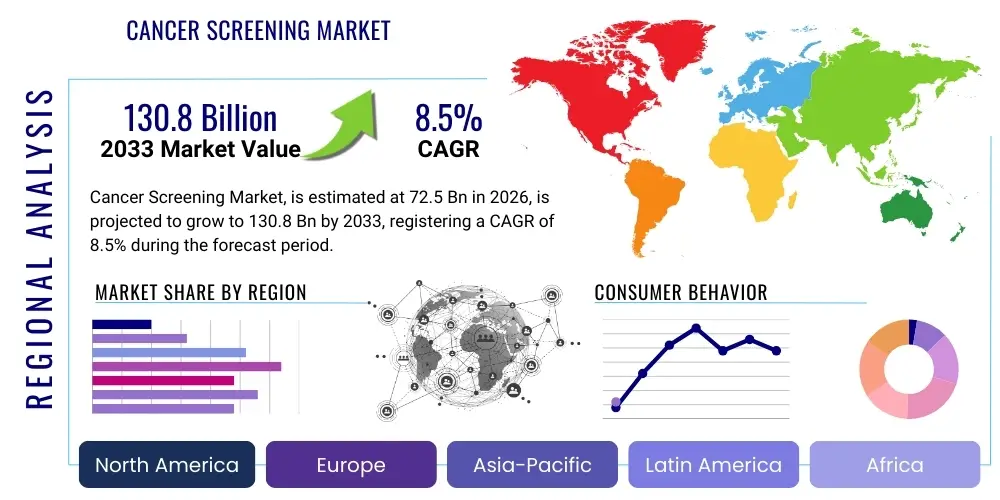

Cancer Screening Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443064 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Cancer Screening Market Size

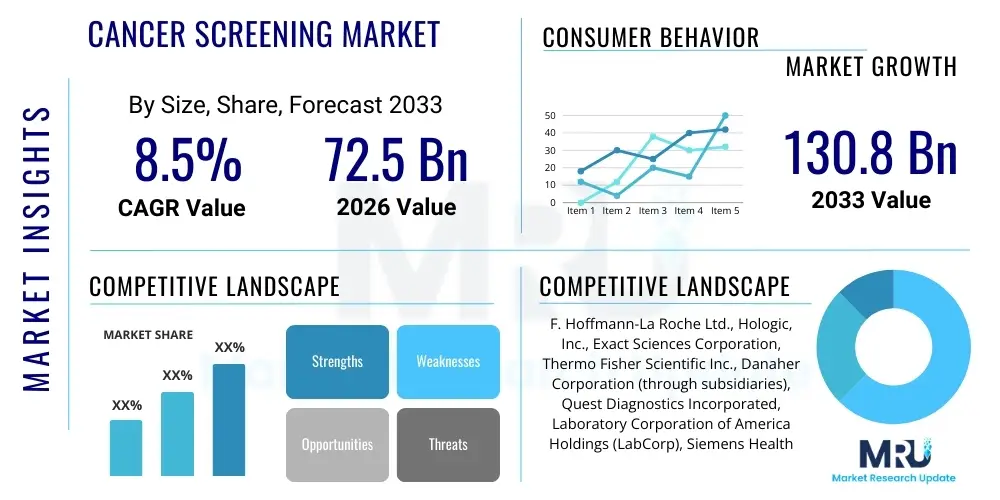

The Cancer Screening Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 72.5 Billion in 2026 and is projected to reach USD 130.8 Billion by the end of the forecast period in 2033.

Cancer Screening Market introduction

The Cancer Screening Market encompasses a wide array of diagnostic tests and procedures designed for the early detection of various cancer types in asymptomatic populations. These methodologies range from traditional imaging technologies such as mammography and colonoscopy to advanced molecular diagnostics like Next-Generation Sequencing (NGS) and liquid biopsy. Early detection is paramount in improving patient outcomes, significantly enhancing survival rates, and reducing the overall financial burden associated with late-stage cancer treatment. The market’s expansion is heavily fueled by global governmental initiatives promoting preventative healthcare, increasing public awareness regarding the importance of routine screening, and continuous technological advancements that offer less invasive and more accurate testing solutions.

Products within this market include instruments, consumables (such as kits and reagents), and software used across different screening modalities. Major applications span screenings for highly prevalent cancers including breast, cervical, colorectal, prostate, and lung cancer. The primary benefit of these products is the shift from diagnostic testing following symptom onset to proactive identification of precancerous conditions or early-stage malignancies, which allows for curative interventions. This preventative approach is fundamentally restructuring oncology care delivery worldwide.

Driving factors propelling market growth include the rising global incidence of cancer, particularly in aging populations across developed and developing economies. Furthermore, the integration of artificial intelligence (AI) and machine learning into diagnostic imaging and pathological analysis is enhancing test accuracy and reducing turnaround times, thereby increasing the efficiency and feasibility of widespread screening programs. Favorable reimbursement policies, particularly in North America and Western Europe, also significantly contribute to the accessibility and adoption of high-cost screening technologies, further sustaining robust market expansion throughout the forecast period.

Cancer Screening Market Executive Summary

The Cancer Screening Market exhibits dynamic growth driven by evolving technological landscapes and heightened global health awareness. Business trends are characterized by substantial investment in liquid biopsy technologies, particularly multi-cancer early detection (MCED) tests, which promise non-invasive screening capabilities. Strategic mergers, acquisitions, and partnerships between established diagnostic companies and innovative biotech startups are commonplace, aiming to consolidate intellectual property and broaden geographical reach. Furthermore, there is a pronounced shift towards personalized screening recommendations based on genetic predisposition and risk factors, moving beyond one-size-fits-all population screening models.

Regionally, North America maintains market dominance due to high healthcare expenditure, established screening infrastructure, and favorable regulatory pathways for novel diagnostics. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate, spurred by expanding healthcare access, rapidly increasing cancer burden due to lifestyle changes, and government investments aimed at building comprehensive cancer control programs in nations like China and India. European growth is steady, supported by robust public health systems and centralized screening guidelines, though adoption rates can vary significantly between Western and Eastern European nations.

Segment trends indicate that the technology segment is being rapidly transformed by molecular diagnostics, which are gradually displacing reliance on traditional screening methods for specific cancers. In terms of application, colorectal cancer screening and breast cancer screening remain the largest segments by revenue due to high guideline compliance and well-established screening protocols. The end-user segment demonstrates increasing utilization by diagnostic laboratories and independent reference labs, which leverage economies of scale to process high volumes of complex molecular tests, supporting decentralized screening efforts globally. The convergence of diagnostics and digital health is a key theme defining current and future market trajectory.

AI Impact Analysis on Cancer Screening Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cancer Screening Market primarily revolve around how AI can enhance diagnostic accuracy, reduce human error, and improve workflow efficiency. Common user concerns focus on the reliability and validation of AI algorithms across diverse patient populations, the high initial cost of integration into existing healthcare infrastructures, and ethical questions surrounding data privacy and algorithmic bias. Users also seek clarity on whether AI-driven tools will genuinely make complex screenings, such as intricate radiological image analysis or genomic data interpretation, more accessible and cost-effective, particularly in resource-limited settings. The overarching expectation is that AI will be transformative, moving screening from reactive population-based models to predictive and individualized risk assessment platforms.

AI is fundamentally optimizing the initial interpretation of screening results, providing substantial decision support to clinicians. In imaging, AI algorithms are becoming proficient at identifying subtle abnormalities in mammograms, CT scans, and colonoscopy images that might be overlooked by the human eye, thus reducing false-negative rates and accelerating the diagnostic pathway. Furthermore, AI is crucial in managing the vast amounts of data generated by multi-omics platforms, such as those used in liquid biopsy, allowing for the rapid identification of complex biomarkers indicative of early-stage malignancy.

Beyond technical analysis, AI systems are being deployed for operational efficiencies, including patient prioritization based on calculated risk scores and optimizing resource allocation for screening programs. This predictive capability ensures that high-risk individuals are targeted more effectively, maximizing the cost-effectiveness and public health impact of screening initiatives. As validation studies mature and regulatory frameworks adapt, the seamless integration of AI into routine clinical workflows promises a significant paradigm shift, offering precise, scalable, and personalized cancer screening solutions that address the inherent variability of human interpretation and the challenge of managing immense datasets.

- Enhanced Diagnostic Precision: AI improves sensitivity and specificity in interpreting radiological images (mammography, CT scans) and pathological slides, minimizing false positives and negatives.

- Workflow Optimization: Automated triage of screening results, prioritizing high-risk cases for immediate review and accelerating diagnostic turnaround times.

- Personalized Risk Stratification: Utilization of machine learning models to analyze vast datasets (clinical, genetic, lifestyle) to predict individual cancer risk and tailor screening frequency and type.

- Development of Multi-Omics Analysis: AI facilitates the interpretation of complex genomic and proteomic data derived from advanced techniques like liquid biopsy, enabling multi-cancer early detection (MCED).

- Reduction of Operational Costs: Automation of repetitive tasks and optimization of laboratory processes leading to lower overall operational expenses for high-volume screening programs.

- Improved Accessibility: Tele-pathology and AI-assisted remote diagnostics can extend specialized screening capabilities to underserved or rural populations.

DRO & Impact Forces Of Cancer Screening Market

The Cancer Screening Market is shaped by powerful Drivers, significant Restraints, and transformative Opportunities, collectively known as DRO, whose interacting forces determine market trajectory. The primary drivers include the escalating global burden of cancer, proactive government screening mandates (such as those for cervical and colorectal cancers), and crucial technological leaps, particularly in non-invasive screening methods like liquid biopsy, which promise higher patient compliance. These positive forces compel healthcare systems and industry stakeholders to continually invest in expanding screening accessibility and efficacy, reinforcing the preventative pillar of oncology care worldwide.

However, market expansion is significantly restrained by challenges such as high initial costs associated with advanced screening technologies (e.g., NGS instruments), insufficient coverage and lack of standardization in reimbursement policies across different geographies, and, critically, varying levels of patient adherence to established screening guidelines. Furthermore, the inherent risk of false positive results in certain mass screening tests leads to unnecessary follow-up procedures, anxiety, and increased healthcare expenditure, posing a persistent credibility hurdle that restraints widespread adoption of some novel tests.

Opportunities for exponential growth are concentrated in the development and commercialization of multi-cancer early detection (MCED) tests, leveraging circulating tumor DNA (ctDNA) and RNA biomarkers, which promise a single, annual blood test for multiple cancers. Additionally, market expansion into emerging economies with underdeveloped screening infrastructure offers substantial potential, provided that low-cost, point-of-care diagnostics can be developed and integrated. The increasing prevalence of companion diagnostics and risk-based screening models, driven by genetic data, also presents significant revenue streams and strategic collaboration opportunities.

The impact forces are substantial: high patient awareness and demand act as a sustaining force, while regulatory scrutiny and the need for robust clinical validation for new tests exert a persistent, challenging pressure. The continuous cycle of innovation, driven by competitive pressures among biotech and medtech firms, ensures that better, faster, and less invasive screening tools are constantly introduced, fundamentally impacting public health policy and clinical practice globally.

Segmentation Analysis

The Cancer Screening Market is intricately segmented based on technology, application, end-user, and geography, reflecting the diversity of screening needs and diagnostic methodologies available globally. Technological segmentation highlights the shift from conventional methods to advanced molecular and genomic screening tools, which are commanding larger market shares due to their enhanced specificity and sensitivity, particularly in identifying early-stage disease or recurrence. Application segmentation details the economic importance of screening programs for the most prevalent cancers, guiding R&D investment towards high-incidence areas like breast, colorectal, and lung cancers, while also catering to niche areas like prostate and cervical screening.

The segmentation by end-user demonstrates the primary consumption channels for screening products and services. Hospitals and specialized cancer centers remain crucial, as they integrate both diagnostic services and subsequent treatment protocols. However, the rise of independent diagnostic laboratories and research institutes, capable of handling complex molecular analysis and high throughput, is rapidly transforming the distribution landscape. These labs often serve as centralized hubs for sophisticated, non-invasive screening tests, making them essential partners in scaling up population screening efforts. Geographic segmentation underscores the disparity in screening maturity and adoption rates, with established markets setting the technology pace and emerging markets providing the highest volume potential for basic screening solutions.

- By Technology:

- Molecular Diagnostics (e.g., PCR, NGS, Microarrays)

- Immunoassays

- Imaging Technologies (e.g., Mammography, MRI, CT, Ultrasound)

- Biopsy

- Endoscopy and Colposcopy

- Point-of-Care (POC) Testing

- By Application:

- Breast Cancer Screening

- Colorectal Cancer Screening

- Cervical Cancer Screening

- Prostate Cancer Screening

- Lung Cancer Screening

- Skin Cancer Screening

- Other Cancers (e.g., Ovarian, Liver)

- By End-User:

- Hospitals and Clinics

- Diagnostic Laboratories and Research Institutes

- Ambulatory Surgical Centers (ASCs)

- Physician Offices

- By Type of Screening:

- Laboratory-Based Screening

- In-Vivo Screening (Imaging, Endoscopy)

Value Chain Analysis For Cancer Screening Market

The value chain for the Cancer Screening Market is extensive, starting with fundamental research and development (R&D) and progressing through complex manufacturing, rigorous clinical validation, streamlined distribution, and ultimately, delivery to the end-user. Upstream activities are dominated by pharmaceutical, biotechnology, and medtech companies focusing on biomarker discovery, assay development, and instrument engineering, demanding significant capital investment in genomic and proteomic platforms. This initial phase requires intensive intellectual property generation and stringent preclinical testing to establish the foundational science for accurate diagnostics.

Midstream processes involve the specialized manufacturing of diagnostic kits, reagents, sophisticated imaging devices, and software algorithms, all requiring compliance with strict quality control standards and regulatory approvals (such as FDA and CE Mark). Distribution channels are critical and include direct sales models for large, capital-intensive instruments, and indirect distribution through partnerships with medical distributors, Group Purchasing Organizations (GPOs), and wholesale pharmacies for high-volume consumables like test kits and reagents. Effective cold-chain logistics are particularly vital for molecular diagnostic components.

Downstream activities center on product deployment and utilization by end-users—primarily hospitals, reference laboratories, and physician offices. Direct distribution involves sales teams engaging directly with large healthcare networks for contract negotiations and technical support, which is common for high-value machinery. Indirect distribution leverages third-party labs (e.g., Quest Diagnostics, LabCorp) which act as large-scale processors, providing screening services to smaller clinics and physician practices. Successful downstream performance hinges on robust clinical integration, technical training for laboratory personnel, and continuous post-market surveillance to ensure reliable test performance and positive patient outcomes.

Cancer Screening Market Potential Customers

Potential customers for the Cancer Screening Market are highly diversified, encompassing the entire healthcare ecosystem that mandates, utilizes, or administers preventative care. The largest and most frequent buyers are governmental and private healthcare providers, including large hospital networks, specialized oncology centers, and integrated delivery networks (IDNs). These entities purchase screening instruments, high-throughput analyzers, and long-term contracts for consumables to facilitate large-scale, routine screening programs mandated by public health guidelines for populations at risk, such as annual mammography or regular colonoscopies.

Independent clinical diagnostic laboratories and reference laboratories represent another substantial customer segment. These labs, such as national chains and regional specialized facilities, utilize complex molecular diagnostic technologies (NGS, Liquid Biopsy) and serve as outsourced testing centers for smaller clinics and physician practices that lack the necessary infrastructure for specialized tests. Their purchasing decisions are driven by throughput capacity, assay accreditation, and the ability to offer a broad testing menu for various cancer types.

Furthermore, academic research institutions and pharmaceutical/biotechnology companies are significant consumers of advanced screening technologies for research purposes, clinical trials, and companion diagnostic development. Finally, primary care physicians and specialists (oncologists, gastroenterologists, gynecologists) serve as indirect customers, driving demand through test referrals and guiding patients toward specific screening modalities. Government public health agencies also act as customers when implementing mass screening campaigns, often procuring large quantities of test kits for centralized distribution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 72.5 Billion |

| Market Forecast in 2033 | USD 130.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | F. Hoffmann-La Roche Ltd., Hologic, Inc., Exact Sciences Corporation, Thermo Fisher Scientific Inc., Danaher Corporation (through subsidiaries), Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings (LabCorp), Siemens Healthineers AG, Illumina, Inc., Bio-Rad Laboratories, Inc., Abbott Laboratories, Koninklijke Philips N.V., Genmab A/S, Myriad Genetics, Inc., GRAIL, Inc., Guardant Health, Inc., Pacific Biosciences of California, Inc., Becton, Dickinson and Company (BD), QIAGEN N.V., Agilent Technologies, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cancer Screening Market Key Technology Landscape

The technological landscape of the Cancer Screening Market is undergoing rapid transformation, moving away from symptom-based testing towards highly sensitive, non-invasive, and molecularly focused methods. Next-Generation Sequencing (NGS) stands as a foundational technology, enabling deep genetic profiling of both tumor tissue and circulating components (ctDNA). NGS platforms allow for the simultaneous detection of numerous mutations and epigenetic markers, supporting the development of highly accurate risk assessment and early detection panels. The increasing affordability and speed of NGS are key factors in its growing integration into clinical screening protocols, particularly for hereditary cancer syndromes and complex solid tumors.

Liquid biopsy, which utilizes NGS and highly sensitive molecular techniques to analyze biomarkers such as ctDNA, circulating tumor cells (CTCs), and exosomes from blood or other body fluids, is the most disruptive technology in the market. Its primary advantage is its non-invasiveness and potential for high-frequency monitoring and screening across multiple cancer types simultaneously (Multi-Cancer Early Detection - MCED). Companies are heavily investing in robust clinical validation studies to prove the clinical utility and high specificity of these tests, aiming for regulatory approval and widespread adoption as a standard screening tool alongside traditional imaging and endoscopy.

Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) integration are pivotal in interpreting the vast datasets generated by these molecular technologies, as well as optimizing traditional imaging. AI algorithms enhance the detection rate in screening mammography and streamline the analysis of digital pathology slides, significantly improving the efficiency and consistency of interpretation. The continued refinement of immunoassay technologies, particularly highly sensitive multiplex assays capable of detecting multiple protein biomarkers in a single sample, also contributes substantially to the technological advancements observed across various screening applications.

Regional Highlights

Regional dynamics play a crucial role in shaping the global Cancer Screening Market, influenced by disparate healthcare infrastructures, varying reimbursement policies, and regional cancer incidence rates. North America, comprising the United States and Canada, currently holds the largest market share, characterized by high disposable income, extensive public and private health insurance coverage leading to high screening adherence rates, and the rapid early adoption of cutting-edge molecular diagnostics and advanced imaging technologies. Significant private investment in biotech and diagnostic startups further consolidates its leadership in innovation and market value.

Europe represents a mature market with high penetration rates for established screening programs, supported by centralized public health systems like the NHS in the UK or comparable systems in Germany and France. The European market emphasizes standardization and cost-effectiveness in screening protocols. Key growth is driven by the expansion of molecular diagnostic offerings and harmonization of screening guidelines across the European Union, addressing the high prevalence of breast, colorectal, and lung cancers across the continent.

The Asia Pacific (APAC) region is forecasted to experience the highest growth rate during the projection period. This explosive expansion is attributed to demographic changes leading to an increased elderly population, rising awareness of preventative health, and substantial improvements in healthcare infrastructure across major economies such as China, Japan, South Korea, and India. Governments in this region are initiating large-scale national cancer control programs, focusing on cost-effective and accessible screening methods, creating immense opportunities for both established imaging technologies and scalable molecular assays.

Latin America and the Middle East and Africa (MEA) are emerging markets, currently characterized by lower overall market penetration but offering significant untapped potential. Growth in these regions is heavily dependent on overcoming barriers related to healthcare access, infrastructure limitations, and establishing robust national screening policies. Strategic partnerships and technology transfers focused on providing affordable, localized screening solutions are key to unlocking market value in these developing regions.

- North America (U.S., Canada): Market leader, driven by high R&D spending, aggressive adoption of liquid biopsy and AI, and established reimbursement mechanisms. Focus on personalized risk assessment and MCED testing.

- Europe (Germany, U.K., France): Second largest market, characterized by standardized national screening programs and mature regulatory pathways. Strong emphasis on high-quality imaging and effective population screening management.

- Asia Pacific (China, Japan, India): Fastest-growing region, fueled by rising cancer incidence, government-led health initiatives, and improving economic conditions leading to increased healthcare spending and infrastructure development.

- Latin America (Brazil, Mexico): Emerging market showing substantial growth potential, requiring foundational investment in public screening services and accessibility to affordable testing solutions.

- Middle East and Africa (MEA): Growth constrained by infrastructure and varying political stability, but high growth in localized screening for common cancers in Gulf Cooperation Council (GCC) nations due to high per capita income and advanced medical city developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cancer Screening Market.- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Exact Sciences Corporation

- Thermo Fisher Scientific Inc.

- Danaher Corporation (through subsidiaries, including Beckman Coulter)

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings (LabCorp)

- Siemens Healthineers AG

- Illumina, Inc.

- Bio-Rad Laboratories, Inc.

- Abbott Laboratories

- Koninklijke Philips N.V.

- Genmab A/S

- Myriad Genetics, Inc.

- GRAIL, Inc.

- Guardant Health, Inc.

- Pacific Biosciences of California, Inc.

- Becton, Dickinson and Company (BD)

- QIAGEN N.V.

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- GE Healthcare

- Bio-Techne Corporation

- Sysmex Corporation

- Epigenomics AG

Frequently Asked Questions

Analyze common user questions about the Cancer Screening market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Cancer Screening Market?

The Cancer Screening Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033, driven primarily by technological advancements in molecular diagnostics and increasing global emphasis on preventative healthcare measures.

Which technology segment is expected to dominate the Cancer Screening Market?

Molecular Diagnostics, particularly technologies supporting Liquid Biopsy and Next-Generation Sequencing (NGS), is expected to dominate the market. These methods offer non-invasive and highly accurate early detection capabilities, driving their rapid clinical adoption and commercial expansion.

What is the primary impact of Artificial Intelligence (AI) on cancer screening?

AI significantly enhances screening accuracy and efficiency by improving the interpretation of complex medical images (e.g., mammography, pathology slides) and large genomic datasets, leading to earlier and more reliable detection of malignant or pre-malignant conditions.

Which geographical region shows the highest growth potential in cancer screening?

The Asia Pacific (APAC) region is anticipated to record the fastest market growth. This trajectory is supported by expanding healthcare infrastructure, rising prevalence of cancer, and increasing governmental investments in large-scale national screening programs across key economies like China and India.

What are the main restraints hindering the global adoption of cancer screening technologies?

Major restraints include the high cost of advanced molecular diagnostic tests, lack of standardized and consistent reimbursement policies across developing nations, and challenges related to ensuring high patient compliance with routine screening guidelines.

What are Multi-Cancer Early Detection (MCED) tests, and how are they changing the market?

MCED tests utilize liquid biopsy techniques to simultaneously screen for multiple types of cancer using a single blood sample. They represent a significant market opportunity by offering a highly convenient, non-invasive method that improves screening accessibility and adherence, shifting the paradigm towards universal annual screening.

How do health policy decisions influence the Cancer Screening Market?

Government mandates for specific screening procedures, updates to clinical guidelines (e.g., lowering the recommended age for colonoscopy screening), and decisions regarding public healthcare reimbursement determine the utilization rates and accessibility of various screening technologies, directly impacting market volume.

Beyond liquid biopsy, what traditional screening methods remain crucial?

Established imaging technologies, such as full-field digital mammography (FFDM), ultrasound, and endoscopy (colonoscopy), remain crucial staples in clinical guidelines due to their proven efficacy, established infrastructure, and regulatory acceptance for specific high-incidence cancers like breast and colorectal cancer.

Who are the primary end-users driving demand for cancer screening products?

The primary end-users are large Diagnostic Laboratories and specialized Reference Labs, followed closely by Hospitals and Integrated Delivery Networks (IDNs). These entities invest in high-throughput instruments and complex assay kits required for mass population screening and advanced molecular analysis.

Why is clinical validation a critical factor for new screening tests?

Stringent clinical validation, demonstrating high sensitivity and specificity in large patient cohorts, is essential for novel screening tests. This validation ensures regulatory approval, secures favorable reimbursement from payers, and establishes clinical trust necessary for widespread adoption and positive patient outcomes.

How is the market addressing the need for decentralized screening?

The market is addressing decentralization through the development of user-friendly Point-of-Care (POC) testing devices and tele-radiology/tele-pathology platforms supported by AI. These technologies allow basic and intermediate screening services to be delivered in smaller clinics and remote settings, improving geographic access.

What role does genetic risk assessment play in modern cancer screening strategies?

Genetic risk assessment identifies individuals with hereditary predispositions to cancer. This data allows clinicians to personalize screening protocols, often recommending earlier onset, higher frequency, or more intensive screening modalities (like MRI instead of just mammography) to improve early detection in high-risk groups.

Are consumables or instruments the major revenue driver in the market?

Consumables, which include reagents, kits, and assay components, typically represent the recurrent and stabilizing revenue stream, often dominating the market size. Instruments, while being high-value initial purchases, contribute substantially to market establishment but are typically less frequent purchases than the ongoing demand for testing materials.

What is the significance of companion diagnostics in the screening value chain?

Companion diagnostics are crucial as they link screening and diagnostic results directly to specific therapeutic strategies, especially in personalized oncology. While primarily used for treatment planning, the early identification of targetable biomarkers through screening methods strengthens the continuum of care and market utility.

How is competition intensifying among liquid biopsy companies?

Competition is intensifying through targeted clinical trials aimed at proving superior sensitivity, rapid commercialization of MCED platforms, strategic partnerships with global laboratory networks, and aggressive intellectual property portfolio expansion, all focused on establishing a dominant position in the early detection space.

What are the ethical considerations regarding genetic screening data privacy?

Ethical considerations primarily involve the secure management of sensitive genomic data generated during screening, ensuring data anonymity, preventing misuse or discrimination based on genetic predispositions, and maintaining transparent patient consent regarding data sharing and future research use.

How does reimbursement parity affect the adoption of new screening technologies?

Lack of reimbursement parity, where novel, highly accurate tests are reimbursed at rates similar to older, less effective methods, acts as a significant restraint. Favorable reimbursement decisions by major payers are critical accelerators for the commercial success and broad adoption of advanced screening diagnostics.

What drives the high market share of breast and colorectal cancer screening applications?

The high market share is driven by the high global incidence rates of these cancers, combined with long-established, widely mandated, and highly effective population-based screening guidelines (e.g., annual mammograms, regular colonoscopies) resulting in consistently high utilization volumes worldwide.

How is environmental screening risk integrated into current cancer strategies?

While not direct screening products, environmental and lifestyle risk assessments are increasingly integrated through digital health platforms and patient questionnaires. These data points, often analyzed by AI, help calculate an individual’s cumulative risk, informing the selection and timing of personalized clinical screening tests.

What are the regulatory hurdles for global market entry of a new screening test?

Regulatory hurdles include demonstrating clinical utility and performance via multi-site trials, obtaining specific certifications (e.g., FDA approval or CE Mark), navigating disparate national regulatory requirements (e.g., China's NMPA, Japan's PMDA), and addressing local accreditation and licensing requirements for laboratory testing.

What is the impact of COVID-19 on the long-term cancer screening market outlook?

The COVID-19 pandemic initially caused significant delays and reduction in routine screening volumes, resulting in a backlog of undetected cases. In the long term, this has increased urgency and demand for efficient, non-invasive, and easily accessible screening solutions, bolstering the adoption of liquid biopsy and home-testing kits.

How do preventative strategies differ between developed and emerging markets?

Developed markets focus on high-cost molecular tests, personalized risk stratification, and continuous upgrades of high-resolution imaging equipment. Emerging markets prioritize scaling up access to basic, cost-effective screening tools (e.g., low-cost HPV testing, visual inspection methods) and building foundational infrastructure for centralized lab processing.

Which key companies are heavily investing in liquid biopsy technology?

Key companies aggressively investing in liquid biopsy include GRAIL, Inc., Guardant Health, Inc., Illumina, Inc., Exact Sciences Corporation, and F. Hoffmann-La Roche Ltd., all focused on developing and commercializing highly sensitive multi-cancer early detection (MCED) assays.

What is the current challenge regarding false positive results in screening?

The challenge of false positives leads to patient anxiety, unnecessary invasive follow-up procedures, and increased healthcare costs. The market is addressing this by enhancing the specificity of molecular assays and using AI to reduce misinterpretation in imaging, thereby lowering unnecessary recalls.

How does the increasing geriatric population influence market demand?

The global increase in the geriatric population directly correlates with a higher incidence of age-related cancers. This demographic shift significantly boosts the demand for high-volume routine screening services and specialized diagnostics tailored for older adults, sustaining market expansion across all major regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Breast Cancer Screening Market Size Report By Type (Mammography Screening, Breast Magnetic Resonance Imaging (MRI) Screening, Breast Ultrasound Screening), By Application (Hospital, Clinic), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Breast Cancer Screening Test Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Blood marker tests, Imaging test, Genetic test, Immunohistochemistry test), By Application (Hospitals, Diagnostic centers, Cancer institutes, Research laboratories.), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager