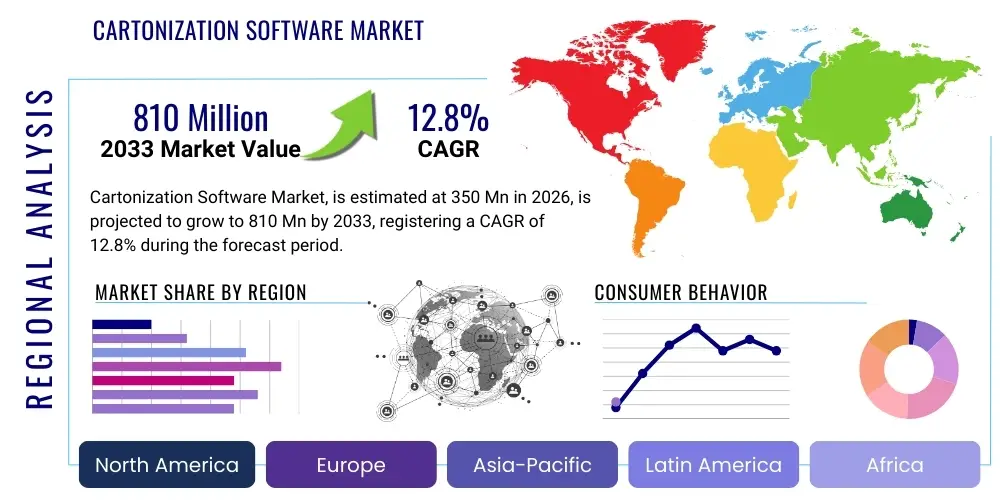

Cartonization Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441114 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Cartonization Software Market Size

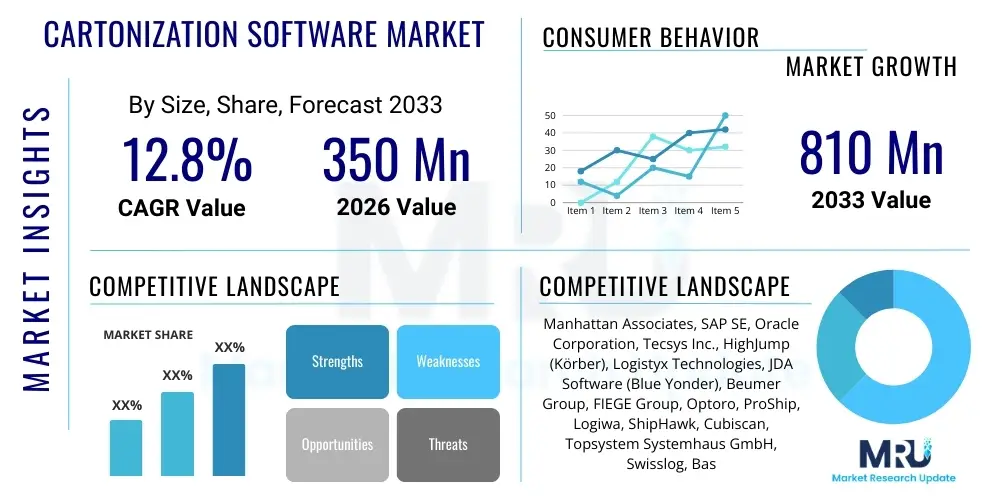

The Cartonization Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at $350 Million USD in 2026 and is projected to reach $810 Million USD by the end of the forecast period in 2033.

Cartonization Software Market introduction

The Cartonization Software Market encompasses specialized software solutions designed to optimize the process of selecting the most appropriate packaging size and configuration for a given set of items. This sophisticated technology utilizes complex algorithms, often incorporating volumetric scanning and weight constraints, to determine the ideal carton or container that minimizes void fill, reduces shipping costs, and maximizes trailer capacity. The software integrates seamlessly with Warehouse Management Systems (WMS), Enterprise Resource Planning (ERP) systems, and supply chain execution platforms, providing a critical layer of efficiency in modern logistics, particularly within e-commerce and high-volume distribution centers.

The product description centers on its core function: achieving packing efficiency through mathematical optimization. Major applications span retail, third-party logistics (3PL), manufacturing, and pharmaceutical distribution, where reducing packaging material waste and optimizing transportation density are paramount operational goals. Key benefits derived from implementation include substantial savings in material costs, reduced freight expenses due to optimized dimensionality, lower labor costs associated with manual packing decisions, and improved sustainability metrics by minimizing carton size and void filler usage. These compelling financial and environmental advantages position cartonization software as an indispensable tool in competitive global supply chains.

Driving factors fueling this market's expansion include the explosive growth of e-commerce, which necessitates rapid and cost-effective fulfillment of complex, multi-item orders. Furthermore, stringent regulatory requirements regarding sustainable packaging and the increasing cost of shipping, often tied to dimensional weight (DIM weight) pricing models adopted by major carriers, force businesses to seek advanced optimization solutions. The continuous pursuit of operational excellence and resilience within logistics operations—driven by globalization and fluctuating consumer demand—ensures a sustained high demand for integrated, algorithmic cartonization capabilities.

Cartonization Software Market Executive Summary

The Cartonization Software Market is experiencing robust growth driven primarily by structural shifts in global business trends, particularly the accelerated digitization of supply chain operations and the pervasive influence of e-commerce fulfillment requirements. Business trends highlight a strong movement towards integrated supply chain execution suites, where cartonization is no longer a standalone tool but a core module of WMS or fulfillment platforms, emphasizing real-time data exchange and algorithmic accuracy. The competitive landscape is characterized by innovation focused on machine learning integration to handle increasingly complex product dimensions and fluctuating order profiles, aiming to reduce solution implementation time and increase dynamic optimization capabilities. Strategic mergers and acquisitions among logistics software providers are also shaping the market structure, consolidating technologies to offer end-to-end optimization.

Regional trends indicate North America and Europe as early adopters and dominant markets, characterized by high labor costs, mature logistics infrastructure, and widespread adoption of DIM weight pricing by parcel carriers, which directly incentivizes carton optimization. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, propelled by surging e-commerce penetration, rapid urbanization, and massive infrastructure investments in warehouse automation, particularly in emerging economies like China and India. These regions present substantial opportunities as they modernize fulfillment processes and seek solutions to manage high-density distribution and cross-border logistics complexities efficiently.

Segmentation trends reveal significant traction in cloud-based deployment models, favored for their scalability, lower initial capital expenditure, and ease of integration with existing cloud ERP platforms. Functionally, the market is segmenting based on complexity, ranging from basic 2D and 3D optimization algorithms to advanced solutions incorporating multi-objective optimization (balancing cost, speed, and sustainability). Furthermore, industry vertical specialization is increasing, with highly tailored solutions emerging for sectors like pharmaceutical cold chain logistics and specialized retail, which have unique constraints regarding product handling, temperature control, and fragility, demanding highly precise carton selections.

AI Impact Analysis on Cartonization Software Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can move cartonization software beyond static rule-sets to truly dynamic and predictive optimization. Key themes center on AI's ability to handle highly irregular product shapes, learn from historical packing failures (damage rates), and predict optimal containerization strategies based on variables like carrier performance, peak season volume fluctuations, and real-time inventory staging constraints. Users express concern about the initial data requirements and computational load of advanced AI models, but they hold high expectations regarding the potential for AI to dramatically enhance algorithmic accuracy, reduce packaging costs further than traditional methods, and enable true prescriptive analytics for operational planning, moving from reactive selection to proactive strategy adjustment within the warehouse.

AI's integration allows cartonization engines to move from mere geometrical fitting to holistic supply chain optimization. By leveraging ML, the software can analyze millions of historical shipping data points—including damage reports, carrier surcharges, and manual packing interventions—to fine-tune the optimization models iteratively. This level of self-learning ensures that the 'optimal' carton chosen is not just mathematically the smallest fit, but the one that offers the best balance of cost savings, minimized damage risk during transit, and efficient throughput on the packing line, addressing highly complex, multi-variable constraints simultaneously.

The most profound impact of AI is in enhancing the solution's adaptability and predictive capability. Traditional cartonization relies on predefined rules and dimension libraries. AI, conversely, enables sophisticated feature extraction from image recognition or 3D scanning of products, dealing effectively with "non-dimensioned" items or complex kits. Furthermore, predictive modeling allows distribution centers to dynamically adjust packaging protocols hours or days in advance based on predicted inbound volumes or specific carrier restrictions, leading to smoother peak period operations and maximized resource utilization, transforming the software into a strategic planning tool rather than just an execution utility.

- Enhanced Algorithmic Accuracy: AI/ML models significantly improve volumetric optimization by learning from real-world packing outcomes and damage data.

- Dynamic Rule Adjustment: Systems automatically adapt packing rules based on real-time factors such as conveyor system constraints, packer performance, and carrier-specific weight limits.

- Predictive Packaging Strategy: AI forecasts optimal carton inventory levels and proactively suggests alternative packaging materials based on anticipated order profiles and peak demand periods.

- 3D Object Recognition: Integration with computer vision enables the handling of irregularly shaped items and multi-component orders with higher precision, minimizing wasted space.

- Sustainability Optimization: ML algorithms prioritize packaging choices that minimize material consumption (void fill and carton size) while maintaining product safety.

DRO & Impact Forces Of Cartonization Software Market

The Cartonization Software Market is shaped by a potent combination of operational necessities (Drivers), technological hurdles and integration complexities (Restraints), and expanding application scope (Opportunities), all contributing to distinct Impact Forces. The primary drivers include the necessity for logistics providers to mitigate the ever-increasing costs associated with dimensional weight (DIM) pricing, the surging volume and complexity of e-commerce order fulfillment, and intense pressure from corporate mandates to achieve verifiable sustainability goals by reducing packaging waste. These factors create an inescapable demand for sophisticated algorithmic tools capable of maximizing packing density and lowering freight expenditures.

Restraints primarily revolve around the initial high capital investment required for implementation, which often includes necessary infrastructure upgrades such as automated dimensioning and scanning equipment (dimensioners), and the complexity of integrating these advanced software solutions with disparate, legacy WMS and ERP systems prevalent in older distribution centers. Furthermore, successful deployment requires meticulous data cleanliness regarding product dimensions, and any inaccuracies in this foundational data can significantly compromise the optimization results, creating a perceived risk for potential adopters. The necessity for highly specialized technical expertise to maintain and tune these complex optimization engines also acts as a constraint, particularly for smaller and mid-sized enterprises.

Opportunities are vast, centering on the untapped potential within small and medium enterprises (SMEs) that are increasingly adopting cloud-based WMS platforms, making cartonization modules more accessible and scalable. The increasing sophistication of optimization—moving into multi-carton, multi-stop optimization for complex shipments—presents a major avenue for expansion. Furthermore, specialized applications within temperature-controlled logistics (cold chain) and dangerous goods handling, where packaging integrity and precise configuration are non-negotiable, offer lucrative niche market development. These factors converge to create a powerful Impact Force where competitive logistics efficiency is directly correlated with the sophistication of packaging optimization technology employed.

Segmentation Analysis

The Cartonization Software Market is comprehensively segmented based on deployment type, offering model, component, enterprise size, and end-user industry, reflecting the diverse operational environments and budget constraints of potential adopters. Analyzing these segments provides a detailed view of current market adoption patterns and future growth vectors. Deployment method is particularly crucial, distinguishing between traditional on-premise installations, favored by large enterprises requiring maximum control and customization, and the rapidly growing cloud-based Software-as-a-Service (SaaS) models, preferred for their flexibility, lower total cost of ownership (TCO), and rapid deployment capabilities, especially appealing to fast-growing e-commerce operations.

Component-based segmentation separates the market into core software (the optimization engine) and integrated services (consulting, implementation, maintenance). While the software engine represents the largest revenue share, services are critical for ensuring proper integration and achieving the desired Return on Investment (ROI), particularly given the complexity of supply chain integration. Enterprise size segmentation clearly delineates the demand profiles, with large enterprises investing heavily in customized, high-throughput solutions, and SMEs driving the demand for standardized, subscription-based, modular SaaS offerings.

The segmentation by end-user vertical reveals varying degrees of market maturity and specific operational needs. E-commerce and retail sectors represent the dominant application area due to high variability in order volumes and the critical need to manage DIM weight costs. However, sectors like manufacturing, particularly those dealing with spare parts or complex kitting, and 3PL providers, who manage fulfillment for multiple clients, are increasingly adopting cartonization to standardize and optimize their disparate packaging requirements across their extensive client base, ensuring sustained diversification of the market application landscape.

- By Deployment Type:

- On-Premise

- Cloud (SaaS)

- By Component:

- Software (Optimization Engine)

- Services (Consulting, Integration, Maintenance)

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By End-User Industry:

- Retail and E-commerce

- 3rd Party Logistics (3PL)

- Manufacturing

- Food and Beverage

- Pharmaceuticals and Healthcare

Value Chain Analysis For Cartonization Software Market

The value chain for the Cartonization Software Market begins with the Upstream analysis, which encompasses key activities such as software design and development, data input standardization (creating and maintaining accurate product dimension libraries), and the crucial development of sophisticated optimization algorithms, often involving advanced mathematical modeling and, increasingly, AI/ML expertise. Key stakeholders at this stage include specialized software developers, data scientists, and intellectual property providers focusing on supply chain optimization logic. The quality and efficiency of the upstream activities directly dictate the accuracy and robustness of the final cartonization solution, emphasizing investment in R&D for algorithmic superiority.

The Downstream analysis involves the distribution, implementation, and application of the software. This phase includes the critical integration of the cartonization engine with client enterprise systems (WMS, ERP, TMS) and the physical warehouse infrastructure (dimensioning machines, conveyor systems). The distribution channel relies heavily on both Direct and Indirect methodologies. Direct sales are common among tier-one providers selling highly customized, on-premise solutions to large global enterprises, providing extensive support and consultative services alongside the software license.

Indirect distribution involves leveraging a network of third-party logistics consultants, system integrators (SIs), and value-added resellers (VARs), particularly for cloud-based or modular solutions targeting SMEs. These intermediaries are vital as they offer localized expertise and facilitate the complex integration process, translating the software’s capabilities into tangible operational improvements for the end-user. Effective downstream strategy relies on robust partner training and certification to ensure flawless deployment, which is paramount to customer satisfaction and long-term market penetration, especially in geographically fragmented regions.

Cartonization Software Market Potential Customers

Potential customers, or end-users/buyers, for Cartonization Software are organizations facing significant challenges related to high shipping costs, excessive packaging material consumption, and inefficient manual packing processes. The primary target segments are companies operating large-scale distribution centers and high-volume fulfillment operations where marginal improvements in packaging efficiency translate into massive annual cost savings. E-commerce pure-plays and omni-channel retailers are prime candidates, given their need to fulfill highly variable B2C orders quickly and cost-effectively, often involving small parcel shipments subject to strict DIM weight calculations by carriers.

Third-Party Logistics (3PL) providers represent a crucial customer segment, as they need standardized, flexible, and highly efficient packaging solutions to manage diverse client product portfolios and ensure profitability across multiple fulfillment contracts. By implementing cartonization software, 3PLs can offer competitive pricing, increase warehouse throughput, and differentiate their service offerings based on superior operational efficiency and sustainability metrics. Manufacturing companies, especially those involved in spare parts distribution or complex, multi-component kit assembly, also constitute a significant base of potential customers, seeking to reduce damage during transit and optimize internal handling processes.

Beyond these core sectors, any organization shipping thousands of parcels monthly and dealing with a variety of product dimensions stands to benefit significantly. This includes specialized segments such as pharmaceutical distributors requiring validated, compliant packaging processes, and food & beverage companies focused on optimizing distribution routes and maximizing payload within temperature-controlled trailers. The increasing pressure on global supply chains to be both cost-efficient and environmentally responsible ensures a broad and expanding base of potential customers across nearly all major commerce verticals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Million USD |

| Market Forecast in 2033 | $810 Million USD |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Manhattan Associates, SAP SE, Oracle Corporation, Tecsys Inc., HighJump (Körber), Logistyx Technologies, JDA Software (Blue Yonder), Beumer Group, FIEGE Group, Optoro, ProShip, Logiwa, ShipHawk, Cubiscan, Topsystem Systemhaus GmbH, Swisslog, Bastian Solutions, Dematic, BoxLogic, FreightPOP |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cartonization Software Market Key Technology Landscape

The technological foundation of the Cartonization Software Market is rooted in sophisticated operational research and applied mathematics, specifically algorithms designed for the three-dimensional bin packing problem (3D-BPP). This core technology utilizes heuristic and deterministic optimization solvers to rapidly evaluate millions of packing scenarios and select the most efficient configuration based on parameters such as internal carton dimensions, product stability, stacking limits, weight distribution, and required void fill percentage. Modern solutions must handle irregular shapes and heterogeneous order compositions, demanding highly performant computational frameworks, often leveraging parallel processing capabilities.

The landscape is rapidly evolving with the integration of advanced technologies designed to enhance both input accuracy and output efficiency. Key technologies include automated dimensioning systems (Dimensioners) that use lasers or computer vision to instantly capture accurate product dimensions, eliminating manual data entry errors which are fatal to optimization accuracy. Furthermore, robust Application Programming Interfaces (APIs) are essential for real-time communication between the cartonization engine and other supply chain systems, allowing dynamic optimization decisions to be made seconds before the items reach the packing station or automation equipment.

The most significant technological shift is the incorporation of Artificial Intelligence and Machine Learning (AI/ML). AI models are used to refine heuristic algorithms by learning from historical shipping data, improving the selection accuracy for complex or fragile items, and enabling predictive modeling for carton inventory management. Furthermore, the shift towards cloud-native architectures utilizing microservices allows for greater scalability and elasticity, enabling the software to handle massive fluctuations in order volume typical of peak e-commerce seasons (e.g., Black Friday), ensuring reliable and fast optimization across globally distributed fulfillment networks.

Regional Highlights

The global Cartonization Software Market displays varied adoption rates and maturity levels across different geographical regions, heavily influenced by local logistics infrastructure, e-commerce penetration, and regulatory pressures concerning packaging and sustainability.

- North America (Dominant Market): Characterized by a highly mature logistics sector, high labor costs, and the widespread use of Dimensional Weight (DIM) pricing by major carriers (FedEx, UPS). This economic environment makes cartonization software a crucial cost-mitigation tool. The region has high adoption rates, particularly among large retailers and 3PLs, and is a major hub for R&D in AI-driven optimization.

- Europe (Mature and Sustainability-Focused): A strong market driven by stringent environmental regulations (e.g., Extended Producer Responsibility schemes) and high cross-border shipping complexity. European adopters prioritize not only cost savings but also verifiable reductions in packaging material waste, driving demand for solutions offering robust sustainability reporting and precise void fill reduction. Germany, the UK, and the Benelux countries are key contributors.

- Asia Pacific (Fastest Growth): Experiencing explosive growth fueled by the rapid expansion of e-commerce, urbanization, and significant government investment in logistics infrastructure across countries like China, India, Japan, and Australia. While the base infrastructure is developing, the sheer volume of parcels and the competitive pressure to offer low-cost shipping make efficient cartonization highly critical, driving rapid uptake of scalable, cloud-based solutions.

- Latin America (Emerging Adoption): Adoption is nascent but accelerating, driven by the professionalization of logistics and the entry of global e-commerce giants. Market focus is primarily on basic 3D optimization to reduce high import/export freight costs and stabilize volatile supply chain operations, especially in Brazil and Mexico.

- Middle East and Africa (MEA) (Niche Growth): Growth is concentrated in logistics hubs (UAE, Saudi Arabia) where large infrastructure projects and regional e-commerce expansion require sophisticated fulfillment technology. Adoption is highly fragmented but focused on managing high-value, multi-modal shipments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cartonization Software Market, reflecting companies that offer both dedicated cartonization modules and comprehensive WMS suites with integrated optimization capabilities.- Manhattan Associates

- SAP SE

- Oracle Corporation

- Tecsys Inc.

- HighJump (Körber)

- Logistyx Technologies

- Blue Yonder (formerly JDA Software)

- Beumer Group

- Topsystem Systemhaus GmbH

- ProShip

- Logiwa

- ShipHawk

- Cubiscan

- BoxLogic

- Swisslog

- Bastian Solutions

- Dematic (KION Group)

- FIEGE Group

- Optoro

- FreightPOP

Frequently Asked Questions

Analyze common user questions about the Cartonization Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is dimensional weight (DIM weight) and how does cartonization software help mitigate its impact?

Dimensional weight is a pricing technique used by carriers where the freight cost is based on the package's volume (dimensions) rather than its actual weight, if the calculated volume weight is higher. Cartonization software mitigates this by applying optimization algorithms to select the smallest possible carton size, thereby reducing the package's overall volume and the associated chargeable DIM weight, leading to direct savings on carrier fees.

Is Cartonization Software a standalone system or integrated within WMS platforms?

While historical solutions often operated standalone, the modern market trend is towards deep integration. Cartonization is increasingly offered as a core optimization module within comprehensive Warehouse Management Systems (WMS) or supply chain execution suites (SCE), ensuring real-time data synchronization with inventory and order management processes for accurate, immediate packing decisions.

What is the typical Return on Investment (ROI) period for implementing advanced Cartonization solutions?

The ROI period for cartonization software is often rapid, typically ranging from 6 to 18 months for high-volume distributors. Savings are generated immediately through reduced packaging material spend (up to 20%), minimized void fill costs, and substantial reductions in annual freight expenditure due to lower DIM weights and optimized truckload capacity utilization.

How does Cartonization Software contribute to corporate sustainability goals?

The software significantly improves sustainability by minimizing the material usage per order. By ensuring the correct, smallest carton is selected, it reduces reliance on void fill (plastic or paper), decreases the total cardboard required, and minimizes the overall carbon footprint of transportation by increasing payload density and reducing the number of required shipment vehicles.

What data inputs are critical for the successful operation of a Cartonization System?

Accurate and standardized data is paramount. Critical inputs include precise dimensions (length, width, height) and weight for every stock-keeping unit (SKU), detailed specifications and inventory levels for all available carton types, and defined constraints related to product fragility, stacking limits, and maximum acceptable carton utilization thresholds.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager