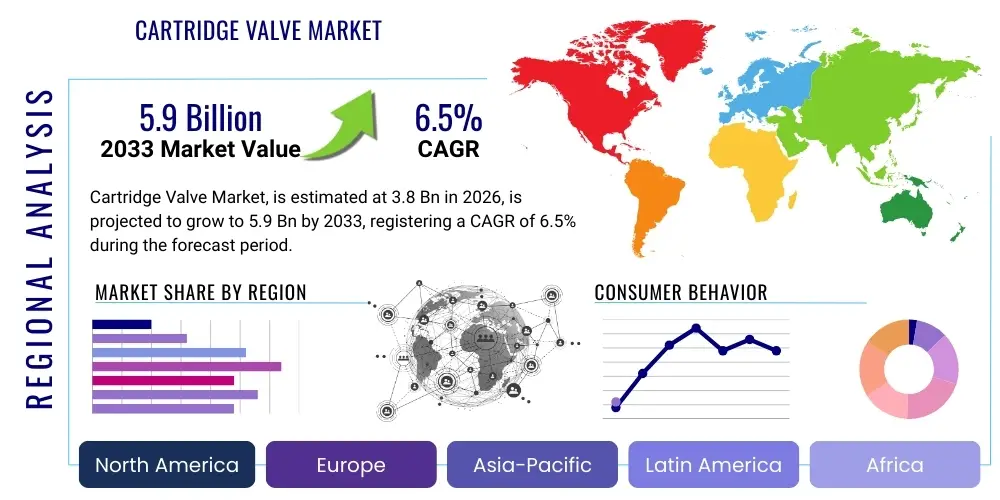

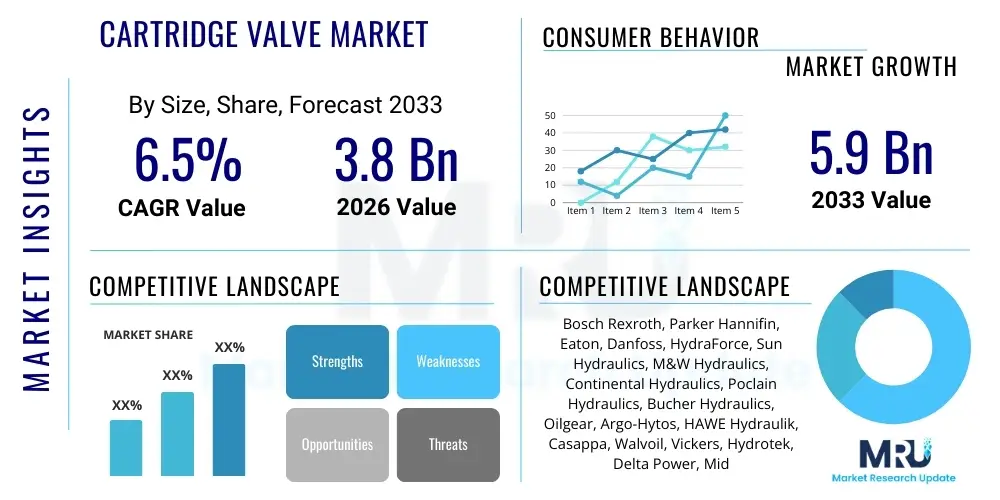

Cartridge Valve Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441142 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Cartridge Valve Market Size

The Cartridge Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033.

Cartridge Valve Market introduction

The cartridge valve market encompasses a specialized segment within hydraulic control systems, offering compact, highly efficient, and robust solutions for fluid power management across various heavy-duty industries. Cartridge valves are essentially encapsulated components that fit into standard manifold blocks, serving critical functions such as directional control, pressure regulation, and flow modulation. Their design inherently offers several advantages over conventional spool or line-mounted valves, including improved response times, reduced leakage paths, and simplified maintenance procedures. This versatility and efficiency are key reasons for their increasing integration into sophisticated hydraulic circuits, especially in applications where space is a premium and high performance under strenuous conditions is mandatory.

Major applications driving the demand for cartridge valves include mobile machinery—suchably excavators, agricultural tractors, and material handling equipment—as well as demanding industrial systems such as plastic injection molding machines, heavy presses, and specialized machine tools. The primary benefit derived from employing cartridge valve technology is the significant reduction in system footprint and weight, which is crucial for modern mobile applications focused on energy efficiency and operational maneuverability. Furthermore, the modular nature of these valves allows for quick design customization and simplified assembly processes, accelerating deployment and minimizing downtime. These benefits, coupled with enhanced durability and pressure handling capabilities, position cartridge valves as foundational components in the advancement of high-power density hydraulic systems.

Driving factors propelling market expansion include the global infrastructure boom, particularly in developing economies, which necessitates high-performance construction and mining equipment, all heavily reliant on precise hydraulic control. Additionally, technological advancements focused on hydraulic system miniaturization and the transition towards proportional control capabilities are further stimulating adoption. Regulatory pressures promoting energy efficiency in industrial machinery also favor cartridge valve integration, as their design often contributes to lower internal pressure drops and improved system efficiency compared to bulkier, traditional valve designs. Consequently, the market trajectory is strongly linked to sustained investment in manufacturing automation and heavy equipment modernization globally.

Cartridge Valve Market Executive Summary

The Cartridge Valve Market is characterized by robust growth, driven primarily by the escalating demand for high-performance and compact hydraulic solutions across multiple industrial and mobile sectors. Key business trends indicate a strong focus on developing smart cartridge valves incorporating integrated sensors and electronics for precise proportional control and connectivity within Industry 4.0 frameworks. Companies are increasingly investing in proprietary manifold design technologies and standardized interface protocols to enhance interoperability and reduce system complexity for end-users. Consolidation remains a pertinent business trend, with major players acquiring specialized technology firms to expand their product portfolios, particularly in highly complex pressure and flow control segments.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, propelled by massive government investment in infrastructure development and rapid industrialization, particularly in China and India. North America and Europe maintain significant market share, characterized by mature markets emphasizing valve precision, energy efficiency, and adherence to stringent safety standards in construction and aerospace applications. Emerging regional trends involve the growing necessity for robust, climate-resilient hydraulic components tailored for extreme operating environments, driving innovation in sealing materials and material science within cartridge valve manufacturing. Furthermore, localized manufacturing hubs are developing in Southeast Asia to mitigate supply chain vulnerabilities and cater specifically to regional original equipment manufacturer (OEM) demands.

Segment trends highlight the dominance of screw-in type cartridge valves due to their ease of installation and established reliability across a broad spectrum of applications. However, the slip-in (or 2-way) cartridge valve segment is experiencing accelerated growth, driven by their superior flow handling capabilities essential for large-scale earthmoving and primary metal processing machinery. Application-wise, the mobile machinery sector remains the largest consumer, fueled by global replacement cycles and the increasing sophistication of agricultural and construction vehicles requiring highly responsive proportional and directional control elements. The increasing digitalization of fluid power control underscores a significant trend towards electronically controlled proportional valves replacing purely mechanical designs, thus elevating the average selling price and technological complexity across key segments.

AI Impact Analysis on Cartridge Valve Market

Common user questions regarding AI's impact on the Cartridge Valve Market generally revolve around how predictive maintenance will be implemented, the potential for AI-driven design optimization, and whether AI can enhance the performance and reliability of hydraulic systems incorporating these valves. Users frequently inquire about the integration of machine learning algorithms to analyze real-time operational data—such as pressure fluctuations, temperature, and cycle times—collected via sensors embedded in or near the valve manifold. Key themes include achieving zero unplanned downtime, optimizing fluid power efficiency through adaptive control, and concerns about the cybersecurity implications of connecting hydraulic systems to broader AI networks. The market anticipates that AI will not only improve the manufacturing process efficiency but fundamentally change the operational lifecycle management of high-value hydraulic components like proportional cartridge valves.

AI's primary influence will manifest in three distinct areas: intelligent diagnostics, generative design, and adaptive control. In intelligent diagnostics, AI models analyze complex sensor data patterns to predict valve wear, fluid contamination issues, or potential seal failures long before they impact system performance, thus facilitating preemptive maintenance scheduling. This capability significantly reduces operational costs and maximizes asset utilization, a major value proposition for end-users in resource-intensive industries. Secondly, Generative AI is being leveraged in the design phase to optimize the internal flow paths and geometries of valve bodies and cartridges, resulting in reduced pressure drop, lower heat generation, and improved flow coefficients, pushing the boundaries of miniaturization and efficiency previously unattainable through traditional engineering methods.

Finally, adaptive control systems powered by AI allow hydraulic machines to dynamically adjust valve opening speeds, pressure limits, and flow rates in response to changing load conditions or environmental factors in real-time. For instance, in an excavator application, AI could modulate the proportional cartridge valves to optimize energy expenditure based on the resistance encountered during digging, improving fuel economy and operational precision. While these implementations require substantial investment in sensor technology and edge computing capabilities within the manifold, the long-term benefits in terms of precision, efficiency, and reliability are expected to solidify AI as a critical enabling technology for advanced hydraulic systems moving forward.

- AI-driven predictive maintenance enhancing valve longevity and reducing operational downtime.

- Generative design optimizing valve internal geometry for superior flow and efficiency.

- Adaptive control systems utilizing machine learning for dynamic operational optimization.

- Automated quality inspection using computer vision in cartridge valve manufacturing.

- Integration of AI algorithms for real-time fault detection and diagnostic reporting.

- Enhanced system energy efficiency through smart, real-time proportional valve adjustment.

DRO & Impact Forces Of Cartridge Valve Market

The Cartridge Valve Market dynamics are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and overarching Impact Forces (F) shaping its trajectory. The dominant drivers include the ongoing trend towards hydraulic system miniaturization and the necessity for increased power density in mobile and industrial equipment, where the compact form factor of cartridge valves offers a significant advantage. Simultaneously, regulatory mandates across developed economies promoting industrial safety and energy efficiency compel OEMs to adopt precise control components, favoring proportional cartridge valves. However, restraints persist, notably the high initial investment required for sophisticated manifold design and machining, which can deter smaller manufacturers, alongside the technical complexity involved in troubleshooting integrated hydraulic manifolds compared to standalone valves.

Opportunities for market expansion are abundant, particularly in the rapid growth of electrically powered mobile machinery, necessitating specialized low-power consumption hydraulic controls compatible with battery systems. Furthermore, the emerging requirement for specialized valves capable of handling high-pressure applications (above 400 bar) in sectors like deep-sea exploration and specialized aerospace equipment presents a lucrative niche. The impact forces influencing the market are strongly linked to global supply chain stability and the volatility of raw material costs, particularly steel and specialized sealing elastomers, which directly affect the profitability and pricing structure of valve manufacturers. Additionally, the rapid pace of digital transformation and the adoption of Industry 4.0 principles necessitate that manufacturers constantly innovate to integrate smart technologies, such as IoT connectivity and embedded diagnostics, into their valve offerings, impacting competitive differentiation.

The cumulative effect of these forces suggests a market moving towards higher specialization and technological sophistication. While the market benefits from universal demand in essential infrastructure sectors (construction, agriculture), it is simultaneously challenged by the need for continuous skills upgrading among technicians who must service increasingly complex electro-hydraulic manifold systems. Strategic differentiation will rely heavily on manufacturers' abilities to offer integrated solutions—combining the valve, manifold, and electronic control unit (ECU)—rather than selling standalone components, thereby capturing greater value across the hydraulic power ecosystem. The shift towards sustainable manufacturing practices also imposes an impact force, driving the development of valves compatible with biodegradable hydraulic fluids, requiring material innovations and rigorous testing.

Segmentation Analysis

The Cartridge Valve Market segmentation provides a crucial framework for understanding the diverse applications and technological preferences across different end-user industries. The market is primarily segmented based on the valve type, operational function, and the specific application sector, reflecting the variety of hydraulic control challenges addressed by these components. Analyzing these segments helps stakeholders identify high-growth areas, assess competitive intensity, and tailor product development strategies to specific functional requirements, whether for high flow rate industrial presses or precision control in mobile steering systems. This granular view confirms the dominance of certain valve configurations, such as the widely accepted screw-in type, while also highlighting the rapid technical evolution occurring within the proportional and flow control categories.

- By Type:

- Screw-in Cartridge Valves

- Slip-in Cartridge Valves (2-way, 3-way, 4-way)

- High-Pressure Cartridge Valves

- By Function/Operation:

- Directional Control Valves

- Pressure Control Valves (Relief, Reducing, Sequence)

- Flow Control Valves (Fixed, Variable, Proportional)

- Check Valves

- By Application/End-Use Industry:

- Mobile Machinery (Construction, Mining, Agricultural, Forestry)

- Industrial Equipment (Machine Tools, Material Handling, Injection Molding)

- Aerospace and Defense

- Oil and Gas

- By Pressure Rating:

- Up to 250 Bar

- 250 Bar to 400 Bar

- Above 400 Bar

Value Chain Analysis For Cartridge Valve Market

The value chain for the Cartridge Valve Market begins with specialized raw material suppliers providing high-grade steel alloys, precision castings, specialized seals (e.g., Nitrile, Viton), and electronic components necessary for proportional variants. Upstream activities are dominated by precision machining and manufacturing, where core intellectual property lies in the internal geometries, surface finish tolerances, and proprietary assembly processes that ensure long-term valve reliability and minimal internal leakage. Key manufacturers often rely on advanced CNC machining centers and stringent quality control protocols to produce the intricate components, which include the sleeve, poppet or spool, spring, and the external housing. Supplier bargaining power is moderate, influenced heavily by the availability of specialized metals and rare earth elements used in solenoids and proportional control coils.

Downstream analysis focuses on the integration and distribution of the finished valve components. Direct channels involve sales teams and application engineers working closely with major Original Equipment Manufacturers (OEMs) in construction, agriculture, and industrial automation to co-design customized manifold solutions utilizing cartridge valves. This direct engagement often includes providing technical support, system design consultation, and rigorous pre-integration testing. Indirect distribution involves a network of specialized hydraulic distributors and system integrators who purchase standard or semi-customized valves in bulk and combine them with other hydraulic components (pumps, actuators) to build complete fluid power systems for smaller or localized end-users. The distributors play a vital role in local stocking, technical training, and providing aftermarket service and replacement parts, bridging the gap between high-volume manufacturers and diverse regional demand.

The distribution channel landscape is highly specialized. For large OEM contracts, direct sales are preferred due to the technical complexity and volume involved. However, the aftermarket and Maintenance, Repair, and Operations (MRO) segment relies almost exclusively on the extensive footprint and inventory capabilities of indirect distribution partners. This dual approach ensures that specialized, high-tech proportional valves are directly managed by the manufacturer's experts during initial deployment, while standardized check and pressure control valves are readily available through local distributors for immediate replacement or system modification. The efficiency of the logistics network and the technical proficiency of the distribution partner are critical success factors in maintaining market penetration and customer satisfaction across the diverse global market.

Cartridge Valve Market Potential Customers

The primary consumers and end-users of cartridge valve technology span across capital-intensive industries that rely heavily on controlled, high-density fluid power transmission. The largest segment of potential customers includes Original Equipment Manufacturers (OEMs) specializing in mobile machinery, such as Caterpillar, John Deere, Komatsu, and Volvo Construction Equipment. These companies require millions of precise control valves annually for integration into sophisticated hydrostatic transmissions, boom controls, steering systems, and auxiliary functions, prioritizing components that offer high flow capacity relative to their physical size and superior resistance to harsh environmental conditions like dust and extreme temperature variations.

A second major category comprises manufacturers of fixed industrial machinery, including producers of plastic injection molding machines, die-casting equipment, and metal forming presses. Customers in this segment, such as KraussMaffei and Sumitomo (SHI) Demag, value the fast response times, high cycle durability, and energy efficiency provided by proportional and servo-quality cartridge valves, which are essential for achieving repeatable, high-precision manufacturing cycles. The compact nature of manifold systems also helps these industrial OEMs reduce the overall footprint of their machinery, which is a significant competitive factor in crowded factory environments.

Furthermore, smaller but highly valuable potential customers exist within the niche sectors of aerospace and defense, specialized marine equipment, and oil and gas exploration. These clients require valves that meet exceptionally rigorous safety and quality standards (e.g., ATEX, AS9100) and can reliably function under extreme pressure (e.g., subsea BOP controls) or temperature ranges. For these customers, the primary purchasing criteria transcend cost, focusing instead on component traceability, certification, long-term operational reliability, and the manufacturer’s capability to provide highly customized solutions tailored to highly demanding specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Rexroth, Parker Hannifin, Eaton, Danfoss, HydraForce, Sun Hydraulics, M&W Hydraulics, Continental Hydraulics, Poclain Hydraulics, Bucher Hydraulics, Oilgear, Argo-Hytos, HAWE Hydraulik, Casappa, Walvoil, Vickers, Hydrotek, Delta Power, Midland-ACS, Concentric AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cartridge Valve Market Key Technology Landscape

The technology landscape of the Cartridge Valve Market is rapidly evolving, moving beyond simple on/off control towards highly precise proportional and digital integration. A primary technological focus is on enhancing the efficiency and responsiveness of proportional solenoid-operated valves, which involves developing advanced coil designs for lower power consumption, higher bandwidth electronics, and sophisticated feedback mechanisms (LVDT sensors) to ensure precise spool or poppet positioning. This shift is crucial for meeting the demands of modern machinery that requires variable speed, pressure, and flow control to optimize energy usage and operational output. Miniaturization technology, utilizing advanced materials and micro-machining, is also central, allowing manufacturers to integrate complex control functions into smaller cartridge envelopes without compromising flow capacity or pressure rating, facilitating denser manifold designs.

Another significant technological trend is the adoption of integrated electronics and smart capabilities. Many contemporary cartridge valve systems are being designed as 'smart components' featuring embedded microcontrollers and communication protocols (e.g., CAN bus, Ethernet/IP) that allow them to interface directly with the machine’s central control unit (ECU). This integration enables real-time diagnostics, remote monitoring, and complex control algorithms to be executed locally at the valve level, enhancing overall system reliability and accelerating response times by eliminating latency associated with centralized processing. Furthermore, the development of specialized sealing technology capable of withstanding extreme temperatures and pressures while maintaining compatibility with environmentally friendly fluids (e.g., bio-oils) remains a critical area of research and development, particularly for mobile and offshore applications.

The manufacturing process itself is benefiting from technological advancements, specifically additive manufacturing (3D printing) of specialized metal components. While 3D printing is not yet standard for high-volume components, it is increasingly used for rapid prototyping of complex manifold blocks and for producing custom flow inserts with highly optimized internal passageways, significantly reducing lead times and manufacturing complexity for bespoke systems. Finally, the pursuit of silent operation and reduced hydraulic noise pollution drives innovation in dampening mechanisms and anti-cavitation features incorporated directly into the valve design. These technological strides collectively position cartridge valves as essential components in the transition towards fully digitized, optimized, and environmentally conscious fluid power systems.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the engine of market growth, driven primarily by massive governmental investment in infrastructure, urbanization, and the continuous expansion of manufacturing capabilities in China, India, and Southeast Asian nations. The region exhibits high demand for both standard and high-flow capacity slip-in valves for heavy construction and mining equipment. Localized manufacturing bases are increasing, putting competitive pricing pressure on global incumbents.

- North America: A mature market characterized by a high demand for technologically advanced components, especially proportional and electro-hydraulic valves used in precision agriculture and sophisticated machine tools. The market is focused on high-quality, reliable components and is an early adopter of IoT-enabled smart valve solutions and high-pressure ratings for oil and gas applications.

- Europe: The European market maintains a strong emphasis on energy efficiency, adherence to strict safety standards (CE marking), and compatibility with sustainable hydraulic fluids. Germany, Italy, and Scandinavia are central hubs, driving innovation in compact, integrated manifold technology for industrial automation, specialized mobile cranes, and forest harvesting machinery.

- Latin America (LATAM): Growth in LATAM is closely tied to commodity cycles and agricultural production, leading to fluctuating but substantial demand for robust, easily maintainable cartridge valves for forestry and heavy earthmoving machinery. Brazil and Mexico are key markets, characterized by price sensitivity but growing interest in basic proportional control solutions.

- Middle East and Africa (MEA): This region is dominated by requirements from the oil and gas sector (upstream and downstream) and large-scale infrastructure projects. Demand is high for corrosion-resistant, high-pressure rated valves capable of operating reliably in high-temperature, dusty environments, often necessitating specialized sealing materials and robust construction for reliable long-term performance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cartridge Valve Market.- Bosch Rexroth Corporation

- Parker Hannifin Corporation

- Eaton Corporation plc

- Danfoss A/S (Sauer-Danfoss)

- HydraForce Inc.

- Sun Hydraulics LLC (A Helios Technologies Company)

- M&W Hydraulics GmbH

- Continental Hydraulics Inc.

- Poclain Hydraulics S.A.

- Bucher Hydraulics GmbH

- Oilgear Company

- Argo-Hytos GmbH

- HAWE Hydraulik SE

- Casappa S.p.A.

- Walvoil S.p.A.

- Vickers (Eaton subsidiary)

- Hydrotek Co. Ltd.

- Delta Power Company

- Midland-ACS Ltd.

- Concentric AB

Frequently Asked Questions

Analyze common user questions about the Cartridge Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using cartridge valves over conventional spool valves?

Cartridge valves offer key benefits including a more compact footprint, higher power density, reduced internal leakage paths, enhanced thermal stability, and simplified maintenance due to their encapsulated design, making them ideal for integrated manifold systems.

Which application segment drives the highest demand for cartridge valves globally?

The Mobile Machinery segment, encompassing construction equipment, agricultural tractors, and mining vehicles, represents the largest consuming market due to the critical need for compact, highly durable, and precise flow/pressure control in these demanding applications.

How is Industry 4.0 influencing the design and functionality of cartridge valves?

Industry 4.0 drives the development of smart cartridge valves featuring integrated electronics, sensors, and communication capabilities (e.g., CAN bus), enabling predictive maintenance, real-time remote diagnostics, and sophisticated proportional control through adaptive algorithms.

What is the key difference between screw-in and slip-in cartridge valve types?

Screw-in valves are fully self-contained units threaded directly into a manifold port, suited for lower to medium flow rates. Slip-in (or 2-way) valves are high-flow components inserted into cavities, primarily functioning as piloted main control elements requiring external pilot signals, ideal for high-volume applications.

What regional market is expected to exhibit the fastest growth in the cartridge valve sector?

The Asia Pacific (APAC) region is forecasted to experience the highest growth rate, fueled by unprecedented growth in infrastructure development, rapid industrial automation, and substantial investment in local OEM manufacturing capabilities, particularly in East and South Asia.

The Cartridge Valve Market's future trajectory is strongly correlated with global infrastructure investment and the increasing sophistication of mobile and industrial hydraulic systems, demanding components that offer high reliability and power density. The market is witnessing a strategic shift toward electro-hydraulic solutions, where proportional cartridge valves, enhanced by embedded intelligence, are becoming the standard for precision control. This technological evolution ensures that, despite being compact components, cartridge valves remain central to the efficiency and productivity gains across global fluid power applications. Manufacturers are focusing heavily on material science innovations and additive manufacturing techniques to meet evolving demands for higher pressure ratings and better performance with specialized, low-viscosity fluids. Competition remains intense, pushing players to continuously optimize their manifold integration services and specialized valve offerings to maintain market share, especially in high-growth regions like Asia Pacific.

In North America and Europe, the emphasis remains on safety compliance and the integration of these valves into interconnected systems compatible with IoT platforms, driving demand for high-end digital control valves. The challenge of high initial manifold design costs is being offset by the long-term operational savings associated with reduced complexity and improved efficiency inherent in cartridge valve manifold assemblies. The long-term viability of the sector is further secured by its foundational role in essential industries like agriculture and construction, which require ongoing modernization and component replacement cycles. This continuous demand guarantees a stable foundation for the market, even amidst cyclical economic fluctuations, reinforcing the projected CAGR through 2033.

Strategic growth avenues primarily involve expansion into high-pressure oil and gas sectors and leveraging the burgeoning electric mobile equipment market, which requires specialized battery-friendly, low-current proportional valves. Companies succeeding in this landscape will be those that effectively blend mechanical precision engineering with advanced digital capabilities, offering integrated solutions that minimize installation complexity and maximize data transparency for the end-user. Furthermore, the commitment to sustainable practices, including the design of valves compatible with biodegradable fluids and minimizing material waste during manufacturing, is becoming a non-negotiable factor for securing major OEM contracts, particularly in European markets. This multifaceted technological and environmental pressure necessitates continuous innovation across the entire value chain, from raw material sourcing to final system integration, thereby sustaining market dynamism.

Further analysis of the competitive environment reveals that major global players maintain their dominance through extensive product portfolios and well-established distribution networks servicing large global OEMs. However, niche manufacturers specializing in specific technology—such as micro-cartridge valves for medical devices or ultra-high-pressure valves for aerospace—continue to capture significant value in their respective sectors. The integration capabilities, specifically the ability to design and manufacture complex custom manifold blocks quickly and efficiently, often serves as the crucial differentiator among competitors. The reliance on external software partners for control algorithm development and predictive maintenance platforms is also growing, indicating a shift towards ecosystem collaboration rather than purely vertical integration. Pricing strategies vary significantly, reflecting the spectrum from high-volume, standard check valves to low-volume, highly customized proportional units, underscoring the market’s technological diversity.

The regulatory environment, particularly concerning safety standards and machinery directives, exerts substantial influence on component design, particularly in regions like Europe, where compliance is paramount. Manufacturers must continually update their product lines to meet evolving requirements for noise emission reduction and operational integrity under fault conditions, driving investment in fail-safe mechanisms and redundant control architectures using multiple cartridge valves within a single manifold. The economic environment, characterized by global supply chain volatility in the aftermath of recent global disruptions, continues to challenge lead times and inventory management for valve manufacturers. Successful market participants are proactively diversifying their sourcing of essential components, such as solenoid coils and highly specialized steel, to mitigate risks and maintain reliable delivery schedules to their high-volume customers, securing long-term contracts based on supply stability and technical reliability.

Emerging markets in Latin America and MEA, while currently smaller, present significant potential for growth as they modernize their heavy equipment fleets and invest in specialized industrial infrastructure. These regions often prioritize durability and ease of repair, favoring screw-in valves with robust construction. Conversely, mature markets demand continuous performance improvements, focusing on micro-leakage reduction, high-speed switching capabilities, and enhanced energy recovery features integrated through advanced hydraulic circuitry. The intersection of these diverse regional demands compels manufacturers to maintain a broad and technically deep product offering, ensuring that they can address highly price-sensitive segments while simultaneously servicing the premium, high-technology requirements of leading global OEMs seeking next-generation proportional control technology.

The role of specialized simulation and modeling software in the design phase cannot be overstated. Manufacturers increasingly use Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA) to virtually optimize the valve and manifold design, significantly reducing the physical prototyping cycles required for new products. This use of advanced simulation is vital for minimizing pressure drop losses and ensuring consistent performance across various fluid temperatures and viscosities, which is critical for complex electro-hydraulic systems. Investment in these simulation tools represents a growing operational expenditure for leading firms, contributing to faster time-to-market for technically superior valves. Furthermore, patent protection surrounding novel spool designs, poppet actuation mechanisms, and specialized seals is a key competitive element, safeguarding technological advantages and ensuring market differentiation.

Looking ahead, the long-term profitability of the Cartridge Valve Market is heavily dependent on the integration of manufacturing automation within the production facilities themselves. Utilizing robotic assembly, automated testing stations, and integrated quality control systems improves the consistency and tolerance levels of the final product, addressing the zero-defect expectation prevalent among high-end industrial and aerospace customers. The sustainability of the market also relies on attracting and training a skilled workforce capable of designing, manufacturing, and servicing these complex electro-hydraulic systems. Workforce expertise in hydraulic engineering coupled with digital control theory is essential for navigating the ongoing transition towards smarter fluid power solutions powered by compact cartridge valve arrays.

Finally, the aftermarket segment—the sales of replacement valves and service parts—represents a substantial and stable revenue stream for established manufacturers, often accounting for a significant portion of annual earnings. The longevity and widespread installation base of hydraulic machinery globally ensure continuous demand for maintenance components. Companies with proprietary designs or specialized interfaces benefit greatly in the aftermarket, often facing less competition than in the initial OEM sales cycle. Therefore, maintaining extensive stock availability through regional distribution partners and ensuring backward compatibility for older hydraulic systems are crucial elements of a successful long-term market strategy, securing sustained profitability throughout the forecast period ending in 2033.

The continuous push for higher operational pressures across applications like mining and specialized drilling equipment is compelling innovation in material composition and sealing technology. Cartridge valve manufacturers are exploring new high-strength steel alloys and advanced ceramic materials to handle pressures exceeding 500 Bar without compromising component life or reliability. This pursuit of ultra-high pressure capabilities is creating highly specialized sub-segments within the market, commanding premium pricing and stringent qualification processes. This focus on material robustness is paralleled by efforts to reduce the overall noise profile of hydraulic systems, achieved through meticulously designed poppet and spool interfaces that minimize turbulent flow and sudden pressure changes during switching operations, meeting increasingly stringent workplace noise regulations.

The complexity of electronic control units (ECUs) associated with proportional cartridge valves is increasing. These ECUs are moving towards field-programmable gate array (FPGA) architectures to handle highly complex, multi-axis motion control simultaneously, requiring high-speed data processing and minimal signal delay. This technological sophistication necessitates strong partnerships between valve manufacturers and industrial electronics specialists, as the performance of the valve is now intrinsically linked to the speed and accuracy of its dedicated electronic driver. The reliability of these integrated electro-hydraulic packages—tested across broad temperature and vibration ranges—is a key competitive factor for winning major contracts, especially in mobile machinery where environmental stressors are most pronounced.

Furthermore, the maintenance and diagnostic features integrated into the cartridge valve systems are becoming increasingly user-friendly. Modern manifolds often include easily accessible test ports and standardized quick-disconnect features for rapid pressure checking and component replacement, minimizing machine downtime. The proliferation of digital twin technology is also beginning to impact the service phase, allowing engineers to simulate potential failures or optimize control parameters remotely, significantly improving efficiency in commissioning and troubleshooting large-scale hydraulic installations that rely on hundreds of integrated cartridge valves. This digital service capability is a growing selling point, especially for geographically dispersed operations like remote mining sites or offshore platforms.

The agricultural machinery sector is rapidly adopting proportional cartridge valves to enhance the precision of functions like automatic depth control, steering guidance, and implement operation. The need for precise, repeatable motion is crucial for maximizing crop yield and efficiency, driving demand for robust and highly responsive flow control cartridges. Manufacturers targeting this sector must ensure their products are designed to withstand vibration and particulate contamination inherent in farming environments while offering plug-and-play simplicity for field technicians. The interplay between hydraulic control and GPS guidance systems is pushing the development of cartridge valves capable of receiving and executing high-frequency digital commands instantaneously, transforming agricultural hydraulics into a high-tech control domain.

In conclusion, the Cartridge Valve Market is characterized by a strong convergence of mechanical innovation and digital integration. While traditional benefits like compact size and high-density power remain central, the future is defined by smart, connected, and highly specialized valves engineered to meet the demands of Industry 4.0, extreme operating conditions, and stringent sustainability goals. The strategic investments being made in AI-driven design, advanced materials, and electronic integration underscore the market’s commitment to providing foundational components for the next generation of highly efficient and reliable fluid power systems globally.

The continuous global focus on renewable energy infrastructure, such as utility-scale wind turbines and concentrated solar power systems, also offers a specialized growth trajectory for the Cartridge Valve Market. These systems require high-reliability hydraulic controls for pitch control mechanisms, brake systems, and heliostat positioning, often operating intermittently but demanding fail-safe mechanisms and high durability over long operational lifetimes. Cartridge valves are favored here due to their robustness and ability to be easily integrated into complex safety-critical hydraulic power units (HPUs). Manufacturers providing certified components that meet rigorous safety integrity level (SIL) requirements are gaining a distinct competitive advantage in this specialized industrial vertical, necessitating meticulous quality control and stringent component traceability from raw material to final installation.

The increasing use of hybrid and electric vehicles in the mobile machinery sector introduces unique challenges and opportunities. Hydraulic systems on these vehicles must often integrate seamlessly with electric motor controls, demanding specialized cartridge valves that can manage highly dynamic load changes while minimizing electrical power consumption. This niche requires innovation in solenoid technology to achieve high switching forces with minimal power draw, facilitating extended battery life and improving overall energy management of the machine. The development of 'power-on-demand' hydraulic systems, heavily reliant on proportional cartridge valves, is a critical technical trend enabling efficiency gains in hybrid construction equipment, paving the way for wider electrification adoption across heavy industry.

Furthermore, standardizing manifold interfaces and cavity dimensions is a persistent market objective that benefits both manufacturers and end-users. While proprietary designs exist, the adherence to globally recognized standards for specific cartridge valve families (e.g., ISO, NFPA) facilitates component interchangeability and simplifies maintenance for fleet operators. Major players actively participate in standardization committees to ensure compatibility, which ultimately reduces the barriers to adoption for new customers entering the market or transitioning from older hydraulic technologies. The ability to supply a standardized, yet highly customizable, product line remains a key strategic capability for market leaders, supporting both the high-volume OEM market and the lower-volume MRO replacement market efficiently.

In terms of supply chain resilience, geopolitical tensions and trade restrictions pose ongoing challenges, particularly regarding the sourcing of specialized materials and microelectronic components critical for advanced proportional valves. Leading market companies are addressing this through dual-sourcing strategies and increasing localized component manufacturing within major regional markets (e.g., North America, Europe, and APAC). This diversification strategy is aimed at reducing dependence on single geographic locations and ensuring a stable supply of key product lines, which is crucial for maintaining relationships with major OEMs who demand guaranteed component delivery for their production lines. This proactive management of supply chain risks is becoming a significant factor influencing competitive positioning and contract longevity within the cartridge valve sector.

The technical sophistication required to design, manufacture, and integrate modern cartridge valve systems underscores the high barrier to entry for potential new competitors. Success requires deep expertise in fluid dynamics, mechanical precision engineering, electronic control systems, and complex material science. This established knowledge base, coupled with extensive patent portfolios held by incumbent market leaders, tends to stabilize the competitive structure, favoring established firms with decades of hydraulic experience. However, smaller, technologically nimble firms often find success by focusing on highly specialized niches, such as miniature proportional valves or solutions designed specifically for next-generation biodegradable fluids, demonstrating the market's capacity for focused innovation and specialized growth opportunities.

The market outlook remains highly positive, underpinned by secular growth trends in global infrastructure and industrial automation. The Cartridge Valve Market is no longer just supplying simple fluid control; it is providing intelligent, integrated control solutions that are essential catalysts for achieving the efficiency and precision demands of modern hydraulic systems. The emphasis on smart functionality, high power density, and continuous system optimization ensures the sustained relevance and growth of cartridge valve technology well into the next decade, consolidating its position as a core element of global fluid power transmission architecture across diverse high-value industrial and mobile applications.

The implementation of stricter environmental regulations, particularly concerning fluid contamination and leakage prevention, is driving manufacturers to enhance the sealing integrity and internal filtration specifications of cartridge valves. New materials and proprietary seal designs are being employed to ensure near-zero external leakage, a critical factor for equipment operating in environmentally sensitive areas. Furthermore, the internal design must accommodate the varying requirements of different hydraulic fluids—including standard mineral oils, fire-resistant synthetics, and environmentally acceptable lubricants (EALs)—without compromising performance or service life. This focus on environmental compatibility adds complexity to the R&D cycle but opens doors to markets committed to green machinery standards.

Digitalization in the industrial sector is pushing cartridge valve systems beyond simple command execution to active data generation. Manifold systems equipped with multiple smart valves act as sensory hubs, providing control systems with comprehensive real-time data on pressure, temperature, and flow conditions across various hydraulic circuits. This data is leveraged for advanced analytics, remote performance monitoring, and rapid fault diagnosis, enabling operators to manage assets based on actual condition rather than fixed schedules. This capability, driven by the increasing adoption of CANopen and similar fieldbus technologies integrated into the valve's electronic controller, solidifies the cartridge valve's role as a key contributor to holistic machine health management and operational transparency.

The educational component remains a vital force impacting market growth. As cartridge valve systems become more integrated and electronically controlled, there is a continuous need for technical training among service technicians, system integrators, and design engineers. Manufacturers offering comprehensive training programs and easily accessible diagnostic tools gain a competitive edge by simplifying the adoption and maintenance of their complex hydraulic solutions. Failure to adequately educate the end-user base on the intricacies of manifold systems, particularly proportional control adjustments, can lead to suboptimal performance and higher perceived complexity, acting as a potential dampener on adoption rates in certain segments.

In summary, the confluence of high technological specialization, robust market demand from critical sectors, and continuous pressure for operational efficiency and environmental compliance defines the Cartridge Valve Market. Success is increasingly tied to the ability to merge mechanical engineering mastery with cutting-edge electronics and data management capabilities, positioning cartridge valves at the forefront of the smart fluid power revolution and ensuring their projected steady market growth through the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager