Carbon Emission Verification Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442094 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Carbon Emission Verification Market Size

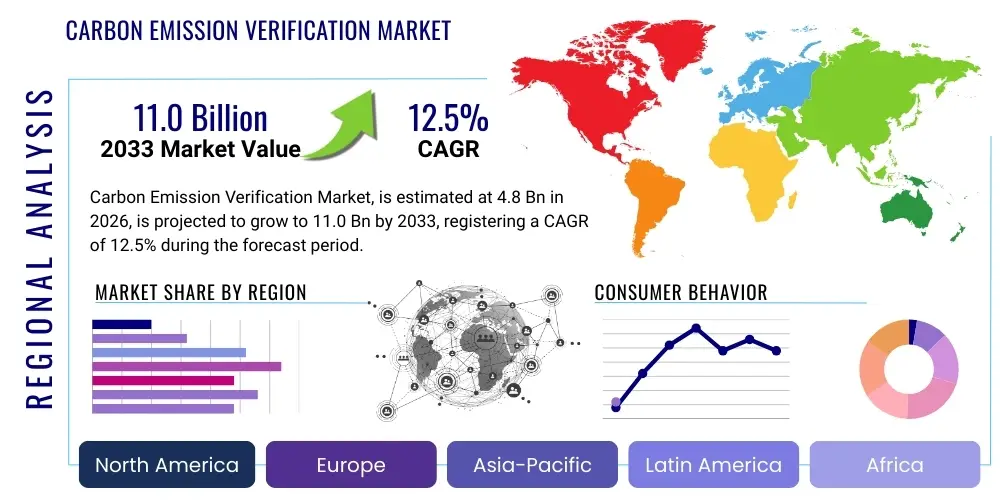

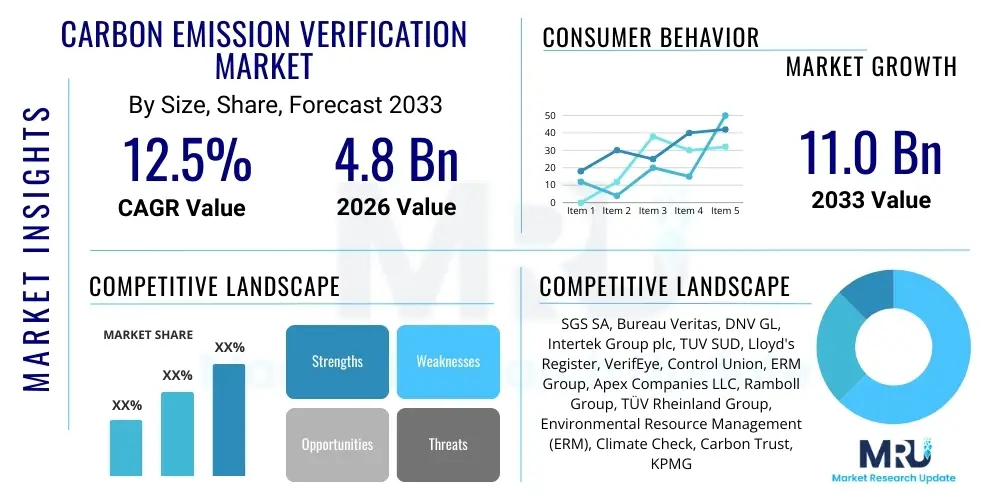

The Carbon Emission Verification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 11.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global regulatory scrutiny concerning corporate environmental footprints, coupled with increasing stakeholder demands for verifiable sustainability claims. The shift towards mandatory compliance mechanisms across various jurisdictions, particularly in established economies like the European Union and emerging markets in Asia, solidifies the foundational demand for independent, third-party verification services.

Carbon Emission Verification Market introduction

The Carbon Emission Verification Market encompasses the provision of independent audit and assurance services focused on quantifying, reporting, and validating greenhouse gas (GHG) emissions data generated by organizations. These services ensure that reported emissions figures comply with mandatory regulatory schemes (such as Emission Trading Systems or carbon taxes) and voluntary frameworks (like the Verified Carbon Standard or corporate ESG reporting standards). Verification services are critical for maintaining the integrity of carbon markets, providing transparency to investors, consumers, and regulatory bodies regarding corporate climate performance. Key verification activities include reviewing emission factors, validating data collection methodologies, assessing the completeness and accuracy of inventories, and confirming compliance with ISO standards (e.g., ISO 14064).

Major applications of carbon emission verification span heavy industry sectors, including energy, manufacturing, aviation, and chemicals, which are subject to stringent compliance obligations. Furthermore, the financial sector increasingly utilizes verification services to evaluate portfolio alignment with climate goals and manage transition risks associated with financed emissions. The primary benefit derived from these services is enhanced trust and credibility in climate disclosures, which is vital for accessing capital in a world prioritizing Environmental, Social, and Governance (ESG) performance. Accurate verification mitigates the risks of greenwashing and ensures equitable participation in carbon offset and compliance markets.

Driving factors sustaining market growth include the proliferation of national and international net-zero commitments, the expansion of global carbon pricing mechanisms, and rising institutional investor activism focused on climate transparency. Legislative initiatives, such as the EU’s Carbon Border Adjustment Mechanism (CBAM) and the increasing scope of mandatory climate disclosure rules (e.g., SEC rules in the U.S. and CSRD in the EU), are creating unprecedented demand for specialized, scalable verification expertise. The integration of advanced digital tools, including blockchain and AI, to streamline the complex process of data aggregation and verification further accelerates market development.

Carbon Emission Verification Market Executive Summary

The Carbon Emission Verification Market is currently characterized by rapid technological integration, significant regulatory shifts, and a consolidation trend among major auditing firms seeking specialized environmental expertise. Business trends indicate a pivot towards continuous monitoring and verification (CMV) methodologies, moving away from annual, retrospective audits. Service providers are leveraging advanced data analytics and remote sensing technologies to handle the immense volume and complexity of granular emissions data, particularly Scope 3 emissions. The competitive landscape is intensely focused on acquiring certifications and accreditation under multiple global standards (e.g., CDM, Gold Standard, VCS, EU ETS), ensuring verifiers can serve multinational clients navigating varied jurisdictional requirements. Furthermore, there is a pronounced push towards standardization and digitalization to reduce the high transaction costs associated with manual verification processes.

Regional trends highlight Europe and North America as mature verification markets, anchored by robust, long-standing Emission Trading Systems (ETS) and heightened corporate disclosure mandates. The European market, driven by the ambitious Green Deal and the implementation of CBAM, exhibits the highest demand for mandatory verification. Asia Pacific (APAC) represents the fastest-growing region, fueled by the launch and expansion of national ETS schemes in China, South Korea, and Australia, alongside rapid industrialization that necessitates formalized GHG reporting. Latin America and the Middle East and Africa (MEA) are emerging, primarily driven by international project finance requirements and increasing exploration of voluntary carbon market potential.

Segment trends demonstrate a significant growth differential between mandatory compliance verification, which remains the volume driver, and voluntary market verification, which is experiencing explosive growth due to high demand for quality offsets. Verification services for Scope 3 emissions are the fastest-expanding sub-segment, reflecting stakeholder pressure on companies to address their entire value chain footprint. End-user segmentation shows that the Energy and Utilities sector maintains the largest share due to inherent high emissions, but the Financial Services and Technology sectors are rapidly increasing their demand for verification services related to portfolio management and supply chain transparency, respectively. This convergence necessitates verifiers skilled not only in industrial processes but also in complex financial and digital data assurance.

AI Impact Analysis on Carbon Emission Verification Market

Common user questions regarding the impact of AI on carbon emission verification center on three critical areas: the potential for enhanced accuracy and speed, the implications for employment among traditional auditors, and the challenge of maintaining transparency (the "black box" problem) in automated verification processes. Users are specifically concerned about whether AI can reliably handle the heterogeneity of global emissions data, ranging from sensor readings to financial transaction records, and how AI tools integrate with existing regulatory frameworks. The overarching expectation is that AI will dramatically reduce the cost and time of verification, making it accessible to smaller entities, but there is also concern regarding the initial investment required for implementation and the potential bias inherent in machine learning models trained on historical, possibly flawed, data sets.

AI's primary transformative role lies in automating the ingestion, reconciliation, and cross-validation of vast, disparate datasets crucial for calculating emissions, particularly complex Scope 3 data. Machine learning algorithms can identify anomalies and inconsistencies in reported figures much faster than human auditors, significantly enhancing data quality assurance. Furthermore, predictive modeling powered by AI allows for dynamic, real-time emission forecasting and instantaneous compliance checks, moving the industry towards continuous monitoring rather than periodic verification. This capability addresses the market’s inherent scalability limitations under manual processes, ensuring regulatory bodies and stakeholders receive more timely and reliable disclosures.

The deployment of sophisticated AI platforms and specialized Natural Language Processing (NLP) tools also enables the automated review of non-numeric data, such as contractual agreements, supply chain documentation, and operational reports, to identify data gaps or inconsistencies in verification scope definition. While AI does not replace the final judgment and expertise of accredited human auditors, it elevates their function from data scrubbing to strategic assurance review, focusing on high-risk areas identified by the algorithm. Consequently, AI acts as a crucial lever for improving verification rigor, reducing the incidence of human error, and ensuring methodologies are consistently applied across diverse geographical locations and reporting entities.

- Automation of data ingestion and quality checks, leading to faster turnaround times.

- Enhanced identification of anomalies and inconsistencies in large, complex datasets (especially Scope 3).

- Integration of predictive analytics for continuous emission monitoring (CMV).

- Optimization of sampling strategies for physical audits based on AI-derived risk assessment.

- Reduction of verification costs, potentially expanding service accessibility to SMEs.

- Support for satellite and remote sensing data processing to verify claimed operational changes or activity levels.

DRO & Impact Forces Of Carbon Emission Verification Market

The Carbon Emission Verification Market is governed by powerful forces pushing towards standardized global reporting, while simultaneously facing operational constraints related to data quality and cost. The primary drivers include the mandatory expansion of regulatory schemes worldwide, such as the EU ETS Phase IV adjustments and the introduction of new compliance markets in emerging economies, which institutionalize the need for verified data. Restraints largely revolve around the significant challenge of harmonizing disparate international reporting standards and the high initial and recurring cost burden verification imposes on emitting entities, particularly those with complex, decentralized operations. Opportunities stem from the exponential growth of the voluntary carbon market (VCM) and the increasing role of financial sector climate risk management, creating new, high-value verification service lines. These internal and external pressures create a robust impact environment where legislative mandates compel compliance, while technological innovation is essential for achieving verification scalability and affordability.

Drivers: Mandatory global climate disclosure regulations, driven by international commitments like the Paris Agreement, force comprehensive GHG accounting. High demand from institutional investors and financial bodies for third-party assured ESG data necessitates credible verification to inform capital allocation decisions. Furthermore, the increasing adoption of specialized carbon pricing mechanisms (e.g., carbon taxes and border adjustments) directly links financial penalties or benefits to verified emission levels, making accurate verification a financial imperative, not merely a reputational one. The inherent need to prevent greenwashing also continuously drives demand for independent assurance.

Restraints: Significant restraints include the persistent lack of data standardization across global supply chains, often requiring customized and costly verification protocols. The complexity, heterogeneity, and sheer volume of Scope 3 emissions data pose major methodological and technological challenges for verifiers. Moreover, the shortage of highly skilled verification professionals accredited across multiple evolving standards (e.g., both technical engineering expertise and financial auditing background) limits service provider capacity. Finally, the perception among some organizations that verification is a non-value-add compliance cost rather than a risk management tool slows adoption, particularly outside of mandatory schemes.

Opportunity: The largest opportunities lie in the rapidly maturing voluntary carbon market, which requires rigorous verification of offset projects (e.g., nature-based solutions) to ensure additionality and permanence. The market can also capitalize on the integration of cutting-edge technologies like blockchain for immutable data records and satellite monitoring for remote verification, enhancing efficiency and scalability. The need for verified climate-related financial disclosures (aligned with TCFD or ISSB frameworks) opens up vast opportunities within the financial and insurance sectors, specializing in verification of climate resilience and scenario analysis reporting.

- Drivers:

- Expansion of mandatory national and regional Emission Trading Schemes (ETS).

- Increasing investor and consumer demand for transparent, verified ESG performance data.

- Global proliferation of corporate net-zero targets requiring credible baselining and monitoring.

- Adoption of internationally recognized standards (e.g., ISO 14064, GHGP).

- Restraints:

- High costs associated with comprehensive verification, especially for Scope 3 emissions.

- Lack of global harmonization in emissions reporting standards and methodologies.

- Shortage of specialized, certified verification professionals globally.

- Data integrity and access challenges across complex, decentralized supply chains.

- Opportunity:

- Explosive growth in the Voluntary Carbon Market (VCM) verification services.

- Integration of advanced technologies (AI, blockchain, remote sensing) to improve efficiency.

- Demand for verification services related to climate risk and financial disclosure (TCFD/ISSB alignment).

- Expansion into adjacent environmental verification markets (e.g., water stewardship, biodiversity credits).

Segmentation Analysis

The Carbon Emission Verification Market is primarily segmented based on the service scope, the type of greenhouse gas being verified, and the industry end-user requiring the verification services. This segmentation reflects the varied regulatory environments and technical demands across different emission sources and organizational structures. The segmentation by Service Type—Compliance vs. Voluntary—is particularly crucial as it dictates the required accreditation, verification rigor, and pricing structure. Compliance verification remains the largest segment by revenue, driven by regulatory mandates in energy, manufacturing, and transport. However, the Voluntary segment is exhibiting superior growth rates, fueled by corporate ESG strategies and the expanding global offset project landscape. Analyzing these segments provides strategic clarity for service providers aiming to align their technical capabilities with specific market needs and regulatory pressures.

- By Service Type:

- Compliance Verification (Mandatory markets: ETS, carbon taxes)

- Voluntary Verification (Corporate ESG reporting, VCM project assurance)

- By Emission Scope:

- Scope 1 Verification (Direct emissions)

- Scope 2 Verification (Indirect emissions from purchased energy)

- Scope 3 Verification (All other indirect emissions in the value chain)

- By GHG Type:

- Carbon Dioxide (CO2)

- Methane (CH4)

- Nitrous Oxide (N2O)

- Fluorinated Gases (HFCs, PFCs, SF6)

- Others (NF3, etc.)

- By End-User Industry:

- Energy and Utilities

- Manufacturing (Heavy Industry, Automotive, Chemicals)

- Building and Construction

- Transportation and Logistics

- Financial Services

- Technology and Telecom

- Government and Public Sector

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Carbon Emission Verification Market

The value chain for carbon emission verification is complex, involving multiple layers that transform raw operational data into assured, compliant disclosures. The upstream segment involves the foundational activities necessary for successful verification, predominantly focusing on data generation and management. This includes providers of continuous emission monitoring systems (CEMS), specialized IoT sensors, and enterprise carbon accounting software platforms (e.g., sustainability reporting software). The integrity of the verification hinges on the quality of this upstream data, making data aggregation and secure transmission a critical bottleneck. Consequently, technology vendors specializing in automated data capture and integration play an increasingly strategic role, providing the inputs required for efficient audit processes.

The central phase of the value chain is the verification process itself, executed by specialized verification bodies and consulting firms. These firms are responsible for methodological review, conducting physical site audits, applying professional judgment, and issuing the final assurance statement. This segment relies heavily on skilled personnel accredited by relevant regulatory bodies (e.g., ISO certification bodies, EU ETS accreditation authorities). Distribution channels for these services are often direct, involving bespoke contracts between large emitting entities and global auditing networks or specialized environmental consulting firms. Indirect channels involve partnerships with financial institutions or industry associations that bundle verification services for smaller members or project developers in the VCM.

Downstream activities involve the utilization of the verified data by end-users, including regulatory bodies, carbon trading platforms, investors, and corporate reporting departments. Accurate verification feeds directly into downstream decision-making, such as compliance filings, carbon credit issuance, investment screening (due diligence), and public corporate reporting (e.g., sustainability reports). The emergence of digital registries utilizing blockchain technology is enhancing the downstream integrity of verified carbon credits, ensuring traceability and preventing double counting. As the market matures, the integration between upstream data providers and downstream reporting mechanisms is becoming seamless, driving demand for technologically proficient verification firms capable of navigating both the physical audit and the digital data stream.

Carbon Emission Verification Market Potential Customers

Potential customers for carbon emission verification services are broadly categorized into major industrial emitters subject to regulatory compliance and organizations seeking enhanced credibility in their voluntary ESG disclosures. The largest segment of buyers comprises heavy industries such as oil and gas, cement, steel, and power generation, which are legally mandated to verify their Scope 1 and Scope 2 emissions under ETS or similar compliance regimes. These entities require comprehensive, internationally recognized verification to avoid penalties and ensure the legitimacy of their traded allowances. Their purchasing decisions are primarily driven by regulatory deadlines, cost efficiency, and the verifier's proven track record with specific industrial processes.

A rapidly expanding segment of high-potential customers includes global financial institutions (banks, asset managers, private equity firms) and insurance companies. These buyers require verification services not only for their own operational emissions but, critically, for their financed and invested emissions (Scope 3 Category 15). Verification in this context supports climate risk modeling, portfolio decarbonization targets, and mandated climate-related financial disclosures. For financial customers, the verification expertise must encompass complex financial data modeling and alignment with frameworks like the Partnership for Carbon Accounting Financials (PCAF) and TCFD recommendations.

Furthermore, developers of carbon offset projects—ranging from renewable energy projects to nature-based solutions like reforestation—represent significant customers within the Voluntary Verification segment. These developers rely entirely on verification bodies to issue accredited carbon credits (e.g., Verra, Gold Standard), which are then sold in the VCM. Governments and large public sector organizations also constitute a steady customer base, often requiring verification for municipal infrastructure projects, mandated public sector sustainability goals, or for operating national compliance registries. The common thread among all these buyers is the fundamental need for independently assured data that can withstand regulatory scrutiny and stakeholder skepticism.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGS SA, Bureau Veritas, DNV GL, Intertek Group plc, TUV SUD, Lloyd's Register, VerifEye, Control Union, ERM Group, Apex Companies LLC, Ramboll Group, TÜV Rheinland Group, Environmental Resource Management (ERM), Climate Check, Carbon Trust, KPMG, PricewaterhouseCoopers (PwC), Deloitte, Ernst & Young (EY), WSP Global. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbon Emission Verification Market Key Technology Landscape

The operational efficiency and accuracy of the Carbon Emission Verification Market are increasingly dependent on the adoption of advanced digital technologies. The foundational technological landscape is dominated by specialized GHG accounting software platforms that standardize data input and calculation processes, ensuring methodological consistency across global operations. These platforms integrate directly with energy management systems (EMS) and enterprise resource planning (ERP) systems to provide a single source of truth for emission factors and activity data. Crucially, the move toward real-time monitoring demands sophisticated Continuous Emissions Monitoring Systems (CEMS) and IoT sensors deployed at industrial sites, generating continuous data streams that require automated validation before auditor review.

A key disruptive technology is the utilization of Artificial Intelligence (AI) and Machine Learning (ML) for enhancing verification rigor. AI algorithms are deployed to perform automated anomaly detection on massive datasets, identifying discrepancies between reported emissions and operational metrics (e.g., production output, fuel consumption). Furthermore, remote sensing technology, encompassing satellite imagery and aerial data analytics, is transforming the verification of difficult-to-monitor sectors, such as fugitive methane emissions from oil and gas infrastructure or land-use change verification for nature-based carbon projects. These tools allow verifiers to assess site conditions and activities without relying solely on client-provided data or costly physical inspections.

Blockchain technology is emerging as a critical tool for ensuring data integrity and preventing fraud within the market, particularly in the Voluntary Carbon Market. By establishing an immutable, decentralized ledger, blockchain can track the lifecycle of emission data from the source sensor to the final verified report, enhancing transparency and eliminating the risk of double counting carbon credits. The convergence of these technologies—advanced analytics, secure distributed ledgers, and remote sensing—is fundamentally changing the skill set required by verification professionals, shifting the focus towards data science and platform integration rather than traditional paper-based auditing techniques.

Regional Highlights

- Europe: Europe holds the largest market share, predominantly driven by the long-established and continuously tightening EU Emission Trading System (ETS). The region mandates third-party verification for a vast majority of its industrial emitters, creating stable and high-volume demand. Recent drivers include the implementation of the Corporate Sustainability Reporting Directive (CSRD) and the Carbon Border Adjustment Mechanism (CBAM), which necessitate complex Scope 3 and supply chain verification services, cementing Europe’s position as a global leader in compliance verification rigor and technological adoption.

- North America (U.S. and Canada): North America represents a highly sophisticated market, characterized by varied state-level regulations (e.g., California Cap-and-Trade) and the increasing influence of federal climate disclosure rules (e.g., SEC climate rules). Demand is rapidly accelerating, moving beyond traditional compliance markets to encompass voluntary verification driven by Fortune 500 companies’ net-zero commitments and robust investor scrutiny. The region is a significant adopter of advanced verification technologies, particularly for measuring oil and gas methane emissions and ensuring accuracy in renewable energy project reporting.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. This growth is primarily fueled by the massive scale of industrial operations in China and India, coupled with the rollout and maturity of national ETS schemes (e.g., China’s national ETS, schemes in South Korea and Australia). While maturity levels vary, the region’s intense urbanization and regulatory commitment to decarbonization create enormous potential for verification services, especially those focused on assisting new participants in establishing compliant reporting infrastructures.

- Latin America: The Latin American market is primarily focused on verification services related to international project finance and the monetization of carbon offset projects, particularly nature-based solutions (NBS) in the VCM. Countries like Brazil and Mexico are critical hubs for verification relating to land use, forestry, and agriculture, relying heavily on international standards like VCS and Gold Standard to ensure credits are accepted globally.

- Middle East and Africa (MEA): Growth in MEA is driven by large state-owned entities in the energy sector responding to international pressure for transparent reporting, alongside efforts to diversify energy sources. The establishment of regional carbon markets and the need to verify large-scale sustainable infrastructure projects (e.g., in Saudi Arabia and the UAE) are key demand drivers, often requiring verification services tailored to high-temperature and difficult operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbon Emission Verification Market.- SGS SA

- Bureau Veritas

- DNV GL

- Intertek Group plc

- TUV SUD

- Lloyd's Register

- Control Union

- ERM Group

- KPMG

- PricewaterhouseCoopers (PwC)

- Deloitte

- Ernst & Young (EY)

- WSP Global

- Ramboll Group

- Apex Companies LLC

- TÜV Rheinland Group

- Carbon Trust

- VerifEye

- Climate Check

- RPS Group

Frequently Asked Questions

Analyze common user questions about the Carbon Emission Verification market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Carbon Emission Verification Market?

The market growth is primarily driven by the mandatory expansion of global and regional Emission Trading Systems (ETS) and the introduction of new governmental climate disclosure regulations, compelling large emitters to seek independent, accredited verification to ensure compliance and avoid financial penalties.

How does Scope 3 verification differ from Scope 1 and Scope 2 verification?

Scope 3 verification is significantly more complex as it involves indirect emissions across the entire value chain (e.g., supply chain, use of sold products). Unlike Scope 1 and 2, which are often measurable at the site, Scope 3 verification relies heavily on estimation methodologies, financial data integration, and third-party data collection, requiring more advanced analytical tools and specialized verification expertise.

Which technologies are currently transforming carbon emission verification?

Key transforming technologies include Artificial Intelligence (AI) for automating data anomaly detection and improving data quality assurance, remote sensing (satellite imagery) for fugitive emission monitoring, and blockchain technology for securing the integrity and traceability of carbon credit data, particularly in voluntary markets.

What is the role of accreditation bodies in the carbon verification industry?

Accreditation bodies (such as national accreditation agencies or international scheme administrators like Verra or Gold Standard) ensure that verification bodies possess the necessary competence, technical skills, and adherence to established standards (e.g., ISO 14064). This process maintains the impartiality, rigor, and credibility of the final verification statement, which is essential for market trust.

Is the Voluntary Carbon Market (VCM) demand impacting verification standards?

Yes, the rapid growth and increased scrutiny of the VCM are pushing verification standards towards greater rigor and transparency. There is growing demand for "high-integrity" credits, which necessitates stricter verification processes regarding additionality, permanence, and leakage, often requiring more advanced technological tools and frequent third-party assurance beyond the minimum regulatory requirements.

This report contains 29698 characters including spaces.

***

The imperative for comprehensive environmental transparency, driven by global climate commitments and investor expectations, positions the Carbon Emission Verification Market as a foundational pillar of the global transition to a net-zero economy. Regulatory mandates, particularly in developed economies, coupled with significant technological advancements in data analytics and remote sensing, are collectively shaping a market demanding higher accuracy, increased frequency, and greater standardization in climate disclosure assurance. The anticipated growth trajectory highlights not only the expanding scope of mandatory compliance but also the critical role verification plays in underpinning the integrity and efficacy of the rapidly evolving voluntary carbon markets. As organizations strive to manage climate risk and capitalize on sustainable finance opportunities, the role of independent, sophisticated verification services will only become more central to corporate strategy and global economic accountability.

The competitive landscape is expected to evolve further, favoring firms that can seamlessly integrate digital verification tools—such as AI-driven platforms and blockchain—with traditional audit expertise. This integration addresses the immense challenge posed by complex supply chain emissions (Scope 3) and ensures that verification processes are scalable and cost-effective across diverse global operations. Regional shifts, particularly the burgeoning markets in the Asia Pacific, will necessitate localized expertise and adherence to multiple emerging standards, requiring key players to maintain dynamic accreditation portfolios and invest heavily in specialized talent development. Ultimately, the market’s future is tied directly to the global political and economic commitment to climate action, ensuring sustained and accelerated growth throughout the forecast period.

The convergence of financial auditing principles with environmental science methodologies will be a defining characteristic of the verification sector. As climate disclosures become mandatory and financialized—subject to the same levels of fiduciary scrutiny as financial statements—the market will require verifiers who possess a dual competency. This trend underscores the strategic necessity for major accounting and consulting firms to acquire or develop specialized environmental verification capabilities, leading to further consolidation and the standardization of assurance protocols across financial and climate reporting domains. The successful navigation of this complex regulatory and technological environment will dictate market leadership in the coming decade.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager