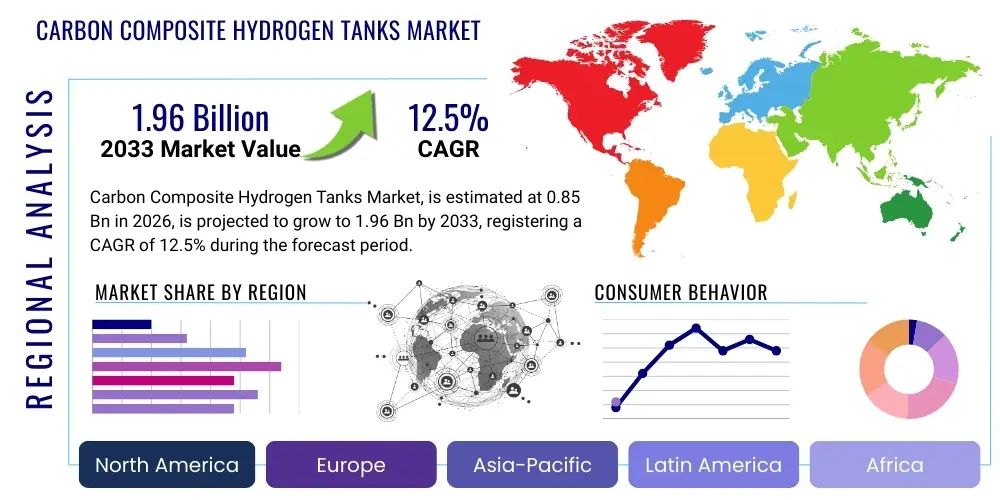

Carbon Composite Hydrogen Tanks Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443437 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Carbon Composite Hydrogen Tanks Market Size

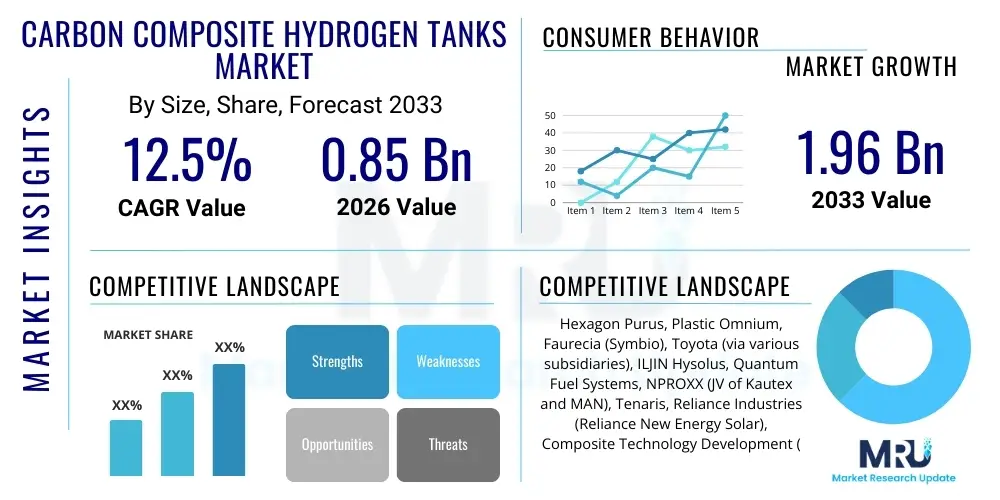

The Carbon Composite Hydrogen Tanks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $0.85 Billion in 2026 and is projected to reach $1.96 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global imperative to decarbonize transportation and industrial sectors, making high-pressure hydrogen storage essential for widespread adoption of fuel cell technology, particularly in heavy-duty vehicles and passenger cars.

Carbon Composite Hydrogen Tanks Market introduction

The Carbon Composite Hydrogen Tanks Market encompasses the production and distribution of advanced lightweight pressure vessels designed specifically for storing hydrogen gas under extremely high pressures, typically 350 bar or 700 bar. These tanks, predominantly Type III (metal liner wrapped with carbon fiber) and Type IV (plastic liner wrapped with carbon fiber), are critical enablers for fuel cell electric vehicles (FCEVs), hydrogen infrastructure, and various stationary storage applications. The inherent strength-to-weight ratio of carbon fiber composites allows these tanks to meet stringent safety standards while minimizing vehicle weight, thereby maximizing efficiency and range in hydrogen-powered systems.

Product Description involves high-performance carbon fiber filaments wound around an inner liner, optimized through sophisticated engineering processes to handle cyclic fatigue and environmental stress. Major Applications span the automotive sector (cars, buses, trucks), aerospace (UAVs, future aircraft), portable power devices, and large-scale industrial hydrogen distribution and refueling stations. Key Benefits include exceptional safety due to robust design, significant weight reduction compared to traditional steel or aluminum tanks, and high storage capacity necessary for practical FCEV operation.

Driving factors propelling market growth include escalating regulatory mandates across North America and Europe aimed at reducing carbon emissions from mobility, coupled with substantial investments in hydrogen production (green and blue hydrogen) and distribution infrastructure globally. Furthermore, technological advancements leading to reduced manufacturing costs and increased durability of Type IV tanks are making hydrogen storage a more viable alternative to conventional fossil fuel infrastructure, positioning carbon composite tanks as a cornerstone technology in the energy transition.

Carbon Composite Hydrogen Tanks Market Executive Summary

The Carbon Composite Hydrogen Tanks Market is experiencing robust growth fueled by pivotal Business Trends, specifically the mass adoption of 700-bar Type IV tanks, which are lightweight, corrosion-resistant, and optimized for FCEV passenger and commercial vehicle integration. Key business developments involve strategic partnerships between tank manufacturers and major automotive OEMs (Original Equipment Manufacturers) to secure long-term supply agreements and standardize tank integration processes. The industry is also witnessing significant vertical integration efforts, with major players investing heavily in in-house carbon fiber production or dedicated composite winding facilities to mitigate supply chain volatility and reduce raw material costs.

Regional Trends indicate that Asia Pacific, particularly South Korea, Japan, and China, dominates current consumption due to strong governmental support for FCEV deployment and established hydrogen roadmaps. Europe is rapidly accelerating, driven by the EU Hydrogen Strategy and significant infrastructure funding under the European Green Deal, focusing heavily on heavy-duty trucking and public transport fleet conversion. North America is poised for exponential growth, spurred by the Inflation Reduction Act (IRA) incentives and increasing demand for long-haul hydrogen trucks, necessitating large, high-capacity carbon composite tanks.

Segments trends highlight the dominance of the Automotive application segment, followed by the emerging Stationary Storage market, which requires larger, more robust tanks for grid balancing and industrial supply. Pressure vessel segmentation clearly favors the 700-bar type, as it is the standard required for achieving competitive driving ranges in FCEVs, making 350-bar tanks increasingly relegated to material handling equipment or auxiliary power units. The market trajectory is decisively moving toward fully thermoplastic-lined, filament-wound Type IV vessels due to their superior performance metrics and lower maintenance requirements over their operational lifespan.

AI Impact Analysis on Carbon Composite Hydrogen Tanks Market

User queries regarding AI’s influence on the Carbon Composite Hydrogen Tanks Market predominantly revolve around optimizing complex manufacturing processes, ensuring structural integrity, and reducing overall production costs. Common concerns include how AI can manage the variability inherent in carbon fiber winding, predict material failure modes under extreme pressures, and accelerate the design iteration cycle. Key expectations center on using Machine Learning (ML) for predictive maintenance of industrial winding machinery, leveraging computational modeling (CFD/FEA) driven by AI algorithms to refine tank geometries for optimal stress distribution, and automating quality control checks on the composite layers to enhance safety and regulatory compliance.

The integration of Artificial Intelligence represents a transformative opportunity, moving tank manufacturing beyond traditional empirical testing toward highly predictive, data-driven design and production. AI algorithms analyze vast datasets derived from simulation and physical testing (pressure cycling, impact analysis) to suggest minor modifications in winding angles, resin curing temperatures, and liner material specifications, leading to lighter, safer, and more cost-effective tanks. Furthermore, AI-powered process control enables real-time adjustments on the factory floor, minimizing material waste and ensuring near-perfect repeatability, which is crucial for achieving the high production volumes required by the automotive industry.

By leveraging digital twins and physics-informed neural networks (PINNs), manufacturers can simulate millions of load cases and fatigue cycles virtually, drastically reducing the time and expense associated with physical prototyping and certification. This capability not only speeds up time-to-market for new tank designs but also helps in proactive identification of potential weak points, enhancing overall product safety. The use of image recognition AI in non-destructive testing (NDT) further ensures that micro-defects or irregularities in the composite structure are detected immediately, guaranteeing tanks meet the rigorous ECE R134 and ISO 19881 standards required for commercial operation.

- AI optimizes carbon fiber winding patterns to minimize weight while maximizing burst pressure resistance.

- Machine learning models predict composite material failure under cyclic fatigue, enhancing tank lifespan and safety standards.

- Generative design algorithms accelerate the prototyping of complex tank geometries suitable for specific vehicle integration spaces.

- AI-driven automated quality control (QC) systems reduce manufacturing defects and improve production repeatability.

- Predictive maintenance schedules for composite manufacturing equipment minimize downtime and operational expenditure.

DRO & Impact Forces Of Carbon Composite Hydrogen Tanks Market

The market dynamics are defined by powerful driving forces centered around global sustainability goals and technological improvements, counterbalanced by significant financial and infrastructure restraints. The major Driver is the accelerating commercialization of Fuel Cell Electric Vehicles (FCEVs) across all mobility segments—passenger, bus, and heavy-duty trucks—where the need for lightweight, energy-dense storage is paramount. Simultaneously, the significant Restraint stems from the high cost of carbon fiber precursors and the energy-intensive process of carbon fiber manufacturing itself, which currently makes the resulting tanks significantly more expensive than traditional fuel storage systems. The core Opportunity lies in the burgeoning non-vehicular applications, specifically drone technology, railway transport, maritime shipping, and distributed power generation, which offer massive, untapped markets requiring custom, large-volume composite storage solutions.

Impact forces acting upon the market are highly concentrated on regulatory alignment and competitive material innovation. Regulatory standardization (e.g., harmonization of ISO and ECE standards) positively impacts market entry and global trade, driving manufacturer confidence. However, the external competitive force from next-generation battery technologies (solid-state batteries) and advancements in alternative hydrogen storage methods (e.g., metal hydrides, liquid organic hydrogen carriers) presents a perpetual threat, pressuring composite tank manufacturers to continually improve cost efficiency and gravimetric density. Furthermore, geopolitical supply chain fragility, particularly concerning high-grade carbon fiber from key global suppliers, directly influences tank pricing and production scalability.

The long-term growth trajectory is positively influenced by strategic government incentives, such as production tax credits and deployment subsidies for FCEVs and hydrogen infrastructure, which mitigate the initial high investment costs for end-users. Conversely, insufficient and slow development of hydrogen refueling station networks remains a critical, overarching restraint, creating 'chicken-and-egg' dilemma that hinders mass consumer adoption. Successful navigation of these D-R-O dynamics depends critically on the industry’s ability to achieve economies of scale in Type IV tank production and secure long-term, stable, and cost-effective supplies of specialized high-tensile carbon fiber.

Segmentation Analysis

The Carbon Composite Hydrogen Tanks Market is rigorously segmented based on material composition (Type), operating pressure, and application, reflecting the diverse requirements of the end-user industries utilizing hydrogen fuel. Understanding these segments is crucial as tank design must be specifically tailored to the safety, volume, and operational environment dictated by the application, with automotive standards demanding the highest level of standardization and pressure tolerance. The market is increasingly shifting towards Type IV vessels due to their inherent advantages in weight, performance, and corrosion resistance, positioning them as the standard for FCEV deployment globally. Pressure segmentation underscores the criticality of 700 bar tanks for achieving necessary driving range in vehicles, while 350 bar tanks cater primarily to industrial vehicles and stationary storage.

- By Type:

- Type III (Aluminum Liner, Carbon Fiber Wrap)

- Type IV (Polymer Liner, Carbon Fiber Wrap)

- By Pressure:

- 350 Bar

- 700 Bar

- Other Pressures (e.g., 500 Bar, 900 Bar for specific R&D or aerospace)

- By Application:

- Automotive (Passenger Vehicles, Commercial Vehicles – Buses/Trucks)

- Aerospace and Defense (UAVs, Satellites)

- Stationary Storage (Hydrogen Refueling Stations, Industrial Power Backup)

- Others (Maritime, Rail, Portable Devices)

Value Chain Analysis For Carbon Composite Hydrogen Tanks Market

The value chain for carbon composite hydrogen tanks is complex, starting with highly specialized upstream activities involving raw material procurement and advanced composite processing. The upstream segment is dominated by the acquisition of precursor materials (Polyacrylonitrile or PAN) and the subsequent high-energy conversion process into high-grade carbon fiber and specialized engineering resins (epoxy). A key bottleneck lies here, as only a limited number of global firms produce the required aerospace-grade carbon fiber necessary for 700-bar applications. Downstream activities involve the highly automated filament winding process, non-destructive testing (NDT), final assembly (including valves and safety systems), and rigorous hydrostatic testing and certification against international standards (ISO, UN ECE).

Distribution Channel analysis reveals a mixed structure depending on the application. For the Automotive segment, distribution is highly Direct, characterized by long-term, volume-based contracts established directly between the major tank manufacturers (e.g., Hexagon Purus, Plastic Omnium) and global automotive OEMs (e.g., Hyundai, Toyota, Daimler). These relationships often involve co-development of tank housing and integration systems. In contrast, distribution for Stationary Storage and smaller industrial applications is typically Indirect, involving specialized engineering procurement and construction (EPC) firms or regional hydrogen solution providers who integrate the tanks into larger system packages for end-users.

The value addition is highest during the filament winding and integration stages, where intellectual property related to stress distribution modeling, liner integrity, and valve technology is applied. Strategic players are striving to internalize the highest value-added processes, specifically carbon fiber production and advanced pressure testing, to gain competitive advantage and secure supply chain resilience against global disruptions. The successful optimization of the entire value chain is critical for reducing the final cost of the tank, which remains the single largest impediment to wider FCEV affordability.

Carbon Composite Hydrogen Tanks Market Potential Customers

The primary End-User/Buyers of carbon composite hydrogen tanks are those sectors fundamentally committed to transitioning away from fossil fuels and requiring high-energy density storage for mobile or critical stationary power applications. Automotive OEMs, particularly manufacturers of heavy-duty trucks (Class 8) and buses, constitute the largest immediate customer segment, driven by governmental mandates requiring zero-emission fleet conversions and the logistical superiority of hydrogen over batteries for long-haul routes. Major logistics and freight companies are rapidly emerging as significant buyers, procuring FCEV fleets to meet corporate sustainability goals and reduce operating costs through subsidized hydrogen fuel.

Beyond mobility, utilities and energy companies represent a growing customer base, utilizing large composite tanks for hydrogen storage at refueling stations (HRS) and as part of grid stability solutions (power-to-gas-to-power systems). These customers demand extremely durable, high-volume storage solutions suitable for continuous cycling and integration into existing infrastructure. Furthermore, specialized aerospace and defense contractors purchase bespoke, ultra-lightweight tanks for high-altitude platform systems (HAPS), drones, and mission-critical applications where weight is an absolute constraint, emphasizing custom engineering and certification over volume pricing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $0.85 Billion |

| Market Forecast in 2033 | $1.96 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hexagon Purus, Plastic Omnium, Faurecia (Symbio), Toyota (via various subsidiaries), ILJIN Hysolus, Quantum Fuel Systems, NPROXX (JV of Kautex and MAN), Tenaris, Reliance Industries (Reliance New Energy Solar), Composite Technology Development (CTD), Worthington Industries, Luxfer Gas Cylinders, FIBA Technologies, Ullit, PST S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbon Composite Hydrogen Tanks Market Key Technology Landscape

The technology landscape for carbon composite hydrogen tanks is characterized by continuous innovation aimed at reducing weight, increasing volumetric efficiency, and lowering manufacturing costs. The central technology remains high-speed, precision Filament Winding, where AI and robotics are increasingly used to control the tension, angle, and saturation of the carbon fiber tows as they are applied to the liner. This precision is critical for managing hoop and helical stresses induced by 700-bar internal pressure. The shift from Type III to Type IV is technologically significant, demanding advanced polymer liners, typically high-density polyethylene (HDPE) or polyamide (PA), that must withstand hydrogen permeation and chemical attack while bonding effectively with the composite structure.

Material science innovation focuses heavily on developing lower-cost, high-tensile strength carbon fibers (sometimes utilizing alternative precursors like pitch) and fast-curing epoxy resin systems to reduce the overall cycle time in the production line. Another critical area is the development of robust Boss and Port technologies—the connection point where valves and tubes enter the tank—which must handle extreme temperatures and pressures without leakage, often employing advanced metallurgy and seal designs. Certification and non-destructive testing (NDT) technologies, including ultrasonic testing and advanced acoustic emission monitoring, are also integral to ensuring that every manufactured tank meets regulatory compliance for safety.

Further technological advancements include tank stacking and modular integration systems, which simplify the installation of multiple tanks in confined spaces within commercial vehicles (trucks and trains). Research into Type V tanks, which eliminate the inner liner entirely through advanced structural thermoplastic composites, represents the cutting edge, offering potential for even lighter storage solutions, though certification challenges remain substantial. Ultimately, technological progress is geared towards optimizing the stress-to-weight ratio and perfecting the manufacturing repeatability required for mass-market automotive penetration.

Regional Highlights

- Asia Pacific (APAC): APAC currently holds the largest market share, driven primarily by ambitious government targets in Japan, South Korea, and China to deploy hydrogen fuel cell fleets. South Korea, home to key manufacturers like Hyundai and ILJIN Hysolus, has heavily subsidized FCEV purchase and infrastructure development. Japan continues its proactive 'Hydrogen Society' initiative, integrating hydrogen into residential power and transport. China is shifting focus from subsidized FCEV buses to hydrogen heavy-duty logistics, driving massive demand for large, 700-bar composite tanks, positioning APAC as the foundational market for high-volume manufacturing scaling.

- Europe: Europe is characterized by strong policy support, specifically the EU Hydrogen Strategy, which aims for widespread hydrogen integration across energy, transport, and industry. Demand is surging from heavy-duty commercial vehicle manufacturers (e.g., Daimler, Volvo) converting diesel platforms to hydrogen FCEVs. Germany and France are leading infrastructure deployment, and the establishment of "Hydrogen Valleys" promotes local manufacturing and usage, guaranteeing a high growth rate, particularly for integrated modular storage systems for trucks and trains.

- North America: North America is an exponential growth market, heavily influenced by state-level mandates (e.g., California’s Advanced Clean Truck rule) and federal incentives (IRA). The primary demand driver is the long-haul trucking sector, requiring large-volume, high-pressure composite tanks to achieve competitive range against diesel trucks. Significant private investment in hydrogen production hubs across the US is establishing the necessary feedstock supply, rapidly accelerating market readiness and production capacity expansion, particularly in Texas and the Pacific Northwest.

- Middle East and Africa (MEA): While currently a smaller market, MEA shows promising long-term potential tied to green hydrogen export ambitions (e.g., Saudi Arabia, UAE). The focus is primarily on industrial stationary storage for massive green hydrogen production facilities and localized use in heavy machinery and mining applications, rather than immediate widespread FCEV consumer adoption.

- Latin America: This region is nascent but focusing initial efforts on utilizing hydrogen in specialized industrial sectors, such as mining trucks in Chile and port logistics in Brazil. Growth is dependent on the establishment of clear governmental hydrogen strategies and securing international funding for infrastructure pilot projects, limiting current demand to smaller, specialized orders.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbon Composite Hydrogen Tanks Market.- Hexagon Purus AS

- Plastic Omnium

- Faurecia (part of Symbio/Stellantis partnership)

- ILJIN Hysolus Co., Ltd.

- Quantum Fuel Systems LLC

- NPROXX GmbH (Joint Venture between Kautex Textron and MAN Energy Solutions)

- Tenaris S.A.

- Toyota Motor Corporation (through various subsidiaries focusing on integration)

- Luxfer Gas Cylinders

- Worthington Industries, Inc.

- Composite Technology Development, Inc. (CTD)

- FIBA Technologies, Inc.

- Ullit SA

- PST S.p.A.

- Reliance Industries Limited (Reliance New Energy Solar)

- Linde plc

- CIMC Enric Holdings Limited

- Kautex Textron GmbH

Frequently Asked Questions

Analyze common user questions about the Carbon Composite Hydrogen Tanks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for carbon composite hydrogen tanks?

The primary driver is the global transition to zero-emission mobility, specifically the mass adoption of Fuel Cell Electric Vehicles (FCEVs) in the heavy-duty trucking and passenger car sectors, requiring lightweight, high-pressure (700 bar) hydrogen storage for extended range and operational efficiency.

How do Type III and Type IV hydrogen tanks differ, and which type dominates the market?

Type III tanks utilize an aluminum liner wrapped in carbon fiber, while Type IV tanks use a polymer (plastic) liner wrapped in carbon fiber. Type IV tanks are significantly lighter, less susceptible to corrosion, and dominate the market, particularly in high-volume automotive applications due to their superior performance metrics and cost-scaling potential.

What are the key technical challenges facing manufacturers of these composite tanks?

The key technical challenges include mitigating the high production cost of aerospace-grade carbon fiber materials, ensuring perfect liner integrity to prevent hydrogen permeation, and achieving high-speed, repeatable filament winding processes required for automotive industry volumes while meeting stringent safety and cyclic fatigue standards.

Which geographical region exhibits the strongest growth potential for this market?

While Asia Pacific currently leads in volume, North America, particularly driven by the adoption in long-haul heavy-duty trucking and substantial infrastructure investment spurred by regulatory incentives like the Inflation Reduction Act (IRA), is projected to exhibit the strongest exponential growth rate over the forecast period (2026–2033).

How does AI contribute to the efficiency and safety of carbon composite hydrogen tank production?

AI significantly enhances production efficiency and safety by optimizing complex composite winding patterns, using predictive analytics to minimize material waste, and implementing advanced machine learning algorithms for non-destructive testing (NDT) to ensure structural integrity and strict regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager