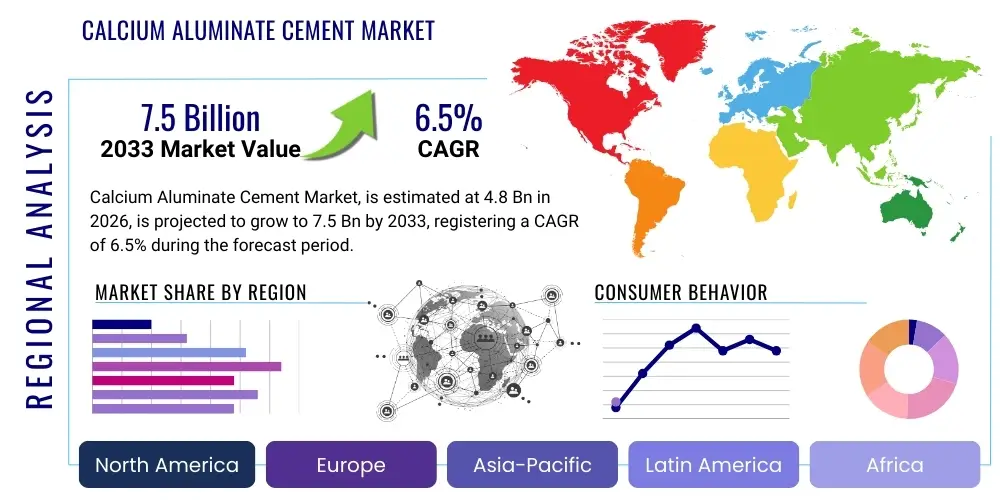

Calcium Aluminate Cement Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441948 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Calcium Aluminate Cement Market Size

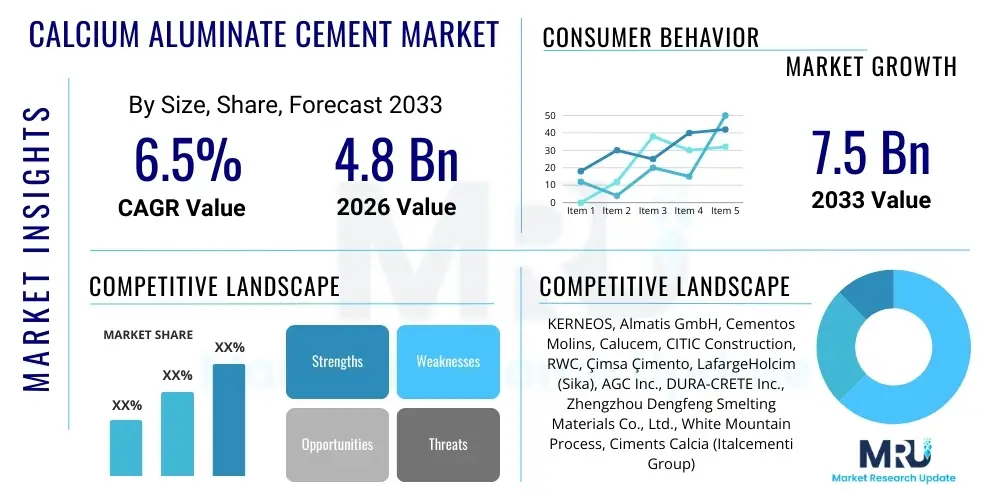

The Calcium Aluminate Cement Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Calcium Aluminate Cement Market introduction

Calcium Aluminate Cement (CAC), often referred to as high-alumina cement, is a specialized binder characterized by its rapid setting time, high early strength development, excellent resistance to chemical corrosion, and superior thermal stability. Unlike Ordinary Portland Cement (OPC), CAC is primarily composed of calcium aluminates rather than calcium silicates, which dictates its distinct performance characteristics crucial for demanding applications. The fundamental composition typically involves the reaction between limestone and bauxite or alumina-rich materials at high temperatures. These superior attributes make CAC indispensable in refractory applications, sewage infrastructure, offshore construction, and specific industrial flooring where resistance to abrasive wear, acidic environments, or high temperatures is mandatory. The market expansion is intrinsically linked to industrial infrastructure development and the increasing need for high-performance construction materials capable of enduring extreme conditions.

The primary applications driving the demand for Calcium Aluminate Cement revolve around the need for materials offering specialized functional properties far exceeding those of conventional cements. In the refractory industry, CAC serves as a critical binder in castables and monolithics used in furnaces, kilns, and incinerators, benefiting from its stability at elevated temperatures. Furthermore, its chemical resistance is highly valued in civil engineering projects, particularly those involving wastewater treatment plants and sewer systems where sulfates and acidic compounds accelerate the degradation of traditional concrete. The product's ability to achieve high strength rapidly also accelerates construction timelines in critical repair and infrastructural maintenance projects, positioning it as a premium solution in the construction chemical landscape.

Key market benefits driving adoption include significantly reduced curing times, crucial for minimizing downtime in industrial operations and infrastructure repair. Furthermore, the inherent durability and longevity of CAC concrete minimize life-cycle maintenance costs for infrastructure projects. The driving factors behind market growth are multifaceted, incorporating global industrialization leading to increased refractory consumption, stringent regulatory requirements for infrastructure durability and safety, and technological advancements enabling the formulation of high-performance blended cements utilizing CAC components. Specifically, growth in the metallurgical and petrochemical industries, coupled with global investments in water and sanitation infrastructure, provides consistent demand stimuli for specialized CAC products, solidifying its position in niche, high-value segments.

Calcium Aluminate Cement Market Executive Summary

The Calcium Aluminate Cement (CAC) market is exhibiting robust growth, driven by escalating demand from high-temperature industrial sectors, particularly metallurgy, glass, and ceramics, where the material’s refractory properties are non-negotiable. Business trends indicate a strong shift towards developing customized, ultra-low cement castables (ULCC) and low cement castables (LCC) that leverage CAC to offer enhanced performance, optimizing resource utilization and energy efficiency in high-heat processes. Strategic collaborations and mergers among key manufacturers are becoming prevalent, aimed at securing bauxite and alumina supply chains and expanding geographical penetration, especially in high-growth industrializing nations. Furthermore, sustainability concerns are influencing product innovation, focusing on energy-efficient manufacturing processes for CAC and exploring alternative raw material sources to reduce environmental impact, although this remains a complex challenge due to the specific chemical requirements of CAC production.

Regionally, the Asia Pacific (APAC) stands out as the dominant growth engine, primarily fueled by massive infrastructural investments in China and India, coupled with rapid industrial expansion, particularly in steel production and glass manufacturing, sectors that are intensive users of refractory materials. North America and Europe, while mature markets, maintain high demand for specialized CAC variants due to stringent building codes requiring durable, chemical-resistant materials in civil infrastructure, wastewater management, and marine applications. These developed regions are characterized by a focus on high-margin, specialized product grades and repair materials, contrasting with APAC's volume-driven demand for basic refractory binders. Market fragmentation exists among numerous smaller regional producers specializing in specific end-user formulations, alongside a few large global players dominating the primary production of clinker and base CAC products.

Segmentation trends highlight the increasing importance of the Refractory segment by application, which continues to account for the largest market share globally due to the irreplaceable nature of CAC binders in high-temperature applications. By product type, the high-purity Calcium Aluminate Cement (containing greater than 70% Al2O3) is experiencing accelerated demand growth, driven by the need for enhanced performance and longevity in ultra-high temperature furnaces. The construction chemical segment, while smaller, is witnessing significant technological refinement, particularly in rapid-set mortars and self-leveling compounds where CAC’s unique hydraulic properties provide a distinct competitive advantage. Successful market strategies increasingly rely on vertical integration to ensure raw material quality and consistent product supply, coupled with intensive R&D to develop performance-enhancing additives and new formulation technologies tailored to specific industrial processes.

AI Impact Analysis on Calcium Aluminate Cement Market

User inquiries regarding AI's influence on the Calcium Aluminate Cement (CAC) market frequently center on optimizing the highly energy-intensive clinker manufacturing process, predicting raw material performance variations, and improving quality control in complex castable formulations. Common themes highlight expectations regarding AI’s ability to minimize operational costs by optimizing kiln efficiency, questions about leveraging machine learning for predictive maintenance of refractory linings (where CAC is used), and the use of computer vision for automated quality inspection of produced cement batches. Users are keen to understand how AI algorithms can help in formulating CAC mixes with specific, difficult-to-achieve properties, such as enhanced thermal shock resistance or optimized setting times, moving beyond traditional trial-and-error methods. There is a strong user interest in using AI for supply chain resilience, predicting price fluctuations of key raw materials like bauxite, and managing logistics complexity in delivering specialty materials globally.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is set to revolutionize CAC production by enabling predictive analytics throughout the manufacturing lifecycle. In the kiln operation phase, AI models analyze massive datasets encompassing temperature profiles, fuel input, raw material feed composition, and resulting clinker chemistry. This real-time analysis allows for minute adjustments that maximize energy efficiency, reduce NOx emissions, and ensure consistent clinker quality, directly addressing the high energy consumption challenge inherent to CAC manufacturing. Furthermore, AI contributes significantly to raw material sourcing by predicting the optimal blend of different bauxite grades to maintain required alumina content while minimizing impurity levels, thereby safeguarding the final product's performance and reducing waste associated with off-spec production batches.

Beyond manufacturing, AI systems are increasingly deployed in quality assurance and application optimization. Advanced sensors and computer vision, supported by deep learning, can detect microscopic structural defects or compositional inhomogeneities in the final cement powder with speed and precision unattainable by human inspection, ensuring every batch meets stringent industry standards for refractory and construction use. In application development, ML models simulate the performance of various CAC-based refractory castables or construction mortars under extreme conditions (e.g., high heat, chemical attack). This simulation capability drastically reduces the R&D cycle time needed to develop specialized formulations, allowing manufacturers to quickly tailor products for specific customer requirements in steel mills or chemical plants. Thus, AI transforms CAC production from a data-intensive empirical process into a highly automated, precise, and optimized manufacturing environment.

- Enhanced Kiln Optimization: AI algorithms minimize fuel consumption and emissions during clinker burning by dynamic parameter adjustments.

- Predictive Maintenance: ML models forecast refractory failure in high-temperature applications, improving safety and minimizing downtime.

- Automated Quality Control: Computer vision and AI analyze cement characteristics (particle size, purity) in real time, ensuring batch consistency.

- Accelerated Material R&D: Machine learning simulates performance of new CAC formulations under stress, speeding up product development.

- Supply Chain Resilience: AI predicts price volatility and logistics bottlenecks for key raw materials such as bauxite and high-purity alumina.

DRO & Impact Forces Of Calcium Aluminate Cement Market

The Calcium Aluminate Cement (CAC) market is governed by powerful and often conflicting dynamics characterized by high performance requirements, specialized application niches, and significant production complexities. The primary drivers (D) include the indispensable nature of CAC in the global refractory industry, particularly in high-growth metallurgical and glass sectors, coupled with increasing infrastructure decay necessitating chemical-resistant and rapid-setting repair materials. However, the market faces notable restraints (R), chiefly the substantially higher cost compared to Ordinary Portland Cement (OPC), which limits its use primarily to specialized, high-value applications. Additionally, the energy-intensive nature of CAC production and the geographic concentration of high-quality raw material sources (bauxite) pose supply and sustainability challenges. Despite these hurdles, significant opportunities (O) exist in developing highly customized and eco-efficient CAC blends, penetrating emerging construction niches like 3D printing and advanced composite materials, and leveraging infrastructural projects focused on sustainable water and sewage management systems that demand extreme durability.

The impact forces within the CAC market amplify the influence of these core drivers and restraints. Technological advancements in blending technologies, which allow for the creation of new low-cement and ultra-low-cement castables (LCC/ULCC), significantly amplify the driver of refractory demand by improving the performance and longevity of industrial furnace linings, thereby increasing CAC’s value proposition. Conversely, stringent environmental regulations globally, especially those targeting high CO2 emissions from cement production, exert immense pressure, acting as a powerful restraint that forces manufacturers to invest heavily in carbon capture or explore alternative fuels, further increasing production costs. The market dynamic is also heavily influenced by the macroeconomic factor of global industrial capital expenditure; when sectors like steel and petrochemicals invest in new capacity or modernization, the demand for CAC surges, reflecting its role as a fundamental industrial input.

A critical impact force is the fluctuating price and availability of high-grade bauxite, the key raw material. Geopolitical tensions or changes in mining regulations can instantly disrupt supply chains, directly impacting profitability and product pricing, acting as a volatile restraint. Conversely, the rising global focus on urban resilience and longevity of infrastructure, particularly in coastal and earthquake-prone regions, provides a robust, sustained opportunity, driving demand for CAC’s superior resistance to sulfate attack and marine environments. The intersection of these forces dictates that market participants must maintain tight control over their supply chain while aggressively investing in specialized application development and regional market penetration strategies, focusing on the distinct performance benefits of CAC that justify its premium pricing structure.

Segmentation Analysis

The Calcium Aluminate Cement market is fundamentally segmented based on factors relating to chemical composition (Alumina Content), end-use application (Refractory, Construction), and product type, reflecting the varied performance requirements across different industrial sectors. Segmentation by alumina content is crucial as it directly correlates with the refractory and chemical resistance properties, with high-purity variants (>70% Al2O3) commanding premium pricing for ultra-high temperature or severe chemical environments. The application segmentation clearly delineates the market into the dominant refractory sector, which utilizes CAC as a binder in specialized castables, and the construction sector, where it is valued for rapid hardening and resistance to chemical attack, especially in niche repair and infrastructure projects. Understanding these segments is vital for manufacturers to tailor their product offerings and marketing strategies to the specific functional needs of diverse industrial buyers.

The refractory application segment is further broken down by the type of refractory product, such as monolithic refractories (castables, gunning mixes) and shaped products, with monolithics being the largest consumer of CAC due to the ease of installation and excellent high-temperature performance provided by CAC binders. Within the construction chemicals segment, CAC is a core ingredient in rapid-setting mortars, specialized grouts, self-leveling floors, and tile adhesives, where speed and durability are paramount. Geographical segmentation reveals diverse consumption patterns, with APAC focused heavily on bulk refractory usage driven by steel production, while developed markets in Europe and North America prioritize high-specification CAC for civil engineering, wastewater, and repair solutions. This granular segmentation allows for precise market sizing and forecasting based on the capital expenditure and industrial output trends of these specific end-user sectors.

- By Alumina Content (Purity):

- Low Alumina (40%-50% Al2O3)

- Medium Alumina (50%-65% Al2O3)

- High Alumina (65%-70% Al2O3)

- Ultra-High Alumina (>70% Al2O3)

- By Application:

- Refractory Applications

- Monolithic Refractories (Castables, Gunning Mixes)

- Pre-cast Shapes and Blocks

- Construction and Civil Engineering

- Specialty Mortars and Grouts

- Rapid-Set Concrete and Repair Materials

- Sewage and Wastewater Treatment Infrastructure

- Flooring and Substrates (Self-Leveling Compounds)

- Chemical Industry

- Mining and Tunneling

- Refractory Applications

- By End-Use Industry:

- Iron & Steel

- Cement & Lime

- Glass & Ceramics

- Non-Ferrous Metals

- Petrochemicals and Refineries

- Water & Waste Management

Value Chain Analysis For Calcium Aluminate Cement Market

The value chain for the Calcium Aluminate Cement market begins with the rigorous upstream analysis of raw material sourcing, predominantly high-grade bauxite and limestone. The quality and purity of bauxite are crucial, influencing the final cement’s properties, especially the alumina content and subsequent performance in high-temperature or corrosive environments. Upstream activities involve specialized mining, beneficiation processes to increase alumina concentration, and secure global logistics for transporting these materials to the clinker manufacturing sites. Given that bauxite availability is geographically concentrated and politically sensitive, manufacturers strive for long-term procurement contracts and vertical integration to mitigate supply risks and ensure consistent material quality, which is critical for maintaining product performance consistency, a non-negotiable factor in refractory applications.

Midstream activities center on the energy-intensive process of clinker production, which involves calcining the prepared raw mix in specialized rotary or shaft kilns at extremely high temperatures (often exceeding 1,400°C). This process requires significant capital investment in highly efficient kiln technology and robust energy management systems to control costs and minimize environmental impact. Following clinkering, the material is ground to the desired fineness, often incorporating additives to tailor properties like setting time or flowability. Quality control at this stage is exhaustive, ensuring the precise mineralogical composition (e.g., C12A7, CA, CA2) required for the target application—whether it is a fast-setting construction grade or a high-purity refractory binder. The concentration of manufacturing expertise and intellectual property regarding clinker formulation represents a significant value-added component in the midstream segment.

Downstream analysis focuses on distribution and the end-user application. Due to the specialty nature of CAC, the distribution channel is highly specific, often bypassing traditional bulk cement routes. Direct distribution is common for large industrial customers (e.g., major refractory producers or construction chemical formulators), allowing for technical support and custom batching. Indirect channels involve specialized distributors or agents who possess specific technical expertise in refractory castables or construction chemistry, acting as consultants to smaller end-users. The ultimate value delivery occurs at the point of application, where the CAC product is formulated into a final castable or mortar. Technical support and application know-how are essential services in the downstream segment, differentiating market leaders who offer comprehensive solutions rather than just raw materials.

Calcium Aluminate Cement Market Potential Customers

The primary end-users and buyers of Calcium Aluminate Cement are concentrated within industrial sectors that demand materials capable of surviving extreme operational conditions—high heat, severe abrasion, or aggressive chemical exposure. The largest consumer base resides in the refractory manufacturing industry, which purchases CAC as a critical binder for producing various types of monolithic and pre-formed refractory materials essential for lining furnaces, kilns, ladles, and reactors across the steel, glass, cement, and petrochemical industries. These manufacturers prioritize specific CAC grades based on required temperature resistance and chemical inertness, making them the most substantial volume buyers globally. Their purchasing decisions are heavily influenced by performance guarantees, material purity, and the consistency of supply, given the catastrophic operational impact of refractory failure.

A secondary, yet rapidly expanding, segment of potential customers includes construction chemical formulators and specialized civil engineering contractors. These buyers utilize CAC for its rapid strength gain and exceptional resistance to corrosive agents, particularly sulfates and chlorides. Applications include specialized repair mortars for bridges, dams, and marine structures, rapid-setting concrete for tunneling and mining operations, and materials for wastewater treatment facilities. Within this segment, the buyers are seeking materials that reduce construction time, minimize downtime, and offer long-term durability in chemically aggressive environments, thereby justifying the higher material cost associated with CAC versus conventional cements. The preference here is often for blended cements or pre-mixed dry mortars containing CAC.

Furthermore, niche potential customers include manufacturers of specialty grouts, self-leveling floor compounds, and heat-resistant adhesives used in highly regulated or specific technical environments. The strategic importance of CAC in these applications means that procurement is often dictated by engineering specifications and compliance with stringent performance standards. Key decision-makers in all these segments typically involve material engineers, procurement specialists focused on specialty chemicals, and technical directors responsible for operational efficiency and infrastructure longevity. The highly technical nature of CAC necessitates that suppliers engage directly with the technical teams of their customers to ensure proper product selection and application protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KERNEOS, Almatis GmbH, Cementos Molins, Calucem, CITIC Construction, RWC, Çimsa Çimento, LafargeHolcim (Sika), AGC Inc., DURA-CRETE Inc., Zhengzhou Dengfeng Smelting Materials Co., Ltd., White Mountain Process, Ciments Calcia (Italcementi Group), Denka Company Limited, Vesuvius plc, Gorka Cement, Union Clay Limited, Buzzi Unicem, F.B.M. S.p.A., Hubei Kingland Industrial Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Calcium Aluminate Cement Market Key Technology Landscape

The technological landscape in the Calcium Aluminate Cement (CAC) market is focused heavily on optimizing production efficiency, enhancing product performance for specialized applications, and addressing sustainability concerns. A core area of technological development involves advanced clinkering techniques, such as improvements in rotary kiln design and alternative fuel usage, aimed at reducing the substantial energy requirements and associated CO2 emissions of the manufacturing process. Innovations in raw material preparation, including enhanced beneficiation and blending techniques for bauxite, ensure higher consistency and purity of the clinker, which is essential for manufacturing ultra-high alumina CAC grades demanded by cutting-edge refractory applications. The adoption of process automation and digital twins in manufacturing is also growing, allowing operators to predict material behavior and adjust inputs in real time, leading to superior quality control and operational stability.

In terms of product formulation technology, significant research and development efforts are dedicated to creating high-performance CAC-based systems. This includes the development of sophisticated admixture packages (e.g., superplasticizers, retarders, and accelerators) that enable CAC to be used effectively in demanding construction applications like 3D printing concrete and self-consolidating materials, offering controlled setting times and improved workability. Furthermore, the refinement of ultra-low cement castable (ULCC) technology is paramount in the refractory segment. ULCC formulations minimize the non-cement binder content, drastically improving the mechanical strength and refractoriness of the final lining at extreme temperatures, thereby extending the service life of industrial furnaces and kilns. These technological advancements shift CAC from a bulk binder to a high-specification engineering material.

Emerging technologies, specifically relating to cement hydration and modification, are also impacting the market. Research into the mineralogy of CAC hydration products and the mechanisms of conversion is enabling manufacturers to produce more stable and durable concrete formulations, counteracting potential long-term strength loss issues sometimes associated with certain CAC applications. Moreover, technological integration with composite materials, such as incorporating nanomaterials or specialized fibers, enhances the physical properties of CAC-based matrices, broadening their application scope in demanding infrastructure projects that require resistance to fire, chemical ingress, and dynamic loading. The focus remains on developing cost-effective production methods that maintain or enhance the unique high-performance attributes inherent to Calcium Aluminate Cement.

Regional Highlights

The global Calcium Aluminate Cement market exhibits diverse growth patterns across key geographic regions, driven by varying levels of industrialization, infrastructure spending, and specific regulatory environments. Asia Pacific (APAC) leads the market in both consumption volume and growth trajectory. This dominance is primarily attributable to massive capital investments in the steel, non-ferrous metals, and glass manufacturing sectors in China, India, and Southeast Asian nations, all of which heavily rely on CAC-based refractory materials. Furthermore, rapid urbanization and infrastructural development requiring robust sewage and chemical-resistant construction materials contribute significantly to regional demand. APAC manufacturers are increasingly focused on scaling production and securing stable raw material supply chains to meet this sustained demand surge.

North America and Europe represent mature markets characterized by stringent quality requirements and a high demand for specialized, high-purity CAC grades. In Europe, the focus is increasingly on sustainable production methods and high-specification applications, particularly in complex civil engineering projects, rapid infrastructure repair (due to dense traffic networks), and compliance with strict environmental regulations concerning water treatment. North America, driven by the massive oil, gas, and petrochemical industries, sees strong demand for CAC in linings and specialized concretes due to its resistance to high temperatures and corrosive chemical environments. These regions demonstrate slower volume growth but significant market value, preferring advanced, customized formulations over bulk product.

The Middle East and Africa (MEA) region is emerging as a critical growth area, propelled by substantial investments in industrial diversification, including the establishment of new aluminum smelters, petrochemical complexes, and expanded oil and gas processing facilities. These projects create intense demand for high-quality refractory and high-performance civil engineering materials. Latin America, particularly Brazil and Mexico, contributes moderate demand, linked to their domestic steel production and mining industries, with market growth contingent on regional economic stability and large-scale government infrastructure initiatives.

- Asia Pacific (APAC): Dominant market share and fastest growth, fueled by high industrial output (steel, cement, glass) and infrastructure modernization in China and India.

- Europe: High value market driven by specialized civil engineering, wastewater treatment, and adherence to rigorous environmental and safety standards; strong R&D focus on advanced refractory solutions.

- North America: Stable demand from energy (oil & gas), petrochemical, and specialized construction sectors, emphasizing materials for corrosive and high-temperature environments.

- Middle East and Africa (MEA): Rapidly growing due to industrial diversification, establishment of new metallurgical facilities, and large-scale infrastructure projects.

- Latin America: Moderate growth linked to commodity production (steel, mining) and regional urbanization projects requiring durable construction materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Calcium Aluminate Cement Market.- KERNEOS

- Almatis GmbH

- Cementos Molins

- Calucem

- CITIC Construction

- RWC (Refractory & Construction Materials)

- Çimsa Çimento Sanayi ve Ticaret A.Ş.

- LafargeHolcim (Sika)

- AGC Inc.

- DURA-CRETE Inc.

- Zhengzhou Dengfeng Smelting Materials Co., Ltd.

- White Mountain Process

- Ciments Calcia (Italcementi Group)

- Denka Company Limited

- Vesuvius plc

- Gorka Cement

- Union Clay Limited

- Buzzi Unicem

- F.B.M. S.p.A.

- Hubei Kingland Industrial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Calcium Aluminate Cement market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Calcium Aluminate Cement (CAC) and Ordinary Portland Cement (OPC)?

CAC differs fundamentally from OPC in composition, being primarily calcium aluminates rather than calcium silicates. This results in CAC offering superior properties including very rapid setting and high early strength, excellent resistance to sulfates and chemical attack, and stability at extreme temperatures, making it essential for refractory and corrosive environments where OPC fails.

In which major industry is Calcium Aluminate Cement most commonly used?

The refractory industry is the largest consumer of CAC, utilizing it as a high-performance binder in monolithic refractories, castables, and gunning mixes. These materials are critical for lining kilns, furnaces, and ladles in high-temperature processes across the steel, glass, cement, and petrochemical sectors globally.

Why is CAC production considered environmentally challenging compared to conventional cement?

CAC production is energy-intensive, requiring higher burning temperatures and specific raw materials like bauxite, leading to a substantial carbon footprint. Manufacturers are actively researching process optimization, including alternative fuels and energy-efficient kiln technologies, to address these sustainability concerns and reduce CO2 emissions.

What is the role of CAC in specialized construction applications?

In construction, CAC is vital for applications demanding rapid strength development and chemical durability, such as quick-setting repair mortars, anchoring grouts, and concrete used in sewage systems and coastal infrastructure exposed to sulfate and chloride aggression. Its fast-setting property minimizes downtime on critical projects.

Which geographical region shows the highest growth potential for the Calcium Aluminate Cement Market?

Asia Pacific (APAC), particularly driven by massive industrial growth and infrastructure spending in China and India, exhibits the highest growth potential. The expansion of steel, glass, and specialized construction projects in this region drives significant demand for high-performance refractory and construction materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager