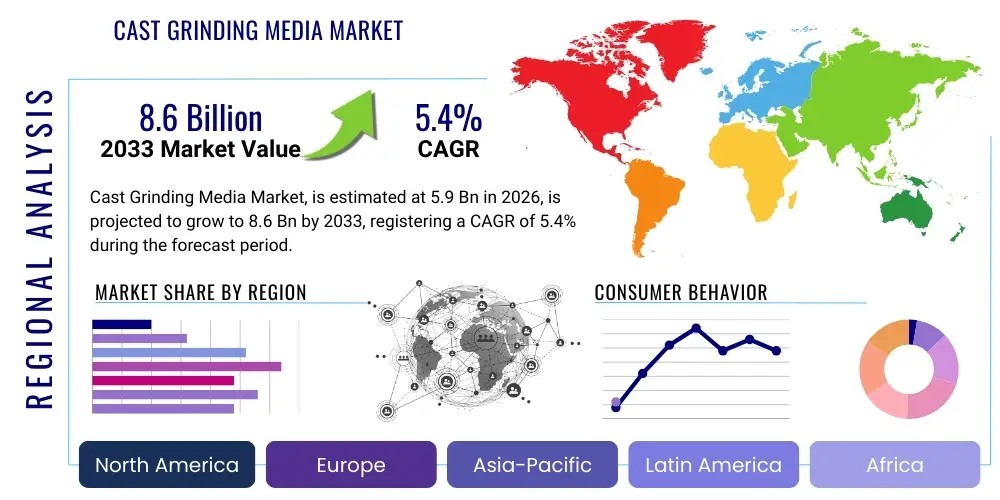

Cast Grinding Media Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443018 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Cast Grinding Media Market Size

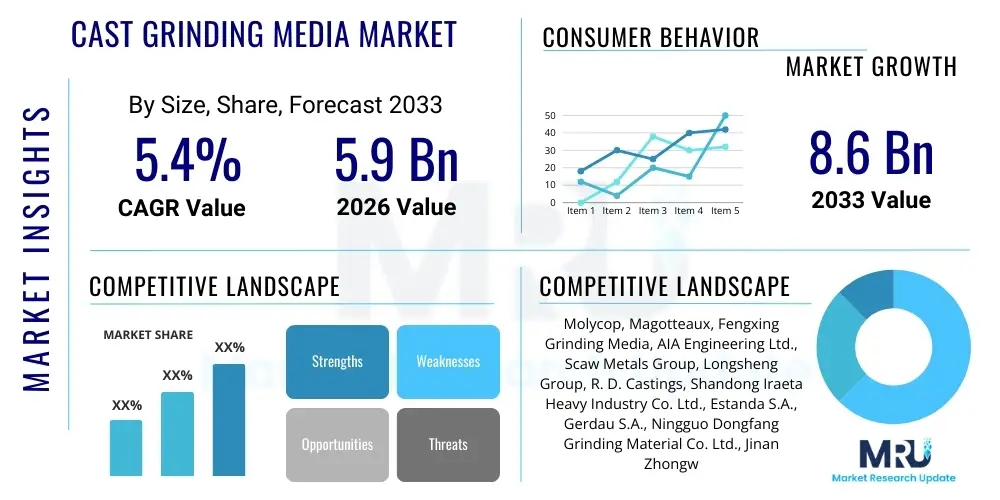

The Cast Grinding Media Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.4% between 2026 and 2033. The market is estimated at USD 5.9 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Cast Grinding Media Market introduction

The Cast Grinding Media Market encompasses the production and supply of metallic abrasive bodies, typically spheres, rods, or cylinders, utilized primarily in milling equipment to grind and reduce particle sizes of raw materials. These media are critical consumables in high-energy processes across heavy industries, designed to offer superior hardness, high wear resistance, and durability under rigorous operational stress. Products are generally categorized based on material composition, such as high chrome cast iron, low chrome cast iron, and specialized alloy blends, each offering distinct performance characteristics tailored to specific applications like wet or dry grinding environments and corrosive slurries.

Major applications of cast grinding media span the mining sector, crucial for processing iron ore, copper, gold, and other minerals; the cement industry, where they facilitate the pulverization of clinker and slag; and power generation, specifically in coal-fired plants for coal pulverization. The fundamental benefit provided by high-quality cast media is enhanced milling efficiency, leading to lower energy consumption per ton of material processed and reduced downtime due to less frequent media replacement. The operational advantages translate directly into lower total cost of ownership for end-users, solidifying their role as indispensable elements in mineral and material processing supply chains worldwide.

The market growth is fundamentally driven by the escalating global demand for minerals and construction materials, particularly in rapidly industrializing economies in Asia Pacific and Latin America. Key driving factors include large-scale infrastructure projects, the transition to deeper, lower-grade ore bodies requiring finer grinding, and continuous technological advancements in casting processes aimed at improving media hardness and structure. Furthermore, the push for operational sustainability and the optimization of resource extraction processes compels major mining and cement companies to adopt higher-performance, longer-lasting cast grinding media, thereby sustaining robust market demand.

Cast Grinding Media Market Executive Summary

The Cast Grinding Media Market is characterized by intense price sensitivity, significant consolidation among key players, and an ongoing shift toward high-performance, high-chrome alloys designed for enhanced operational lifespan and reduced wear rates. Business trends reflect increased focus on vertical integration by dominant manufacturers to control raw material supply (especially scrap steel and ferrochrome) and optimize production efficiency, particularly through automated casting and quality control systems. Geographically, the market expansion is predominantly centered in the Asia Pacific region, fueled by massive mining projects and burgeoning cement production capacity in countries like China, India, and Indonesia. North America and Europe maintain a mature market status, prioritizing premium, specialty media due to stringent operational efficiency standards and high labor costs, driving innovation towards customized product specifications.

Regional trends clearly show APAC dominating both production and consumption, capitalizing on proximity to raw materials and a vast customer base in mining and construction. Meanwhile, Latin America presents strong growth opportunities due to its extensive mineral reserves (copper and iron ore) and ongoing mill optimization efforts. Segment trends indicate that high-chrome cast grinding balls remain the fastest-growing category, favored for their superior resistance to impact and abrasion, especially in large-scale semi-autogenous grinding (SAG) and ball mill operations within the mineral processing industry. The cement sector, while large, shows slower growth compared to mining, focusing on optimizing existing media types rather than rapid material transition. Technological advancements, such as predictive wear modeling and digital inventory management, are becoming standard requirements for large supply contracts, integrating media supply into overall plant maintenance strategies.

Overall, the market trajectory is highly correlated with global commodity prices and mining capital expenditure cycles. The executive outlook suggests that successful companies will be those that effectively manage the balance between offering cost-competitive standard media and developing high-margin, specialized products with superior metallurgical properties. Furthermore, sustainability pressures are beginning to influence material selection, with increasing emphasis on media with lower carbon footprints in their production, potentially favoring processes that utilize efficient electric arc furnaces (EAF) or improved resource utilization, thus shaping future investment decisions across the value chain.

AI Impact Analysis on Cast Grinding Media Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cast Grinding Media Market frequently center on predictive maintenance capabilities, optimization of grinding circuits, and enhanced quality control during manufacturing. Key themes include how AI can reduce media consumption rates by fine-tuning mill operations, the application of machine learning for analyzing wear patterns and predicting replacement cycles, and the potential for AI-driven process automation in foundries to improve the consistency and metallurgical quality of cast products. Concerns often revolve around the initial investment required for sensor implementation in legacy mills and the availability of skilled personnel to interpret complex data, while expectations are high regarding significant reductions in operational expenditure (OpEx) and improved overall grinding efficiency due to real-time feedback loops. AI is viewed as a transformative tool moving the industry beyond traditional reactive maintenance.

- AI-driven Predictive Maintenance: Utilizing sensor data from mills (vibration, acoustic, power draw) to anticipate media wear rates and timing optimal replenishment, minimizing unscheduled downtime.

- Grinding Circuit Optimization: Machine learning algorithms analyze ore characteristics and media load specifications in real-time to adjust feed rates, rotational speed, and media composition for peak energy efficiency.

- Manufacturing Process Control: AI algorithms monitor casting parameters (temperature, cooling rates, chemical composition) to ensure uniform hardness and reduce internal defects in the final cast grinding balls, improving batch consistency.

- Supply Chain and Inventory Management: Predictive analytics forecast media demand based on anticipated production schedules and commodity market fluctuations, optimizing raw material procurement and inventory levels.

- Wear Analysis and Digital Twins: Creation of digital representations of ball mills to simulate different media types and operational conditions, allowing users to select the most cost-effective and durable cast media configuration.

- Automated Quality Inspection: Implementation of computer vision systems combined with AI to rapidly identify surface flaws, shape irregularities, and internal porosity in finished cast media, enhancing quality assurance.

DRO & Impact Forces Of Cast Grinding Media Market

The dynamics of the Cast Grinding Media Market are governed by a robust combination of drivers stemming from industrial growth, restraints related to raw material volatility, and significant opportunities arising from efficiency demands and technology adoption. The primary driving force is the expanding global mining industry, particularly the requirement to process lower-grade ores, which necessitates finer grinding and, consequently, higher consumption of grinding media. Complementary to this is the massive infrastructure spending in emerging economies, bolstering demand from the cement manufacturing sector. Restraints primarily involve the high dependency on volatile raw material markets—specifically scrap metal and ferrochrome—leading to fluctuating production costs that compress profit margins. Furthermore, the intense competition from forged grinding media manufacturers often presents a pricing pressure challenge for cast media producers, especially in specific lower-impact applications.

Opportunities are largely concentrated in the development and adoption of ultra-premium, high-performance cast media (e.g., specific high-chrome content alloys) that offer significantly extended operational life, reducing replacement frequency and long-term operating costs for end-users. The rising adoption of advanced grinding technologies, such as large-scale SAG mills, also necessitates specialized, high-impact cast media, creating niche growth areas. Moreover, geographical expansion into untapped mining regions in Africa and Central Asia provides fertile ground for new market penetration. The overall impact forces suggest a market moving towards specialization and quality, where technological superiority in casting processes will become a critical competitive differentiator, allowing producers to justify premium pricing over lower-quality, mass-produced alternatives.

The market faces external impact forces related to environmental and sustainability mandates. Increased scrutiny on the energy intensity of grinding operations and the manufacturing footprint of the media itself are compelling companies to innovate casting techniques that are more energy-efficient and utilize recycled content where possible. Economic downturns or prolonged periods of low commodity prices pose a substantial threat, leading mining companies to curtail capital expenditures and postpone media purchases. Conversely, geopolitical stability in major mineral-producing regions acts as a positive force, ensuring consistent operational uptime and steady demand flow for consumable grinding materials, emphasizing the market's fundamental linkage to global macroeconomic health and mineral extraction cycles.

Segmentation Analysis

The Cast Grinding Media Market is segmented based on critical performance and application characteristics, including material type, product shape, application industry, and geography. Material segmentation (high chrome, low chrome, etc.) is fundamental as it defines the media's hardness and suitability for different grinding environments, directly impacting cost and operational lifespan. Product shape segmentation (balls, rods, cylindrical) addresses the specific requirements of various mill types and grinding mechanisms. Application segmentation is crucial, differentiating consumption patterns between high-volume, continuous operations like mining and cement versus specialty chemical or filler processing. This multi-faceted segmentation allows manufacturers to tailor their production, marketing, and distribution strategies to meet the precise, highly technical requirements of specialized end-user environments.

- By Material Type:

- High Chrome Cast Iron Grinding Media

- Low Chrome Cast Iron Grinding Media

- Medium Chrome Cast Iron Grinding Media

- Special Alloy Cast Media (e.g., Ni-Hard, Martensitic Alloys)

- By Product Shape:

- Grinding Balls (most common)

- Grinding Cylpebs/Cylinders

- Grinding Rods (less common in cast media)

- By Application:

- Mining and Mineral Processing (Copper, Gold, Iron Ore, Platinum)

- Cement Production (Clinker Grinding, Slag Grinding)

- Thermal Power Generation (Coal Pulverization)

- Chemical and Petrochemical Processing

- Other Industrial Applications (e.g., Ceramic Manufacturing)

- By Size:

- Small Diameter (Below 50 mm)

- Medium Diameter (50 mm to 90 mm)

- Large Diameter (Above 90 mm)

Value Chain Analysis For Cast Grinding Media Market

The value chain for the Cast Grinding Media Market begins with upstream activities centered on raw material procurement, primarily scrap iron/steel, ferrochrome, ferro-manganese, and other alloying elements essential for achieving desired metallurgical properties. Effective management of this upstream segment is critical, as the volatility in commodity prices directly influences the final cost of the grinding media. Manufacturers prioritize establishing long-term, stable relationships with large-scale scrap metal dealers and chrome suppliers to mitigate supply risks and optimize cost structures. Sophisticated producers also invest heavily in material sorting and pre-treatment to ensure the highest quality input materials, which is paramount for high-performance cast alloys, where impurities can compromise the media's wear resistance and structural integrity.

The core manufacturing stage involves complex metallurgical processes, including melting, alloying, casting (often utilizing automated or semi-automated molding systems like DISA), heat treatment, and stringent quality control. Heat treatment is a decisive factor, transforming the microstructure to achieve optimal hardness and impact resistance. Downstream activities involve distribution, logistics, and end-user engagement. Due to the high weight and volume of grinding media, logistics and efficient shipping management are significant cost components. Companies often strategically locate production facilities near major mining hubs or ports to reduce freight costs. Distribution channels are bifurcated, involving direct sales to large mining conglomerates and integrated cement producers, and indirect sales through specialized industrial distributors and agents for smaller operators.

The market exhibits a high degree of service integration in the downstream segment. Direct engagement allows manufacturers to offer technical support, perform wear rate analysis in the client's mills, and provide tailored product recommendations. This consultative approach strengthens customer loyalty and acts as a barrier to entry for lower-cost competitors. The effectiveness of the value chain is measured by the producer's ability to minimize material wastage, optimize energy consumption during casting, and ensure rapid, reliable delivery, maintaining the critical link between high-quality input materials (upstream) and the demanding operational requirements of the end-user (downstream). The integration of digital tools for tracking media performance in active mills is increasingly enhancing value capture in the downstream service component.

Cast Grinding Media Market Potential Customers

The primary customers for Cast Grinding Media are industrial entities that require large-scale comminution (size reduction) processes. The most significant end-user segment is the global mining industry, encompassing companies involved in the extraction and processing of base metals (copper, nickel, zinc), precious metals (gold, silver), and bulk commodities (iron ore, bauxite). These mining operations represent high-volume consumers, often purchasing hundreds of thousands of tons of grinding media annually, making long-term supply agreements the preferred procurement model. Their purchase decisions are driven by media lifespan, impact toughness, cost per ton of ore processed, and the reliability of the supplier to handle substantial and continuous demand.

The second major consumer base resides within the cement manufacturing industry. Cement producers utilize cast grinding media, often medium to low chrome balls, primarily in closed-circuit ball mills for grinding clinker, gypsum, and other additives to produce the final cement product. While the specifications may be less demanding than in high-impact mining applications, consistency and bulk availability are paramount. Other industrial buyers include coal power generators requiring media for coal pulverization before combustion, and, to a lesser extent, manufacturers in the chemical and ceramic industries who use specialized media for ultra-fine grinding processes, demanding precise size distribution and non-contamination characteristics.

Ultimately, the typical buyers are procurement departments, often advised by technical metallurgy and operations teams, within multi-national corporations or large national industrial players. For large mining houses, the focus is increasingly on Total Cost of Ownership (TCO) rather than unit price, prioritizing high-quality cast media that reduce mill relining frequency and improve recovery rates. Therefore, successful market penetration relies on demonstrating superior wear resistance and providing rigorous technical support, validating the media's performance in real-world milling conditions to secure high-value, long-term contracts with these influential potential customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.9 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 5.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Molycop, Magotteaux, Fengxing Grinding Media, AIA Engineering Ltd., Scaw Metals Group, Longsheng Group, R. D. Castings, Shandong Iraeta Heavy Industry Co. Ltd., Estanda S.A., Gerdau S.A., Ningguo Dongfang Grinding Material Co. Ltd., Jinan Zhongwei Casting and Forging Grinding Ball Co. Ltd., Union Grinding Media, VICARB SA, Christian Pfeiffer Maschinenfabrik GmbH, ME Elecmetal, Hunan Hengzhao Steel Ball Co., Ltd., Anhui Fengxing Wear Resistant Material Co. Ltd., Qingzhou Hengrui Casting Industrial Co., Ltd., Dongguang Grinding Media Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cast Grinding Media Market Key Technology Landscape

The technology landscape for the Cast Grinding Media Market is continuously evolving, driven by the imperative to produce harder, tougher, and more cost-effective media. A foundational technology is advanced foundry practices, specifically involving automated or semi-automated casting systems, such as the widely adopted vertical flaskless molding technology (e.g., DISA lines) and precision horizontal casting setups. These systems are crucial for maintaining dimensional accuracy, surface finish, and high production throughput. Significant investment is directed towards optimizing melting and alloying processes, utilizing sophisticated induction furnaces and closely monitored atmospheric controls to ensure precise control over the chemical composition of the melt, which is critical for achieving optimal chrome and carbon ratios in high-chrome media. This precision minimizes segregation and guarantees uniform microstructure throughout the ball, essential for maximum wear life.

A second crucial technological area is the development and optimization of heat treatment protocols. The desired wear resistance and toughness of cast media are largely determined by the specific quenching and tempering sequences applied post-casting. Modern facilities use advanced controlled atmosphere furnaces and tailored quenching methods (oil, water, or polymer solutions) coupled with sophisticated temperature monitoring systems to achieve the desired martensitic or pearlitic matrix structure. Innovations are focusing on proprietary heat treatment cycles that enhance the depth of hardening and reduce the internal stresses within the media, mitigating the risk of premature breakage under high-impact milling conditions prevalent in SAG mills. Furthermore, non-destructive testing (NDT) techniques, including ultrasonic testing and eddy current methods, are employed to rapidly check for internal flaws or porosity, ensuring only structurally sound media reach the end-user.

The integration of Industry 4.0 concepts represents the leading edge of technological advancement. This includes leveraging Internet of Things (IoT) sensors within the foundry environment for real-time monitoring of machine performance and process variables, feeding data into AI/ML models for predictive quality assurance and process optimization. Additionally, in the downstream application, specialized suppliers are developing smart grinding media embedded with passive or active tracking mechanisms to gather data on in-mill residency time, impact forces, and wear trajectory. This application-side technology provides invaluable feedback, allowing manufacturers to rapidly iterate on alloy composition and size specifications, thereby establishing a closed-loop innovation system that constantly pushes the boundaries of media performance and further solidifies the market's dependence on specialized metallurgical expertise and digital integration.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily due to the overwhelming concentration of mineral processing, iron ore mining, and cement manufacturing capacity, particularly in China, India, and Australia. The regional growth is propelled by massive infrastructure investment and lower labor costs enabling competitive production, establishing the region as a global manufacturing hub for cast grinding media.

- North America: Characterized by a mature, high-value market focused heavily on operational efficiency. Demand is concentrated in large-scale copper, gold, and iron ore mines, which prioritize premium, high-chrome media to minimize replacement frequency and energy consumption. The market exhibits high technological adoption, often demanding specialized media sizes for large SAG mills.

- Latin America (LATAM): A critical growth region driven by extensive mineral reserves, especially copper in Chile and iron ore in Brazil. This region presents substantial opportunities for foreign producers, often characterized by severe grinding environments requiring media with high impact resistance and long wear life, creating significant demand for robust, specialized cast products.

- Europe: A relatively stable market, with demand primarily stemming from cement production and specialized industrial applications. Manufacturing output is often focused on high-quality, specialty media tailored for specific industrial grinding tasks, adhering to strict environmental and quality standards imposed by regional regulations.

- Middle East and Africa (MEA): Emerging as a high-potential market, particularly driven by expanding mining activities in South Africa, West Africa, and Saudi Arabia (for cement and mineral exploration). The market is highly cost-sensitive but also increasingly requires media suitable for challenging, often abrasive, ore bodies encountered in new mining developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cast Grinding Media Market.- Molycop

- Magotteaux (A part of the Etex Group)

- AIA Engineering Ltd.

- Scaw Metals Group

- Fengxing Grinding Media (Anhui Fengxing Wear Resistant Material Co. Ltd.)

- Longsheng Group

- R. D. Castings

- Shandong Iraeta Heavy Industry Co. Ltd.

- Estanda S.A.

- Gerdau S.A.

- Ningguo Dongfang Grinding Material Co. Ltd.

- Jinan Zhongwei Casting and Forging Grinding Ball Co. Ltd.

- Union Grinding Media

- VICARB SA

- Christian Pfeiffer Maschinenfabrik GmbH

- ME Elecmetal

- Hunan Hengzhao Steel Ball Co., Ltd.

- Anhui Zhongyi Grinding Material Co., Ltd.

- Qingzhou Hengrui Casting Industrial Co., Ltd.

- Dongguang Grinding Media Co., Ltd.

- Nantong Hengyue Metal Products Co., Ltd.

- Northern Casting (Pty) Ltd.

- Bradken (Caterpillar Inc.)

- Nanjing Zhicheng Casting Co., Ltd.

- Jiangsu Zhongda New Material Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Cast Grinding Media market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of high chrome cast grinding media over low chrome media?

High chrome cast media offer superior hardness, significantly higher wear resistance, and better performance in corrosive or highly abrasive wet grinding environments compared to low chrome alternatives, leading to extended operational lifespan and lower consumption rates per ton of material processed.

Which application segment drives the largest demand for cast grinding media globally?

The Mining and Mineral Processing segment represents the largest consumer base for cast grinding media. This segment, covering the extraction of copper, gold, iron ore, and other minerals, requires continuous, high-volume inputs of durable media for comminution processes in ball and SAG mills.

How does the volatility of raw material prices impact the Cast Grinding Media Market?

Raw material volatility, especially concerning steel scrap and ferrochrome, directly translates into fluctuating production costs. This compression of margins necessitates robust risk management strategies for manufacturers and often leads to price adjustments in contracts with end-users.

What is the current growth outlook for the Cast Grinding Media Market in the Asia Pacific region?

The APAC region holds the strongest growth outlook, driven by extensive infrastructure development, increasing cement capacity, and ongoing expansion of mineral processing activities, particularly in emerging economies like India and Indonesia, demanding high volumes of cast media.

What role does heat treatment play in the quality and performance of cast grinding media?

Heat treatment is a critical technological step that dictates the final microstructure, hardness, and toughness of the media. Optimized quenching and tempering processes are essential to achieve a stable, highly wear-resistant martensitic matrix, preventing premature failure and maximizing efficiency in the mill.

What is the difference between cast and forged grinding media?

Cast grinding media are produced by pouring molten metal into molds, often achieving specialized alloy structures (like high-chrome iron) suitable for abrasive wear. Forged media are made by heating steel and shaping it through high-pressure forging, typically resulting in superior impact resistance and uniformity, often used where impact forces are dominant.

What is the projected market size for cast grinding media by 2033?

The Cast Grinding Media Market is projected to reach approximately USD 8.6 Billion by the end of 2033, growing at a CAGR of 5.4% over the forecast period, driven by persistent demand from the global mining and construction sectors.

How do manufacturers ensure the dimensional accuracy of large cast grinding balls?

Dimensional accuracy, crucial for mill performance, is ensured through precision molding technologies, such as automated vertical flaskless molding (DISA), strict control over cooling rates, and advanced post-casting finishing processes to meet stringent industry standards for sphericity and size tolerances.

Which technology is currently enhancing quality control in the casting process?

The integration of artificial intelligence (AI) and machine learning (ML) with computer vision and real-time process monitoring is enhancing quality control by predicting and correcting deviations in casting temperatures and chemical mixes, leading to fewer internal defects and higher product consistency.

What are Cylpebs and where are they primarily used?

Cylpebs are cylindrical or ovular grinding media shapes, primarily used in certain fine grinding applications within the cement industry and occasionally for pigment grinding. Their shape offers a different contact surface area compared to traditional balls, optimizing grinding efficiency for specific material types.

What impact do sustainability mandates have on media selection?

Sustainability mandates are pushing end-users to select media with extended wear life (reducing waste) and encouraging manufacturers to adopt more energy-efficient casting processes (like electric arc furnaces) and increase the use of high-quality recycled content, aiming for a lower carbon footprint across the supply chain.

Why is the Latin America region considered a high-growth opportunity for cast media?

Latin America's extensive, high-value mineral reserves (especially in copper and iron ore) necessitate continuous, large-scale milling operations. Ongoing mine expansions and the need for process optimization create high, sustained demand for advanced, specialized cast grinding media capable of handling abrasive ore bodies.

What is the role of technical support in the downstream value chain?

Technical support, often involving metallurgical consultants and mill auditors, provides critical value downstream by helping customers analyze media wear rates, optimize mill operating parameters, and select the best media specification, significantly enhancing customer retention and driving preference for high-quality suppliers.

How are advancements in alloying techniques influencing the market?

Advancements in alloying techniques, involving the precise addition of elements like molybdenum, vanadium, and nickel, are creating specialized cast media with superior performance characteristics, such as enhanced impact resistance without compromising hardness, necessary for challenging modern mining applications.

What segment of the Cast Grinding Media market is currently demonstrating the highest growth rate?

The High Chrome Cast Iron Grinding Media segment is demonstrating the highest growth rate, driven by the mining sector's shift towards processing harder and lower-grade ores, which requires media that can withstand higher impact and abrasion over prolonged periods.

What are the key concerns users have regarding the implementation of AI in grinding circuits?

Key concerns include the substantial initial capital investment required for installing necessary sensors and data infrastructure, ensuring data security for sensitive operational metrics, and the current shortage of specialized personnel capable of effectively managing and utilizing complex AI-driven optimization systems.

In the context of the supply chain, why is geographical location critical for media manufacturers?

Due to the high weight and bulk nature of grinding media, logistics and freight costs represent a significant operational expense. Manufacturers benefit greatly from strategic facility location near major raw material sources or key end-user hubs (ports, large mines) to minimize transportation costs and improve delivery timelines.

What are the advantages of direct sales channels for manufacturers?

Direct sales channels enable manufacturers to establish deep, long-term partnerships with large industrial end-users, facilitating detailed technical collaboration, customized product development, and better control over pricing and service provision, leading to higher-margin sales.

How does the market size of small diameter media compare to large diameter media?

Small diameter media (below 50 mm) generally see high volume demand in specialized regrinding applications and specific cement mill circuits. However, large diameter media (above 90 mm) often command higher value due to the critical nature of their use in primary SAG mills and their more complex casting requirements, especially in the mining sector.

What are the typical defects found in cast grinding media that quality control aims to mitigate?

Quality control processes focus on mitigating defects such as internal porosity, micro-cracking due to improper cooling, segregation of alloying elements, and surface flaws (e.g., shrinkage cavities). These defects directly compromise the media's structural integrity and performance.

How is the market influenced by shifts in global commodity prices?

The market is highly correlated with global commodity prices (copper, gold, iron ore). High commodity prices generally lead to increased mining capital expenditure, higher production volumes, and thus greater demand for grinding media, while prolonged low prices restrain investment and media consumption.

What is a key differentiator for cast media producers seeking a competitive edge?

A critical differentiator is technological superiority in metallurgical R&D and casting processes, enabling the production of highly specialized alloys with documented superior wear rates, which allows producers to justify premium pricing and secure contracts based on proven total cost of ownership (TCO) benefits.

Why is the cement industry a stable, though slower-growing, consumer of cast grinding media?

The cement industry provides stable demand because its operations are generally consistent and less cyclical than mining. However, growth is slower as milling technology is mature, and the focus is more on media longevity and maintenance optimization rather than rapid expansion requiring new media types.

What specific benefit does high-chrome media provide in wet grinding?

High-chrome cast media exhibit excellent resistance to corrosion-abrasion synergy, a major issue in wet grinding environments where both mechanical wear and chemical attack (corrosion) degrade standard media rapidly. The passive oxide layer formed by the high chrome content protects the media surface.

Which geographical region represents the largest production base for cast grinding media?

Asia Pacific, particularly China, is recognized as the largest global production base for cast grinding media, benefiting from lower operating costs, vast raw material accessibility, and proximity to major consumption markets in the mining and construction sectors.

What is meant by the "Total Cost of Ownership" (TCO) in grinding media procurement?

TCO refers to the holistic cost evaluation for grinding media, encompassing not just the purchase price, but also replacement frequency, associated labor costs, energy consumption savings achieved through better grinding efficiency, and downtime reduction, favoring high-quality, long-lasting products.

How do manufacturers manage supply chain risk related to ferrochrome?

Manufacturers mitigate ferrochrome risk by securing long-term supply contracts, diversifying suppliers globally, and in some cases, vertically integrating or hedging against price fluctuations through financial instruments, given ferrochrome is essential for high-chrome alloy production.

What are Ni-Hard alloys and their typical application?

Ni-Hard alloys are specialized nickel-chromium white cast irons used where severe abrasion is the primary concern. They are typically employed in slurry pumps, mill liners, and sometimes as low-to-medium impact grinding media in highly abrasive milling environments outside the main ball mill circuit.

What primary constraint limits the adoption of high-performance cast media?

The primary constraint is the higher initial unit cost of high-performance (e.g., ultra-high chrome) cast media compared to standard or forged products, requiring substantial CapEx for inventory, which can be challenging for smaller operators or those facing immediate liquidity pressures.

How does the move towards processing lower-grade ore bodies affect media demand?

Processing lower-grade ores requires finer grinding (more energy and time) to liberate the valuable minerals, significantly increasing the specific consumption rate (kilograms of media per ton of ore) and driving up overall market demand for durable grinding media.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager