Card Printers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442701 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Card Printers Market Size

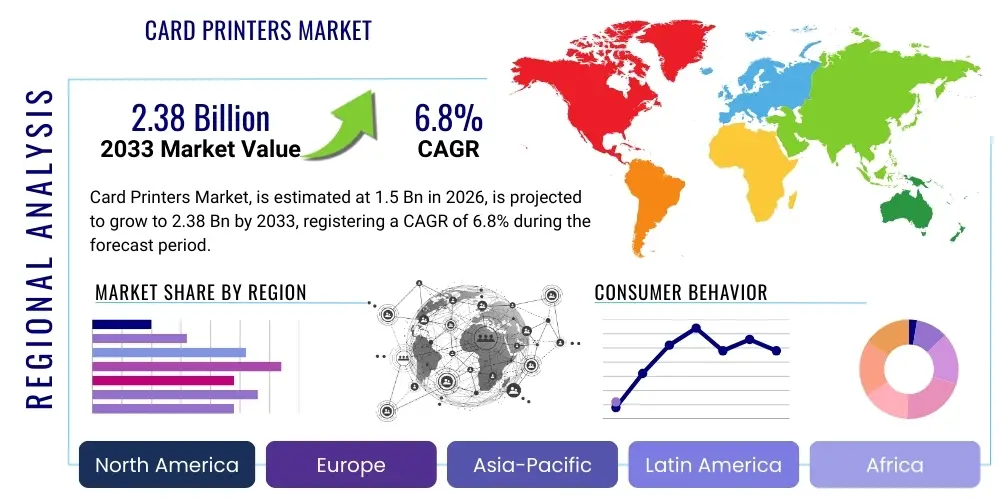

The Card Printers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.38 Billion by the end of the forecast period in 2033.

Card Printers Market introduction

The Card Printers Market encompasses specialized hardware solutions designed for instant, on-demand personalization and issuance of plastic cards, including identity badges, financial cards, access control credentials, and membership cards. These devices utilize various printing technologies, predominantly dye-sublimation and retransfer methods, to produce high-quality, durable, and secure printed cards. The core objective of these systems is to enhance security, facilitate immediate issuance, and provide customized visual elements and embedded electronic features necessary for modern access and transaction management across diverse sectors. Key product characteristics include single- or dual-sided printing capabilities, magnetic stripe encoding, smart card chip encoding (contact and contactless), and lamination options for increased durability and security.

Major applications of card printers span critical infrastructure and services, including corporate environments where they are essential for employee identification and physical access management, and governmental organizations requiring secure citizen identification, driver's licenses, and border control documents. Furthermore, the banking, financial services, and insurance (BFSI) sector heavily relies on these printers for instant issuance of debit and credit cards, drastically improving customer experience and reducing logistics costs associated with centralized card production. The education sector uses them for student IDs and campus access, while the retail industry leverages them for loyalty and gift card programs, driving customer engagement.

The primary benefits driving the adoption of card printers include enhanced security through embedded features like holograms and UV printing, flexibility in design and personalization at the point of issuance, and operational efficiency resulting from rapid production turnaround times. Technological advancements, particularly in connectivity options such as Wi-Fi and mobile printing, alongside improved printing resolutions and higher throughput rates, are continually driving market expansion. These factors collectively position card printers as indispensable tools for organizations prioritizing robust identification and secure access solutions in an increasingly digital and security-conscious world.

Card Printers Market Executive Summary

The global Card Printers Market is characterized by robust growth driven by escalating demands for enhanced security protocols across corporate and governmental infrastructures, coupled with the rising necessity for personalized, instantaneous card issuance, particularly within the BFSI and healthcare sectors. Business trends indicate a significant shift toward retransfer printing technology, valued for its superior edge-to-edge printing quality and durability, over traditional direct-to-card methods. Furthermore, integration capabilities with complex security systems, including biometric identification and centralized credential management software, are defining competitive advantages for key market players. The market is witnessing increased innovation focused on modular designs that allow users to upgrade printers with lamination modules or encoding functionalities post-purchase, optimizing investment and flexibility.

Regionally, Asia Pacific (APAC) is projected to exhibit the highest growth rate, fueled by substantial governmental investments in national ID programs, expanding urbanization, and the rapid adoption of digital financial services, especially in emerging economies like India and China. North America and Europe, representing mature markets, maintain dominance in market value, primarily due to stringent regulatory compliance standards necessitating high-security credentials and the widespread adoption of smart card technology in enterprise environments. Growth in these regions is stable, focusing on replacements and upgrades to advanced encoding and networked printing solutions to support distributed issuance models.

Segment trends reveal that dual-sided printing capacity continues to be the preferred choice across professional applications, maximizing card utility for both identity and operational information. Regarding end-users, the BFSI sector’s instant issuance model is the fastest-growing application area, whereas the Government segment remains the largest contributor to market revenue due to large-scale, long-term ID projects. Technology segmentation highlights a crucial pivot towards enhanced connectivity features, including secure cloud integration and mobile device management, catering to the decentralized issuance needs of modern organizations. The emphasis remains on delivering secure, reliable, and high-volume printing solutions that comply with global data protection and security standards.

AI Impact Analysis on Card Printers Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Card Printers Market predominantly revolve around security enhancement, operational efficiency, and the future of issuance workflows. Users frequently ask: "How can AI improve the security features embedded in printed cards?" or "Will AI automate maintenance and reduce downtime in high-volume card issuance centers?" There is significant interest in AI's role in predictive maintenance, diagnosing printing issues before failure, optimizing consumable inventory management, and enhancing fraud detection capabilities during the personalization process. Expectations center on AI streamlining the entire card lifecycle, from initial design verification to post-issuance validity checks, thereby transforming the card personalization process from a manual operation into an intelligent, automated security feature.

The integration of AI algorithms into card printer software suites is poised to revolutionize the quality control aspect of card production. AI-powered vision systems can instantaneously analyze printed cards for microscopic defects, color inconsistencies, or misalignment errors with far greater accuracy and speed than human inspection, ensuring that every issued credential meets stringent security and branding standards. This capability minimizes waste, reduces costly reprints, and ensures the integrity of personalized security features like micro-text or complex graphical elements, directly contributing to operational cost savings and improved throughput reliability in commercial and governmental issuance centers.

Furthermore, AI is instrumental in fortifying the security of the issuance ecosystem itself. By analyzing historical printing patterns, user access logs, and environmental telemetry data, AI can establish baseline behavioral profiles for secure printer operation. Any deviation from these norms—such as unusual print volumes, unauthorized access attempts, or anomalies in encoding requests—triggers immediate alerts. This proactive security monitoring transforms the printer from a mere output device into an intelligent node within a broader security network, actively participating in the prevention of insider threats and unauthorized credential fabrication. This elevated security profile is critical for sectors handling highly sensitive credentials like government IDs and financial instruments.

- AI-driven predictive maintenance forecasts hardware failures, reducing printer downtime by optimizing service schedules.

- Enhanced quality control using machine vision algorithms ensures defect-free security features on every card.

- Automated fraud detection identifies anomalous printing requests and unauthorized card issuance attempts in real-time.

- Optimization of print settings (color calibration, ribbon usage) based on material analysis, maximizing consumable efficiency.

- Integration with centralized credential management systems using AI for robust user authentication and access control for the printer itself.

DRO & Impact Forces Of Card Printers Market

The dynamics of the Card Printers Market are significantly influenced by a compelling balance between driving forces, market restraints, and emerging opportunities, all contributing to the overall impact forces shaping its trajectory. Key drivers include the global expansion of digital identification and access control needs, necessitating secure, personalized credentials across numerous industries. The mandate for instant issuance, particularly within the BFSI sector to improve customer service and reduce waiting times for credit and debit cards, exerts substantial upward pressure on market growth. Furthermore, governmental initiatives worldwide to replace traditional paper documents with robust, secure electronic ID cards (e-IDs) and driver's licenses require specialized, high-security card printers capable of encoding complex data and integrating sophisticated security features like holograms and biometric data.

Conversely, the market faces several restraining factors that temper its growth potential. High initial investment costs associated with advanced card printing systems, particularly those incorporating retransfer technology and lamination modules, can be prohibitive for small and medium-sized enterprises (SMEs). Environmental concerns regarding plastic card waste and the consumables (ribbons, film) used in the printing process are also emerging constraints, pushing the industry toward more sustainable card materials and eco-friendly printing solutions. Additionally, the proliferation of digital credentials and mobile IDs, while not yet fully replacing physical cards, poses a long-term existential challenge to the necessity of physical card issuance, potentially slowing down adoption rates in specific non-governmental sectors.

Opportunities for expansion are abundant, particularly in integrating Card Printers with the Internet of Things (IoT) platforms and cloud-based issuance solutions, allowing for decentralized, secure printing managed from anywhere. Emerging economies present vast untapped markets where rapid infrastructural development and increased security awareness are driving first-time adoption of electronic identification systems. Technological advancement in printer connectivity, enhanced encoding capabilities for highly sophisticated smart chips (such as those used in secure contactless payment systems), and the development of cost-effective, durable printing solutions tailored for harsh environments represent significant avenues for future revenue generation and market penetration. These impact forces collectively define the market structure, favoring manufacturers that can offer highly secure, technologically advanced, and environmentally conscious printing solutions.

Segmentation Analysis

The Card Printers Market is meticulously segmented based on key functional and technical attributes, allowing for granular market analysis and targeted strategy development. Primary segmentation categories include the printing technology employed, the connectivity interface offered, the specific type of card printer (single-sided vs. dual-sided), and the diverse end-user applications across various vertical markets. This structured breakdown is essential for understanding product performance preferences, regional demands, and competitive positioning within specialized niches, such as high-volume centralized issuance versus low-volume desktop printing environments. Each segment reflects unique security requirements, operational scale, and budget considerations dictated by the end-user profile.

- Technology: Dye Sublimation (Direct-to-Card), Retransfer, Inkjet

- Connectivity: USB, Ethernet/Networked, Wireless (Wi-Fi, Bluetooth)

- Type: Single-Sided Printers, Dual-Sided Printers

- End-User: BFSI (Banking, Financial Services, and Insurance), Government & Public Sector, Healthcare, Education, Retail & E-commerce, Corporate & Enterprise, Others (Transportation, Hospitality)

- Features: Encoding (Magnetic Stripe, Contact Smart Card, Contactless Smart Card), Lamination, Security Features (UV printing, Holograms)

Value Chain Analysis For Card Printers Market

The value chain of the Card Printers Market begins with the upstream suppliers responsible for providing essential components and raw materials. This includes manufacturers of high-precision printing mechanisms (printheads), electronic components (microprocessors, circuit boards), specialized plastic card materials (PVC, PET, Polycarbonate blanks), and sophisticated consumables like dye sublimation ribbons and retransfer films. The quality and cost of these raw materials directly impact the final product quality and the manufacturer’s profitability. Strategic relationships with reliable, high-quality component suppliers are crucial for maintaining production consistency and technological competitiveness, particularly concerning the precision engineering required for encoding modules.

The midstream stage is dominated by Card Printer Original Equipment Manufacturers (OEMs). These companies focus on the research, development, assembly, and integration of the core printing and encoding technologies. They invest heavily in intellectual property related to secure printing algorithms, connectivity protocols, and software drivers that interface with end-user credential management systems. OEMs often differentiate themselves through proprietary security enhancements, modular design flexibility, printing speed, and the overall reliability of their hardware. Successful OEMs maintain stringent quality control processes and often offer specialized software suites for personalized card design and issuance management.

The downstream distribution channel involves a complex network of authorized distributors, value-added resellers (VARs), and system integrators. These intermediaries play a vital role in market penetration by providing localized sales, installation, training, and critical post-sale technical support and maintenance services. The channel includes direct sales to large governmental and financial institutions requiring customized solutions, as well as indirect distribution through retail channels and e-commerce platforms for desktop and low-volume printers targeted at SMEs. Effective distribution management, reliable inventory of consumables, and proficient technical support are key success factors in the downstream segment, ensuring high customer satisfaction and minimal printer downtime in critical applications.

Card Printers Market Potential Customers

Potential customers for card printers are found predominantly in sectors where secure identification, reliable access control, and instant credential issuance are operational necessities. The largest and most demanding segment is the Government and Public Sector, which uses card printers for national identification cards, passports, driver's licenses, and border control credentials. These customers require highly secure printers capable of handling durable card materials (like Polycarbonate) and integrating advanced security features, including laser engraving and complex chip encoding, often necessitating high-volume, centralized issuance solutions managed through secure governmental networks.

Another major segment is the Banking, Financial Services, and Insurance (BFSI) industry. Financial institutions utilize card printers for instant issuance programs, allowing customers to walk into a branch and receive a personalized debit or credit card immediately. This drives customer loyalty and reduces operational delays associated with centralized mailing. These applications demand reliable printers with robust magnetic stripe and smart card encoding capabilities, along with secure connectivity to core banking systems to prevent data breaches during the personalization process.

Furthermore, the Corporate and Enterprise sector represents a significant volume of potential customers, requiring card printers for employee badges, visitor management systems, and physical access control cards (e.g., prox cards or smart access cards). Retail and Education sectors also constitute substantial markets; retailers use these devices for customer loyalty programs, gift cards, and employee IDs, while educational institutions issue student and faculty ID cards that often double as access control or cashless payment mechanisms on campus. Healthcare providers use them for patient identification, staff badges, and secure medical record access, highlighting the necessity of these devices across virtually all large-scale organizational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.38 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zebra Technologies, HID Global, Entrust Corporation, Evolis, Magicard, Datacard Group, Matica Technologies, Fargo, Nisca, IDP Corp, SwiftColor, CIM USA, Promag, Digital Identification Solutions, Kanematsu, Screen (DNP), DASCOM, Kaba Group, NBS Technologies, Unicard |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Card Printers Market Key Technology Landscape

The technological landscape of the Card Printers Market is primarily dominated by two sophisticated printing methods: dye-sublimation (direct-to-card) and retransfer technology. Dye-sublimation is the most widely adopted method, utilizing heat to transfer color dye directly from a ribbon onto the surface of a plastic card. It offers speed, affordability, and acceptable image quality for standard ID badges and membership cards. While cost-effective for general use, direct-to-card technology is susceptible to minor card edge imperfections and wear, which can be a limitation in high-security or high-usage applications. Advancements in this segment focus on improved printhead longevity and enhanced ribbon formulations to boost color fidelity and UV resistance.

Retransfer printing, often referred to as reverse transfer, represents the high-end segment, essential for superior image quality, durability, and security. This process involves printing the image onto a clear film first, which is then thermally bonded to the card surface. This method achieves true edge-to-edge printing, protects the image beneath a layer of film, and is the preferred choice for printing on non-PVC materials like polycarbonate and PET, commonly required for government IDs and driver's licenses due to their increased longevity and resistance to counterfeiting. Technological evolution in retransfer focuses on increasing printing speeds and integrating sophisticated inline lamination and laser engraving modules for maximum credential security.

Beyond the core printing mechanisms, the landscape is defined by critical encoding and security integration technologies. Smart card encoding modules (both contact and contactless, supporting standards like ISO 14443 and FeliCa) are standard features, enabling the personalization of embedded chips necessary for modern access control and payment systems. Magnetic stripe encoding remains relevant for legacy systems, while optional features such as holographic overlays, tactile impressions, and fluorescent UV printing capabilities are increasingly deployed to deter forgery. Furthermore, network connectivity, driven by secure network cards (Ethernet) and wireless options (Wi-Fi), facilitates distributed issuance environments, ensuring that printers can be securely managed and utilized across large enterprise networks or geographically dispersed locations.

Regional Highlights

The Card Printers Market exhibits varied growth dynamics and adoption patterns across major global regions, influenced by localized regulatory environments, economic development, and security requirements.

- North America: This region holds a significant share of the market value, characterized by the early adoption of smart card technology and stringent compliance requirements in corporate and healthcare sectors. The demand is driven by the regular upgrade cycles for access control credentials, sophisticated government ID programs, and robust adoption of instant financial card issuance programs by major banks. High market maturity translates to a focus on advanced features like high-security retransfer printing and network-enabled centralized issuance solutions.

- Europe: Growth is steady, propelled by EU regulations mandating enhanced security features for citizen identification, electronic health cards, and standardized corporate access protocols (GDPR compliance driving data security needs). Countries like Germany, France, and the UK prioritize durable materials (Polycarbonate) and high-security printing features, maintaining a strong demand for advanced lamination and encoding printers.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, primarily fueled by massive governmental projects to implement national ID cards (Aadhaar in India, similar programs in Southeast Asia), rapid urbanization, and exponential growth in the BFSI sector's instant issuance needs. Lower labor costs often necessitate high-volume, cost-effective printing solutions, although security awareness is rapidly driving the adoption of retransfer technology in key urban centers.

- Latin America (LATAM): The region shows moderate growth, driven by modernization of banking infrastructure and increased awareness of physical security, leading to higher penetration of personalized employee badges and financial cards. Market expansion is sometimes hindered by economic volatility but presents significant opportunity as governments invest in upgraded security credentials.

- Middle East and Africa (MEA): Growth is primarily concentrated in the GCC nations due to high investment in infrastructure, tourism, and security sectors. Projects involving e-passports, national IDs, and secure employee credentials in oil and gas and government sectors are the key revenue drivers, demanding reliable, high-security printers suitable for challenging operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Card Printers Market.- Zebra Technologies

- HID Global

- Entrust Corporation (formerly Datacard Group)

- Evolis

- Magicard (Ultra Electronics Group)

- Matica Technologies AG

- Nisca (Kanematsu)

- IDP Corp, Ltd.

- SwiftColor (SNBC)

- CIM USA

- Promag Co., Ltd.

- Digital Identification Solutions AG (DISO)

- DASCOM (Shenzhen) Co., Ltd.

- Kaba Group (dormakaba)

- NBS Technologies Inc.

- Unicard International

- Screen Holdings Co., Ltd. (DNP)

- Valid S.A.

- Assa Abloy

- Gemalto (Thales Group)

Frequently Asked Questions

Analyze common user questions about the Card Printers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between Dye Sublimation and Retransfer Card Printing?

Dye sublimation, or direct-to-card printing, applies the image directly onto the card surface and is cost-effective but may leave a slight white border. Retransfer technology prints onto a film first, which is then heat-applied to the card, offering superior edge-to-edge printing, enhanced durability, and better results on complex card materials like polycarbonate, making it ideal for high-security applications.

Which industries are driving the highest demand for Card Printers currently?

The highest demand is driven primarily by the Government and Public Sector for large-scale national ID and driver's license programs, and the BFSI (Banking, Financial Services, and Insurance) sector, due to the widespread shift towards instant issuance of personalized credit and debit cards at branch locations to enhance customer experience.

What are the key security features integrated into modern Card Printers?

Modern card printers integrate multiple security features, including magnetic stripe and smart card chip encoding (contact and contactless), UV fluorescent printing (for covert security images), holographic lamination overlays to prevent tampering, and internal digital security protocols to protect sensitive data during the printing process.

How is cloud technology influencing the Card Printers Market?

Cloud technology is enabling decentralized and distributed card issuance. Cloud-based credential management software allows organizations to securely manage printer fleets and issue credentials remotely across multiple locations, streamlining enterprise operations and reducing the need for local IT infrastructure dedicated solely to card printing.

What are the primary factors restraining market growth in developed regions?

Key restraints include the high initial capital investment required for advanced retransfer and lamination printers, coupled with the increasing maturation of digital credential and mobile ID technologies, which potentially reduce the long-term dependency on physical plastic cards in certain non-governmental use cases.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- ID Card Printers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Card Printers Market Size Report By Type (Dye Sub Printers, Inkjet Printers), By Application (Enterprise, School, Government, Commercial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- ID Card Printers Market Statistics 2025 Analysis By Application (Enterprise, School, Government, Commercial), By Type (Dye Sub Printers, Inkjet Printers), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- ID Card Printers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Single Sided, Double Sided, Retransfer Printer), By Application (Industrial/Manufacturing, Transportation/Logistics, Banking, Healthcare, Government, Educational Institutes, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Plastic Card Printers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Stationary, Portable), By Application (Residential, Commercial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager