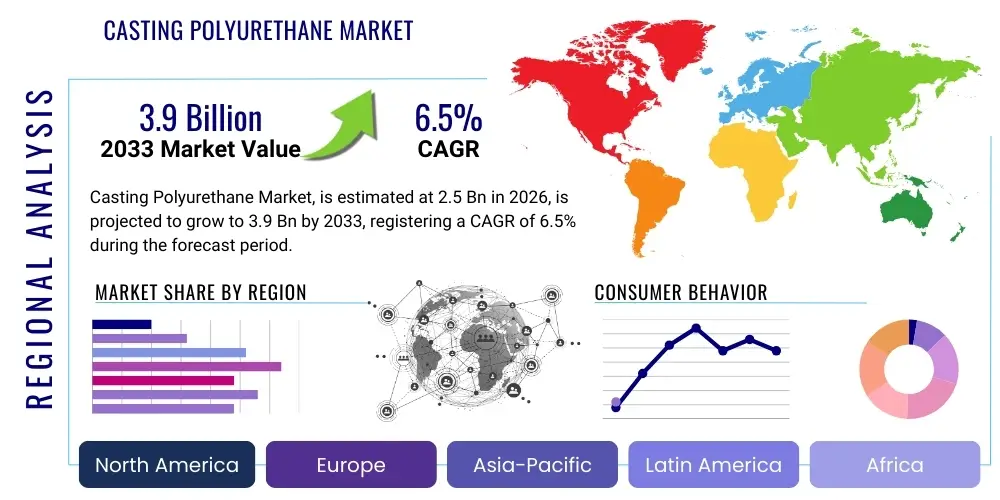

Casting Polyurethane Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441166 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Casting Polyurethane Market Size

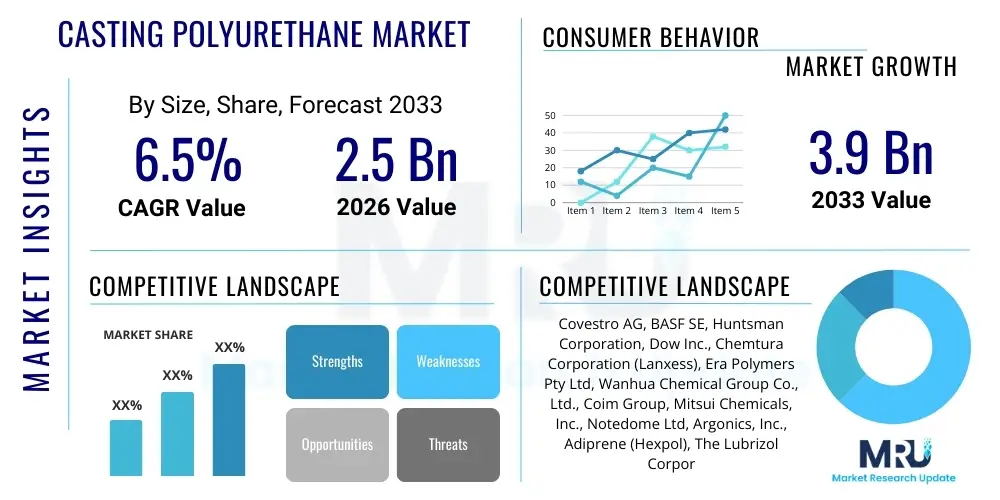

The Casting Polyurethane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.9 Billion by the end of the forecast period in 2033.

Casting Polyurethane Market introduction

Casting Polyurethane (CPU) refers to a versatile class of thermoset elastomers and polymers formed by reacting liquid prepolymers with curative agents, typically polyols or diamines, which are then poured or cast into a mold and cured, usually under elevated temperatures. This process allows for the creation of intricate parts with exceptional physical properties, distinguishing them from traditional thermoplastic polyurethanes (TPUs) or reaction injection molded (RIM) polyurethanes by offering superior abrasion resistance, high load-bearing capacity, resilience, and resistance to oils, chemicals, and extreme temperatures. These unique characteristics make CPU materials indispensable across demanding industrial sectors, offering a balance of elasticity and hardness that is crucial for heavy-duty applications.

The product is fundamentally defined by its flexible processing method—liquid casting—which contrasts sharply with injection molding, enabling the production of large, thick-section parts and specialized components where high material integrity is paramount. Major applications span industrial wheels and rollers, specialized seals and gaskets, material handling equipment components, mining screens, and various automotive suspension parts. The inherent flexibility in tailoring the chemical formulation allows manufacturers to achieve a wide spectrum of hardness (Shore A to Shore D) and performance specifications, addressing highly specific requirements across diverse end-use verticals. The market growth is inherently tied to the resurgence in industrial manufacturing activity and the increasing demand for high-performance elastomers that can significantly extend the service life of critical infrastructure and machinery.

Key driving factors fueling the market expansion include the rapid industrialization in developing economies, particularly Asia Pacific, necessitating robust and durable materials for infrastructure projects and manufacturing facilities. Furthermore, the push towards lighter, more energy-efficient components in the automotive and aerospace industries stimulates demand for CPU, which can often replace metal components while maintaining equivalent or superior performance under stress. The material's superior durability compared to standard rubber and plastics translates directly into reduced downtime and maintenance costs for end-users, solidifying its position as a preferred material solution in rugged operating environments, such as mining and construction. Benefits extend beyond longevity to include reduced noise levels, improved safety, and enhanced operational efficiency.

Casting Polyurethane Market Executive Summary

The Casting Polyurethane Market is experiencing robust growth driven primarily by advancements in elastomer technology and expanding application scope across heavy industries. Business trends indicate a strong focus on sustainable formulations, including bio-based polyols and low-toxicity curatives, in response to stringent environmental regulations, particularly in Europe and North America. Strategic shifts among major manufacturers involve increased investment in automated casting processes and rapid prototyping capabilities to meet customized component demands quickly. Mergers, acquisitions, and strategic partnerships, particularly concerning vertically integrated suppliers of MDI and TDI based prepolymers, are defining the competitive landscape, aiming for enhanced supply chain resilience and cost optimization in the face of fluctuating raw material costs. Furthermore, the proliferation of specialized, high-performance CPU systems, such as those designed for extreme temperature resistance or dynamic load applications, is unlocking new revenue streams and commanding premium pricing.

Regional trends highlight the Asia Pacific region as the dominant and fastest-growing market, largely due to explosive growth in construction, mining, and general manufacturing sectors in China and India, which heavily rely on cast polyurethane components for material handling and operational machinery. North America and Europe, while mature, exhibit stable growth, concentrating on high-value, niche applications like advanced medical devices and specialized oil and gas components, where superior regulatory compliance and performance guarantee premium adoption. Emerging markets in Latin America and the Middle East & Africa are showing promising potential, stimulated by heavy investment in infrastructure development and industrial diversification, driving initial adoption of standard CPU products, particularly in the mining and aggregate sectors.

Segment trends reveal that the MDI (Methylene Diphenyl Diisocyanate) prepolymer segment is leading the market owing to its lower toxicity profile and superior performance characteristics compared to TDI (Toluene Diisocyanate)-based systems, aligning with global health and safety standards. The applications segment is dominated by Industrial Wheels and Rollers, essential for conveyor systems and forklifts across logistics and manufacturing, while the mining and construction end-use industry maintains the highest demand growth rate due to the severe wear conditions inherent in these operations. There is an observable shift towards hybrid CPU systems incorporating fillers or reinforcements to achieve properties previously unattainable by conventional elastomeric systems, addressing complex engineering challenges in areas requiring both high impact and cutting resistance, thereby pushing the boundaries of material science in this domain.

AI Impact Analysis on Casting Polyurethane Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the traditionally labor-intensive and chemistry-dependent casting polyurethane manufacturing process, focusing primarily on optimization, quality control, and predictive maintenance. Common user concerns revolve around the integration cost of AI systems, the necessity for highly specialized datasets (e.g., rheological properties, cure kinetics), and the ability of AI models to effectively predict the performance and longevity of CPU parts under diverse, real-world operational stresses. Key expectations center on AI’s capacity to optimize formulation composition in real-time, based on desired end-product specifications (e.g., hardness, rebound, abrasion resistance), minimizing material waste and accelerating R&D cycles. Furthermore, significant interest exists in using machine learning algorithms to detect subtle defects during the casting and curing stages, ensuring zero-defect manufacturing and improving overall yield and consistency, which are critical in demanding end-use applications like specialized automotive bushings or high-speed conveyor wheels. The overarching theme is leveraging AI to transition from empirical formulation development to data-driven predictive manufacturing.

- Optimization of raw material blending ratios (prepolymer and curative) using machine learning to achieve precise physical property targets, thereby reducing trial-and- error cycles.

- Predictive modeling of the exothermic curing process to control temperature profiles accurately, minimizing internal stress and ensuring homogeneous cross-linking density in thick-section parts.

- Implementation of AI-powered vision systems for automated, non-destructive inspection of cast parts, detecting micro-voids, porosity, and surface irregularities with higher accuracy than human inspection.

- Forecasting equipment failure (e.g., mixer speeds, mold temperature controllers) within casting machinery, enabling preventive maintenance and reducing unexpected downtime.

- AI-driven supply chain management, predicting fluctuations in raw material costs (diisocyanates, polyols) and optimizing inventory levels based on demand forecasts for specific CPU product lines.

- Development of digital twins for high-performance CPU components, simulating real-world aging and wear characteristics to validate product design before physical prototyping, accelerating time-to-market.

DRO & Impact Forces Of Casting Polyurethane Market

The market dynamics for casting polyurethane are shaped by strong drivers, moderate restraints, and compelling opportunities, all interconnected and amplified by various impacting forces. The primary drivers revolve around the inherent material superiority of cast PU over traditional elastomers and plastics, particularly its outstanding abrasion and tear resistance, which is highly sought after in heavy industrial environments like mining, oil and gas, and construction. Furthermore, the versatility of the casting process, allowing for the creation of components in complex geometries and varying sizes, supports customized engineering solutions. Restraints include the volatility of key petrochemical feedstock prices, namely crude oil derivatives used to produce MDI and TDI, which directly affects the final component cost and profitability margins. Additionally, the complex nature of handling diisocyanates necessitates strict regulatory compliance and sophisticated safety protocols, posing barriers to entry for new market participants and potentially slowing production scaling.

Opportunities for market expansion are abundant, particularly through the development of specialized CPU formulations, such as flame-retardant grades for aerospace and building sectors, or high-temperature resistant polyurethanes for extreme service conditions. The growing focus on material recycling and the subsequent potential for incorporating recycled content into certain CPU formulations presents a sustainable avenue for growth, appealing to environmentally conscious industries. Impact forces, driven by evolving material science and regulatory changes, are pushing manufacturers towards bio-based and non-isocyanate polyurethane (NIPU) systems, representing a significant technological shift that could fundamentally alter the raw material landscape. The global trend towards automation in logistics and material handling continuously increases the demand for high-quality wheels and rollers, a core application for cast polyurethane, thus exerting sustained upward pressure on market volume.

The interplay of these forces suggests a market trajectory favoring innovation and specialization. While cost sensitivity remains a constraint, particularly in high-volume, lower-specification applications, the unique performance attributes of cast polyurethane secure its indispensable role in high-stress, engineered applications. The shift towards solvent-free, cleaner casting systems, supported by technological advancements in metering and dispensing equipment, is mitigating some operational restraints related to safety and environmental impact. Geopolitical stability and global industrial output remain critical macro factors that directly influence the capital expenditure of end-user industries (mining, construction, heavy machinery), thereby acting as significant external impact forces on market demand for durable CPU components.

Segmentation Analysis

The Casting Polyurethane Market is comprehensively segmented based on the type of material (Prepolymer), the range of hardness (System Type), the specific technique utilized (Process), and the final application or end-use industry. This multi-faceted segmentation allows for a precise analysis of market dynamics, revealing varying growth rates and demand characteristics across different product offerings and geographical regions. The market’s segmentation reflects the high degree of customization inherent in casting polyurethane production, where the choice of prepolymer, curative, and processing method directly dictates the final physical properties of the component, tailoring it for specific industrial requirements, such as heavy duty abrasion or high impact resilience.

- By Type (Prepolymer):

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diisocyanate (TDI)

- Aliphatic Diisocyanate (ADI)

- By Hardness (System Type):

- Ether-based Polyurethane

- Ester-based Polyurethane

- Caprolactone-based Polyurethane

- By Application:

- Industrial Wheels and Rollers

- Seals, Gaskets, and Diaphragms

- Mining and Aggregate Screens

- Cushion Pads and Bumpers

- Automotive Suspension and Bushes

- Miscellaneous (Scrapers, Liners, Tooling)

- By End-Use Industry:

- Mining and Construction

- Material Handling and Logistics

- Automotive and Transportation

- Oil and Gas

- General Industrial

- Footwear and Textile

- Medical Devices

Value Chain Analysis For Casting Polyurethane Market

The value chain for the Casting Polyurethane Market is extensive, beginning with the foundational petrochemical industry and culminating in highly specialized industrial components. Upstream activities are dominated by major chemical producers responsible for synthesizing critical raw materials, primarily aromatic and aliphatic diisocyanates (MDI, TDI, HDI) and polyols (polyether and polyester polyols). This stage is characterized by high capital investment and complex chemical processing, and it dictates the quality and cost stability of the entire chain. Intermediate players then utilize these raw materials to synthesize the liquid prepolymers—the core product sold to the casters. Quality control at the prepolymer stage is paramount as it pre-determines the final physical properties of the cast component, involving precise molecular weight control and strict impurity management.

The midstream involves the core activity of casting. Specialized polyurethane systems houses and custom casters purchase prepolymers and curatives, mixing them precisely and pouring the reaction mixture into molds. This stage requires significant technical expertise in formulation, thermal management (curing profiles), and mold design (often using sophisticated CNC machining for metal or specialized composites). Distribution channels are bifurcated: direct distribution is common for large OEM contracts and complex, high-volume industrial components (e.g., large mine screening media), where direct technical consultation between the caster and the end-user is essential. Indirect distribution, leveraging specialized chemical distributors, is typical for smaller-volume, general-purpose casting materials or standardized product lines.

Downstream activities involve the incorporation of the cast polyurethane components into machinery and equipment across various end-user industries. For example, in the material handling sector, cast wheels and rollers are integrated into conveyor systems and forklifts. In the mining sector, CPU liners and screening media are installed in processing plants. The performance feedback loop from the downstream users (e.g., abrasion life, impact resistance reports) is crucial for the continuous improvement and customization of upstream prepolymer formulations. Direct sales channels provide superior technical support and facilitate custom formulation services, whereas indirect channels offer broader geographical reach and faster delivery of standard parts, effectively catering to both highly specialized and general industrial demand simultaneously.

Casting Polyurethane Market Potential Customers

Potential customers for the Casting Polyurethane Market span every heavy industrial sector that relies on durable, high-performance mechanical components capable of operating reliably under continuous stress, high load, or abrasive conditions. The primary end-users are large-scale mining operations and quarry companies that utilize CPU for screening media, conveyor scrapers, and mill liners due to its superior resistance to wet abrasion and impact, resulting in significantly reduced operational downtime compared to steel or rubber alternatives. Equipment manufacturers (OEMs) specializing in material handling systems (forklifts, industrial trucks, automated guided vehicles—AGVs) are major buyers, procuring millions of specialized wheels, tires, and load-bearing rollers annually, demanding specific load capacities and rebound characteristics essential for smooth logistics operations.

Furthermore, the automotive and transportation sectors represent a consistent demand base, particularly for specialized components such as suspension bushings, vibration isolators, and engine mounts where the high dynamic properties and durability of cast polyurethane are critical for noise reduction and extending vehicle life. The oil and gas industry is another significant customer, primarily utilizing CPU for pipeline pigging components, seals, subsea buoyancy modules, and specialized protective coatings where resistance to hydrocarbons, high pressure, and saltwater environments is mandatory. General manufacturing, including heavy machinery producers and capital equipment builders, also consumes CPU components extensively for tooling, press brake pads, cushioning devices, and protective liners, valuing the material's ability to resist compression set and dampen excessive vibration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Covestro AG, BASF SE, Huntsman Corporation, Dow Inc., Chemtura Corporation (Lanxess), Era Polymers Pty Ltd, Wanhua Chemical Group Co., Ltd., Coim Group, Mitsui Chemicals, Inc., Notedome Ltd, Argonics, Inc., Adiprene (Hexpol), The Lubrizol Corporation, Custom Urethane Products, Inc., Gallagher Corporation, SPI Performance Coatings, Inc., Armacell International GmbH, Recticel NV/SA, RAMPF Group, Inc., Trelleborg AB. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Casting Polyurethane Market Key Technology Landscape

The technological landscape of the Casting Polyurethane Market is focused primarily on enhancing material performance, improving processing efficiency, and ensuring environmental compliance. A key technological advancement involves the precise metering and mixing equipment, specifically dynamic mix heads and vacuum degassing systems. These technologies are crucial for processing low-viscosity, fast-reacting CPU systems, ensuring the complete removal of air bubbles and moisture before casting, which is vital for component integrity in high-stress applications. The shift towards automated casting and curing cells, utilizing robotics for mold handling and integrated thermal sensors for precise temperature mapping during the exothermic curing phase, significantly reduces variability and labor costs, pushing manufacturing towards Industry 4.0 standards.

In terms of material science, significant research is centered on developing high-performance hybrid polyurethanes. This involves incorporating advanced reinforcing fillers, such as graphene, carbon nanotubes, or specialized mineral fibers, to substantially boost mechanical properties like stiffness, impact strength, and thermal conductivity without sacrificing the material's inherent elasticity. Furthermore, advancements in specialized curative chemistry, including slow-acting diamines or novel blocked isocyanates, allow for extended pot life and complex, large-format casting processes that require prolonged liquid stability before gelation. This technology allows for the creation of exceptionally large liners and custom tooling parts previously challenging to achieve with conventional fast-cure systems.

Another area of intense technological focus is the development and commercialization of Non-Isocyanate Polyurethane (NIPU) systems. Driven by safety and environmental mandates concerning MDI and TDI, NIPU utilizes alternative chemistry pathways, often based on cyclic carbonate reactions, to achieve polyurethane-like structures. While currently facing challenges regarding cost and achieving performance parity with traditional systems in all high-stress metrics (e.g., high rebound), NIPU represents the future direction of greener chemistry in the casting market. Concurrently, the use of computer-aided engineering (CAE) for mold flow analysis and finite element analysis (FEA) simulation is becoming standard practice, allowing casters to optimize mold design and predict part behavior under load, drastically reducing physical prototyping costs and accelerating development cycles for bespoke industrial components.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, driven by massive infrastructure spending, robust growth in the manufacturing sector (particularly heavy machinery and logistics hubs in China and India), and burgeoning automotive production. The region benefits from lower operating costs and rapidly expanding industrial capacities, leading to high consumption of both MDI- and TDI-based CPU for bulk industrial applications like conveyor components and construction equipment wear parts.

- North America: Characterized by high demand for specialized, high-performance CPU systems, especially in the oil and gas (subsea applications), aerospace, and high-tech material handling sectors. Strict regulatory environments encourage the adoption of MDI and aliphatic systems over TDI, focusing on quality and compliance. Innovation in robotic dispensing and high-precision casting is highly concentrated here.

- Europe: A mature market defined by stringent environmental regulations (REACH), driving innovation towards bio-based polyols and solvent-free casting processes. Key demand comes from the automotive sector (for vibration damping and NVH reduction components), specialized tooling, and advanced medical applications. Germany, in particular, leads in specialized engineering and high-end industrial machinery manufacturing, requiring premium CPU components.

- Latin America (LATAM): Growth is primarily fueled by large-scale mining operations (especially in Chile, Peru, and Brazil) and commodity extraction industries. The market exhibits high demand for durable, heavy-duty screening media and mill liners designed to withstand aggressive wear and impact forces typical in hard rock mining environments. Investment fluctuations in the resource sector are a key market variable.

- Middle East and Africa (MEA): Growth is tied to diversification efforts away from oil dependency, leading to increasing investment in construction, logistics infrastructure, and general industrialization. Demand focuses on robust, temperature-resistant CPU materials for applications in extreme climate conditions, particularly seals, pipe supports, and protective linings in the region's expanding oil and water infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Casting Polyurethane Market.- Covestro AG

- BASF SE

- Huntsman Corporation

- Dow Inc.

- Lanxess AG (formerly Chemtura)

- Era Polymers Pty Ltd

- Wanhua Chemical Group Co., Ltd.

- Coim Group

- Mitsui Chemicals, Inc.

- Notedome Ltd

- Argonics, Inc.

- Adiprene (Hexpol AB)

- The Lubrizol Corporation

- Custom Urethane Products, Inc.

- Gallagher Corporation

- Trelleborg AB

- RAMPF Group, Inc.

- Hennecke GmbH

- PolyTek Development Corp.

- SPI Performance Coatings, Inc.

Frequently Asked Questions

Analyze common user questions about the Casting Polyurethane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of casting polyurethane over traditional rubber and plastics?

Casting polyurethane offers superior performance characteristics, most notably significantly higher abrasion and tear resistance, greater load-bearing capacity, and excellent rebound resilience. Unlike traditional materials, CPU formulations can be precisely tailored to exhibit properties ranging from soft elastomer to rigid plastic, making them ideal for high-stress industrial applications demanding longevity and high dynamic performance.

Which prepolymer type (MDI vs. TDI) dominates the market and why is this distinction important?

While both MDI and TDI systems are widely used, MDI (Methylene Diphenyl Diisocyanate) prepolymers are increasingly dominating due to their lower vapor pressure and superior toxicology profile, which simplifies industrial handling and aligns with stricter health and safety regulations, particularly in developed regions. MDI-based systems are often preferred for high-performance elastomers requiring excellent dynamic properties and hydrolysis resistance.

What is the main driver for the Casting Polyurethane Market growth in the Asia Pacific region?

The primary driver in the Asia Pacific region is the rapid and sustained expansion of heavy industrial sectors, including mining, construction, and large-scale manufacturing (especially in material handling and logistics). These industries require massive volumes of wear-resistant components like wheels, rollers, and screening media, where the durability and cost-effectiveness of cast polyurethane offer significant operational advantages over competing materials.

How do fluctuating raw material prices impact the profitability of CPU manufacturers?

Raw material costs, particularly diisocyanates (MDI and TDI) and polyols, are highly volatile as they are petrochemical derivatives. Fluctuations directly impact the manufacturing cost of prepolymers and subsequently the final component price, squeezing profit margins for casters. This volatility necessitates robust supply chain management, strategic hedging, and the ability to quickly implement price adjustments for end-user components.

What technological innovations are shaping the future of casting polyurethane production?

Key technological innovations include the development of Non-Isocyanate Polyurethane (NIPU) systems for enhanced safety and sustainability, the implementation of advanced automated metering and mixing equipment (Industry 4.0 standards) for improved quality control, and the integration of specialized fillers (like nanotechnology-based reinforcements) to create hybrid CPU materials with ultra-high mechanical strength and thermal stability for demanding niche applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager