Car Brake Cleaners Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441364 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Car Brake Cleaners Market Size

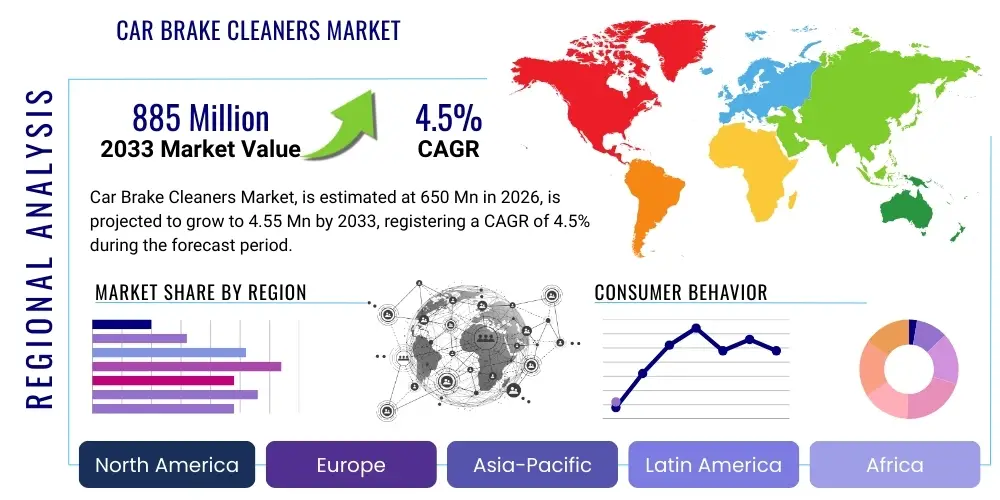

The Car Brake Cleaners Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 885 Million by the end of the forecast period in 2033.

Car Brake Cleaners Market introduction

The Car Brake Cleaners Market encompasses the manufacturing and distribution of specialized chemical formulations designed to remove grease, oil, brake fluid, dirt, and other contaminants from braking system components, primarily rotors, drums, pads, calipers, and springs. These cleaners are essential maintenance products, ensuring optimal brake performance by eliminating residues that can compromise friction, cause squealing, or lead to premature wear. The market is characterized by a high volume of consumer and professional usage, driven by the critical safety function of vehicle braking systems and the necessity for routine maintenance.

Product offerings primarily include non-chlorinated and chlorinated formulations, although regulatory shifts in environmental and health standards increasingly favor non-chlorinated options. Major applications span the automotive aftermarket, including do-it-yourself (DIY) enthusiasts, independent repair shops, and professional service centers, as well as original equipment manufacturers (OEMs) during vehicle assembly and maintenance phases. The fundamental benefit of using these specialized cleaners is the quick, effective, and residue-free cleaning they provide, which extends component life and maintains peak braking efficiency, directly contributing to road safety.

Driving factors for sustained market expansion include the increasing global vehicle parc, particularly in developing economies, leading to higher demand for maintenance chemicals. Furthermore, the growing average age of vehicles necessitates more frequent brake maintenance. Strict governmental safety regulations mandating periodic vehicle inspections and the continuous development of higher-performance, often more sensitive, braking systems (like those in electric vehicles) further underpin the demand for high-quality brake cleaning solutions. However, the market faces constraints related to volatile organic compound (VOC) regulations, pushing manufacturers toward developing more environmentally friendly, albeit sometimes more costly, acetone-based or water-based alternatives.

Car Brake Cleaners Market Executive Summary

The Car Brake Cleaners Market is experiencing robust business trends characterized by a significant shift towards environmentally conscious formulations, primarily driven by stringent regulations on volatile organic compounds (VOCs) in North America and Europe. Key market players are investing heavily in research and development to offer high-performance, non-chlorinated products that meet safety standards without compromising cleaning efficacy. The competitive landscape is marked by consolidation and strategic partnerships aimed at securing distribution channels in both the professional repair sector and the rapidly expanding e-commerce segment, which is democratizing access for DIY consumers. Digital marketing and AEO strategies focused on educational content regarding vehicle maintenance are playing a crucial role in capturing consumer attention and preference.

Regionally, North America and Europe currently dominate the market share, owing to established automotive maintenance cultures, high vehicle ownership rates, and early adoption of advanced maintenance products. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This accelerated growth is attributed to rapid motorization, increasing disposable incomes, and the modernization of automotive service infrastructure in countries like China, India, and Southeast Asian nations. Regulatory harmonization efforts across regions are influencing product composition globally, requiring manufacturers to maintain diverse product portfolios tailored to specific regional environmental mandates, such as California’s strict VOC limitations.

Segment trends highlight the dominance of the aftermarket application segment, which is further split between professional usage (mechanics, garages) and DIY usage. While professional mechanics demand large volumes and fast-drying, industrial-strength cleaners, the DIY segment prioritizes ease of use and readily available aerosol packaging. The non-chlorinated segment, driven by regulatory pressure and perceived user safety benefits, is rapidly overtaking chlorinated options, fundamentally reshaping the product mix available on shelves. Furthermore, the increasing adoption of electric vehicles (EVs), which utilize regenerative braking more frequently but still require periodic inspection and cleaning for caliper function and rust prevention, represents a niche growth opportunity requiring specialized, corrosion-inhibiting formulations.

AI Impact Analysis on Car Brake Cleaners Market

User queries regarding AI's impact on the Car Brake Cleaners Market primarily focus on operational efficiency, supply chain optimization, and the integration of predictive maintenance systems. Common themes include whether AI can predict brake cleaning needs accurately (reducing unnecessary maintenance), how automation affects the usage rate of cleaners in large workshops, and the role of machine learning in optimizing inventory management for distributors. Users are concerned about whether enhanced vehicle diagnostics, often supported by AI algorithms, will eventually lead to fewer unplanned repairs but also expect that AI will streamline the selection and procurement process for specialized chemicals based on vehicle type and operational history. The overarching expectation is that AI will drive efficiency and precision across the entire product lifecycle, from manufacturing safety compliance to end-user predictive maintenance schedules.

- Predictive Maintenance Integration: AI-driven telematics and vehicle sensors predict brake wear and contamination levels, optimizing the timing for cleaning and replacement, potentially shifting demand from reactive to scheduled maintenance.

- Supply Chain Optimization: Machine learning algorithms enhance inventory forecasting for manufacturers and distributors, matching production levels with fluctuating seasonal and regional aftermarket demands, reducing warehousing costs.

- Automated Quality Control: AI vision systems are increasingly used in the manufacturing process of brake cleaners (e.g., aerosol filling, labeling inspection) ensuring higher product consistency and regulatory compliance.

- Workshop Efficiency: AI-powered workshop management systems use data analytics to track chemical usage rates and efficiency in professional settings, informing best practices and purchasing decisions for mechanics.

- E-commerce Personalization: AI algorithms personalize product recommendations for DIY consumers based on vehicle model, maintenance history, and local environmental regulations (e.g., suggesting compliant, non-chlorinated formulas in specific states).

DRO & Impact Forces Of Car Brake Cleaners Market

The dynamics of the Car Brake Cleaners Market are fundamentally shaped by the interplay between strict safety mandates, environmental compliance requirements, and evolving automotive technology. Drivers, such as the increasing global vehicle population and the resultant need for consistent maintenance, maintain strong foundational demand. Conversely, environmental regulations, specifically those limiting VOC content and pushing for safer, less toxic formulations, act as significant restraints, necessitating costly reformulation and potentially higher product prices. Opportunities arise from technological advancements in water-based and bio-degradable solvents and the untapped potential in emerging economies where vehicle maintenance standardization is improving rapidly. These forces combine to create a market environment where innovation in chemical formulation and adherence to regional compliance dictates competitive advantage.

The primary impact forces include the constant imperative of road safety, which ensures that brake cleaners remain a non-negotiable part of vehicle servicing, and the regulatory pressure exerted by environmental agencies (like the EPA and equivalent European bodies). Economic factors, such as the volatility of petrochemical raw material costs, significantly influence manufacturing margins, particularly for petroleum-based solvents. Furthermore, consumer education and the rise of the DIY culture, facilitated by readily available instructional content online, amplify the demand for easy-to-use, consumer-friendly aerosol formats. Geopolitical stability and global trade dynamics also impact the market through the supply chain of chemical precursors and the distribution of finished goods.

The restraint related to the perception of efficacy in non-chlorinated products is gradually being overcome through advanced chemical engineering. Historically, chlorinated solvents were favored for their rapid evaporation and potent degreasing capabilities; however, modern non-chlorinated formulas, often acetone- or alcohol-based, are closing this performance gap while meeting compliance standards. This transition, while expensive for manufacturers, presents a long-term opportunity for sustainable growth and allows market leaders to differentiate themselves based on both performance and environmental responsibility. The ongoing transition towards electric and hybrid vehicles, despite reduced brake wear, still provides market opportunities for cleaners focused on preventing corrosion and maintaining caliper function.

Segmentation Analysis

The Car Brake Cleaners Market is meticulously segmented across product type, solvent composition, packaging format, application end-use, and distribution channel, providing a granular view of market dynamics and consumer preferences. Understanding these segments is crucial for manufacturers tailoring product formulations (e.g., high-performance chlorinated for industrial use where permitted, or eco-friendly non-chlorinated for mass retail) and optimizing distribution strategies. The market structure reflects a clear divide between professional-grade industrial products, typically sold in bulk or large aerosols, and consumer-grade products emphasizing ease of use and safety warnings, predominantly sold through retail and e-commerce channels. The largest volume segment remains the non-chlorinated type due to widespread regulatory mandates, driving innovation within this category.

- By Product Type:

- Non-Chlorinated Brake Cleaner

- Chlorinated Brake Cleaner

- By Solvent Composition:

- Petroleum-Based Solvents

- Acetone-Based Solvents

- Alcohol-Based Solvents (e.g., Methanol, Isopropyl Alcohol)

- Water-Based (Aqueous) Solutions

- By Packaging Type:

- Aerosol Cans (Most Dominant)

- Drums and Bulk Containers

- Pump Spray Bottles

- By Application End-use:

- Automotive OEM (Manufacturing & Assembly)

- Automotive Aftermarket (Professional Repair Shops, Garages)

- Automotive Aftermarket (DIY Consumers)

- By Distribution Channel:

- Retail Stores (Auto Parts Stores, Mass Merchandisers)

- E-commerce Platforms

- Distributors/Wholesalers (Serving Professional Shops)

Value Chain Analysis For Car Brake Cleaners Market

The value chain for the Car Brake Cleaners Market begins with the upstream procurement of essential chemical raw materials, including various solvents (petroleum distillates, acetone, various alcohols, chlorinated hydrocarbons, and surfactants) and specialized packaging components, predominantly aerosol cans and valves. Suppliers of these raw materials, often large petrochemical companies and specialty chemical manufacturers, wield significant influence, particularly given the volatility of oil prices impacting petroleum-based solvent costs. Manufacturers focus on blending, formulating, and packaging these chemicals, where regulatory compliance and efficient filling operations are key cost drivers. Optimization at this stage involves mitigating the high costs associated with VOC-compliant solvents and ensuring complex supply chains are resilient to geopolitical disruptions affecting precursor chemical availability.

The downstream segment is dominated by distribution networks crucial for market penetration. Direct channels include manufacturers supplying large OEM assembly plants or major national repair chains under contract. Indirect channels, which form the bulk of aftermarket sales, involve complex networks of regional distributors, wholesalers, and, critically, retail outlets. Retail channels, encompassing specialized auto parts stores (e.g., AutoZone, O’Reilly) and mass merchandisers (e.g., Walmart), are essential touchpoints for the DIY consumer. The rapid growth of e-commerce platforms has fundamentally altered this downstream segment, allowing smaller manufacturers greater market access and enabling consumers to compare prices and product specifications instantly, thereby increasing price sensitivity in certain market segments.

Distribution logistics must adhere to stringent regulations concerning the transport and storage of hazardous materials (due to flammability and pressure under aerosol format). The increasing prominence of e-commerce necessitates specialized fulfillment centers capable of handling Hazmat shipping requirements, often adding complexity and cost compared to non-hazardous goods. Success in the downstream market relies heavily on brand recognition, shelf presence, and efficient logistics that minimize lead times for professional users who require immediate availability of these essential maintenance chemicals. Marketing efforts are targeted both at the professional mechanic, emphasizing performance and compliance, and the DIY user, focusing on safety, ease of use, and instructional support.

Car Brake Cleaners Market Potential Customers

The primary customer base for Car Brake Cleaners is highly segmented, reflecting diverse needs and purchasing behaviors. Professional repair shops, including independent garages, franchised dealerships, and specialized brake repair centers, represent the highest volume purchasers. These customers demand industrial-grade, fast-acting formulas, often purchased in bulk drums or large aerosol cans, prioritizing speed and efficacy in high-throughput environments. They are highly responsive to product performance data, professional recommendations, and favorable bulk pricing agreements offered by distributors. Their purchasing decisions are often tied to regulatory requirements for waste disposal and compliance with health and safety standards related to solvent exposure.

The second major segment consists of the Do-It-Yourself (DIY) consumers, individuals who perform basic vehicle maintenance and repairs at home. This segment primarily purchases standard-sized aerosol cans through retail outlets and e-commerce. DIY users prioritize accessibility, clear instructions, and brand trust, often opting for non-chlorinated formulas due to safety concerns regarding indoor use and handling. They are heavily influenced by online tutorials, product reviews, and educational content that simplifies the brake cleaning process. The growth of vehicle customization and restoration hobbies further fuels demand in this segment, especially concerning classic or performance vehicles.

Finally, automotive Original Equipment Manufacturers (OEMs) constitute a significant, though specialized, customer base. OEMs utilize brake cleaners during the assembly process to ensure components are contaminant-free before final fitting. This segment requires high-purity, often specialized, cleaners delivered under strict quality control contracts, focusing on formulations that do not degrade seals, plastics, or surrounding paint finishes. Furthermore, fleet operators and government agencies maintaining large vehicle pools represent institutional buyers requiring bulk purchases and long-term supply contracts, emphasizing total cost of ownership and environmental sustainability of the cleaning agents used.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 885 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CRC Industries, Permatex (ITW), 3M, WD-40 Company, Berryman Products, Brake Parts Inc (BPI), Valvoline, Gunk (RSC Chemical Solutions), K&N Engineering, Star Brite, SCL International, Hi-Gear Products, Penray, Cyclo Industries, Lucas Oil, Motorcraft (Ford), ACDelco (GM), Wynn's, Bosh Chemical, ZEP Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Brake Cleaners Market Key Technology Landscape

The key technological developments in the Car Brake Cleaners Market center primarily on chemical formulation to achieve regulatory compliance and superior performance simultaneously. The most significant shift is the development of advanced solvent systems that effectively replace hazardous chlorinated solvents. This involves intricate blending of high-purity acetone, various alcohols (like isopropyl and ethanol), and specialized proprietary petroleum distillates designed to meet stringent Volatile Organic Compound (VOC) limits set by regulatory bodies such as the Environmental Protection Agency (EPA) in the US and the European Chemicals Agency (ECHA). Manufacturers are employing sophisticated analytical chemistry to ensure rapid evaporation rates and powerful degreasing properties in these new, compliant formulas, thereby addressing mechanic concerns about drying time.

Another area of technological focus is the optimization of aerosol delivery systems. Advances in propellant technology and valve design aim to maximize cleaning pressure, minimize overspray, and ensure complete depletion of the product from the can, which improves efficiency and reduces waste. Furthermore, technology is driving the introduction of aqueous (water-based) brake cleaning solutions. While historically less popular due to longer drying times and the potential for corrosion, modern aqueous cleaners incorporate corrosion inhibitors and high-performance surfactants, making them viable for certain professional applications, especially where flammable solvents are prohibited or strictly controlled.

The third major technological thrust is the integration of these products into professional workshop workflows, leveraging material science. This includes formulating brake cleaners that are safer for surrounding vehicle materials, such as specific paint finishes, rubber seals, and ABS sensors, which are becoming increasingly delicate in modern vehicles. Research is ongoing into biodegradable and bio-derived solvents to further enhance the environmental profile of these products, positioning them for future regulatory environments where sustainability will be a major determinant of market success. The focus is on achieving a 'green' yet high-performance product that minimizes health risks for end-users and reduces environmental impact.

Regional Highlights

- North America: This region holds a commanding market share, characterized by a large installed base of vehicles, a highly organized aftermarket service sector, and a strong DIY culture. Growth is stable, primarily driven by replacement demand and the constant need for maintenance. The region is highly sensitive to VOC regulations, particularly strict state-level rules in areas like California, which forces market leaders to predominantly sell non-chlorinated, highly engineered formulations.

- Europe: Europe is a mature market focusing heavily on sustainability and compliance with REACH regulations and national environmental standards. The professional sector is dominant, requiring bulk purchases of eco-friendly and high-performance cleaners. The standardization of vehicle safety checks across the EU ensures consistent demand, with a noticeable trend toward low-VOC and bio-based products being favored across Germany, the UK, and France.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by exponential growth in vehicle production and sales, particularly in China and India. As middle-class incomes rise, the transition from local, often improvised, cleaning methods to professional maintenance chemicals accelerates. The market is fragmented, with varying regulatory standards, but global players are rapidly establishing manufacturing and distribution footprints to capitalize on the enormous potential for both OEM and aftermarket sales.

- Latin America (LATAM): The LATAM market exhibits moderate growth, driven by increasing vehicle density and the formalization of the automotive service industry. Price sensitivity is higher in this region, leading to a complex mix of imported premium products and domestically manufactured, often more basic, solvent-based cleaners. Brazil and Mexico are the key revenue generators, where infrastructure improvements are bolstering professional maintenance standards.

- Middle East and Africa (MEA): Growth in MEA is linked to infrastructure projects and high luxury vehicle ownership in the GCC countries, which demand high-end maintenance products. Brake cleaner consumption is substantial due to the severe operating conditions (heat, dust) that necessitate frequent brake system upkeep. The African market is nascent but expanding, with demand centered around urbanized centers and formal imported vehicle fleets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Brake Cleaners Market.- CRC Industries

- Permatex (ITW)

- 3M

- WD-40 Company

- Berryman Products

- Brake Parts Inc (BPI)

- Valvoline

- Gunk (RSC Chemical Solutions)

- K&N Engineering

- Star Brite

- SCL International

- Hi-Gear Products

- Penray

- Cyclo Industries

- Lucas Oil

- Motorcraft (Ford)

- ACDelco (GM)

- Wynn's

- Bosh Chemical

- ZEP Inc.

Frequently Asked Questions

Analyze common user questions about the Car Brake Cleaners market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between chlorinated and non-chlorinated brake cleaners?

Chlorinated brake cleaners contain powerful solvents that offer rapid cleaning and drying but are toxic and regulated due to environmental and health concerns. Non-chlorinated cleaners, typically acetone or alcohol-based, are safer, VOC-compliant alternatives, although their drying time or cost may differ slightly from traditional formulas. Regulatory pressure increasingly mandates the use of non-chlorinated types in many regions.

Are brake cleaners safe to use on sensitive materials like rubber and ABS sensors?

High-quality, modern brake cleaners, especially those labeled as safe for plastics and rubber, are formulated to be non-corrosive and safe for most standard automotive components, including ABS sensors and rubber seals. It is crucial to verify the product's specifications, as some older or highly aggressive chlorinated formulations can damage sensitive parts, especially paint finishes.

Why is the Asia Pacific (APAC) region experiencing the highest growth in the brake cleaners market?

APAC growth is driven by massive motorization rates, increased vehicle sales, improving road infrastructure, and the formalization of vehicle maintenance services. As more consumers transition from rudimentary repairs to professional service, the demand for certified, high-quality maintenance chemicals like brake cleaners surges across key economies such as China and India.

How do stringent VOC regulations impact the cost and performance of brake cleaners?

VOC regulations compel manufacturers to replace cheaper, volatile solvents with more expensive, compliant chemical blends (like high-purity acetone or specialized alcohols). This reformulation often increases the manufacturing cost and, consequently, the retail price. While modern low-VOC formulas maintain high performance, the initial industry shift required significant R&D investment.

What role does the e-commerce channel play in the distribution of brake cleaners?

E-commerce is critical for reaching the growing DIY consumer segment, offering convenience, product reviews, and competitive pricing. It enables manufacturers to bypass traditional retail intermediaries and provides direct access to a national or global customer base, accelerating sales velocity, particularly for consumer-focused aerosol products.

The market analysis indicates a clear trajectory toward specialized, regulatory-compliant formulations, where performance and environmental stewardship are becoming equally important drivers of competitive success. Manufacturers must continually innovate in solvent technology and optimize supply chain resilience to maintain market position and capture the high-growth opportunities emerging from the APAC region.

Further analysis of the value chain reveals that efficiency in aerosol packaging technology and strategic partnerships with professional maintenance franchises are essential for optimizing profitability and market reach. The transition away from traditional, hazardous materials is not merely a regulatory compliance issue but a fundamental shift in product development philosophy, aligning with global consumer demand for safer automotive maintenance products.

The segmentation data underscores the divergence between professional and DIY needs. Professional mechanics prioritize quick-drying, residue-free power, often tolerating bulk purchasing, while DIY users prioritize ease of application and enhanced safety labeling. This requires brands to manage dual product portfolios and distinct marketing strategies, differentiating premium industrial lines from accessible consumer products sold through mass retail channels.

Geographically, North America and Europe set the pace for innovation due to early adoption of stringent environmental standards, forcing rapid product evolution. Conversely, the sheer volume potential in APAC mandates establishing robust local manufacturing and distribution hubs to manage logistics complexity and capitalize on escalating vehicle ownership trends. Investment in localized technical support and regulatory adherence in emerging markets will be key to unlocking long-term shareholder value in the Car Brake Cleaners Market.

The impact of AI, while currently subtle, is poised to revolutionize the procurement and maintenance scheduling aspects of the market. Predictive maintenance protocols, utilizing vehicle telematics, will refine the timing of brake cleaning interventions, reducing waste and optimizing chemical usage rates. This efficiency drive aligns perfectly with the professional segment's focus on operational cost reduction and lean inventory management, offering a future opportunity for digital service integration alongside chemical sales.

Addressing the restraint of raw material price volatility is critical for sustaining manufacturer margins. Companies are adopting multi-sourcing strategies and exploring flexible formulation chemistries that allow for interchangeable solvents based on commodity pricing without compromising final product performance. This operational agility is becoming a non-negotiable requirement in a global market susceptible to geopolitical supply chain disruptions. The emphasis on high-performance non-chlorinated products continues to drive the market's technological evolution, ensuring that safety and efficacy goals are met simultaneously.

The strategic expansion into related maintenance chemicals, such as specialized cleaners for electric vehicle braking systems (which require distinct solutions due to lower heat generation and increased corrosion risk), represents a vital avenue for sustained growth. Market leaders are positioning their brands not just as suppliers of brake cleaners, but as comprehensive partners in vehicle maintenance, offering solutions tailored to emerging powertrain technologies and increasingly complex vehicle architectures. This holistic approach ensures relevance in a rapidly transforming automotive landscape.

The increasing frequency of vehicle inspections in many jurisdictions, driven by mandatory safety standards, acts as a perpetual demand driver for brake maintenance products. Regulators recognize the critical nature of braking systems, compelling both professional service providers and private owners to maintain components in peak condition, directly benefiting the consumption rates of high-quality, residue-free brake cleaners. This regulatory backing provides a strong, stable foundation for the market's continued expansion throughout the forecast period.

Furthermore, the competitive strategy of key players often involves product bundling. Manufacturers frequently package brake cleaners with related items, such as brake lubricants, caliper greases, and anti-squeal compounds, offering integrated solutions to professional mechanics. This strategy increases the average transaction value and reinforces brand loyalty within the crucial professional aftermarket segment. Digital educational content, targeting both DIYers and new mechanics, remains a powerful tool for establishing brand authority and ensuring correct product application, which maximizes performance outcomes and customer satisfaction.

The environmental opportunities within the market are vast. Developing water-based cleaners that achieve parity in drying time and cleaning power with solvent-based alternatives represents the ultimate technological breakthrough. Companies that successfully navigate this challenge will gain a significant competitive edge, especially in markets with the most severe environmental restrictions. The focus on sustainability extends beyond the chemical formulation to packaging, with increasing interest in recycled materials and reduced-waste aerosol designs, appealing to environmentally conscious consumers and corporate sustainability mandates.

In summary, the Car Brake Cleaners Market is transitioning from a commodity chemical market to a technology-driven segment defined by chemical ingenuity, environmental compliance, and sophisticated distribution logistics. Success is contingent upon balancing cost pressures from raw materials with the investment required for R&D in compliant, high-performance formulations, while simultaneously catering to the distinct needs of the professional service sector and the expanding, digitally informed DIY consumer base.

The market continues to show resilience against macroeconomic fluctuations because brake maintenance is a non-discretionary vehicle safety requirement. Even during economic downturns, vehicle owners typically prioritize necessary maintenance over replacement, ensuring sustained baseline demand for these critical cleaning solutions. This inherent stability makes the market attractive for long-term investment, despite the challenges posed by stringent regulatory landscapes and competitive intensity.

Further examination of the distribution channel reveals that major auto parts retailers are increasingly leveraging private label brands. While private labels often compete aggressively on price, leading brands counteract this pressure by emphasizing superior performance guarantees, professional endorsements, and specialized formulations that private labels often cannot replicate effectively. This bifurcated retail market structure allows premium brands to maintain margin stability through performance differentiation, while budget options capture the highly price-sensitive segments of the market.

The future trajectory is heavily influenced by vehicle electrification. While EVs require less frequent friction braking maintenance, the need for corrosion protection and cleaning of caliper mechanisms remains critical, creating a demand for new, specialized cleaners that are non-conductive and optimized for the unique materials and low-heat environment of electric vehicle braking systems. This specialized niche represents a significant opportunity for innovation and differentiation for market leaders in the latter half of the forecast period.

The extensive analysis confirms that the Car Brake Cleaners Market is characterized by moderate but stable growth, underpinned by fundamental safety requirements and accelerated by regional expansion in APAC. Strategic focus areas for maximizing profitability include managing regulatory complexity, investing in sustainable chemical technologies, and optimizing e-commerce logistics to capture the dual segments of professional and DIY consumers efficiently.

Finally, the long-term health of the market depends on proactive regulatory engagement. Manufacturers who participate in shaping future VOC and hazardous material standards are better positioned to integrate compliance into their R&D pipelines early, securing a competitive advantage over companies forced to react hastily to legislative changes. This proactive stance ensures that the supply of essential, high-quality brake maintenance products remains uninterrupted across all major global markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager