Cat Food Subscription Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443358 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Cat Food Subscription Service Market Size

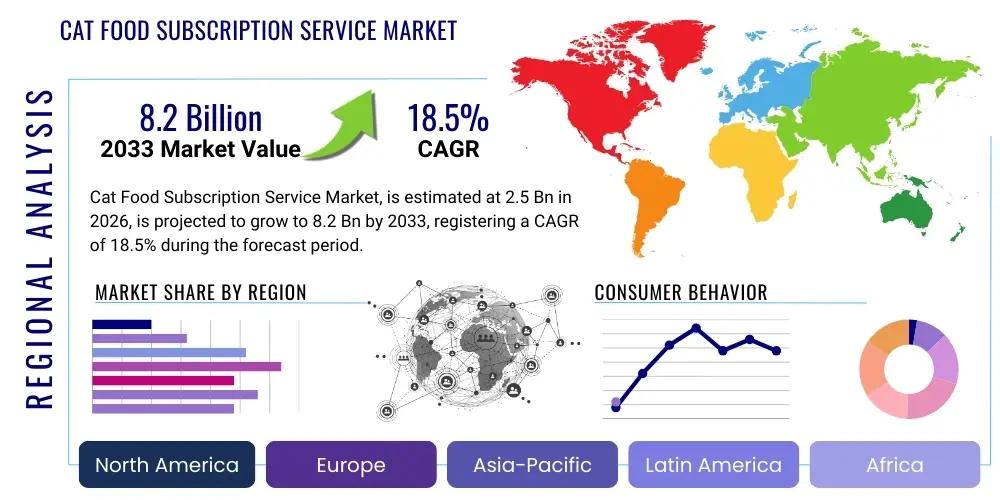

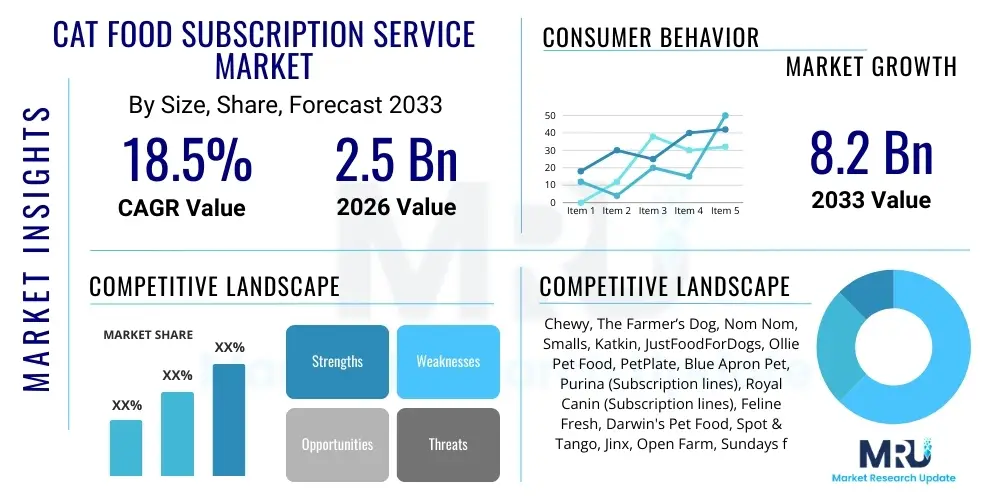

The Cat Food Subscription Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $8.2 Billion by the end of the forecast period in 2033.

Cat Food Subscription Service Market introduction

The Cat Food Subscription Service Market encompasses businesses that offer recurring, scheduled deliveries of specialized cat food products directly to the consumer's doorstep. This model leverages convenience, personalization, and high-quality nutritional offerings to cater to the evolving demands of modern pet owners. The core product description spans various formulations, including fresh/human-grade meals, customized kibble blends, and specialized therapeutic diets, all designed to ensure optimal feline health. Major applications of these services include automated inventory management for busy households, provision of tailored nutritional plans based on breed, age, and existing health conditions, and access to premium, often regionally sourced, ingredients that are typically unavailable in standard retail channels. The shift toward premiumization and humanization of pet care is the primary accelerator for this market segment.

Key benefits driving the rapid adoption of cat food subscription services include unparalleled convenience through automated, hassle-free replenishment, ensuring pets never run out of necessary provisions. Furthermore, these platforms utilize sophisticated data analytics and sometimes veterinary consultations to provide highly customized meal plans, addressing specific dietary restrictions such as allergies or weight management concerns, which significantly enhances the value proposition for discerning pet parents. These services often guarantee fresher ingredients and superior quality control compared to mass-produced retail alternatives, aligning perfectly with the increasing trend where pets are viewed as integral family members requiring the highest standard of care.

Driving factors for sustained market growth include the robust global increase in pet ownership, particularly among millennials and Gen Z consumers who prioritize digital convenience and customized solutions. Technological advancements enabling efficient supply chain management, temperature-controlled logistics for fresh food delivery, and sophisticated user interfaces for managing subscriptions contribute significantly. Furthermore, the growing awareness regarding the adverse effects of generic, low-quality commercial cat foods is propelling consumers toward specialized, nutritionist-approved subscription brands, positioning the market for substantial expansion throughout the forecast period.

Cat Food Subscription Service Market Executive Summary

The Cat Food Subscription Service Market is experiencing robust acceleration, primarily fueled by shifting consumer behavior toward premium pet care and the critical need for convenience in urbanized lifestyles. Business trends highlight a strong focus on direct-to-consumer (D2C) models, leveraging digital engagement, and investing heavily in personalization algorithms powered by data from cat profiles (age, weight, activity, allergies). Key segment trends indicate explosive growth within the fresh and human-grade food categories, significantly outpacing traditional dry kibble subscriptions, reflecting a premiumization strategy adopted by market leaders. Additionally, therapeutic and specialized diet subscriptions are seeing heightened demand as veterinary science increasingly emphasizes dietary management for feline health conditions.

Regional trends indicate North America and Europe currently dominate the market share, driven by high disposable incomes, established digital infrastructure, and a deeply ingrained culture of premium pet spending. However, the Asia Pacific (APAC) region is poised for the highest CAGR, spurred by rapidly increasing pet ownership rates in emerging economies like China and India, coupled with rising middle-class awareness regarding pet nutrition. Companies are strategically expanding their logistical networks in APAC to capitalize on this untapped potential, often adapting meal plans to suit local ingredient sourcing and storage capabilities. Competition is intensifying, forcing established players to diversify product offerings and improve retention through flexible subscription terms and loyalty programs.

Overall, the market trajectory is highly positive. The executive summary confirms that strategic innovation focuses on minimizing churn rates, enhancing the customer experience through predictive reordering and integrated wellness tracking, and ensuring supply chain resilience against potential disruptions. Major businesses are prioritizing sustainable sourcing and eco-friendly packaging, responding to a parallel consumer trend toward environmental consciousness, thereby embedding long-term value into their subscription models and securing future market leadership.

AI Impact Analysis on Cat Food Subscription Service Market

Common user questions regarding AI's impact on the Cat Food Subscription Service Market center primarily on how technology can improve dietary accuracy, automate order adjustments, and enhance supply chain visibility. Users frequently ask: "Can AI truly diagnose my cat's nutritional needs better than a vet?" "Will AI-driven inventory prediction prevent stockouts?" and "How is personalized pricing determined using machine learning?" The core themes involve validating the trustworthiness and scientific rigor of AI recommendations, assessing the tangible benefits to convenience and cost, and understanding how machine learning algorithms optimize logistics, particularly concerning fresh food delivery schedules and spoilage minimization. Users expect AI to deliver hyper-personalized nutritional plans and seamless customer journeys.

AI's influence is transformative, moving the industry beyond basic static recommendations to dynamic, predictive nutrition management. Machine learning models analyze vast datasets encompassing feline health records, breed-specific nutritional requirements, activity levels tracked via wearables, and consumption patterns captured through smart feeding devices. This granular data allows subscription services to fine-tune ingredient ratios, calorie counts, and supplement additions in real-time. For instance, if a cat's weight data indicates a slight gain, the AI automatically adjusts the portion size for the next delivery cycle, ensuring immediate and precise intervention without requiring manual client input, thereby maximizing efficacy and customer satisfaction.

Furthermore, AI significantly optimizes the operational backbone of subscription services. Predictive analytics forecasts demand fluctuations based on seasonality, customer cohort behavior, and macro-economic factors, dramatically reducing food waste and inventory holding costs. In logistics, AI optimizes delivery routes based on dynamic traffic data and temperature control requirements for fresh meals, ensuring on-time delivery and maintaining product integrity. This sophisticated integration of AI throughout the value chain—from personalized formulation and predictive demand planning to optimized last-mile delivery—is critical for achieving scalability and maintaining competitive advantage in this highly convenience-driven market.

- AI-driven Hyper-Personalized Nutrition: Customizing caloric intake and nutrient profiles based on real-time activity and health data.

- Predictive Inventory Management: Utilizing machine learning to forecast demand, minimizing waste and ensuring ingredient availability.

- Dynamic Pricing and Promotions: Offering tailored discounts and subscription adjustments based on customer behavioral segmentation.

- Automated Customer Support (Chatbots): Enhancing 24/7 service efficiency for routine inquiries regarding order tracking and dietary modifications.

- Supply Chain Optimization: Real-time route planning and temperature monitoring using IoT sensors and AI algorithms to maintain fresh food quality during transit.

- Feline Health Monitoring: Integration with smart devices to analyze feeding speed, frequency, and remaining portion sizes to alert owners to potential health issues requiring dietary change.

DRO & Impact Forces Of Cat Food Subscription Service Market

The Cat Food Subscription Service Market is strongly influenced by a robust set of dynamic forces encompassing Drivers (D), Restraints (R), and Opportunities (O). The primary drivers include the escalating humanization of pets, leading to increased spending on premium, health-focused nutrition, and the strong consumer preference for e-commerce and convenience, accelerated by post-pandemic digital adoption. Restraints primarily involve the high initial cost barrier associated with premium fresh food services compared to conventional kibble, which limits adoption among budget-conscious demographics, alongside persistent logistical challenges related to maintaining cold chain integrity for perishable products across vast geographical areas. Significant opportunities exist in geographical expansion into untapped international markets, the vertical integration of vet-approved prescription diets, and the adoption of cutting-edge sustainable and ethical sourcing practices that resonate strongly with the target consumer base. These forces interact dynamically, with technological advancements acting as a powerful impact force mitigating logistics restraints and amplifying opportunities.

Impact forces further refine the market trajectory. The substitution threat is moderate to high; while traditional retail offers cheaper alternatives, the unique value proposition of convenience and personalization offered by subscriptions makes direct substitution difficult for the core target audience. The bargaining power of buyers is high due to the low switching costs between competing subscription services and the proliferation of introductory offers, compelling companies to focus intensely on service quality and retention strategies. Conversely, the bargaining power of suppliers (especially those providing premium, novel, or specialized ingredients like novel proteins or unique supplements) is growing, necessitating strong, long-term contractual relationships to secure consistent sourcing and stable pricing. Regulatory frameworks concerning pet food labeling and safety standards globally pose a constant pressure, requiring significant operational adherence and transparency, which impacts entry barriers.

Overall market profitability and competitive intensity are extremely high. Companies are forced into innovation, not only in product formulation but also in developing proprietary data analytics platforms to optimize customer lifetime value. Success hinges on mastering complex cold chain logistics and delivering demonstrable health benefits to the feline population. The cumulative effect of these drivers and opportunities, particularly leveraging advanced technology to overcome restraints like cost perception and logistical complexity, points toward sustained high growth, making it a critical focus area within the broader pet care industry.

Segmentation Analysis

The Cat Food Subscription Service Market is segmented based on critical characteristics including Product Type, Diet Type, Cat Age, and Pricing Model, allowing providers to precisely target specific consumer needs and behaviors. Product segmentation distinguishes between shelf-stable options like Dry Kibble and Wet Canned Food, and the rapidly expanding segments of Fresh/Refrigerated Food and Freeze-Dried/Raw Diets. Diet Type stratification is crucial for addressing specific health concerns, covering categories such as Grain-Free, Natural/Organic, High-Protein, and Prescription/Therapeutic formulations. Segmentation by Cat Age (Kitten, Adult, Senior) ensures that nutritional content is appropriate for the metabolic and developmental stage of the feline, while Pricing Model segmentation (Monthly, Bi-Weekly, Quarterly) dictates the frequency and commitment level required from the consumer. This structured approach enables sophisticated marketing and tailored product development, essential for maximizing penetration in a competitive landscape.

The most lucrative segment currently resides within the Fresh/Human-Grade Food category under Product Type, driven by the consumer perception that fresh preparation offers superior health benefits and palatability compared to processed alternatives. Within Diet Type, the demand for natural and grain-free options continues to accelerate as pet owners seek to minimize artificial additives and potential allergens. Targeting the Senior Cat demographic represents a significant growth opportunity, as these pets often require specialized, calorie-controlled, and joint-supportive diets that are optimally delivered through customized subscription plans, providing a crucial value-add service to owners managing aging companions.

Understanding these segment dynamics is paramount for market players. Successful strategies involve creating flexible subscription tiers that cater to both budget-conscious consumers seeking bulk savings (e.g., quarterly wet food delivery) and premium buyers requiring highly customized, weekly fresh meal kits. The convergence of Age-specific needs with therapeutic diets (e.g., high-protein, low-phosphorus diets for senior cats with kidney concerns) is a rapidly growing niche, demonstrating the maturation of the market toward specialized wellness solutions rather than general food delivery.

- Product Type:

- Dry Food (Kibble)

- Wet Food (Canned/Pouches)

- Fresh/Refrigerated Food

- Freeze-Dried/Raw Food

- Diet Type:

- Grain-Free

- Natural/Organic

- High-Protein

- Prescription/Therapeutic Diets

- Limited Ingredient Diets

- Cat Age:

- Kitten

- Adult

- Senior

- Pricing Model:

- Monthly Subscription

- Bi-Weekly Subscription

- Quarterly Subscription

Value Chain Analysis For Cat Food Subscription Service Market

The Value Chain for the Cat Food Subscription Service Market begins with Upstream Analysis, which focuses on sourcing high-quality, often human-grade ingredients, including novel proteins, specialized vitamins, and proprietary supplements. This stage involves rigorous supplier vetting, emphasizing ethical and sustainable sourcing, and maintaining strict compliance with safety and nutritional standards. Operations then involve R&D for proprietary nutritional formulations, often collaborating with veterinary nutritionists, followed by specialized manufacturing processes (e.g., flash-freezing, gentle cooking) designed to preserve nutrient integrity, differentiating these services from mass production lines. Efficient inventory management and preparation of individualized meal kits form the core manufacturing activities, requiring substantial investment in specialized kitchen facilities and quality control protocols.

The Downstream Analysis highlights the critical role of logistics and distribution. Cat food subscription services predominantly utilize Direct-to-Consumer (D2C) channels, bypassing traditional retail intermediaries. This requires robust, temperature-controlled shipping infrastructure (cold chain logistics) to ensure fresh products maintain quality from the production facility to the consumer's home. Distribution channels are primarily categorized as Direct (owned e-commerce platforms and proprietary delivery fleets in select urban areas) and Indirect (partnerships with third-party logistics providers specializing in refrigerated parcel shipping, such as FedEx Cold Chain or specialized regional carriers). The integration of technology for order fulfillment, personalized packaging, and last-mile tracking is crucial for enhancing customer satisfaction and maintaining the subscription model's convenience promise.

The critical difference between success and failure in this market lies in mastering the final mile and the post-sale interaction. Post-delivery customer engagement—including personalized follow-up, dietary consultations, and managing subscription modifications via user-friendly interfaces—is paramount for retention. The high cost of customer acquisition necessitates minimizing churn. Thus, the value chain is highly reliant on technology and data analytics to optimize every step, from predicting the exact nutritional needs of a cat to ensuring the package arrives intact and on time. Transparency regarding ingredient sourcing and preparation methods also adds considerable perceived value, cementing customer loyalty.

Cat Food Subscription Service Market Potential Customers

The primary End-Users/Buyers of Cat Food Subscription Services are modern pet owners characterized by high disposable incomes, strong affinity for premiumization, and a persistent need for time-saving convenience solutions. This demographic predominantly includes urban-dwelling Millennials and Gen X professionals who view their cats as family members and prioritize their long-term health and wellness over cost considerations. These consumers are typically highly educated regarding pet nutrition and are proactive in seeking out specialized dietary solutions for health management, allergies, or specific life stage requirements (e.g., kittens requiring high caloric density or senior cats needing joint support). They are digitally native and highly comfortable managing recurrent payments and personalized profiles online.

A significant segment of potential customers includes owners whose cats suffer from chronic or recurring health issues (such as chronic kidney disease, diabetes, or severe allergies) requiring strict, often customized, prescription-grade diets. These owners rely on the precision and consistency offered by subscription models, often coordinating these services directly with veterinary recommendations. Furthermore, high-volume, multi-cat households also represent a crucial customer base, as the logistical challenge of consistently purchasing and transporting large quantities of specialized food is effectively solved by automated home delivery, placing a high value on the convenience aspect of the subscription model.

Finally, the growing environmental consciousness among consumers is creating a receptive market for services that emphasize sustainable packaging, ethically sourced ingredients, and minimized food waste. Buyers who prioritize ethical consumption are increasingly drawn to subscription brands that can demonstrate a clear commitment to ecological responsibility. Therefore, the successful provider targets not just the functional need for food, but the emotional, health-driven, and ethical concerns of affluent, busy, and wellness-focused pet parents.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $8.2 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chewy, The Farmer’s Dog, Nom Nom, Smalls, Katkin, JustFoodForDogs, Ollie Pet Food, PetPlate, Blue Apron Pet, Purina (Subscription lines), Royal Canin (Subscription lines), Feline Fresh, Darwin's Pet Food, Spot & Tango, Jinx, Open Farm, Sundays for Dogs. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cat Food Subscription Service Market Key Technology Landscape

The technological landscape underpinning the Cat Food Subscription Service market is dynamic and revolves primarily around advanced data science, cold chain logistics innovation, and seamless e-commerce platform architecture. Critical technologies include Machine Learning (ML) algorithms that power personalized feeding recommendations, allowing services to analyze vast amounts of behavioral, physiological, and preference data to formulate the optimal nutritional plan for individual cats. This personalization is a core differentiator, moving beyond generic products to scientifically tailored meals. Furthermore, robust cloud computing infrastructure is essential for handling high transaction volumes, managing complex recurring billing cycles, and supporting sophisticated CRM systems that track customer interactions and dietary changes over time, ensuring a frictionless user experience.

In the physical operational space, technology focusing on supply chain integrity is paramount, especially for providers dealing with fresh and raw food. This includes the deployment of Internet of Things (IoT) sensors within packaging and transportation vehicles to provide real-time monitoring of temperature and humidity, guaranteeing the safety and freshness of perishable goods during transit. This cold chain technology, often coupled with predictive analytics for route optimization, minimizes spoilage and reduces logistical costs, directly impacting profitability. Additionally, companies are increasingly adopting automation in their fulfillment centers for accurate portioning and customized packaging, accelerating throughput and reducing human error in the kitting process.

Finally, the consumer-facing technology landscape is dominated by mobile applications and interactive web platforms designed for high engagement. These platforms utilize advanced user interface (UI) and user experience (UX) design principles to simplify subscription management, enable easy pausing or modification of orders, and integrate wellness tracking features. Emerging technologies also include blockchain for supply chain transparency, allowing customers to verify the origin and quality of ingredients, which builds crucial trust and reinforces the premium positioning of subscription services. The overall technological trend is toward integrated systems that link veterinary consultation platforms, production facilities, and customer front-ends via data analytics for a truly holistic service offering.

Regional Highlights

The market dynamics for Cat Food Subscription Services vary significantly across global regions, driven by disparate pet ownership rates, economic factors, and cultural attitudes toward premium pet expenditure. North America, particularly the United States and Canada, remains the largest and most mature market segment. This dominance is attributable to high disposable incomes, deeply embedded e-commerce habits, and the highest per-pet spending globally, fueled by the strong humanization trend. Market penetration of fresh and specialized food subscriptions is highest here, and competition focuses heavily on product diversification and logistical speed, with established cold chain networks facilitating rapid delivery across large geographic areas.

Europe represents the second-largest market, characterized by strong growth in countries like the UK, Germany, and France. European consumers show a particularly high preference for organic, locally sourced, and sustainably packaged products, influencing subscription services to prioritize ethical sourcing certifications and minimize their carbon footprint. While logistical challenges exist due to varying national regulations and complex cross-border shipping, the strong demand for wellness-focused and breed-specific diets sustains robust growth. Regulatory compliance, especially concerning EU-wide pet food standards, is a critical operational factor defining market success in this region.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This acceleration is driven by the rapid expansion of the middle class in economies like China, Japan, South Korea, and Southeast Asia, leading to increased pet adoption and a greater capacity to spend on premium services. Urbanization trends in APAC necessitate convenient solutions like subscriptions. While logistical infrastructure is still developing in some areas, particularly concerning refrigerated transport, the sheer volume of new pet owners entering the market makes APAC the foremost strategic expansion target for global subscription providers, often requiring culturally adapted meal formulations (e.g., incorporating regional ingredients or addressing specific common local dietary deficiencies).

Latin America (LATAM) and the Middle East and Africa (MEA) currently hold smaller market shares but offer long-term potential. Growth in LATAM is concentrated in major urban hubs like Brazil and Mexico, where digital adoption and premiumization trends are rising. The MEA region is nascent, with limited cold chain infrastructure proving a significant barrier. However, increased wealth in the Gulf Cooperation Council (GCC) countries presents opportunities for high-end, specialized pet services catering to affluent populations who demand imported, high-quality nutritional solutions for their pets.

- North America: Market leader due to high pet spending, established e-commerce adoption, and mature cold chain infrastructure; focus on high personalization and speed.

- Europe: Strong preference for sustainability, organic sourcing, and regulatory compliance; high growth in the UK and Germany driven by wellness trends.

- Asia Pacific (APAC): Fastest growing region, fueled by rising middle-class income and increasing urbanization; market entry strategies focus on localized ingredients and developing cold chain networks.

- Latin America (LATAM): Emerging market potential concentrated in major urban areas (Brazil, Mexico); focus on digital platform reliability and entry-level subscription tiers.

- Middle East and Africa (MEA): Nascent market; high potential in affluent GCC countries, constrained by challenging logistics and infrastructure development outside of key urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cat Food Subscription Service Market.- Chewy

- The Farmer’s Dog

- Nom Nom

- Smalls

- Katkin

- JustFoodForDogs

- Ollie Pet Food

- PetPlate

- Blue Apron Pet (Hypothetical/Expanding services)

- Purina (Subscription lines)

- Royal Canin (Subscription lines)

- Feline Fresh

- Darwin's Pet Food

- Spot & Tango

- Jinx

- Open Farm

- Sundays for Dogs (Expanding to Cat)

- Bella & Duke

- A Pup Above (Expanding to Cat)

- Raw Paws Pet Food

Frequently Asked Questions

Analyze common user questions about the Cat Food Subscription Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using a cat food subscription service?

The primary benefits include maximizing convenience through automated home delivery, ensuring optimized feline nutrition via personalized meal plans, guaranteeing product freshness, and saving time on routine grocery runs, all contributing to superior pet health management.

How do cat food subscription services handle personalization and dietary requirements?

Subscription services use detailed intake questionnaires and sometimes AI algorithms to analyze the cat’s age, weight, breed, activity level, and existing allergies. This data is used to customize ingredient ratios and portion sizes, often collaborating with veterinary nutritionists for therapeutic diets.

Is fresh or human-grade cat food subscription superior to traditional kibble?

Many experts and pet owners perceive fresh or human-grade options as superior due to better ingredient quality, higher moisture content, and minimal processing, which can improve palatability, digestion, and hydration, though traditional kibble subscriptions remain popular for cost and shelf stability.

What is the key challenge facing the fresh cat food subscription segment?

The primary challenge is maintaining the cold chain logistics required for fresh and raw perishable products, ensuring they remain frozen or refrigerated from the production facility to the consumer's doorstep without compromising safety or quality, which often translates to higher overall operational costs.

Which geographical region demonstrates the highest potential growth for these services?

The Asia Pacific (APAC) region, driven by countries like China and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, increasing disposable incomes, and accelerating adoption of Westernized pet ownership and premium care standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager