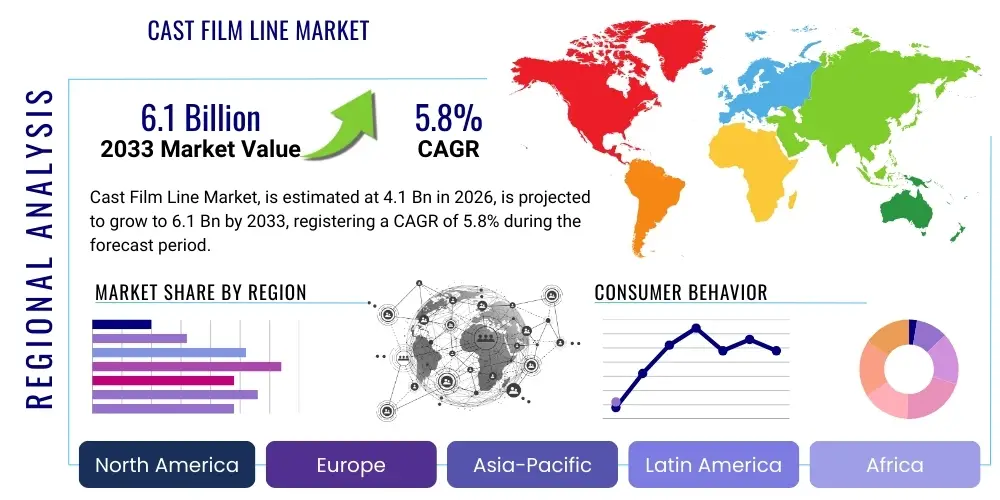

Cast Film Line Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442598 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Cast Film Line Market Size

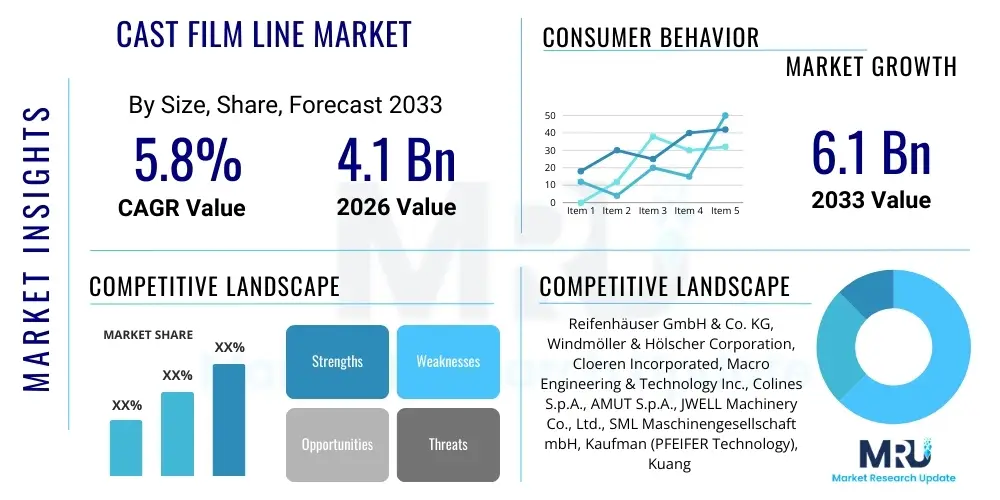

The Cast Film Line Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Cast Film Line Market introduction

The Cast Film Line Market encompasses the manufacturing and sale of sophisticated machinery utilized for producing thin plastic films via the flat die extrusion process, followed by rapid quenching on a chilled roll stack. These high-precision production lines are critical for creating films used extensively across flexible packaging, hygiene products, lamination, and specialized industrial applications. Key features of modern cast film lines include multi-layer co-extrusion capabilities, advanced thickness control systems (such as automatic die gap control), highly efficient melt pumps, and sophisticated winding technologies optimized for tension control and roll uniformity. The continuous demand for high-quality, stretchable, and barrier films, particularly in the food and beverage packaging sector, serves as the fundamental driver propelling investment in this specialized capital equipment market.

Cast film lines are primarily segmented based on the complexity of the film structure—ranging from mono-layer systems for commodity films to highly advanced 9-layer or 11-layer lines designed for complex barrier packaging requiring multiple resin types (e.g., PE, PP, EVOH, Nylon). The major applications for these films include stretch wrap for palletizing, sanitary films (diaper backsheets), lamination films, and agricultural silage wrap. Benefits derived from using cast films, compared to blown films, often include superior clarity, better dimensional stability, and higher throughput rates, which are essential for high-volume converters seeking operational efficiency. Furthermore, the ability to rapidly cool the film in the casting process allows for the production of specific resin grades, like specialized linear low-density polyethylene (LLDPE) films, favored for their excellent puncture resistance and high stretch ratios.

Driving factors in this market include the global expansion of e-commerce, which necessitates durable and efficient protective packaging, and the increasing consumer preference for packaged and processed foods, particularly in developing economies. Technological advancements focusing on greater energy efficiency, faster line speeds (exceeding 600 meters per minute in some applications), and enhanced automation are crucial in attracting replacement cycles and new capacity installations. Environmental pressures also influence the market, pushing manufacturers towards designing lines capable of handling sustainable materials, such as bio-based polymers and high proportions of post-consumer recycled (PCR) resins, ensuring future relevance and compliance with regulatory frameworks.

Cast Film Line Market Executive Summary

The Cast Film Line Market is defined by intense competition centered on technological superiority, particularly in co-extrusion precision and line speed optimization. Current business trends indicate a strong pivot towards digitalization, implementing Industry 4.0 principles to enable predictive maintenance, real-time process monitoring, and remote diagnostics, thereby enhancing operational uptime for converters. Investment in machinery capable of producing complex multi-layer barrier films, especially those incorporating ethylene-vinyl alcohol (EVOH) or metallocene-catalyzed resins, is soaring due to the stringent requirements of extended shelf life for perishable goods. Furthermore, the market is experiencing a significant shift towards modular line design, allowing users flexibility to quickly adapt equipment configurations for various film types and thicknesses, catering to specialized, high-margin applications.

Regionally, the Asia Pacific (APAC) stands as the undeniable leader in terms of both consumption and new capacity installation, driven primarily by the massive manufacturing base in China and the surging domestic packaging demand in India and Southeast Asian nations. North America and Europe, while mature markets, emphasize high-end technology adoption, focusing on maximizing efficiency and minimizing scrap rates, often initiating replacement cycles for older, less efficient machinery. European markets, in particular, lead in sustainable technology adoption, demanding cast film lines optimized for processing mono-material structures suitable for full circularity and recycling, thereby setting global benchmarks for eco-friendly production.

Segment trends reveal that the Multi-Layer segment (specifically 5-layer and 7-layer lines) dominates the market share owing to the growing requirement for high-performance stretch films and specialized barrier packaging. The Polyethylene (PE) material segment maintains its prominence due to its versatility and cost-effectiveness, although demand for specialized polypropylene (PP) and thermoplastic elastomer (TPE) lines is seeing accelerated growth for medical and hygiene applications, respectively. The application segment is heavily concentrated in Food & Beverage Packaging, reflecting the global reliance on flexible films for product preservation, safety, and branding. The continuous pursuit of operational excellence and sustainable manufacturing practices will continue to shape segment dynamics throughout the forecast period.

AI Impact Analysis on Cast Film Line Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Cast Film Line Market primarily revolve around questions of operational efficiency, quality consistency, and the potential for fully autonomous film production. Users are keen to understand how AI-driven predictive maintenance algorithms can minimize costly downtime associated with extruder wear, die blockages, or winding malfunctions. A significant theme is the expectation that AI will refine process control beyond traditional PID (Proportional-Integral-Derivative) systems, achieving sub-micron thickness tolerances and optimizing resin blends in real-time based on material flow variations and ambient conditions. Concerns often focus on the complexity of integrating AI platforms with legacy machinery and the specialized training required for operators to leverage sophisticated data analytics effectively. Overall, the expectation is that AI will transform cast film production from an experience-based operation to a data-driven, highly reproducible manufacturing process, delivering superior yield and reduced waste.

- Enhanced Process Optimization: AI algorithms fine-tune extrusion temperature profiles, melt pressure, and chilling roll speeds in real-time, achieving immediate stability and minimizing material deviation.

- Predictive Maintenance: Utilization of machine learning models to analyze vibration, motor current, and temperature data, predicting potential failures (e.g., gear box wear, melt pump degradation) before critical breakdown.

- Automated Quality Control (AQC): Integration of computer vision systems and deep learning for instantaneous defect detection (gels, fish eyes, gauge bands), automatically adjusting process parameters or alerting operators.

- Recipe Management and Optimization: AI suggests optimal resin formulation ratios and processing parameters based on desired film specifications (tensile strength, dart drop, clarity) and raw material costs.

- Energy Efficiency Management: Machine learning models analyze energy consumption patterns across heating zones, drives, and cooling systems, recommending operational adjustments to lower energy intensity per kilogram of film produced.

DRO & Impact Forces Of Cast Film Line Market

The dynamics of the Cast Film Line Market are shaped by powerful Drivers and significant Restraints, moderated by burgeoning Opportunities, all contributing to the overall Impact Forces dictating market trajectory. Key drivers include the relentless expansion of the flexible packaging sector, fueled by urbanization and rising disposable incomes globally, which increases demand for specialized barrier films. The continuous technological push towards high-speed, wide-format machinery also drives replacement and expansion cycles. Restraints primarily involve the high capital expenditure required for installing advanced multi-layer cast film lines, posing a significant barrier to entry for smaller manufacturers, coupled with the volatility of raw material (polymer) prices, which impacts overall profitability and investment decisions. Opportunities lie squarely in developing machines optimized for sustainable, bio-degradable, and recycled polymers, and penetrating niche markets such as high-purity medical films and specialized protective films.

Impact forces currently prioritize efficiency and sustainability. The efficiency force manifests through the requirement for higher throughput and reduced energy consumption, prompting manufacturers to invest in advanced linear motors and specialized chill roll geometries that optimize heat transfer. The sustainability force is exerting immense pressure across the value chain, demanding that new equipment is designed to handle challenging PCR (Post-Consumer Recycled) materials effectively without compromising film integrity or increasing energy input. This interplay between economic efficiency and environmental responsibility is the dominant force shaping procurement decisions among major film converters.

The market also faces external impact forces related to geopolitical instability and trade tariffs, which affect the supply chain of critical components and the cost of imported machinery. Manufacturers are responding by focusing on localized supply chain networks and standardized machine platforms to mitigate risks associated with global supply chain disruption. Furthermore, the evolving regulatory landscape surrounding plastics, particularly in Europe and parts of Asia, necessitates continuous innovation in recycling-compatible film structures, ensuring that manufacturers who rapidly adapt their line technology to meet these mandates gain a competitive advantage.

Segmentation Analysis

The Cast Film Line Market is structurally complex, segmented extensively by Type (focusing on layer complexity), Material Processed, and Application. This segmentation is crucial as it dictates the required technological sophistication and target end-user base. The dominant segmentation factor remains the number of layers a line can produce, directly correlating with the functional complexity and barrier properties of the final film product. The market landscape is increasingly skewed toward sophisticated multi-layer systems (5-layer and above) to meet stringent performance specifications demanded by modern packaging, while the material segmentation highlights the continued reliance on polyethylene (PE) but also signals accelerated growth in specialized materials like polypropylene (PP) for specific industrial and hygiene applications. Understanding these segments provides critical insights into manufacturing capacity allocation and future investment trajectories within the global film extrusion industry.

- By Type

- Single-Layer Cast Film Lines

- Multi-Layer Cast Film Lines

- 3-Layer

- 5-Layer

- 7-Layer

- 9+ Layers (High Barrier/Specialty)

- By Material Processed

- Polyethylene (PE)

- LLDPE (Linear Low-Density Polyethylene)

- LDPE (Low-Density Polyethylene)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Nylon (Polyamide)

- EVOH (Ethylene-Vinyl Alcohol Copolymer)

- Others (including TPE, Biodegradable Polymers)

- Polyethylene (PE)

- By Application

- Flexible Packaging (Food & Beverage, Consumer Goods, Industrial)

- Hygiene Films (Diaper Backsheets, Sanitary Products)

- Agricultural Films (Silage Wrap, Greenhouse Film)

- Lamination Films

- Stretch Wrap (Palletizing)

- Others (Medical, Technical Films)

Value Chain Analysis For Cast Film Line Market

The Value Chain for the Cast Film Line Market begins with the upstream suppliers responsible for providing highly specialized components and raw materials crucial for machinery construction. This includes precision steel and alloys for dies and chill rolls, advanced electronic components (PLCs, servo drives), and highly specialized heating elements and pumps. Success in the upstream segment depends heavily on global supplier reliability and adherence to strict engineering tolerances. Key upstream activities include the design and manufacturing of specialized melt pumps and automated flat extrusion dies, which are critical proprietary technologies ensuring uniform film thickness and high throughput rates. The performance and innovation capability of these component suppliers directly dictate the overall efficiency and speed of the final cast film line.

The core segment of the value chain is the Original Equipment Manufacturer (OEM), which designs, assembles, and installs the complete cast film line. This stage involves complex R&D in co-extrusion technology, cooling efficiency (chill roll stack design), and high-speed winding systems. Aftermarket services, including installation, commissioning, maintenance contracts, and spare parts supply, represent a significant, high-margin revenue stream for OEMs. Downstream activities involve film converters and final end-users. Film converters purchase the lines, processing polymer resins into finished rolls of film which are then sold to brands and manufacturers for applications ranging from food wrapping to agricultural uses. The demand pull from large downstream film converters heavily influences the technological specifications and output capacity required from the OEMs.

Distribution channels for cast film lines are typically direct, involving highly skilled sales engineers and specialized technical teams from the OEM, due to the high capital cost, complexity, and customization required for each line installation. Indirect channels, involving local agents or distributors, are more common in regions where the OEM lacks a direct sales presence or requires local regulatory expertise, especially in emerging markets. The direct channel facilitates comprehensive pre-sale consulting, custom configuration, and long-term service agreements, ensuring the optimal integration of the machinery into the customer’s production environment. The effectiveness of the service network, particularly the ability to provide rapid diagnostics and parts replacement globally, is a major differentiator in securing long-term customer relationships and repeat sales.

Cast Film Line Market Potential Customers

The primary potential customers and end-users of cast film lines are large-scale plastic film converters and integrated packaging solution providers who require high-volume, precision film production capabilities. These customers invest in cast film lines to manufacture specific film products such as stretch wrap for palletizing (a major commodity application), multi-layer barrier films for extending the shelf life of packaged food (dairy, meat, snacks), and specialized films for personal hygiene products (e.g., breathable backsheets for diapers and sanitary napkins). Growth in emerging economies directly translates to increased investment from local converters seeking to meet burgeoning domestic consumer demand for processed and packaged goods, making these regions prime targets for new equipment sales.

A second crucial customer segment includes companies specialized in technical and industrial films. This includes manufacturers producing lamination films for graphic arts, protective films for electronic displays or surfaces, and specialized agricultural films designed for specific climate requirements. These buyers prioritize lines offering extremely tight gauge control, superior optical properties (high clarity), and the ability to process specialized, often higher-cost resins. Their purchasing decisions are driven by the technical specifications and reproducibility offered by the equipment rather than just sheer throughput volume.

Finally, material producers, specifically major petrochemical companies, occasionally invest in pilot or research-scale cast film lines. While not the primary end-users for production volume, these companies utilize the equipment to test new polymer formulations, optimize processing parameters, and demonstrate material performance characteristics to their downstream customers. Additionally, large, multinational brand owners involved in captive packaging operations may acquire these lines to internalize critical film production, ensuring supply chain control and proprietary material integration. Their procurement criteria are often focused on the highest levels of automation, integration, and data reporting capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Reifenhäuser GmbH & Co. KG, Windmöller & Hölscher Corporation, Cloeren Incorporated, Macro Engineering & Technology Inc., Colines S.p.A., AMUT S.p.A., JWELL Machinery Co., Ltd., SML Maschinengesellschaft mbH, Kaufman (PFEIFER Technology), Kuang Hsing Machine Co., Ltd., ALPHA, C.M.G. S.p.A., Polytype Converting GmbH, Kiefel GmbH, Davis-Standard LLC, Hosokawa Alpine Aktiengesellschaft, Erema Engineering Recycling Maschinen und Anlagen GmbH, Graham Engineering Corporation, Sumitomo Heavy Industries Ltd., Zhejiang Light Industry Machinery Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cast Film Line Market Key Technology Landscape

The technological landscape of the Cast Film Line Market is primarily driven by advancements aimed at increasing throughput, enhancing film quality (particularly gauge control and optical properties), and improving energy efficiency. A core technology is the evolution of co-extrusion dies, specifically those offering automatic lip adjustment (auto-dies) utilizing thermal expansion or electronic actuators coupled with in-line scanning gauges. These systems minimize gauge variation across the film width, a critical factor for high-performance applications like lamination and thin-gauge stretch wrap. Furthermore, manufacturers are increasingly integrating high-efficiency, multi-screw extrusion systems that allow for optimized melt temperatures and reduced shear stress on sensitive polymers, thus improving overall material properties and line stability, even at extreme speeds. The shift from hydraulic to precision electric servo drives across the line, particularly for winding and chill roll operations, is also a notable technological improvement contributing to superior tension control and significant energy savings.

Another major area of technological focus is the chilling and cooling system. The performance of the chill roll stack is paramount, as rapid and uniform cooling determines the film's crystallinity, clarity, and dimensional stability. Modern systems often employ specialized internal baffling designs, high-flow water circulation, and sometimes even vacuum boxes positioned near the die exit to ensure intimate contact between the molten film web and the primary chill roll. This is particularly crucial when processing high-melt strength polymers. Furthermore, high-speed winding technology is undergoing continuous refinement, moving towards non-stop, fully automatic turret winding systems capable of handling extremely large diameter rolls (up to 1,000 mm) at high speeds, while minimizing tail preparation time and ensuring perfect roll geometry, which is essential for subsequent converting processes.

Currently, the most disruptive technologies entering the landscape involve Industry 4.0 integration. This includes the implementation of advanced sensor arrays, centralized PLC systems, and cloud connectivity to enable comprehensive data logging and analysis. Remote diagnostic capabilities allow OEMs to monitor and troubleshoot complex line issues globally, drastically reducing response times and minimizing physical service intervention costs. Furthermore, in the realm of sustainable production, there is significant development in filtration and melt recycling systems integrated directly into the cast film line, allowing converters to reprocess edge trim and start-up waste immediately, thereby significantly reducing scrap rates and promoting material circularity within the production facility itself. This integration is vital for the economic viability of thin-gauge film production.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global cast film line market, primarily driven by expansive manufacturing bases in China and India, coupled with rapid industrialization and escalating domestic consumption of packaged goods across Southeast Asia. The region is characterized by high volume installations, often focusing on wide-width machines for applications like agricultural films, hygiene products, and commodity stretch wrap. Investment is strongly supported by government initiatives promoting local manufacturing and the emergence of massive, localized film conversion giants requiring continuous capacity expansion. Furthermore, APAC is increasingly adopting sophisticated multi-layer technology to meet the rising demand for higher quality, specialized barrier packaging for export and high-end domestic markets.

- North America: This region represents a mature yet technologically demanding market. Growth here is primarily driven by replacement cycles for older machinery, necessitated by the need for enhanced energy efficiency, automation, and the capability to process recycled content. North American converters prioritize high throughput and maximum reliability. The shift towards mono-material flexible packaging solutions designed for recyclability is a critical regional driver, compelling investment in specialized co-extrusion dies and highly controlled winding systems that can handle materials with inherently variable properties.

- Europe: Europe is the global leader in technological innovation related to sustainability and advanced manufacturing standards. The market is intensely focused on machinery capable of processing high percentages of PCR (Post-Consumer Recycled) content and designing films for circularity, often in anticipation of stringent EU regulations. European converters demand highly modular, flexible systems that can switch quickly between various complex recipes (e.g., films incorporating high barrier layers like EVOH). Although installation volumes may be lower than in APAC, the average value per machine is often higher due to the incorporation of advanced automation, precision controls, and specialized sustainable processing features.

- Latin America (LATAM): This region experiences moderate growth, largely influenced by economic stability in major economies like Brazil and Mexico. Demand is concentrated in flexible packaging for food and beverages. Market participants often seek cost-effective, reliable cast film lines. Investment decisions are highly sensitive to exchange rate fluctuations and imported capital equipment costs. Recent trends show increased interest in 5-layer lines to improve barrier properties for local food supply chains.

- Middle East and Africa (MEA): Growth in MEA is largely fueled by infrastructure projects, expanding urbanization, and the establishment of local manufacturing hubs, particularly in the Gulf Cooperation Council (GCC) countries. The market requires robust, reliable machinery suitable for challenging operational environments (e.g., high ambient temperatures). Agricultural films and commodity stretch wrap are significant application segments, although specialized packaging demand is emerging in wealthier, urbanized centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cast Film Line Market.- Reifenhäuser GmbH & Co. KG

- Windmöller & Hölscher Corporation

- Cloeren Incorporated

- Macro Engineering & Technology Inc.

- Colines S.p.A.

- AMUT S.p.A.

- JWELL Machinery Co., Ltd.

- SML Maschinengesellschaft mbH

- Kaufman (PFEIFER Technology)

- Kuang Hsing Machine Co., Ltd.

- ALPHA

- C.M.G. S.p.A.

- Polytype Converting GmbH

- Kiefel GmbH

- Davis-Standard LLC

- Hosokawa Alpine Aktiengesellschaft

- Erema Engineering Recycling Maschinen und Anlagen GmbH

- Graham Engineering Corporation

- Sumitomo Heavy Industries Ltd.

- Zhejiang Light Industry Machinery Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Cast Film Line market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between cast film and blown film technologies?

Cast film is produced via flat die extrusion followed by immediate cooling on highly polished chill rolls, resulting in superior clarity, higher throughput speeds, better gauge control, and excellent dimensional stability, typically used for stretch wrap, barrier films, and lamination. Blown film involves extruding upward through an annular die and cooling via an air ring, yielding better balanced mechanical properties (tensile strength in both directions) and better tear resistance, commonly used for heavy-duty sacks and industrial liners.

How is sustainability influencing the purchasing decisions for new cast film lines?

Sustainability is a dominant factor, driving converters to purchase lines capable of processing high levels of Post-Consumer Recycled (PCR) content and designing films with mono-material structures (e.g., all-PE films) that meet regional recycling mandates. OEMs are responding with specialized screw designs and enhanced filtration systems to handle material impurities efficiently.

Which segment of the Cast Film Line Market is exhibiting the fastest growth?

The Multi-Layer Cast Film Lines segment, particularly 5-layer and 7-layer configurations, is experiencing the fastest growth. This is attributed to the increasing global demand for high-performance barrier packaging required for perishable goods, demanding precise co-extrusion of multiple polymers like PE, EVOH, and Nylon to ensure extended shelf life and product protection.

What role does Industry 4.0 play in modern cast film production?

Industry 4.0 integrates AI and IoT for real-time process monitoring, automated quality control, and predictive maintenance. This digitalization minimizes downtime, optimizes material usage by ensuring sub-micron gauge accuracy, and allows for remote diagnostics, thereby significantly enhancing overall equipment efficiency (OEE) and reducing operational costs.

Where is the primary geographical demand center for new cast film line installations?

Asia Pacific (APAC), particularly China and India, remains the primary geographical center for new cast film line installations. This dominance is driven by massive regional growth in packaging consumption, rapid industrialization, and continuous expansion of local film converting capabilities to serve vast domestic markets and international export demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager