Cane Harvesters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442707 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Cane Harvesters Market Size

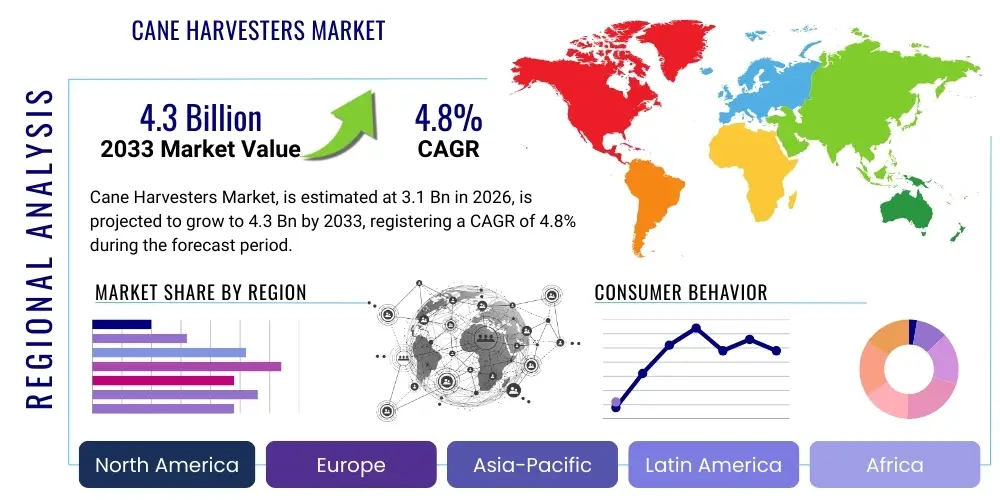

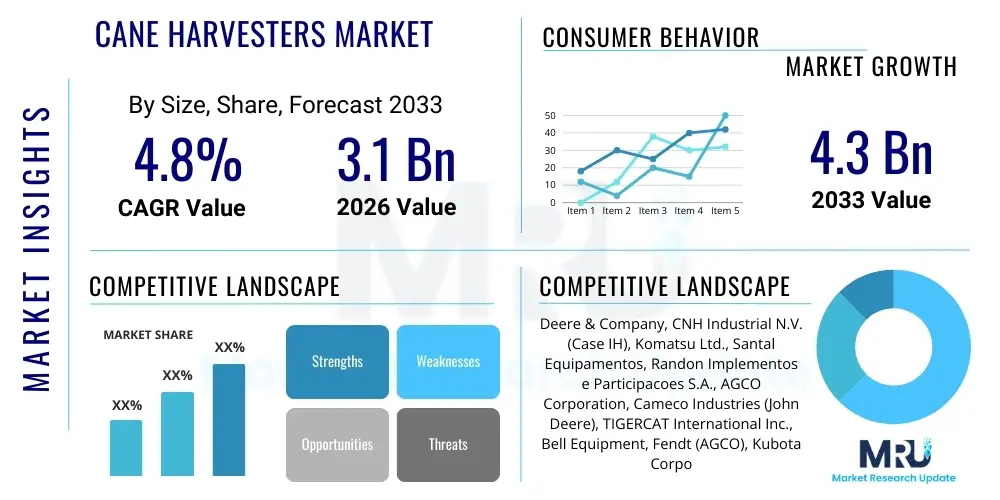

The Cane Harvesters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.3 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating global demand for sugar and biofuels, alongside the critical need for mechanized farming practices to counteract rising agricultural labor costs and enhance operational efficiencies across major sugarcane-producing nations like Brazil, India, and China. Furthermore, technological advancements leading to high-capacity, fuel-efficient, and precision-guided harvesting machinery are reinforcing market expansion, making mechanized harvesting a preferred solution over traditional manual methods.

Cane Harvesters Market introduction

The Cane Harvesters Market encompasses the manufacturing, distribution, and utilization of specialized agricultural machinery designed for efficiently cutting and processing sugarcane stalks. These sophisticated machines, primarily categorized into whole stalk harvesters and cut & chop harvesters, are instrumental in minimizing harvesting time, reducing crop loss, and significantly lowering labor dependency in large-scale sugarcane operations. Key applications include supplying raw cane to sugar mills for white sugar production, providing feedstock for ethanol and biofuel manufacturing plants, and ensuring timely delivery of high-quality produce to meet industrial processing schedules. The primary benefits derived from mechanized cane harvesting include vastly improved yield realization, standardized harvesting quality, and the ability to operate across various terrains and weather conditions, which manual labor often restricts. Major driving factors propelling this market include global population growth necessitating higher sugar production, stringent governmental regulations promoting biofuel integration, and continuous innovation in machine telematics and automation designed to optimize field logistics and resource consumption.

Cane Harvesters Market Executive Summary

The Cane Harvesters Market is characterized by robust business trends centered on automation and sustainability, driven by major global agricultural shifts. Current business trends indicate a strong move toward high-horsepower, track-based harvesters offering superior stability and reduced soil compaction, particularly crucial in regions experiencing high rainfall or challenging terrain. Manufacturers are focusing heavily on developing machines compliant with stringent Tier 4/Stage V emission standards, reflecting a commitment to environmental stewardship and operational longevity. Segmentation trends highlight the dominance of the cut & chop harvester segment due to its efficiency in preparing cane for immediate processing, thereby minimizing sucrose inversion post-harvest. However, whole stalk harvesters maintain relevance in specific geographical areas where traditional processing methods or logistical constraints necessitate longer cane pieces. The technological integration of GPS, telematics, and predictive maintenance systems is becoming standard, transforming these assets from simple machinery into complex data-gathering platforms that contribute directly to farm management efficiency and profitability metrics.

Regional trends demonstrate that the Asia Pacific (APAC) region, spearheaded by the massive sugarcane economies of India and China, along with the established market leader Brazil (often classified independently or within Latin America for specific reports), constitutes the largest market share, driven by rapid mechanization adoption to mitigate labor shortages and enhance farm scalability. North America and Europe, while having smaller sugarcane areas, show higher penetration rates of advanced, highly automated, and precision-enabled machinery, reflecting a focus on optimization and operational cost reduction rather than sheer volume capacity expansion. Latin America, particularly Brazil, remains a critical hub, not only for consumption but also for the manufacturing and export of cane harvesting technology, continually setting benchmarks for capacity and efficiency. These regional dynamics collectively illustrate a global market aggressively pursuing efficiency gains through technological adoption, underscoring the shift from purely manual farming to fully industrialized agricultural processes.

AI Impact Analysis on Cane Harvesters Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can transform the core functionality of cane harvesters, focusing heavily on operational autonomy, yield prediction accuracy, and maintenance optimization. Key questions revolve around achieving level 5 autonomy for driverless harvesting fleets, the potential for AI algorithms to dynamically adjust cutting heights and cleaning fan speeds based on real-time sensor data (such as soil moisture and trash content), and how predictive maintenance driven by ML models can minimize expensive downtime during critical harvest windows. Users are particularly concerned about the feasibility, cost-effectiveness, and reliability of integrating these advanced technologies into existing harvester fleets, alongside data security and the necessary skills gap mitigation for operators. The consensus expectation is that AI will shift the role of the operator from manual control to fleet management and supervision, maximizing output per hour while simultaneously reducing fuel consumption and minimizing overall crop losses.

AI’s influence is rapidly moving the Cane Harvesters market toward smart farming ecosystems, fundamentally altering the economics of sugarcane cultivation. By integrating sophisticated deep learning models with telematics and IoT sensors installed on harvesters, AI enables unprecedented levels of operational precision. For instance, AI algorithms can analyze satellite imagery and drone data pre-harvest, generating detailed field maps that dictate optimal path planning for harvesters, preventing overlap and ensuring efficient fuel use. Furthermore, AI-powered systems are being developed to identify and mitigate operational hazards in real-time, such as identifying foreign objects or excessively difficult terrain sections, thereby protecting the machinery from damage and enhancing overall safety. This integration elevates the harvester from a mechanical tool to a vital component of a digitized agricultural supply chain, linking field performance directly to mill processing requirements and inventory management.

The application of predictive analytics, a core subset of AI, is proving indispensable for equipment maintenance in this heavy-duty sector. Harvesters operate under extremely harsh conditions, and unexpected mechanical failure results in significant financial losses. ML models trained on historical maintenance records, engine performance data, and component stress readings can accurately predict the likelihood and timing of component failure, allowing maintenance teams to schedule interventions proactively. This shift from reactive or time-based maintenance to condition-based predictive maintenance maximizes the uptime of expensive capital assets, ensuring that harvesting capacity is available exactly when required. This strategic use of AI minimizes Total Cost of Ownership (TCO) for fleet operators and provides a significant competitive advantage in time-sensitive agricultural operations, ensuring seamless supply to refineries and biofuel producers.

- Autonomous Harvesting: Enables level 4/5 driverless operation through real-time path planning and obstacle avoidance systems.

- Precision Yield Mapping: Utilizes machine learning to correlate sensor data (moisture, trash) with GPS location for granular yield measurement.

- Predictive Maintenance: ML models analyze telematics data to forecast component failure, drastically reducing unplanned downtime.

- Dynamic Crop Management: AI adjusts cutting mechanisms and cleaning fan speeds instantly based on observed crop density and trash levels.

- Fuel Efficiency Optimization: Algorithms suggest optimal engine load and driving speed profiles to minimize consumption per hectare harvested.

DRO & Impact Forces Of Cane Harvesters Market

The dynamics of the Cane Harvesters market are shaped by a complex interplay of driving forces, inherent constraints, and emerging strategic opportunities. Primary market drivers include the accelerating demand for high-capacity harvesting solutions fueled by shrinking labor availability and rising wage rates in key sugarcane producing regions, particularly in Latin America and Asia. Simultaneously, opportunities arise from the increasing governmental support for sustainable farming practices, which favors mechanized systems capable of residue management (like trash blanketing) and reduced soil disturbance. Impact forces are currently dominated by the necessity of enhancing operational efficiency and lowering the carbon footprint of agricultural machinery, pushing manufacturers towards electric or hybrid harvesters. However, the market faces significant restraints, including the high initial capital investment required for modern, large-scale machinery and the critical shortage of skilled operators and maintenance personnel capable of managing sophisticated electronic and hydraulic systems prevalent in contemporary harvesters. The overall strategic direction is heavily influenced by the need to integrate seamlessly into the broader concept of Agriculture 4.0.

Drivers: A paramount driver is the persistent pressure on agricultural producers to increase output while simultaneously minimizing operational costs. Mechanization offers a direct route to achieving economies of scale that are impossible with manual labor, addressing issues such as the limited time window for optimal harvesting (sugar content deteriorates quickly post-maturity) and the variability of labor quality. Furthermore, the global push toward bioenergy, primarily sugarcane ethanol, especially in countries like Brazil and India, mandates a reliable, high-volume supply chain, which only modern, high-speed harvesters can reliably support. The development of advanced, specialized tracks and wheels also allows harvesters to operate in fields previously inaccessible to machinery, expanding the addressable market and improving utilization rates.

Restraints: The market’s most significant constraint lies in the capital intensity of the investment. A state-of-the-art cane harvester represents a substantial financial commitment, often prohibitive for small and medium-sized farmers, especially in developing economies. This limits market penetration and sustains the reliance on traditional harvesting methods in fragmented agricultural landscapes. Additionally, infrastructural deficiencies, such as poor rural road networks and limited access to specialized maintenance facilities, particularly in African and some Asian markets, complicate the logistics of deploying and servicing these large, heavy machines. Finally, the resistance from agricultural labor unions in some regions, concerned about displacement due to mechanization, represents a social restraint that policymakers must navigate.

Opportunities: Significant opportunities exist in the refurbishment and used equipment market, providing lower-cost entry points for smaller operators seeking to transition to mechanization. The development and commercialization of smaller, more maneuverable harvesters specifically tailored for steep slope farming and smaller plot sizes present a critical avenue for market expansion into non-traditional areas. Crucially, the integration of 5G connectivity and sophisticated telematics systems opens up new revenue streams for manufacturers through subscription-based precision agriculture services, remote diagnostics, and performance optimization consulting. The focus on developing harvesters capable of effectively managing trash (sugarcane residue) for soil health and carbon sequestration purposes aligns perfectly with global sustainability mandates, creating a strong market differentiator.

- Drivers: Rising labor costs; critical need for faster harvest cycles; increased demand for bioethanol feedstock; government subsidies promoting agricultural mechanization.

- Restraints: High initial investment cost; lack of skilled operating personnel; complex maintenance requirements; unfavorable field sizes/topography in certain regions.

- Opportunity: Development of compact harvesters for small holdings; growing market for retrofit telematics and IoT solutions; expanding biofuel policy support; emphasis on residue management technologies.

- Impact Forces: Technological innovation focused on reducing fuel consumption and emissions (Tier 4/Stage V compliance); integration of sophisticated sensor technology for trash reduction and yield quality improvement; fierce competitive pressure driving pricing strategy.

Segmentation Analysis

The Cane Harvesters Market is systematically segmented based on product type, operational mechanism, application, and geography, allowing for targeted strategic planning and resource allocation across diverse agricultural landscapes globally. Product segmentation generally focuses on whether the machine processes the entire stalk or cuts the cane into billets, reflecting differing requirements from sugar mills and processing plants regarding cane preparation and logistics. Operational segmentation often distinguishes between tracked and wheeled harvesters, reflecting adaptation to various soil conditions and weather patterns, with tracked versions typically preferred in softer, wetter environments prevalent in many tropical sugarcane growing areas. This granular breakdown is essential for manufacturers to tailor their R&D and product portfolios to specific regional needs, ensuring maximum efficiency and adoption rates among diverse farming communities worldwide.

Application-based segmentation emphasizes the end-use destination of the harvested cane, predominantly bifurcating between supplying feedstock for traditional sugar refining and providing biomass for increasingly vital ethanol and renewable energy production. The requirements for cane destined for ethanol production, particularly concerning trash content and bulk density, can influence the design specifications of the harvester’s cleaning system. Furthermore, the market differentiates between self-propelled harvesters, which dominate large-scale operations due to their maneuverability and power, and tractor-pulled implements, which offer a more economical entry point for smaller farms already owning high-horsepower tractors. Understanding these nuances is critical for accurately projecting demand and customizing marketing messages for target end-user groups, highlighting features like productivity, fuel efficiency, and maintenance simplicity relevant to their operational context.

- By Product Type:

- Whole Stalk Harvesters

- Cut & Chop Harvesters (Billet Harvesters)

- By Technology/Mechanism:

- Tracked Harvesters

- Wheeled Harvesters

- Self-Propelled Harvesters

- Tractor-Pulled Harvesters

- By Engine Capacity (HP):

- Up to 250 HP

- 251 HP to 350 HP

- Above 350 HP

- By Application:

- Sugar Mills and Refineries

- Ethanol and Biofuel Production

- Other Industrial Uses (e.g., Molasses, Bagasse)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Cane Harvesters Market

The value chain for the Cane Harvesters Market begins with upstream activities, primarily involving the sourcing of specialized components such as heavy-duty engines, complex hydraulic systems, precision GPS units, advanced steel alloys for cutting mechanisms, and high-performance track/wheel assemblies. Key suppliers in this stage include major industrial engine manufacturers (like Cummins or Caterpillar) and specialized hydraulic component providers. The quality and reliability of these upstream inputs directly dictate the performance, longevity, and TCO of the final harvesting machine. The core value addition occurs in the manufacturing stage, where major OEMs design, assemble, and rigorously test the final harvesters, focusing on optimizing weight distribution, cutting efficiency, and emissions compliance. Research and development investments, particularly in automation and telematics integration, constitute a significant portion of the value added during this phase, creating intellectual property that defines competitive advantage.

Downstream activities center on the distribution channel, which typically involves a mix of direct sales to large corporate farming entities and sales through authorized, specialized dealer networks that manage regional inventory, financing, and after-sales support. Given the high cost and complexity of harvesters, the dealer network plays a crucial role in providing necessary technical training, parts availability, and rapid field service, which are essential factors in purchasing decisions. Indirect channels also include leasing or rental services, particularly popular in fragmented markets where farmers prefer operational expenditure over capital investment. The end-user segment, consisting mainly of large plantation owners, sugar co-operatives, and ethanol producers, realizes the final value through increased efficiency and reduced harvesting costs, linking the performance of the harvester directly to their profitability metrics. Efficient logistics, minimizing the transport time of harvested cane to the mill, is the critical final step in maximizing the value realized by the end-users.

Cane Harvesters Market Potential Customers

Potential customers for cane harvesters are primarily large-scale agricultural enterprises and vertically integrated companies deeply involved in the global sugarcane supply chain. The main buyers are sugar mill owners who operate captive plantations or manage expansive cooperative farming schemes, requiring continuous, high-volume feedstock supply for refinery operations. Ethanol producers, particularly in regions like Brazil and the United States, constitute another major end-user category, driven by the need for consistent, quality biomass to meet renewable fuel production mandates. Furthermore, large private farming groups and agricultural contractors specializing in harvesting services for multiple smaller growers represent a rapidly expanding customer segment, as they acquire fleets of machinery to offer mechanized services on a fee-per-hectare basis, enabling smaller farmers to access high-tech equipment without the massive capital outlay. These customers prioritize machine reliability, cutting capacity (tonnes per hour), fuel efficiency, and the availability of sophisticated telematics and diagnostic support, ensuring minimal interruption during the time-critical harvest season.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, CNH Industrial N.V. (Case IH), Komatsu Ltd., Santal Equipamentos, Randon Implementos e Participacoes S.A., AGCO Corporation, Cameco Industries (John Deere), TIGERCAT International Inc., Bell Equipment, Fendt (AGCO), Kubota Corporation, Same Deutz-Fahr (SDF), Claas KGaA mbH, Harvester India, Valtra Inc., Kverneland Group, Zoomlion Heavy Industry Science and Technology Co., Ltd., Versatile, Inc., Mahindra & Mahindra Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cane Harvesters Market Key Technology Landscape

The technological landscape of the Cane Harvesters Market is rapidly evolving, moving beyond simple mechanical efficiency toward integrated digital intelligence and enhanced sustainability. A cornerstone of this evolution is the widespread adoption of Global Positioning System (GPS) and Geographic Information System (GIS) technologies, which enable harvesters to navigate fields with centimeter-level accuracy, optimizing cutting paths, minimizing fuel waste, and producing precise yield maps for subsequent farm management decisions. Coupled with sophisticated hydraulic systems, modern harvesters now feature automated height control for the base cutter, crucial for maximizing cane recovery while preventing excessive soil pickup (which contaminates the product and dulls the blades). This precision engineering minimizes mechanical stress and wear, contributing significantly to machine lifespan and reduced maintenance expenditure, which is vital given the heavy operational hours harvesters endure annually.

Further innovation is driven by the integration of Internet of Things (IoT) sensors and advanced telematics platforms, transforming harvesters into connected machines. These systems continuously monitor critical operating parameters such as engine load, fuel consumption rates, hydraulic pressure, and component temperatures, transmitting data in real-time to fleet managers and service centers. This remote monitoring capability supports the transition to predictive maintenance models, allowing service teams to diagnose potential issues remotely and deploy preventative maintenance kits before a failure occurs, drastically improving machine uptime during the harvest season. Additionally, in compliance with global emission standards (e.g., EU Stage V and US Tier 4 Final), engine technology now utilizes complex after-treatment systems, including Diesel Particulate Filters (DPF) and Selective Catalytic Reduction (SCR), ensuring powerful performance while minimizing environmental impact, though this adds complexity and cost to the engine unit.

Looking ahead, the development focuses heavily on automation, alternative power sources, and improving harvested cane quality. Advanced sensors, often utilizing machine vision and hyperspectral imaging, are being deployed to assess trash content (non-sugarcane material like leaves and dirt) in the harvested billets, allowing the cleaning system's fans to dynamically adjust their speed to optimize trash removal without expelling valuable cane. While fully electric harvesters remain challenging due to the massive power requirements and continuous operational cycles, hybrid electric models are gaining traction, leveraging regenerative braking and optimized power distribution to enhance fuel efficiency. These technological advancements collectively aim to deliver cleaner, smarter, and more cost-effective harvesting operations, cementing technology as the primary competitive battleground among market participants.

Regional Highlights

- Latin America (LATAM): Dominated by Brazil, which is the world's largest sugarcane producer and consumer of harvesters, often driven by the massive ethanol industry. The region demands extremely high-capacity, robust machinery capable of 24/7 operation and residue management. Mechanization rates are extremely high, influencing global pricing and technological standards.

- Asia Pacific (APAC): Characterized by highly diverse market needs, ranging from the huge, expanding mechanized farms in Australia to fragmented small holdings in India and China. Growth is rapid, fueled by government initiatives promoting mechanization to overcome severe labor shortages and infrastructure development supporting larger machinery deployment. The market shows a strong interest in medium-capacity, fuel-efficient models.

- North America (NA): Primarily focused on Louisiana and Florida, this region demands highly precise harvesters integrated with the latest GPS technology for sophisticated yield mapping and compliance with stringent environmental regulations. The emphasis is on optimization and minimal environmental footprint rather than sheer volume capacity expansion found in LATAM.

- Europe: The market for cane harvesters is very niche, concentrated primarily in Mediterranean areas like Spain and Portugal, and relies heavily on imported technology. Demand is stable, prioritizing specialized, high-quality, and highly reliable machinery tailored for specific soil types and smaller operational scales.

- Middle East & Africa (MEA): Emerging market where mechanization is growing steadily, particularly in large governmental or corporate farming projects in Egypt, South Africa, and Sudan. The market is highly price-sensitive, balancing the need for reliable equipment against substantial investment costs, often seeking robust, easily maintainable machinery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cane Harvesters Market.- Deere & Company

- CNH Industrial N.V. (Case IH)

- Komatsu Ltd.

- Santal Equipamentos

- Randon Implementos e Participacoes S.A.

- AGCO Corporation

- Cameco Industries (John Deere Subsidiary)

- TIGERCAT International Inc.

- Bell Equipment

- Fendt (AGCO)

- Kubota Corporation

- Same Deutz-Fahr (SDF)

- Claas KGaA mbH

- Harvester India

- Valtra Inc.

- Kverneland Group

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Versatile, Inc.

- Mahindra & Mahindra Ltd.

- Marchesan Implementos e Maquinas Agricolas Tatu S.A.

Frequently Asked Questions

Analyze common user questions about the Cane Harvesters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Cane Harvesters Market?

The central driver is the acute shortage of agricultural labor globally, particularly in major sugarcane producing regions, forcing farmers and plantations to adopt high-speed, mechanized harvesting solutions to maintain production levels and ensure cost-competitiveness.

How do Cut & Chop harvesters differ from Whole Stalk harvesters in application?

Cut & Chop (billet) harvesters are preferred for modern operations as they chop the cane into small pieces suitable for direct processing and transport, minimizing post-harvest sucrose loss. Whole Stalk harvesters leave the stalk intact and are generally used where cane must be stacked or tied for specialized transport or storage.

Which geographical region dominates the Cane Harvesters Market in terms of volume and technological adoption?

Latin America, driven overwhelmingly by Brazil, holds the largest market share in terms of volume and sets the standard for high-capacity machinery, while Asia Pacific is the fastest-growing market due to rapid mechanization initiatives in countries like India and China.

What role does telematics play in optimizing cane harvester operations?

Telematics systems, often leveraging IoT and GPS, enable real-time tracking of machine performance, fuel consumption, and location. This data is critical for predictive maintenance scheduling, optimizing fleet logistics, and providing precise operational reports to management, maximizing machine uptime.

What are the main technological challenges faced by the cane harvester industry regarding sustainability?

Key challenges include meeting stringent global engine emission standards (Tier 4/Stage V) while maintaining high power output, developing economically viable hybrid or electric power solutions, and improving efficiency in trash management to enhance soil health and reduce burning practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager