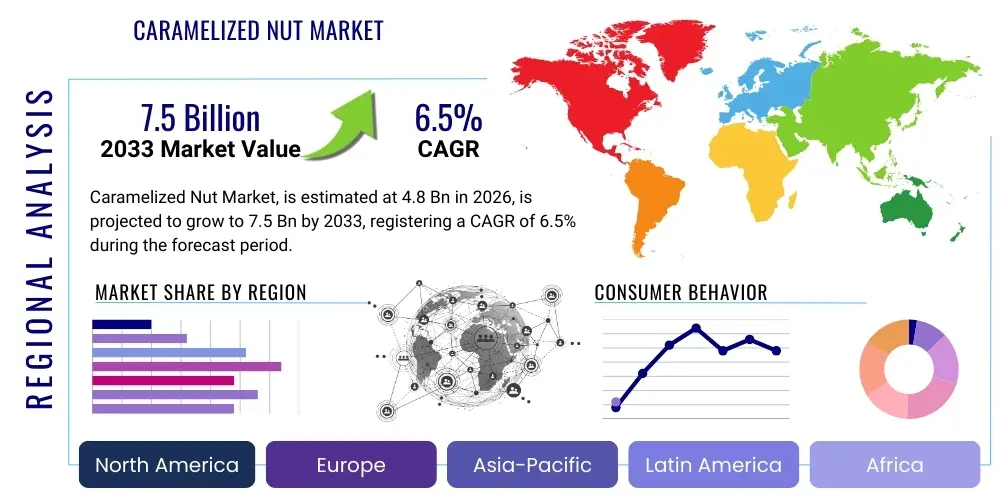

Caramelized Nut Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442602 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Caramelized Nut Market Size

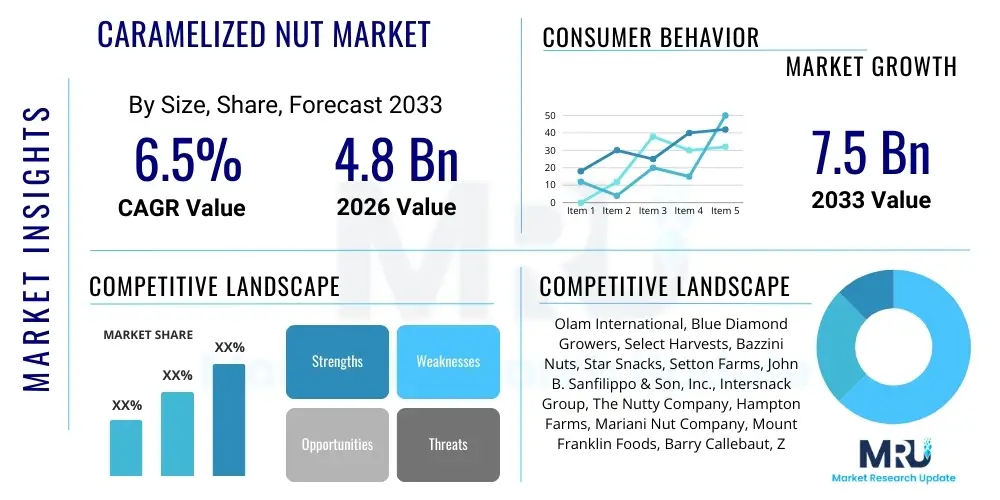

The Caramelized Nut Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating consumer demand for premium, indulgence-focused snack options and the increasing application of caramelized nuts as a high-value ingredient across the confectionery, bakery, and dairy industries. Geographically, North America and Europe currently dominate the market share, yet Asia Pacific is anticipated to register the highest growth rate, fueled by shifting dietary preferences, rising disposable incomes, and the adoption of Western snacking trends. Market growth is further underpinned by technological advancements in processing and packaging that enhance product shelf life and texture consistency, catering to both industrial and retail segments demanding superior quality and variety.

Caramelized Nut Market introduction

The Caramelized Nut Market encompasses the production, distribution, and sale of various nuts, such as almonds, pecans, walnuts, and cashews, coated with a hardened layer of caramelized sugar or syrup, often enhanced with flavors like cinnamon, vanilla, or honey. These products serve multiple roles, ranging from ready-to-eat premium snacks to high-quality ingredients utilized in complex food formulations like ice creams, baked goods, chocolates, and specialized breakfast cereals. The core value proposition of caramelized nuts lies in their unique textural contrast—the crunch of the nut combined with the glassy, sweet exterior—and their rich, intense flavor profile. Major applications span industrial ingredient use (B2B), food service distribution (cafés, restaurants), and direct retail consumption (snack packs, bulk bins). The driving factors supporting this market include the global 'snackification' trend, where consumers replace traditional meals with small, frequent indulgences; the growing perception of nuts as a healthy source of protein and essential fats, despite the sugar coating; and continuous flavor innovation, which introduces exciting and novel variants, such as spicy caramel or salted caramel coatings, to attract diverse consumer demographics seeking sophisticated flavors and textural experiences.

Product description highlights the versatility of caramelized nuts, noting that while traditional preparation involves dry roasting followed by hot sugar coating, modern manufacturing utilizes sophisticated vacuum tumbling and fluid bed systems to ensure uniform coating thickness and minimal breakage, essential for high-volume industrial applications. The nuts are valued not only for their flavor but also for their functional role in preventing moisture migration in confectionery items and providing structural integrity and visual appeal in artisanal baked goods. The inherent benefits derived from the market expansion include supporting nut agriculture in key regions, fostering innovation in food processing equipment, and offering consumers healthier, though indulgent, alternatives to highly processed candies. Furthermore, the market is seeing a notable trend toward incorporating alternative sweeteners, such as erythritol, stevia, or maple syrup, to address increasing consumer scrutiny regarding high sugar content, thereby broadening the product appeal to health-conscious segments and expanding its functional attributes.

Driving factors are intricately linked to macro-economic trends, particularly the premiumization of snacks in developed economies where consumers are willing to pay a higher price point for perceived superior quality, natural ingredients, and artisanal preparation claims. The increasing penetration of international food retail chains and the rapid growth of e-commerce platforms have significantly improved the distribution reach, making niche caramelized nut products accessible globally. Regulatory environments, particularly those focused on food safety and allergen labeling, also influence market dynamics, pushing manufacturers toward stricter quality control protocols and clear communication regarding processing methods and ingredient sourcing. The continuous desire for convenience, coupled with the functional benefits of nut consumption, positions caramelized nuts favorably against traditional confectionery items, ensuring sustained growth across key consumption regions like North America and Western Europe, while emerging economies present untapped potential for market penetration and volume expansion.

Caramelized Nut Market Executive Summary

The Caramelized Nut Market is characterized by robust growth, primarily propelled by favorable business trends focused on ingredient premiumization, sustainable sourcing, and technological refinement in coating processes. Key business trends show a strong emphasis on clean label products, leading manufacturers to replace artificial flavorings and colorants with natural extracts and fruit concentrates. This commitment to natural ingredients not only meets consumer expectations for transparency but also commands a higher market price, supporting profitability. Regional trends indicate that while mature markets like the U.S. and Germany maintain strong consumption due to established snacking cultures and advanced retail infrastructure, the fastest market acceleration is observed in the Asia Pacific region, particularly China and India, driven by rapidly urbanizing populations adopting international food trends and demanding convenient, high-quality sweet snacks. These emerging markets represent significant long-term growth vectors for global producers seeking expansion beyond saturated Western economies.

Segment trends reveal that almonds and pecans remain the dominant nut types due to their versatility and wide availability, though specialized variants like macadamia and pistachios are experiencing faster relative growth in high-end specialty retail channels, reflecting diversification in consumer palates. Application-wise, the industrial segment, specifically the confectionery and baking industries, holds the largest market share, leveraging caramelized nuts for texture and flavor enhancement in high-volume products. However, the ready-to-eat snack segment is exhibiting accelerated growth, supported by innovative packaging solutions that prioritize freshness and portion control, aligning with modern consumer lifestyles focused on mobility and convenience. Manufacturers are also increasingly investing in R&D to develop low-sugar or sugar-free caramelized options, utilizing polyols and natural zero-calorie sweeteners, a trend that is crucial for maintaining market relevance amidst global health scrutiny regarding sugar intake and addressing the rising prevalence of dietary restrictions, thus ensuring market longevity.

The competitive landscape is moderately fragmented, featuring large, established food processors alongside numerous artisanal and regional players specializing in unique flavor profiles and sustainable sourcing practices. Strategic collaborations, including mergers and acquisitions, are common, particularly among companies seeking to vertically integrate the supply chain from raw nut sourcing to final product packaging, ensuring ingredient quality control and mitigating price volatility risks. Financial performance across the sector is strong, supported by efficient logistics and manufacturing scalability, though profitability is constantly challenged by fluctuating global commodity prices for nuts and sugar, necessitating sophisticated hedging strategies. Overall, the market trajectory is positive, driven by sustained consumer indulgence habits and the continuous innovation in flavor formulation, making caramelized nuts a highly resilient and dynamic category within the broader food industry, attracting consistent investment in automated processing capabilities and market outreach programs.

AI Impact Analysis on Caramelized Nut Market

Analysis of common user questions related to the impact of AI on the Caramelized Nut Market reveals three core themes: optimization, customization, and quality assurance. Consumers and industry stakeholders frequently inquire about how Artificial Intelligence can stabilize volatile raw material costs, specifically questioning if AI-driven predictive modeling can accurately forecast global nut harvests and sugar price fluctuations (Optimization). Secondly, there is substantial interest in personalized flavors and whether AI algorithms can analyze consumer data (social media trends, purchase history) to predict the next trending flavor or customize coatings based on individual health metrics and preferences (Customization). Finally, users often express concerns about maintaining consistent quality across mass production, asking how machine learning and computer vision systems can detect subtle defects, ensure uniform caramelization thickness, and prevent cross-contamination or allergen risk with higher efficiency than traditional manual inspection methods (Quality Assurance). These inquiries indicate a market readiness to embrace AI not just for efficiency gains, but as a critical tool for risk management and hyper-personalized product development, fundamentally transforming how caramelized nuts are produced and marketed to the end consumer, focusing on maximizing yield while minimizing waste.

The integration of Artificial Intelligence is poised to revolutionize the operational efficiency of caramelized nut processing, primarily through optimizing complex supply chain logistics and enhancing manufacturing throughput. AI algorithms are increasingly being used to manage inventory levels of perishable nuts and track real-time commodity pricing, enabling manufacturers to make dynamic purchasing decisions that minimize exposure to price volatility, thereby improving overall cost structures. Furthermore, AI-driven process control systems monitor variables such as oven temperature, coating spray rate, and drum rotation speed during the caramelization process. These systems employ machine learning to continuously adjust parameters based on sensor feedback, ensuring the precise application of the caramel layer, which is crucial for achieving consistent crunch and texture and reducing batch-to-batch variation, a persistent challenge in traditional confectionery manufacturing that relies heavily on experienced human operators, leading to substantial energy and material savings.

Beyond the factory floor, AI profoundly influences consumer engagement and product innovation within the caramelized nut sector. Predictive analytics models analyze large datasets related to regional taste profiles, seasonal demands, and social media trending ingredients to inform R&D teams about high-potential new flavor combinations, such as unique spice blends or savory caramel coatings, mitigating the financial risk associated with launching new products. Moreover, computer vision systems equipped with deep learning capabilities are deployed on inspection lines to perform high-speed quality control checks, identifying microscopic cracks, inconsistent coating distribution, or extraneous matter that might be missed by human eyes. This enhanced vigilance significantly improves food safety compliance, reduces product recalls related to quality issues, and reinforces brand trust among consumers, positioning AI as an indispensable tool for achieving operational excellence in a highly competitive food manufacturing environment.

- AI-Powered Predictive Sourcing: Utilizing machine learning models to forecast global nut yields and optimize purchasing schedules, stabilizing raw material costs and ensuring supply continuity, crucial for high-volume production planning.

- Automated Quality Inspection: Deployment of computer vision and deep learning algorithms on conveyor belts to identify minuscule defects in caramel coating uniformity and potential foreign material contamination at high speeds, surpassing human error rates.

- Personalized Flavor Development: Analyzing consumer digital footprints and regional demographic data using AI analytics to generate targeted new product concepts (e.g., localized spice blends or low-glycemic coatings), accelerating innovation cycles.

- Optimized Production Efficiency: Implementing AI-driven process control systems that adjust roasting, tumbling, and cooling parameters in real-time, minimizing energy consumption and material waste while ensuring consistent texture and coating thickness across batches.

- Enhanced Traceability and Food Safety: Utilizing blockchain technology linked with AI data input for end-to-end supply chain transparency, quickly isolating the source of contamination or quality issues, thereby dramatically reducing recall times and improving consumer confidence in food safety protocols.

DRO & Impact Forces Of Caramelized Nut Market

The Caramelized Nut Market dynamic is governed by a confluence of Drivers (D), Restraints (R), Opportunities (O), and Impact Forces, summarized by a powerful trend toward premium indulgence underpinned by health consciousness. Key drivers include the global consumer shift towards convenient, nutrient-dense snacking options, where nuts are perceived as inherently healthier than pure confectionery, even when caramelized. This is compounded by the relentless demand for sensory experiences in food, met by the unique crunch and flavor of the caramelized coating. Restraints primarily involve the high volatility of raw material prices, particularly for nuts (almonds, pecans) and sugar commodities, which directly affect manufacturer margins and retail pricing stability. Furthermore, growing public concern and regulatory pressure regarding high sugar consumption pose a long-term challenge, necessitating significant investment in developing appealing low-sugar alternatives. Opportunities are vast, driven by geographic expansion into untapped emerging markets in Asia and Latin America, the integration of functional ingredients (probiotics, vitamins) into coatings, and the development of sustainable, ethically sourced supply chains. The overarching impact forces—such as increasing regulatory scrutiny on labeling, rapid e-commerce proliferation, and climate change affecting agricultural yields—dictate operational adaptability, requiring manufacturers to maintain lean, flexible production capabilities to navigate market volatility successfully while prioritizing transparency and environmentally conscious practices.

Drivers fueling consistent growth stem from two primary areas: lifestyle changes and perceived health benefits. The accelerating pace of modern life has cemented snacking as a core eating habit, increasing the demand for portable, satisfying, and high-energy products like caramelized nuts. While the product is an indulgence, nuts themselves benefit from a strong 'halo effect' due to their natural protein, fiber, and healthy fat content. Consumers increasingly rationalize the purchase of premium snacks by focusing on the nutritional contribution of the base ingredient, thereby driving sales even in health-conscious segments. Moreover, the versatility of caramelized nuts as an ingredient in applications such as artisanal yogurt toppings, gourmet salads, and high-end baked goods expands their market footprint beyond simple ready-to-eat consumption, securing their value within both B2C and B2B channels that are actively seeking high-quality, flavorful inclusions to differentiate their final products.

Significant restraints require proactive mitigation strategies from market participants. The supply chain dependency on agricultural yields makes the market vulnerable to adverse weather patterns, pests, and political instability in key growing regions, leading to sharp price spikes that manufacturers often struggle to pass on to consumers without impacting sales volume. Addressing the sugar content restraint is crucial; regulatory bodies in many developed economies are imposing sugar taxes or promoting stricter dietary guidelines, pressuring companies to reformulate existing products. This necessitates substantial R&D expenditure on finding satisfactory sugar substitutes—including allulose, monk fruit, and specialized chicory root fibers—that can replicate the textural and preservation properties of traditional sugar without compromising the caramelized flavor and structural integrity of the coating. Companies that successfully navigate these formulation challenges and secure stable, diversified raw material sources will gain a considerable competitive advantage.

Market opportunities are concentrated on product diversification and strategic market entry. There is an opportunity to innovate beyond traditional sweet caramel by introducing savory or spicy coatings (e.g., chili-lime caramel, smoked paprika), tapping into the growing consumer interest in globally inspired, complex flavor profiles. Furthermore, the burgeoning demand for certified organic, Non-GMO Project verified, and fair-trade products offers a premium pathway for brands focusing on ethical sourcing and ingredient purity. Geographically, emerging economies in Southeast Asia and Latin America, characterized by expanding middle classes and increasing exposure to global confectionery standards, present high-potential markets where targeted distribution and localized flavor adaptation can unlock significant revenue streams. Capturing these opportunities requires investment in cold chain logistics to maintain quality in varied climates and strategic partnerships with local distributors who possess deep understanding of regional consumer preferences and regulatory requirements.

DRO & Impact Forces Of Caramelized Nut Market

- Drivers: Growing demand for premium, indulgent snacks; high nutritional perception of nuts (protein, fiber); extensive application in confectionery, bakery, and dairy industries; global growth in coffee and dessert culture driving specialty inclusion use.

- Restraints: Extreme volatility and unpredictability of global raw nut and sugar commodity prices; increasing consumer scrutiny and regulatory pressures related to high caloric and sugar content in coated products; complex allergen management requirements in processing facilities.

- Opportunities: Development of low-sugar/sugar-free formulations using alternative sweeteners (stevia, allulose); geographical expansion into high-growth Asia Pacific and Latin American markets; innovation in unique, globally-inspired savory and spiced caramel flavor profiles; utilizing functional ingredients like superfoods or probiotics in the coating mixture.

- Impact Forces: Climate change significantly impacts major nut crop yields (almonds in California, pecans in Texas), leading to supply instability; rising consumer demand for transparent and sustainable supply chains (Fair Trade, organic certification); accelerated shift to e-commerce and direct-to-consumer models for specialty products; stringent food safety regulations imposing higher compliance costs.

Segmentation Analysis

The Caramelized Nut Market is comprehensively segmented based on three critical parameters: Nut Type, Application, and Distribution Channel. This segmentation allows manufacturers to tailor product development, marketing strategies, and operational focus to specific high-value areas. By Nut Type, the market is categorized into almonds, pecans, walnuts, cashews, and others, with almonds and pecans consistently holding the largest market share due to their desirable texture, widespread cultivation, and processing versatility. Application segmentation distinguishes between industrial use, which includes confectionery, bakery, and dairy manufacturing as B2B ingredients, and direct consumer/retail use, which focuses on ready-to-eat packaged snacks. The industrial segment typically demands bulk supply and specific particle sizes, while the retail segment emphasizes premium packaging and flavor variety.

The segmentation by Distribution Channel is crucial for market access, dividing sales into supermarkets/hypermarkets, convenience stores, specialized retail (health food stores, gourmet shops), and online retail channels. The traditional brick-and-mortar retail channels (supermarkets) remain the primary source of sales volume, benefiting from high foot traffic and impulse purchasing opportunities. However, the fastest growth is currently being observed in the online retail segment, driven by better logistical networks, the convenience of subscription models for healthy snacks, and the ability for smaller, artisanal producers to reach a national or international audience without reliance on major chain listing agreements. Specialized retail stores, meanwhile, cater to high-end consumers seeking premium, organic, or ethically sourced and unique flavor combinations, offering higher price points and margin potential, demonstrating the diversification in consumer purchasing habits.

Analyzing these segments reveals strategic priorities for market players. Companies focused on industrial supply must invest heavily in quality control automation and large-scale bulk processing to maintain competitive pricing and high supply reliability. Conversely, brands targeting the retail or specialty segment must concentrate on flavor innovation, attractive and sustainable packaging design, and targeted digital marketing campaigns that highlight the artisanal or premium nature of the product. The trend toward customized ingredient blends is also creating a lucrative sub-segment within industrial applications, where manufacturers develop proprietary caramelized nut specifications—such as specific salt levels, sugar types, or crunch factors—exclusively for large confectionery or ice cream producers, securing long-term contracts and strengthening B2B relationships while mitigating competition from standard commodity offerings.

- By Nut Type:

- Almonds (Dominant volume due to versatility and widespread supply)

- Pecans (High value, strong presence in baking and specialty retail)

- Walnuts (Growing use, associated with health benefits)

- Cashews (Popular in Asian-inspired and premium coatings)

- Others (Pistachios, Macadamias, Hazelnuts – niche and high-end)

- By Application:

- Industrial Ingredients (Confectionery, Bakery, Dairy, Cereals)

- Retail/Direct Consumption (Ready-to-eat snacks, gift packs)

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Retail Stores (Gourmet, Health Food)

- Online Retail (E-commerce platforms, D2C websites)

Value Chain Analysis For Caramelized Nut Market

The Value Chain for the Caramelized Nut Market begins at the Upstream stage with the rigorous sourcing and procurement of high-quality raw nuts and specialized sweetening agents. This stage is dominated by large agricultural cooperatives and commodity traders who manage the complexities of global supply, ensuring nuts meet stringent quality standards regarding moisture content, size, and flavor profile before processing. Quality checks, particularly concerning aflatoxin levels and foreign material, are critical at this juncture. Midstream activities involve the primary manufacturing processes: cleaning, roasting (to enhance flavor and shelf life), and the sophisticated caramelization coating application, often using automated vacuum tumblers or fluid bed dryers to ensure homogeneity and minimal breakage. Packaging follows, where decisions regarding modified atmosphere packaging (MAP) or vacuum sealing are made to maximize the product’s relatively short shelf life and maintain the desired crunch and texture integrity, focusing heavily on operational efficiency and energy optimization during high-volume production runs.

Downstream activities center on distribution and market access, navigating a complex network that includes bulk sales to industrial clients (B2B) and packaged goods distribution to retail channels (B2C). Distribution channels are bifurcated into direct sales, often managed through dedicated B2B logistics networks for industrial ingredients requiring specific delivery schedules, and indirect sales through third-party wholesalers, retailers, and modern e-commerce fulfillment centers for consumer products. The rise of e-commerce necessitates specialized logistics for managing temperature and humidity control during transport to prevent sticking or degradation of the caramelized coating, adding a layer of complexity to the final mile delivery compared to non-coated commodities, thus impacting the final cost structure and profitability across regions and market segments.

The crucial elements differentiating value capture within the chain are technological adoption and branding. Companies that invest in advanced coating technologies (e.g., precise temperature control systems and continuous batch processing) capture higher value by offering superior, consistent product quality with extended shelf stability, which is highly valued by industrial buyers. Strong consumer branding, particularly emphasizing artisanal quality, unique flavor combinations, or sustainable/organic sourcing claims, allows retail-focused businesses to command premium pricing. Furthermore, vertical integration, where a company controls both the sourcing of nuts and the final coating/packaging process, reduces transactional costs and mitigates market risks associated with price fluctuations, solidifying their competitive position and ability to quickly respond to shifts in consumer demand and regulatory compliance requirements related to traceability.

Caramelized Nut Market Potential Customers

Potential customers for the Caramelized Nut Market are diverse, spanning both large-scale B2B industrial users and individual B2C consumers, each requiring tailored product formats and delivery methods. The primary B2B segment includes major confectionery and chocolate manufacturers who utilize caramelized nuts as inclusions or decorations in their premium product lines, valuing consistency, particle size uniformity, and bulk pricing efficiency. Dairy manufacturers represent another significant industrial buyer, using caramelized nuts as crucial texture and flavor additions in ice creams, yogurts, and specialized desserts. Furthermore, the bakery industry incorporates these products into gourmet breads, pastries, and granola, valuing their high-heat stability and contribution to shelf appeal and taste complexity, often requiring custom specifications regarding sugar type and degree of caramelization to fit their specific formulation needs and industrial mixing equipment tolerances.

On the B2C side, the core customer base comprises health-conscious snackers and consumers seeking premium, indulgent ready-to-eat options. This segment is characterized by a high willingness to pay for quality packaging, natural ingredients, and innovative flavor combinations, often purchasing through online channels or specialized gourmet retail stores. Consumers use caramelized nuts as on-the-go snacks, dessert toppings, or as ingredients in home baking, favoring resealable, portion-controlled packaging that emphasizes convenience and maintaining product freshness after opening. Specialty gift retailers and seasonal confectioners also represent a niche but high-value customer segment, particularly during holidays, requiring attractive, often custom-branded, packaging that positions the product as a luxury item suitable for gifting and immediate consumption.

A rapidly growing customer segment is the Food Service industry, including high-end coffee chains, independent bakeries, and fine-dining restaurants. These entities purchase caramelized nuts in specific bulk formats for use as toppings for specialty drinks, desserts, and artisanal plates, leveraging the product's sophisticated image to enhance the perceived value of their offerings. This segment demands reliability in supply and consistency in product aesthetic, as the visual presentation is critical to their customer experience and brand image. Targeting the food service sector requires strong relationships with regional food distributors and an assurance of continuous quality supply, emphasizing the need for robust supply chain management to serve these demanding professional kitchens efficiently and maintain stable pricing agreements regardless of commodity market fluctuations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olam International, Blue Diamond Growers, Select Harvests, Bazzini Nuts, Star Snacks, Setton Farms, John B. Sanfilippo & Son, Inc., Intersnack Group, The Nutty Company, Hampton Farms, Mariani Nut Company, Mount Franklin Foods, Barry Callebaut, Zentis GmbH & Co. KG, Kanegrade Ltd., Cargill Incorporated, Archer Daniels Midland (ADM), Olvi Group, Diamond Foods, Inc., Superior Nut Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Caramelized Nut Market Key Technology Landscape

The technological landscape in the Caramelized Nut Market is defined by a focus on precision manufacturing, automation, and shelf-life extension to meet high industrial quality standards and consumer expectations for perfect texture. A core technology advancement lies in continuous fluid bed coating systems, which have largely replaced older batch-processing methods. These systems suspend the nuts in a stream of heated air while the caramelizing syrup is atomized and sprayed onto the surfaces, ensuring an incredibly uniform, thin, and consistent coating that dries rapidly. This not only minimizes nut breakage, crucial for maintaining product integrity in premium packaging, but also significantly reduces processing time and energy consumption compared to traditional rotating drum coaters. Furthermore, specialized infrared sorting technology is integrated post-processing to instantly detect and remove nuts that are over-caramelized, insufficiently coated, or contain minor surface defects, guaranteeing a flawless end product essential for B2B contracts.

Another area of significant technological investment is in advanced packaging solutions designed to combat the primary challenges of moisture absorption and oxidation, which lead to staleness and loss of crunch. Modified Atmosphere Packaging (MAP) techniques and multi-layer film structures incorporating high barrier properties (such as EVOH or metallized films) are now standard practice. These technologies extend the product’s critical sensory quality shelf life, making long-distance distribution feasible, especially into emerging tropical markets where ambient humidity is high. Automation also dominates the sorting and weighing processes, using highly sensitive load cells and robotics to ensure accurate portion control and minimal giveaway, critical for maintaining profitability in the high-volume ready-to-eat snack segment, alongside real-time data integration with inventory management systems.

In response to health and safety imperatives, the market is leveraging sophisticated analytical instrumentation. Near-Infrared (NIR) spectroscopy and Hyperspectral Imaging are increasingly used in real-time quality control, allowing manufacturers to instantly measure coating thickness, sugar crystallization state, and residual moisture content non-destructively, ensuring compliance with strict specifications required by major food purchasers. Furthermore, technology related to alternative sweetener processing is evolving rapidly. Specialized low-temperature vacuum infusion techniques are being refined to allow heat-sensitive natural sweeteners like stevia or monk fruit to be incorporated into the caramel coating without thermal degradation, enabling the creation of genuinely delicious low-sugar and functional caramelized nut products that successfully mimic the taste and mouthfeel of traditional sugar-coated varieties, thus future-proofing the product line against shifting dietary trends and regulatory requirements for nutritional content reduction.

Regional Highlights

- North America: Dominates the global market share, driven by a deeply ingrained snacking culture, high disposable incomes, and the strong presence of major nut and confectionery manufacturers. The U.S. market leads in flavor innovation, particularly in salted caramel and functional nut coatings, while Canada shows consistent demand for organic and non-GMO certified products. Robust retail infrastructure and high adoption of e-commerce channels contribute to strong per capita consumption.

- Europe: Characterized by high demand for artisanal, premium, and ethically sourced caramelized nuts, particularly in Western European nations like Germany, France, and the UK. This region emphasizes stringent quality control standards (e.g., EU food safety regulations) and clean label ingredients. The industrial segment is significant, driven by the continent's large bakery and patisserie sectors, which require specialized high-quality nut ingredients for gourmet products and seasonal specialties.

- Asia Pacific (APAC): Projected to be the fastest-growing market globally, propelled by rapidly increasing urbanization, rising middle-class disposable incomes, and the growing influence of Western snacking habits. Countries like China and India are experiencing explosive growth, although distribution relies heavily on modern trade channels and customized flavor profiles catering to local palates (e.g., less sweet or incorporating regional spices). Significant investment in cold chain logistics is crucial for market penetration.

- Latin America: An emerging market showing strong potential, particularly in Brazil and Mexico, driven by increasing consumption of prepared foods and the growing presence of international food companies. The market remains price-sensitive, placing a strong emphasis on efficient, low-cost production methods. Opportunities exist in leveraging locally sourced nuts and integrating unique regional flavors into the caramelization process to appeal to local consumer preferences effectively.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, fueled by high per capita wealth and a demand for premium, imported confectionery and snack items, often positioned as luxury goods. The region serves as a growing hub for processing, though consumption remains reliant on international brands. Challenges include intense heat requiring robust packaging technology and complex import regulations, necessitating strong local partnerships for effective market navigation and regulatory compliance adherence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Caramelized Nut Market.- Olam International

- Blue Diamond Growers

- Select Harvests

- Bazzini Nuts

- Star Snacks

- Setton Farms

- John B. Sanfilippo & Son, Inc.

- Intersnack Group

- The Nutty Company

- Hampton Farms

- Mariani Nut Company

- Mount Franklin Foods

- Barry Callebaut

- Zentis GmbH & Co. KG

- Kanegrade Ltd.

- Cargill Incorporated

- Archer Daniels Midland (ADM)

- Olvi Group

- Diamond Foods, Inc.

- Superior Nut Company

Frequently Asked Questions

Analyze common user questions about the Caramelized Nut market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Caramelized Nut Market?

The market growth is fundamentally driven by the global trend toward premium, convenient snacking, the perceived health benefits of nuts (protein and fiber content), and the continuous innovation in flavor profiles catering to consumer demand for unique sensory experiences and sophisticated indulgence options across all major regional markets.

How is raw material price volatility impacting manufacturer margins in this industry?

Raw material price volatility, particularly concerning almonds, pecans, and sugar commodities, significantly challenges manufacturer margins. Companies mitigate this through advanced commodity hedging, diversified sourcing strategies across various geographical regions, and implementing vertical integration to control input costs and stabilize supply chains effectively.

Which geographical region is expected to exhibit the highest growth rate during the forecast period 2026-2033?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapid urbanization, increasing middle-class disposable income, the adoption of Western confectionery and snacking trends, and expanding retail distribution networks across countries like China and India.

What key technological advancements are improving product quality and shelf life in caramelized nut production?

Key technological advancements include the adoption of continuous fluid bed coating systems for uniform caramelization, high-speed infrared sorting for defect removal, and Modified Atmosphere Packaging (MAP) techniques, which collectively enhance product consistency, reduce breakage, and significantly extend the texture and flavor integrity shelf life.

What is the primary difference in demand between the Industrial and Retail application segments?

The Industrial segment (B2B) demands large-volume supply, strict uniformity in particle size and coating thickness, and consistent reliability for use as an ingredient in complex food matrices (e.g., ice cream). The Retail segment (B2C) focuses on premium, attractive packaging, flavor innovation, and convenience for direct, ready-to-eat consumption, often commanding higher price points for specialty variants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager