Carbide Tipped Needle Holders Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440962 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Carbide Tipped Needle Holders Market Size

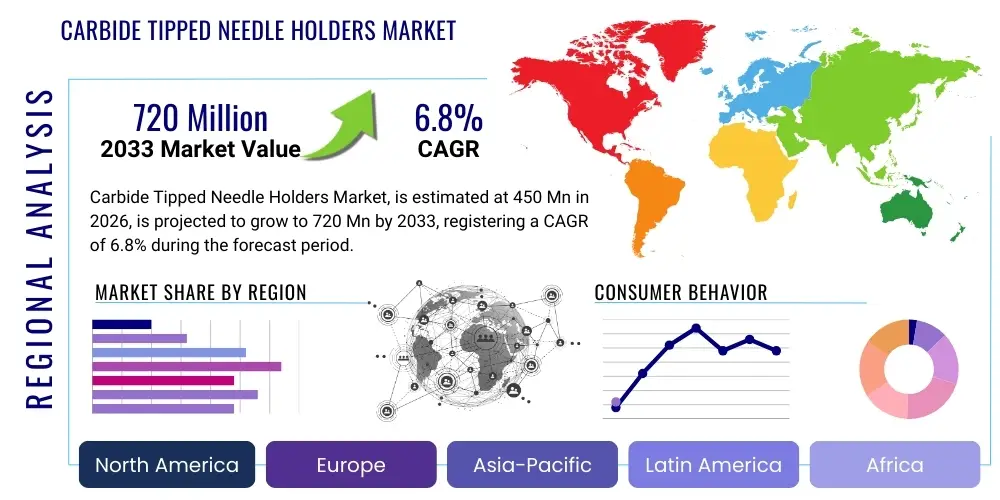

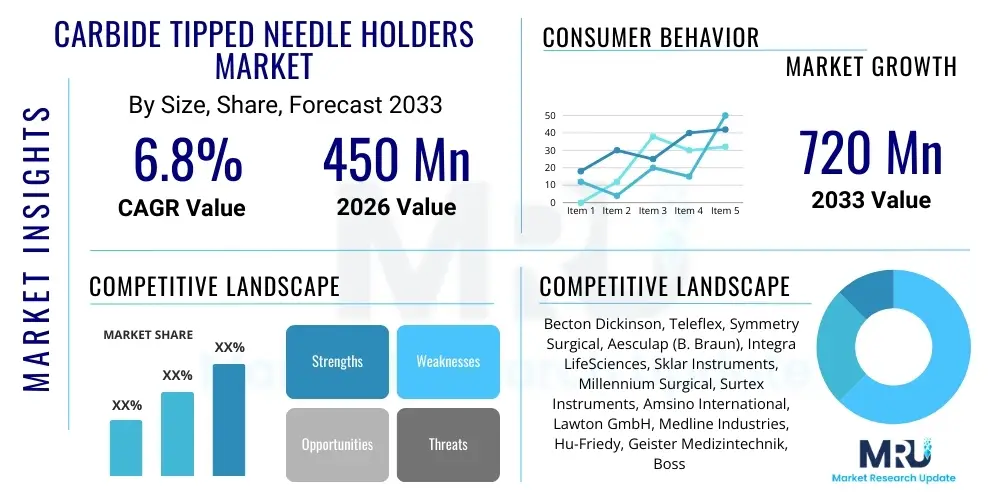

The Carbide Tipped Needle Holders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033.

Carbide Tipped Needle Holders Market introduction

The Carbide Tipped Needle Holders Market encompasses the production and distribution of specialized surgical instruments critical for suturing procedures across various medical disciplines. These instruments are distinct from standard needle holders due to the incorporation of tungsten carbide inserts or tips onto the jaws. This hard metallic material significantly enhances the instrument's longevity, grip strength, and precision, particularly when handling delicate sutures or working with tough tissue under high tension. The superior durability and reliability offered by carbide tips make these needle holders essential tools in sophisticated surgical environments, including cardiovascular, orthopedic, and neurosurgery, where instrument failure or slippage is unacceptable and could compromise patient outcomes. The primary application of these tools is to securely hold and maneuver surgical needles during closure, ensuring accurate placement and tight knots.

The key product types range from standard needle holders, such as the Mayo-Hegar or Olsen-Hegar patterns, modified with carbide inserts, to highly specialized, self-retaining (or ratchet) models designed for specific operational requirements, such as laparoscopic surgery or microsurgery. Major applications span acute care facilities, ambulatory surgical centers (ASCs), specialized clinics, and veterinary hospitals. The inherent benefits of using carbide-tipped instruments include reduced instrument replacement frequency, superior tactile feedback for the surgeon, and a diminished risk of needle slippage, which is crucial for maintaining surgical efficiency and safety. The robust nature of the carbide tips resists wear and corrosion significantly better than stainless steel, leading to consistent performance over many sterilization cycles and years of service, thereby justifying the higher initial investment for healthcare providers focused on long-term cost-effectiveness and surgical quality.

Driving factors propelling this market growth include the rising volume of surgical procedures globally, fueled by an aging population and increasing prevalence of chronic diseases requiring surgical intervention. Furthermore, the growing focus on enhanced patient safety standards and stringent requirements for high-precision surgical tools are encouraging hospitals and ASCs to upgrade their surgical inventory to premium instruments like carbide tipped models. Technological advancements in instrument design, material science, and manufacturing precision also contribute significantly, enabling the production of smaller, more ergonomic instruments suitable for minimally invasive and robotic-assisted procedures. This ongoing demand for instruments that deliver high performance and reliability in complex surgical settings ensures a stable and accelerating growth trajectory for the Carbide Tipped Needle Holders Market.

Carbide Tipped Needle Holders Market Executive Summary

The Carbide Tipped Needle Holders Market is characterized by robust growth, driven by key business trends emphasizing quality assurance, surgical volume expansion, and technological integration. Business trends indicate a strong move toward long-term instrument investment, favoring premium products that reduce operating room downtime and replacement costs. Manufacturers are concentrating on developing ergonomic designs and introducing specialized coatings to further enhance the instruments' lifespan and performance in demanding sterilization environments. Regional trends highlight North America and Europe as mature, high-value markets demanding stringent quality standards, while the Asia Pacific region is experiencing rapid growth due to improving healthcare infrastructure, increasing surgical capacity, and rising health expenditure, making it a critical area for expansion for global market players. Furthermore, the expansion of ambulatory surgical centers worldwide is creating decentralized demand nodes, shifting purchasing power and requiring manufacturers to adapt their distribution strategies accordingly.

Segment trends reveal that the hospital segment maintains the largest market share due to the sheer volume and complexity of surgeries performed, requiring extensive inventory of specialized instruments. However, ambulatory surgical centers (ASCs) are poised to exhibit the highest growth rate, reflecting the global shift towards outpatient surgical care for cost-efficiency and patient convenience. By application, General Surgery remains the foundational segment, yet high-precision disciplines like cardiovascular and orthopedic surgery drive the premium pricing and innovation within the market, owing to the critical requirement for absolute grip and control in these procedures. Material analysis confirms that Tungsten Carbide remains the dominant material due to its unmatched hardness and wear resistance, despite ongoing research into next-generation carbide composites. Overall, the market remains highly competitive, with established surgical instrument manufacturers leveraging their reputation and extensive distribution networks to maintain leadership, while newer, specialized firms focus on niche applications and innovative designs.

The strategic outlook for this market involves firms focusing on mergers, acquisitions, and strategic partnerships to expand geographic reach and product portfolios, particularly integrating advanced manufacturing techniques like precision milling and automated quality control systems. Regulatory compliance remains a significant factor, especially in highly regulated markets like the US (FDA) and EU (MDR), influencing the pace of new product introduction and market entry. The market structure, while mature, still offers opportunities for innovation, particularly in creating instruments optimized for robotic surgery platforms and disposable surgical kits, addressing the dual needs of high precision and sterility. Successful companies in this space must balance the inherent demand for durable, reusable instruments with the emerging clinical requirements for specialized, procedure-specific tooling, ensuring their product lines cater to both traditional surgical environments and modern, high-tech operating rooms.

AI Impact Analysis on Carbide Tipped Needle Holders Market

User queries regarding AI's influence on the Carbide Tipped Needle Holders Market commonly revolve around automation in manufacturing, quality control enhancement, and the potential for AI-driven surgical robotics to alter the design requirements of hand-held instruments. Key themes include whether AI can standardize the precision grinding and insertion of carbide tips, thereby reducing production variance and cost; how machine vision systems, powered by AI, can detect microscopic material flaws or geometric deviations in the instruments that human inspectors might miss; and, critically, the future role of reusable instruments as robotic surgery—often integrated with AI for planning and execution—becomes more pervasive. Users are seeking assurances that traditional surgical tools will remain relevant, or if their specifications will need to adapt significantly to integrate seamlessly with smart operating room technologies and AI-guided procedural workflows, focusing on issues such as RFID tagging and compatibility with automated inventory management systems.

The consensus suggests that AI's primary near-term impact will be felt in optimizing the supply chain and enhancing the manufacturing process, rather than directly replacing the physical instrument itself. Advanced algorithms are already being deployed to predict equipment maintenance schedules based on usage data (analyzed through AI), ensuring instruments remain in optimal condition. Furthermore, machine learning models are crucial for analyzing surgical instrument inventory needs across large hospital systems, minimizing overstocking while preventing shortages of critical tools like carbide tipped needle holders. This integration helps healthcare providers achieve better cost control and efficiency in surgical operations. AI is fundamentally viewed as a supporting technology that elevates the reliability and operational life of these instruments, rather than rendering them obsolete.

Long-term implications involve AI influencing surgical training and procedure simulation, which might standardize the selection and use of specific needle holder designs based on procedure type and surgeon proficiency data. As robotic surgery systems become more refined, AI will help design robotic end-effectors that mimic the precision and tactile feedback achieved by high-quality hand-held instruments. This creates an indirect influence on carbide tipped needle holders; while they might not be used directly by the robot, their design principles—especially regarding grip pressure, tip hardness, and jaw alignment—will inform the development of superior robotic tooling. The expectation is a synergistic evolution where AI enhances the utilization and performance verification of these instruments, securing their continued importance in specialized manual surgical tasks where tactile feedback remains paramount.

- AI optimizes the precision manufacturing and quality control of carbide tip insertion.

- Machine vision systems utilize AI for defect detection, increasing instrument reliability standards.

- AI-driven inventory management reduces stock variance and ensures timely availability of instruments.

- Predictive maintenance schedules, managed by AI, extend the lifespan of reusable needle holders.

- AI informs the ergonomic and mechanical design of future robotic surgical tools based on existing carbide holder performance.

DRO & Impact Forces Of Carbide Tipped Needle Holders Market

The market dynamics for Carbide Tipped Needle Holders are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the Impact Forces governing market expansion. The core drivers stem from the essential nature of these instruments in complex surgeries, where superior performance is non-negotiable, coupled with the global increase in surgical procedure volume driven by demographic shifts and improved access to healthcare. However, market penetration is restrained by the high initial cost relative to standard stainless steel alternatives and the stringent requirement for careful cleaning and sterilization procedures necessary to maintain the integrity of carbide tips, often necessitating specialized protocols and training. Significant opportunities lie in emerging markets and the development of specialized product lines for high-growth areas like robotic and minimally invasive surgery (MIS), requiring instruments that offer both enhanced precision and compatibility with advanced imaging systems. The collective impact forces push the market toward innovation in material science and operational efficiency within healthcare facilities.

Drivers: A principal driver is the undeniable superiority of carbide tips in providing an unparalleled, non-slip grip on surgical needles, crucial for precise tissue approximation, especially in high-tension procedures like cardiovascular grafting or deep orthopedic suturing. This enhanced performance directly translates into improved surgical outcomes and reduced operative time, making these instruments the standard choice for specialist surgeons. Furthermore, the longevity and resistance to corrosion and wear, significantly reducing the Total Cost of Ownership (TCO) over the instruments' life cycle compared to lower-quality steel options, encourages hospitals, despite the higher upfront investment, to prioritize carbide tipped instruments for long-term inventory stability. The continuously increasing complexity of surgical procedures necessitates tools capable of managing finer sutures and tougher tissues, reinforcing the demand for high-grade carbide instruments, which offer the requisite strength and reliability for these demanding tasks.

Restraints: The primary restraint remains the substantial initial capital outlay required for purchasing carbide tipped needle holders, which can be prohibitive for smaller clinics or healthcare facilities in developing economies with tight budgetary constraints. Another significant hurdle is the vulnerability of the carbide inserts themselves; while extremely hard, they can be brittle and prone to chipping or breaking if dropped or handled improperly, necessitating strict adherence to specialized handling and reprocessing protocols. This vulnerability increases the risk of premature instrument failure and raises maintenance costs. Additionally, the proliferation of low-cost, counterfeit, or substandard instruments from unauthorized sources poses a competitive threat, often confusing procurement managers and potentially compromising patient safety, forcing established manufacturers to invest heavily in brand protection and educational initiatives focusing on quality standards.

Opportunities: Major opportunities reside in expanding the product portfolio into specialized areas such as bariatric surgery and pediatric surgery, where instruments need unique lengths, angles, and tip configurations. Crucially, the growth in robotic-assisted surgery presents a dual opportunity: designing compatible hand-held instruments for docking and setup, and applying carbide technology principles to enhance the grasping capability of robotic end-effectors. Furthermore, the vast and underserved markets in APAC and Latin America, driven by rapid infrastructure development and growing medical tourism, offer substantial revenue potential for companies establishing strong local distribution and manufacturing partnerships. Innovation in protective coatings and sterilization-resistant alloys to further enhance instrument durability and reduce the risk associated with high-temperature sterilization cycles also represents a key pathway for market differentiation and growth.

- Drivers: Rising complexity of surgical procedures; superior grip and precision; long-term durability reducing TCO; increasing volume of surgeries globally.

- Restraints: High initial purchase price; potential for carbide tip chipping if mishandled; competitive threat from low-quality, cheaper alternatives; complexity of cleaning and sterilization protocols.

- Opportunity: Expansion into high-growth areas like ASCs and emerging markets; specialized instruments for robotic and MIS procedures; development of corrosion-resistant coatings; strategic partnerships in high-demand regions.

- Impact Forces: Technological innovation in materials and design; stringent regulatory standards mandating high quality; cost sensitivity in procurement balanced against necessity for surgical excellence; shift towards high-value surgical care models.

Segmentation Analysis

The Carbide Tipped Needle Holders Market is meticulously segmented based on Type, Application, Material, and End-User, reflecting the diverse requirements of the global surgical landscape. Understanding these segmentations is crucial for manufacturers to tailor their product development, marketing, and distribution strategies effectively. The segmentation by Type primarily differentiates between instruments offering standard locking mechanisms and those incorporating automatic or self-retaining features, often used in micro-surgical settings. Application segmentation focuses on the anatomical or procedural context in which the instrument is utilized, such as open surgery versus minimally invasive procedures. Material segmentation focuses heavily on the specific alloy used for the carbide inserts, primarily tungsten carbide due to its superior mechanical properties. Finally, the End-User segmentation categorizes purchasing entities based on their operational scope and patient volume, differentiating between large hospital systems and smaller specialized clinics.

Detailed analysis of these segments reveals varying growth dynamics. For instance, while standard (non-self-retaining) needle holders represent the largest volume segment, the market for specialized self-retaining holders, particularly those designed for delicate, deep-cavity work or vascular surgery, commands the highest average selling price and demonstrates faster revenue growth. Geographically, segmentation helps in identifying localized market needs; for example, North American markets show a higher propensity for specialized orthopedic and cardiovascular instruments, whereas emerging Asian markets may show higher initial demand for robust, general-purpose instruments suitable for diverse surgical settings. This granular view allows companies to allocate resources efficiently, focusing research and development on segments exhibiting the greatest unmet clinical need and financial return potential, such as ergonomic instruments optimized for long duration or complex laparoscopic procedures.

The convergence of material and application segmentation is particularly informative for market strategy. The dominance of tungsten carbide tips underscores the industry's prioritization of extreme hardness and wear resistance, which is non-negotiable for instruments undergoing hundreds of sterilization cycles. However, as procedures become smaller and more precise, there is a subtle demand shift towards instruments that balance durability with reduced weight and superior tactile feedback. Therefore, manufacturers are exploring advanced manufacturing techniques that integrate carbide tips seamlessly into lightweight handles, optimizing the user experience without compromising the core performance benefits derived from the carbide material. This holistic segmentation approach ensures that market reports accurately capture both the volume and value drivers across the entire product ecosystem.

- By Type: Standard Needle Holders, Self-Retaining Needle Holders (e.g., Castroviejo, Ryder, Micro-Needle Holders).

- By Application: Open Surgery, Minimally Invasive Surgery (MIS), Robotic Surgery Assistance.

- By Material: Tungsten Carbide Tipped, Chromium Carbide Tipped, Other Carbide Alloys.

- By End-User: Hospitals, Ambulatory Surgical Centers (ASCs), Specialized Clinics, Veterinary Hospitals, Academic & Research Institutions.

- By Specialty: General Surgery, Cardiovascular Surgery, Orthopedic Surgery, Gynecology, Neurosurgery, Plastic Surgery.

Value Chain Analysis For Carbide Tipped Needle Holders Market

The value chain for the Carbide Tipped Needle Holders Market begins with the upstream segment, which involves the sourcing and processing of raw materials, primarily high-grade stainless steel (usually 420 or 440 series) for the main body and tungsten carbide blanks or sintered inserts for the tips. This stage is dominated by specialized metallurgical firms and carbide powder producers, where quality control over alloy composition and purity is paramount, as it directly impacts the instrument’s corrosion resistance and mechanical strength. Key upstream activities include precision forging of the instrument blanks, meticulous machining of the jaws, and the intricate, high-temperature brazing or welding process required to permanently secure the ultra-hard carbide tips onto the stainless steel jaws. The cost structure at this stage is heavily influenced by global metal commodity prices and the energy intensity of the precision manufacturing processes involved in carbide preparation.

The midstream phase focuses on manufacturing, which is highly complex, involving precision grinding, polishing, finishing, and rigorous quality assurance. Market leaders employ advanced computer numerical control (CNC) machining and robot-assisted polishing to achieve the precise jaw alignment and tip curvature necessary for optimal function. Quality checks include hardness testing, corrosion resistance validation, and geometric conformity testing, ensuring compliance with global regulatory standards (e.g., ISO 13485). The downstream segment involves distribution, moving products from manufacturers to end-users. This segment utilizes both direct and indirect channels. Direct channels involve large manufacturers selling directly to major hospital groups or governmental healthcare procurement agencies, allowing for better margin control and specialized technical support. Indirect channels rely heavily on authorized medical equipment distributors, third-party logistics (3PL) providers, and surgical supply wholesalers who manage inventory, regional penetration, and local customer service, particularly critical in geographically dispersed or fragmented markets.

Effective distribution channel management is a critical success factor in this market. Indirect channels are often preferred in markets requiring specialized knowledge of local tenders, regulations, and import logistics. Conversely, the growth of e-commerce platforms and centralized procurement portals for surgical supplies is beginning to streamline the process, though the high-value, specialized nature of carbide tipped instruments means that relationship-based sales and technical detailing remain essential. Furthermore, the necessity for robust post-sale support, including repair and sharpening services for carbide tips, often falls within the downstream activities, contributing significantly to customer loyalty and the long-term perceived value of the instrument. The entire chain emphasizes quality traceability, requiring detailed documentation from raw material sourcing through to the final sterile packaging, ensuring patient safety and regulatory compliance.

Carbide Tipped Needle Holders Market Potential Customers

The primary customers for Carbide Tipped Needle Holders are organizations and facilities that perform surgical procedures regularly and require high-quality, durable instruments to ensure patient safety and surgical precision. Hospitals, particularly large tertiary and quaternary care centers with high-volume operating theaters and specialized surgical departments (e.g., cardiovascular, neurosurgery, orthopedics), represent the largest purchasing segment. These institutions prioritize instrument reliability and longevity to minimize replacement cycles and operational risk. Procurement decisions within hospitals are often centralized, requiring vendors to meet stringent supply chain requirements, competitive pricing structures, and robust service agreements, including instrument tracking and maintenance programs, due to the substantial capital outlay involved in equipping multiple surgical suites.

Ambulatory Surgical Centers (ASCs) constitute the fastest-growing customer segment. ASCs focus predominantly on outpatient and less complex procedures, prioritizing efficiency and cost-effectiveness. While ASCs may require smaller inventories compared to major hospitals, their demand for high-quality instruments remains strong, driven by the need for quick turnaround times and minimal procedural complications. The increasing shift of general surgery, gynecological procedures, and certain orthopedic interventions to the ASC setting fuels steady demand for diverse sizes and patterns of carbide tipped needle holders. This segment is highly sensitive to the balance between initial cost and long-term durability, making carbide tipped instruments an attractive investment for their proven reliability and reduced need for frequent replacement, aligning with the lean operational models of ASCs.

Other significant potential customers include specialized private surgical clinics, dental surgeons performing complex implant or oral surgery requiring precise suturing, and veterinary hospitals, particularly those focused on specialized animal surgeries. Academic and research institutions also purchase these instruments for surgical training labs and preclinical research. These diverse customer groups emphasize different aspects of the instrument's performance; while high-volume hospitals focus on TCO and standardization, specialized clinics often prioritize unique, custom-designed instrument configurations tailored to specific procedures. Manufacturers must therefore maintain a broad and flexible product line to effectively serve the varied needs and budgetary cycles of this heterogeneous customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton Dickinson, Teleflex, Symmetry Surgical, Aesculap (B. Braun), Integra LifeSciences, Sklar Instruments, Millennium Surgical, Surtex Instruments, Amsino International, Lawton GmbH, Medline Industries, Hu-Friedy, Geister Medizintechnik, Boss Instruments, Karl Storz, Olympus Corporation, Novo Surgical, Prestige Medical, VOGT Medical, KLS Martin Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbide Tipped Needle Holders Market Key Technology Landscape

The technology landscape of the Carbide Tipped Needle Holders Market is centered on precision engineering and advanced materials science, focusing primarily on achieving optimal metallurgical bonding between the carbide insert and the stainless steel body. Key technologies involve the use of specialized vacuum brazing techniques, which ensure a robust, contamination-free, and high-strength junction between the dissimilar metals, critical for preventing tip detachment during heavy use or repeated sterilization cycles. Furthermore, advancements in precision grinding and CNC milling are crucial for creating the complex jaw patterns (serrated, cross-hatched, or smooth) required for specific surgical needs, ensuring that the carbide tips offer uniform grip pressure and optimal needle control, which is essential for managing fine sutures often used in ophthalmic or vascular procedures. Continuous improvements in these manufacturing processes reduce dimensional tolerance errors, thereby enhancing the functional lifespan and overall reliability of the instrument.

Material technology remains a significant focus. While tungsten carbide is the gold standard, manufacturers are consistently researching new carbide compositions or surface treatments designed to further enhance corrosion resistance and edge retention. For example, proprietary surface passivation techniques are employed post-manufacture to create a protective oxide layer on the stainless steel, maximizing resistance to harsh cleaning detergents and high-temperature steam sterilization (autoclaving), which can degrade lower-quality metals over time. Moreover, the integration of advanced material testing protocols, utilizing non-destructive testing (NDT) methods like eddy current testing or ultrasonic inspection, ensures that the quality of the carbide-steel interface is flawless before the instrument reaches the surgeon's hand, directly addressing patient safety concerns and regulatory compliance demands. This technological focus ensures that even seemingly traditional instruments benefit from continuous, state-of-the-art metallurgical and engineering improvements.

The emerging technological trend involves optimizing instrument designs for integration into modern surgical environments, particularly for minimally invasive and robotic platforms. This includes developing longer, slender shafts with specialized locking mechanisms for laparoscopic surgery, demanding exceptional strength-to-weight ratios achieved through advanced metallurgy. For robotic surgery, although the robot uses separate end-effectors, the principles of carbide tipping are applied to these robotic jaws to provide superior grasp and manipulation, influencing the design criteria for new robotic instruments. Additionally, the increasing use of unique laser-etched identifiers, often integrated with RFID chips, is a critical technology for modern instrument tracking and inventory management systems, ensuring that highly valuable carbide instruments are correctly identified, tracked through sterilization cycles, and maintained according to strict usage protocols, thereby optimizing asset utilization within large healthcare institutions.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most valuable market for Carbide Tipped Needle Holders. This dominance is driven by high healthcare expenditure, the early adoption of advanced surgical technologies, and the presence of numerous large academic medical centers and specialized ASCs demanding premium-quality instruments. The market is highly regulated by the FDA, leading manufacturers to prioritize quality, traceability, and robust clinical validation. Demand is particularly strong in high-precision surgical fields such as cardiovascular, neurosurgery, and orthopedic procedures, which rely heavily on the non-slip performance and durability of carbide tips. The emphasis on minimizing infection rates and maximizing instrument lifespan further consolidates the region's preference for superior, high-cost instruments, sustaining market growth through continuous instrument upgrades and technological enhancements.

- Europe: Europe stands as the second-largest market, characterized by stringent quality standards enforced by the EU's Medical Device Regulation (MDR) and a strong public and private healthcare system network. Western European countries (Germany, UK, France) are major contributors, exhibiting high demand due to established surgical practices and a strong focus on reusable, durable instruments to achieve long-term cost savings. Germany, in particular, is a hub for surgical instrument manufacturing and innovation. Market expansion is supported by an aging population requiring increasing numbers of complex surgical interventions. The European market shows a robust preference for standardized instrument sets and requires suppliers to offer comprehensive maintenance and sharpening services to ensure the instruments meet exacting longevity expectations.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, primarily fueled by rapid economic development, increasing public and private investment in healthcare infrastructure, and the expansion of medical tourism. Countries such as China, India, Japan, and South Korea are key growth engines. While Japan and South Korea represent mature markets with high standards similar to the West, China and India offer substantial volume growth potential, though price sensitivity remains a factor in procurement decisions. The rising prevalence of lifestyle diseases requiring surgical treatment and improving access to sophisticated medical care in previously underserved areas drive the explosive demand. Market players focus on establishing localized manufacturing and extensive distribution networks to capitalize on the sheer size and diversity of this regional market, balancing high-quality offerings with competitive pricing strategies.

- Latin America (LATAM): The LATAM market, while smaller, offers significant potential, driven by improving healthcare access in major economies like Brazil and Mexico. Market growth is often volatile, influenced by economic stability and government healthcare funding. The demand centers around equipping new private hospitals and addressing backlogs in public healthcare systems. Cost-effectiveness is a primary procurement driver, but there is a growing recognition of the TCO benefits of durable carbide instruments, leading to gradual market penetration for premium products alongside high volume demand for more affordable options. Strategic local partnerships are essential for navigating complex regulatory and import logistics within this region.

- Middle East and Africa (MEA): The MEA market shows heterogeneous growth, heavily concentrated in the GCC states (UAE, Saudi Arabia, Qatar), which are investing massively in world-class medical facilities and specialized surgical capabilities, attracting international expertise. These high-income segments prioritize state-of-the-art equipment, driving significant demand for high-end carbide tipped needle holders. In contrast, the African continent presents nascent market opportunities, primarily focused on essential surgical instruments, with growth dependent on infrastructure development and humanitarian aid initiatives. The regional market growth is strongly correlated with capital investments in specialized healthcare centers, particularly those focusing on complex trauma and elective surgeries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbide Tipped Needle Holders Market.- Becton Dickinson (BD)

- Teleflex Incorporated

- Symmetry Surgical

- Aesculap (A B. Braun Company)

- Integra LifeSciences

- Sklar Instruments

- Millennium Surgical

- Surtex Instruments

- Amsino International

- Lawton GmbH

- Medline Industries

- Hu-Friedy (A Cantel Medical Company)

- Geister Medizintechnik GmbH

- Boss Instruments

- Karl Storz SE & Co. KG

- Olympus Corporation

- Novo Surgical

- Prestige Medical

- VOGT Medical Vertrieb GmbH

- KLS Martin Group

Frequently Asked Questions

Analyze common user questions about the Carbide Tipped Needle Holders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using carbide tipped needle holders over standard stainless steel versions?

Carbide tipped needle holders offer significantly superior grip strength, preventing needle slippage during suturing, and possess much higher durability and wear resistance. This longevity translates to a lower Total Cost of Ownership (TCO) and consistent performance over hundreds of sterilization cycles, making them essential for complex, high-precision surgical procedures.

In which surgical specialties is the demand for carbide tipped needle holders highest?

Demand is highest in specialties requiring fine, precise suturing under tension and demanding high instrument reliability, including Cardiovascular Surgery, Neurosurgery, Micro-surgery, and complex Orthopedic procedures. General surgery also remains a significant volume driver.

How does the high initial cost of carbide tipped instruments impact their adoption rates in developing markets?

The high initial cost acts as a restraint in price-sensitive developing markets, where standard stainless steel instruments might be prioritized. However, increasing awareness of the long-term durability and the associated reduction in replacement costs (TCO benefits) is gradually driving adoption among specialized and private facilities in these regions.

Are carbide tipped instruments compatible with modern robotic surgery platforms?

While the actual robot end-effectors are specialized, the underlying material technology of carbide is crucial for the design of the robotic jaws to ensure superior grip. Furthermore, carbide tipped needle holders remain essential hand-held tools for assisting surgeons during the setup, docking, and specific manual stages of robotic-assisted procedures.

What is the key technological challenge in manufacturing carbide tipped needle holders?

The primary technological challenge involves achieving a flawless, permanent, and high-strength metallurgical bond between the extremely hard carbide insert (typically tungsten carbide) and the softer stainless steel instrument body, ensuring the tip does not detach or fracture under severe operational stress or repeated sterilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager