Catheter Holder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443367 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Catheter Holder Market Size

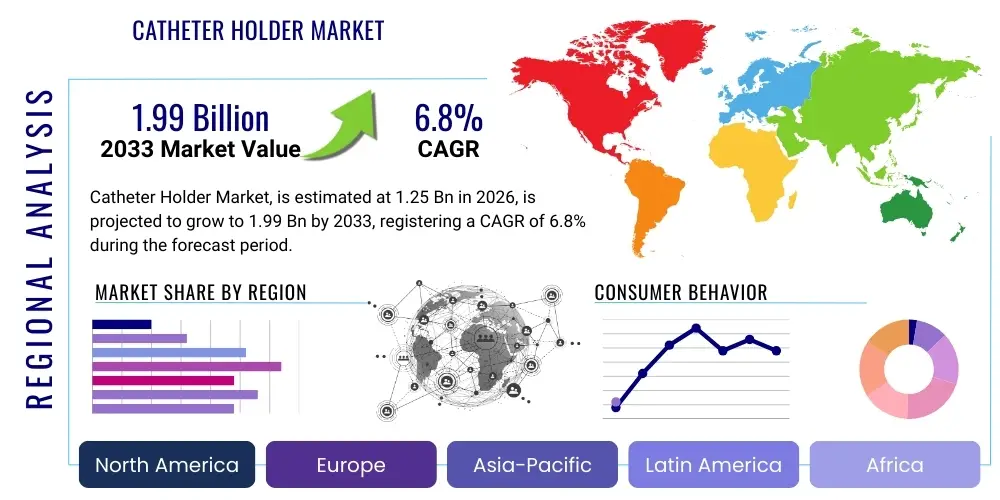

The Catheter Holder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.25 Billion USD in 2026 and is projected to reach $1.99 Billion USD by the end of the forecast period in 2033.

Catheter Holder Market introduction

The Catheter Holder Market is a critical subsegment of the global medical consumables industry, centered on devices explicitly engineered to provide reliable external stabilization and securement for various types of indwelling catheters. These devices are essential for preventing inadvertent catheter migration, kinking, or accidental dislodgement, which are common causes of serious complications, including catheter failure, local site infection, or severe vessel trauma. The product range encompasses a variety of designs, from adhesive patches utilizing advanced skin-friendly gels to non-adhesive strap mechanisms that secure the catheter to the patient’s limbs or torso. The fundamental goal of these holders is to replace outdated methods, such as adhesive tape, with clinical-grade solutions that improve patient comfort, minimize strain on insertion sites, and significantly reduce the workload associated with catheter maintenance for healthcare professionals. The escalating need for enhanced infection control measures in acute care settings globally serves as a foundational element driving the adoption and evolution of these securement solutions. The emphasis on evidence-based practice further solidifies the market, as clinical guidelines increasingly recommend specialized holders over traditional methods due to demonstrated reductions in mechanical phlebitis and infiltration rates, particularly in pediatric and geriatric populations, who are most vulnerable to complications from device failure. This rigorous clinical justification ensures sustainable demand irrespective of short-term economic fluctuations in healthcare spending.

The diverse applications of catheter holders span virtually every area of clinical medicine, reflecting the necessity of secure access in chronic and acute treatments. In urology, they are indispensable for securing Foley and suprapubic catheters, managing urinary drainage in post-operative patients, or those with long-term incontinence. Within critical care and oncology, holders are paramount for stabilizing vascular access devices—including Peripherally Inserted Central Catheters (PICCs), central lines, and peripheral IVs—which are vital for medication administration, chemotherapy, and fluid management. The benefits extend beyond mere mechanical stability; utilizing dedicated holders is proven to be a cornerstone of bundled care protocols designed to reduce the prevalence of Catheter-Associated Urinary Tract Infections (CAUTIs) and Catheter-Related Bloodstream Infections (CRBSIs), thereby translating directly into lower healthcare costs and improved patient safety metrics across the board. The enhanced securement provided by these devices also facilitates earlier patient ambulation, a key recovery metric, by ensuring that normal body movements do not compromise the integrity of the catheter line, thereby reducing overall hospital length of stay (LOS).

The ongoing expansion of the market is largely attributable to macro-demographic shifts, particularly the global increase in the population aged 65 and older, who disproportionately require chronic disease management involving long-term catheterization. Furthermore, technological progress in material science has paved the way for next-generation products, featuring superior adherence without causing skin trauma, moisture-wicking properties, and enhanced breathability, which are vital for maintaining skin integrity during extended use. The movement toward shorter hospital stays and the subsequent growth of sophisticated home healthcare services have amplified the demand for securement products that are intuitive for non-professional caregivers to apply and maintain, ensuring clinical standards are upheld even outside the hospital environment. This combination of demographic pressure, technological refinement, and regulatory scrutiny establishes a robust and accelerating growth trajectory for the Catheter Holder Market throughout the forecast period. The strategic adoption of single-use, disposable securement devices is also increasingly favored globally to address concerns related to cross-contamination and reprocessing costs, adding another layer of demand resilience to the consumables market segment.

Catheter Holder Market Executive Summary

The Catheter Holder Market is positioned for substantial expansion, underpinned by converging business, regional, and segment dynamics. Business strategies across major market players are heavily concentrated on innovation in skin-friendly securement technologies, recognizing that Medical Adhesive-Related Skin Injury (MARSI) is a key clinical challenge and market restraint. Companies are prioritizing the development of silicone-based and hydrocolloid adhesives, alongside the proliferation of non-adhesive mechanical securement systems, to capture market share through superior patient outcomes. Strategically, manufacturers are engaging in collaborative R&D efforts with catheter manufacturers to ensure seamless product compatibility and are utilizing global distribution networks, often via Group Purchasing Organizations (GPOs), to gain economies of scale. The drive towards patenting novel locking mechanisms and establishing defensible intellectual property remains a core competitive tactic, particularly as companies seek to differentiate their offerings based on clinical validation and efficacy in complex care scenarios, thus establishing brand loyalty among critical care nurses and infection prevention specialists.

Geographically, market growth showcases a distinct dual dynamic: stable, high-value demand in mature markets and aggressive volume growth in emerging regions. North America and Europe retain dominance in revenue generation due to high healthcare spending, mandatory compliance with stringent infection control guidelines (like those from the CDC and NICE), and high adoption rates of premium, technologically advanced products. These regions benefit from established reimbursement structures that recognize the value of complication-reducing devices. Conversely, the Asia Pacific region, specifically economies like China, India, and Southeast Asia, is projected to witness the highest Compound Annual Growth Rate (CAGR). This accelerated growth is primarily propelled by mass urbanization, rapid improvements in healthcare infrastructure, the expansion of medical insurance coverage, and the increasing affordability of and access to modern medical devices for a rapidly expanding middle class that is increasingly afflicted by chronic vascular and urinary conditions.

Analysis of market segmentation reveals distinct performance indicators. The urinary catheter securement application segment retains the largest market volume due to the high global prevalence of incontinence and post-surgical requirements. However, the vascular access securement segment, particularly for PICC lines and central venous catheters, demonstrates the highest value growth due to the critical nature of these devices and the clinical preference for premium, dedicated mechanical holders (such as proprietary stabilization devices) that minimize risk of catastrophic failure. In terms of end-users, the accelerating shift of care delivery from inpatient facilities to specialized Ambulatory Surgical Centers (ASCs) and, most notably, Home Care settings, fundamentally alters distribution requirements. The Home Care sector demands securement solutions designed for patient self-management, emphasizing simplicity, prolonged wear time, discretion, and robust durability, driving innovation in material and design tailored for non-clinical environments and presenting a strong investment opportunity for decentralized sales models.

AI Impact Analysis on Catheter Holder Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is anticipated to exert a profound yet indirect influence on the Catheter Holder Market, primarily through enhanced monitoring, predictive analytics, and optimization of clinical protocols rather than immediate changes to the physical product design. Common user questions often focus on the potential for AI to move securement from a passive mechanical process to an actively monitored component of care. Specifically, inquiries center on utilizing AI to analyze real-time patient data, such as motion sensors embedded in specialized dressings or sophisticated wound cameras, to detect subtle shifts in catheter tension or early signs of skin breakdown around the securement site. This capability could allow clinicians to intervene proactively, adjusting the holder or replacing it before complications like dislodgement or Medical Adhesive-Related Skin Injury (MARSI) occur, dramatically improving the inherent effectiveness and longevity of the mechanical securement device itself. The resulting data feedback loop informs best practices and validates the superior performance of advanced securement products.

The key themes emerging from user expectations relate to risk mitigation and operational efficiency in high-acuity environments. Users anticipate that ML algorithms, trained on vast datasets of successful and failed catheter securement events across different patient cohorts, will eventually inform the optimal choice and placement of various holder types based on individual patient parameters, including skin type, anticipated mobility levels, and anatomical factors unique to the securement location. Furthermore, integrating AI into hospital logistics systems is expected to streamline procurement by accurately predicting real-time demand for specific holder sizes and types based on patient census, planned surgical schedules, and historical complication rates, thereby minimizing inventory waste and preventing critical supply shortages. While the Catheter Holder remains a low-tech medical consumable in its essence, its application is becoming increasingly sophisticated and data-driven through the AI infrastructure deployed in the wider hospital environment, driving preference for products that generate reliable performance data.

The long-term influence of AI technology on this sector involves aiding manufacturers in optimizing the design process itself. AI-driven simulations can analyze material stress distribution, adhesive performance under varying environmental conditions (humidity, sweat), and ergonomic fit based on large-scale 3D anatomical models, leading to the creation of holders with demonstrably reduced failure rates and enhanced patient compliance. This application shifts the competitive focus from simple material improvement to design optimization informed by comprehensive computational modeling and validated clinical data. Therefore, while AI will not be physically integrated into every holder in the near term, it serves as a critical background technology enhancing the clinical value, design integrity, and performance predictability of the mechanical securement systems offered by manufacturers, ultimately increasing clinician confidence in adoption and driving market growth through verifiable superior performance statistics and improved compliance rates globally.

- AI-driven predictive maintenance modeling for catheter longevity, alerting clinicians to potential securement failure before dislodgement occurs, leveraging data from continuous patient monitoring systems.

- Optimization of catheter placement and securement location based on complex patient anatomy and predicted movement patterns analyzed by machine learning models, improving device customization and stability.

- Enhanced inventory and supply chain management through AI forecasting of localized demand fluctuations for specific holder types within large hospital networks, reducing logistics costs and improving stock availability compliance.

- AI integration into Electronic Health Records (EHRs) to analyze CAUTI and CRBSI risk factors specifically related to current catheter securement practices, providing real-time, evidence-based clinical guidance and automated auditing of procedural compliance.

- Development of AI-optimized materials selection, analyzing stress points, adhesive longevity, and material degradation rates under clinical use conditions to inform future securement device design iterations, ensuring maximal durability and skin compatibility.

- Automated image analysis systems utilizing AI to detect microscopic or early-stage signs of localized infection or skin inflammation surrounding the insertion and securement site, prompting immediate, targeted clinical corrective action.

DRO & Impact Forces Of Catheter Holder Market

The dynamic trajectory of the Catheter Holder Market is fundamentally shaped by powerful synergistic factors involving disease prevalence, regulatory pressures, and ongoing technological refinement. Key drivers include the overwhelming statistical increase in the global geriatric demographic, a population segment inherently requiring more frequent and long-term catheterization for conditions such as chronic kidney disease, cardiovascular failure, and severe diabetes. Simultaneously, the market is vigorously propelled by mandatory and increasingly stringent global healthcare standards aimed at reducing healthcare-associated infections (HAIs). Organizations such as the World Health Organization (WHO) and national regulatory bodies actively promote the use of dedicated, clinically proven securement devices over generic tape, positioning catheter holders as an essential component of infection prevention bundles, thereby ensuring steady and non-negotiable demand across all acute and chronic care settings.

However, the market faces significant restraints that dampen immediate expansion and necessitate strategic mitigation. The most pronounced challenge is the widespread issue of skin integrity compromise, particularly Medical Adhesive-Related Skin Injuries (MARSI), contact dermatitis, and allergic reactions resulting from prolonged use of adhesive securement devices, especially in fragile, immunocompromised, or elderly patients. This restraint drives clinical hesitancy toward certain products and pushes Research and Development (R&D) towards more expensive, advanced non-irritating materials. Furthermore, the lack of complete universal standardization in securement protocols globally, coupled with high price sensitivity in large-volume government tenders and in developing economies, restricts the universal adoption of premium, technologically advanced holders, compelling manufacturers to maintain complex product tiers to compete effectively across diverse economic and clinical landscapes, adding to supply chain complexity.

Significant opportunities for sustained long-term growth reside in the rapid commercialization of genuinely innovative solutions, such as securement devices impregnated with antimicrobial agents (e.g., silver or chlorhexidine), which offer a dual function of mechanical securement and local infection prophylaxis. The accelerating global trend towards decentralized care, specifically the expansion of high-acuity procedures being managed in home care or ambulatory settings, creates a robust demand for securement products optimized for patient self-management—being easy to apply, comfortable, and discreet. The combination of strong regulatory demand for infection control (a major driver) and the persistent clinical challenge of skin injury (a major restraint) creates an overriding impact force that compels market innovation towards safer, smarter, and evidence-based securement technologies. This mandates that compliance and verifiable patient safety outcomes remain the paramount competitive differentiators, shifting procurement decisions away from basic cost considerations toward total cost of care reduction via complication avoidance.

Segmentation Analysis

In-depth segmentation of the Catheter Holder Market provides a comprehensive view of consumption patterns, clinical preferences, and growth hot spots, allowing stakeholders to precisely align their offerings with specific medical requirements. The delineation by Product Type—adhesive versus non-adhesive/strap systems—is critical, as it addresses different patient demographics and duration of use; adhesive solutions dominate volume in short-to-medium-term applications due to their ease of sterilization and application, while non-adhesive systems are gaining momentum for chronic care where skin preservation is paramount. Furthermore, segmentation by Application, notably separating high-volume urinary securement from high-value vascular access securement, enables targeted investment strategies, particularly in R&D aimed at stabilizing increasingly complex central venous access devices which require the utmost security to prevent catastrophic failure, such as those used in critical pediatric care where patient movement is unpredictable.

The segmentation based on End-User clearly illustrates the evolving landscape of healthcare delivery. While hospitals, particularly tertiary care centers with complex surgical procedures, remain the largest revenue generator due to the critical nature of their patient population, the fastest growth is observed within the Home Care and Long-Term Care segments. This shift mandates manufacturers to focus on product design characteristics such as extended wear time (up to 7 days), reduced profile for patient discretion, and simplified application procedures suitable for non-professional caregivers or patients themselves. Material segmentation—involving specialized polymers, breathable fabrics, and advanced hydrocolloids—is intertwined with the demand for skin integrity management, with high-performance hydrocolloid products commanding a price premium due to their proven ability to mitigate skin damage associated with repeated removal and reapplication of securement devices in chronic settings.

Detailed analysis across these dimensions confirms that future market success will depend on flexibility and specialization. The market is moving away from generic securement solutions toward highly specialized, purpose-built devices—a dedicated mechanical holder for a PICC line must meet different clinical criteria, tensile strength requirements, and fluid ingress protection standards than a simple adhesive holder for a peripheral IV catheter. Geographical segmentation further refines market strategy, confirming North America and Europe as stable targets for premium, high-margin product launches and innovation, while the high-volume APAC region necessitates robust manufacturing scale and highly competitive pricing structures to capture the expanding middle-market volume there. Strategic segmentation analysis ensures that R&D resources are optimally allocated to develop products and distribution channels that align precisely with proven clinical need and regional economic capacity, driving profitability through targeted market penetration.

- By Product Type:

- Adhesive Catheter Holders (e.g., Hydrocolloid-based, Silicone-based, Acrylic-based Patches, specialized for long wear)

- Non-Adhesive Catheter Holders (e.g., Elastic Straps, Fabric Fasteners, Mechanical Locking Devices, advanced Tape-free Securement Systems)

- Integrated Device Securement (Holders pre-attached to specialized antimicrobial dressings or transparent films)

- By Application:

- Urinary Catheter Securement (Foley Catheters, Indwelling Catheters, External Condom Catheters for male and female anatomy)

- Vascular Catheter Securement (PICC Lines, Midlines, Central Venous Catheters, Arterial Lines, Specialized high-flow Peripheral IV Catheters)

- Drainage Catheter Securement (Nephrostomy Tubes, Biliary Drainage Tubes, Chest Tubes, J-P Drains, Vacuum-Assisted Closure drains)

- Enteral Feeding Tube Securement (Gastrostomy, Jejunostomy Tubes, Nasogastric Lines)

- By End-User:

- Hospitals and High-Acuity Clinics (ICUs, ORs, Emergency Departments, dedicated Catheter Labs)

- Ambulatory Surgical Centers (ASCs) and Outpatient Facilities (focused on short-term access)

- Home Care Settings and Patient Self-Management (emphasizing ease of use and discretion)

- Long-Term Care Facilities and Skilled Nursing Homes (focused on high skin integrity performance)

- By Material:

- Fabric/Woven Textile (High breathability straps, elasticized bands, cotton/polyester blends)

- Plastic/Polymer (Rigid mechanical locking bases, ABS, Polypropylene for durability)

- Foam and Hydrocolloid (High-adherence, low-irritation adhesive components)

- Silicone-based (Non-irritating, re-positionable adhesives, gentle on fragile skin)

- By Geography:

- North America (U.S., Canada, Mexico) - Premium Market Focus

- Europe (Germany, U.K., France, Italy, Spain, Nordic Region) - Regulatory Compliance Driven

- Asia Pacific (APAC) (China, India, Japan, South Korea, Australia) - Volume and Growth Market

- Latin America (LATAM) (Brazil, Argentina, Chile) - Price Sensitive Growth

- Middle East and Africa (MEA) (GCC Countries, South Africa) - High-Value Niche and Emerging Adoption

Value Chain Analysis For Catheter Holder Market

The upstream segment of the Catheter Holder value chain is characterized by a critical reliance on highly specialized material suppliers, primarily focusing on advanced medical-grade components. This involves securing consistent supplies of hypoallergenic, biocompatible synthetic polymers for rigid bases, high-performance, non-shedding textiles for strap systems, and crucially, proprietary chemical formulations for skin-friendly adhesives, such as sophisticated hydrocolloids and non-irritating silicones. The challenge in the upstream stage is twofold: first, maintaining strict quality control and ensuring all raw materials meet the rigorous standards set by regulatory bodies (e.g., FDA Class I/II, European MDR); second, managing the global procurement of these specialty chemicals, which can be prone to supply chain volatility. Strategic sourcing aims to mitigate these risks and cost fluctuations, demanding strong, often exclusive, long-term relationships between device manufacturers and specialized chemical firms to protect proprietary adhesive technologies that fundamentally differentiate premium products in the competitive marketplace.

The midstream phase encompasses the design, manufacturing, sterilization, and final assembly processes, representing the core area where intellectual property regarding mechanical design and process efficiency creates substantial competitive barriers. Modern catheter holder production utilizes highly advanced precision injection molding for complex mechanical components and specialized, controlled environment coating technologies for adhesive patches, often executed within ISO 13485 certified cleanroom environments. Manufacturers continuously invest in state-of-the-art automation equipment to ensure high-volume, defect-free output while maintaining absolute sterile packaging integrity. Crucial activities here include rigorous functional and quality testing, such as verification of locking mechanisms' tensile strength, adhesive shear testing under simulated patient movement, and packaging validation against moisture ingress, ensuring the product's safety and functionality under various storage and transport conditions before clinical use.

The downstream distribution channels are multifaceted and strategically segmented, reflecting the diversity of end-users and procurement methods. Direct sales teams are often employed by market leaders to manage strategic relationships with major institutional purchasers, such as large hospital networks and Group Purchasing Organizations (GPOs), enabling custom negotiation, volume discounting, and direct clinical product training. This model is highly efficient for high-volume sales of specialized or premium mechanical securement systems. Conversely, indirect distribution utilizes an extensive network of medical wholesalers, specialized logistics providers, and independent regional distributors, which is essential for achieving wide geographic reach, penetrating smaller clinics, Ambulatory Surgical Centers (ASCs), and the highly fragmented but rapidly growing Home Care market. Effective distribution strategy must manage the complexity of inventory (due to dozens of SKUs for various catheter types) while ensuring rapid, reliable delivery to maintain sterile stock levels in decentralized patient care settings globally, often involving temperature-controlled or specialized warehousing for medical consumables.

Catheter Holder Market Potential Customers

The primary and most concentrated customer base for catheter holders resides within the acute care segment, specifically large general hospitals, trauma centers, and specialized medical centers. These institutions drive the highest demand volumes for both urinary and high-acuity vascular securement devices across critical units such as Intensive Care Units (ICUs), surgical suites, post-anesthesia care units, and oncology departments, where reliable access is non-negotiable. Hospital procurement managers prioritize products that offer demonstrably superior clinical performance, evidenced by lower rates of catheter-related complications (CAUTIs, CRBSIs, and mechanical failures), which directly impacts institutional quality scores, accreditation status, and crucial governmental reimbursement rates. Purchasing decisions are heavily influenced by clinical evidence, consensus from nurse leadership, and successful adoption into hospital-wide standardization programs aimed at streamlining inventory and improving workflow efficiency across various departments, often leveraging GPO contracts for bulk discounts on standardized, clinically validated products.

A significant and increasingly influential customer segment includes Long-Term Care (LTC) facilities and Skilled Nursing Facilities (SNFs). This sector caters predominantly to an aging population with elevated prevalence of chronic conditions and decreased mobility, necessitating reliable, long-duration catheter securement. For this customer group, product features emphasizing skin preservation, such as non-irritating adhesives and adjustable, gentle straps with extended wear capabilities, are paramount, as residents often have fragile, compromised skin prone to breakdown and slow healing. The procurement focus here critically balances quality and durability with intense budget constraints, as LTC facilities manage care over extended periods and seek solutions that reduce the frequency of device maintenance, minimize supply consumption, and decrease associated staff time required for troubleshooting securement failures.

The fastest-expanding customer segment globally is the Home Care sector, comprising specialized home health agencies and increasingly important direct-to-consumer sales channels addressing patient self-management. This segment represents a fundamental shift in healthcare delivery, where patients manage vascular access (e.g., PICC lines for infusion therapy), urinary drainage, and enteral feeding tubes outside of clinical oversight. These customers require holders that are simple to understand, exceptionally easy for patients or unskilled family caregivers to apply and remove, and specifically designed for maximum comfort, prolonged wear, and discretion, allowing the patient to maintain a high quality of life and mobility. Manufacturers must strategically tailor their packaging, instructions, and marketing for non-clinical users and ensure products meet the specific regulatory requirements associated with at-home medical device usage to effectively penetrate this high-growth, consumer-driven market segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion USD |

| Market Forecast in 2033 | $1.99 Billion USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Becton, Dickinson and Company (BD), Cardinal Health, ConvaTec Group Plc, Smith & Nephew, TIDI Products, LLC, Medline Industries LP, C. R. Bard (now part of BD), Centurion Medical Products, Baxter International Inc., Hollister Incorporated, Dynarex Corporation, Merit Medical Systems, Inc., Dale Medical Products Inc., Vancive Medical Technologies, Securement Medical, Inc., StatLock Stabilization Devices, M. C. Johnson Co., Inc., Marlen Manufacturing & Development Co., Clinisupplies Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Catheter Holder Market Key Technology Landscape

The key technological advancements defining the modern Catheter Holder Market are overwhelmingly concentrated on biomaterials engineering and mechanical refinement aimed at simultaneously optimizing securement reliability and enhancing patient skin health. A leading trend involves sophisticated adhesive technology, moving away from harsh acrylics toward advanced hydrocolloid and silicone-based formulations. These next-generation adhesives provide superior moisture management, reducing maceration risk, and critically, feature reduced adherence to epidermal cells, thereby minimizing pain and the risk of Medical Adhesive-Related Skin Injuries (MARSI) during product removal, a significant concern for pediatric and geriatric care. Manufacturers are heavily investing in proprietary polymer matrices that ensure strong, sustained catheter fixation, even under conditions of high humidity, patient perspiration, or slight movement, maintaining integrity for up to seven days as required by stringent clinical protocols for infection control bundles.

Another major technological focus is the perfection of non-adhesive mechanical securement systems. These innovations, often realized as rigid or semi-rigid plastic housings or clips, rely on a robust physical lock with the catheter hub or luer connection, entirely bypassing the need for adhesives on sensitive skin. Devices like the StatLock system exemplify this technology, providing secure, reliable stabilization for critical vascular access devices, which is paramount for preventing the 'piston effect' and reducing insertion site trauma. Ongoing engineering refinement focuses on making these mechanical systems lower profile, easier for single-hand application by clinicians under pressure, and universally compatible with a broader range of catheter sizes and brands, driving standardization and reducing complexity in hospital inventories, which is a major efficiency driver.

Furthermore, an emerging and high-growth technological area involves the integration of materials with proactive clinical functions, specifically through antimicrobial technology embedding. This involves incorporating antimicrobial agents, such as ionic silver compounds or specific antiseptic coatings (like Chlorhexidine Gluconate - CHG), directly into the material components (straps, adhesives, or plastic bases) of the holder. The goal is to create a zone of inhibition around the catheter insertion site, actively mitigating the risk of microbial colonization and subsequent infection transmission, thus transforming the holder from a purely mechanical device into a proactive infection control tool. While current adoption is concentrated in high-risk areas like ICUs and oncology units, this technology represents a significant long-term shift towards enhancing the clinical utility, value proposition, and overall patient safety profile of advanced catheter securement devices globally, ultimately reducing the total economic burden of HAIs.

Regional Highlights

- North America: Dominates the global market in terms of revenue, primarily driven by the United States. High adoption is mandated by stringent quality reporting requirements, such as those imposed by CMS, and robust reimbursement policies that penalize hospitals for HAIs like CAUTI and CRBSI. The market benefits from substantial investment in R&D, a high concentration of leading global medical device manufacturers, and a willingness among healthcare providers to adopt premium, advanced mechanical and adhesive securement solutions that minimize complications and improve verifiable operational metrics.

- Europe: Characterized by a high demand for technologically sound and clinically proven securement products, influenced significantly by the comprehensive European Medical Device Regulation (MDR), which enforces rigorous standards for safety and performance. Western European countries, particularly Germany, the UK, and the Nordic nations, exhibit mature market characteristics with stable growth, prioritizing safety and quality over sheer cost savings, often favoring non-adhesive or advanced hydrocolloid solutions. Eastern Europe is a steady growth market, gradually increasing its adoption of standardized holders as healthcare infrastructure modernizes and integrates into broader EU quality standards.

- Asia Pacific (APAC): Positioned as the highest growth potential region (fastest CAGR). This exponential expansion is powered by dramatic improvements in healthcare access, significant government investments in public health infrastructure modernization, and the sheer volume of patients requiring treatment due to chronic diseases. Countries like China and India are undergoing a rapid transition from basic taping methods to internationally recognized advanced securement standards, offering vast untapped volume markets for manufacturers willing to offer cost-competitive, high-quality products tailored to the regional demographic needs and economic constraints.

- Latin America (LATAM): Exhibits moderate, yet steady, growth driven by the expansion of private sector healthcare, improvements in regulatory oversight, and rising medical tourism, particularly in economic hubs like Brazil, Mexico, and Chile. The market remains sensitive to economic volatility and local price competition, often leading to a preference for locally manufactured or value-tier products, though increasing clinical focus on adherence to international infection control guidelines is slowly driving demand for more advanced, certified international products in key metropolitan centers.

- Middle East and Africa (MEA): Growth is significantly bifurcated, with substantial infrastructural investment and high per capita usage of premium, high-end devices in wealthy Gulf Cooperation Council (GCC) nations (Saudi Arabia, UAE, Qatar), often benchmarking against stringent European or North American standards for acute care. The broader African sub-continent presents significant logistical and infrastructure challenges, limiting high-end securement adoption, focusing primarily on essential, cost-effective devices to meet basic clinical needs in major urban health centers, often relying on international aid and government procurement programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Catheter Holder Market.- 3M Company

- Becton, Dickinson and Company (BD)

- Cardinal Health

- ConvaTec Group Plc

- Smith & Nephew

- TIDI Products, LLC

- Medline Industries LP

- Hollister Incorporated

- Baxter International Inc.

- Centurion Medical Products

- Dynarex Corporation

- Merit Medical Systems, Inc.

- Dale Medical Products Inc.

- Vancive Medical Technologies

- Securement Medical, Inc.

- StatLock Stabilization Devices (part of BD)

- M. C. Johnson Co., Inc.

- Marlen Manufacturing & Development Co.

- Clinisupplies Ltd.

- Argon Medical Devices, Inc.

Frequently Asked Questions

Analyze common user questions about the Catheter Holder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Catheter Holder Market?

The primary drivers are the increasing global incidence of chronic diseases requiring long-term catheterization, the expansion of the elderly population necessitating continuous care, and stringent regulatory emphasis on reducing healthcare-associated infections (HAIs), particularly CAUTIs, by promoting reliable securement methods. This convergence of demographic and clinical pressures ensures sustained high demand.

How do adhesive and non-adhesive catheter holders differ in application?

Adhesive holders provide secure attachment directly to the skin using specialized patches, offering high security and stability for long periods. Non-adhesive holders (straps or mechanical clips) secure the catheter to a limb or clothing, minimizing skin irritation and being preferred for patients with fragile skin or when frequent site access or dressing changes are required to maintain skin integrity.

Which region holds the largest market share for catheter holders and why?

North America currently holds the largest revenue market share due to its established advanced healthcare infrastructure, high levels of clinical awareness regarding HAI prevention, substantial per capita healthcare spending, and proactive implementation of infection prevention protocols mandated by leading health organizations, favoring premium, clinically validated products.

What major challenges does the market face regarding product adoption?

Key challenges include ensuring product standardization across diverse clinical environments, managing skin integrity issues such as MARSI caused by prolonged adhesive use, and navigating the significant price sensitivity prevalent among procurement groups and in high-volume, cost-conscious emerging markets globally.

What recent technological innovations are impacting securement device design?

Recent innovations include the development of advanced hydrocolloid and silicone adhesives that minimize skin trauma, the incorporation of antimicrobial coatings into securement materials to reduce infection risk, and the increased adoption of robust, tape-free mechanical locking systems for superior stability, particularly for high-risk vascular access lines used in critical care settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager