CAD Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442610 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

CAD Software Market Size

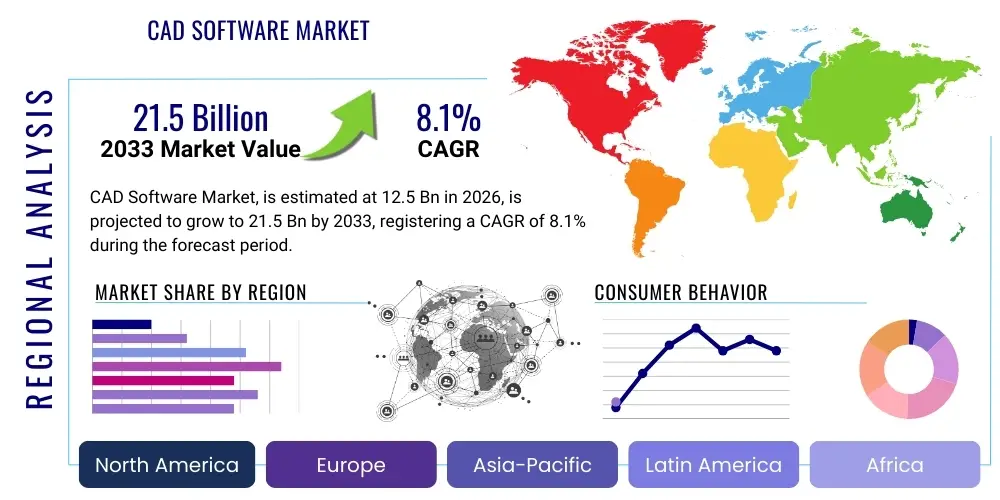

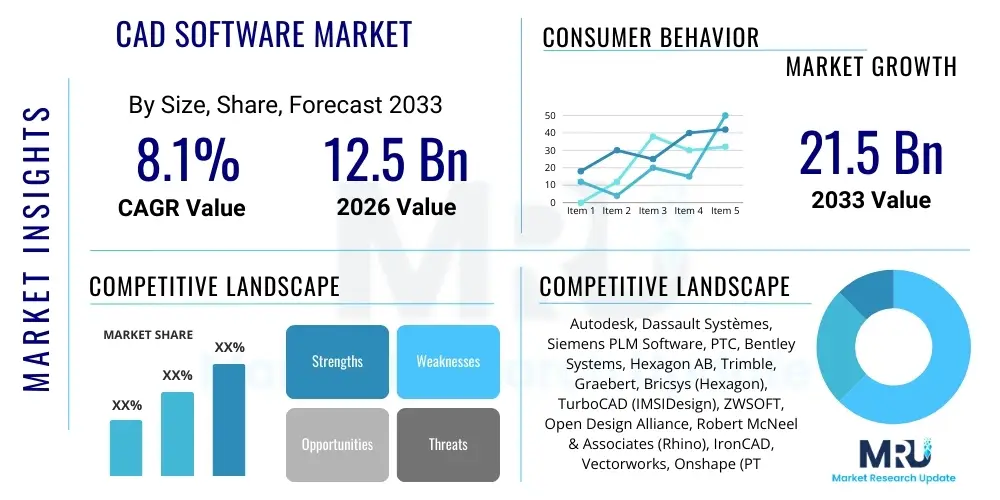

The CAD Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $21.5 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the accelerated adoption of 3D modeling technologies across core engineering sectors and the increasing necessity for digital transformation initiatives, particularly within the manufacturing and construction industries globally.

CAD Software Market introduction

The Computer-Aided Design (CAD) Software Market encompasses tools utilized by engineers, architects, designers, and construction professionals to create, modify, analyze, and optimize graphical representations of physical objects. This software facilitates highly accurate, efficient, and iterative design processes, replacing traditional manual drafting methods. Key products range from basic 2D drafting applications to complex 3D parametric modeling, surface modeling, and specialized Building Information Modeling (BIM) solutions. The inherent capabilities of CAD software—such as visualization, simulation, and collaboration—are crucial for product development cycles, enhancing precision, reducing prototyping costs, and accelerating time-to-market across numerous industrial verticals.

Major applications of CAD software span critical industries, including automotive, aerospace and defense, architecture, engineering, and construction (AEC), and consumer goods manufacturing. The principal benefit of adopting advanced CAD systems is the seamless integration they offer with downstream processes like Computer-Aided Manufacturing (CAM) and Computer-Aided Engineering (CAE), forming a comprehensive digital thread for product lifecycle management (PLM). Furthermore, modern cloud-based CAD solutions are democratizing access to professional design tools, enabling enhanced real-time collaboration among distributed teams and significantly improving project efficiency and responsiveness.

The market is predominantly driven by sustained investment in infrastructure projects globally, particularly the surge in commercial and residential construction requiring advanced BIM solutions. Moreover, the continual technological advancements in 3D scanning, additive manufacturing (3D printing), and the growing demand for highly customized products across the automotive and consumer electronics sectors mandate the use of sophisticated 3D CAD tools. These factors, combined with the increasing emphasis on optimizing design workflows and minimizing design errors, establish a strong foundational demand for CAD software solutions across small, medium, and large enterprises worldwide.

CAD Software Market Executive Summary

The CAD Software Market demonstrates sustained growth, underpinned by a significant transition toward cloud-native and subscription-based deployment models, offering greater scalability and lower upfront costs to end-users, particularly Small and Medium Enterprises (SMEs). Business trends show heightened M&A activities focused on acquiring specialized simulation capabilities and integrating AI/ML technologies to enhance generative design features and automate repetitive design tasks. Companies are shifting their revenue models from perpetual licensing to Software as a Service (SaaS) subscriptions, ensuring predictable recurring revenue streams and fostering continuous innovation through frequent software updates and feature enhancements, thereby solidifying customer loyalty and retention.

Regionally, North America maintains market leadership due to the high concentration of major CAD vendors, early adoption of advanced technologies like Digital Twins and AR/VR integration in design, and robust R&D spending in aerospace and defense sectors. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid industrialization, large-scale infrastructure development projects in China and India, and increasing governmental mandates promoting digital construction (BIM) practices. Europe maintains a steady market presence, driven by strict regulatory requirements in manufacturing and the automotive industry's continuous drive for electric vehicle (EV) innovation, demanding sophisticated simulation and design optimization tools.

Segment trends highlight the 3D CAD segment retaining dominance, driven by complex engineering requirements and the necessity for visualization and simulation capabilities across mechanical and industrial design. Cloud-based deployment is the fastest-growing segment, surpassing on-premise solutions due to advantages in accessibility, collaboration, and simplified IT management. The Architecture, Engineering, and Construction (AEC) application vertical, boosted by mandated BIM standards, shows significant momentum, closely followed by the Manufacturing sector, which relies heavily on CAD for precision engineering, tooling, and integration with advanced robotics and automation systems in smart factories.

AI Impact Analysis on CAD Software Market

Common user questions regarding AI's impact on the CAD Software Market center around three core themes: workflow automation, ethical concerns, and skill requirements. Users frequently ask: "How exactly will AI tools like generative design change the role of a traditional CAD engineer?" "Are AI algorithms reliable enough to handle complex structural constraints and material science simultaneously?" and "What training is necessary to manage AI-driven design outputs effectively?" Key concerns revolve around data security when utilizing cloud-based AI solvers, the potential erosion of traditional design intuition, and the required transparency (explainability) in complex AI-generated models. Users expect AI to move beyond simple optimization and fully integrate intelligent decision-making into the initial design conception phase, reducing the iterative cycle time dramatically while ensuring designs remain compliant and manufacturable.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the CAD landscape, moving it from a purely descriptive tool to a proactive, prescriptive platform. Generative design, a core AI application, allows engineers to define design goals, parameters, constraints (such as weight, strength, cost, and manufacturing method), and material properties, after which the AI algorithm automatically explores thousands of design alternatives, optimizing the topology based on the criteria provided. This capability significantly accelerates the ideation phase, often yielding counter-intuitive, highly efficient, and optimized designs that human engineers might not conceive, thereby pushing the boundaries of material efficiency and product performance.

Furthermore, AI algorithms are being applied to automate numerous non-creative, repetitive tasks within the CAD workflow, such as model cleaning, feature recognition, defect detection in simulated models, and automatic drafting of standardized components. Predictive maintenance integration using CAD models linked to operational data (Digital Twins) allows for real-time performance analysis and design modification suggestions, closing the loop between design and operational reality. This analytical capability enhances the value proposition of CAD software, positioning it as an integral part of the larger Industrial Internet of Things (IIoT) and smart manufacturing ecosystems, thereby justifying significant investment from large enterprises seeking operational excellence.

- AI-driven Generative Design: Automatic creation and optimization of complex geometries based on defined performance goals and constraints.

- Predictive Simulation: Use of ML to rapidly predict simulation outcomes, reducing reliance on time-consuming Finite Element Analysis (FEA) processing cycles.

- Automated Feature Recognition: AI algorithms recognizing common design elements (e.g., fillets, holes, pockets) for faster modification and standardization.

- Intelligent Design Validation: Automated checking against manufacturability rules, stress limits, and regulatory compliance requirements.

- Digital Twin Enhancement: Linking CAD models with real-time sensor data and AI analytics for continuous optimization and performance prediction.

- Workflow Automation: AI streamlining tasks such as meshing, rendering optimization, and creation of documentation from 3D models.

DRO & Impact Forces Of CAD Software Market

The CAD Software Market is primarily driven by the increasing global emphasis on product innovation, sophisticated design complexity in manufacturing sectors like aerospace and automotive, and the mandatory adoption of Building Information Modeling (BIM) standards in the construction industry across developed economies. These driving forces compel enterprises to upgrade legacy systems to advanced 3D and cloud-based platforms to maintain competitiveness and ensure regulatory compliance. Simultaneously, the market faces restraints, chiefly high initial capital expenditure associated with purchasing sophisticated licenses and specialized hardware, coupled with the steep learning curve and shortage of highly skilled CAD professionals capable of maximizing the potential of complex parametric and generative design tools. This skills gap acts as a significant barrier to entry, particularly for smaller firms in developing regions.

Significant opportunities are emerging from the convergence of CAD with frontier technologies, including Virtual Reality (VR) and Augmented Reality (AR) for immersive design review and visualization, and the integration with Additive Manufacturing (3D printing). The expanding scope of the Industrial Internet of Things (IIoT) and smart cities initiatives further drives the demand for accurate digital representations, pushing CAD utilization into operational and maintenance phases, beyond traditional design. Cloud adoption represents a major opportunity, allowing vendors to tap into the SME segment with flexible, pay-as-you-go subscription models, lowering the financial hurdle for adoption and accelerating market penetration in emerging economies.

The impact forces within the market are predominantly technological and competitive. The competitive landscape mandates continuous innovation, particularly in integrating physics-based simulation and AI/ML capabilities directly into the design interface. Furthermore, the standardization effort, such as promoting interoperability between different CAD systems and formats (e.g., STEP, IGES, IFC), significantly impacts market dynamics, influencing purchasing decisions based on ease of integration within existing PLM and enterprise resource planning (ERP) ecosystems. The shift towards open-source CAD solutions, though niche, represents a disruptive force that pressures established vendors to enhance their proprietary offerings with unparalleled features and user experience.

Segmentation Analysis

The CAD Software Market is highly segmented based on type, deployment model, application, and end-user, reflecting the diverse needs across different industries and enterprise sizes. Analyzing these segments provides a clear understanding of where growth capital is being allocated and which technological shifts are driving market share changes. The segmentation highlights the growing preference for 3D modeling due to its necessity in advanced manufacturing and visualization, alongside the rapid uptake of cloud deployment driven by the need for agility and remote access. Understanding these segment dynamics is critical for vendors aiming to tailor their product offerings and market strategies effectively.

The core segments include 2D CAD, which remains relevant for simple drafting and documentation, and 3D CAD, which dominates complex product development and engineering analysis. Deployment models delineate between traditional On-premise installations, favored by large enterprises with strict data security mandates, and the rapidly ascending Cloud-based models that offer scalability and accessibility. Application segmentation reveals the foundational reliance of AEC and Manufacturing sectors on CAD, with emerging growth in verticals like media and entertainment utilizing specialized CAD tools for animation and virtual environments. The end-user dichotomy between large enterprises and SMEs further defines pricing strategies and feature packaging requirements, with SMEs often prioritizing user-friendly, cloud-based solutions over highly specialized, expensive desktop platforms.

- By Type:

- 2D CAD

- 3D CAD

- Parametric Modeling

- Direct Modeling

- Surface Modeling

- By Deployment Model:

- On-premise

- Cloud-based (SaaS)

- By Application:

- Architecture, Engineering, and Construction (AEC)

- Building Information Modeling (BIM)

- Infrastructure Design

- Manufacturing

- Automotive

- Aerospace & Defense

- Industrial Machinery

- Consumer Goods

- Media & Entertainment

- Others (e.g., Healthcare, Education)

- Architecture, Engineering, and Construction (AEC)

- By End-User:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For CAD Software Market

The value chain for the CAD software market begins with the upstream activities of core technology providers, which include intellectual property (IP) developers specializing in computational geometry, visualization algorithms, and simulation kernels (e.g., meshing and solver technology). These fundamental technology layers are licensed or developed in-house by major CAD vendors. Upstream suppliers also include cloud infrastructure providers (AWS, Azure, Google Cloud) that host the growing number of SaaS CAD platforms, ensuring necessary computational power and scalability. The competitive advantage at this stage often lies in possessing proprietary, high-performance kernels that enable unique features like generative design or high-fidelity real-time rendering, differentiating the core product offering.

The midstream involves the core CAD software developers (e.g., Autodesk, Dassault Systèmes, Siemens PLM) who integrate the underlying technologies, build user interfaces, and develop specialized modules for specific applications (e.g., electrical design, piping, sheet metal). This stage is characterized by significant R&D investment in ensuring seamless interoperability with other enterprise systems (PLM, ERP) and continually optimizing the user experience for complex workflows. The distribution channel plays a crucial role in delivering the product to end-users. Direct distribution, via the vendor's own website and sales team, is common for large enterprise contracts and cloud subscriptions, offering better control over pricing and customer relationship management.

Indirect distribution relies heavily on an extensive network of Value-Added Resellers (VARs) and system integrators. These partners are vital for localization, providing technical support, specialized training, and tailoring customized solutions for regional SMEs, often acting as the primary customer interface in emerging markets. Downstream activities involve the end-users—the engineers, architects, and designers—who utilize the software for design and engineering tasks, integrating the CAD outputs into manufacturing (CAM), analysis (CAE), and project management systems. The feedback loop from these downstream users is critical for vendors to refine software functionality, address interoperability issues, and develop new features aligning with evolving industry standards like Industry 4.0 and sustainable design practices.

CAD Software Market Potential Customers

Potential customers for CAD software span nearly every industry involved in the design, engineering, or manufacture of physical products and structures. The primary buyers are concentrated within the Architecture, Engineering, and Construction (AEC) sector, which relies on BIM software to manage complex, multi-stakeholder building projects from conceptualization through facility management. These customers seek tools that offer robust collaboration features, clash detection capabilities, and adherence to regional governmental BIM mandates, driving demand for advanced, large-scale modeling solutions.

The second major segment comprises the Manufacturing industry, specifically automotive, aerospace, industrial machinery, and high-tech electronics firms. These buyers require sophisticated 3D parametric modeling and direct modeling software integrated with advanced simulation (CAE) capabilities to optimize component design for weight reduction, stress tolerance, and thermal performance. Their purchasing decisions are heavily influenced by the software’s ability to interface seamlessly with Computer-Aided Manufacturing (CAM) equipment and facilitate the unique constraints of additive manufacturing processes, making specialized modules highly desirable.

Furthermore, educational institutions represent a significant customer base, requiring bulk licenses for training the next generation of engineers and designers, often preferring accessible, low-cost or educational versions of industry-standard software. Small and Medium-sized Enterprises (SMEs) are emerging as critical growth drivers, increasingly adopting subscription-based, cloud-native CAD solutions due to their lower total cost of ownership (TCO) and ease of deployment, enabling them to compete effectively with larger counterparts without substantial upfront hardware investment. These SMEs prioritize user-friendliness and integrated project management features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $21.5 Billion |

| Growth Rate | 8.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Autodesk, Dassault Systèmes, Siemens PLM Software, PTC, Bentley Systems, Hexagon AB, Trimble, Graebert, Bricsys (Hexagon), TurboCAD (IMSIDesign), ZWSOFT, Open Design Alliance, Robert McNeel & Associates (Rhino), IronCAD, Vectorworks, Onshape (PTC), Shapr3D, Solidworks (Dassault Systèmes), Fusion 360 (Autodesk), Altair Engineering. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CAD Software Market Key Technology Landscape

The technological evolution of the CAD software market is characterized by a drive toward greater computational intelligence, enhanced interoperability, and ubiquitous access. Cloud computing platforms represent a foundational shift, enabling Software as a Service (SaaS) models that facilitate real-time, global collaboration on complex projects without requiring high-end localized hardware. This transition has also lowered the barrier to entry for smaller design firms and startups. Key developments include the enhancement of core modeling kernels to handle complex, organic shapes necessary for aesthetic design and topology optimization, supporting advanced manufacturing processes such as multi-axis CNC machining and intricate metal additive manufacturing.

Furthermore, the integration of advanced visualization and validation tools is paramount. This includes physics-based simulation (CAE), computational fluid dynamics (CFD), and kinematic analysis, which are increasingly being moved upfront in the design process, allowing engineers to validate designs earlier and more frequently—a concept known as 'shift-left' engineering. The utilization of Virtual Reality (VR) and Augmented Reality (AR) headsets and peripherals for interactive design review and digital prototyping is also maturing, providing immersive environments that dramatically improve communication and reduce the need for expensive physical prototypes, especially in the AEC sector for walk-throughs and site monitoring.

The most transformative technical trend is the pervasive adoption of AI/ML, specifically within generative design and optimization frameworks. These technologies necessitate powerful cloud processing and robust data pipelines to feed algorithms with material properties, manufacturing limitations, and historical performance data. Moreover, the development of Digital Twin technology, where CAD models serve as the foundational geometric representation, is expanding the utility of design software beyond the creation phase into the operation and maintenance lifecycles of assets. This requires seamless integration with IoT data streams and PLM systems, demanding high data integrity and robust data management features within the core CAD platform.

- Cloud-Native CAD Architecture: Shifting from desktop installations to scalable, web-based platforms accessible via browsers or lightweight clients.

- Generative Design Algorithms: Utilizing AI/ML to create optimized geometries based on performance specifications rather than explicit geometry creation.

- Simulation Integration (CAE/CFD): Embedding advanced analysis tools directly within the modeling environment for real-time design validation.

- Building Information Modeling (BIM): Specialized tools focusing on data-rich 3D models for architecture and construction planning, mandatory in many regions.

- Digital Twin Frameworks: Using CAD models as the geometric basis for real-time monitoring and management of physical assets integrated with IoT data.

- AR/VR Visualization: Employing mixed reality technologies for collaborative design review, immersive prototyping, and site inspection overlays.

- Parametric and Direct Hybrid Modeling: Offering designers flexibility to use both history-based parametric modeling and intuitive direct editing within the same platform.

- Interoperability Standards: Enhancing support for neutral file formats (e.g., STEP AP 242, IFC) and proprietary format conversion to ensure smooth data exchange across the value chain.

Regional Highlights

- North America: Dominates the global market share, attributed to the presence of key industry leaders (e.g., Autodesk, PTC), high technological penetration rates, and significant R&D spending, particularly in the aerospace, defense, and high-tech manufacturing sectors. The rapid adoption of cloud-based CAD solutions and strong venture capital funding for design software startups further cement its leading position.

- Europe: Represents a mature market characterized by stringent industrial regulations and high adoption rates in the automotive and industrial machinery segments, driven by continuous innovation in electric and autonomous vehicles. Strong governmental support for BIM mandates across countries like the UK, Germany, and France ensures steady growth in the AEC sector.

- Asia Pacific (APAC): Projected as the fastest-growing region globally, primarily fueled by massive infrastructure investments in countries such as China, India, and Southeast Asia. Rapid industrialization, increasing foreign direct investment in manufacturing facilities, and the growing base of SMEs adopting digital tools for competitiveness are key growth drivers.

- Latin America (LATAM): Exhibits moderate growth driven by urbanization and mining activities, leading to increased demand for specialized civil engineering and plant design software. Market growth is gradually accelerating as local governments promote digital transformation initiatives in public works.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, propelled by mega-construction projects (e.g., smart cities) and diversification efforts away from oil reliance, leading to high-value investment in advanced AEC and infrastructure CAD tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CAD Software Market.- Autodesk Inc.

- Dassault Systèmes SE

- Siemens PLM Software (Siemens Digital Industries Software)

- PTC Inc.

- Bentley Systems, Incorporated

- Hexagon AB

- Trimble Inc.

- Graebert GmbH

- ZWSOFT Co., Ltd.

- Robert McNeel & Associates (Rhino)

- IronCAD, LLC

- Vectorworks, Inc.

- Bricsys NV (A Hexagon Company)

- Onshape (A PTC Business)

- Solidworks (A Dassault Systèmes Brand)

- Shapr3D Zrt.

- Open Design Alliance

- SpaceClaim (A business unit of Ansys)

- ProgeSOFT S.A.

- Altair Engineering Inc.

Frequently Asked Questions

Analyze common user questions about the CAD Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from traditional on-premise CAD systems to cloud-based solutions?

The primary driver is the need for enhanced global collaboration, flexible subscription pricing (SaaS), and reduced IT overhead. Cloud-based CAD offers scalability, automatic updates, and accessibility from any device, significantly lowering the total cost of ownership (TCO) and enabling real-time design reviews for distributed teams, making it particularly attractive to SMEs and global enterprises seeking agility and data management efficiency.

How is Building Information Modeling (BIM) influencing the CAD Software Market, especially in the AEC sector?

BIM is fundamentally transforming the AEC sector by mandating the use of intelligent, data-rich 3D models throughout the entire project lifecycle, not just geometry creation. This shift has driven increased demand for specialized BIM-centric CAD software, promoting interoperability (IFC standards), and integrating construction management tools, thereby making BIM a prerequisite for large-scale public and private construction projects globally.

What role does Artificial Intelligence (AI) play in modern CAD, specifically regarding generative design?

AI is used in modern CAD primarily through generative design, which allows users to input performance criteria (e.g., load-bearing capacity, weight, material) rather than drawing geometry. The AI algorithm then automatically generates thousands of structurally optimized designs, accelerating the ideation phase and producing complex, highly efficient forms often optimized for additive manufacturing (3D printing), fundamentally changing how engineers approach component creation and optimization.

Which CAD segment is projected to experience the fastest growth during the forecast period?

The Cloud-based deployment segment is anticipated to exhibit the highest CAGR. This rapid growth is supported by increasing corporate acceptance of SaaS models, the critical requirement for remote work capabilities post-pandemic, and the increasing adoption of cloud infrastructure by vendors to deliver high-performance computing necessary for advanced simulations and AI-driven generative features without requiring substantial local hardware investments.

What challenges are restraining market growth, and how are vendors addressing them?

The main restraints are the high upfront costs associated with perpetual licenses and the persistent shortage of engineering professionals skilled in highly specialized, advanced CAD features like FEA and topology optimization. Vendors are addressing these by transitioning to affordable, flexible subscription models (SaaS) and investing heavily in simplified user interfaces and embedded AI tools to automate complex tasks, thus reducing the dependency on highly specialized expertise and lowering the skill barrier to entry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- CAD Software For Healthcare Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Softwear, Service), By Application (Breast Cancer, Lung Cancer, Colon Cancer, Pulmonary Embolism, Interstitial Disease, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- CAD Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud, On-Premise), By Application (Aerospace & Defense, Manufacturing, Automotive, Healthcare, Media & Entertainment, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- 3D CAD Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud, On-premise), By Application (AEC, Manufacturing, Automotive, Healthcare, Media & Entertainment, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- CAM and CAD Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Operating Systems, Windows, Mac OS, Linux/Android/Web Browser), By Application (Software, 3D Software, 2D Software, Real-time Software), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager