels, primarily comprising electrical wholesalers, specialized distributors, and large retail hardware chains, which provide inventory and local fulfillment services to electrical contractors and small to medium enterprises (SMEs). Efficient logistics and strategic warehousing are crucial here to manage diverse product sizes and ensure timely delivery to frequently distant construction sites.

Downstream analysis centers on the end-users: electrical contractors, system integrators, OEMs, and facility management teams responsible for the final installation and maintenance. The influence of downstream actors is substantial, as product specifications often adhere to the preferred installation methods and product familiarity of local contractors. Key downstream activities include system design consultation, installation services, and post-installation maintenance and upgrading. The trend toward digitalization necessitates strong collaboration between manufacturers and system integrators to ensure raceway systems are compatible with emerging cable types (e.g., Category 8, high-fiber count cables). Successful downstream engagement relies heavily on providing comprehensive training, technical documentation, and product certifications to build trust and preference among professional installers, ultimately ensuring that the final application maximizes the benefits offered by the raceway system in terms of safety and longevity.

Cable Raceway Systems Market Potential Customers

The primary potential customers and buyers of cable raceway systems are diverse and span virtually every sector of the built environment, fundamentally categorized into infrastructure developers, specialized contractors, and Original Equipment Manufacturers (OEMs). Infrastructure developers, including government agencies, utility companies, and private real estate firms, are heavy consumers, particularly for large-scale projects such as hospitals, airports, metro systems, and commercial skyscraper complexes. These customers require highly reliable, durable, and often customized raceway solutions that comply with stringent fire and safety regulations, focusing on long-term performance and minimizing lifecycle maintenance costs. Their purchasing decisions are driven by total cost of ownership (TCO) and adherence to project timelines and safety specifications rather than just initial purchase price.

Specialized contractors, including electrical installation firms and system integrators, form the largest volume purchasing segment. They purchase raceway systems for installation across various projects, ranging from residential renovations to complex industrial control panel wiring. For this customer group, factors such as ease of installation, availability of standardized components, and product certifications are critical. Contractors favor systems that offer quick installation mechanisms, reducing labor time and complexity, such as snap-on covers, modular fittings, and pre-punched mounting holes. Their purchasing behavior is often guided by specific project budgets and the desire for widely accepted, highly flexible products that can be sourced reliably through local distribution channels, minimizing delays and unexpected costs.

OEMs represent a distinct segment, incorporating raceway systems directly into their manufactured products, such as industrial machinery, specialized vehicles (trains, buses), or control cabinets. These buyers demand highly standardized, often custom-sized, and sometimes proprietary raceway solutions that seamlessly integrate into their equipment design. Compliance with internal manufacturing standards and consistent quality control are paramount for OEMs, ensuring the integrity and safety of the final assembled product. This segment often involves long-term, fixed-specification supply contracts, prioritizing bulk pricing stability and guaranteed component compatibility over market variability, demonstrating a strategic and recurring demand pattern for specialized cable containment solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Legrand, Schneider Electric, ABB Ltd., Atkore International, Hubbell Incorporated, Eaton Corporation, HellermannTyton (A Delphi Technologies Brand), Panduit Corporation, Leviton Manufacturing Co., Ltd., Thomas & Betts (A Member of the ABB Group), Chalfant Manufacturing Company, Snake Tray, Wiremold (Part of Legrand), MonoSystems Inc., Teaflex, Marshall-Tufflex, PFLITSCH GmbH, B.T. Cablexpert, Vantrunk, and Dura-Line Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cable Raceway Systems Market Key Technology Landscape

The technological landscape of the Cable Raceway Systems Market is rapidly evolving, driven by the need for enhanced safety, faster installation, and greater environmental compatibility. A fundamental technology shift involves the pervasive adoption of advanced polymer chemistry, particularly the move towards halogen-free (HF) and low-smoke zero-halogen (LSZH) thermoplastic materials. These materials significantly reduce the emission of corrosive and toxic fumes during a fire event, making them essential in densely populated areas, public transport, and critical infrastructure like hospitals and data centers. The manufacturing processes for these non-metallic systems increasingly utilize high-precision extrusion and injection molding techniques, ensuring tight tolerances for component interlocking and enhancing overall system integrity and fire resistance ratings. Furthermore, surface treatment technologies for metallic raceways, such as specialized galvanization processes and powder coatings, are continually being refined to improve corrosion resistance in harsh industrial or outdoor environments, extending the operational lifespan of the cable management infrastructure.

In terms of installation methodology, the market is capitalizing on modular and pre-fabricated technologies. Manufacturers are developing raceway systems featuring tool-less, snap-fit assemblies and innovative mounting hardware that drastically reduce installation time and labor costs. This modular approach aligns perfectly with modern construction trends, facilitating scalability and simplifying retrofitting. Furthermore, the integration of Building Information Modeling (BIM) platforms is now a key technological requirement, allowing engineers to digitally plan complex raceway paths in 3D, optimizing fill rates, preventing physical clashes, and ensuring compliance before construction even begins. This digital integration minimizes rework and enhances project efficiency, transforming the traditional approach to cable route planning from a purely physical task to a data-driven process, thus adding intellectual value to the product offering.

The emerging technological frontier involves "smart raceway" concepts, where the cable management system transcends its role as a passive enclosure. Smart raceways incorporate embedded IoT sensors designed to monitor critical operational parameters within the channel. These sensors can track cable temperature, detect humidity levels, measure current load variations, or register unauthorized physical access. Data collected by these sensors is transmitted via integrated wireless modules to a central Building Management System (BMS) or AI-driven predictive maintenance platform. This allows facility managers to proactively identify potential thermal runaways, excessive load conditions, or structural stress before they lead to catastrophic system failure. While still nascent, this convergence of physical containment infrastructure with digital intelligence represents the most significant long-term technological trend, promising enhanced reliability and a fundamental shift in how physical layer assets are managed and maintained throughout their operational lifecycle.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, type, and technological maturity of the Cable Raceway Systems Market, influenced heavily by local construction standards, economic development cycles, and regulatory enforcement levels.

- North America: Characterized by mature infrastructure and stringent adherence to NFPA (National Fire Protection Association) and NEC (National Electrical Code) standards. Demand is driven by the massive concentration of hyper-scale and co-location data centers, requiring high-specification, compartmentalized metallic raceway systems for superior fire and EMI protection. The region exhibits high adoption rates for advanced, specialized solutions, including wire basket systems and specialized fiberglass raceways for corrosive industrial sites. Retrofitting aging commercial and residential properties for smart building technologies also contributes significantly to sustained market growth.

- Europe: The European market is highly regulated, particularly by the IEC standards and EU directives promoting environmental sustainability and safety (e.g., REACH, RoHS). There is exceptionally strong demand for halogen-free, low-smoke, and self-extinguishing non-metallic raceway systems in public buildings and transport infrastructure (railways, metro systems). Germany and the UK lead in industrial automation, driving demand for robust, shielded metallic cable management solutions for machinery. The focus on energy efficiency and smart grid integration also stimulates innovation in specialized outdoor and underground ducting systems.

- Asia Pacific (APAC): This region is the primary engine of global market growth due to rapid urbanization, massive government investment in infrastructure (e.g., China’s Belt and Road Initiative, India’s Smart Cities Mission), and booming industrialization. The construction sector, particularly residential and commercial high-rises, drives huge volume demand for cost-effective PVC and plastic trunking systems. Simultaneously, the burgeoning IT and Telecommunication sector, spurred by 5G rollout and massive data center construction in Japan, Singapore, and Australia, creates a high-value niche for premium, high-density cable trays and metallic raceways. Regulatory compliance, though improving, often varies significantly between countries.

- Latin America: Market growth is moderate but steady, driven by infrastructure upgrades, particularly in Brazil and Mexico. Demand is concentrated in commercial developments and essential utilities, focusing on balancing cost-effectiveness with necessary safety standards. Political and economic volatility can impact large project timelines, leading to fluctuating demand, but the necessity for modernizing legacy electrical systems in industrial facilities provides a continuous market baseline for standard metallic and non-metallic raceways.

- Middle East and Africa (MEA): Growth is primarily fueled by large-scale, high-capital projects in the GCC nations (Saudi Arabia, UAE) related to diversification efforts, oil and gas sector infrastructure, and major smart city developments (e.g., NEOM). The extreme climate necessitates highly durable, UV-resistant, and corrosion-proof metallic and FRP raceways. Africa’s market, while smaller, is growing rapidly in telecommunications and power generation segments, where basic, reliable, and affordable non-metallic systems are primarily used for network expansion and rural electrification projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cable Raceway Systems Market.- Legrand

- Schneider Electric

- ABB Ltd.

- Atkore International

- Hubbell Incorporated

- Eaton Corporation

- HellermannTyton (A Delphi Technologies Brand)

- Panduit Corporation

- Leviton Manufacturing Co., Ltd.

- Thomas & Betts (A Member of the ABB Group)

- Chalfant Manufacturing Company

- Snake Tray

- Wiremold (Part of Legrand)

- MonoSystems Inc.

- Teaflex

- Marshall-Tufflex

- PFLITSCH GmbH

- B.T. Cablexpert

- Vantrunk

- Dura-Line Corporation

Frequently Asked Questions

Analyze common user questions about the Cable Raceway Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between metallic and non-metallic cable raceways?

Metallic raceways (steel, aluminum) offer superior mechanical protection, electromagnetic shielding, and robust fire resistance, making them ideal for industrial and data center environments. Non-metallic raceways (PVC, specialized plastics) are lighter, easier to install, corrosion-resistant, and often cost-effective, primarily used in commercial, residential, and regulated indoor spaces that require high fire safety standards like low-smoke zero-halogen (LSZH) properties.

How do cable raceway systems contribute to fire safety in modern buildings?

Modern cable raceway systems are critical to fire safety by utilizing materials that are flame-retardant and self-extinguishing, preventing the spread of fire via cabling pathways. Specialized systems, such as fire-rated raceways, maintain circuit integrity for critical systems (e.g., emergency lighting, fire alarms) during a specified period of fire exposure, ensuring life safety functionality as per NEC and IEC standards.

Which end-user application segment is projected to show the highest growth rate?

The IT & Telecommunication sector, specifically driven by continuous global investment in hyper-scale data centers, edge computing infrastructure, and 5G network expansion, is projected to maintain the highest overall demand volume. However, the Industrial Automation segment, fueled by the rapid adoption of Industry 4.0 and manufacturing plant modernization, is expected to exhibit the highest Compound Annual Growth Rate (CAGR) due to the necessity for protected, high-reliability cable management solutions.

What are the key factors driving the shift towards modular and snap-fit cable raceway designs?

The primary drivers are the demand for reduced installation labor time and complexity, coupled with the rising trend in modular and prefabricated construction. Modular, snap-fit designs allow for rapid assembly without specialized tools, significantly lowering total project costs and accelerating deployment schedules, making them highly favored by electrical contractors and large construction firms.

What is the role of BIM (Building Information Modeling) in the installation of cable raceways?

BIM plays a crucial role by enabling engineers to create precise 3D digital models of the entire raceway network. This minimizes construction errors, optimizes cable routing paths for maximum fill capacity and accessibility, and ensures full compliance with spatial constraints and safety codes before any physical installation begins, drastically improving project accuracy and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager