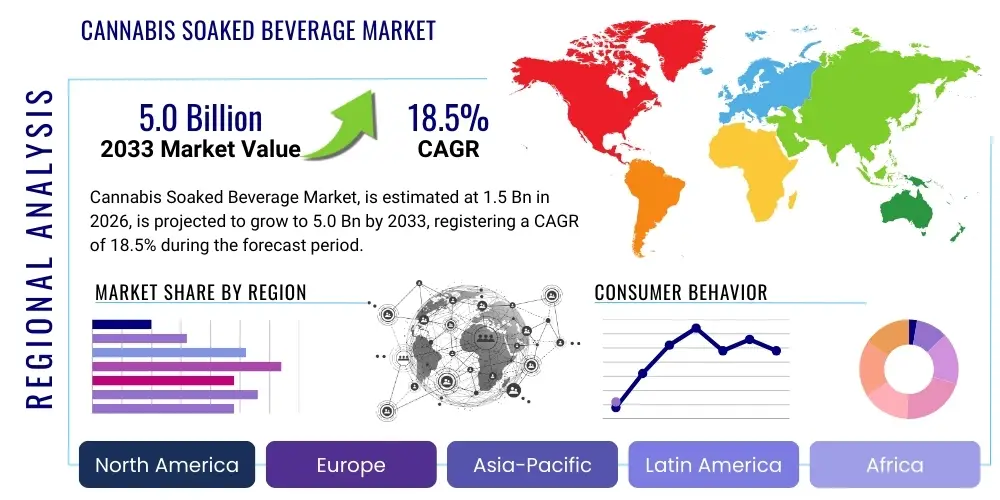

Cannabis Soaked Beverage Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443036 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Cannabis Soaked Beverage Market Size

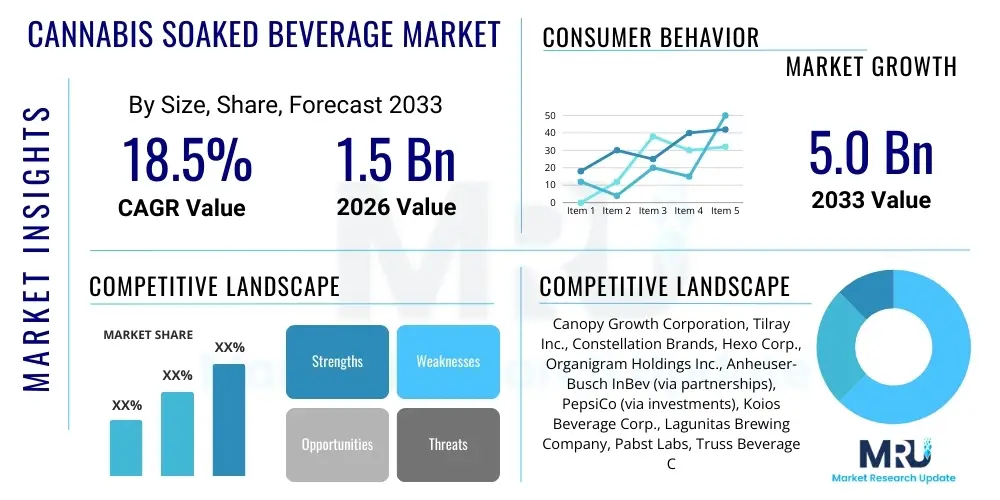

The Cannabis Soaked Beverage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033. This substantial expansion is driven primarily by the progressive global legalization of cannabis for both recreational and medicinal purposes, coupled with a significant shift in consumer preferences toward healthier, non-alcoholic alternatives that offer functional benefits.

Market valuation growth reflects the increasing investment in advanced formulation technologies, specifically nano-emulsification, which addresses critical consumer pain points such as delayed onset time and unpredictable potency associated with traditional edible products. These technological advancements facilitate the production of stable, water-soluble cannabinoid ingredients (THC and CBD) suitable for diverse beverage applications, ranging from sparkling waters and teas to functional health drinks and mocktails. Furthermore, established beverage giants are aggressively entering or partnering within this domain, leveraging their vast distribution networks and branding expertise to accelerate market penetration across legally permissible jurisdictions.

The projected financial trajectory underscores the beverage category's potential to become the dominant delivery method for cannabis consumption, particularly appealing to the 'cannabis curious' consumer segment seeking discretion and measured dosing control. Regulatory clarity, although fragmented, is continuously improving in key North American and European markets, mitigating operational risks and fostering greater capital investment, thereby solidifying the robust compound annual growth rate anticipated throughout the forecast period.

Cannabis Soaked Beverage Market introduction

The Cannabis Soaked Beverage Market encompasses ready-to-drink products infused with cannabinoids, predominantly Tetrahydrocannabinol (THC) and Cannabidiol (CBD). These products are positioned as alternatives to traditional alcoholic beverages and smokable cannabis, offering consumers a more socially acceptable, discreet, and controlled method of consumption. Product descriptions often highlight rapid onset times—typically within 10 to 20 minutes—a key feature achieved through advanced infusion technologies like nano-emulsification, which enhances the bioavailability of cannabinoids. Major applications span social consumption, relaxation, wellness, and symptom management, appealing to demographics ranging from millennials seeking low-dose recreational experiences to older adults utilizing CBD for therapeutic relief.

The primary benefits driving market adoption include precision dosing, which allows users to manage their intake accurately, and the absence of combustion byproducts or alcohol-related risks, aligning with broader health and wellness trends. The discretion afforded by beverages packaged similarly to mainstream soft drinks or sparkling waters significantly reduces the stigma associated with cannabis use. Furthermore, the rapid onset time mimics the experiential timeline of alcohol, making these products more suitable for social settings compared to slow-acting traditional edibles. These factors collectively position cannabis-infused beverages as a disruptive force within both the cannabis and non-alcoholic beverage industries.

Driving factors for market growth include the widening legal landscape for recreational cannabis, particularly in North America; growing consumer interest in functional beverages; and the innovation in flavor masking and formulation stability. The competitive environment is intensifying as cannabis companies partner with established beverage industry leaders, bringing professional marketing and high-volume manufacturing capabilities to the sector. This convergence is normalizing cannabis consumption, pushing beverages from niche dispensary items into broader retail consideration, pending further legislative changes across global regions.

Cannabis Soaked Beverage Market Executive Summary

The Cannabis Soaked Beverage Market is characterized by vigorous business trends centered on strategic partnerships between experienced cannabis cultivators/extractors and established global beverage manufacturers. This collaborative approach addresses the critical need for scalable production, sophisticated flavor development, and robust supply chain management, while navigating complex regulatory hurdles unique to cannabis commerce. Key business strategies include heavy investment in intellectual property surrounding water-soluble cannabinoid formulations and dose standardization, aiming to build strong consumer trust through consistent product quality and predictable effects. Financial models reflect high initial capital expenditure related to specialized equipment and compliance, offset by anticipated high margins driven by premium pricing and expanding distribution footprint in legally defined markets.

Regionally, North America, spearheaded by the United States and Canada, remains the epicenter of market activity, accounting for the vast majority of current sales and innovation. However, European markets, particularly Germany and the UK (focused predominantly on CBD products), are showing accelerated regulatory movement, positioning them as significant growth vectors in the medium term. Asian markets, while currently restrictive, represent immense long-term potential, contingent upon pivotal shifts in governmental regulatory stances toward medical and recreational cannabis use. Regional trends are heavily influenced by local jurisdiction laws concerning THC potency limits, permissible retail channels, and cross-border trade restrictions, necessitating highly localized market entry strategies.

Segment trends indicate a strong consumer preference for lower-dose (2mg to 5mg THC or higher CBD content) beverages, promoting session-ability and minimizing user anxiety regarding overconsumption. Sparkling water, functional teas, and seltzers dominate the product types due to their low-calorie and health-conscious perception. The CBD segment currently holds a larger market share globally due to less restrictive regulations compared to THC, but the THC segment is projected to exhibit faster growth, particularly in recreational states, driven by innovation in flavor profiles and faster-acting formulations. Furthermore, segmentation by ingredient type, such as isolating cannabinoids versus full-spectrum extracts, reflects manufacturers' efforts to cater to varied consumer preferences regarding the "entourage effect" and flavor purity.

AI Impact Analysis on Cannabis Soaked Beverage Market

User queries regarding AI's influence in the cannabis beverage sector frequently center on optimization, personalization, and compliance efficiency. Common questions involve how AI can ensure precise micro-dosing uniformity across massive production batches, how machine learning can predict regulatory changes across disparate jurisdictions, and the application of AI in developing novel, appealing flavor profiles that mask the inherent bitterness of cannabinoids. Consumers are keenly interested in personalized experiences—using AI to recommend ideal THC:CBD ratios and flavor profiles based on user-reported effects and biometric data. Manufacturers focus on leveraging AI for predictive maintenance in complex nano-emulsification machinery, supply chain risk management (especially sourcing compliant cannabis biomass), and automating quality control to maintain high safety standards required in this highly scrutinized market segment.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the operational efficiency and strategic direction of the Cannabis Soaked Beverage Market. AI algorithms are crucial in enhancing manufacturing precision, particularly in the delicate process of achieving stable nano-emulsions necessary for water solubility. These systems analyze vast datasets related to temperature, pressure, and ingredient ratios to minimize batch variation, ensuring that advertised potency levels are consistently met—a regulatory mandate that requires absolute accuracy. Furthermore, AI-driven demand forecasting leverages complex variables, including localized regulatory status, seasonal purchasing habits, and social media sentiment, enabling manufacturers to optimize inventory levels and reduce waste in a product category with strict shelf-life requirements.

Beyond operational improvements, AI plays a pivotal role in consumer engagement and new product development (NPD). ML models analyze flavor chemistry and consumer preference data to accelerate the creation of novel and successful beverage formulations, identifying synergistic flavor combinations that effectively mask cannabinoid taste profiles without relying on excessive sugar. In terms of compliance, AI systems continuously monitor and map the ever-changing fragmented global regulatory environment, providing real-time alerts and scenario planning capabilities that ensure multinational beverage companies remain compliant across varying limits on potency, packaging, and marketing claims, significantly mitigating legal exposure.

- Enhanced Precision Dosing and Quality Control: AI algorithms ensure micro-dosing accuracy in nano-emulsification processes.

- Predictive Regulatory Compliance: ML models track and predict changes in local, regional, and national cannabis laws, minimizing compliance risk.

- Optimized Supply Chain Management: AI forecasts demand based on complex localized data, improving inventory efficiency and biomass sourcing.

- Personalized Product Recommendation: Utilizing consumer data to suggest optimal cannabinoid ratios (THC:CBD) and flavor selections.

- Accelerated Flavor Development: Machine learning analyzes chemical compound interactions to create effective flavor masking agents and appealing new profiles.

- Automation of Lab Testing: AI-powered computer vision systems automate pathogen and contaminant screening, ensuring product safety.

DRO & Impact Forces Of Cannabis Soaked Beverage Market

The market dynamics of Cannabis Soaked Beverages are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces propelling or hindering growth. Key drivers include the acceleration of cannabis legalization, particularly recreational adult use in high-population states and countries, providing legitimate retail channels. Consumer desire for discreet, socially acceptable cannabis consumption methods and the appeal of rapid-onset formulations (mimicking the speed of alcohol) are major demand catalysts. However, the market is significantly restrained by highly fragmented and often conflicting regulatory frameworks across different jurisdictions, stringent advertising restrictions, and persistent challenges in securing necessary banking and financial services due to the federal illegality of cannabis in key regions. These restraints increase operational costs and complexity for large-scale manufacturers.

Opportunities abound primarily through technological innovation, specifically in advanced stabilization and bioavailability enhancement techniques such as ultrasonic nano-emulsification, which expands the range and quality of product offerings. Furthermore, the convergence with the massive functional beverage market presents a vast avenue for growth, allowing companies to position cannabis beverages alongside vitamins, adaptogens, and wellness ingredients. The shift away from traditional smoking methods, driven by health consciousness, creates a favorable environment for novel ingestion methods like beverages. The impact forces are thus heavily weighted toward regulatory evolution; as more markets transition from medical-only to adult-use, the barriers to entry decrease and the operational scalability potential dramatically increases, accelerating mass market acceptance.

The immediate impact forces are dominated by consumer education and the ongoing 'social normalization' of cannabis consumption. Successful market players are those who can effectively manage the supply chain complexity—from securing compliant, high-quality cannabis extracts to ensuring the stability of the final nano-emulsified product during transport and shelf life. The pressure to standardize potency and guarantee consistent user experiences is paramount; product recalls or potency mislabeling can severely damage consumer trust in this nascent category. Consequently, the greatest long-term impact force will be the adoption of global or regional standardization protocols for dosing and testing, which will unlock significant cross-border trade potential and attract further mainstream beverage industry investment.

Segmentation Analysis

The Cannabis Soaked Beverage Market is fundamentally segmented based on factors including cannabinoid type, product category, distribution channel, and dosage strength. This segmentation is crucial for manufacturers to target specific consumer needs, ranging from wellness-focused individuals seeking high CBD content to recreational users desiring low-dose THC seltzers for social settings. The dominance of CBD in the segmentation landscape stems from its wider legal acceptance and perception as a wellness ingredient, while the THC segment, though currently smaller, drives the highest revenue growth in established recreational markets. The complex regulatory environment mandates specific labeling and marketing strategies for each segment, particularly regarding medical versus recreational positioning, thereby influencing the choice of distribution channels—ranging from specialized dispensaries to general retail outlets for low-THC or hemp-derived CBD products.

Product categorization further dissects the market into carbonated drinks (seltzer, soda), non-carbonated drinks (tea, coffee, shots), and specialized functional beverages (wellness drinks with added adaptogens or vitamins). This diverse segmentation reflects the industry's attempt to capture market share from various existing beverage categories, competing directly with alcoholic drinks, traditional soft drinks, and specialty health beverages. Dosage segmentation, ranging from micro-dose (1–2mg) to standard-dose (5–10mg), addresses the varying tolerance and consumption goals of the user base. The evolution of extraction and infusion technologies directly impacts this segmentation by enabling the creation of stable products tailored to specific potency demands.

Geographic segmentation remains a critical factor, with highly mature markets like North America driving innovation in recreational THC beverages, while Europe and parts of Asia focus heavily on regulatory-compliant CBD infusions. Understanding these geographical nuances is essential for market entry, as regulatory variance dictates permissible cannabinoid concentrations, approved ingredients, and overall product shelf placement. Strategic success relies on developing highly modular product lines that can be adapted rapidly to meet the specific legal requirements and evolving consumer trends within each identified segment, ensuring both compliance and market relevance.

- Cannabinoid Type:

- THC-dominant

- CBD-dominant

- Balanced (THC:CBD)

- Minor Cannabinoids (CBG, CBN, etc.)

- Product Category:

- Sparkling Water/Seltzers

- Juices and Smoothies

- Teas and Coffees

- Functional Shots/Elixirs

- Mocktails/Specialty Beverages

- Dosage Strength:

- Micro-Dose (1-2 mg)

- Low-Dose (3-5 mg)

- Standard-Dose (6-10 mg)

- High-Dose (10+ mg)

- Distribution Channel:

- Dispensaries (Recreational and Medical)

- Online Retail/Direct-to-Consumer (DTC)

- Specialty Health Stores

- General Retail (where legally permitted for CBD)

Value Chain Analysis For Cannabis Soaked Beverage Market

The value chain for the Cannabis Soaked Beverage Market is complex and highly regulated, beginning with the Upstream segment involving the cultivation and harvesting of cannabis biomass. This initial stage requires adherence to stringent agricultural standards, focusing on specific strains optimized for high yield of target cannabinoids (e.g., high THC or high CBD). Following cultivation, the process moves to extraction, where cannabinoids are separated using methods like CO2 or ethanol extraction. The quality and purity of the resulting crude oil or distillate are paramount, directly impacting the safety and efficacy of the final product. Vertical integration, where companies control cultivation, extraction, and manufacturing, is a common strategy to ensure quality consistency and manage cost fluctuations in the raw material supply.

The Midstream segment focuses on advanced manufacturing, which is the most technologically intensive part of the value chain. This stage involves converting the lipid-soluble cannabinoid extracts into water-soluble nano-emulsions. This step is critical for achieving the desired rapid onset and bioavailability characteristics expected by consumers. Beverage formulation and production follow, involving flavor compounding, mixing, stabilization, pasteurization, and highly accurate filling and packaging. Regulatory compliance is heaviest at this stage, requiring specialized equipment and rigorous quality control testing (QA/QC) to verify cannabinoid consistency and ensure zero contaminants. Unlike traditional beverage production, cannabis beverage manufacturing requires specialized licenses and strict security protocols.

Downstream analysis covers the distribution channel, which is significantly constrained by regulatory divergence. Direct distribution typically involves proprietary systems serving licensed cannabis dispensaries (medical or recreational). Indirect distribution channels are only applicable for hemp-derived CBD beverages, which can often utilize traditional wholesalers and retailers (e.g., supermarkets, convenience stores) in regions permitting general CBD sales. However, the THC beverage market is almost exclusively reliant on highly restricted, direct-to-dispensary models. Effective distribution necessitates cold chain management for stability and sophisticated inventory tracking to comply with mandatory "seed-to-sale" regulatory reporting, making logistics highly specialized and costly compared to standard consumer packaged goods (CPG).

Cannabis Soaked Beverage Market Potential Customers

The primary consumer base for the Cannabis Soaked Beverage Market is highly diversified, encompassing both existing cannabis users and a substantial segment of "cannabis-curious" mainstream consumers who are new to the product category. Existing users are drawn to beverages for the superior precision dosing and discretion they offer compared to edibles or smoking. This segment includes individuals utilizing cannabis for chronic pain management, anxiety reduction, or sleep aid, who prioritize the consistent effects delivered by advanced formulations. These customers often seek higher-potency THC products in jurisdictions where recreational sales are permitted, valuing the reliable onset experience for therapeutic consistency.

A significantly growing segment comprises social consumers, particularly younger adults (Millennials and Gen Z) and those previously committed to the traditional alcoholic beverage market. These consumers are actively seeking low-calorie, non-alcoholic alternatives that provide a manageable buzz or relaxing effect without the negative health consequences associated with alcohol. Products like low-dose THC seltzers (2mg to 5mg) appeal directly to this demographic, facilitating social "session-ability." This group values branding, flavor innovation, and the integration of functional ingredients, viewing cannabis beverages as a premium lifestyle choice that aligns with broader wellness trends and sober-curiosity movements.

Another crucial customer segment consists of older adults (Baby Boomers and Gen X) primarily focused on wellness applications, often preferring CBD-dominant beverages for anxiety, inflammation, and joint pain. These buyers prioritize ingredient transparency, medical legitimacy, and ease of consumption. They are less likely to frequent traditional dispensaries and are more often reached through health food stores or online CBD platforms where regulations permit. Consequently, successful targeting requires tailored marketing emphasizing health benefits and leveraging scientific data to build trust among this risk-averse, yet growing, segment of end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Canopy Growth Corporation, Tilray Inc., Constellation Brands, Hexo Corp., Organigram Holdings Inc., Anheuser-Busch InBev (via partnerships), PepsiCo (via investments), Koios Beverage Corp., Lagunitas Brewing Company, Pabst Labs, Truss Beverage Co., Artet, Dixie Brands, Vita Coco, Aurora Cannabis Inc., Cronos Group Inc., Curaleaf Holdings Inc., Green Thumb Industries, Trulieve Cannabis Corp., The Alkaline Water Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cannabis Soaked Beverage Market Key Technology Landscape

The technological landscape of the Cannabis Soaked Beverage Market is dominated by advancements aimed at solving the inherent challenges of infusing hydrophobic (oil-based) cannabinoids into aqueous (water-based) solutions, while ensuring rapid absorption and long-term product stability. The paramount technology is nano-emulsification, which uses high-shear processing, such as ultrasonic liquid processing or high-pressure homogenization, to break down cannabis oil into microscopic droplets (nanoparticles) less than 100 nanometers in diameter. These tiny droplets are then encapsulated by stabilizing agents (surfactants) to create a water-soluble emulsion. This process is essential because it drastically improves the bioavailability of the cannabinoids, leading to the sought-after rapid onset time, which is critical for consumer acceptance as an alternative to alcohol.

A secondary, yet equally vital, technological focus involves flavor masking and stabilization techniques. Raw cannabis extracts often possess bitter or earthy notes that are challenging to hide in delicate beverage matrices. Advanced flavor chemistry, often coupled with AI analysis, is used to identify and neutralize these off-notes, ensuring the final product maintains a clean, palatable flavor profile comparable to mainstream premium beverages. Furthermore, ensuring the emulsion remains stable over the product’s shelf life is a continuous technological hurdle. Stability technologies must prevent "ringing" (oil separation), sedimentation, and cannabinoid degradation due to light and oxidation, necessitating specialized packaging solutions like opaque, UV-protected cans and bottles, and adherence to strict cold chain logistics.

The market also relies heavily on advanced analytical technology for quality assurance and regulatory compliance. High-Performance Liquid Chromatography (HPLC) is the standard for precise potency testing, verifying the exact milligrams of THC and CBD in every batch—a non-negotiable regulatory requirement. Future technology adoption focuses on continuous flow manufacturing systems for nano-emulsification, aimed at scaling production dramatically while maintaining quality uniformity. The successful commercialization and growth of this market depend entirely on the effectiveness and affordability of these infusion and stability technologies, which allow cannabis companies to transition from small-batch artisanal production to industrial-scale CPG manufacturing.

Regional Highlights

- North America (Dominant Market Hub): The United States and Canada represent the most mature and significant markets due to advanced recreational and medical legalization frameworks. North America drives global innovation, particularly in THC-infused rapid-onset seltzers and functional beverages. High consumer adoption rates, significant capital investment, and the presence of major key players and established partnerships between CPG and cannabis firms solidify its leadership position. Regulatory fragmentation within the U.S. (state-by-state laws) necessitates complex, but rewarding, localized market strategies, leading to intense competition and product diversity.

- Europe (Emerging CBD Focus): Europe is characterized by a fragmented but rapidly evolving regulatory environment, with a strong current focus on hemp-derived CBD beverages, which benefit from less stringent restrictions compared to THC. Countries like the UK, Germany, and Switzerland are key markets, prioritizing wellness and non-intoxicating applications. The primary challenge is navigating the Novel Food status requirements for cannabinoids in the EU, which demands substantial investment in toxicological data and compliance documentation. THC market entry remains largely restricted to medical channels, pending broader policy reform.

- Asia Pacific (Long-Term Potential, High Restraints): The APAC region currently presents the highest regulatory barriers, with most nations maintaining strict prohibition on cannabis, including beverages. Exceptions exist in select areas like Thailand, which has liberalized hemp laws, creating localized opportunities for low-potency CBD beverages. Market growth remains highly contingent on future policy shifts, but the sheer size of the consumer base, particularly in wellness-conscious economies like Japan and Australia (which has a medical framework), signifies immense untapped long-term revenue potential should regulatory landscapes liberalize.

- Latin America (Developing Markets): Latin American markets, notably in countries like Uruguay, Mexico, and potentially Colombia, are gradually developing legal frameworks that encompass cannabis derivatives, including beverages. Growth is primarily driven by medical legalization and state-controlled recreational models (as seen in Uruguay). Challenges include developing robust, secure supply chains and overcoming infrastructure limitations, but the region offers favorable cultivation costs and emerging consumer interest in botanical functional drinks.

- Middle East and Africa (Niche and Highly Restrictive): This region is generally defined by extreme regulatory limitations on cannabis products. South Africa is a notable exception, offering some allowances for personal use and potentially opening doors for localized, controlled market development, particularly for low-THC or CBD products. Market opportunities are currently limited to highly specialized, regulated medical cannabis channels, requiring long-term monitoring for potential regulatory shifts that could unlock consumer packaged goods adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cannabis Soaked Beverage Market.- Canopy Growth Corporation

- Tilray Inc.

- Constellation Brands

- Hexo Corp.

- Organigram Holdings Inc.

- Anheuser-Busch InBev (via partnerships, notably with Tilray's Truss Beverage Co.)

- Koios Beverage Corp.

- Lagunitas Brewing Company (Heineken Subsidiary)

- Pabst Labs

- Truss Beverage Co. (Joint Venture between Molson Coors and Hexo)

- Artet

- Dixie Brands

- Vita Coco

- Aurora Cannabis Inc.

- Cronos Group Inc.

- Curaleaf Holdings Inc.

- Green Thumb Industries

- Trulieve Cannabis Corp.

- The Alkaline Water Co.

- Beboe Brands

- BevCanna Enterprises Inc.

- Chalice Brands Ltd.

- Mirth Provisions

Frequently Asked Questions

Analyze common user questions about the Cannabis Soaked Beverage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technology is used to make cannabis drinks fast-acting?

The primary technology is nano-emulsification, which breaks down oil-based cannabinoids (THC/CBD) into tiny, water-soluble nanoparticles. This process significantly enhances the bioavailability, allowing the body to absorb the compounds quickly, resulting in a rapid onset time (typically 10–20 minutes).

How do cannabis-infused beverages compare to traditional edibles regarding potency control?

Cannabis beverages offer superior precision dosing and predictable effects compared to traditional edibles. Due to rapid onset achieved via nano-emulsification, consumers can gauge the effects much faster, reducing the risk of overconsumption and providing better control over their experience.

Is the market for cannabis beverages expected to surpass traditional cannabis products like edibles and vapes?

The beverage segment is projected to be one of the fastest-growing categories in the cannabis market. While not yet surpassing traditional categories in volume, its alignment with health trends and its social acceptability positions it to capture significant market share from both the traditional alcohol and non-alcoholic CPG sectors.

What is the primary regulatory challenge facing multinational cannabis beverage manufacturers?

The main challenge is regulatory fragmentation. Manufacturers must comply with varying, often conflicting, state-level (in the U.S.) or national-level regulations regarding permissible cannabinoid limits, packaging restrictions, marketing claims, and distribution channels, necessitating complex localized compliance strategies.

Which cannabinoid is currently dominating the global cannabis beverage market?

CBD-dominant beverages currently hold a larger global share due to less restrictive federal and international regulations compared to THC. However, the THC-infused segment is forecast to achieve a significantly higher growth rate as more regions implement adult-use legalization frameworks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager