Cake Softener Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442925 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Cake Softener Market Size

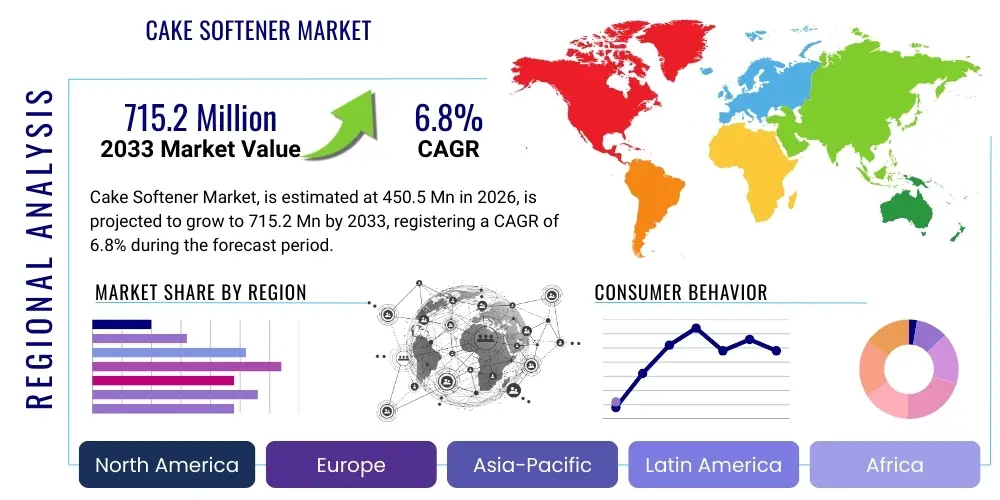

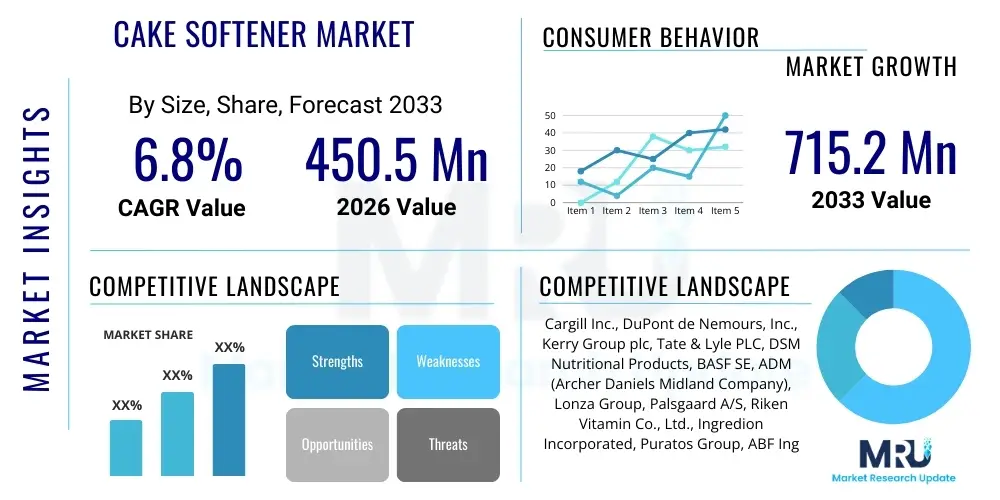

The Cake Softener Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 715.2 Million by the end of the forecast period in 2033.

Cake Softener Market introduction

The Cake Softener Market encompasses a specialized segment of functional food ingredients crucial for modern baking, primarily designed to enhance the textural attributes, moisture retention, crumb uniformity, and critically, the shelf stability of various baked goods, most notably cakes. These ingredients operate through sophisticated chemical and biochemical mechanisms, predominantly functioning as powerful emulsifiers or enzyme systems that influence the structure of starch and protein networks within the batter and subsequent baked product. The core function is to delay the process of staling, technically known as starch retrogradation, where gelatinized starch molecules recrystallize, leading to undesirable hardness and dryness. By interspersing themselves within the starch network, softeners like monoglycerides prevent this hardening, ensuring the cake remains palatable, moist, and soft for an extended period, which is indispensable for large-scale industrial production and distribution across long supply chains.

The product portfolio within this market is highly diversified, ranging from synthetic emulsifiers, which offer high cost-efficiency and performance, to innovative, naturally derived enzyme preparations that align with increasing consumer demand for 'clean label' products. Major applications span the entire spectrum of commercial baking, including ready-to-eat packaged cakes, frozen desserts, industrial cake mixes sold to household consumers, and products tailored for the extensive food service sector. Beyond merely inhibiting staling, softeners also play a key role in improving the initial quality of the cake, often by increasing batter stability during mixing and baking, allowing for higher tolerance to processing variations, and optimizing volume and air incorporation, which yields a lighter, more desirable crumb structure. The collective benefits translate directly into reduced waste, enhanced brand reputation through consistent product quality, and significantly expanded market reach due to prolonged freshness.

Driving factors underpinning the consistent expansion of the Cake Softener Market are multifaceted. Globally, shifts towards highly convenient, packaged food consumption, driven by rapid urbanization and increasingly busy consumer lifestyles, necessitates products with guaranteed, long shelf lives. Manufacturers, especially in high-volume, low-margin segments, rely on these ingredients as essential quality insurance. Furthermore, continuous technological advancements in ingredient science, particularly in the fields of enzymatic modification and encapsulation, allow for the development of tailored softeners that address specific baking challenges, such as reducing fat content without sacrificing texture, or achieving high-quality results in challenging low-sugar or gluten-free formulations. This sustained innovation, coupled with the need for competitive differentiation in a crowded retail landscape, ensures robust market demand and investment in sophisticated softening technologies across all major geographical regions, making it a dynamically evolving segment within the broader food ingredient industry.

Cake Softener Market Executive Summary

The global Cake Softener Market is characterized by accelerating momentum, driven fundamentally by the globalization of food consumption habits and the persistent innovation required to meet stringent consumer demands for both indulgence and nutritional transparency. Business trends highlight a pronounced pivot towards ingredient functionalization and specialization, where suppliers are moving away from single-purpose ingredients to integrated systems that address multiple challenges—such as staling, emulsification, and aeration—simultaneously. Strategic corporate activities, including targeted acquisitions of biotechnology firms specializing in enzymes and collaborative partnerships with global food processing equipment manufacturers, are focused on integrating softener solutions seamlessly into next-generation automated baking lines. Furthermore, sustainability and ethical sourcing have become central competitive differentiators, particularly regarding palm oil derivatives, necessitating complex certification and traceability systems, significantly impacting sourcing and procurement dynamics for industry leaders.

Regional dynamics illustrate a stark divergence between market maturity and growth potential. Mature markets, specifically North America and Western Europe, exhibit demand centered on premiumization, clean-label compliance, and functional efficacy in highly specialized product lines like vegan or low-sugar cakes. Innovation here is focused on optimizing dosage and minimizing ingredient declarations. In contrast, the rapid, explosive growth forecast for the Asia Pacific region is driven by fundamental market penetration, characterized by large-scale capital investment in new commercial bakeries and an escalating consumer base transitioning from artisanal to packaged, shelf-stable goods. This region demands high-volume, cost-optimized softeners, often favoring proven emulsifier technologies. The structural differences necessitate distinct market entry and product standardization strategies for multinational suppliers to effectively capture growth across diverse socioeconomic landscapes.

Analysis of segment trends reveals that while synthetic emulsifiers (e.g., Mono- and Diglycerides) maintain volume dominance due to their cost-effectiveness and versatility, the Enzyme segment is witnessing the highest relative growth rate, indicative of the industry's sustained commitment to clean labeling. This trend is forcing traditional emulsifier manufacturers to invest heavily in refining their processes to achieve higher purity and better compliance with non-GMO and ethical sourcing mandates. Furthermore, the application segment shows increasing demand from specialized ready-mix producers, emphasizing the need for powdered, highly stable softener formats suitable for long-term storage in dry ingredients. The convergence of these trends—cost pressure, functional optimization, and ethical sourcing—is shaping a market environment where competitive advantage is derived not just from the ingredient's performance, but also from the transparency and sustainability of its entire production lifecycle, demanding holistic operational excellence from market leaders.

AI Impact Analysis on Cake Softener Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Cake Softener Market frequently revolve around optimizing complex formulations, predicting ingredient stability under varied processing conditions, and enhancing quality control efficiency. The industry is actively questioning how predictive AI models can revolutionize the traditional, labor-intensive process of recipe development, specifically how machine learning can analyze hundreds of trial data points (e.g., moisture content, textural hardness, elasticity) to instantly recommend the optimal blend and concentration of various softeners—ranging from traditional emulsifiers to new enzyme cocktails—to achieve a desired textural outcome for a specific shelf life target. Concerns often touch upon data governance, the need for large, high-quality internal datasets to train these models, and the initial substantial investment required to integrate AI-powered formulation platforms into existing R&D infrastructure, balancing potential gains against implementation costs.

The profound impact of AI lies in its ability to leverage vast datasets derived from R&D trials, production runs, and even consumer feedback to create highly accurate simulation models. These models are capable of forecasting the performance parameters of cake softeners under numerous variables, such as variations in flour protein content, changes in oven temperature profiles, or slight alterations in water activity. By simulating the complex physical and chemical interactions (e.g., emulsifier-starch-protein binding), AI drastically reduces the time spent in physical prototyping. This acceleration is crucial for developing specialized products, such as softeners optimized for high-fiber or gluten-free cakes, where achieving acceptable texture is notoriously challenging. AI ensures that the ingredient systems developed are robust, providing reliable performance regardless of the unavoidable natural variability in agricultural raw materials, thereby translating directly into higher product consistency and reduced manufacturing waste.

Furthermore, AI is increasingly instrumental in automating and optimizing industrial production lines. Integration of AI-driven sensor networks (Internet of Things or IoT) within commercial bakeries allows for real-time monitoring of ingredient dosage and mixing parameters. If a slight deviation in the viscosity of a batter is detected—potentially indicating an issue with the softener's dispersion or efficacy—the AI system can instantaneously adjust the mixing time, temperature, or even the ingredient dosage to preemptively correct the batch. This level of precision, previously unattainable, significantly enhances operational efficiency and product quality assurance. Beyond manufacturing, AI systems are optimizing ingredient procurement by analyzing global commodity market trends, political stability in sourcing regions, and seasonal yield forecasts, offering predictive insights that help ingredient suppliers secure stable, cost-effective, and ethically certified raw material supplies, thereby managing the perennial industry challenge of price volatility and sustainability compliance.

- AI-driven predictive modeling optimizes softener efficacy and dosage, reducing R&D cycles and formulation costs by up to 30%.

- Machine Learning enhances real-time quality control via IoT sensors, ensuring consistent crumb structure and moisture content across high-volume batches.

- AI algorithms improve supply chain forecasting for volatile raw materials (e.g., vegetable oils), minimizing costs, managing inventory risk, and supporting sustainability tracking.

- Automated systems accelerate the identification and scaling of novel, clean-label enzyme-based softeners by analyzing biochemical reaction efficiencies.

- Data analytics supports sustainability tracking of ingredient sourcing and monitors compliance with clean label and ethical sourcing standards, improving regulatory adherence and consumer trust.

- AI assists in customizing softener blends for niche markets, such as optimizing performance for specific regional flour types or extreme climatic storage conditions.

- Predictive maintenance schedules for production equipment are optimized by AI, minimizing downtime related to ingredient processing and blending machinery.

DRO & Impact Forces Of Cake Softener Market

The Cake Softener Market’s trajectory is heavily influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming formidable impact forces. Key drivers include the overwhelming global demand for convenient, ready-to-eat bakery products, which inherently require sophisticated anti-staling solutions to maximize commercial viability across long distribution chains. The sustained trend of urbanization, particularly in emerging economies, accelerates the reliance on industrial food production, creating massive volume demands for cost-effective, high-performance softeners. Additionally, regulatory demands concerning reduced trans fats and healthier product profiles are paradoxically driving demand for softeners, as they are crucial tools for maintaining texture and moisture in formulations where traditional fats have been removed or minimized, necessitating high functional performance from the remaining ingredients.

However, the market faces significant structural restraints. Paramount among these is the escalating volatility and instability of raw material supply, particularly palm oil and its derivatives, driven by geopolitical instability, climate change impacts on agricultural yields, and mounting pressure regarding deforestation and unsustainable harvesting practices. This supply instability introduces severe pricing challenges and operational risks for ingredient manufacturers. Furthermore, a growing segment of health-conscious consumers exhibits strong resistance to ingredients perceived as 'synthetic' or 'chemical additives,' presenting a substantial reputational barrier for traditional emulsifier softeners. This restraint forces manufacturers into complex and expensive R&D pipelines focused solely on natural and enzyme-based alternatives, which often require higher technical expertise and command premium pricing, affecting market accessibility in price-sensitive regions.

The opportunities inherent in the market are centered around technological breakthroughs and geographical expansion. The continuous evolution of biotechnology allows for the development of entirely new enzyme systems that provide superior anti-staling effects without the negative consumer perception associated with chemical emulsifiers, carving out a lucrative premium segment. Geographically, significant opportunities exist in penetrating underdeveloped commercial bakery sectors in South Asia, Africa, and specific regions of Latin America, where the adoption of modern industrial techniques is still nascent but rapidly accelerating. Strategic market positioning involves offering tailored, regionally specific solutions that address local ingredient variations (e.g., high-ash content flour) while aligning with localized regulatory standards. Successfully navigating the conflicting demands—high performance versus clean labeling, cost efficiency versus sustainability—is the primary determinant of success, with impactful forces like regulatory shifts (e.g., EU food additive regulations) and global trade dynamics continuously resetting the competitive landscape and shaping investment decisions across the value chain.

- Drivers: Rising global demand for convenience bakery products; Necessity for extended shelf life and consistent quality in industrial baking; Regulatory pressure to reduce saturated/trans fats, requiring functional softeners as replacements.

- Restraints: Severe volatility in raw material pricing, particularly vegetable oil derivatives; Strong consumer resistance and negative perception toward synthetic food additives; High R&D costs associated with developing certified clean-label enzymatic solutions.

- Opportunity: Development and commercialization of next-generation clean-label, natural, and specialized enzyme-based softening solutions; Expansion into high-growth emerging markets (APAC and MEA) by customizing products for local manufacturing needs; Formulation of softeners specifically for specialized diets (e.g., keto, vegan, high-protein baking).

- Impact Forces: Increasing global stringency of food safety and additive labeling regulations (AEO priority); Disruptions in global commodity supply chains affecting feedstock availability; Accelerating consumer-driven ethical sourcing and sustainability mandates impacting ingredient selection.

Segmentation Analysis

Segmentation analysis of the Cake Softener Market provides a critical framework for understanding demand patterns and technology adoption across various end-user profiles and ingredient types. The market is fundamentally segmented by the functional mechanism employed (Type), the context of consumption (Application), and the raw material origin (Source). This multidimensional view reveals that functional performance remains the paramount criterion for the largest segment, Commercial Bakeries, necessitating ingredients that deliver maximal shelf-life extension and crumb stability under rigorous industrial conditions. However, the burgeoning Household segment, driven by baking mixes, prioritizes ease of use and perceived ingredient naturalness, favoring sophisticated powdered forms and clean-label messaging, creating a significant tension between technological efficacy and market positioning.

The Type segmentation clearly illustrates the technology trajectory. Emulsifiers, chiefly distilled monoglycerides (DMG), currently dominate the volume, capitalizing on decades of proven reliability and exceptional cost-to-performance ratio. However, the Enzyme segment, primarily utilizing specialized maltogenic amylases and sometimes lipases, is the fastest-growing sector. Enzymes achieve anti-staling effects through targeted biochemical hydrolysis of starch chains, which is viewed favorably by consumers and regulators. The complexity of enzyme formulation is higher, but the resulting clean-label status justifies the premium pricing in key European and North American markets. Manufacturers are increasingly offering combination products, leveraging the immediate emulsifying power of monoglycerides with the long-term anti-staling effect of targeted enzymes to provide a holistic solution package.

Furthermore, segmentation by Source highlights the ethical and sustainability concerns permeating the industry. While traditionally synthetic or chemically derived softeners (e.g., certain propylene glycol esters) offered robust performance, the market is aggressively pivoting towards Natural and Plant Derived sources, particularly lecithins from sunflower or rapeseed, and specialized protein hydrolysates. This source-based differentiation is heavily influenced by regional consumer preference—European markets prioritize non-GMO and sustainable palm-free options, while developing Asian markets often prioritize cost efficiency, driving volume demand for robust, commodity-based sources. Understanding these segment interactions is vital for tailoring regional supply chains; for example, high-volume production in APAC may utilize cost-effective synthetic softeners, whereas premium European exports often mandate certified natural and enzymatic alternatives to ensure market access and compliance with local labeling conventions.

- By Type:

- Emulsifiers (Distilled Monoglycerides (DMG), Propylene Glycol Monoesters (PGME), Diacetyl Tartaric Acid Esters of Monoglycerides (DATEM), Sodium Stearoyl Lactylate (SSL), Lecithin)

- Enzymes (Maltogenic Amylases, Glucose Oxidase, Fungal Alpha-Amylases, Lipases for fat structure modification)

- Modified Fats and Oils (Structured Lipids, Specialty Shortenings)

- Hydrocolloids and Gums (Xanthan Gum, Carrageenan, for enhanced moisture binding)

- By Application/End-User:

- Commercial Bakeries (Industrial Scale production of bread, cakes, and sweet goods)

- Household (Retail sales of ready-to-use baking mixes and direct-to-consumer ingredients)

- Food Service (QSRs, Hotels, Catering, relying on pre-baked or frozen products)

- Specialty/Artisan Baking (Focus on premium, clean-label, or organic certified softeners)

- By Source:

- Synthetic/Chemical Based (Historically dominant, cost-effective)

- Natural/Plant Derived (Sunflower, Soy, Rapeseed lecithin, and botanical extracts)

- Enzymatic (Microbial fermentation derived)

- By Form:

- Powder (Preferred for dry mixes and ease of dosing)

- Liquid/Paste (Used in large industrial mixers for immediate incorporation into batters)

- Encapsulated Forms (For delayed release and thermal stability during baking)

Value Chain Analysis For Cake Softener Market

The Cake Softener Market value chain is a complex, multi-tiered structure, starting with the cultivation and extraction of primary agricultural commodities in the upstream segment. This involves global sourcing of feedstock such as palm kernel oil, soybean oil, or specialty starches, as well as maintaining fermentation capabilities for biotechnology-derived enzymes. The key challenge at this stage is managing the highly competitive and often volatile global commodity markets, ensuring ethical sourcing standards (especially for palm derivatives), and maintaining high purity levels necessary for food-grade processing. Upstream innovation focuses on genetic modification or selection of microbial strains to increase enzyme yield and stability, alongside advanced fractionation techniques for vegetable oils to isolate specific lipid components required for high-performance emulsifiers.

The intermediate stage is dominated by specialized chemical and biochemical processing—the core competency of market leaders. Here, the raw lipids are chemically modified (e.g., esterification, transesterification) or enzymes are purified, concentrated, and formulated into functional ingredient systems. This midstream activity is critical for value addition, transforming simple commodities into high-performance food additives that perform reliably under industrial conditions. Ingredient manufacturers frequently invest in proprietary processing technologies, such as molecular distillation for monoglycerides or advanced drying techniques for encapsulated powders, to enhance stability and ease of application. Technical formulation expertise dictates product differentiation, focusing on blends that offer multi-functional benefits, such as combined emulsification, staling inhibition, and aeration improvement.

Distribution and downstream application represent the final stages. Distribution channels are highly dependent on the end-user size. Direct distribution channels, involving dedicated technical sales teams, service the Tier 1 multinational food processors and large commercial bakeries, providing highly customized solutions and crucial application support. Indirect channels rely on a network of food ingredient distributors, who manage inventory, warehousing, and often reformulation for smaller regional bakeries and household mix producers. The final consumer point is the retail sale of the baked good itself. Downstream success relies on proving the functional and economic benefit—a superior, consistent cake texture and extended shelf life—which justifies the ingredient cost. Therefore, the value chain is less about simple material transfer and more about the continuous transfer of technical knowledge, ensuring that the sophisticated ingredients are utilized optimally to maximize commercial outcome and consumer satisfaction.

Cake Softener Market Potential Customers

The primary customer demographic for the Cake Softener Market is centered on the industrial food processing sector, specifically those engaged in high-volume production of bakery and confectionery items requiring predictable quality control and maximum shelf life. This segment includes multinational food and beverage conglomerates such as General Mills, Mondelēz International, and Grupo Bimbo, whose operational scale necessitates bulk procurement of highly reliable emulsifier and enzyme systems. These large-scale clients prioritize technical performance data, supply security, regulatory compliance documentation, and competitive pricing structures suitable for continuous, high-speed manufacturing environments. Their purchasing criteria often mandate softeners that are thermally stable, highly dispersible in various batter matrices, and proven to deliver consistent anti-staling effects across diverse product lines, representing the critical volume demand segment of the market.

A rapidly expanding customer base is composed of the intermediate manufacturers specializing in prepared baking mixes, both for commercial wholesale and direct retail to the household consumer. These customers require softeners in specialized powdered formats that maintain stability over long periods when mixed with other dry ingredients like flour, sugar, and leavening agents. For this segment, the softener must be formulated to react reliably upon the addition of liquid at the point of use, ensuring an optimal baking outcome for the end consumer. Their focus is heavily weighted toward ease of incorporation, non-clumping properties, and adherence to clean label mandates, as these mixes are often purchased by consumers actively scrutinizing ingredient lists. Furthermore, the specialized market of gluten-free and vegan bakery producers forms a niche but high-value customer group, requiring softeners specifically engineered to compensate for the structural deficits caused by omitting traditional ingredients like gluten or eggs, driving demand for high-cost, high-functional specialty softeners.

Finally, the extensive Food Service network, including institutional caterers, large hotel chains, quick-service restaurant (QSR) suppliers, and specialized frozen dessert manufacturers, constitutes a significant customer segment. These clients rely on cake softeners to ensure that pre-baked or frozen products maintain their structural integrity and freshness after complex logistical handling, including freezing, thawing, and prolonged holding times under warming lamps or display cases. For these users, the softeners act as insurance against textural degradation post-preparation. Their purchasing decisions are often channeled through large ingredient distributors or specialized food service product providers, emphasizing the logistical reliability and consistent product quality across multiple operating sites. The collective necessity across all customer types is the desire to decouple product quality from the constraints of time, ensuring a superior consumer experience regardless of when or where the cake is consumed.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 715.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Inc., DuPont de Nemours, Inc., Kerry Group plc, Tate & Lyle PLC, DSM Nutritional Products, BASF SE, ADM (Archer Daniels Midland Company), Lonza Group, Palsgaard A/S, Riken Vitamin Co., Ltd., Ingredion Incorporated, Puratos Group, ABF Ingredients (AB Mauri), Stepan Company, WSP (Wilmar International), Lasenor Emul, Estelle Chemicals Pvt. Ltd., Bakels Group, Fiberstar, Inc., Batory Foods. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cake Softener Market Key Technology Landscape

The key technology landscape of the Cake Softener Market is dominated by advancements in molecular gastronomy and biotechnology, aimed at enhancing functional specificity and compliance with emerging clean-label demands. A primary focus area is the continued refinement of enzymatic technologies, specifically engineering maltogenic alpha-amylases to exhibit increased thermal stability, ensuring they survive the high temperatures of the baking process while retaining maximum activity to inhibit starch retrogradation during cooling and storage. Modern enzyme technology leverages precision fermentation and genetic selection of microbial strains to produce highly pure, targeted enzymes that minimize off-flavors and deliver predictable softening curves, a major technological leap from earlier, less-specific enzyme preparations.

Another crucial technological frontier involves encapsulation and controlled-release mechanisms for traditional emulsifiers. Microencapsulation of ingredients like monoglycerides using protective barriers (often based on modified starches or protein matrices) enhances their stability within dry baking mixes, prevents premature reactions, and ensures the emulsifier is released at the optimal time during the baking cycle. This technology is critical for manufacturers of long-shelf-life baking mixes and frozen dough products, providing performance stability under challenging storage conditions. Furthermore, continuous investment in specialized processing equipment, such as high-shear mixing and homogenization units, is required to create highly stable, fine-particle emulsions and lipid structures that maximize surface area and functional interaction within the batter matrix, leading to superior aeration and crumb homogeneity in the final cake.

The convergence with analytical chemistry and data science is also shaping the technology landscape significantly. Advanced analytical techniques, including Differential Scanning Calorimetry (DSC) and Texture Profile Analysis (TPA), are employed in R&D labs to precisely measure starch gelatinization, retrogradation kinetics, and crumb firmness, providing quantifiable metrics for comparing the performance of different softeners. This data, increasingly managed and processed by AI algorithms, drives informed formulation decisions, enabling the rapid development of custom blends optimized for specific nutritional profiles (e.g., low-fat or high-protein recipes). The future of the technology landscape is rooted in creating sustainable, highly efficient, and functionally specialized ingredients derived from novel sources (e.g., botanical extracts, algae-based components) that satisfy both the technical requirements of industrial baking and the ethical demands of modern consumers, making ingredient science an exercise in balancing functional performance with consumer perception and ecological responsibility.

Regional Highlights

Regional variance in the Cake Softener Market is profound, driven by economic development, established food manufacturing infrastructure, and deeply ingrained consumer preferences and regulatory oversight. North America, characterized by its mature and highly consolidated industrial bakery sector, exhibits sophisticated demand. The market here is less about volume growth and more about qualitative performance, focusing heavily on specialized applications, such as softeners optimized for high-volume, continuous processing lines, and those compliant with evolving health mandates (e.g., non-GMO certification, reduced sugar baking). Innovation is paramount, with a strong uptake of premium enzyme-based solutions that allow for clear, favorable labeling and address the high consumer expectations for indulgence combined with perceived health benefits, often commanding a significant price premium over basic commodity emulsifiers.

Europe mirrors North America in its maturity but is defined by the world’s most stringent regulatory environment regarding food additives and ingredient sourcing, notably the rigorous control of E-numbers and a strong consumer commitment to sustainability and local sourcing. This regulatory pressure makes Europe a leader in the development and adoption of certified organic, ethical, and palm-oil-free softening solutions. Ingredient suppliers must invest heavily in traceability systems and environmental impact assessments to succeed, pushing the market towards advanced, second- and third-generation enzymatic softeners and functional plant extracts. The European market, therefore, sets the global standard for ethical production and clean labeling, heavily influencing sourcing decisions for global ingredient manufacturers aiming to maintain international relevance and access to key Western consumer segments.

The Asia Pacific (APAC) region represents the epicenter of volumetric growth and future potential. This rapid expansion is a direct consequence of soaring middle-class populations, increasing urbanization, and the adoption of modern retail formats, which necessitate a transition from fresh, daily-baked goods to packaged, shelf-stable products. Countries like China, India, and Indonesia are witnessing unprecedented capital deployment in new, large-scale commercial bakery infrastructure. Demand here is dual-pronged: a high-volume, cost-sensitive segment driving uptake of traditional, cost-effective emulsifiers (DMG), and a growing premium segment in urban centers seeking imported or high-quality packaged goods that demand advanced, consistent softeners. Successful strategies in APAC require localized technical support to adapt softener performance to unique regional flours and high humidity climates, alongside scalable manufacturing capacity to meet exponential volume increases efficiently.

Latin America and the Middle East & Africa (MEA) constitute burgeoning markets where infrastructure development and increasing foreign investment are rapidly modernizing the food production sector. In LATAM, fluctuating currency and economic instability often place a premium on ingredient cost-efficiency, but there is strong growth potential as consumer purchasing power stabilizes and distribution networks improve. In the MEA region, particularly the Gulf Cooperation Council (GCC) countries, reliance on imported raw materials and an increasing preference for sophisticated Western-style baked goods drive demand for high-quality, stable softeners that ensure product integrity throughout challenging desert climates and complex logistical routes. These regions offer multinational suppliers significant whitespace opportunity, provided they can successfully navigate regulatory diversity, manage logistical complexity, and offer training to local bakers transitioning from traditional to industrial methodologies, emphasizing the functional reliability and long-term economic benefits of specialized cake softening systems.

- North America: High penetration in industrial baking; Strong focus on functional foods (gluten-free, high-protein); Driven by demand for premium, high-performance softeners and clear labeling mandates.

- Europe: Defined by strict clean-label requirements, ethical sourcing, and sustainability mandates; Leads in the rapid adoption of specialized enzymatic and natural solutions; Innovation concentrates on palm-free and non-GMO formulations.

- Asia Pacific (APAC): Fastest growing region globally; Fueled by urbanization, rising disposable incomes, and exponential growth in packaged food consumption; High volume demand for cost-effective emulsifiers in emerging economies (China, India), coupled with premium segment growth in established urban centers.

- Latin America (LATAM): Growth linked to increasing retail organization, modernization of local bakeries, and improving economic stability; Market requires resilient softeners to counteract humidity and manage logistical variability.

- Middle East & Africa (MEA): Emerging market driven by substantial infrastructure investment in food processing; Demand focused on high-stability ingredients necessary for handling hot climates and extensive supply chains, primarily in GCC and key African nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cake Softener Market.- Cargill Inc.

- DuPont de Nemours, Inc.

- Kerry Group plc

- Tate & Lyle PLC

- DSM Nutritional Products

- BASF SE

- ADM (Archer Daniels Midland Company)

- Lonza Group

- Palsgaard A/S

- Riken Vitamin Co., Ltd.

- Ingredion Incorporated

- Puratos Group

- ABF Ingredients (AB Mauri)

- Stepan Company

- WSP (Wilmar International)

- Lasenor Emul

- Estelle Chemicals Pvt. Ltd.

- Bakels Group

- Fiberstar, Inc.

- Batory Foods

Frequently Asked Questions

Analyze common user questions about the Cake Softener market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are cake softeners and how do they prevent staling?

Cake softeners are specialized food ingredients, primarily highly functional emulsifiers (like monoglycerides) or targeted enzymes (like amylases), designed to enhance cake texture and moisture retention. They prevent staling by inhibiting the recrystallization process (retrogradation) of starch molecules within the crumb structure, thereby maintaining a soft, fresh mouthfeel and extending the product’s commercial shelf life significantly, which is vital for industrial distribution systems.

Are enzyme-based softeners considered 'clean label' alternatives?

Yes, enzyme-based softeners, such as specialized maltogenic amylases, are widely favored as clean label solutions across mature markets (AEO focus). This preference stems from the fact that enzymes function as processing aids, and their activity is typically terminated by the heat of baking. Consequently, they often do not need to be listed as chemical ingredients on the final consumer product label, aligning perfectly with consumer demand for simpler, more recognizable ingredient declarations.

What is the primary factor driving the growth of the Cake Softener Market?

The primary driver is the accelerating global demand for packaged and convenience bakery products, particularly in fast-developing markets like APAC. The necessity for industrial bakeries to guarantee consistent quality, mitigate textural degradation, and ensure extended shelf stability across complex supply chains makes cake softeners a non-negotiable component for achieving commercial viability and competitive differentiation.

How does the volatility of raw material prices affect the market?

Volatility in the cost of key raw materials, especially agricultural commodities like vegetable oils used for mono- and diglycerides, poses a significant restraint. These fluctuations introduce severe cost risks for ingredient manufacturers, potentially squeezing margins and necessitating frequent price adjustments for the end product, complicating long-term contracting and operational stability for both suppliers and commercial bakeries.

Which geographical region exhibits the highest growth potential for cake softeners?

The Asia Pacific (APAC) region is projected to exhibit the highest and most explosive volumetric growth. This rapid expansion is fundamentally driven by profound shifts in consumer lifestyles due to urbanization and increasing middle-class disposable income, fueling unprecedented investment in large-scale commercial baking and the subsequent adoption of modern softening technology, particularly in high-volume, cost-sensitive segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager