Cassava Bioethanol Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441267 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Cassava Bioethanol Market Size

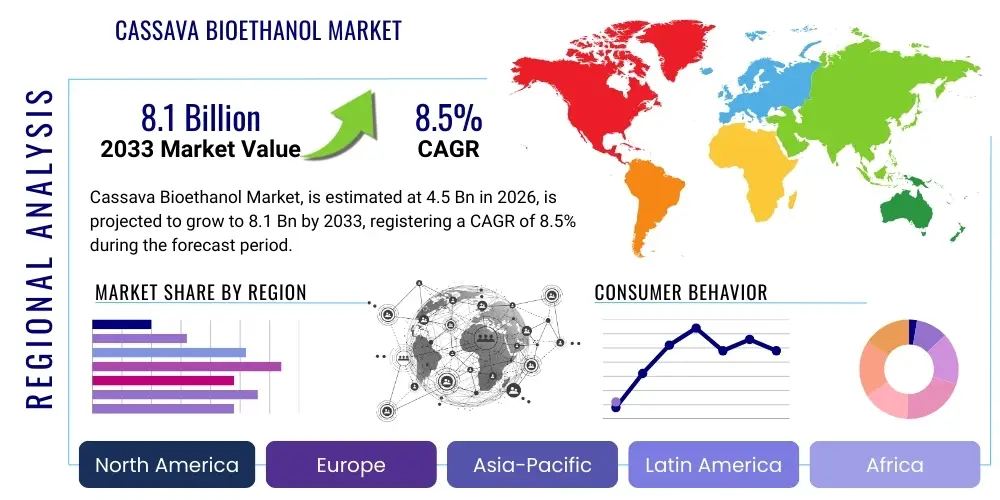

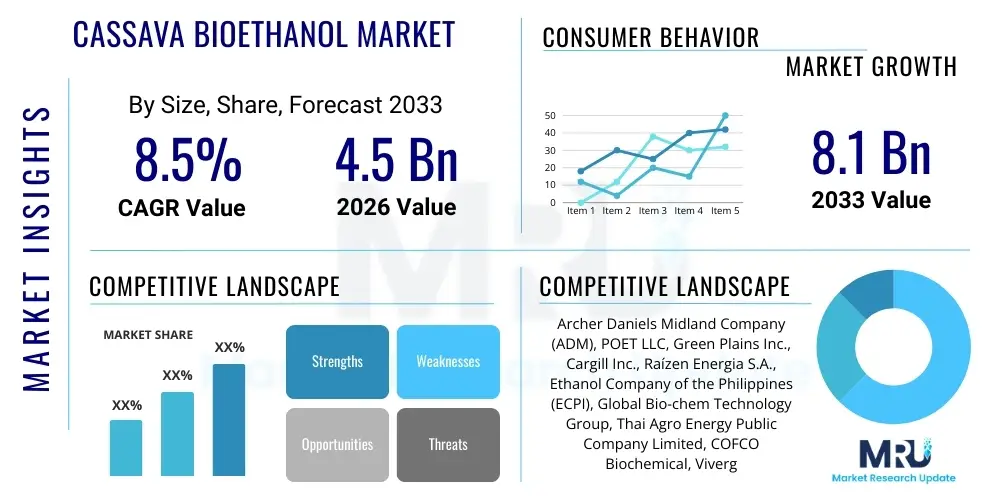

The Cassava Bioethanol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Cassava Bioethanol Market introduction

The Cassava Bioethanol Market encompasses the production and utilization of ethanol derived from cassava roots, a starch-rich feedstock, primarily for blending with conventional gasoline as a sustainable transport fuel. Cassava bioethanol stands out due to the crop's high starch yield, resilience to adverse climate conditions, and relatively low cultivation input requirements compared to corn or sugarcane in certain tropical regions. This biofuel is a key component in national renewable energy strategies aimed at reducing reliance on fossil fuels, mitigating greenhouse gas emissions, and enhancing energy security, particularly in Southeast Asia and Africa where cassava is a staple crop and abundant resource. The product is categorized mainly into fuel grade, which adheres to strict specifications for automotive use (like E10 or E85 blends), and industrial grade, utilized in sectors such as chemicals and pharmaceuticals.

Major applications of cassava bioethanol center on the transportation sector, serving as an octane booster and a volumetric substitute for gasoline. Governmental mandates across developing economies, seeking to implement E-blending targets, are the primary driving factors for market growth. Beyond fuel, its versatility allows for applications in manufacturing ethyl acetate, ethanol-based disinfectants, and various solvent systems. The inherent benefits include socio-economic upliftment in rural areas through increased demand for cassava farming, reduced trade deficits concerning oil imports, and the development of decentralized biorefinery infrastructure. Furthermore, the push towards second-generation bioethanol production, leveraging cassava stems and leaves (lignocellulosic biomass), promises to enhance efficiency and address the 'food versus fuel' debate.

Driving factors are inherently linked to global climate policy and energy economics. Increasing volatility in crude oil prices makes locally sourced biofuels economically attractive. Simultaneously, commitments made under the Paris Agreement compel nations to decarbonize the transport sector rapidly. Technological advancements, particularly in enzymatic saccharification and fermentation processes, are continually improving the yield and cost-effectiveness of converting cassava starch into ethanol, making it competitive against other staple-derived feedstocks. This synergy of policy support, technological refinement, and economic incentive establishes a robust foundation for the continued expansion of the cassava bioethanol industry throughout the forecast period.

Cassava Bioethanol Market Executive Summary

The Cassava Bioethanol Market is characterized by robust growth, propelled primarily by governmental blending mandates and favorable regulatory frameworks emphasizing carbon neutrality. Business trends indicate a strong focus on integration, with major petrochemical and energy firms investing heavily in upstream processing facilities and establishing integrated biorefineries that utilize both the starch and the lignocellulosic components of the cassava plant. Furthermore, there is a pronounced shift towards establishing large-scale facilities near major cassava cultivation hubs, particularly in countries like Thailand, Nigeria, and Indonesia, to minimize logistics costs and secure stable feedstock supply. The competitive landscape is defined by efficiency improvements in fermentation and distillation, driving down operational expenditures and making cassava bioethanol economically viable even during periods of fluctuating fossil fuel prices.

Regional trends are clearly bifurcated, with Asia Pacific (APAC) dominating the production and consumption landscape due to widespread cassava farming, supportive policy environments (e.g., in China and Thailand for E10 mandates), and the large, rapidly expanding automotive market. Conversely, Africa represents the greatest untapped potential, driven by governments seeking to leverage domestic agricultural output for industrial applications and energy independence. North America and Europe, while having limited cassava cultivation, significantly influence the market through advanced enzyme technology export and investment in sustainable feedstock research, pushing global standards for efficiency and carbon intensity reduction. Geopolitical stability and reliable crop yield are becoming critical success factors influencing investment decisions across all major operating regions.

Segmentation trends highlight the enduring dominance of the Transportation Fuel segment, especially for low-level blends (E10/E15). However, the Industrial Grade segment is gaining traction, driven by demand for bio-based chemicals and solvents as industries seek renewable alternatives to petroleum-derived inputs. The technological segment shows a clear progression toward Enzymatic Hydrolysis over older, less efficient acid-based methods, owing to higher ethanol yields and reduced environmental impact. Investment remains concentrated on maximizing the conversion efficiency of the total cassava root biomass, signaling a move towards circular economy principles within the bioethanol production cycle, which further solidifies the segment's attractive investment profile for the long term.

AI Impact Analysis on Cassava Bioethanol Market

User queries regarding the integration of Artificial Intelligence (AI) in the Cassava Bioethanol Market overwhelmingly focus on three core areas: optimizing agricultural yield and resilience, enhancing processing efficiency, and streamlining complex global supply chains. Users are keenly interested in how machine learning models can predict cassava diseases, optimize fertilizer usage based on hyper-local climate data, and ultimately stabilize feedstock prices—a major constraint in the market. Furthermore, a significant cluster of questions addresses the use of AI in biorefinery operations, specifically leveraging predictive maintenance for fermentation tanks and using deep learning algorithms to fine-tune enzyme dosage and reaction times for maximum ethanol conversion efficiency. The overarching expectation is that AI will transform cassava bioethanol production from a commodity-driven agricultural process into a highly optimized, data-driven, and cost-efficient industrial operation, thereby ensuring its competitiveness against traditional fossil fuels and first-generation biofuels.

- AI-driven Precision Agriculture: Optimizing cassava planting, irrigation, and harvesting schedules using satellite imagery and IoT sensors to maximize starch yield and predict harvest quantities, thereby stabilizing feedstock availability.

- Biorefinery Process Optimization: Implementing machine learning algorithms to monitor and control fermentation kinetics, temperature, pH levels, and enzyme activity in real-time, significantly increasing ethanol conversion rates and reducing batch cycle times.

- Predictive Maintenance and Quality Control: Utilizing AI models for early fault detection in processing equipment and analyzing spectroscopic data to ensure consistent fuel grade purity, minimizing downtime and operational waste.

- Supply Chain and Logistics Management: Deploying AI for optimal routing and scheduling of cassava transport from farms to biorefineries, and managing inventory levels of enzymes and finished ethanol product, thereby reducing logistical bottlenecks and costs.

- Market Trend Forecasting: Applying natural language processing (NLP) and predictive modeling to anticipate regulatory changes, crude oil price fluctuations, and competitor strategies, enabling proactive business decisions and dynamic pricing strategies.

- Sustainability Modeling and GHG Reduction: Using AI tools to calculate and minimize the carbon intensity of the entire production lifecycle (from farm to pump), ensuring compliance with stringent international sustainability standards and improving the biofuel's environmental profile.

DRO & Impact Forces Of Cassava Bioethanol Market

The Cassava Bioethanol Market is primarily driven by supportive governmental policies mandating biofuel blending and the intrinsic need for sustainable energy sources to combat climate change, offering producers guaranteed domestic demand. However, the market faces significant restraints, chiefly stemming from the volatility of cassava feedstock prices, which are heavily influenced by agricultural yields, competing demand from the food sector, and climatic variations, often impacting the final cost of bioethanol production and jeopardizing project feasibility. Opportunities lie in technological advancements, particularly the development of high-efficiency enzymes and yeasts capable of utilizing entire cassava biomass (including the cellulosic components), thereby improving overall resource utilization and reducing waste. These internal dynamics are magnified by external impact forces, including global crude oil price fluctuations and stringent international sustainability certification requirements (e.g., ISCC), which dictate market competitiveness and access to premium export markets, ultimately shaping investment decisions and long-term strategic planning.

The primary driver remains the global regulatory push, exemplified by ambitious E20 or E85 targets set by major emerging economies. This policy environment de-risks initial capital investments, providing a stable consumption floor for producers. Furthermore, cassava's status as a drought-resistant crop offers a geographical diversification advantage over sugarcane or corn, appealing to countries seeking resilient energy supply chains. Restraints, besides feedstock price instability, include the significant capital expenditure required for setting up modern, integrated biorefineries and the necessity for extensive infrastructure development—from dedicated transport links to efficient water management systems—especially in rural production areas. These high initial costs often create barriers to entry for smaller players and necessitate robust financing mechanisms, sometimes requiring government subsidies or public-private partnerships to overcome.

The key opportunity resides in expanding beyond fuel applications into the high-value biochemicals sector, utilizing ethanol as a platform molecule for deriving green ethylene, butadiene, and other petrochemical substitutes. This integration into the broader bioeconomy enhances profit margins and mitigates dependence on the fluctuating transport fuel market. The impact forces are multifaceted: economic forces determine the viability of bioethanol relative to gasoline; technological forces continuously redefine efficiency and sustainability metrics; and political forces dictate access to markets through tariffs, subsidies, and blending mandates. Success in the cassava bioethanol market therefore requires a strategic approach that balances technological innovation, rigorous cost control, and adept navigation of complex international trade and climate policies.

Segmentation Analysis

Segmentation of the Cassava Bioethanol Market provides crucial insights into the diverse end-use applications and technological pathways driving demand. The market is fundamentally segmented by Type, distinguishing between Fuel Grade and Industrial Grade ethanol based on purity and specification requirements, reflecting different regulatory environments and consumer needs. Further segmentation by Application clearly delineates the massive influence of the Transportation sector versus the growing, high-value demand from the Chemicals and Pharmaceutical industries. Understanding these segments allows market participants to tailor their production capabilities and commercial strategies, focusing either on high-volume commodity fuel sales or specialized, high-purity solvent markets. The increasing technological segmentation by Process, particularly the shift from conventional hydrolysis to advanced enzymatic methods, underscores the industry's commitment to improving yield efficiency and sustainability metrics, which are critical for long-term growth and competitiveness.

- By Type

- Fuel Grade Bioethanol (E10, E85 blends, etc.)

- Industrial Grade Bioethanol (Solvents, Beverages, Chemical Feedstock)

- By Application

- Transportation Fuel (Automotive and Aviation)

- Chemical Intermediates (e.g., Ethyl Acetate, Bio-plastics)

- Pharmaceutical and Cosmetics (Sanitizers, Solvents)

- Alcoholic Beverages (Industrial Alcohol)

- By End-User

- Automotive Industry

- Chemical Manufacturing

- Energy & Utility Sector (Blending Facilities)

- Pharmaceutical Industry

- By Process

- Conventional Hydrolysis and Fermentation (Acid/Base)

- Enzymatic Hydrolysis (Advanced Saccharification)

- Integrated Biorefinery Systems

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Cassava Bioethanol Market

The Cassava Bioethanol value chain begins intensely upstream with raw material sourcing and preparation. This stage involves the cultivation of cassava, often characterized by smallholder farming in developing nations, followed by initial harvesting, cleaning, and transportation to the processing facility. Upstream activities are critical as the quality and starch content of the feedstock directly dictate the efficiency and yield of the final product. Optimization efforts in this stage focus on implementing precision agriculture techniques, ensuring consistent high-starch varieties are planted, and minimizing pre-processing losses. Challenges include securing stable supply contracts and mitigating price volatility driven by climate-related yield variations, requiring producers to often engage in forward contracting or vertical integration with large agricultural cooperatives to ensure security of supply.

The midstream segment is characterized by complex industrial processing, starting with starch extraction and saccharification, where long starch chains are broken down into fermentable sugars, followed by the actual fermentation of these sugars into ethanol using specialized yeast strains. This is succeeded by rigorous distillation and dehydration processes to achieve the requisite purity (typically 99.5% for fuel grade). Technological superiority in the midstream—especially the adoption of advanced enzymatic hydrolysis methods—is the primary differentiator among competitors, enabling lower energy consumption and higher throughput. Furthermore, many modern facilities integrate co-product recovery, transforming fermentation residue (vinasse) into animal feed or fertilizer, thus enhancing the overall economic viability and environmental profile of the operation.

The downstream activities involve the blending, storage, and distribution of the finished bioethanol product. Distribution channels typically operate through large centralized blending facilities, where bioethanol is mixed with gasoline to meet specific national blending mandates (e.g., E10, E20). Direct distribution often occurs to chemical and pharmaceutical end-users requiring industrial-grade ethanol. Indirect channels involve bulk selling to large oil marketing companies or government-controlled petroleum distributors. Key downstream considerations include securing efficient rail or pipeline access, maintaining stringent quality control during transport to prevent contamination, and navigating the complex interplay of government regulations that dictate pricing, tax incentives, and mandatory blending volumes, ultimately determining market access and consumption levels.

Cassava Bioethanol Market Potential Customers

The primary potential customers and end-users of Cassava Bioethanol are large national and multinational entities operating within regulated industries, particularly the energy and chemical sectors. Government-owned or private Oil Marketing Companies (OMCs) represent the largest consumer base, driven by compliance with national biofuel blending mandates that require a fixed percentage of ethanol content in commercial gasoline sold at the pump. These customers prioritize bulk supply reliability, consistency in fuel grade specifications (anhydrous ethanol purity), and the ability of producers to provide internationally certified sustainable volumes, ensuring they meet both legislative and corporate social responsibility targets globally. The stability of supply is paramount, leading many OMCs to seek long-term procurement contracts.

A rapidly expanding customer base resides in the chemical and industrial manufacturing sector. Manufacturers focused on green chemistry are transitioning from conventional petrochemical feedstocks to bio-based alternatives for producing derivatives such as ethyl acetate, ethylene, and various solvents. These customers seek Industrial Grade bioethanol, demanding exceptional purity, often higher than fuel grade, and requiring robust documentation regarding the bio-origin and sustainable sourcing of the product. The competitive advantage here lies not just in price, but in establishing a consistent, traceable supply chain that supports the manufacturer's overall decarbonization strategy, opening up premium pricing opportunities outside the highly price-sensitive fuel market.

Finally, the pharmaceutical and food and beverage industries constitute niche but high-value customer segments. Pharmaceutical manufacturers utilize high-purity ethanol for disinfectants, sanitizers, and active ingredient extraction, demanding compliance with strict pharmacopeia standards. The food and beverage sector uses industrial alcohol for manufacturing various spirits and flavor extracts. For both these segments, purity, regulatory adherence, and the absence of contaminants are non-negotiable requirements. These customers are less sensitive to minor price fluctuations but place a high premium on supplier certification, reliable logistics, and a guaranteed separation of their supply chain from the fuel production streams to prevent cross-contamination risks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archer Daniels Midland Company (ADM), POET LLC, Green Plains Inc., Cargill Inc., Raízen Energia S.A., Ethanol Company of the Philippines (ECPI), Global Bio-chem Technology Group, Thai Agro Energy Public Company Limited, COFCO Biochemical, Vivergo Fuels, Granbio, Centerra Co-op, Novozymes, AB Sugar, Renewable Energy Group (REG). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cassava Bioethanol Market Key Technology Landscape

The technological landscape of the Cassava Bioethanol Market is rapidly evolving, moving away from simple, energy-intensive processes toward highly efficient, sustainable, and integrated solutions. The core technological advancement centers on the saccharification and fermentation stages. Traditional acid hydrolysis is being systematically replaced by enzymatic hydrolysis, which utilizes specialized, thermostable amylase and glucoamylase enzymes to break down cassava starch into fermentable glucose with higher yields, lower energy input, and reduced corrosive byproducts. The optimization of these enzyme cocktails, often engineered through industrial biotechnology giants, is crucial for minimizing processing time and overall production costs, positioning enzymatic methods as the industry standard for new biorefinery projects seeking optimal operational expenditure profiles.

A second critical area is the development and commercial deployment of advanced fermentation technologies, particularly using genetically modified (GM) yeast strains (like Saccharomyces cerevisiae) that exhibit enhanced tolerance to high ethanol concentrations and process inhibitors, maximizing the productivity of the fermentation tanks. Furthermore, integrated biorefinery concepts are emerging as the leading infrastructure model. These facilities are designed not only to convert the high-starch root but also to efficiently utilize the residual lignocellulosic biomass (peel, stem) through cellulosic ethanol technology (Second Generation Bioethanol). This integration drastically increases the feedstock utilization rate and allows producers to generate high-value co-products, such as biogas (from vinasse digestion) or specialty chemicals, significantly improving the overall profitability and environmental sustainability profile of the entire operation, moving towards zero-waste processing.

Furthermore, innovations in dehydration and distillation techniques are essential for meeting the stringent purity requirements of fuel-grade ethanol. Advancements like Molecular Sieve Dehydration (MSD) technology and energy integration systems are employed to reduce the energy footprint associated with removing residual water content. The adoption of advanced process control and automation systems, often augmented by AI, ensures precise temperature and flow management throughout the plant, optimizing recovery and purity. These technological investments, particularly in large-scale facilities across Asia Pacific, demonstrate the industry's commitment to achieving cost parity with petroleum gasoline and consolidating cassava bioethanol's position as a sustainable, competitive fuel source globally.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC, particularly Southeast Asia (Thailand, Indonesia, China), is the largest and fastest-growing region for cassava bioethanol due to abundant cassava cultivation, favorable tropical climates, and proactive governmental policies establishing aggressive biofuel blending mandates (E10, E20). Thailand is a major global exporter, benefiting from established logistics and advanced milling capabilities. China’s substantial demand for industrial alcohol and fuel ethanol further solidifies the region's market leadership. The availability of low-cost labor and large agricultural tracts provides a substantial competitive advantage in raw material procurement and processing efficiency.

- Latin America (LATAM) Influence: While sugarcane dominates the bioethanol market in Brazil, cassava-based production plays a vital role in diversified energy strategies across other LATAM countries, leveraging existing technology and expertise developed for other first-generation feedstocks. The region focuses on integrating advanced distillation techniques and establishing cross-border trade agreements for ethanol products. Brazil, in particular, influences the global market through its technological leadership in yeast strains and process optimization, often exporting know-how to cassava-producing nations.

- Middle East & Africa (MEA) Potential: Africa represents a high-potential, nascent market. Countries like Nigeria and Ghana, which are among the world’s largest cassava producers, are increasingly viewing bioethanol production as a critical strategy for energy independence, rural employment, and utilizing surplus agricultural output. Development is currently focused on securing foreign direct investment, establishing supportive regulatory frameworks, and overcoming infrastructural and logistical bottlenecks associated with scaling up production from pilot facilities to commercial biorefineries.

- North America and Europe (Policy Drivers and Technology): These regions are characterized by limited domestic cassava production but exert influence through policy setting (e.g., Renewable Energy Directives in Europe) and serving as technology exporters. They are key markets for high-purity industrial grade bioethanol and are primary drivers in the development and commercialization of next-generation enzymes and fermentation organisms necessary for improving cassava bioethanol conversion yields globally. Stringent environmental regulations in these areas set the international standards for sustainability and carbon intensity metrics that global producers must meet.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cassava Bioethanol Market.- Archer Daniels Midland Company (ADM)

- POET LLC

- Green Plains Inc.

- Cargill Inc.

- Raízen Energia S.A.

- Ethanol Company of the Philippines (ECPI)

- Global Bio-chem Technology Group

- Thai Agro Energy Public Company Limited

- COFCO Biochemical

- Vivergo Fuels

- Granbio

- Centerra Co-op

- Novozymes

- AB Sugar

- Renewable Energy Group (REG)

- Siam Modified Starch Co., Ltd. (SMS)

- Advanced Biochemical (Thailand) Co., Ltd.

- Kirin Holdings Company, Limited

- Gevo, Inc.

- Lallemand Biofuels & Distilled Spirits

Frequently Asked Questions

Analyze common user questions about the Cassava Bioethanol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Cassava Bioethanol?

The primary driver is governmental mandates requiring the blending of bioethanol with gasoline (E-blending targets) to enhance energy security, reduce crude oil imports, and comply with national greenhouse gas emission reduction commitments, particularly within high-growth regions like APAC.

How does Cassava Bioethanol compare economically to corn or sugarcane ethanol?

Cassava bioethanol often exhibits superior economic viability in regions where cassava is abundant and climate-resilient, offering higher starch yields per hectare than corn. While typically requiring more complex enzymatic processing than sugarcane, its lower feedstock cultivation costs in developing economies make it highly competitive when processing efficiency is optimized.

What technological advancements are most crucial for the market's future growth?

Crucial technological advancements include the adoption of high-efficiency enzymatic hydrolysis for starch conversion, the development of robust yeast strains that tolerate high ethanol concentrations, and the implementation of integrated biorefinery models to utilize residual biomass (lignocellulosic material) for co-product generation, thereby improving overall profitability and sustainability.

What are the key sustainability challenges facing the Cassava Bioethanol industry?

The primary sustainability challenges include minimizing the "food versus fuel" debate by utilizing non-edible parts of the plant, ensuring sustainable water and land usage during cultivation, and reducing the carbon intensity of the production process, which requires rigorous tracking of inputs and transportation logistics.

Which geographical region holds the highest potential for capacity expansion?

Asia Pacific currently dominates production, but the Middle East & Africa (MEA), particularly countries in West Africa, holds the highest untapped potential for future capacity expansion. This is driven by massive existing cassava production, governmental push for industrialization, and the urgent need for domestic energy solutions to curb oil dependency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager