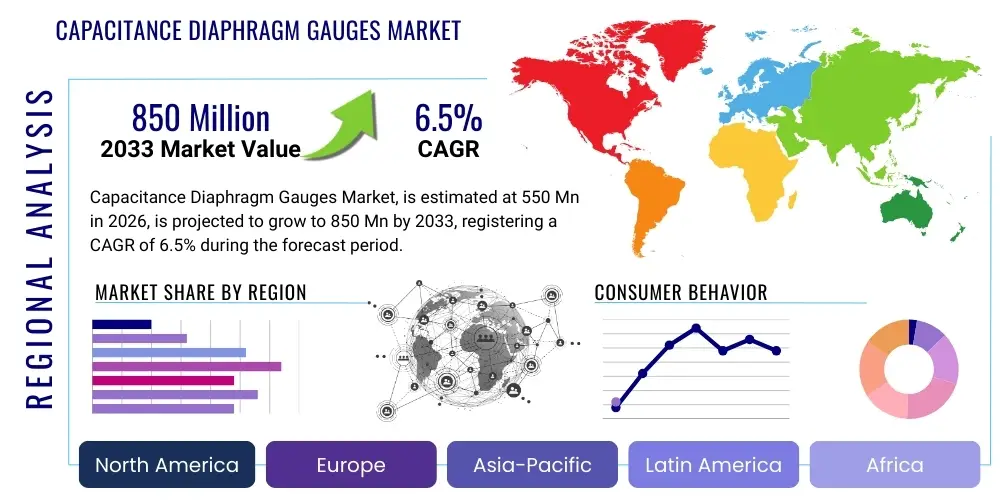

Capacitance Diaphragm Gauges Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441492 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Capacitance Diaphragm Gauges Market Size

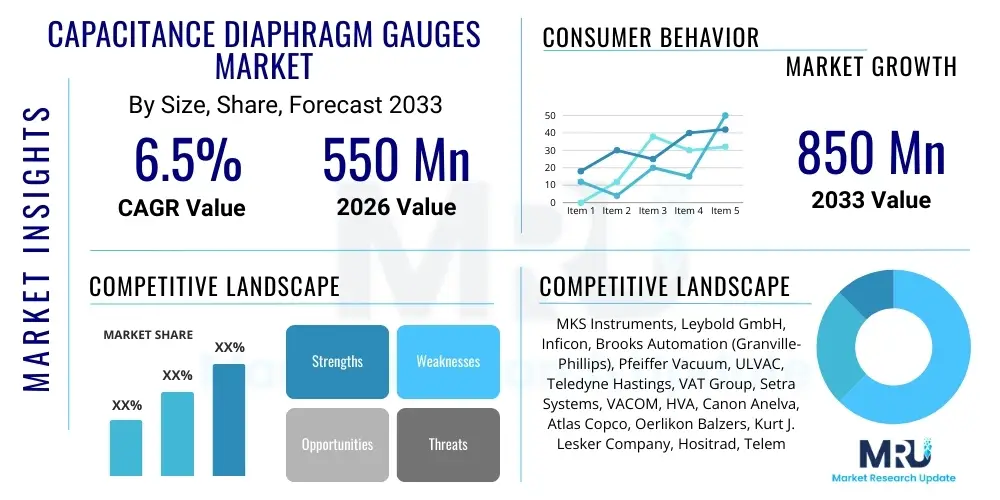

The Capacitance Diaphragm Gauges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $850 Million by the end of the forecast period in 2033.

Capacitance Diaphragm Gauges Market introduction

Capacitance Diaphragm Gauges (CDGs), often referred to as MKS gauges, are precision instruments fundamental to vacuum metrology, designed to measure absolute pressure independent of gas composition. These gauges operate on the principle of detecting changes in capacitance between a taut, electrically conductive diaphragm and a fixed electrode, where pressure variations induce minute deflections in the diaphragm. This technology offers exceptional stability, repeatability, and linearity, making it indispensable for processes requiring highly accurate and repeatable pressure control, particularly in the high-to-medium vacuum range.

The core applications driving the adoption of CDGs span high-tech manufacturing and complex scientific research. The semiconductor and electronics industries rely heavily on CDGs for plasma etching, thin-film deposition (CVD/PVD), and load-lock chamber monitoring, where minor pressure deviations can severely impact yield and device performance. Furthermore, their high accuracy is critical in calibration standards laboratories, pharmaceutical freeze-drying (lyophilization), and advanced material processing, ensuring regulatory compliance and quality control across sensitive vacuum processes.

Major driving factors include the rapid expansion of semiconductor fabrication facilities globally, fueled by demand for advanced memory chips and microprocessors, necessitating stringent process control within vacuum systems. The increasing complexity of materials science research, particularly in nanotechnology and superconductivity, further demands the precision offered by CDGs. Benefits of these instruments encompass their gas-type independence, excellent long-term stability, rapid response time, and the availability of variants optimized for harsh environments, such as those involving corrosive or high-temperature gases, thus cementing their position as the preferred choice for primary vacuum measurement.

Capacitance Diaphragm Gauges Market Executive Summary

The global Capacitance Diaphragm Gauges market is positioned for robust growth, driven primarily by accelerating capital expenditure within the semiconductor industry, particularly in Asia Pacific, and sustained technological advancements focused on enhancing gauge stability and expanding measurement range capabilities. Business trends highlight a pronounced shift towards digital interface integration and improved thermal stability mechanisms to minimize zero drift errors in highly variable operational environments. Leading manufacturers are investing heavily in producing gauges with enhanced corrosion resistance through specialized coatings and materials like Inconel and alumina ceramics, catering specifically to aggressive chemical vapor deposition (CVD) and plasma processes.

Regional trends indicate that the Asia Pacific (APAC) region, spearheaded by China, South Korea, Taiwan, and Japan, remains the dominant hub for market expansion due to massive investments in new fabrication plants (fabs) and R&D activities related to memory (DRAM, NAND) and logic chip production. North America and Europe maintain strong market shares driven by advanced research institutions, aerospace applications, and specialized vacuum coating industries, emphasizing gauges with superior linearity and ultra-low pressure resolution. Emerging markets are focusing on upgrading existing industrial vacuum infrastructure, creating demand for standard and entry-level high-accuracy CDGs.

Segmentation trends reveal that high-accuracy gauges (those offering better than 0.1% of reading) continue to capture the largest market share by value, reflecting the industry's unwavering need for precision at critical process points. The 1 Torr to 100 Torr measurement range segment is witnessing particularly strong adoption, aligning perfectly with standard semiconductor etch and deposition parameters. Furthermore, the push for miniaturization and integration into complex automated vacuum tools is fueling demand for compact, ruggedized sensors capable of providing real-time data connectivity, thus solidifying the gauge market's trajectory towards digitalization and predictive analytics.

AI Impact Analysis on Capacitance Diaphragm Gauges Market

User queries regarding AI's influence on the Capacitance Diaphragm Gauges market frequently revolve around how artificial intelligence and machine learning (ML) can improve calibration cycles, predict sensor failure, and optimize vacuum process efficiency. Key concerns focus on whether AI integration will necessitate significant hardware modifications or primarily involve software enhancements for data analysis. Users are keenly interested in leveraging AI for advanced diagnostics, moving beyond simple error flagging to genuine predictive maintenance schedules, thereby maximizing uptime in high-cost fabrication environments. Expectations center on AI utilizing historical pressure data, alongside corresponding temperature and flow parameters, to model ideal gauge performance and detect subtle drift or degradation before catastrophic process failures occur.

The implementation of AI/ML algorithms is poised to revolutionize the operational utility of CDGs by transitioning vacuum monitoring from reactive error correction to proactive process optimization. AI can analyze vast datasets generated by arrays of gauges across a vacuum system, identifying correlations between pressure fluctuations, gas compositions, and end-product quality that are imperceptible to traditional statistical monitoring. This deep learning capability allows for dynamic pressure setpoint adjustments, minimizing energy consumption and improving uniformity across large-scale coating or etching batches, leading to significant efficiency gains and reduction in scrap material in semiconductor manufacturing.

Specifically, AI impact manifests in two critical areas: predictive maintenance and enhanced process control. For maintenance, ML models trained on vibration, temperature, and historical drift data can accurately forecast the remaining useful life (RUL) of a specific gauge, triggering recalibration or replacement only when necessary, moving away from time-based maintenance. For process control, AI-driven feedback loops, utilizing CDG data, can instantly compensate for environmental variables or minor system leaks, ensuring the vacuum environment remains within ultra-tight specifications, a necessity for next-generation lithography and three-dimensional integrated circuit manufacturing.

- AI optimizes calibration schedules, reducing downtime and maintaining measurement accuracy by predicting zero drift.

- Machine learning algorithms enable predictive maintenance, forecasting potential gauge failures based on real-time operational signatures.

- AI enhances process control by analyzing multivariate data from CDGs, temperature sensors, and flow controllers to dynamically adjust vacuum parameters.

- Data fusion capabilities allow AI to integrate pressure measurements with yield data, optimizing throughput in semiconductor fabrication.

- Automated diagnostics utilize AI to quickly identify and isolate the source of vacuum system anomalies detected by the gauge network.

DRO & Impact Forces Of Capacitance Diaphragm Gauges Market

The Capacitance Diaphragm Gauges market is primarily driven by the exponential growth in global semiconductor capital spending, necessitated by the proliferation of 5G technology, artificial intelligence infrastructure, and advanced consumer electronics demanding smaller, faster chips. The necessity for ultra-clean, tightly controlled vacuum environments in these fabrication processes directly mandates the use of highly precise, gas-independent measurement tools like CDGs. Restraints primarily involve the high initial cost and complex calibration requirements associated with ultra-high accuracy gauges, alongside vulnerability to corrosive byproducts in harsh plasma environments, which can necessitate frequent replacement or protective measures. Opportunities abound in developing next-generation gauges with enhanced connectivity (IoT integration), expanded measurement ranges into the high vacuum regime, and material science breakthroughs that improve resistance to aggressive chemistries used in advanced etching processes. These dynamics are shaped by Porter's Five Forces, where buyer power is moderate (due to reliance on proprietary calibration), supplier power is high (dominated by a few specialized technology providers), and the threat of substitution is low given the unique accuracy profile of CDG technology, driving continuous innovation and specialization.

Specific drivers include the global expansion of memory manufacturing (e.g., 3D NAND technology requiring extremely repeatable layer deposition) and the pharmaceutical sector’s increased reliance on lyophilization for stabilizing biological drugs and vaccines, both requiring precise pressure monitoring. The transition towards smart manufacturing and Industry 4.0 mandates sensors capable of providing high-fidelity, instantaneous digital output, further accelerating CDG integration. Conversely, a major constraint is the inherent limitation in measuring pressures below 10-5 Torr, where other technologies such as ionization gauges become necessary, restricting the CDG’s utility in ultra-high vacuum (UHV) applications. Furthermore, the sensitivity of the diaphragm to temperature fluctuations requires complex, energy-intensive temperature stabilization mechanisms, adding to the gauge’s operational complexity and overall cost.

Impact forces shape market competition and technological direction. Competitive rivalry is intensifying as major players seek differentiation through superior long-term stability and reduced maintenance requirements. The opportunity space is vast, particularly in the development of low-cost, disposable or modular CDG solutions for emerging industrial applications, and in integrating enhanced diagnostic features that allow users to monitor the gauge's internal health status. The persistent demand for smaller feature sizes in microelectronics ensures that the demand for absolute, repeatable pressure measurement remains non-negotiable, acting as a powerful, sustained driver that offsets cost restraints. Furthermore, geopolitical tensions affecting global supply chains for specialized materials (like high-purity ceramics and Inconel alloys) introduce a level of supply risk that manufacturers must mitigate through diversified sourcing and localized production capabilities.

Segmentation Analysis

The Capacitance Diaphragm Gauges market segmentation provides a granular view of diverse end-user requirements and technological specialization across various industries. The market is primarily divided based on the accuracy level required (standard vs. high accuracy), the physical range of vacuum measurement they are optimized for, and the specific application sector where they are deployed. This categorization is crucial for manufacturers to tailor product specifications, such as material construction (e.g., stainless steel vs. corrosion-resistant alloys) and digital interface capabilities, to meet the stringent demands of complex processes like plasma etching, where sub-Torr accuracy is mandatory, versus standard industrial vacuum monitoring which allows for slightly wider tolerances.

Technological differentiation based on measurement range is highly significant, separating gauges optimized for low vacuum (e.g., 1000 Torr down to 10 Torr), medium vacuum (10 Torr down to 10-3 Torr), and high vacuum applications (below 10-3 Torr). While CDGs traditionally excel in the medium and high vacuum ranges, continuous innovation focuses on improving their lower detection limits, providing seamless measurement across transitional vacuum regimes. Furthermore, the market differentiates products by output format, including analog, digital (RS-232, EtherCAT), and wireless versions, reflecting the ongoing industry shift towards interconnected, data-intensive manufacturing environments where remote monitoring and digital data logging are standard operational necessities for compliance and process optimization.

- By Type:

- High Accuracy Gauges (Accuracy better than 0.1% of reading)

- Standard Accuracy Gauges (Accuracy 0.1% to 0.5% of reading)

- By Measurement Range:

- Below 10-3 Torr (High Vacuum)

- 10-3 Torr to 10 Torr (Medium Vacuum)

- Above 10 Torr (Low Vacuum/Rough Vacuum)

- By Application:

- Semiconductor & Electronics Manufacturing (Etching, CVD, PVD)

- Pharmaceutical and Biotechnology (Lyophilization, Sterilization)

- Research and Development (Particle Accelerators, Surface Science)

- Industrial Vacuum Processes (Coating, Heat Treatment, Metallurgy)

- Aerospace and Defense

- By Material:

- Inconel and Hastelloy Diaphragms (Corrosion Resistance)

- Stainless Steel Diaphragms (Standard Applications)

- Ceramic Diaphragms (High Temperature/Harsh Environment)

Value Chain Analysis For Capacitance Diaphragm Gauges Market

The value chain for the Capacitance Diaphragm Gauges market begins with highly specialized upstream suppliers providing raw materials such as high-purity metals (Inconel, stainless steel), advanced ceramic components, and precision electronics necessary for manufacturing the highly sensitive diaphragms and temperature stabilization circuits. Upstream activities are characterized by strict quality control and high barriers to entry due to the proprietary nature of thin-film deposition and micro-machining required for diaphragm fabrication. Key manufacturers source these specialized components, focusing on maintaining long-term stability and minimal hysteresis in the final product. Vertical integration, especially among dominant players like MKS Instruments, often occurs in the manufacturing stage to protect intellectual property related to sensor design and calibration methodology, ensuring market advantage.

The central phase involves R&D, manufacturing, and rigorous testing, where the gauge’s core performance metrics (accuracy, repeatability, and drift) are established. Distribution channels are highly critical due to the technical nature of the product. Direct sales channels are often employed when dealing with major semiconductor Original Equipment Manufacturers (OEMs) and large research institutions, allowing manufacturers to provide bespoke technical support, integration services, and complex calibration packages. This direct approach ensures precise fitting into high-cost, customized vacuum systems and facilitates continuous feedback loops necessary for product improvement and quick resolution of technical issues in critical applications.

Conversely, indirect distribution, utilizing specialized distributors, value-added resellers (VARs), and system integrators, is common for serving smaller industrial customers, R&D labs, and aftermarket sales. These indirect partners provide local inventory, basic technical assistance, and faster delivery times for standard-model gauges. Downstream activities involve installation, routine calibration (a significant recurring revenue stream), maintenance, and eventual end-of-life disposal or recycling. The strength of the value chain is determined by the seamless collaboration between manufacturers and certified calibration laboratories, as traceability to national standards is paramount for regulatory compliance, especially in semiconductor and pharmaceutical production environments.

Capacitance Diaphragm Gauges Market Potential Customers

The primary end-users and buyers of Capacitance Diaphragm Gauges are entities operating high-precision vacuum processes where gas-independent absolute pressure measurement is non-negotiable for product quality and process repeatability. The semiconductor industry stands as the single largest consumer, including fabrication facilities (fabs) like TSMC, Samsung, and Intel, along with Original Equipment Manufacturers (OEMs) such as Applied Materials, Lam Research, and TEL, who integrate CDGs directly into their advanced vacuum coating and etching tools. These customers prioritize gauges offering the highest accuracy, robust corrosion resistance, and digital communication protocols to integrate seamlessly into complex factory automation systems, demanding high volumes of specialized, low-range gauges for critical chamber monitoring.

Another crucial segment comprises research institutions and national standards laboratories (e.g., NIST, NPL, PTB). These buyers utilize CDGs as primary reference standards for calibrating other vacuum sensors or for ultra-precise scientific experiments such, particle accelerators, and fusion research (Tokamak reactors). For these end-users, traceability, low uncertainty, and long-term stability override cost considerations. The pharmaceutical industry, particularly companies involved in biologic drug manufacturing and large-scale lyophilization, represents a rapidly growing customer base. Here, CDGs ensure precise vacuum levels required during the freeze-drying cycle, which is critical for preserving drug efficacy and shelf life, with compliance with GMP (Good Manufacturing Practices) and FDA regulations being a major purchasing criterion.

Finally, industrial coating and material science companies, involved in processes like solar panel manufacturing, optical coating, and vacuum metallurgy, constitute a significant group of potential customers. These industrial users typically require standard-to-medium accuracy CDGs for process monitoring and control across large, high-throughput vacuum chambers. The demand is often driven by the need to ensure uniformity and consistency in the deposited thin films or surface treatments. Purchasing decisions in this segment are often balanced between required accuracy, overall device durability, and favorable total cost of ownership (TCO), including the frequency and expense of required calibration services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $850 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MKS Instruments, Leybold GmbH, Inficon, Brooks Automation (Granville-Phillips), Pfeiffer Vacuum, ULVAC, Teledyne Hastings, VAT Group, Setra Systems, VACOM, HVA, Canon Anelva, Atlas Copco, Oerlikon Balzers, Kurt J. Lesker Company, Hositrad, Telemark, Shimadzu Corporation, A&N Corporation, Varian Medical Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Capacitance Diaphragm Gauges Market Key Technology Landscape

The technological landscape of Capacitance Diaphragm Gauges is defined by continuous advancements aimed at achieving greater accuracy, improving resistance to corrosive media, and enhancing data output capabilities for Industry 4.0 integration. The core technology centers around ultra-precision machining of the diaphragm and electrode assembly, often utilizing materials like Inconel or ceramic (Alumina) to ensure maximum mechanical stability and minimal susceptibility to thermal expansion and chemical attack, crucial factors in advanced plasma environments. Recent technological strides involve implementing advanced temperature stabilization techniques, such as active thermal control loops and sophisticated thermal shields, which maintain the diaphragm at a precise, elevated temperature (often 45°C or higher) to minimize zero drift caused by ambient temperature fluctuations, thereby significantly improving overall stability and accuracy over extended operational periods.

A major trend involves the shift towards digital sensors and advanced signal processing. Modern CDGs are increasingly incorporating embedded microprocessors capable of performing internal linearizations, temperature corrections, and self-diagnostics, providing fully compensated pressure readings directly in digital formats (e.g., EtherCAT, DeviceNet). This digitalization reduces signal noise susceptibility inherent in analog transmission and facilitates seamless integration into Distributed Control Systems (DCS) and Semiconductor Equipment Communication Standard/Generic Equipment Model (SECS/GEM) protocols used in semiconductor fabs. Furthermore, manufacturers are exploring MEMS-based (Micro-Electro-Mechanical Systems) CDGs, aiming for radical miniaturization, lower power consumption, and potential for array deployment within constrained vacuum chambers, although high-accuracy, large-diaphragm sensors still dominate the premium segment.

Material innovation remains critical, particularly the development of specialized coatings and diaphragm surface treatments to mitigate fouling and erosion caused by aggressive process gases, such as fluorine-based and chlorine-based chemistries used in deep silicon etching. These protective measures ensure long-term stability and reduce the need for frequent, costly recalibrations. The ongoing refinement of electrode geometry and vacuum reference side design also plays a crucial role in improving sensitivity at the lowest pressure ranges. Finally, the convergence of CDG technology with predictive analytics software utilizes the high-resolution, digital output of these sensors to feed advanced process models, enabling real-time fault detection and proactive adjustment of process parameters based on instantaneous pressure feedback and historical performance data.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and the fastest-growing region for Capacitance Diaphragm Gauges, primarily due to the intense concentration of global semiconductor manufacturing capabilities, particularly in Taiwan, South Korea, China, and Japan. Massive investments in advanced wafer fabrication plants (fabs) focused on 7nm, 5nm, and 3nm node technologies necessitate thousands of high-accuracy CDGs for controlling critical processes like atomic layer deposition (ALD) and chemical vapor deposition (CVD). The strong government support for domestic semiconductor and advanced materials R&D further accelerates the adoption of these precision instruments. Local manufacturers and global players are establishing regional calibration and service centers to meet the escalating demand and minimize operational downtime for their high-value customers.

- North America: North America holds a significant market share, driven by strong R&D spending in government and university laboratories, sophisticated aerospace and defense applications, and a resurgence in domestic semiconductor manufacturing, particularly in the US. Companies in this region focus heavily on gauges offering best-in-class traceability, ultra-high vacuum stability, and robust compliance with strict regulatory standards (e.g., NIST calibration standards). Demand is concentrated in specialized sectors such as fusion energy research, vacuum thin-film deposition for optical components, and precision instrument manufacturing, emphasizing technological leadership and superior long-term performance over cost optimization.

- Europe: Europe represents a mature market, characterized by strong demand from advanced industrial vacuum coating sectors, automotive component manufacturing, and the large-scale pharmaceutical industry. Countries like Germany and Switzerland are home to key vacuum equipment manufacturers and research institutes, driving innovation in gauge design, particularly regarding industrial automation integration and long-term stability in harsh environments. The focus here is balanced between adopting highly accurate gauges for lyophilization processes in biotech and utilizing rugged, digitally enabled CDGs for general industrial vacuum processes and leakage testing.

- Latin America, Middle East, and Africa (LAMEA): These regions currently hold a smaller share but are showing nascent growth, primarily linked to petrochemical processing, general industrial vacuum applications, and expanding academic research centers. Demand is often focused on standard accuracy gauges for basic process monitoring and upgrading older vacuum infrastructure. Market growth is gradually accelerating due to foreign investment in manufacturing facilities that require moderate precision vacuum controls, alongside increasing local efforts in basic materials science research.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Capacitance Diaphragm Gauges Market.- MKS Instruments

- Leybold GmbH (Atlas Copco Group)

- Inficon

- Brooks Automation (Granville-Phillips)

- Pfeiffer Vacuum

- ULVAC

- Teledyne Hastings

- VAT Group

- Setra Systems (Fortive Corporation)

- VACOM Vakuum Komponenten & Messtechnik GmbH

- HVA LLC

- Canon Anelva Corporation

- Oerlikon Balzers

- Kurt J. Lesker Company

- Shimadzu Corporation

- Varian Medical Systems

- TSI Incorporated

- Emerson Electric Co.

- Busch Vacuum Solutions

- Agilent Technologies

Frequently Asked Questions

Analyze common user questions about the Capacitance Diaphragm Gauges market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a Capacitance Diaphragm Gauge over other vacuum sensors?

The primary advantage of a CDG is its gas composition independence, meaning its pressure reading is based solely on mechanical deflection and is not influenced by the type of gas being measured, unlike thermal or ionization gauges. This makes CDGs ideal for primary pressure standards and critical semiconductor processes using complex gas mixtures.

How frequently should Capacitance Diaphragm Gauges be recalibrated to maintain high accuracy?

Recalibration frequency for CDGs depends heavily on the application environment and required accuracy level. For critical high-accuracy applications (e.g., semiconductor etch chambers), annual or even semi-annual recalibration is common. AI-driven predictive maintenance models are increasingly being used to optimize this cycle, scheduling calibration only when the measured drift exceeds acceptable thresholds.

Which materials are most commonly used in CDGs for applications involving corrosive gases?

For applications involving corrosive gases, such as those found in plasma etching, the diaphragm and exposed internal surfaces of CDGs are typically constructed from highly resistant alloys like Inconel or Hastelloy. These materials offer superior chemical resistance and maintain mechanical stability under high temperatures and harsh chemical exposure, reducing sensor degradation.

In the context of the semiconductor industry, what role do high-accuracy Capacitance Diaphragm Gauges play?

High-accuracy CDGs are critical in the semiconductor industry for precisely controlling process pressures in chambers used for thin-film deposition (CVD, PVD), plasma etching, and load-lock operations. Their precision ensures highly repeatable processes, which is essential for maintaining high yield rates and achieving the microscopic feature sizes required for modern microprocessors and memory chips.

What is the significance of thermal control in the operation of a Capacitance Diaphragm Gauge?

Thermal control is vital because the capacitance measurement is highly sensitive to changes in the diaphragm's physical dimensions. Active temperature stabilization (heating the gauge to a fixed, elevated temperature) minimizes thermal expansion effects, eliminating zero drift and ensuring the gauge maintains its specified accuracy and repeatability regardless of ambient or process temperature fluctuations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager