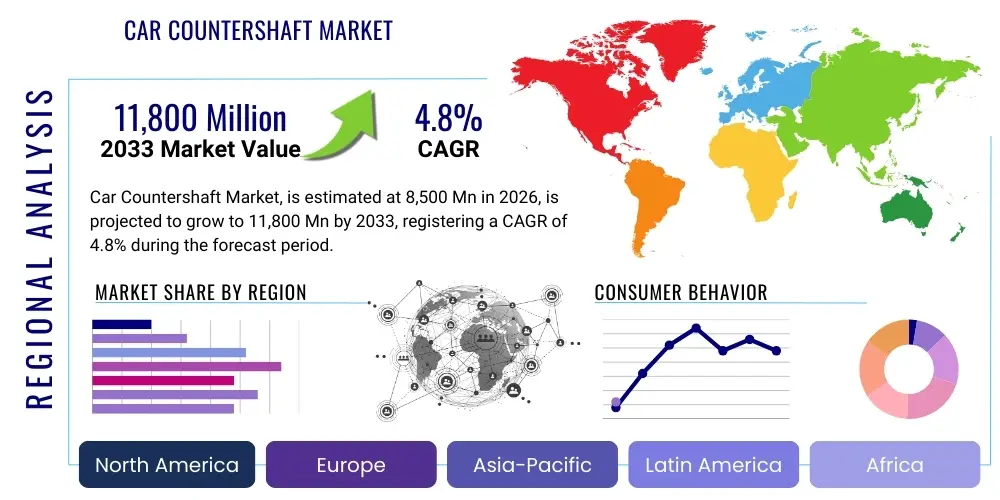

Car Countershaft Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442055 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Car Countershaft Market Size

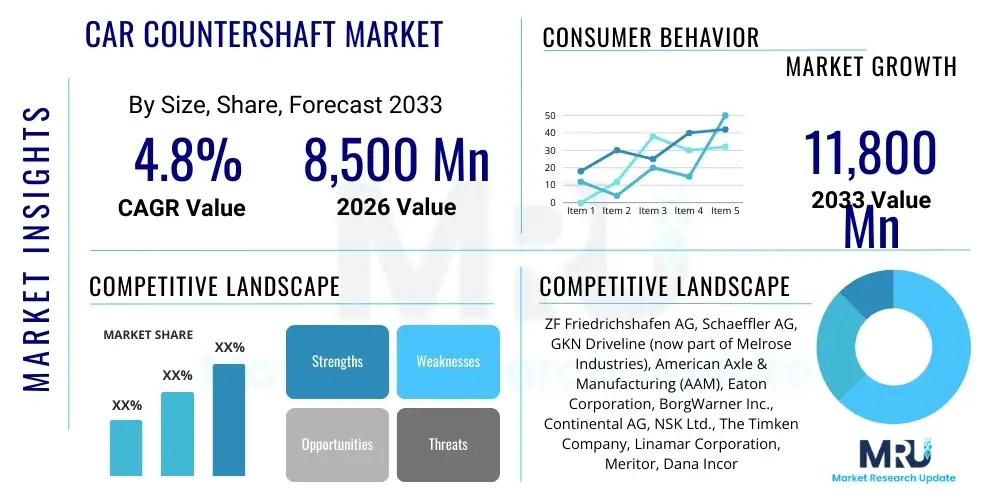

The Car Countershaft Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 8,500 Million in 2026 and is projected to reach USD 11,800 Million by the end of the forecast period in 2033.

Car Countershaft Market introduction

The Car Countershaft Market encompasses the manufacturing, distribution, and utilization of essential components within automotive transmission systems, primarily responsible for transferring torque and rotational motion between the input shaft and the main shaft in manual, automated manual transmissions (AMT), and certain automatic transmission (AT) configurations. The countershaft, often referred to as a lay shaft, is a critical element, hosting specific gears that mesh with the gears on the main shaft, thereby facilitating the selection of different gear ratios necessary for varying driving conditions and speeds. Its primary function ensures seamless and efficient power delivery from the engine to the wheels, fundamentally defining the vehicle's performance characteristics, fuel efficiency, and overall driving dynamics. Product durability and precision engineering are paramount, as the component operates under high stress, fluctuating temperatures, and sustained vibrational loads within the gearbox casing, necessitating stringent material selection and manufacturing tolerances.

Major applications of countershafts are concentrated within conventional powertrain systems, predominantly in internal combustion engine (ICE) vehicles, spanning passenger cars, light commercial vehicles, and heavy-duty trucks. Although the global automotive industry is undergoing a transformative shift toward electrification, countershafts remain highly relevant in hybrid electric vehicles (HEVs) that utilize complex multi-speed transmissions to manage power flow from both the engine and electric motor. The continued strength in emerging and developing markets, where ICE vehicle sales and manual transmission preference remain robust, sustains the demand trajectory for high-quality countershaft systems. Furthermore, advancements in specialized transmissions, such as Dual Clutch Transmissions (DCTs), often employ sophisticated countershaft arrangements to manage multiple clutch inputs simultaneously, driving innovation in component design and metallurgical science.

The primary benefits offered by modern countershaft designs include enhanced transmission efficiency, reduced weight through advanced materials (e.g., specific steel alloys and heat treatments), and improved noise, vibration, and harshness (NVH) characteristics. Key driving factors propelling market growth include the global mandate for improved fuel economy, pushing OEMs to adopt transmissions with increased gear counts (e.g., 6-speed MTs or 8-speed ATs), which inherently require more complex countershaft assemblies. Simultaneously, the burgeoning demand for high-performance vehicles, necessitating robust torque handling capabilities and rapid shift times, further stimulates research and development efforts in optimized countershaft geometry and surface finishes, ensuring longevity and reliable operation across diverse operational parameters. The replacement market, fueled by aging vehicle fleets and the inherent wear and tear on transmission components, also constitutes a significant and stable segment of the market demand.

Car Countershaft Market Executive Summary

The Car Countershaft Market demonstrates resilience driven by strong demand in Asian and developing economies, offsetting the gradual structural decline in mature markets transitioning rapidly to Battery Electric Vehicles (BEVs). Business trends emphasize consolidation among Tier 1 suppliers, who are focusing on vertical integration and acquiring specialized manufacturing capabilities related to advanced gear cutting and heat treatment processes to meet increasingly stringent OEM requirements for precision and durability. Furthermore, there is a pronounced trend toward designing lighter, higher-strength countershafts using sophisticated steel alloys and advanced forging techniques, directly addressing the industry’s pursuit of weight reduction and improved vehicle performance. Suppliers are strategically investing in highly automated production lines capable of mass-producing complex shaft geometries required for modern multi-speed and hybrid transmissions, thereby optimizing cost structures and ensuring supply chain responsiveness, particularly to major automotive hubs in China, India, and Southeast Asia.

Regionally, Asia Pacific (APAC) stands as the dominant market, propelled by high volume production of passenger cars and light commercial vehicles, coupled with a persistent consumer preference for manual transmission vehicles in nations like India. North America and Europe, while facing a plateau in traditional ICE sales, represent high-value markets focusing on complex, premium-grade countershafts utilized in luxury vehicles, performance cars, and sophisticated dual-clutch transmission systems. Regional expansion strategies for market participants increasingly involve establishing localized manufacturing bases in key growth regions to mitigate logistics costs, manage trade tariffs effectively, and comply with local content regulations mandated by various national governments. This geographical redistribution of manufacturing capabilities is critical for sustaining market relevance and improving time-to-market for new transmission models.

Segmentation trends highlight the increasing technological complexity within the market. Countershafts designed for Automatic and Automated Manual Transmissions (AMTs) are capturing a greater market share compared to traditional manual transmission (MT) systems, reflecting the global consumer shift towards driving convenience. The material segment is characterized by a steady move towards specialized steel alloys that offer superior yield strength and fatigue resistance while enabling lightweighting efforts. The OEM segment remains the predominant sales channel, commanding significant volume due to long-term supply agreements and the necessity for highly customized components tailored precisely to specific transmission architectures. However, the aftermarket segment is steadily expanding, driven by the requirement for quality replacement parts, especially in regions characterized by older average vehicle ages and intensive commercial usage patterns.

AI Impact Analysis on Car Countershaft Market

Common user questions regarding AI's impact on the Car Countershaft Market primarily revolve around how machine learning can optimize the highly technical manufacturing processes, specifically heat treatment and gear profiling, to minimize defects and maximize material yield. Users frequently inquire about the application of predictive maintenance enabled by AI, extending the operational lifespan of countershafts in heavy-duty or performance applications. Key themes emerging from these inquiries include efficiency gains through automated quality control using computer vision, supply chain resilience enhanced by predictive analytics for raw material sourcing, and the potential for AI-driven generative design to create novel, structurally superior countershaft geometries that reduce weight without compromising strength. The consensus expectation is that AI will not fundamentally change the product itself but will revolutionize its design validation, quality assurance, and manufacturing efficiency, leading to faster iteration cycles and superior product consistency, thereby setting new standards for Tier 1 suppliers.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning algorithms to anticipate countershaft failure in vehicle transmissions, allowing for proactive servicing and reducing unexpected downtime, particularly critical for commercial fleets.

- Generative Design Optimization: Employing AI tools to explore thousands of design iterations, optimizing countershaft geometry for maximum torsional rigidity and minimum mass, leading to significant material savings and improved fuel efficiency.

- Automated Quality Control (AQC): Integrating computer vision and machine learning models for high-speed inspection of surface finish, gear tooth accuracy, and dimensional tolerances, significantly reducing human error in the highly sensitive manufacturing phase.

- Supply Chain Risk Modeling: Applying AI to analyze global geopolitical and economic indicators to predict potential disruptions in raw material supply (e.g., specialized steel alloys), enhancing inventory management and procurement strategies.

- Process Parameter Tuning: Using machine learning within the manufacturing plant to dynamically adjust parameters in forging, machining, and crucial heat treatment processes (e.g., carburizing, quenching) to ensure optimal metallurgical properties and component consistency.

DRO & Impact Forces Of Car Countershaft Market

The dynamics of the Car Countershaft Market are characterized by a complex interplay of systemic drivers related to automotive engineering standards and structural restraints imposed by global regulatory shifts toward zero-emission mobility. A primary driver is the sustained global increase in vehicle production, particularly in APAC, alongside continuous technological demands for high-efficiency transmissions. These transmissions, essential for meeting stricter environmental regulations (like CAFE standards), rely heavily on precisely engineered countershafts to manage the increased complexity of multiple gear ratios. Simultaneously, the relentless pursuit of lightweighting across the automotive sector acts as a significant driving force, compelling manufacturers to invest in R&D for advanced, low-density, high-strength materials and innovative manufacturing processes that reduce rotational inertia and overall vehicle weight, thereby directly improving fuel economy and reducing emissions.

However, the rapid acceleration of the electric vehicle (EV) transition, especially in regulatory-driven markets in Europe and North America, poses the most substantial long-term restraint. Battery Electric Vehicles (BEVs) typically employ single-speed reduction gearboxes or highly simplified two-speed transmissions that often negate the need for the complex countershaft systems found in traditional ICE gearboxes, leading to a structural decline in demand in mature markets. Furthermore, the inherent volatility of raw material prices, specifically high-grade alloy steels (Nickel, Chromium, Molybdenum), introduces significant cost pressures and unpredictability in the supply chain. Opportunities, conversely, are abundant in the field of hybrid technology; sophisticated Hybrid Electric Vehicles (HEVs) require robust transmission components to seamlessly integrate engine and motor power, opening specialized niche markets for high-performance countershafts capable of handling transient loading conditions unique to hybrid powertrains.

The overall impact forces are moderate to high, heavily skewed by the impending shift in vehicle architecture. While immediate market growth is secured by continued reliance on ICE platforms and strong demand from emerging economies, the long-term viability hinges on the industry's ability to adapt components for next-generation hybrid and specialized EV applications, such as multi-speed transmissions being developed for performance EVs. Key impact forces include regulatory mandates favoring low emissions (Driver), accelerated battery cost reductions making BEVs more competitive (Restraint), and the opportunity residing in advanced manufacturing technologies (e.g., powder metallurgy and precision forging) that allow component suppliers to offer premium, highly optimized products that are less susceptible to commoditization and offer better performance guarantees across demanding applications.

Segmentation Analysis

The Car Countershaft Market is comprehensively segmented based on several critical dimensions, including the type of vehicle (which dictates load requirements and size), the specific transmission architecture (determining complexity and number of shafts), the materials used (impacting weight and strength), and the distribution channel (delineating OEM versus aftermarket sales). Understanding these segments is crucial for strategic market entry and product positioning, as component specifications vary dramatically between a light-duty passenger car manual gearbox and a heavy-duty commercial vehicle automatic transmission system. The segmentation reflects the technological evolution within the automotive sector, prioritizing performance, durability, and cost-efficiency across different end-use applications and operational environments.

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- By Transmission Type:

- Manual Transmission (MT)

- Automatic Transmission (AT)

- Automated Manual Transmission (AMT)

- Dual Clutch Transmission (DCT)

- Continuously Variable Transmission (CVT - where applicable, primarily auxiliary or specific ratio components)

- By Material Type:

- Standard Alloy Steel (e.g., Chromium-Molybdenum steels)

- High-Strength Steel Alloys (e.g., Nickel-Chromium steels)

- Specialty Materials (e.g., Forged Aluminum for specific lightweight applications)

- By Sales Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket (Replacement and Service)

Value Chain Analysis For Car Countershaft Market

The value chain for the Car Countershaft Market begins with upstream activities dominated by raw material extraction and specialized metallurgical processing. Upstream suppliers are typically global steel manufacturers providing high-purity alloy steels necessary for the demanding mechanical and thermal requirements of transmission components. Key processes in this stage include precise alloying, ingot casting, and specialized forging preparation. The performance and cost of the final countershaft are heavily influenced by the consistency and quality of these input materials, necessitating strong, long-term relationships between Tier 2 suppliers (steel manufacturers) and Tier 1 component manufacturers. Efficient sourcing, negotiating favorable commodity prices, and ensuring robust inventory management against global price fluctuations are critical success factors at this initial stage of the value chain, directly affecting the profitability downstream.

The midstream phase involves the core manufacturing processes executed primarily by specialized Tier 1 automotive suppliers. This stage includes complex operations such as precision forging, computer numerical control (CNC) machining, specialized gear hobbing and shaping, heat treatment (carburizing and quenching for hardening), and grinding/finishing to meet extremely tight dimensional tolerances and surface roughness specifications. Direct distribution involves delivering the finished countershafts to Original Equipment Manufacturers (OEMs) who integrate them directly into transmission assemblies on their production lines. This direct channel is characterized by high volume, stringent quality audits, and just-in-time (JIT) delivery protocols, requiring the supplier to operate highly efficient, globally synchronized production facilities to minimize inventory risks and ensure assembly line continuity for major automotive brands.

Downstream activities involve the distribution of components to the aftermarket through both direct supply to OEM service networks and indirect channels encompassing independent distributors, wholesalers, and retail auto parts stores. The aftermarket segment requires robust logistics capabilities to handle lower volumes but higher product diversity (catering to multiple vehicle models and years). Indirect channels are vital for reaching independent repair shops and consumers globally, demanding effective marketing and branding to ensure counterfeit avoidance and trust in component quality. Success in the downstream sector relies on maintaining comprehensive product catalogs, competitive pricing, and efficient spare parts fulfillment, ensuring that genuine, high-quality countershafts are readily available for maintenance and repair throughout the operational life of the vehicle fleet, sustaining the product's lifespan and the supplier's ongoing revenue stream.

Car Countershaft Market Potential Customers

The primary consumers and end-users of car countershafts are segmented into two distinct categories: Original Equipment Manufacturers (OEMs) and the automotive Aftermarket. OEMs constitute the largest volume segment, comprising global automotive assembly companies (e.g., Toyota, Volkswagen, General Motors, Ford, Hyundai-Kia) and specialized transmission manufacturers (e.g., ZF Friedrichshafen, Aisin, Getrag/Magna). These customers require millions of units annually, manufactured to exact, often proprietary, specifications, demanding ultra-high precision, long-term durability guarantees, and strict adherence to specific metallurgical compositions tailored for their unique transmission architectures. Their purchasing decisions are driven by factors such as established technical capability, proven track record of quality (measured in parts per million defect rates), cost efficiency achieved through economies of scale, and the supplier's geographical proximity to major assembly plants.

The secondary, yet equally vital, customer base is the Aftermarket, which includes independent maintenance and repair facilities (IMRs), regional automotive parts wholesalers, and specialized distributors serving older vehicles and regions with demanding road conditions. Aftermarket buyers prioritize product longevity, immediate availability across a broad range of legacy and current models, and competitive pricing for replacement parts. While the volumes are lower per order than OEM contracts, the aftermarket provides stable, high-margin revenue streams that are less susceptible to the cyclical nature of new vehicle production. This segment requires suppliers to manage a vast SKU (Stock Keeping Unit) list and maintain robust distribution networks to ensure timely supply of replacement countershafts crucial for maintaining the operational reliability of the global vehicle fleet.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8,500 Million |

| Market Forecast in 2033 | USD 11,800 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Schaeffler AG, GKN Driveline (now part of Melrose Industries), American Axle & Manufacturing (AAM), Eaton Corporation, BorgWarner Inc., Continental AG, NSK Ltd., The Timken Company, Linamar Corporation, Meritor, Dana Incorporated, JTEKT Corporation, Musashi Seimitsu Industry Co., Ltd., Bharat Forge Ltd., Shaanxi Fast Gear Co., Ltd., Riken Corporation, Hitachi Astemo, Magna International Inc., NTN Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Countershaft Market Key Technology Landscape

The technological landscape of the Car Countershaft Market is defined by continuous innovation focused on achieving superior metallurgical properties, precision geometry, and reduced mass. Advanced forging techniques, such as cold and warm forging, are increasingly utilized to optimize grain structure, enhancing the strength-to-weight ratio and reducing machining waste compared to traditional machining methods. Critical technological processes include highly automated, multi-axis CNC machining centers capable of achieving micron-level tolerances for gear teeth profiles and bearing surfaces, which are paramount for minimizing friction, reducing NVH levels, and ensuring optimal meshing efficiency within the transmission system. Furthermore, the integration of advanced sensors and real-time monitoring systems within the manufacturing environment allows for instantaneous adjustments to process parameters, ensuring high consistency and preventing defects associated with thermal warping or material fatigue initiation points.

A crucial area of technological advancement lies in heat treatment processes, particularly sophisticated carburizing and nitriding techniques. Carburizing involves increasing the carbon content on the outer layer of the steel to create a hard, wear-resistant surface while maintaining a tough, shock-absorbing core. Modern implementations involve vacuum carburizing, which offers superior control over the carbon diffusion profile, leading to highly uniform case depth and reduced distortion, minimizing the need for extensive post-heat treatment grinding. Similarly, induction hardening is used selectively on specific high-stress areas of the countershaft to localize increased hardness, enhancing durability without compromising the overall component integrity. These specialized thermal processes are essential for the component to withstand the high torque, cyclical loading, and shear forces exerted during aggressive driving or heavy-duty use over the vehicle's lifespan.

In response to lightweighting mandates, material science innovation is highly focused on developing specialized, micro-alloyed steels (such as 20CrMnTi or high-performance tool steels) that offer superior mechanical properties while being suitable for high-volume manufacturing. Furthermore, surface engineering technologies, including specialized coatings (e.g., DLC – Diamond-Like Carbon) or micro-peening, are being deployed to reduce frictional losses between mating surfaces, significantly contributing to the overall transmission efficiency and longevity. The combination of optimized material selection, advanced forming, precision machining, and highly controlled surface treatments defines the competitive technological edge in the market, allowing leading suppliers to provide components compatible with the demanding performance requirements of modern high-speed and complex automated transmission systems, including those used in high-end hybrid vehicles requiring precise torque management.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market volume due to high production rates in key manufacturing hubs like China, India, Japan, and South Korea. The region exhibits sustained growth, primarily driven by continued sales of ICE vehicles and the persistent high consumer preference for manual transmission vehicles in emerging economies. Investment in automated manufacturing facilities and raw material sourcing capacity expansion characterizes this market.

- Europe: Characterized by high technological adoption and stringent regulatory pressure (Euro 7 standards). The market is transitioning rapidly towards hybridization and electrification, favoring high-precision countershafts for complex DCTs and specialized hybrid transmission systems. Germany, France, and Italy are central to R&D and premium component manufacturing, though the overall volume demand for traditional countershafts is expected to taper due to BEV adoption.

- North America: A mature market defined by a strong preference for automatic transmissions and large vehicle segments (trucks and SUVs). Demand is focused on robust, high-torque capacity countershafts. While the region is a leader in EV adoption, continued strong sales in light truck and hybrid segments sustain demand for sophisticated multi-speed transmission components.

- Latin America (LATAM): Offers steady growth potential, supported by local automotive assembly operations, especially in Brazil and Mexico. The market relies heavily on cost-effective, durable components suitable for standard manual transmissions, often serving as a key export hub for global OEMs catering to specific regional market needs.

- Middle East and Africa (MEA): A nascent but growing market, driven by increasing vehicle parc size and infrastructural development. Demand is concentrated in the aftermarket segment for reliable, high-durability replacement parts, influenced heavily by global OEM investment in regional assembly plants, particularly in South Africa and the UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Countershaft Market.- ZF Friedrichshafen AG

- Schaeffler AG

- GKN Driveline (now part of Melrose Industries)

- American Axle & Manufacturing (AAM)

- Eaton Corporation

- BorgWarner Inc.

- Continental AG

- NSK Ltd.

- The Timken Company

- Linamar Corporation

- Meritor

- Dana Incorporated

- JTEKT Corporation

- Musashi Seimitsu Industry Co., Ltd.

- Bharat Forge Ltd.

- Shaanxi Fast Gear Co., Ltd.

- Riken Corporation

- Hitachi Astemo

- Magna International Inc.

- NTN Corporation

Frequently Asked Questions

Analyze common user questions about the Car Countershaft market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a countershaft in a car transmission?

The primary function of a countershaft, or lay shaft, is to transfer torque from the transmission input shaft to the main shaft, utilizing various gear ratios to control vehicle speed and manage power output from the engine to the drive wheels efficiently.

How is the electric vehicle (EV) transition impacting the demand for countershafts?

The EV transition is creating a structural restraint, as most Battery Electric Vehicles (BEVs) use simplified, single-speed reduction gearboxes that eliminate the complex multi-shaft architecture traditional ICE transmissions require, leading to declining long-term demand in mature markets.

Which material technologies are crucial for modern countershaft manufacturing?

Modern countershafts rely heavily on specialized high-strength alloy steels (e.g., Nickel-Chromium steels) combined with advanced manufacturing technologies like precision forging, specialized heat treatments (carburizing/nitriding), and precise CNC machining to achieve required durability and lightweighting goals.

Which geographical region holds the largest market share for car countershafts?

The Asia Pacific (APAC) region currently holds the largest market share, driven by high-volume vehicle manufacturing in countries like China and India, strong domestic demand for ICE vehicles, and continued preference for robust manual transmission systems.

What are the key differences between OEM and Aftermarket countershaft demand?

OEM demand is characterized by extremely high volume, customized specifications, and stringent quality control for new vehicle assembly, while Aftermarket demand is driven by the need for reliable, widely available replacement parts for repair and maintenance of existing vehicle fleets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager