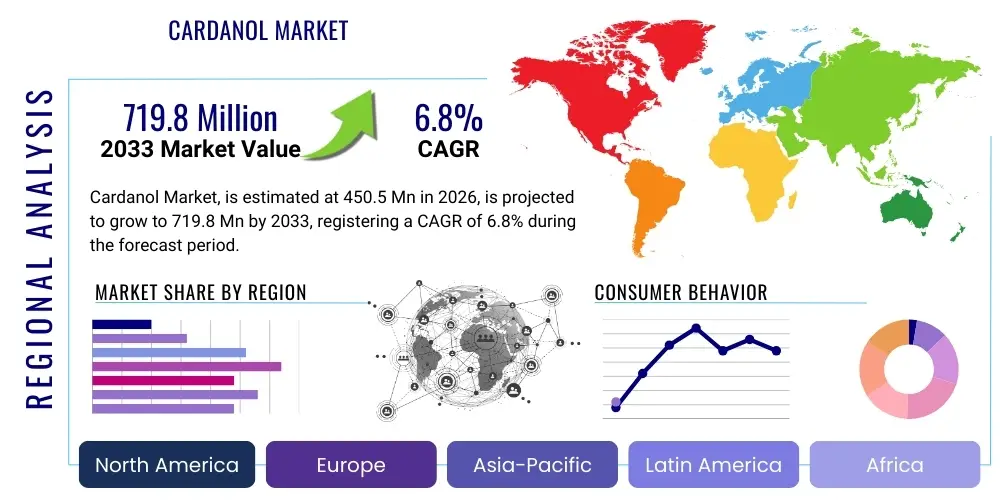

Cardanol Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441583 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Cardanol Market Size

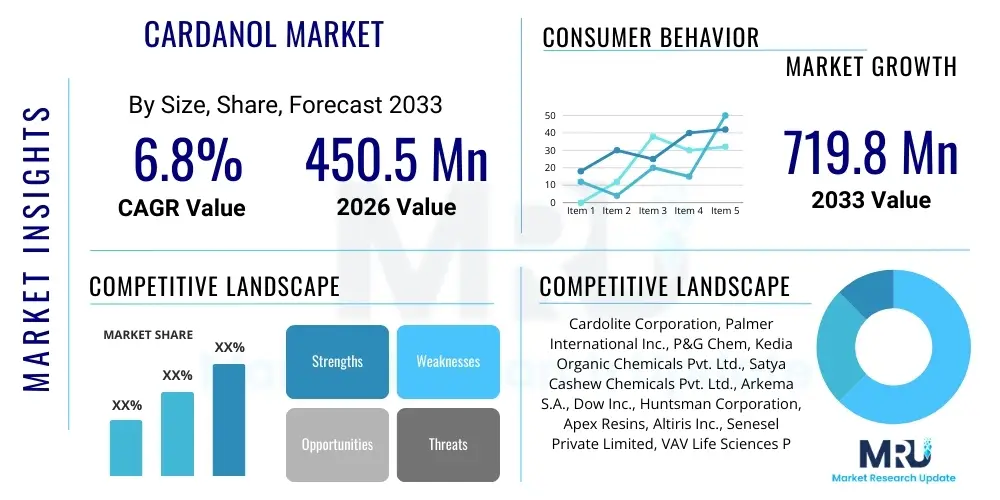

The Cardanol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 million in 2026 and is projected to reach USD 719.8 million by the end of the forecast period in 2033.

Cardanol Market introduction

Cardanol is a monophenolic compound derived primarily from Cashew Nut Shell Liquid (CNSL), a natural, non-edible, and renewable resource obtained during the processing of cashew nuts. This versatile chemical intermediary is highly valued across numerous industrial sectors due to its unique chemical structure, which imparts hydrophobicity, excellent thermal stability, chemical resistance, and friction-reducing properties to resultant polymers and resins. Its chemical versatility allows it to be modified via reactions such as hydroxymethylation, hydrogenation, and ethoxylation, creating a vast array of high-performance derivatives suitable for specialized applications.

The core applications of Cardanol revolve around the manufacturing of surface coatings, protective paints, high-performance adhesives, and specialized friction materials such as brake linings and clutch facings. In the coatings industry, Cardanol-modified epoxy resins and polyurethanes offer superior resistance to corrosion and harsh chemicals, making them essential for marine, aerospace, and industrial maintenance applications. Furthermore, its inherent bio-based nature positions it as an environmentally friendly alternative to traditional petroleum-based phenols, aligning with global sustainability trends and driving increased adoption, particularly in regulated markets like Europe and North America.

Key benefits driving market adoption include its low cost relative to synthetic performance chemicals, inherent thermal stability (crucial for friction applications), and capacity to improve flexibility and water resistance in polymer matrices. The primary factors propelling the market forward include the rapid expansion of the automotive and infrastructure sectors in Asia Pacific, necessitating robust protective coatings, and the increasing global regulatory pressure favoring sustainable and renewable raw materials in chemical manufacturing processes.

Cardanol Market Executive Summary

The Cardanol market is characterized by robust growth, primarily fueled by the burgeoning demand for sustainable and high-performance materials across diverse industrial verticals. Business trends indicate a significant shift towards high-purity Cardanol grades (Cardanol 90% and above) required for demanding applications in electronics encapsulation and advanced composite manufacturing, pushing manufacturers to invest in cleaner distillation and purification technologies. Strategic mergers, acquisitions, and long-term supply agreements within the CNSL value chain are becoming common as companies seek to secure reliable raw material supply and mitigate price volatility risks. Innovation remains a critical differentiator, focusing on developing novel Cardanol derivatives tailored for UV-curable coatings and specialty surfactants.

Regionally, Asia Pacific (APAC) continues to dominate the production and consumption landscape, driven by massive infrastructure investments, rapid industrialization, and the presence of major cashew processing nations (India, Vietnam). China and India represent the largest consumer base for Cardanol in epoxy resins and friction materials. North America and Europe, while having smaller consumption volumes, are high-value markets focused on Cardanol applications within green chemistry initiatives, high-specification protective coatings (marine and energy sectors), and niche segments like bio-based surfactants and corrosion inhibitors, often adhering to stringent REACH and EPA standards.

Segment trends highlight the dominance of the Coatings and Adhesives application segment, which utilizes Cardanol for its excellent curing properties and resistance profiles. However, the Friction Materials segment, though smaller, exhibits steady, high-margin growth due to the consistent global demand for reliable brake components in automotive and heavy machinery. Purity segmentation is witnessing the fastest growth in the higher-purity grades, reflecting the end-users’ requirement for consistent performance in precision applications where impurities could compromise product integrity, such as electrical insulation materials or food-contact adhesives.

AI Impact Analysis on Cardanol Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cardanol market frequently center on optimizing raw material sourcing, enhancing synthesis efficiency, and improving quality control consistency. Users are keen to understand how AI-driven predictive analytics can manage the inherent volatility of CNSL supply, which is highly dependent on agricultural yields and seasonal harvests. Furthermore, there is significant interest in utilizing AI and machine learning (ML) models to simulate complex chemical reactions, accelerating the discovery and formulation of new Cardanol derivatives with tailored performance characteristics, particularly for sophisticated applications like specialty polymers and bio-resins. Concerns often revolve around the initial capital expenditure required for integrating AI systems into traditional chemical processing plants and the need for specialized data scientists in a relatively niche industrial sector.

AI is beginning to integrate into the Cardanol manufacturing process primarily through advanced data analytics aimed at improving yield and minimizing waste. ML algorithms can analyze real-time processing data (temperature, pressure, catalyst concentration) to precisely control distillation parameters, ensuring optimal purity levels are achieved consistently, thereby reducing energy consumption and operational costs. On the supply chain side, predictive maintenance facilitated by AI monitors critical processing equipment, preventing unscheduled downtime, which is vital in minimizing batch variations and maintaining continuous production schedules essential for key automotive suppliers.

In the R&D domain, AI algorithms are employed to analyze vast chemical databases to predict the performance of Cardanol-based oligomers when combined with various hardeners or co-monomers, drastically reducing the number of costly and time-consuming laboratory experiments. This optimization capability accelerates the market readiness of next-generation bio-epoxies and high-solids coatings formulations. For marketing and distribution, AI tools are used to forecast demand based on macroeconomic indicators, regional construction projects, and automotive production schedules, allowing manufacturers to optimize inventory management and pricing strategies for different Cardanol grades across geographically dispersed markets.

- AI optimizes CNSL sourcing and inventory management, mitigating raw material price volatility.

- Machine learning models enhance distillation and purification processes, guaranteeing higher Cardanol purity (e.g., >95%).

- Predictive analytics streamline chemical reaction parameters, reducing waste and energy consumption during synthesis.

- AI accelerates R&D by simulating the performance of novel Cardanol derivatives in coatings and polymers.

- Demand forecasting using AI improves supply chain responsiveness and market pricing strategies.

- Computer vision and ML ensure stringent quality control for Cardanol batches utilized in high-precision applications.

DRO & Impact Forces Of Cardanol Market

The Cardanol market dynamics are fundamentally shaped by the synergy between strong demand for sustainable performance chemicals and the inherent supply constraints related to its agricultural origin. Key drivers include the global push for bio-based chemicals as substitutes for phenol and other petrochemicals, driven by environmental mandates and consumer preference, especially in Europe and North America. Simultaneously, the rapid growth of construction and automotive industries, particularly in developing economies, continuously elevates the requirement for durable, thermally stable, and corrosion-resistant materials, directly boosting Cardanol uptake in coatings and composite segments. These pervasive global requirements establish a solid foundation for consistent market expansion.

However, the market faces significant restraints, chiefly the highly variable price and supply of raw Cashew Nut Shell Liquid (CNSL). As CNSL is a byproduct of the seasonal cashew harvest, global production volumes fluctuate based on climate and agricultural practices, leading to price volatility that complicates long-term procurement and stable pricing for Cardanol manufacturers and downstream consumers. Furthermore, achieving the high-purity specifications (low residual CNSL content) required for sensitive applications demands sophisticated and costly manufacturing technologies, creating a barrier to entry for smaller players and adding to the final product cost, thereby challenging its price competitiveness against synthetic alternatives in certain mass-market applications.

Opportunities abound, particularly in exploiting advanced chemical modification pathways for Cardanol to create highly specialized products. Developing next-generation Cardanol-based epoxy curing agents, specialized polyols for polyurethane foams, and non-ionic surfactants offer significant future growth avenues. Moreover, the increasing adoption of friction materials in Electric Vehicles (EVs), which require specific thermal and wear characteristics, presents a niche market opportunity for modified Cardanol resins. The primary impact force accelerating market expansion is the convergence of stringent environmental regulations (mandating sustainable sourcing) and continuous innovation in distillation and purification techniques, ensuring Cardanol can meet the quality demands of highly technical end-user industries.

Segmentation Analysis

The Cardanol market is comprehensively segmented primarily based on its Purity Grade, which dictates its suitability for different applications, and by the Application Sector, reflecting the diverse end-uses across various industries. The purity grade segmentation is crucial because contaminants (such as residual CNSL components) can negatively impact the final product's curing time, color stability, and performance characteristics, especially in sensitive coatings and electrical insulation materials. Higher purity grades command premium pricing due to the complexity of multi-stage distillation processes required.

Application segmentation illustrates the versatility of Cardanol, ranging from bulk use in friction materials (where thermal resistance is key) to high-value use in specialty surfactants and corrosion inhibitors. The market is witnessing a trend towards specialization, with manufacturers developing specific Cardanol derivatives optimized for performance in niche areas such as marine antifouling coatings or high-temperature aerospace composites. Understanding these segments is vital for stakeholders, allowing them to focus R&D efforts and marketing strategies on the fastest-growing or highest-margin segments, such as advanced polyols derived from Cardanol.

Geographically, market segmentation reveals disparities in consumption patterns and regulatory frameworks. Asia Pacific dominates the volume consumption driven by infrastructural demand, while Europe and North America lead in value consumption due to stringent material specifications and a high willingness to pay for certified bio-based content. The ongoing investment in renewable chemical synthesis techniques globally is further driving the refinement of segment boundaries, promoting differentiation between standard industrial grades and specialty performance grades tailored for the electronics and medical device industries.

- By Purity Grade:

- Cardanol 90% (Standard Industrial Grade)

- Cardanol 95% and Above (High-Purity/Specialty Grade)

- By Application:

- Coatings and Paints (Marine, Protective, Automotive)

- Adhesives and Sealants (Structural, Construction)

- Friction Materials (Brake Linings, Clutch Facings)

- Surfactants and Intermediates (Detergents, Emulsifiers)

- Laminating Resins and Composites

- Others (Electrical Insulating Materials, Foam Production)

- By End-User Industry:

- Automotive and Transportation

- Construction and Infrastructure

- Marine

- Aerospace

- Electrical and Electronics

- Industrial Manufacturing

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Cardanol Market

The Cardanol value chain commences upstream with the procurement of raw Cashew Nut Shell Liquid (CNSL). This stage is heavily dependent on agricultural sourcing and primary cashew processing units, primarily located in tropical regions like India, Vietnam, Brazil, and parts of Africa. Upstream activities involve crushing the cashew shell and extracting the raw CNSL, followed by rudimentary thermal or solvent-based demetallization and filtration. The quality and stability of this crude CNSL directly influence the efficiency and cost of downstream Cardanol production, making stable long-term sourcing contracts crucial for manufacturers aiming for high purity output.

The midstream phase involves the complex chemical processing of crude CNSL into Cardanol. This conversion typically involves fractional distillation or solvent extraction methods under high vacuum to separate Cardanol (primarily the meta-substituted alkylphenol) from other components like Cardol and Anacardic Acid. The level of technological sophistication in this phase determines the final purity grade (90%, 95%, or higher). Manufacturers often invest heavily in advanced catalytic processes and proprietary column designs to meet stringent customer specifications, particularly those serving the electronics and aerospace sectors requiring colorless, highly stable products.

Downstream activities involve the formulation and distribution of Cardanol derivatives. Distribution channels are bifurcated into direct sales to large end-users (e.g., major friction material manufacturers or multinational coatings companies) and indirect sales through specialized chemical distributors and agents, particularly reaching smaller formulators in niche geographic markets. The end products—such as Cardanol-based epoxy resins, curing agents, friction particles, and polyurethane polyols—are then utilized by end-user industries, including automotive, marine, and construction, highlighting the deep integration of Cardanol into performance material supply chains.

Cardanol Market Potential Customers

Potential customers for Cardanol are broadly segmented across high-performance materials industries that prioritize durability, chemical resistance, and thermal stability, along with a growing focus on bio-based content. Manufacturers of protective coatings and industrial maintenance paints represent a significant customer base, particularly those serving marine vessels, offshore structures, and chemical processing facilities, which require superior resistance to corrosive environments and aggressive solvents. The automotive sector, including OEM suppliers for brake pads, clutch facings, and structural adhesives, relies heavily on Cardanol's capacity to maintain integrity under extreme heat and friction, positioning them as essential buyers of Cardanol resins and friction powders.

In the construction and infrastructure segment, buyers include manufacturers of specialty flooring, concrete coatings, and high-solid protective primers. Cardanol-based formulations provide superior adhesion to various substrates, enhanced water resistance, and often possess faster curing times compared to traditional phenol-based alternatives. Furthermore, the electronics and electrical insulation industry constitutes a high-value customer base, purchasing ultra-high-purity Cardanol derivatives for potting compounds, encapsulation materials, and laminating resins where consistent dielectric properties and heat dissipation are non-negotiable performance criteria.

Finally, the chemical intermediates and specialty additives sector represents a key customer group, utilizing Cardanol to synthesize bio-based surfactants, demulsifiers for oilfield chemicals, and specialized polyols used in the production of rigid and flexible polyurethane foams. These buyers seek Cardanol not just for its performance attributes but also to enhance their product sustainability profile, aligning with green chemical mandates and facilitating easier market access in ecologically conscious economies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 719.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cardolite Corporation, Palmer International Inc., P&G Chem, Kedia Organic Chemicals Pvt. Ltd., Satya Cashew Chemicals Pvt. Ltd., Arkema S.A., Dow Inc., Huntsman Corporation, Apex Resins, Altiris Inc., Senesel Private Limited, VAV Life Sciences Pvt. Ltd., Gold Coast Cashew Private Limited, Shivam Cashew Industry, Krown Cashew Products |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cardanol Market Key Technology Landscape

The technological landscape of the Cardanol market is heavily focused on refining and synthesizing higher purity grades and developing specialized derivatives to enhance end-use performance. The foundational technology remains the fractional distillation of crude Cashew Nut Shell Liquid (CNSL) under high vacuum. However, modern advancements involve continuous distillation columns coupled with proprietary packing materials designed to minimize thermal degradation and maximize the separation efficiency of Cardanol from Cardol and polymeric residues. This sophisticated processing is essential for meeting the stringent color and purity specifications demanded by high-end applications like clear protective coatings and electrical potting materials.

Beyond purification, significant technological effort is directed toward chemical modification pathways. One critical area is the hydrogenation of Cardanol to produce saturated derivatives, which eliminates the inherent unsaturation in the alkyl side chain. This hydrogenation process improves color stability, UV resistance, and oxidative stability, making these derivatives highly suitable for high-performance exterior coatings and stabilizers. Another essential technology involves the development of proprietary catalysts for the synthesis of Cardanol-based epoxy hardeners and advanced phenolic resins, offering superior reactivity and faster curing speeds at lower temperatures compared to traditional synthetic alternatives.

Furthermore, green chemistry technologies are gaining prominence. Manufacturers are exploring supercritical fluid extraction (SFE) as an environmentally benign alternative to solvent-based extraction methods for initial CNSL refinement. This shift aims to reduce the environmental footprint associated with manufacturing while ensuring high product quality. Research also focuses on utilizing enzymatic processes to selectively convert or separate CNSL components, potentially leading to purer and more cost-effective Cardanol streams, thereby enhancing overall sustainability and regulatory compliance, particularly in stringent markets like the European Union.

Regional Highlights

- Asia Pacific (APAC): Dominance in Production and Consumption

The APAC region holds the undisputed leadership position in the Cardanol market, driven by the convergence of high raw material availability and enormous demand across key industrial sectors. Countries like India and Vietnam are global leaders in cashew nut production and CNSL extraction, providing a localized and cost-effective supply chain for Cardanol manufacturers. This proximity to raw materials lowers transportation costs and enhances production competitiveness, cementing APAC's role as the global manufacturing hub for standard and mid-grade Cardanol.

Consumption within APAC is primarily propelled by the rapid expansion of infrastructure, automotive manufacturing, and shipbuilding industries, especially in China and India. The demand for industrial protective coatings, construction adhesives, and high-volume friction materials for vehicles continues to grow at an accelerating pace. Furthermore, governmental initiatives promoting "Make in India" and domestic manufacturing drives the uptake of locally sourced bio-based raw materials like Cardanol, although regulatory scrutiny regarding high-purity grades often lags behind that of Western counterparts.

- North America: Focus on High-Performance and Bio-based Alternatives

The North American market is characterized by high-value consumption and a pronounced emphasis on technological innovation and adherence to strict environmental standards. While the region lacks significant CNSL raw material sourcing, it serves as a critical consumer of high-purity and specialized Cardanol derivatives. Demand is concentrated in advanced applications such as aerospace coatings, specialized electrical components, and high-performance composites where performance specifications supersede cost concerns.

The region benefits from substantial investments in R&D aimed at developing sophisticated Cardanol derivatives, particularly for use in bio-based polyurethane and epoxy systems that comply with VOC (Volatile Organic Compound) reduction regulations imposed by bodies like the EPA. The automotive sector, particularly the rapidly expanding Electric Vehicle (EV) segment, represents a lucrative niche, requiring advanced friction and thermal management materials, which drives the market for specialty Cardanol resins utilized in advanced polymer blends and brake materials.

- Europe: Leading Green Chemistry Adoption and Regulatory Compliance

Europe is a pivotal market for Cardanol due to its stringent regulatory environment, exemplified by REACH, which favors sustainable, bio-based chemical inputs over traditional petrochemicals. This regulatory landscape strongly incentivizes the use of Cardanol in coatings, adhesives, and specialty chemicals to improve formulation sustainability scores and gain regulatory approval. European end-users, particularly in Germany, the UK, and France, are willing to pay a premium for certified sustainable Cardanol sources.

The demand drivers include the mature marine coatings sector, which requires highly durable and corrosion-resistant formulations, and the advanced manufacturing sector, which uses Cardanol in insulating resins and specialized composite components. European manufacturers are leaders in developing advanced Cardanol derivatives, focusing heavily on enhancing attributes like low color, low toxicity, and precise molecular weight distribution, often importing high-purity Cardanol 95%+ grades from global suppliers for sensitive formulations.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Industrialization and Resource Proximity

LATAM, led by Brazil, is important due to its substantial cashew production, positioning it as a key sourcing region for CNSL. Consumption is tied primarily to domestic infrastructure projects and automotive maintenance sectors. The market utilizes Cardanol predominantly in standard protective coatings and industrial adhesives, often focusing on cost-efficiency rather than ultra-high purity grades. Growth here is intrinsically linked to macroeconomic stability and governmental investment in construction and energy sectors.

The MEA region is emerging as a consumer, largely driven by oil and gas infrastructure expansion, requiring immense volumes of protective and anticorrosion coatings where Cardanol-modified epoxy systems excel. While local production remains limited outside of African cashew processing hubs, the demand for resilient materials in harsh desert and offshore environments provides a steady market for imported Cardanol and its derivatives, particularly for pipeline and refinery maintenance applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cardanol Market.- Cardolite Corporation

- Palmer International Inc.

- P&G Chem

- Kedia Organic Chemicals Pvt. Ltd.

- Satya Cashew Chemicals Pvt. Ltd.

- Arkema S.A.

- Dow Inc.

- Huntsman Corporation

- Apex Resins

- Altiris Inc.

- Senesel Private Limited

- VAV Life Sciences Pvt. Ltd.

- Gold Coast Cashew Private Limited

- Shivam Cashew Industry

- Krown Cashew Products

- Aditya Chemical Industries

- Wacker Chemie AG

- BASF SE

- Hexion Inc.

- Nagase ChemteX Corporation

Frequently Asked Questions

Analyze common user questions about the Cardanol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for high-purity Cardanol?

High-purity Cardanol (95%+ grade) is primarily driven by its use in specialized applications such as electrical encapsulants, high-performance structural adhesives in aerospace, and advanced marine coatings where consistent color stability and low conductivity are essential. Its high purity ensures optimal performance in precision manufacturing processes.

How does the sustainability profile of Cardanol compare to petrochemical-based phenols?

Cardanol holds a significant advantage as a bio-based chemical derived from Cashew Nut Shell Liquid (CNSL), a renewable agricultural byproduct. This contrasts sharply with traditional phenols and petrochemicals derived from fossil fuels, positioning Cardanol favorably under global mandates seeking sustainable and environmentally preferable raw materials, especially in Europe.

What impact does the price volatility of CNSL raw material have on the Cardanol market?

Raw CNSL supply is seasonal and subject to climate variability, leading to significant price volatility. This fluctuation creates challenges for Cardanol manufacturers regarding stable cost structures and consistent profit margins. Companies mitigate this through long-term sourcing contracts and investment in efficient production technologies to optimize yield.

Which geographical region is expected to exhibit the fastest growth in the Cardanol market?

The Asia Pacific (APAC) region is projected to experience the fastest market growth, primarily due to intense industrialization, massive ongoing infrastructure development projects, and the expanding automotive production base in countries like China and India, which fuels high consumption volumes across all application segments.

What role does Cardanol play in the Friction Materials industry?

Cardanol resins are crucial binders in non-asbestos friction materials (e.g., brake linings and clutch facings). They provide excellent thermal stability, ensuring the brake pads maintain structural integrity and friction performance even under high operating temperatures, making them essential components for automotive and industrial braking systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager