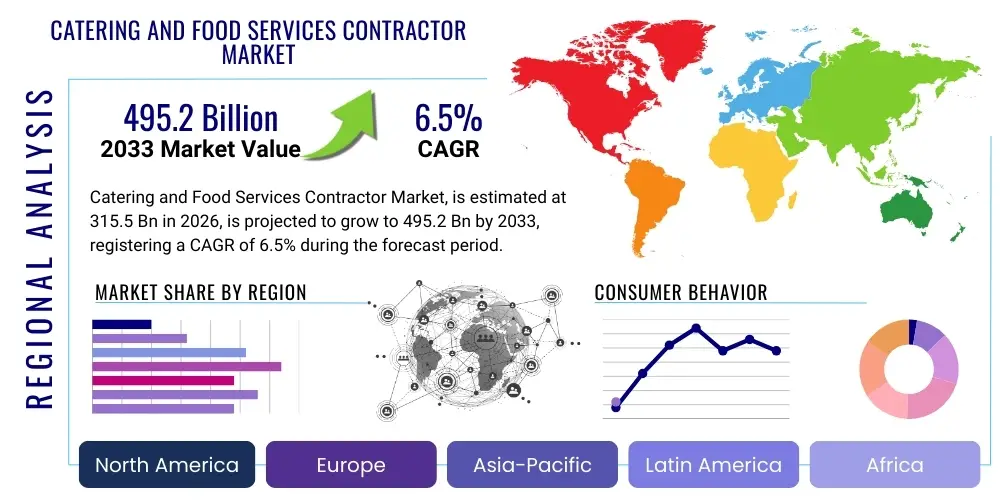

Catering and Food Services Contractor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442778 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Catering and Food Services Contractor Market Size

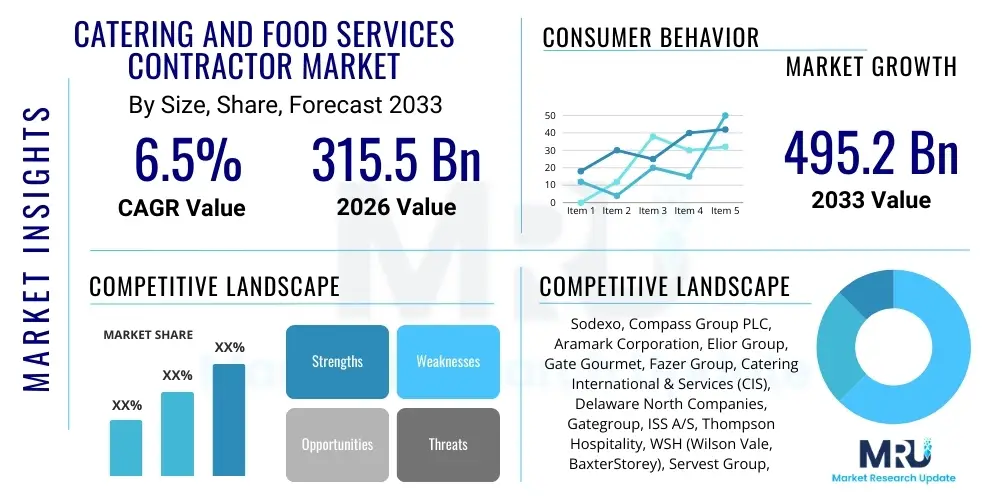

The Catering and Food Services Contractor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 315.5 Billion in 2026 and is projected to reach USD 495.2 Billion by the end of the forecast period in 2033.

Catering and Food Services Contractor Market introduction

The Catering and Food Services Contractor Market encompasses specialized businesses that provide outsourced culinary, dining, and related hospitality services to institutions, corporations, educational facilities, healthcare providers, and remote sites. These contractors manage everything from daily cafeteria operations and executive dining to large-scale event catering and vending machine management, allowing client organizations to focus on their core competencies while maintaining high standards of food quality and service efficiency. The market is defined by long-term contractual agreements and emphasizes integrated service models, moving beyond simple food preparation to include logistics, supply chain management, menu development focused on nutritional and dietary trends, and comprehensive facility staffing.

The core product offering within this sector is integrated food service management, which involves strategic planning, procurement of sustainable and local ingredients, sophisticated kitchen management systems, and compliance with stringent food safety and regulatory standards across multiple jurisdictions. Major applications span high-volume institutional settings such, as corporate campuses requiring daily employee meals, hospitals needing specialized patient diets, primary and secondary educational institutions implementing student meal programs, and remote work camps in sectors like mining or oil and gas. The diversity of applications necessitates highly adaptable service models, ranging from fine dining setups for corporate events to highly efficient grab-and-go options for fast-paced environments, all driven by the contractor's ability to achieve economies of scale and operational excellence.

Key benefits driving the expansion of this market include cost optimization for client organizations through centralized purchasing power, improved quality control due to professional management, and enhanced employee or customer satisfaction through varied and specialized menus. Furthermore, contractors often bring technological advantages, such as mobile ordering platforms and inventory management software, that are costly for individual organizations to implement. Driving factors accelerating market growth include the rising trend of outsourcing non-core activities globally, increasing demand for convenient and healthy eating options in institutional environments, stringent health and safety regulations mandating professional food handling, and the continuous expansion of corporate and educational infrastructure, particularly in developing economies demanding modern catering solutions.

Catering and Food Services Contractor Market Executive Summary

The global Catering and Food Services Contractor Market is undergoing significant transformations characterized by a shift toward sustainable sourcing, customized nutritional programs, and technology integration. Business trends are heavily influenced by corporate consolidation, with major players acquiring regional specialists to expand geographic reach and segment penetration, especially within the healthcare and education sectors where long-term contracts offer stable revenue streams. The post-pandemic environment has accelerated the adoption of hybrid service models, including sophisticated pre-packaged meal solutions and contactless delivery systems, prioritizing safety and flexibility. Furthermore, corporate clients increasingly demand transparent supply chains and robust environmental, social, and governance (ESG) reporting from their food service partners, making sustainability a critical competitive differentiator.

Regionally, North America and Europe remain the dominant markets, leveraging mature institutional infrastructure and a high propensity for outsourcing, though growth rates are stabilizing. The Asia Pacific (APAC) region, however, is projected to exhibit the highest growth trajectory, fueled by rapid urbanization, expanding middle-class populations, and substantial investment in new infrastructure projects—particularly in countries like China, India, and Southeast Asia—which require standardized, high-volume food services for schools, offices, and industrial complexes. The Middle East and Africa (MEA) are also experiencing significant expansion, driven by large government projects, tourism sector growth, and the development of major corporate centers, necessitating high-quality, reliable food service management solutions adapted to local dietary customs and labor regulations.

Segmentation trends indicate that the commercial segment (corporate and business services) holds the largest market share due to the high frequency and volume of daily service requirements, though the healthcare segment is showing robust growth propelled by aging populations and complex dietary needs managed by specialized contractors. By type, the contract catering segment—involving long-term, fixed-site management—dominates revenue, but event catering is seeing resurgence, adapting with flexible, highly scalable models optimized through digital booking and planning tools. The operational shift emphasizes personalized service delivery, leveraging data analytics to predict consumption patterns, minimize food waste, and optimize labor schedules, ensuring profitability while meeting the diverse demands of modern clientele across all key segments.

AI Impact Analysis on Catering and Food Services Contractor Market

User inquiries regarding AI's impact on the Catering and Food Services Contractor Market primarily center on efficiency gains, predictive analytics for inventory management, labor optimization, and the personalization of customer experience. Key themes revolve around whether AI will replace frontline staff versus augmenting management capabilities. Users are concerned about the implementation costs and data privacy implications, while simultaneously expecting AI to solve chronic industry problems such as high food waste, volatile ingredient pricing, and difficulties in optimizing complex supply chains across diverse sites. The consensus expectation is that AI will be most transformative in back-of-house operations—such as kitchen automation, advanced demand forecasting, and sophisticated regulatory compliance monitoring—rather than direct customer interaction, ensuring operational resilience and enhancing profitability margins.

The integration of Artificial Intelligence tools is fundamentally changing how catering contractors manage complexity and risk. Predictive AI models, trained on historical sales data, seasonal variations, and external factors like local weather or client event schedules, enable highly accurate demand forecasting. This capability significantly reduces perishable inventory spoilage, a major cost drain in the industry, by precisely determining ingredient needs and optimal production volumes for daily operations. Furthermore, AI-driven routing and logistics optimization for multisite contract management ensures timely delivery of provisions and prepared meals, particularly critical for large, geographically dispersed client portfolios, thereby improving service reliability and maximizing vehicle utilization.

Beyond logistics, AI is profoundly impacting menu development and quality assurance. Machine learning algorithms analyze customer feedback, dietary trends, and individual health requirements to generate highly personalized menu recommendations, especially valuable in specialized settings like hospitals or senior living facilities where nutritional compliance is paramount. In terms of operational efficiency, AI-powered robotics are being piloted for repetitive tasks such as portioning, cleaning, and preparation, leading to enhanced hygiene standards and reduced dependency on manual labor in high-turnover roles. This strategic adoption allows human staff to focus on higher-value activities like presentation, customer interaction, and quality control, thereby maintaining the essential human element of hospitality while improving overall productivity and compliance.

- AI-driven demand forecasting and inventory optimization reducing food waste by up to 15-20%.

- Automated compliance monitoring ensuring adherence to global and local food safety regulations (HACCP).

- Personalized menu generation based on demographic data and real-time customer feedback analysis.

- Optimization of labor scheduling and task assignment using predictive workload models.

- Integration of robotic systems for high-volume, repetitive kitchen tasks (e.g., dishwashing, basic prep).

- Enhanced supply chain transparency and risk management through blockchain integration coupled with AI validation.

DRO & Impact Forces Of Catering and Food Services Contractor Market

The dynamics of the Catering and Food Services Contractor Market are primarily driven by the increasing propensity of organizations, across commercial, educational, and healthcare sectors, to outsource non-core services to professional third-party providers to achieve cost efficiencies and operational specialization. This outsourcing trend is further fueled by the contractor market's ability to leverage economies of scale in procurement, utilize specialized technological solutions for inventory and customer management, and adapt quickly to evolving regulatory environments, particularly concerning food safety and sustainability mandates. Conversely, market growth faces significant restraints due to the inherent complexity and volatility of food commodity prices, persistent labor shortages in many geographies requiring contractors to continually invest in retention and automation, and high setup costs associated with customizing service models for diverse client needs, which often necessitates substantial initial capital investment.

Opportunities for expansion are abundant, particularly in emerging markets where modernization of institutional food service infrastructure is rapid, and through the development of niche market segments, such as specialized catering for seniors, medically complex patients, or tech-centric corporate clients demanding ultra-sustainable and localized menus. Furthermore, the development of sophisticated hybrid models that combine on-site services with cloud kitchens and advanced delivery systems presents a major growth pathway, allowing contractors to serve clients beyond their physical campus boundaries and expand their revenue streams. The industry is constantly pressured by the need to innovate in health and wellness offerings, with a specific focus on plant-based menus and allergen management, positioning contractors who excel in these areas for competitive advantage.

Impact forces currently shaping the market include rapid technological adoption, primarily in mobile ordering, payment systems, and kitchen management software, which is raising operational efficiency benchmarks across the industry. The impact of regulatory shifts, such as stricter nutritional guidelines implemented in educational and healthcare sectors, forces contractors to continuously adapt menus and procurement strategies, serving as a catalyst for innovation in ingredient sourcing and preparation methods. Furthermore, changing consumer preferences, favoring transparency regarding ingredient origins, ethical sourcing, and environmental impact, heavily influence competitive positioning, making comprehensive sustainability reporting and localized sourcing strategies critical impact forces that determine long-term contract retention and market reputation among large institutional buyers.

Segmentation Analysis

The Catering and Food Services Contractor Market is comprehensively segmented across several dimensions to reflect the diversity of client needs and operational models. These segments include categorization by Type, such as Contract Catering (long-term, fixed-site management) and Event Catering (episodic, large-scale events); by Application, which separates the market into Business & Industry (B&I), Education, Healthcare, and Sports & Leisure; and by Service Type, differentiating between Food Service and Support Service (e.g., cleaning, facility management). This detailed segmentation is vital for market players to tailor their service offerings, pricing strategies, and logistical infrastructure to specific end-user demands, recognizing the specialized nature of feeding, for example, hospital patients versus university students or corporate executives, each requiring unique menus, compliance standards, and staffing levels.

- By Type:

- Contract Catering

- Event Catering

- By Application:

- Business & Industry (B&I)

- Education (K-12, Higher Education)

- Healthcare (Hospitals, Senior Living)

- Sports & Leisure (Stadiums, Theme Parks)

- Government & Defense

- By Service Type:

- Food Service

- Support Service (Cleaning, Facility Management)

Value Chain Analysis For Catering and Food Services Contractor Market

The value chain for the Catering and Food Services Contractor Market begins with the upstream activities centered on raw material procurement, encompassing the sourcing of fresh produce, meats, dairy, and processed goods. This initial stage is heavily focused on establishing strategic relationships with certified suppliers, often negotiating large-volume contracts to secure favorable pricing and guarantee consistent quality. Key upstream challenges include managing price volatility in global commodity markets, ensuring supplier adherence to ethical and sustainability standards (e.g., fair trade, animal welfare), and implementing advanced traceability systems to verify origin and maintain food safety protocols. The efficiency of upstream logistics, including cold chain management and centralized warehousing, significantly impacts the overall cost structure and quality of the final delivered food product across the contractor's entire client portfolio.

The midstream phase involves the core processing and operational services performed by the contractor. This includes menu development and testing, highly efficient food preparation, adherence to specialized dietary needs, and meticulous site-specific kitchen management. This stage is where value is added through standardization of recipes, implementation of Lean management principles to minimize waste, and integration of technology for kitchen automation and inventory control. The distribution channel, which spans both direct and indirect routes, is crucial. Direct distribution involves on-site production and service (e.g., managing a corporate cafeteria), while indirect channels may include centralized preparation in a commissary kitchen followed by logistical distribution to multiple service points, requiring specialized fleet management and temperature-controlled transport.

The downstream segment focuses on service delivery and consumption, encompassing aspects such as customer interaction, point-of-sale efficiency, dining room management, and comprehensive feedback collection. Success in the downstream is measured by customer satisfaction scores, efficiency of service throughput (critical during peak meal times), and the contractor's ability to maintain high aesthetic and hygiene standards. Direct channels enhance customer intimacy and allow for immediate feedback implementation, whereas indirect channels necessitate robust service level agreements (SLAs) regarding delivery timing and quality maintenance. Ultimately, the entire value chain is linked by digital platforms that ensure seamless data flow from procurement forecasting (upstream) to real-time sales reporting and feedback analysis (downstream), optimizing the continuous cycle of service improvement and cost control.

Catering and Food Services Contractor Market Potential Customers

The potential customer base for the Catering and Food Services Contractor Market is extensive and highly diversified, primarily comprising large organizations and institutions that seek specialized management for their dining operations rather than managing them internally. The largest and most lucrative customers are typically found within the Business & Industry (B&I) segment, including multinational corporations, major manufacturing plants, technology firms, and financial institutions that require consistent, high-quality meal services for thousands of employees daily. These corporate clients demand flexible service models, often encompassing executive dining, retail cafes, and specialized catering for internal meetings, prioritizing efficiency, diversity of offering, and the use of dining services as a key component of employee retention and wellness programs.

A second major category of customers includes public sector and non-profit institutions, notably in the Education and Healthcare sectors. Educational institutions, from large public universities managing extensive residential dining halls and retail outlets to K-12 school districts requiring large-scale, nutritionally compliant meal programs, represent stable, long-term contractual opportunities. Similarly, hospitals and elder care facilities are critical end-users, requiring highly specialized clinical diet management, strict food safety controls, and 24/7 service capability, often contracting with firms that possess specific expertise in patient nutrition and complex regulatory compliance, making specialization a key purchasing criterion.

Furthermore, niche markets such as Sports & Leisure, including stadiums, convention centers, and airports, and the increasingly significant Remote Site Services segment (e.g., offshore drilling rigs, construction camps, military bases) constitute highly valuable customers. These buyers require contractors capable of high-volume, event-driven service delivery with the flexibility to scale rapidly, or conversely, those who can maintain high standards in isolated, challenging logistical environments. The decision-making process for these customers is driven by a combination of price competitiveness, proven track record, demonstrated capacity for innovation, and the contractor's ability to manage complex labor and supply chain logistics under restrictive or high-pressure operating conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 315.5 Billion |

| Market Forecast in 2033 | USD 495.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sodexo, Compass Group PLC, Aramark Corporation, Elior Group, Gate Gourmet, Fazer Group, Catering International & Services (CIS), Delaware North Companies, Gategroup, ISS A/S, Thompson Hospitality, WSH (Wilson Vale, BaxterStorey), Servest Group, CH&CO, Eurest Services, ABM Industries, Mitsui & Co. (via affiliated catering services), Atalian Servest, Autogrill S.p.A., and Do & Co AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Catering and Food Services Contractor Market Key Technology Landscape

The technology landscape within the Catering and Food Services Contractor Market is rapidly evolving, moving far beyond traditional point-of-sale (POS) systems to embrace integrated digital ecosystems designed to enhance efficiency, safety, and customer engagement. Core technological adoption centers around sophisticated Enterprise Resource Planning (ERP) systems specifically tailored for food service operations, which centralize modules for procurement, inventory management, financial accounting, and workforce scheduling across multiple operational sites. These systems are crucial for maintaining real-time visibility into complex, distributed operations, ensuring standardized quality control, and maximizing cost-effectiveness by leveraging centralized data analytics to optimize ingredient purchasing and labor deployment in response to fluctuating demand patterns.

Furthermore, customer-facing technology is transforming service delivery and consumer experience. Mobile applications and dedicated digital platforms facilitate pre-ordering, contactless payment, and personalized meal selection, significantly reducing waiting times and enhancing throughput, particularly in high-volume settings like corporate campuses and university dining halls. The integration of Internet of Things (IoT) sensors is also becoming standard practice, especially for crucial aspects of food safety. IoT devices monitor and log temperatures in refrigerators, freezers, and ovens continuously, providing automated compliance checks and predictive maintenance alerts, thereby dramatically reducing the risk of foodborne illness and ensuring adherence to stringent regulatory standards like HACCP, which is non-negotiable for institutional contracts.

The future of the technology landscape is heavily influenced by advancements in automation and AI. Cloud-based kitchen management software utilizing Machine Learning (ML) algorithms is now being implemented for waste reduction by optimizing batch sizes based on historical consumption data and demand forecasting. Robotics and advanced automated preparation equipment are being piloted in high-labor cost environments to handle repetitive, high-precision tasks, such as vegetable preparation and complex recipe assembly, increasing both speed and consistency. This reliance on sophisticated software and automation tools is not just about cost savings; it is a critical differentiator that enables contractors to offer highly flexible, customizable, and reliable services that align with the increasingly complex operational requirements and sustainability goals of their institutional clientele.

Regional Highlights

Regional dynamics play a crucial role in shaping the Catering and Food Services Contractor Market, with distinct operational styles and growth drivers dominating different geographical areas. North America, characterized by its mature corporate and educational outsourcing culture, holds a substantial market share, driven by large, multi-site contracts in the Business & Industry (B&I) and Healthcare segments. Key market activity here focuses on innovation in healthy, quick-service options and intense competition among major global players for high-value national contracts, particularly in the U.S. and Canada, where technology integration for efficiency is paramount.

Europe represents another cornerstone of the global market, marked by strong regulatory frameworks concerning food quality, labor rights, and sustainability. Countries such as the UK, France, and Germany are highly penetrated by contractor services, particularly in the public sector (schools and hospitals). The trend in Europe is leaning toward hyper-localization of sourcing—demanding transparent supply chains and high ethical standards—which requires contractors to establish robust regional procurement networks that often prioritize smaller, local suppliers over large international distributors, driving differentiation based on sustainable practices.

The Asia Pacific (APAC) region stands out for its rapid, high-growth potential. Market expansion is driven by urbanization, massive infrastructure development, and the increasing westernization of dietary habits in key economies like China, India, and Australia. The focus in APAC is often on large-scale industrial catering, supporting manufacturing hubs and rapidly expanding educational institutions. Contractors entering this market must navigate complex local regulations, diverse culinary preferences, and varying levels of supply chain maturity, leading to a strong demand for scalable and culturally sensitive service models. The market in this region is less saturated than in the West, offering significant first-mover advantages.

- North America (U.S., Canada): Mature outsourcing market; dominance in B&I and Healthcare; focus on technology integration, personalized service, and health & wellness menus.

- Europe (UK, Germany, France): High penetration in public sector; strong emphasis on sustainability, ethical sourcing, and compliance with stringent labor and food quality regulations.

- Asia Pacific (China, India, Australia): Fastest growth region; driven by urbanization and infrastructure projects; high demand for scalable industrial and educational catering solutions.

- Latin America (Brazil, Mexico): Growing industrial and manufacturing presence driving B&I contracts; market characterized by cost sensitivity and increasing regulatory formalization.

- Middle East & Africa (MEA): High growth driven by tourism, mega-projects (e.g., GCC nations), and remote site catering (oil & gas, mining); demand for high-end hospitality services and expatriate dining solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Catering and Food Services Contractor Market.- Sodexo

- Compass Group PLC

- Aramark Corporation

- Elior Group

- Gate Gourmet

- Fazer Group

- Catering International & Services (CIS)

- Delaware North Companies

- Gategroup

- ISS A/S

- Thompson Hospitality

- WSH (Wilson Vale, BaxterStorey)

- Servest Group

- CH&CO

- Eurest Services

- ABM Industries

- Mitsui & Co. (via affiliated catering services)

- Atalian Servest

- Autogrill S.p.A.

- Do & Co AG

Frequently Asked Questions

Analyze common user questions about the Catering and Food Services Contractor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Catering and Food Services Contractor Market?

Market growth is predominantly driven by increasing outsourcing trends across institutional sectors (B&I, Education, Healthcare) seeking operational efficiencies, the demand for specialized nutritional management, and the contractors' ability to integrate advanced technology for improved service quality and cost control.

How is the adoption of AI and automation influencing contract catering operations?

AI primarily enhances back-of-house efficiency through precise demand forecasting, optimized inventory management to minimize waste, automated labor scheduling, and ensuring regulatory compliance via continuous monitoring, allowing human staff to focus on high-value customer service.

Which geographical region offers the highest growth potential for catering contractors?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, offers the highest growth potential due to rapid urbanization, significant government and corporate infrastructure investment, and lower current market saturation compared to North America and Europe.

What are the greatest restraints or challenges facing the food service contractor industry?

Key restraints include the volatile nature of global food commodity prices, persistent shortages of skilled labor across most major markets, and the necessity for continuous high capital expenditure to maintain compliance with evolving health, safety, and sustainability regulations.

What major sustainability and ESG trends are impacting contract catering decisions today?

Clients increasingly prioritize contractors demonstrating robust Environmental, Social, and Governance (ESG) performance, demanding transparent sourcing, reduction of food miles, comprehensive waste minimization strategies, and the integration of plant-based and locally sourced menu options.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager