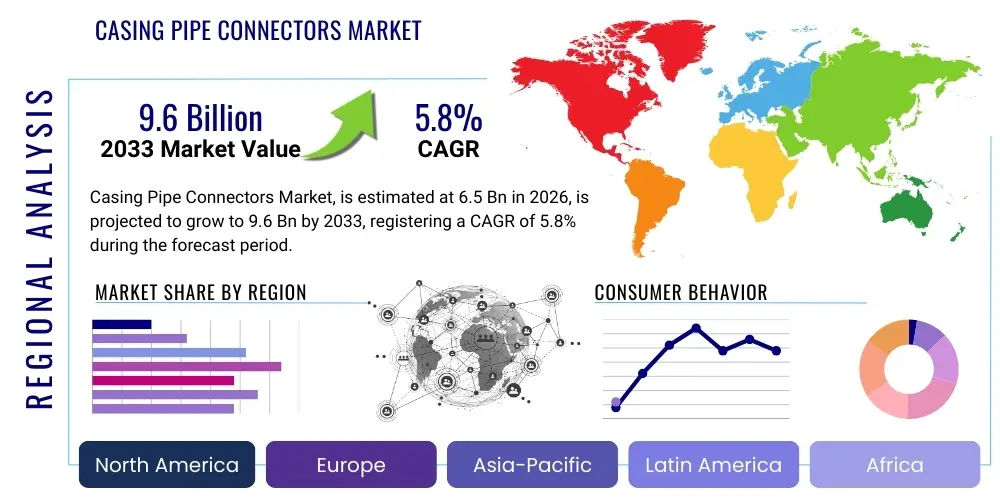

Casing Pipe Connectors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441618 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Casing Pipe Connectors Market Size

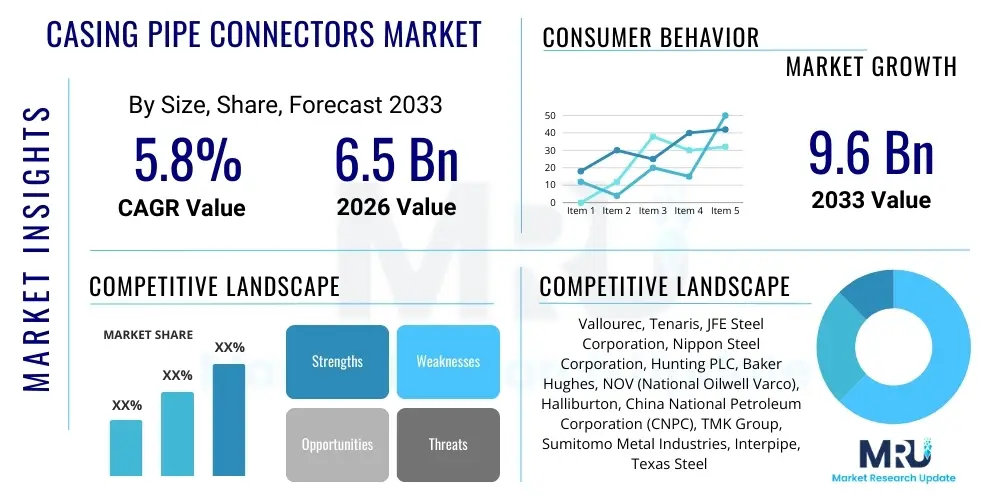

The Casing Pipe Connectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Casing Pipe Connectors Market introduction

The Casing Pipe Connectors Market constitutes the specialized industrial segment dedicated to manufacturing and supplying coupling systems essential for joining sections of steel pipe used in downhole drilling operations, primarily within the oil and gas industry, but increasingly in geothermal and carbon capture utilization and storage (CCUS) applications. Casing pipes are critical structural elements that stabilize the wellbore, prevent contamination of groundwater, and facilitate the safe passage of hydrocarbons to the surface. The integrity and reliability of the connectors are paramount, directly influencing well longevity, operational safety, and overall project cost efficiency. Connectors must withstand immense axial tension, compression, high internal and external pressures, and corrosive environments, necessitating precision engineering and stringent material specifications.

Product descriptions within this market range broadly, including but not limited to threaded and coupled (T&C) connectors, premium connections, and specialized proprietary sealing mechanisms. Premium connections, characterized by metal-to-metal seals and semi-flush or flush designs, are increasingly preferred, especially in complex drilling environments such such as deep water, high-pressure/high-temperature (HPHT) wells, and horizontal drilling projects, where standard API connections might fail. These advanced connections offer superior torque capacity, enhanced leak resistance, and improved fatigue life, which are crucial for maintaining wellbore stability and maximizing recovery rates in challenging geological formations.

Major applications of casing pipe connectors are intrinsically linked to upstream exploration and production (E&P) activities globally. Driving factors for market growth include the resurgence in oil and gas exploration activities in frontier areas, particularly offshore deep-water basins and unconventional shale plays, which demand high-specification casing and robust connector technology. The inherent benefits of using high-quality connectors—reduced non-productive time (NPT) due to connection failures, improved well integrity management, and compliance with increasingly rigorous environmental and safety regulations—further propel market expansion. Additionally, the replacement of aging infrastructure and the push towards advanced drilling methodologies contribute significantly to the sustained demand for premium casing pipe connector solutions.

Casing Pipe Connectors Market Executive Summary

The global Casing Pipe Connectors Market is experiencing a robust period of expansion, driven primarily by favorable business trends centered around increased capital expenditure in upstream oil and gas, alongside technological innovation aimed at conquering ultra-deep and unconventional reserves. Business trends indicate a strong move away from standard API connections toward proprietary, premium threaded connections (PTCs) that feature gas-tight seals and superior bending strength. Manufacturers are focusing heavily on intellectual property protection and licensing agreements to solidify their market position, recognizing that differentiation in connection technology provides a substantial competitive advantage in tender processes for major E&P projects. The integration of advanced machining techniques and novel materials, such as high-strength alloys and specialized coatings, is a central theme driving product evolution and market value.

Regionally, the market dynamics are characterized by polarized growth patterns. North America, particularly the U.S., remains a powerhouse due to sustained activity in shale drilling, requiring large volumes of intermediate and production casing with robust connections suitable for horizontal stress and repeated cycling. However, the highest growth rates are anticipated in the Asia Pacific and the Middle East, fueled by substantial national oil company (NOC) investments in mega-projects and the imperative to maximize existing field yields through enhanced oil recovery (EOR) techniques and infill drilling. Regional trends also show increasing localization of manufacturing and supply chain capabilities in high-demand zones to reduce logistics costs and lead times, particularly in Saudi Arabia, UAE, and China.

Segment trends highlight the dominance of premium connections over standard connections in terms of value, despite standard connections leading in volume in less complex operational areas. Functionally, the segment catering to high-pressure, high-temperature (HPHT) applications is demonstrating exceptional demand growth, reflecting the industry's need to access deeper, more challenging reservoirs. Furthermore, there is a distinct trend towards automation and digitalization in connection make-up processes. This trend emphasizes the need for connectors optimized for automated torque control systems, ensuring consistent, repeatable, and verifiable joint integrity, which translates directly into lower operational risk and enhanced well lifetime assurance.

AI Impact Analysis on Casing Pipe Connectors Market

User queries regarding the impact of Artificial Intelligence (AI) on the Casing Pipe Connectors Market frequently revolve around optimizing manufacturing precision, predicting potential connection failures, and streamlining supply chain logistics in dynamic drilling environments. Users are particularly interested in how machine learning can enhance Quality Control (QC) processes, moving beyond manual inspection to predictive modeling of thread wear and sealing surface defects. Key concerns include the upfront investment required for integrating AI-driven monitoring systems into existing manufacturing plants and the reliability of AI algorithms in interpreting highly complex material and structural data derived from connection inspections both before and after deployment. Expectations center on AI providing a tangible reduction in non-productive time (NPT) caused by defective connections or improper make-up procedures, thereby increasing operational efficiency.

AI’s influence is primarily felt in three critical domains: advanced manufacturing, predictive maintenance, and optimized drilling execution. In manufacturing, AI models analyze real-time sensor data from CNC machines to detect micro-deviations in thread geometry and profile, ensuring that every connection manufactured adheres precisely to proprietary tolerances, a requirement vital for premium connections. This proactive adjustment minimizes scrap rates and significantly elevates product quality consistency across high-volume production batches. Furthermore, AI systems are instrumental in material traceability and certification management, creating immutable digital records for each connector, which addresses the industry’s increasing need for transparency and regulatory compliance regarding material source and handling.

Operationally, AI systems are integrated into automated drilling rigs to monitor connection make-up parameters—torque, turn, and hydraulic pressure—comparing real-time signatures against optimal digital twins of the specific connection type. Any deviation suggesting potential galling, cross-threading, or insufficient sealing pressure is flagged immediately, preventing costly remedial operations downhole. This predictive analysis extends to modeling the remaining fatigue life of connections under specific downhole stress profiles, informed by seismic and geological data. By providing precise life predictions, AI supports better decision-making regarding string design and replacement schedules, thus optimizing expenditure and mitigating catastrophic failure risks associated with casing string collapse.

- AI optimizes CNC machining parameters for ultra-high-precision thread cutting, reducing manufacturing defects.

- Machine learning algorithms predict connection fatigue life based on downhole stress simulation and historical failure data.

- Predictive analytics in supply chain management forecasts demand fluctuations based on E&P activity, optimizing inventory levels for specialized connectors.

- Real-time monitoring during connection make-up uses AI to verify torque-turn signatures against optimal standards, ensuring gas-tight sealing integrity.

- AI enhances visual inspection systems (VIMS) by identifying subtle surface flaws and dimensional inconsistencies invisible to manual inspection.

DRO & Impact Forces Of Casing Pipe Connectors Market

The Casing Pipe Connectors Market is shaped by a powerful interplay of Drivers, Restraints, and Opportunities (DRO), collectively channeled through various impact forces primarily driven by the volatility of global energy markets and continuous technological demands in upstream exploration. A primary driver is the global imperative for energy security, which fuels extensive capital investment in offshore drilling, especially in technically demanding ultra-deepwater and Arctic regions where only premium, highly reliable connections can be utilized. This demand is reinforced by the global increase in horizontal drilling and hydraulic fracturing, requiring long casing strings that subject connectors to severe bending moments and complex load cycles, thereby necessitating higher performance specifications and material strength. The critical nature of well integrity regulations also acts as a powerful driver, pushing operators towards certified, superior quality connections to minimize environmental and safety liabilities associated with downhole failures.

Conversely, the market faces significant restraints, chiefly the cyclical volatility of crude oil prices, which directly impacts E&P capital expenditure. Prolonged periods of low oil prices can lead to project cancellations or delays, subsequently suppressing demand for high-cost specialized connectors. Furthermore, the stringent material and manufacturing requirements necessary for premium connections create high barriers to entry, limiting competition and potentially leading to supply concentration risks. The slow, arduous qualification process required by major operators for new connection designs often delays the commercialization and widespread adoption of innovative connector technologies. The increasing focus on renewable energy sources also acts as a long-term restraint, potentially diverting investment away from traditional fossil fuel exploration, though the Casing Pipe Connectors Market is diversifying slightly into geothermal and CCUS applications to partially offset this.

Opportunities within the sector are abundant, centered around technological diversification and geographical expansion. The burgeoning market for carbon capture and storage (CCS) requires robust, long-lasting casing connections capable of handling potentially corrosive CO2 injection environments, opening a niche for specialized alloy connectors. Similarly, the geothermal energy sector, characterized by extremely high temperatures and highly corrosive geothermal fluids, demands connections far exceeding standard API specifications, providing a substantial avenue for premium technology providers. Furthermore, the ongoing digitalization of the oilfield presents opportunities for companies to integrate smart connection features, such as embedded sensors for real-time monitoring of connection stress and strain, enhancing predictive maintenance capabilities and delivering superior value proposition to end-users.

Segmentation Analysis

The Casing Pipe Connectors Market is structurally segmented across key dimensions including connection type, application depth, performance standards, and material composition, all of which directly influence pricing and end-user adoption rates. Segmentation by connection type, which is the most critical determinant of product performance, distinguishes between standard connections, primarily based on American Petroleum Institute (API) specifications (such as Buttress and Short/Long Thread Casing), and proprietary premium connections. Premium connections command higher prices due to their specialized thread forms, advanced sealing capabilities—often metal-to-metal seals—and superior resistance to tension, compression, and gas leakage, making them essential for non-conventional and critical drilling projects.

Segmentation by performance standards generally correlates with the severity of the operational environment. This includes connections designed for high-pressure/high-temperature (HPHT) wells, which demand superior yield strength and thermal stability, connections for sour service (H2S and CO2 environments), requiring specialized corrosion-resistant alloys, and connections tailored for deepwater or extended-reach drilling (ERD), which require high bending capacity and fatigue resistance. This granular segmentation allows manufacturers to target specific, high-value drilling campaigns, ensuring their product specifications precisely match the geological and operational demands of the wellbore, which is a key factor in ensuring project success and mitigating liability risks.

Further analysis of the market segments reveals that application depth is a critical factor, categorizing demand into surface casing (shallow depth, low performance requirements), intermediate casing (medium depth, moderate stability requirements), and production casing/liner (deepest section, highest performance demands, gas-tight sealing critical). The production casing segment, utilizing the most complex and robust connectors, generates the highest revenue due to the absolute requirement for flawless well integrity over the entire operational life of the well. The complexity and high cost of remediation for production casing failure solidify the demand inelasticity for premium connections in this specific application area.

- By Connection Type:

- API Connections (e.g., Buttress Thread, Short Thread Casing)

- Premium Connections (Proprietary Threaded Connections - PTCs)

- By Performance Standard:

- High-Pressure/High-Temperature (HPHT)

- Sour Service (H2S/CO2 resistant)

- Standard Service

- By Casing Application:

- Surface Casing

- Intermediate Casing

- Production Casing and Liners

- By End-Use Industry:

- Oil and Gas (Upstream E&P)

- Geothermal Energy

- Carbon Capture and Storage (CCS)

Value Chain Analysis For Casing Pipe Connectors Market

The value chain for the Casing Pipe Connectors Market begins with upstream activities involving the sourcing and processing of raw materials, predominantly high-grade steel billets and specialized alloys (e.g., chrome, nickel-based alloys). Critical upstream analysis focuses on the stability of steel pricing, the availability of specialized metallurgical grades, and the capabilities of primary steel mills, as these factors significantly influence production cost and lead times for finished connectors. Steel manufacturers often work closely with connection developers to ensure the raw pipe meets the mechanical and chemical composition required for subsequent threading and sealing processes, especially for non-standard, high-strength casing used in deep wells.

The core manufacturing stage involves the precision machining of the connector threads and couplings, which represents the highest value-add segment of the chain. This stage is dominated by companies holding proprietary threading technology and utilizing highly specialized CNC equipment to achieve the stringent tolerances required for gas-tight sealing. Following machining, connectors undergo rigorous quality control (QC) testing, including drift testing, hydrostatic pressure tests, and non-destructive examination (NDE) methods such as ultrasonic and magnetic particle inspection. Distribution channels involve a complex network, typically blending direct sales from large manufacturers to major integrated oil companies (IOCs) and national oil companies (NOCs) for mega-projects, with indirect distribution through specialized oilfield service (OFS) distributors or authorized agents who manage inventory and supply logistics for smaller independent operators and regional drilling programs.

Downstream analysis focuses on the end-use application at the wellsite, where the efficiency of the connection make-up and running process dictates overall drilling efficiency. The final segment of the value chain often includes post-sale technical support, connection make-up supervision, and comprehensive training provided by the connector manufacturer to the drilling crew. The trend towards vertical integration is evident among major industry players who possess capabilities spanning pipe rolling, connector threading, and field services, allowing them greater control over quality assurance and intellectual property protection, mitigating risks associated with unauthorized replication or substandard handling of proprietary designs.

Casing Pipe Connectors Market Potential Customers

Potential customers for casing pipe connectors are primarily concentrated within the global upstream oil and gas sector, categorized into three distinct buying groups: International Oil Companies (IOCs), National Oil Companies (NOCs), and Independent Exploration and Production (E&P) companies. IOCs, such as ExxonMobil, Chevron, and Shell, represent major buyers of premium connections due to their involvement in complex, high-risk projects like deepwater offshore drilling and HPHT environments where connection failure is economically catastrophic. These entities prioritize technical specifications, proven reliability, and extensive global field service support, often engaging in multi-year framework agreements with approved connector suppliers to ensure standardized quality across their worldwide operations.

National Oil Companies (NOCs), including Saudi Aramco, Sinopec, and Petrobras, represent the largest volume segment of the market, driven by massive domestic resource development programs. While some NOCs utilize standard API connections for conventional onshore drilling, many are rapidly adopting premium connections to maximize recovery from complex fields and ensure the integrity of their strategic reserves. Purchasing decisions in this segment are heavily influenced by local content requirements, strategic partnerships, and technology transfer opportunities, often leading to joint venture manufacturing or licensing agreements with international threading specialists.

Independent E&P companies, focusing largely on onshore unconventional plays (e.g., shale gas/oil in North America), constitute a high-volume, cost-sensitive customer base. These operators require reliable, high-speed make-up connections suitable for fast-paced multi-well pad drilling. While they are often more receptive to innovative cost-effective solutions, the sustained demand for long horizontal laterals ensures a consistent requirement for intermediate-level premium connections capable of handling substantial bending stress and friction during installation. The diversification of the market into adjacent sectors like geothermal and CCUS also creates a niche customer base of specialized utility operators and industrial firms requiring highly durable, corrosion-resistant connectors for non-hydrocarbon applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vallourec, Tenaris, JFE Steel Corporation, Nippon Steel Corporation, Hunting PLC, Baker Hughes, NOV (National Oilwell Varco), Halliburton, China National Petroleum Corporation (CNPC), TMK Group, Sumitomo Metal Industries, Interpipe, Texas Steel Pipe & Supply, VAM Services, Hydril (Tenaris), Oil Country Tubular Limited (OCTL), TPCO (Tianjin Pipe Group), Butting Group, US Steel Tubular Products, Chelpipe Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Casing Pipe Connectors Market Key Technology Landscape

The technological landscape of the Casing Pipe Connectors Market is primarily defined by continuous innovation in thread geometry, sealing mechanisms, and material science aimed at maximizing connection integrity under extreme operational stress. A pivotal technology is the proprietary threaded connection (PTC), which moves beyond the limitations of trapezoidal API threads. PTCs incorporate features such as hooked or wedge threads that provide enhanced resistance to jump-out and compression, crucial for deep directional wells where complex loads are common. These advanced thread forms are often designed specifically for optimal torque shoulders and precise load distribution, ensuring the connection maintains its integrity even when subjected to significant bending moments and cyclic loading during drilling and production phases.

A second major technological development involves the widespread adoption of metal-to-metal (MTM) sealing systems. Unlike conventional connections that rely on thread compounds and thread interference for sealing, MTM seals use precision-machined conical or spherical surfaces that deform slightly upon make-up, creating a high-contact-stress, gas-tight seal independent of the thread interference. This technology is indispensable for HPHT and sour service applications where even minor gas leakage (gas migration) can compromise well integrity and pose severe environmental hazards. Recent technological advancements focus on optimizing the MTM sealing surface with specialized coatings, such as manganese phosphate or nickel alloys, to minimize friction and prevent galling during repeated make-up and break-out cycles.

Furthermore, digital technologies are rapidly becoming integral to the connector landscape. Smart connections, though still nascent, incorporate embedded RFID tags or micro-sensors that allow for automated tracking of each joint’s history—including manufacturing data, QC results, and previous make-up torque values. This digitalization supports the industry trend toward "intelligent strings" and improves well lifecycle management. Simultaneously, advanced manufacturing techniques, including computer-aided manufacturing (CAM) and specialized robotic threading systems, are essential for consistently replicating the ultra-tight tolerances required by premium connector designs, driving both quality assurance and production efficiency across the leading global manufacturers.

Regional Highlights

Regional dynamics in the Casing Pipe Connectors Market reflect the concentration of global oil and gas reserves, levels of technological adoption, and the maturity of drilling operations. North America, dominated by the United States and Canada, represents the largest consuming market by volume. The relentless pace of unconventional shale drilling, characterized by high-volume requirements for intermediate and production casing for thousands of horizontal wells, drives consistent demand. The region exhibits high acceptance of both standard API and performance-critical premium connections, leveraging highly localized supply chains and technologically advanced drilling equipment. While drilling activity is susceptible to short-term price fluctuations, the structural demand for well integrity in complex shale reservoirs ensures robust consumption of high-specification connectors tailored for long lateral sections and high internal pressures.

The Middle East and Africa (MEA) region is characterized by massive, long-term mega-projects spearheaded by National Oil Companies (NOCs). This region is becoming increasingly critical due to extensive capital investments in expanding production capacity and executing demanding sour gas projects (e.g., in Saudi Arabia and Qatar) and deep-water exploration in West Africa. Demand here is overwhelmingly focused on premium connections capable of handling severe corrosive environments (high H2S and CO2 content) and high reservoir temperatures. Strategic partnerships and the establishment of local manufacturing facilities by major global suppliers are key regional features, driven by government mandates to enhance local content and strengthen domestic industrial bases while ensuring a stable supply of certified materials for critical national infrastructure.

Asia Pacific (APAC) shows the fastest growth trajectory, led primarily by deepwater exploration activities in Southeast Asia (e.g., Indonesia, Malaysia) and substantial onshore unconventional gas development in China and Australia. This region is diverse, combining established mature fields requiring infrastructure replacement with frontier areas demanding the highest performance connectors for complex geological structures. Europe, conversely, features a more mature market with relatively stable demand, focused mainly on North Sea decommissioning activities, strict environmental compliance, and specialized high-performance requirements for limited remaining exploration (e.g., Norwegian deepwater). Latin America's market volatility is high, tied closely to the investment decisions of large NOCs like Petrobras and Pemex, with significant demand drivers coming from deepwater projects off the coast of Brazil and conventional drilling restoration in countries like Argentina and Colombia.

- North America: Dominates volume driven by expansive shale and horizontal drilling requiring high fatigue resistance and efficient make-up connections.

- Middle East & Africa (MEA): High value market segment driven by NOC mega-projects, demanding specialized premium connections for severe sour service and high-temperature wells.

- Asia Pacific (APAC): Highest growth market fueled by deepwater exploration and unconventional resource development in China and Australia, necessitating localized high-specification production.

- Europe: Stable demand centered on decommissioning, stringent regulatory compliance, and niche application of specialized connectors in mature North Sea basins.

- Latin America: Market growth tied to major offshore deepwater projects, particularly in Brazil and Mexico, requiring technologically advanced, corrosion-resistant casing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Casing Pipe Connectors Market.- Vallourec

- Tenaris

- JFE Steel Corporation

- Nippon Steel Corporation

- Hunting PLC

- Baker Hughes

- NOV (National Oilwell Varco)

- Halliburton

- China National Petroleum Corporation (CNPC)

- TMK Group

- Sumitomo Metal Industries

- Interpipe

- Texas Steel Pipe & Supply

- VAM Services

- Hydril (Tenaris)

- Oil Country Tubular Limited (OCTL)

- TPCO (Tianjin Pipe Group)

- Butting Group

- US Steel Tubular Products

- Chelpipe Group

Frequently Asked Questions

Analyze common user questions about the Casing Pipe Connectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between API connections and Premium Connections?

API connections are standard, less expensive thread forms (like Buttress) used for conventional, shallower wells. Premium connections (PTCs) feature proprietary thread profiles and specialized metal-to-metal seals, offering superior gas tightness, high torque capacity, and enhanced fatigue resistance essential for HPHT and complex directional drilling environments.

How does connection quality impact overall well integrity and operational safety?

Connection quality is the most critical factor in well integrity, as connection failure can lead to catastrophic casing collapse, leakage of hydrocarbons or drilling fluids, and environmental damage. High-quality, certified connections ensure proper pressure containment and load bearing, mitigating the risk of non-productive time and costly well remediation.

Which geographical region exhibits the highest demand growth for premium casing pipe connectors?

The Middle East and Asia Pacific regions currently exhibit the highest demand growth for premium casing pipe connectors, primarily driven by NOC investments in large-scale sour gas projects and deepwater exploration initiatives requiring specialized, high-performance tubular solutions.

What role does digitalization play in the future of the Casing Pipe Connectors Market?

Digitalization enhances manufacturing precision through AI-driven quality control, optimizes connection make-up procedures via automated torque-turn monitoring, and facilitates real-time well integrity management through smart connections with embedded tracking systems, leading to verifiable performance assurance.

What are the key technological advancements driving market competition among major suppliers?

Competition is driven by advancements in metal-to-metal sealing technology, the development of new wedge and hooked thread geometries for superior load resistance, and innovations in high-strength, corrosion-resistant alloy materials suitable for increasingly challenging downhole service conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager