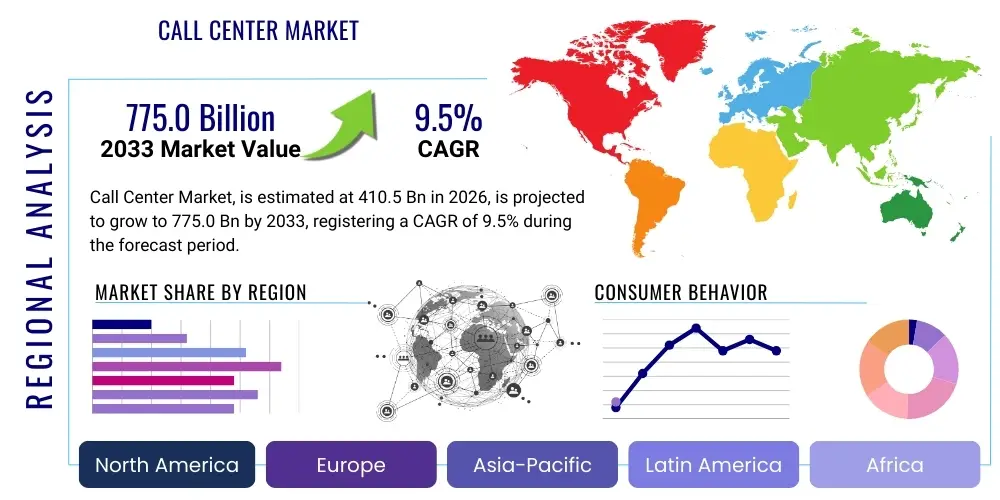

Call Center Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441382 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Call Center Market Size

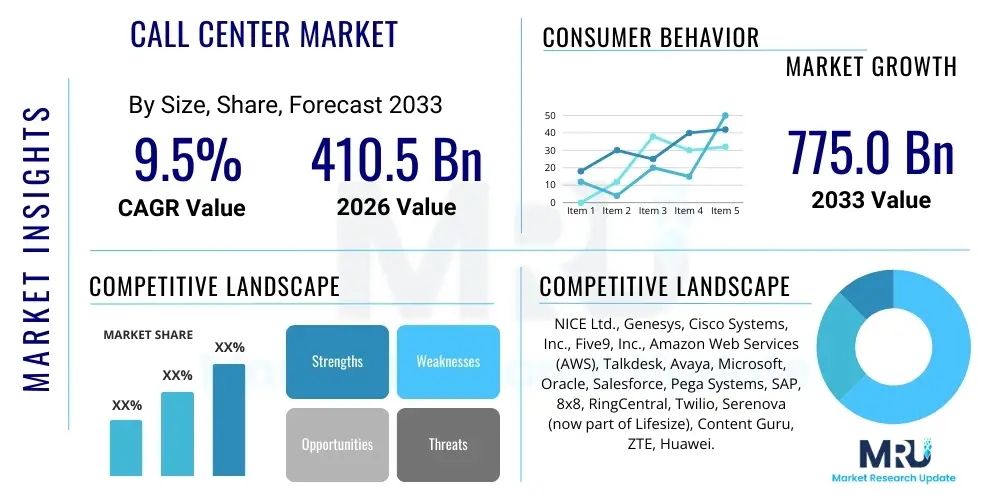

The Call Center Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 410.5 Billion in 2026 and is projected to reach USD 775.0 Billion by the end of the forecast period in 2033.

Call Center Market introduction

The global Call Center Market encompasses the vast infrastructure, technology, and service ecosystem dedicated to managing customer interactions, both inbound and outbound, across various communication channels. This includes traditional telephony systems, sophisticated omnichannel platforms incorporating email, chat, social media, and emerging conversational AI tools. The increasing complexity of modern customer journeys, coupled with the necessity for brands to provide seamless, personalized, and 24/7 support, drives the consistent expansion of this market. Product offerings range from automated systems (IVR, chatbots) and Workforce Management (WFM) software to Business Process Outsourcing (BPO) services.

Major applications of call center technologies span critical business functions, notably customer service and support, technical helpdesks, sales and telesales, and collections management. Key benefits derived from modernizing call center operations include enhanced customer satisfaction (CSAT), reduced operational expenditure through automation and efficiency gains, increased agent productivity, and superior data collection for strategic business insights. Furthermore, the adoption of cloud-based Contact Center as a Service (CCaaS) models has lowered the barrier to entry and increased scalability, profoundly benefiting Small and Medium-sized Enterprises (SMEs) seeking enterprise-level capabilities.

Driving factors for market growth are primarily linked to the digital transformation agenda across industries, heightened global competition necessitating differentiated customer experience (CX), and the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML). The COVID-19 pandemic accelerated the shift toward remote and distributed call center operations, permanently embedding flexibility and cloud infrastructure as essential market components. Regulatory requirements concerning data privacy and security, such as GDPR and CCPA, also drive investment in compliant, secure communication platforms, further fueling the demand for advanced, integrated call center solutions.

Call Center Market Executive Summary

The Call Center Market is experiencing a paradigm shift characterized by accelerated technological adoption, transforming traditional cost centers into strategic revenue drivers focused on customer experience (CX). Business trends indicate a massive shift from premises-based Private Branch Exchange (PBX) systems to flexible, scalable Cloud Contact Center as a Service (CCaaS) platforms, facilitating distributed workforces and global operational agility. Outsourcing remains a robust component of the market, particularly BPO providers leveraging automation to offer hybrid human-AI services, resulting in optimized service delivery and lower transactional costs for clients across industries such as finance, healthcare, and retail. Furthermore, the convergence of Customer Relationship Management (CRM) tools with call center technology (CTI integration) is crucial for delivering unified, context-aware interactions.

Regional trends reveal that North America and Europe currently dominate the market due to early adoption of advanced CX technologies, substantial investment in digital infrastructure, and a high concentration of large enterprises with complex customer bases. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, driven by rapid urbanization, massive growth in e-commerce, the rising penetration of smartphones, and the emergence of countries like India and the Philippines as global BPO hubs. Latin America is also growing steadily, supported by multinational companies establishing nearshore contact centers to serve North American markets efficiently.

Segment trends highlight the increasing importance of the Software segment over Hardware, particularly solutions related to Workforce Optimization (WFO), Quality Management, and predictive analytics. Within deployment models, CCaaS is the undisputed leader in growth momentum, favored for its flexibility, lower Total Cost of Ownership (TCO), and rapid deployment capabilities. Industry vertical analysis shows that the Banking, Financial Services, and Insurance (BFSI) sector, along with Healthcare and Life Sciences, are the largest end-users, primarily due to their stringent regulatory requirements and the necessity of managing massive volumes of sensitive customer interactions securely. Omnichannel routing capabilities, which seamlessly blend voice and digital channels, are now mandatory features driving segment spending.

AI Impact Analysis on Call Center Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Call Center Market predominantly revolve around three critical themes: job displacement, service quality enhancement, and return on investment (ROI) from automation. Users frequently question how quickly AI, specifically Generative AI and advanced Natural Language Processing (NLP), will replace human agents and the nature of the remaining human roles. There is also a strong expectation regarding AI's ability to solve complex customer issues autonomously and provide proactive, personalized service, moving beyond simple transactional support. Finally, businesses are concerned about the implementation costs and the practical timeframe required to integrate AI tools such as virtual assistants and intelligent routing engines into legacy infrastructure while ensuring data security and ethical compliance.

AI is fundamentally reshaping the operational landscape of call centers, transitioning them from purely transactional hubs to data-driven strategic centers. Intelligent automation, through chatbots and IVR systems, handles routine queries efficiently, offloading up to 50% of standardized interactions, thereby reducing wait times and improving First Call Resolution (FCR) rates. This shift allows human agents to focus on high-value, emotionally complex, or unique customer problems, effectively elevating the quality of human intervention. Furthermore, AI-powered analytics tools provide real-time agent guidance, sentiment analysis, and predictive modeling, enabling supervisors to identify training gaps and anticipate customer churn before it occurs. This symbiotic relationship, known as "augmented intelligence," significantly improves both agent morale and customer satisfaction scores.

The long-term influence of AI dictates a transition toward highly skilled, empathetic human agents who manage exceptions and handle complex problem-solving scenarios, complemented by a fully integrated AI layer managing the majority of high-volume interactions. Generative AI is increasingly used for automatically summarizing lengthy calls, drafting follow-up emails, and creating dynamic training content, optimizing the post-interaction workload. The adoption trajectory suggests that AI integration will become non-negotiable for competitive differentiation, ensuring that call centers can meet the escalating demands for instant, high-quality, and personalized service across all communication channels, thereby driving long-term market efficiency and profitability.

- Automation of routine tasks (tier-zero support) through chatbots and voicebots.

- Real-time agent augmentation via AI-driven conversational guidance and knowledge retrieval.

- Predictive analytics for anticipating customer needs and managing potential churn proactively.

- Enhanced quality assurance and compliance monitoring through automated sentiment and tone analysis.

- Intelligent routing systems (AI-Powered IVR) to match customers to the most qualified agent or resource instantly.

- Reduction in operational costs and improvement in Average Handle Time (AHT).

- Creation of hyper-personalized customer journeys using machine learning algorithms.

DRO & Impact Forces Of Call Center Market

The dynamics of the Call Center Market are governed by powerful drivers and restraining factors, balanced by significant opportunities that collectively determine the direction of future growth. A primary driver is the pervasive demand for improved customer experience (CX), making sophisticated, multi-channel interaction capabilities mandatory for retaining competitive advantage across all industries. This driver is intrinsically linked to the growing accessibility and maturity of cloud-based technologies (CCaaS), which simplify deployment and management. Restraints often include the significant initial capital expenditure required for comprehensive technology overhaul, particularly for large, legacy enterprises, coupled with persistent concerns regarding data security, compliance in a fragmented regulatory landscape, and the challenges associated with integrating disparate systems. Opportunities, however, are abundant, primarily revolving around the massive potential of integrating advanced AI, expanding into niche verticals like remote patient monitoring in healthcare, and the sustained growth of the BPO sector in emerging economies. These forces collectively propel the market toward continuous technological innovation and service evolution.

A key internal impact force is the necessity for workforce optimization (WFO) tools. As agent salaries and training costs rise, businesses are compelled to invest in software solutions that maximize agent efficiency, forecast demand accurately, and ensure high-quality output through continuous monitoring and coaching. The shift to remote work models, exacerbated by global events, has cemented the requirement for secure, reliable cloud infrastructure (CCaaS) capable of supporting geographically dispersed teams without compromising service quality or data integrity. This operational evolution acts as a perpetual driver, ensuring that traditional, premises-based models become increasingly obsolete as organizations prioritize agility and business continuity. Failure to adapt to these infrastructural demands results in competitive stagnation.

Externally, the most significant impact forces relate to consumer expectations and technological maturity. Consumers now demand instantaneous resolutions and seamless transitions between channels (omnichannel experience); this demand compels companies to adopt sophisticated unified communications platforms. Furthermore, the rapid advancement in Artificial Intelligence and Generative AI tools constantly raises the bar for automation capabilities, forcing solution providers to frequently upgrade their offerings. Regulatory pressure, particularly regarding personalized data handling (e.g., GDPR, CCPA), imposes constraints but simultaneously creates opportunities for vendors specializing in highly secure, compliant, and privacy-focused communication solutions. The combination of high consumer expectations and rapidly evolving, complex technology creates a strong gravitational pull toward continuous market investment and innovation.

Segmentation Analysis

The Call Center Market is comprehensively segmented based on components, deployment models, organization size, and industry vertical, reflecting the varied requirements of end-users worldwide. Component segmentation distinguishes between necessary hardware (e.g., servers, networking equipment), critical software (WFO, CRM integration, analytics), and the professional services essential for consultation, implementation, and managed support. The shift toward cloud-based models means the Software and Services segments are outpacing Hardware growth. Deployment analysis focuses on the rapid expansion of Cloud-based solutions (CCaaS) due to their scalability and cost-efficiency, contrasting sharply with the slow, steady decline of traditional On-premise installations. Organization size segmentation highlights the particular needs of SMEs, which benefit tremendously from subscription-based cloud services, versus Large Enterprises, which often require extensive customization and hybrid infrastructure.

Industry vertical segmentation provides crucial insight into end-user spending priorities. The Banking, Financial Services, and Insurance (BFSI) sector remains the dominant segment, driven by high transaction volumes, complex regulatory environments, and the need for personalized security checks. Retail and E-commerce are experiencing rapid growth, necessitated by the boom in online shopping and the need for efficient logistics and return handling support. The Healthcare and Life Sciences sector also exhibits strong adoption, particularly in managing patient appointment scheduling, insurance queries, and telehealth support, often requiring specialized compliance features like HIPAA adherence. This granular segmentation allows market participants to tailor their solutions effectively, focusing on vertical-specific pain points such as compliance, security, or peak demand management.

Further analysis of the functional application segmentation reveals the primary drivers of technology adoption. Customer interaction management (CIM) and workforce optimization (WFO) solutions are integral to enhancing efficiency and agent performance. CIM tools ensure seamless omnichannel experiences, while WFO platforms address key operational challenges like scheduling, quality monitoring, and agent training. The growing sophistication of analytics software, capable of deriving actionable insights from vast amounts of structured and unstructured customer data, represents the highest growth segment within the software category, enabling predictive modeling and superior decision-making capabilities.

- By Component:

- Hardware (Servers, Switches, Networking Equipment)

- Software (Workforce Optimization (WFO), Interactive Voice Response (IVR), Automatic Call Distribution (ACD), Analytics and Reporting, Customer Relationship Management (CRM) Integration)

- Services (Integration and Implementation, Consulting, Managed Services)

- By Deployment Model:

- On-premise

- Cloud-based (Contact Center as a Service - CCaaS)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Retail and E-commerce

- Telecom and IT

- Government and Public Sector

- Healthcare and Life Sciences

- Travel and Hospitality

- Others (Utilities, Education)

Value Chain Analysis For Call Center Market

The value chain of the Call Center Market is complex, stretching from core infrastructure providers to final service delivery platforms, involving technology vendors, telecommunications companies, and service providers. The upstream segment is dominated by hardware manufacturers (networking gear, servers) and foundational software developers specializing in operating systems, databases, and core communication protocols. Telecommunication carriers also play a crucial upstream role, providing the foundational connectivity (PSTN, VoIP, SIP Trunking) necessary for voice and data transmission. Ensuring interoperability and reliable foundational infrastructure are the primary value drivers at this stage, setting the technological constraints for downstream operations.

The midstream section involves Call Center solution vendors (both premises and cloud-based), who develop and integrate specialized applications like Automatic Call Distribution (ACD), Workforce Management (WFM), and advanced analytics platforms. These vendors aggregate the upstream technologies and customize them to meet specific enterprise needs. Their value proposition centers on integration capabilities, feature richness (omnichannel support, AI incorporation), and the ability to scale. Distribution channels are typically indirect, relying heavily on value-added resellers (VARs) and system integrators (SIs) who offer localized support, installation, and maintenance, especially for large, complex enterprise deployments.

The downstream segment consists of end-users (enterprises across all verticals) and Business Process Outsourcing (BPO) service providers. BPOs represent a major channel, delivering managed call center services to multiple clients, leveraging scale and specialized labor pools. Direct distribution often occurs for Cloud Contact Center as a Service (CCaaS) solutions, where enterprises subscribe directly to the vendor's platform. The final point of value delivery is the interaction itself, where the efficiency, quality, and context provided by the platform directly influence customer loyalty and business outcomes. The seamlessness between direct channel usage (enterprise-owned centers) and indirect channels (BPO partners) is a critical success factor in optimizing the downstream experience.

Call Center Market Potential Customers

Potential customers for Call Center Market solutions are ubiquitous, encompassing virtually every industry vertical that engages in systematic customer interaction management. The primary buyers are organizations seeking to centralize, optimize, or modernize their customer service, sales, and technical support functions. Large enterprises, particularly those in the Banking, Financial Services, and Insurance (BFSI) sector, represent the highest-value customers due to their necessity for high-security, high-volume transactional handling and mandatory compliance auditing. Their purchasing decisions are often guided by the need for robust, scalable, and highly integrated platforms capable of supporting millions of interactions monthly, alongside sophisticated analytics capabilities for fraud detection and risk management.

A second crucial customer segment comprises Small and Medium-sized Enterprises (SMEs) and high-growth technology startups. These organizations prioritize scalability, low upfront investment, and rapid deployment, making them ideal targets for subscription-based Contact Center as a Service (CCaaS) models. SMEs often leverage CCaaS to gain access to enterprise-level features, such as advanced routing and omnichannel integration, which would otherwise be financially prohibitive. Their purchasing criteria heavily emphasize user-friendly interfaces, seamless CRM integration, and predictable, operational expenditure (OpEx) models.

Furthermore, Business Process Outsourcing (BPO) providers constitute a unique and highly influential customer group. They act as intermediaries, purchasing advanced technology platforms and then leveraging them to serve multiple third-party clients across various geographic locations and time zones. BPOs are focused on maximizing agent utilization, minimizing technology sprawl, and demonstrating adherence to stringent Service Level Agreements (SLAs). Their investment decisions are heavily influenced by the platform's ability to support multi-tenancy, rapid client onboarding, and extensive workforce optimization (WFO) features, driving demand for technologically advanced, vendor-agnostic systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 410.5 Billion |

| Market Forecast in 2033 | USD 775.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NICE Ltd., Genesys, Cisco Systems, Inc., Five9, Inc., Amazon Web Services (AWS), Talkdesk, Avaya, Microsoft, Oracle, Salesforce, Pega Systems, SAP, 8x8, RingCentral, Twilio, Serenova (now part of Lifesize), Content Guru, ZTE, Huawei. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Call Center Market Key Technology Landscape

The Call Center Market technology landscape is currently undergoing a rapid transformation, driven primarily by the adoption of sophisticated software and cloud infrastructure. The core technology remains the integration of Computer Telephony Integration (CTI), enabling the seamless connection between telephony systems and enterprise applications like CRM databases, ensuring agents have instant access to customer history. However, the dominant shift is toward Contact Center as a Service (CCaaS) platforms, which offer modular, subscription-based access to necessary tools such as Automatic Call Distribution (ACD), Interactive Voice Response (IVR), and predictive dialers. CCaaS leverages public and private cloud environments, offering unparalleled scalability, rapid deployment, and simplified maintenance compared to legacy Private Branch Exchange (PBX) systems.

Artificial Intelligence (AI) and Machine Learning (ML) represent the most disruptive technological advancements impacting the market. This includes Natural Language Processing (NLP) for sophisticated voice and text analysis, driving the effectiveness of conversational AI (chatbots and voicebots). These technologies facilitate intelligent self-service and enhance human agent capabilities through real-time transcriptions, sentiment analysis, and next-best-action recommendations. Furthermore, advanced predictive routing algorithms, powered by ML, analyze agent performance and customer profiles to ensure the call is routed to the agent most likely to achieve a positive outcome, significantly enhancing First Contact Resolution (FCR) rates.

The omnichannel ecosystem is another crucial technological pillar. Modern call centers must manage interactions seamlessly across voice, email, SMS, social media direct messages, and emerging messaging apps without losing context. This requires robust Unified Communications as a Service (UCaaS) integration, allowing agents to switch channels while maintaining a single, unified view of the customer journey. Technologies like Workforce Optimization (WFO) suites, which include quality management, performance monitoring, and advanced scheduling tools, are essential for managing the performance and compliance of an increasingly remote and distributed agent workforce, ensuring operational excellence across all communication channels.

Regional Highlights

- North America: This region maintains its position as the largest market share holder, driven by the early adoption of advanced technologies like CCaaS and AI-powered automation. The presence of major market players (NICE, Genesys, Five9) and a substantial corporate ecosystem with high investment in customer experience (CX) platforms contribute significantly to its dominance. Regulatory compliance requirements, particularly in the BFSI and Healthcare sectors, necessitate continuous investment in secure, cutting-edge communication infrastructure, keeping the demand for sophisticated cloud solutions consistently high.

- Europe: The European market is characterized by robust growth, propelled by strict data privacy regulations (GDPR) and strong demand for multilingual and geographically distributed call center capabilities. Western European countries, such as the UK, Germany, and France, are rapidly transitioning from legacy on-premise systems to cloud-based models to enhance flexibility and address cross-border regulatory complexities. The focus here is strongly on compliance-as-a-service features integrated into contact center platforms.

- Asia Pacific (APAC): APAC is anticipated to record the highest CAGR during the forecast period. This rapid expansion is fueled by massive growth in e-commerce, the increasing digital maturity of consumers in countries like China and India, and the establishment of these countries as global BPO hubs. Government initiatives promoting digitalization and the large, young, digitally literate population drive high investment in call center infrastructure and services, often bypassing premises-based models directly for cloud deployment.

- Latin America (LATAM): Growth in LATAM is primarily driven by nearshore outsourcing trends serving the North American market, combined with rising domestic consumption requiring local customer support. Countries like Brazil and Mexico are seeing increased adoption of cloud-based solutions to overcome infrastructural limitations and provide competitive service offerings. Economic stability and the need for localized, Spanish/Portuguese language support make LATAM a critical emerging market for CCaaS vendors.

- Middle East and Africa (MEA): The MEA market is developing, with growth concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) due to large-scale infrastructure projects and government-led digital transformation agendas. High-security requirements, especially in the government and finance sectors, necessitate robust technology solutions. Africa, while having a smaller market size, presents future growth opportunities driven by mobile penetration and improving internet infrastructure, leading to targeted investment in remote and mobile-enabled contact center solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Call Center Market.- NICE Ltd.

- Genesys

- Cisco Systems, Inc.

- Five9, Inc.

- Amazon Web Services (AWS)

- Talkdesk

- Avaya

- Microsoft (Dynamics 365)

- Oracle Corporation

- Salesforce.com, Inc.

- Pega Systems

- SAP SE

- 8x8, Inc.

- RingCentral, Inc.

- Twilio, Inc.

- Content Guru

- Serenova (now part of Lifesize)

- Aspect Software (now Alvaria)

- TTEC Holdings, Inc.

- Concentrix Corporation

Frequently Asked Questions

Analyze common user questions about the Call Center market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the shift to Cloud Contact Center as a Service (CCaaS)?

The primary driver is the need for operational agility, scalability, and reduced capital expenditure (CapEx). CCaaS offers rapid deployment, supports remote workforces efficiently, and ensures business continuity, making it ideal for managing unpredictable market demands and maximizing cost efficiency compared to fixed on-premise solutions.

How is Artificial Intelligence (AI) fundamentally changing the role of human call center agents?

AI is augmenting, rather than entirely replacing, human agents. AI automates transactional and routine inquiries (tier-zero support), allowing human agents to focus on high-value, complex, emotional, or unique problem-solving tasks, significantly elevating the overall quality and personalization of customer service interactions.

Which industry vertical holds the largest share in the Call Center Market expenditure?

The Banking, Financial Services, and Insurance (BFSI) industry consistently holds the largest market share. This dominance is due to the necessity for managing high volumes of critical, sensitive transactions, adhering to strict regulatory compliance, and requiring advanced security features for customer authentication and fraud prevention.

What is the biggest challenge currently restraining the growth of the Call Center Market?

The most significant restraining factor is ensuring robust data security and maintaining global regulatory compliance (such as GDPR and HIPAA) across diverse, multi-channel platforms. Integrating advanced, AI-driven solutions into existing legacy infrastructure without introducing security vulnerabilities also presents a major technical challenge.

Why is the Asia Pacific (APAC) region expected to demonstrate the highest Compound Annual Growth Rate (CAGR)?

APAC's high CAGR is driven by aggressive digital transformation initiatives, the booming e-commerce sector, rapid urbanization, increasing smartphone penetration, and the region's strong position as a preferred hub for global Business Process Outsourcing (BPO) services, necessitating massive investments in modern communication infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Call Center AI Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Call Center AI Market Statistics 2025 Analysis By Application (BFSI, Retail and E-commerce, Telecommunications, Health Care, Media and Entertainment), By Type (Cloud-Based, On-Premise), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Contact and Call Centre Outsourcing Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Outbound call center services, Inbound call center services, Outsource date entry services, Man-power outsourcing, Outsource web enabled services, Outsource market reasearch services), By Application (Internet industry, Insurance, Finance and banking, Service industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager