Carpet Manufacturing Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441377 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Carpet Manufacturing Machines Market Size

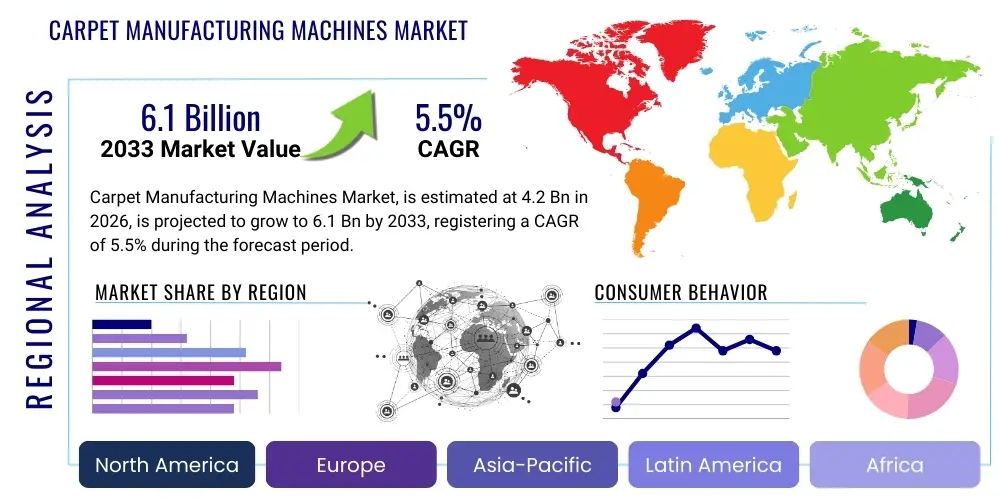

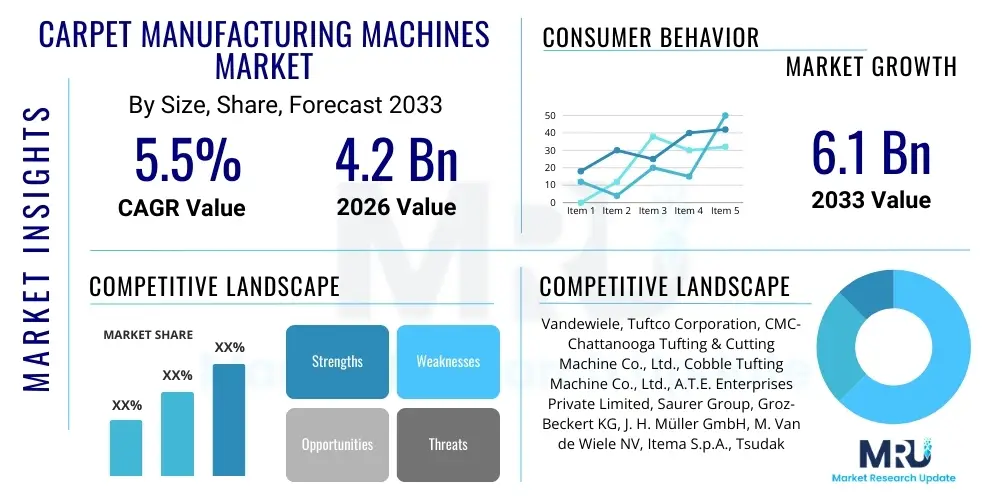

The Carpet Manufacturing Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at $4.2 Billion in 2026 and is projected to reach $6.1 Billion by the end of the forecast period in 2033.

Carpet Manufacturing Machines Market introduction

The Carpet Manufacturing Machines Market encompasses a sophisticated range of industrial equipment utilized for the high-volume production of various carpet types, including tufted, woven, needle-punched, and knitted carpets. These machines are crucial components in the textile industry value chain, enabling manufacturers to meet the escalating global demand for flooring solutions across residential, commercial, and automotive sectors. The primary products include high-speed tufting machines, weaving looms (such as Wilton and Axminster), and specialized finishing and coating machinery. Technological advancements, particularly in automation and precision engineering, are consistently driving the evolution of this market, allowing for increased production efficiency, reduced material waste, and the creation of complex, high-definition carpet designs. The emphasis is increasingly shifting towards machines that can process sustainable and recycled fibers, aligning with global environmental, social, and governance (ESG) standards.

Major applications of these manufacturing machines span across several high-growth industries. Residential construction remains a foundational application, driven by new housing starts and remodeling activities globally. Commercial applications, including hospitality (hotels, resorts), corporate offices, and institutional buildings (schools, hospitals), demand durable, high-traffic carpet solutions, dictating specific technological requirements for the machinery producing them. Furthermore, the automotive sector uses specialized, highly precise machines to produce molded carpets and floor mats for vehicle interiors, emphasizing lightweight materials and rapid cycle times. The benefits derived from modern carpet manufacturing machines include unparalleled production speed, versatility in handling different fibers and backing materials, superior quality control mechanisms, and the ability to rapidly switch between product lines, which is essential for customized or fast-fashion flooring trends.

The driving factors propelling the growth of this market are multifaceted, centering on urbanization, increasing disposable incomes in emerging economies, and persistent infrastructure development. The push for automated and energy-efficient machinery is also significant, as manufacturers seek to lower operational costs and improve overall profitability. Additionally, the growing consumer preference for aesthetic and comfortable interiors, coupled with continuous innovation in fiber technology (e.g., stain-resistant and antibacterial carpets), compels carpet manufacturers to invest in the latest generation of production equipment capable of processing these advanced materials effectively. Regulatory compliance concerning worker safety and environmental emissions also necessitates the adoption of modern, enclosed, and highly efficient manufacturing systems.

Carpet Manufacturing Machines Market Executive Summary

The Carpet Manufacturing Machines Market is exhibiting robust growth, fundamentally shaped by shifting global business trends focusing on automation, digitalization (Industry 4.0), and sustainability. Business trends highlight a consolidation among machinery manufacturers, coupled with intense research and development efforts aimed at increasing machine speed, precision, and minimizing downtime through predictive maintenance solutions enabled by the Industrial Internet of Things (IIoT). Regional trends indicate that Asia Pacific, spearheaded by China and India, remains the dominant growth engine due to expansive infrastructure projects and a surging domestic demand for affordable and luxury carpets. Conversely, established markets in North America and Europe emphasize the replacement cycle of older machinery with high-efficiency, digitally integrated systems, driving demand for premium, specialized equipment. Segmentation trends reveal that tufting machines continue to hold the largest market share owing to their high throughput and versatility, while the demand for high-end weaving machinery is experiencing steady growth driven by the luxury and custom carpet segments.

Investment patterns across the globe are heavily favoring integrated manufacturing lines that offer end-to-end solutions, encompassing raw material preparation, primary manufacturing, and intricate finishing processes such as latex application and shearing. This comprehensive approach maximizes operational synergy and reduces reliance on multiple independent suppliers. The competitive landscape is characterized by leading European manufacturers who maintain a technological edge in complex weaving and sophisticated electronic control systems, facing increasing competition from Asian counterparts focused on scalability and competitive pricing. Strategic market expansion is being pursued through localized production facilities and enhanced aftermarket service networks, recognizing that lifecycle support is a crucial differentiating factor for high-capital machinery.

The sustainability mandate is rapidly evolving from a niche consideration to a core operational requirement, impacting the machinery market profoundly. Manufacturers are demanding machines that facilitate the use of recycled PET, bio-based polymers, and minimal water consumption during dyeing and finishing processes. This trend is influencing R&D priorities, pushing towards modular machine designs that are easier to upgrade and maintain, extending their operational life and conforming to circular economy principles. Furthermore, geopolitical stability and global trade dynamics, particularly tariffs on imported machinery and finished carpets, introduce complexity, requiring manufacturers to maintain flexible supply chains and adapt their sourcing and distribution strategies frequently to mitigate economic risks.

AI Impact Analysis on Carpet Manufacturing Machines Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Carpet Manufacturing Machines Market typically revolve around operational efficiency gains, the future of skilled labor, and the potential for hyper-customization. Users frequently ask: "How can AI reduce material waste in tufting?", "Will AI-driven diagnostics replace human maintenance technicians?", and "Can AI enable batch-of-one carpet production economically?" The analysis reveals that key themes center on autonomous quality control, predictive maintenance, and optimized machine performance tuning. Users expect AI to transcend simple automation by providing cognitive capabilities that dramatically improve precision, especially in complex pattern generation and fault detection, thereby addressing the persistent industry challenges of minimizing scrap rates and maximizing uptime in highly demanding, continuous manufacturing environments.

The integration of AI algorithms, particularly machine learning (ML) models, is fundamentally transforming the operational paradigm of carpet manufacturing. In quality control, AI-powered vision systems are employed to inspect carpet surfaces in real-time, detecting minuscule defects—such as missing tufts or color inconsistencies—with far greater speed and accuracy than human operators. This immediate feedback loop allows machine parameters to be adjusted autonomously, minimizing the production of substandard goods and resulting in substantial material and energy savings. Furthermore, in the context of predictive maintenance, ML algorithms analyze vast datasets streaming from machine sensors (vibration, temperature, power consumption) to forecast potential component failures, enabling proactive intervention and shifting maintenance strategies from reactive to condition-based, thereby optimizing the utilization rate of capital equipment.

Beyond quality and maintenance, AI is critically influencing design and production flexibility. Generative AI tools are being explored to assist designers in creating novel, complex patterns optimized for specific machine capabilities and material limitations, accelerating the time-to-market for new products. On the operational side, AI-driven scheduling and resource allocation systems manage complex production lines, optimizing the flow of different yarn types and coordinating multiple machines to fulfill diverse orders efficiently. This enhanced cognitive capability allows manufacturers to pursue mass customization strategies more cost-effectively, catering to specialized architectural projects and designer specifications without the prohibitive setup costs previously associated with small-batch or personalized production runs, ultimately increasing market responsiveness and competitive advantage.

- AI-driven real-time quality inspection reducing defect rates by up to 20%.

- Predictive maintenance analytics forecasting component failure, increasing uptime by 15-25%.

- Optimization of yarn tension and feed rates via ML models, minimizing fiber breakage and waste.

- Enhanced energy consumption management through intelligent load balancing across large machine parks.

- Accelerated design cycle using Generative AI for pattern creation and simulation.

- Autonomous fault detection in high-speed weaving and tufting processes.

- Improved supply chain logistics planning for raw materials based on forecasted production needs.

- Hyper-customization capability supported by AI-optimized production scheduling.

DRO & Impact Forces Of Carpet Manufacturing Machines Market

The Carpet Manufacturing Machines Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the Impact Forces that shape its trajectory. Key drivers include rapid urbanization, leading to increased demand for residential and commercial flooring, particularly in developing regions. Furthermore, the persistent need for efficiency gains and reduced labor costs compels manufacturers to invest in advanced, automated machinery, driving replacement and expansion cycles. Opportunities abound in the realm of sustainable manufacturing, where machine developers focusing on equipment compatible with recycled materials and low-impact production processes stand to capture significant market share. Conversely, the high initial capital investment required for state-of-the-art tufting and weaving machinery acts as a significant restraint, particularly for small and medium-sized enterprises (SMEs), coupled with the vulnerability of the market to macroeconomic volatility and cyclical slowdowns in the construction sector. The confluence of these forces dictates market evolution, favoring suppliers who can offer financing solutions, long-term maintenance contracts, and technological superiority.

The primary impact forces can be categorized into technological, economic, and regulatory factors. Technologically, the shift towards Industry 4.0, integrating IoT, AI, and cloud computing into machinery operations, is rapidly accelerating obsolescence for older equipment and simultaneously opening vast avenues for smart manufacturing integration. Economically, fluctuations in raw material prices, particularly synthetic polymers and metals used in machine construction, directly affect manufacturing costs and pricing strategies. Trade barriers and global economic stability also play a critical role, influencing cross-border sales and investment in new capacity. Regulatory forces, primarily environmental standards regarding factory emissions, noise pollution, and energy efficiency (especially in Europe), pressure machinery designers to develop cleaner and quieter operational systems, transforming compliance into a potential competitive differentiator for early adopters.

The overall impact of these forces suggests a widening gap between technologically advanced machinery manufacturers and those reliant on conventional, slower production methods. The demand structure is polarizing: high-growth markets demand high throughput and moderate cost, while established markets prioritize precision, specialized capabilities (e.g., precise patterning for luxury rugs), and robust digital integration. Successfully navigating this landscape requires strategic flexibility, focusing on modular machine design to cater to diverse regional needs, and prioritizing R&D into proprietary software and control systems that offer a distinct operational advantage. The sustainability imperative will increasingly be a non-negotiable factor, shifting market power toward machinery capable of handling biodegradable or recycled materials efficiently, thus aligning commercial objectives with global environmental responsibilities.

Segmentation Analysis

The Carpet Manufacturing Machines Market is meticulously segmented based on Machine Type, Application, Operation Mode, and Technology, reflecting the specialized needs and capabilities within the textile manufacturing ecosystem. This segmentation provides a granular view of market dynamics, enabling stakeholders to pinpoint high-growth areas and tailor their product strategies. Key differentiators include the output volume, the type of carpet fabric produced (e.g., loop pile, cut pile), and the level of automation employed. Analysis shows that the Tufting Machine segment dominates due to its ability to produce the vast majority of machine-made carpets quickly and cost-effectively, whereas segments like Axminster and Wilton looms cater to the premium and specialized architectural markets demanding intricate patterns and higher durability. Understanding these segmentation nuances is essential for market players aiming for optimal resource allocation and targeted innovation in machine design.

- By Machine Type:

- Tufting Machines (Broadloom, Single-needle, Multi-needle)

- Weaving Machines (Axminster Looms, Wilton Looms, Face-to-Face Looms)

- Needle Punching Machines

- Finishing and Coating Equipment (Latex Applicators, Shearing Machines, Backing Lines)

- Carpet Printing Machines (Digital Printing, Rotary Screen Printing)

- By Operation Mode:

- Automatic/Computer-Controlled Machines

- Semi-Automatic Machines

- By Application:

- Residential Carpeting

- Commercial Carpeting (Office, Hospitality, Retail)

- Automotive Carpeting and Textiles

- Industrial and Institutional Carpeting

- By Technology:

- Mechanical Technology

- Electronic Jacquard Technology

- High-Speed Digital Control Systems

Value Chain Analysis For Carpet Manufacturing Machines Market

The value chain for the Carpet Manufacturing Machines Market is complex, beginning with the upstream supply of precision components and culminating in the end-user deployment and long-term service support of the equipment. Upstream analysis focuses on specialized component suppliers, including manufacturers of electronic controls, servo motors, specialized needles and hooks (for tufting machines), and high-strength machine tool steel. The reliance on suppliers capable of delivering high-tolerance, durable parts is crucial, as the performance and longevity of the final carpet machinery depend heavily on the quality of these core components. Strong relationships with these niche suppliers, often located in industrialized regions like Germany, Japan, and Italy, are essential for maintaining a competitive edge in machine quality and technological integration.

The core manufacturing stage involves the assembly, testing, and system integration of the complex machinery. Manufacturers often employ sophisticated Computer-Aided Manufacturing (CAM) techniques and lean production principles to ensure precision engineering and cost control. Downstream activities involve distribution, installation, and comprehensive aftermarket support. Distribution channels are typically a mix of direct sales forces for large, custom orders and specialized regional distributors who manage sales, financing, and localized technical support for smaller clients. Direct channels are preferred for high-value or technologically unique machines, allowing for greater control over sales narratives and direct client engagement during the complex commissioning process.

The profitability of the value chain is increasingly shifting towards the aftermarket services and spare parts segment. Due to the high capital cost of machinery, end-users prioritize extended operational life and minimized downtime. Therefore, the provision of timely maintenance, rapid spare parts delivery, and software updates constitutes a significant revenue stream for machine manufacturers. Indirect distribution, leveraging local agents and third-party maintenance providers, expands geographic reach but requires stringent quality control standards to protect the brand reputation. Successful firms optimize their distribution network to balance the benefits of direct customer relationship management with the logistical efficiency offered by specialized regional partners, ensuring that technical expertise is readily available to all global clientele.

Carpet Manufacturing Machines Market Potential Customers

The potential customers for Carpet Manufacturing Machines are diverse, ranging from global textile conglomerates to specialized local rug manufacturers, all seeking efficiency, precision, and versatility in their production processes. The primary buyers fall into the categories of integrated carpet producers who manage the entire supply chain from fiber processing to finished goods, and specialized contract manufacturers who focus exclusively on producing custom carpets for specific sectors like hospitality or luxury residential projects. These customers exhibit high demands regarding machine reliability, throughput capacity, and the ability to process novel and recycled materials efficiently. Purchasing decisions are heavily influenced by the Total Cost of Ownership (TCO), including energy efficiency, required labor input, and the expected operational lifespan of the equipment.

A significant segment of buyers comprises large multinational flooring companies that require broadloom tufting machines capable of 24/7 high-volume output to supply mass-market needs. These major players often engage in multi-million dollar capital expenditure projects to replace or expand entire production lines, focusing on sophisticated electronic control systems that offer rapid pattern changeovers and minimal waste generation. Furthermore, textile mills in emerging markets, driven by government incentives and expanding domestic middle classes, represent a fast-growing customer base focused on acquiring robust, cost-effective, and highly automated entry-to-mid-level machinery to scale up production rapidly.

Another crucial customer segment includes niche manufacturers specializing in high-end, custom-designed area rugs and wall-to-wall carpets. These buyers prioritize sophisticated weaving looms (Axminster, Wilton) and digital printing machines that offer unparalleled resolution and design intricacy, justifying a higher capital outlay. Architectural and interior design firms frequently influence the procurement decisions indirectly by specifying carpet types that necessitate specific machine capabilities. Therefore, successful market penetration requires machinery manufacturers to engage not only with production managers but also with executive-level decision-makers and key industry specifiers who dictate quality benchmarks and technological requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.2 Billion |

| Market Forecast in 2033 | $6.1 Billion |

| Growth Rate | CAGR 5.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vandewiele, Tuftco Corporation, CMC-Chattanooga Tufting & Cutting Machine Co., Ltd., Cobble Tufting Machine Co., Ltd., A.T.E. Enterprises Private Limited, Saurer Group, Groz-Beckert KG, J. H. Müller GmbH, M. Van de Wiele NV, Itema S.p.A., Tsudakoma Corp., Titan Textile Machines Pvt. Ltd., Rius Clapers S.A., Mattex, Oerlikon Textile GmbH & Co. KG, Picanol N.V., Zhaoshan Mechanical & Electrical Industrial Co., Ltd., DAHU Tufting Machines, BBA Fiberweb, TMT Textile Machinery Trade. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carpet Manufacturing Machines Market Key Technology Landscape

The Carpet Manufacturing Machines Market is characterized by a rapidly evolving technology landscape focused on achieving higher production speeds, greater design flexibility, and minimizing the environmental footprint. The core technological advancements center on the transition from purely mechanical systems to electronically controlled, software-driven machinery. Electronic Jacquard technology, particularly in weaving looms, has revolutionized pattern complexity, allowing manufacturers to create highly detailed, multi-color designs previously unattainable with mechanical systems, significantly enhancing product differentiation in the premium market segments. In tufting, the shift towards electronic pattern control and servo motor synchronization ensures precision in stitch placement and pile height variance, which is critical for producing structured loop and cut pile carpets with high dimensional stability and superior aesthetic quality.

The most transformative technology currently influencing the market is the integration of Industry 4.0 components, encompassing the Industrial Internet of Things (IIoT) and advanced control software. These technologies enable machines to communicate operational data in real-time, facilitating centralized monitoring and data analysis across entire factory floors. This connectivity supports sophisticated capabilities such as remote diagnostics, proactive fault resolution via cloud-based services, and automated parameter adjustments based on detected material variations or ambient environmental conditions. Furthermore, the adoption of high-speed digital printing technology for carpets is gaining significant traction, offering a cost-effective alternative for complex, short-run designs compared to traditional yarn dyeing and tufting methods, drastically reducing lead times and inventory requirements for customized orders.

Furthermore, technology related to sustainability is becoming paramount. Key machinery innovations include high-efficiency backing and coating lines that minimize the use of latex and associated volatile organic compounds (VOCs), often replacing them with thermoplastic or hot-melt adhesives. There is also extensive development in machinery designed specifically to handle challenging recycled and bio-based fibers without compromising throughput or quality. Precision shearing and finishing technologies utilize advanced lasers and sensors to ensure uniform pile height with minimal material wastage, further contributing to overall operational sustainability and material cost reduction, confirming technology's role not just as an efficiency driver but as a compliance enabler.

Regional Highlights

Regional dynamics heavily influence the demand and supply structure of the Carpet Manufacturing Machines Market, reflecting diverse economic conditions, infrastructure investment priorities, and consumer preferences. Asia Pacific (APAC) holds the largest market share and is projected to exhibit the highest growth rate during the forecast period. This dominance is primarily attributed to rapid urbanization, massive government investment in infrastructure and housing, and the flourishing textile industries in China, India, and Turkey. These countries serve both expansive domestic markets and act as global manufacturing hubs for finished carpets, necessitating continuous investment in high-throughput, cost-efficient tufting and needle punching machinery to meet escalating volume demands. The regional focus is on capacity expansion and the adoption of machines that offer the best balance between initial cost and productivity, though there is a growing trend towards incorporating Western technological standards for quality and automation.

Europe represents a mature but critical market, driven less by new capacity expansion and more by the replacement of aging machinery with technologically superior, highly specialized, and energy-efficient models. European manufacturers, particularly those in Belgium, Germany, and Italy, are often technological leaders, focusing on complex weaving machinery (Wilton, Axminster) and niche equipment optimized for luxury and high-specification contract markets. The region's stringent environmental regulations and high labor costs necessitate investment in fully automated systems integrated with sophisticated software for minimal human intervention and superior quality control. Europe also acts as a primary innovation hub, where many leading machinery manufacturers are headquartered, dictating global standards for precision and machine design.

North America, another mature market, exhibits strong demand for advanced, flexible machinery capable of handling a variety of specialty fibers and producing aesthetically diverse products. The focus here is on vertical integration and maximizing operational efficiency, with a robust market for aftermarket parts and technical services. The Middle East and Africa (MEA) region shows emerging potential, particularly in countries with significant infrastructure development (e.g., Saudi Arabia, UAE) and established textile bases (e.g., Turkey, Egypt). Investments in MEA are often characterized by large, single-project procurements aimed at establishing new manufacturing capabilities, prioritizing machinery that offers reliability and established service support, often sourcing highly automated European systems to offset local challenges related to skilled labor availability and consistent quality output.

- Asia Pacific (APAC): Dominant market share fueled by infrastructure growth, high volume production, and massive textile industry expansion in China and India. Focus on cost-effective, high-speed tufting machines and rapid capacity build-up.

- Europe: Replacement-driven market focused on technological upgrades, energy efficiency, and compliance with strict environmental standards. Demand concentrated on advanced weaving looms and precision finishing equipment for high-end residential and contract markets.

- North America: Stable demand for high-automation machinery, specialized in processing diverse fiber types and catering to strong residential remodeling and commercial retrofitting segments. Strong emphasis on digital integration (IIoT) and responsive customer service networks.

- Latin America (LATAM): Developing market characterized by localized manufacturing needs and sensitivity to capital expenditure. Demand primarily targets durable, mid-range tufting machines to supply growing domestic residential construction sectors, particularly in Brazil and Mexico.

- Middle East & Africa (MEA): High growth potential linked to ambitious regional infrastructure projects, especially in the GCC countries. Procurements focus on established, robust European and Turkish machinery for both specialized mosque carpet production and general contract flooring.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carpet Manufacturing Machines Market.- Vandewiele

- Tuftco Corporation

- CMC-Chattanooga Tufting & Cutting Machine Co., Ltd.

- Cobble Tufting Machine Co., Ltd.

- A.T.E. Enterprises Private Limited

- Saurer Group

- Groz-Beckert KG

- J. H. Müller GmbH

- M. Van de Wiele NV

- Itema S.p.A.

- Tsudakoma Corp.

- Titan Textile Machines Pvt. Ltd.

- Rius Clapers S.A.

- Mattex

- Oerlikon Textile GmbH & Co. KG

- Picanol N.V.

- Zhaoshan Mechanical & Electrical Industrial Co., Ltd.

- DAHU Tufting Machines

- BBA Fiberweb

- TMT Textile Machinery Trade

Frequently Asked Questions

Analyze common user questions about the Carpet Manufacturing Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for carpet manufacturing machines?

The increasing pace of global urbanization, coupled with rising middle-class disposable incomes in emerging economies, significantly drives demand for both residential and commercial flooring solutions, necessitating increased investment in high-capacity carpet manufacturing machinery.

Which machine type holds the largest market share globally?

Tufting machines hold the largest market share due to their high production speed, versatility, and cost-effectiveness in manufacturing broadloom carpets and tiles, which cater to the mass residential and commercial sectors worldwide.

How does Industry 4.0 affect carpet machine investments?

Industry 4.0 integration, specifically IIoT and AI, enables predictive maintenance, real-time quality control, and optimized production scheduling, leading manufacturers to invest in digitally controlled machines to achieve superior efficiency and substantial reductions in operational downtime and material waste.

Which geographic region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region, particularly China and India, is projected to exhibit the fastest market growth, driven by extensive construction activities, rising domestic demand, and government initiatives supporting the modernization and expansion of the local textile industry base.

What technological advancement is key for sustainable carpet production?

The development of specialized machinery capable of efficiently processing recycled content (like PET yarn) and integrating low-VOC backing systems, such as advanced hot-melt and thermoplastic coating lines, is crucial for meeting global sustainability mandates and reducing the environmental footprint of carpet manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Carpet Manufacturing Machines Market Statistics 2025 Analysis By Application (Residential, Commercial), By Type (Tufting Machine, Wilton Carpet Loom, Axminster Carpet Loom), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Carpet Manufacturing Machines Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Tufting Machine, Wilton Carpet Loom, Axminster Carpet Loom), By Application (Residential, Commercial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager