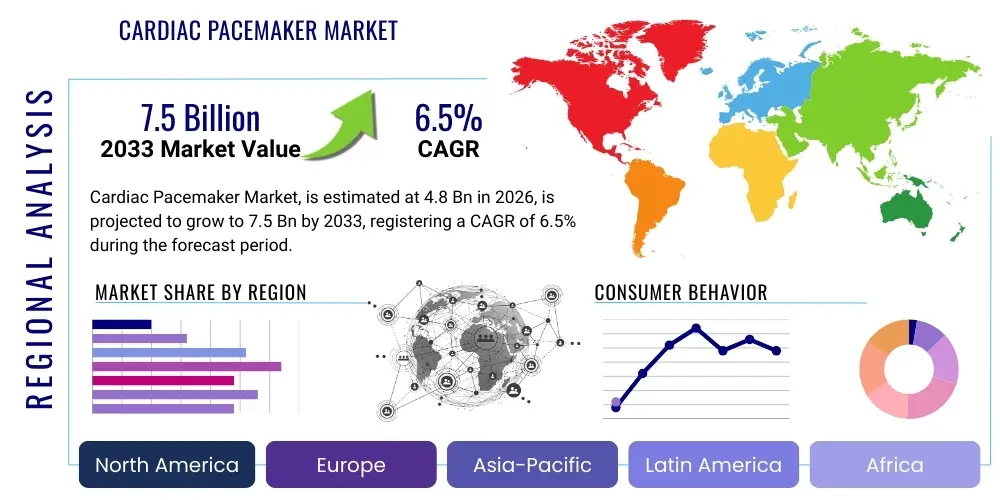

Cardiac Pacemaker Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441837 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Cardiac Pacemaker Market Size

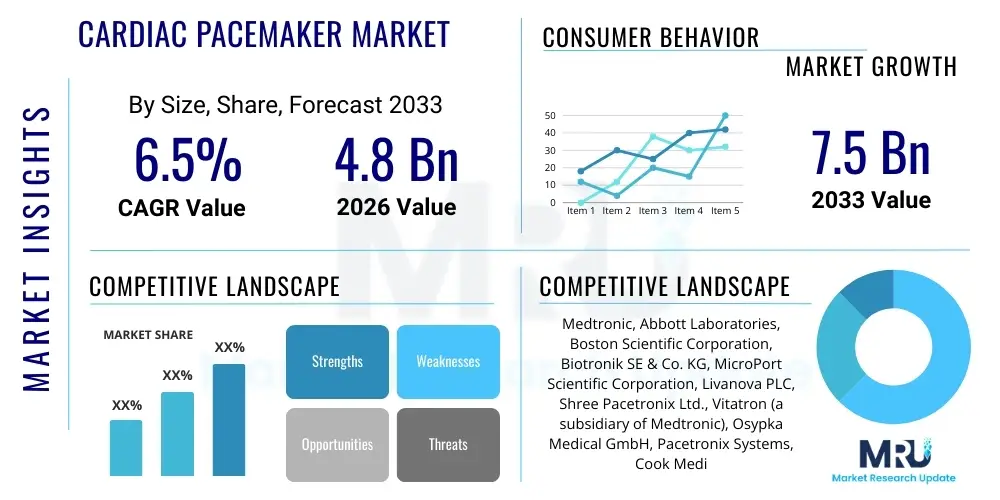

The Cardiac Pacemaker Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Cardiac Pacemaker Market introduction

The Cardiac Pacemaker Market encompasses devices designed to regulate the electrical impulses of the heart, primarily treating conditions such as bradycardia, where the heart beats too slowly. These medical devices deliver electrical stimuli to the heart muscle, maintaining an adequate heart rate and preventing symptoms associated with insufficient cardiac output, thereby significantly improving patient quality of life and survival rates. The fundamental product categories include traditional implantable pacemakers (single-chamber, dual-chamber, and biventricular) and the rapidly emerging segment of leadless pacemakers. Technological advancements, particularly miniaturization, enhanced battery life, and MRI compatibility, are continuously reshaping the competitive landscape, making devices safer and less invasive for recipients globally. Demand is fundamentally driven by the escalating prevalence of cardiovascular diseases, an aging global population susceptible to chronic heart conditions, and improved diagnostic capabilities leading to earlier intervention.

Major applications of cardiac pacemakers extend beyond simple bradycardia management to include specialized therapies for heart failure (using Cardiac Resynchronization Therapy or CRT-P devices) and prophylactic implantation in high-risk patients following myocardial infarction or certain conduction system disorders. The adoption of remote monitoring technologies has further solidified the market, allowing healthcare providers to continuously track device performance and patient cardiac rhythms without frequent in-person visits, enhancing patient compliance and facilitating proactive medical intervention. The market benefits substantially from increased healthcare expenditure across developed and rapidly developing economies, coupled with favorable reimbursement policies for life-sustaining cardiovascular implants, which accelerates the integration of high-cost, advanced pacemaker systems into standard care protocols.

Key driving factors supporting the market expansion include the paradigm shift towards personalized medicine, where pacemakers are programmed based on specific patient physiological requirements, and the introduction of advanced features like rate-responsive pacing and physiological sensors. Furthermore, global efforts to manage non-communicable diseases, especially those related to cardiac health, coupled with technological breakthroughs reducing post-operative complications, ensure sustained growth. The continuous refinement of device algorithms to optimize energy use and minimize unnecessary ventricular pacing represents a critical trend, aiming for devices that mimic natural cardiac physiology as closely as possible while reducing long-term complications associated with chronic implantation.

Cardiac Pacemaker Market Executive Summary

The Cardiac Pacemaker Market is characterized by robust technological innovation, competitive consolidation among major global medical device manufacturers, and expanding geographic penetration into emerging economies. Current business trends heavily favor the development and adoption of leadless pacing technology, which offers significant advantages in terms of reduced complications associated with traditional transvenous leads, driving premium pricing and faster market adoption in centers of excellence. Furthermore, manufacturers are investing heavily in connectivity solutions, integrating pacemakers with digital health platforms and secure cloud infrastructure to enable sophisticated data analysis and real-time remote patient management. This shift towards data-driven cardiac rhythm management represents a crucial differentiator, transforming pacemakers from passive implants into active components of a comprehensive cardiovascular monitoring ecosystem. The stringent regulatory environment in regions like North America and Europe, while posing barriers to entry, also mandates high standards for device safety and efficacy, further consolidating market share among established players capable of navigating complex approval processes.

Regionally, North America maintains its dominance due to high disposable income, well-established healthcare infrastructure, and favorable reimbursement structures for expensive cardiovascular procedures, coupled with a high prevalence of aging-related heart rhythm disorders. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid expansion of healthcare access, increasing awareness regarding cardiac arrhythmia treatment, and a burgeoning patient population. Significant investments in healthcare infrastructure development, particularly in countries like China and India, are opening new avenues for market players, although pricing pressures and the need for localized product strategies remain important challenges. European markets exhibit steady, stable growth, driven by early adoption of advanced pacing modalities and strong governmental support for implantable medical device technologies, emphasizing value-based healthcare outcomes.

Segment trends highlight the shift from conventional dual-chamber pacemakers towards advanced, physiologically sophisticated devices, including MRI-conditional pacemakers becoming the industry standard due to the increasing need for diagnostic imaging compatibility. The battery segment is undergoing continuous refinement, with improvements in lithium-ion and other proprietary battery chemistries extending device longevity, reducing the frequency of replacement surgeries. In terms of end-users, hospitals remain the primary consumers due to the necessity of specialized surgical environments for implantation procedures, although ambulatory surgical centers are gaining traction for routine replacements and less complex primary implantations. The ongoing convergence of diagnostics and therapy within the pacemaker device itself is defining future growth trajectory, emphasizing devices that can dynamically adapt pacing parameters based on real-time physiological status.

AI Impact Analysis on Cardiac Pacemaker Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Cardiac Pacemaker Market frequently revolve around personalized therapy optimization, predictive maintenance of device function, and the efficiency of remote monitoring data analysis. Users are keenly interested in how AI algorithms can improve the longevity of devices by optimizing pacing energy expenditure and how machine learning can predict adverse cardiac events, such as atrial fibrillation or impending heart failure exacerbations, far earlier than traditional methods. A key concern focuses on data security, regulatory oversight for AI-driven clinical decisions, and ensuring that AI integration maintains or enhances device reliability. The core expectation is that AI will move pacemakers beyond simple rate control to sophisticated, adaptive devices capable of truly personalized, closed-loop pacing therapy.

AI's primary influence is manifesting through sophisticated algorithms that interpret vast datasets generated by remote monitoring systems. Traditional monitoring often relies on clinicians manually reviewing alerts; AI automates this process, flagging only clinically significant events and reducing the burden of false positives, thereby enhancing the efficiency of remote care delivery. Moreover, AI is instrumental in refining device programming. By analyzing a patient's historical rhythm data, activity levels, and lead impedance trends, AI models can recommend optimal pacing modes and parameters, maximizing physiological synchrony and minimizing unnecessary pacing, which directly conserves battery life and improves patient outcomes. This capability allows for therapeutic personalization at a scale previously unattainable.

Looking ahead, AI is expected to revolutionize the design phase of future pacemakers, optimizing electrode placement through computational modeling and predicting material degradation, thereby enhancing device reliability and reducing manufacturing costs. Furthermore, in clinical settings, AI-powered diagnostic tools integrated into the pacemaker telemetry system will assist in the differential diagnosis of complex arrhythmias detected by the device. This integration streamlines clinical workflows, potentially reducing the time from event detection to therapeutic adjustment. The integration of AI also provides manufacturers with unprecedented insight into real-world device performance and patient response, fueling rapid iterative improvements in device functionality and safety profiles.

- AI-driven optimization of pacing parameters for enhanced battery longevity.

- Predictive analytics for early detection of lead failure or component malfunction.

- Automated analysis of remote monitoring data, reducing clinical alert fatigue.

- Machine learning for personalized rhythm management and adaptive pacing therapy.

- Improved diagnostic accuracy of complex arrhythmias through embedded AI algorithms.

- Simulation and modeling of device performance during the product development lifecycle.

DRO & Impact Forces Of Cardiac Pacemaker Market

The dynamics of the Cardiac Pacemaker Market are shaped by a powerful confluence of demographic factors, technological advancements, and stringent regulatory controls. The major drivers stem from the global increase in the geriatric population, which has a higher propensity for bradyarrhythmias and other chronic cardiac conditions requiring pacing intervention, alongside the rising prevalence of modifiable risk factors contributing to cardiovascular disease progression in younger demographics. Simultaneously, technological innovation, especially the transition towards leadless and MRI-compatible pacemakers, significantly improves patient acceptance and clinical safety, creating powerful growth momentum. However, high initial device costs and procedural expenses, coupled with intense regulatory scrutiny and the risk of device recalls, act as substantial restraints. The central opportunity lies in expanding market penetration into underserved low- and middle-income countries, coupled with the ongoing development of cost-effective, high-performance battery technologies to maximize device longevity and reduce lifetime care costs.

Market growth is highly susceptible to impact forces related to healthcare policy and public perception of implantable medical devices. Government regulations regarding medical device approval, intellectual property protection, and mandatory safety standards exert immense pressure on manufacturers, necessitating long and costly R&D cycles. Furthermore, geopolitical stability affects global supply chains for critical components, impacting manufacturing scale and cost efficiency. The perceived efficacy and safety of new generations of pacemakers, often communicated through clinical studies and professional society guidelines, strongly influence adoption rates among cardiologists and electrophysiologists. Economic factors, particularly insurance coverage and public healthcare budgeting decisions, directly dictate patient access to advanced pacing therapies, especially in regions relying heavily on centralized healthcare funding mechanisms.

A critical impact force is the intellectual property landscape, characterized by complex patent portfolios held by dominant market players. Litigation over core pacing technologies can impede the entry of new competitors or force licensing agreements, impacting overall market innovation and pricing. Another significant force is the pressure for value-based healthcare outcomes, which pushes manufacturers to demonstrate not only device functionality but also long-term cost-effectiveness and measurable improvements in patient quality of life. This requires extensive post-market surveillance and data collection, transforming the competitive environment from purely technical specification battles to evidence-based health economics demonstrations. The ongoing threat of cybersecurity vulnerabilities, especially concerning remotely monitored devices, also acts as a profound impact force, demanding continuous investment in robust, secure communication protocols to maintain clinical trust and regulatory compliance in the digital age.

Segmentation Analysis

The Cardiac Pacemaker Market is systematically segmented based on Product Type, Technology, Application, and End-User, reflecting the diverse clinical needs and technological maturity within the cardiology sector. Product type segmentation distinguishes between Implantable Pacemakers and External Pacemakers, with the implantable segment dominating due to its long-term therapeutic nature. Implantable devices are further categorized by chamber specification (single-chamber, dual-chamber, biventricular/CRT-P), with dual-chamber pacemakers holding the largest market share, offering a balanced approach to rate synchronization and physiological pacing benefits for a broad patient demographic. The growing trend toward specialized, minimally invasive solutions is driving the rapid expansion of leadless pacemakers within the implantable category, promising significant long-term market disruption due to their reduced invasiveness and infection risk.

Technology-based segmentation reveals the shift towards devices that are compatible with modern medical imaging techniques, specifically focusing on MRI-conditional pacemakers, which have become the expected standard of care globally, replacing older, non-conditional devices. Furthermore, advances in battery technology and sophisticated monitoring capabilities define sub-segments, including rate-responsive pacemakers that adapt pacing based on physiological demand (e.g., activity levels) and pacemakers integrated with remote monitoring capabilities. Application segmentation is predominantly driven by the underlying cardiac condition being treated, such as Arrhythmias (Bradycardia, Tachycardia), Heart Failure (requiring CRT-P), and Syncope, each demanding slightly different device specifications and programming complexities. Bradycardia management remains the largest application area, constituting the primary indication for device implantation.

End-user segmentation clearly identifies Hospitals and Cardiac Centers as the primary consumers, owing to the infrastructural requirements, specialized surgical expertise, and post-operative care necessary for pacemaker implantation and follow-up. These facilities handle the high volume of initial implantations and complex device replacements. However, the increasing sophistication and stability of remote monitoring systems are expanding the role of specialized Cardiac Clinics and Ambulatory Surgical Centers (ASCs), particularly for routine battery replacement and follow-up care in established patient populations. The segmentation underscores a market moving towards personalized devices that offer superior long-term performance, integrate seamlessly with digital health ecosystems, and prioritize patient safety and diagnostic flexibility through features like MRI compatibility.

- By Product Type:

- Implantable Pacemakers

- Single-Chamber Pacemaker

- Dual-Chamber Pacemaker

- Biventricular/CRT-P Pacemaker

- Leadless Pacemaker

- External Pacemakers

- By Technology:

- MRI-Conditional Pacemakers

- Rate-Responsive Pacemakers

- Remote Monitoring Pacemakers

- By Application:

- Arrhythmias (Bradycardia, Sick Sinus Syndrome, Heart Block)

- Heart Failure (Cardiac Resynchronization Therapy - CRT)

- Syncope and Other Conduction Disorders

- By End-User:

- Hospitals and Cardiac Centers

- Ambulatory Surgical Centers (ASCs)

- Specialized Cardiac Clinics

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (Japan, China, India, Australia, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (South Africa, GCC Countries, Rest of MEA)

Value Chain Analysis For Cardiac Pacemaker Market

The value chain for the Cardiac Pacemaker Market begins with intensive upstream activities focused on raw material procurement and highly specialized component manufacturing. This upstream segment is dominated by suppliers providing critical components such as advanced lithium-ion battery cells with extended lifespan, specialized biocompatible materials (e.g., titanium, medical-grade polymers for casing), microprocessors, and high-purity electrical leads. Suppliers in this phase require stringent quality control certifications (ISO 13485) and often engage in long-term, exclusive contracts with pacemaker manufacturers due to the specialized nature and strict regulatory requirements of these inputs. Research and Development (R&D) is intrinsically linked to the upstream phase, focusing on miniaturization, enhanced cybersecurity features, and developing proprietary pacing algorithms. The competitive advantage at this stage often relies on intellectual property related to battery longevity and lead integrity.

The manufacturing and assembly stage is highly centralized, typically involving complex, sterile production environments and rigorous testing protocols mandated by regulatory bodies like the FDA and CE. Leading manufacturers focus on optimized production processes to minimize defect rates, which are critically important for life-sustaining implants. Distribution and logistics form the midstream of the value chain. Due to the high value and sensitive nature of pacemakers, distribution channels must be meticulously managed, often involving direct sales forces or specialized distributors with certified temperature-controlled storage and handling capabilities. Training for clinical staff on new device models is a key component of the distribution effort, ensuring safe and effective implantation.

Downstream activities center on the healthcare system and patient interaction. This involves the implantation procedure performed by electrophysiologists in hospitals, followed by crucial post-implantation care and monitoring. The trend towards remote monitoring has dramatically altered the downstream component, shifting follow-up responsibilities partly from in-person clinic visits to remote data transmission managed by proprietary device networks and secure cloud infrastructure. The indirect channel involves group purchasing organizations (GPOs) and health insurance providers who influence pricing and market access through contractual agreements. Ultimately, the downstream value is realized through successful patient outcomes, tracked through post-market surveillance and long-term device performance data, which loops back to inform upstream R&D activities.

Cardiac Pacemaker Market Potential Customers

Potential customers for cardiac pacemakers are primarily individuals suffering from specific cardiac arrhythmias and conduction system disorders that necessitate external electrical intervention to maintain appropriate heart rhythm. The largest demographic segment comprises the elderly population (aged 65 and above), as the incidence of conditions like sick sinus syndrome, chronic atrial fibrillation with slow ventricular response, and high-degree atrioventricular (AV) block increases significantly with age. These individuals typically present with symptoms such as fainting (syncope), severe fatigue, and dizziness, indicating inadequate cardiac output requiring permanent pacing. Due to the chronic and life-sustaining nature of the device, these patients represent a continuous market for initial implantation and subsequent device replacements throughout their remaining lifespan.

Beyond the geriatric cohort, another significant segment includes younger patients with congenital heart defects, inherited conduction disorders (such as Brugada syndrome or Long QT syndrome in specific circumstances), or those requiring pacing therapy following cardiac surgery or myocardial infarction that resulted in irreversible damage to the heart's electrical pathways. Furthermore, a growing patient population requiring Cardiac Resynchronization Therapy (CRT-P devices) for severe heart failure represents a high-value niche segment. These patients benefit from specialized biventricular pacing to synchronize the contraction of the left and right ventricles, leading to improved heart function and quality of life, positioning them as key targets for advanced, high-cost devices.

The primary direct institutional buyers are hospitals, specialized cardiac centers, and electrophysiology laboratories, which procure the devices in bulk through negotiated contracts with manufacturers or GPOs. These institutions act as gatekeepers, providing the environment and expertise for implantation. Secondary customers include private cardiac clinics and ambulatory surgical centers increasingly involved in routine replacement procedures. The ultimate decision-makers are the electrophysiologists and cardiologists who determine the necessity, type, and specific brand of the pacemaker based on clinical guidelines, device performance history, and patient physiological requirements, making professional education and clinical evidence critical factors in the purchasing cycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Abbott Laboratories, Boston Scientific Corporation, Biotronik SE & Co. KG, MicroPort Scientific Corporation, Livanova PLC, Shree Pacetronix Ltd., Vitatron (a subsidiary of Medtronic), Osypka Medical GmbH, Pacetronix Systems, Cook Medical, GE Healthcare, Lepu Medical Technology, CardioComm Solutions, Inc., Zoll Medical Corporation, Sorin Group (now part of Livanova), Qinming Medical, AtriCure, Inc., Teleflex Incorporated, Schiller AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cardiac Pacemaker Market Key Technology Landscape

The technological landscape of the Cardiac Pacemaker Market is undergoing a rapid evolution, primarily driven by the imperative to improve patient safety, enhance diagnostic flexibility, and extend device longevity. The most significant shift is the widespread adoption of Magnetic Resonance Imaging (MRI)-Conditional technology. Historically, pacemakers were absolute contraindications for MRI due to the risk of lead heating and device malfunction. Modern pacemakers are engineered with specialized materials and filtering systems that allow patients to safely undergo MRI procedures, crucial for diagnosing common co-morbidities like stroke or cancer. This feature is now a fundamental requirement for market competitiveness, significantly influencing replacement cycles as older non-MRI devices are phased out.

Another transformative technology is the Leadless Pacemaker (LP). LPs, such as Medtronic’s Micra, represent a major advancement by eliminating the need for transvenous leads, which are often the source of long-term complications, including infection, lead fracture, and venous occlusion. These miniature, self-contained devices are implanted directly into the right ventricle via a minimally invasive catheter approach. While currently limited to single-chamber pacing, the R&D focus is on expanding leadless technology to dual-chamber functionality, which would dramatically accelerate their adoption and solidify their position as the gold standard for many patients. The reduced risk profile associated with LPs addresses a critical clinical restraint related to lead-related morbidity and mortality.

Furthermore, the integration of advanced sensors and telemetry capabilities is defining the current generation of pacemakers. Devices now feature sophisticated physiological sensors (e.g., accelerometers, minute ventilation sensors) enabling Rate-Responsive Pacing, which dynamically adjusts the heart rate based on the patient's metabolic demand, providing more physiological pacing than fixed-rate modes. Crucially, Remote Monitoring (RM) capability, facilitated by secure wireless connectivity and proprietary home monitoring units, allows for continuous, proactive surveillance of device status and cardiac rhythm. RM not only enhances patient safety by detecting asymptomatic issues early but also reduces the necessity for frequent clinical visits, lowering overall healthcare costs and optimizing resource allocation within cardiac clinics globally.

Regional Highlights

The global Cardiac Pacemaker Market demonstrates distinct regional dynamics heavily influenced by healthcare spending, regulatory frameworks, demographic profiles, and technological absorption rates. North America, specifically the United States, represents the largest market share holder. This dominance is attributable to the high prevalence of cardiac diseases among an affluent, aging population, coupled with an advanced healthcare system that provides high reimbursement rates for sophisticated implantable devices. The region is characterized by early and rapid adoption of cutting-edge technologies, such as leadless and MRI-compatible pacemakers, driven by strong competitive forces among leading manufacturers and favorable clinical guidelines from major cardiology societies. The U.S. market sets the benchmark for technological innovation and pricing structures globally.

Europe holds the second-largest market position, exhibiting stable, mature growth, particularly in Western European nations like Germany, the U.K., and France. Market expansion here is driven by universal healthcare access, comprehensive national health insurance coverage for necessary procedures, and a strong regulatory focus on device safety and efficacy established by the European Medicines Agency (EMA). European demand is characterized by a strong preference for devices offering proven longevity and clinical utility, with a high uptake of CRT-P devices for heart failure management. Eastern European countries are rapidly improving their healthcare infrastructure, presenting long-term growth potential as they harmonize their clinical practices with established Western European standards.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally throughout the forecast period. This rapid expansion is fundamentally driven by massive patient populations, rising incidences of lifestyle-related heart diseases, and significant improvements in healthcare expenditure and infrastructure, particularly in populous economies like China, India, and South Korea. While historically reliant on lower-cost or refurbished devices, the APAC market is increasingly adopting high-end pacemakers due to rising medical tourism and the establishment of international-standard cardiac centers. Market players often face unique challenges in APAC related to varying reimbursement schemes and the necessity of developing cost-sensitive product variants to penetrate the broader consumer base effectively. Latin America and the Middle East and Africa (MEA) represent smaller but growing markets, primarily constrained by limited healthcare access and lower per capita spending, though specific urban centers in Brazil, Mexico, and GCC countries show high demand for advanced pacing technologies.

- North America: Dominant market share due to advanced healthcare system, high procedure volumes, and early adoption of leadless pacemakers and CRT devices.

- Europe: Stable growth fueled by universal healthcare coverage, high geriatric population density, and strict adherence to MRI-conditional standards.

- Asia Pacific (APAC): Highest CAGR, driven by rising health awareness, massive population susceptible to heart disease, and increasing public and private healthcare investment in countries like China and India.

- Latin America (LATAM): Growth driven by expanding private healthcare sector and increasing awareness, particularly in urban areas, though constrained by economic instability.

- Middle East and Africa (MEA): Growth concentrated in affluent GCC countries, focusing on establishing specialty cardiac care centers and attracting medical tourism.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cardiac Pacemaker Market.- Medtronic

- Abbott Laboratories (formerly St. Jude Medical)

- Boston Scientific Corporation

- Biotronik SE & Co. KG

- MicroPort Scientific Corporation

- Livanova PLC

- Shree Pacetronix Ltd.

- Vitatron (a subsidiary of Medtronic)

- Osypka Medical GmbH

- Pacetronix Systems

- Cook Medical

- GE Healthcare

- Lepu Medical Technology

- CardioComm Solutions, Inc.

- Zoll Medical Corporation

- Sorin Group (now part of Livanova)

- Qinming Medical

- AtriCure, Inc.

- Teleflex Incorporated

- Schiller AG

Frequently Asked Questions

Analyze common user questions about the Cardiac Pacemaker market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Cardiac Pacemaker Market?

The primary driver is the rapid aging of the global population, which correlates directly with a significantly increased incidence of chronic bradyarrhythmias and other heart conduction disorders requiring pacemaker intervention. Additionally, continuous technological advances, such as leadless and MRI-compatible devices, enhance patient acceptance and clinical utility.

How do leadless pacemakers compare in performance to traditional transvenous pacemakers?

Leadless pacemakers (LPs) are generally comparable in efficacy for single-chamber pacing but offer superior safety by eliminating lead-related complications, such as lead fracture, venous occlusion, and device pocket infections. They are currently smaller and inserted via a minimally invasive route, often resulting in quicker recovery times.

Which regions hold the largest and fastest-growing market shares?

North America currently holds the largest market share due to its established infrastructure and high adoption of advanced devices. However, the Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), driven by improving healthcare access and rising prevalence of cardiovascular diseases in countries like China and India.

What role does AI play in modern pacemaker technology?

AI is increasingly used to optimize pacemaker function, primarily through analyzing large datasets from remote monitoring systems to personalize pacing parameters, predict potential device malfunctions, and streamline the detection of clinically significant cardiac events, thereby improving overall efficiency and battery life.

What are the key technological advancements expected to define the future market?

The future market will be defined by the expansion of leadless technology to dual-chamber pacing, the integration of advanced physiological sensors for true closed-loop adaptive pacing, and enhanced cybersecurity features to ensure the integrity of remotely monitored patient data and device programming integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager