Cationic Etherification Agents Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442846 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Cationic Etherification Agents Market Size

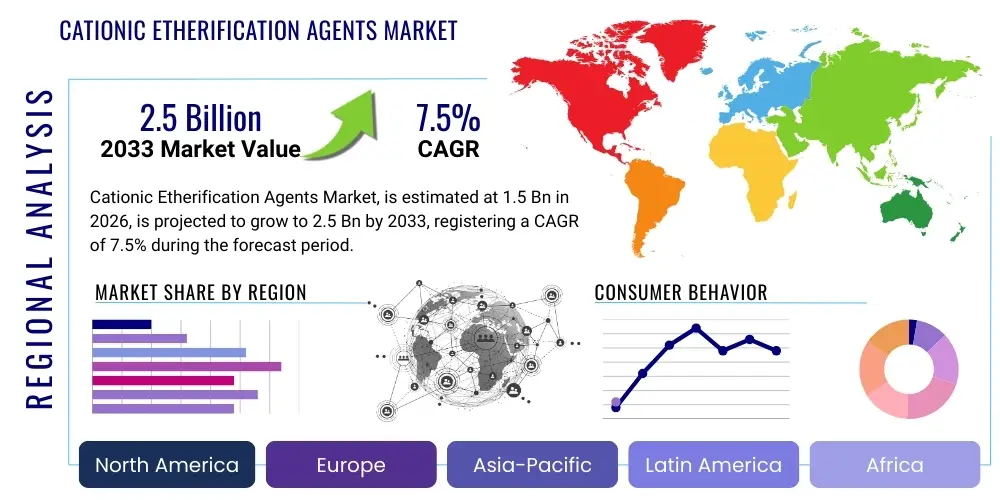

The Cationic Etherification Agents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.5 Billion by the end of the forecast period in 2033.

Cationic Etherification Agents Market introduction

Cationic Etherification Agents (CEAs) constitute a critical class of specialty chemicals primarily utilized for modifying polymers and substrates by introducing permanent cationic charges, significantly altering their physicochemical properties. The most prominent CEA is 3-Chloro-2-Hydroxypropyl Trimethyl Ammonium Chloride (CHPTAC), derived typically from epichlorohydrin and trimethylamine. These agents are essential intermediates in the production of functionalized polymers, predominantly employed in sectors requiring enhanced flocculation, increased viscosity, and improved affinity for negatively charged surfaces, such such as cellulose, starches, and natural gums. Their intrinsic chemical structure allows for facile reaction with hydroxyl groups present in these polysaccharides, leading to high-efficiency grafting and subsequent functional performance improvement.

The core application of CEAs lies in the modification of starch and cellulose derivatives, which are crucial raw materials in the paper, textile, and construction industries. In paper manufacturing, cationic starch, produced using CEAs, serves as a superior wet-end additive and surface sizing agent, improving fiber retention, drainage, and final product strength. Beyond traditional uses, the agents are increasingly vital in the booming personal care sector, where they are used to modify guar gum and other hydrocolloids to create superior conditioning agents and thickeners for shampoos and body washes. The stability and reactivity profile of CEAs make them indispensable for achieving specific performance characteristics across a wide industrial spectrum, justifying their high value in specialty chemical markets globally.

Major benefits derived from the use of Cationic Etherification Agents include enhanced wet and dry strength in paper products, improved emulsification stability in cosmetics, and superior friction reduction capabilities in oilfield applications, particularly in hydraulic fracturing fluids. Driving factors for market expansion include the sustained growth of the packaging and printing industries, particularly in Asia Pacific, the increasing global demand for high-performance drilling fluids in the energy sector, and stringent quality requirements in high-end personal care formulations. Furthermore, advancements in chemical synthesis leading to higher purity and more environmentally benign production methods are accelerating adoption across sensitive applications, ensuring continued market momentum through the forecast period.

Cationic Etherification Agents Market Executive Summary

The Cationic Etherification Agents market is characterized by robust growth, driven primarily by sustained demand from the paper and textile industries, coupled with escalating requirements in the oil & gas sector for specialized drilling chemicals. Business trends indicate a strong push towards developing bio-based and highly concentrated CEA formulations to minimize transportation costs and address sustainability concerns, particularly in European and North American markets. Major manufacturers are focusing on capacity expansion and backward integration to secure critical raw materials, such as epichlorohydrin, thereby mitigating supply chain volatility. Innovation in production processes, emphasizing reduced energy consumption and lower byproduct formation, remains a core competitive differentiator among leading global players, resulting in a more consolidated market structure favoring large-scale, integrated chemical producers.

Regionally, the Asia Pacific (APAC) market dominates both consumption and production volumes, largely attributable to the massive scale of manufacturing in China and India, particularly in the paper and packaging sectors. This regional dominance is further cemented by lower operational costs and increasing domestic demand for personal care and construction chemicals. Europe and North America, while mature markets, demonstrate growth primarily in high-value applications, such as advanced polymer modification and sustainable chemical initiatives. Segment trends confirm that 3-Chloro-2-Hydroxypropyl Trimethyl Ammonium Chloride (CHPTAC) remains the dominant product type due to its cost-effectiveness and broad application base, although Glycidyl Trimethylammonium Chloride (GTAC) is gaining traction in specialized, high-purity applications, especially within pharmaceutical and advanced cosmetic formulations where minimizing trace impurities is paramount. The modification of starch continues to be the largest application segment, fundamentally linked to global paper production rates and the ongoing shift toward fiber-based packaging solutions.

Overall market trajectory is highly positive, bolstered by macroeconomic stability and technological advancements that improve the efficiency of the cationization process. Key strategic imperatives for market players include expanding distribution networks in emerging economies, investing in digital technologies for demand forecasting, and establishing strong regulatory compliance frameworks. The increasing complexity of end-use applications requires CEAs with highly specific degrees of substitution and reactivity, pushing manufacturers towards custom synthesis and strong R&D collaboration with end-users. This trend toward bespoke chemical solutions ensures that specialized CEAs continue to command premium pricing, supporting healthy market revenue generation despite potential volatility in commodity raw material costs.

AI Impact Analysis on Cationic Etherification Agents Market

Common user inquiries regarding AI's impact on the Cationic Etherification Agents market frequently center on three critical areas: optimization of the complex chemical synthesis process, precision in predictive maintenance for large-scale production facilities, and acceleration of R&D for novel, bio-based cationic agents. Users are keenly interested in how machine learning algorithms can model reaction kinetics to optimize yield and purity, especially concerning temperature control and reagent dosing in highly exothermic reactions like the manufacturing of CHPTAC. Furthermore, there is significant focus on AI's ability to predict raw material price fluctuations and manage sophisticated global supply chains, mitigating risks associated with commodity volatility (e.g., epichlorohydrin and trimethylamine). The overarching theme is the expectation that AI integration will lead to higher efficiency, reduced operational expenditure, and a faster pathway to sustainable chemical alternatives.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the manufacturing landscape of Cationic Etherification Agents by enabling hyper-efficient process control. AI models utilize real-time sensor data from reaction vessels to dynamically adjust parameters such as pH, pressure, and catalyst concentration, minimizing byproduct formation and maximizing the yield of the desired cationic product. This level of precision is crucial in specialty chemical production where even marginal improvements in purity translate into substantial cost savings and enhanced performance in highly sensitive end-use applications like pharmaceuticals or high-grade cosmetic thickeners. This optimization capability directly addresses historical challenges related to batch consistency and energy utilization in CEA synthesis.

Beyond process optimization, AI is a powerful tool in predictive market analytics and enhanced logistics management for Cationic Etherification Agents. Given that CEAs are highly sensitive to market fluctuations in both upstream raw materials and downstream application demand (e.g., paper industry cycles), ML algorithms analyze vast datasets of commodity prices, geopolitical events, and end-user inventory levels to provide highly accurate demand forecasts. This predictive capability allows manufacturers to optimize production schedules, reduce warehousing costs, and implement just-in-time inventory management, crucial for a bulk specialty chemical that often involves complex, global transportation chains. The ability of AI to model complex, non-linear market relationships offers a significant competitive edge to early adopters.

- AI-driven optimization of reaction parameters (temperature, pressure, dosing) for maximizing CEA yield and purity.

- Predictive maintenance analytics to minimize downtime and extend the lifespan of large-scale chemical reactors and production lines.

- Machine Learning (ML) used for modeling complex molecular structures, accelerating the discovery of novel, sustainable, bio-based etherification agents.

- Enhanced supply chain risk management through AI forecasting of raw material price volatility (epichlorohydrin, trimethylamine) and demand fluctuations.

- Automated quality control (AQC) using computer vision and spectroscopic data analysis to ensure batch consistency and adherence to stringent industry standards.

- Simulation of complex industrial processes (e.g., starch modification) using digital twins, allowing end-users to optimize application efficiency and dosage requirements.

DRO & Impact Forces Of Cationic Etherification Agents Market

The Cationic Etherification Agents market is propelled by key Drivers such as the robust and sustained growth in the global paper and packaging industry, particularly the demand for higher strength and quality paper requiring enhanced cationic starch modification. Simultaneously, significant Restraints include the inherent toxicity and hazardous nature of key raw materials, like epichlorohydrin, leading to stringent environmental and worker safety regulations that increase operational complexity and cost. Opportunities are primarily centered around the shift towards green chemistry, focusing on the development and commercialization of bio-based etherification agents derived from renewable resources, offering alternatives that minimize regulatory scrutiny. These internal market dynamics are heavily influenced by external Impact Forces, particularly fluctuating prices of petrochemical raw materials and intensified global competition leading to pricing pressures and a continuous need for process innovation among established manufacturers.

A primary driver is the pervasive use of CEAs in hydraulic fracturing operations within the oil & gas industry. Cationic polymers, synthesized using these agents, serve as effective friction reducers and viscosity modifiers in fracturing fluids, which is critical for maximizing well output. As global energy demand remains high and unconventional drilling techniques proliferate, the consumption of CEAs in specialized oilfield chemicals is projected to grow substantially, especially in regions like North America and the Middle East. Furthermore, regulatory support and consumer preferences favoring biodegradable and sustainable packaging materials are indirectly boosting CEA demand, as they are instrumental in creating high-performance, recyclable paper products that meet evolving environmental mandates globally.

Conversely, the market faces significant restraints related to supply chain security and environmental impact. The dependency on highly regulated precursors means that manufacturers must invest heavily in advanced waste treatment and closed-loop systems, adding significant capital expenditure. The potential for price spikes or supply disruptions of key intermediates poses a constant operational risk. However, these challenges simultaneously create compelling opportunities. The pursuit of sustainable Cationic Etherification Agents, such as those utilizing glycerine derivatives instead of epichlorohydrin (partially addressing the environmental burden), represents a major avenue for technological differentiation and market penetration, especially for companies aiming to comply with strict European directives like REACH. The inherent trade-off between cost-effectiveness and environmental compliance remains the defining strategic tension in this specialty chemicals sector.

Segmentation Analysis

The Cationic Etherification Agents market is systematically segmented based on product type, application, and end-use industry, reflecting the chemical nuances and diverse functional requirements of global consumers. Understanding these segments is crucial as the choice of etherification agent (e.g., CHPTAC vs. GTAC) directly correlates with the required degree of substitution and the purity level demanded by the final application. Segmentation analysis highlights the varying growth trajectories, with high-purity applications, such as personal care and pharmaceuticals, demonstrating faster expansion due to rising consumer expectations for cosmetic performance and strict adherence to regulatory standards, compared to the bulk commodities sectors like paper manufacturing.

The product segmentation differentiates between halogen-containing agents, like CHPTAC, and epoxy-based agents, like GTAC. CHPTAC, due to its favorable cost profile and established manufacturing base, dominates the volume market, serving staple industries such as starch and cellulose modification for industrial uses. GTAC, although typically higher in cost, offers advantages in terms of reactivity and is often preferred when low residual salt content and high purity are required, making it ideal for specialized applications in high-end polymer synthesis and water treatment processes. The strategic decision by manufacturers to invest in either established CHPTAC capacity or specialized GTAC facilities reflects distinct strategies targeting commodity dominance versus niche high-margin segments.

Application and end-use segmentation reveal the depth of CEA penetration across major industries. The modification of starch stands out as the single largest application due to its indispensable role in paper sizing, where cationic starch significantly improves paper properties. Beyond paper, CEAs are critical in modifying natural gums (like guar gum) for the burgeoning oil & gas sector (drilling fluids) and for the cosmetics industry (conditioning agents). The end-use perspective shows that the Paper & Pulp industry drives overall volume, while the rapidly expanding Personal Care and emerging niche markets like Advanced Materials and Specialty Adhesives provide the primary drivers for value growth and innovation in novel CEA formulations.

- By Type:

- 3-Chloro-2-Hydroxypropyl Trimethyl Ammonium Chloride (CHPTAC)

- Glycidyl Trimethylammonium Chloride (GTAC)

- Others (e.g., novel green agents)

- By Application:

- Starch Modification

- Cellulose Modification (e.g., HEC, CMC)

- Guar Gum Modification

- Tannins and Lignin Modification

- Others (e.g., Synthetic Polymer Modification)

- By End-Use Industry:

- Paper & Pulp Industry

- Oil & Gas Industry (Drilling Fluids)

- Textile Industry

- Personal Care & Cosmetics

- Water Treatment

- Construction Chemicals

- Pharmaceuticals

- By Form:

- Aqueous Solution

- Solid/Crystalline Powder

Value Chain Analysis For Cationic Etherification Agents Market

The value chain for Cationic Etherification Agents is intricate, beginning with the highly integrated upstream analysis involving the sourcing and refinement of petrochemical intermediates. The primary raw materials, specifically epichlorohydrin (EPI) and trimethylamine (TMA), are derivative products of the petrochemical industry, linking the CEA market directly to crude oil and natural gas price volatility. EPI production often involves complex chlorination or glycerin-based processes, requiring specialized chemical synthesis plants. Successful CEA manufacturers must maintain robust relationships with key upstream suppliers or engage in backward integration, as the purity and consistent supply of these precursors critically impact the quality and cost-effectiveness of the final etherification agent. Any disruption or price increase in the petrochemical sector immediately ripples through the CEA manufacturing cost structure, affecting downstream pricing strategies.

The midstream stage involves the highly specialized manufacturing of the Cationic Etherification Agents themselves, utilizing complex chemical reactions, typically involving high pressure and temperature control. This stage requires significant capital investment in reaction and purification equipment, adhering to stringent safety and environmental regulations (e.g., handling corrosive chlorine-containing intermediates). Following synthesis, the products, often sold in concentrated aqueous solution form, move through dedicated distribution channels. Direct distribution is common for large-volume customers, such as major integrated paper manufacturers or specialized oilfield service companies, allowing for technical support and customized delivery schedules. Indirect distribution, leveraging chemical distributors and regional agents, serves smaller or geographically dispersed end-users, ensuring wider market access but potentially adding complexity to inventory management and technical service provision.

Downstream analysis focuses on the application and end-user adoption across diverse sectors. Key downstream processes involve the modification of polymers like starch and cellulose, where the performance of the CEA is evaluated based on the achieved degree of substitution and stability of the resulting cationic polymer. The demand pull from downstream markets is fundamentally driven by specific functional requirements: high wet-strength in paper, conditioning efficacy in cosmetics, or high salt tolerance in oilfield chemicals. This complexity necessitates close collaboration between CEA producers and end-users, especially in R&D, to tailor agents for optimal performance in increasingly specialized applications. The ultimate value delivery resides in the enhanced performance characteristics the CEA imparts to the final product, solidifying its role as a high-value-add specialty chemical intermediary.

Cationic Etherification Agents Market Potential Customers

The primary customers for Cationic Etherification Agents span a wide range of industrial sectors, predominantly revolving around entities that utilize large volumes of natural polysaccharides or require high-performance flocculation and binding capabilities. The largest and most consistent buyers are integrated Paper & Pulp manufacturing companies. These entities require CEAs in massive quantities to produce cationic starch, an essential wet-end additive critical for improving fiber retention, water drainage on the paper machine, and the final mechanical strength of the paper sheet. Given the scale of global paper production, paper mills represent the foundational demand base, often negotiating long-term supply contracts directly with major CEA manufacturers to ensure price stability and consistent chemical characteristics necessary for continuous operations.

A rapidly expanding segment of high-value customers includes specialty chemical formulators serving the Oil & Gas industry. These customers purchase CEAs to synthesize specialized cationic polymers used as friction reducers, diverting agents, and fluid loss additives in complex drilling and hydraulic fracturing operations. These applications demand high-purity, stable agents capable of performing under extreme conditions of temperature and pressure, leading to premium pricing and stringent quality specifications. Furthermore, major global and regional players in the Personal Care and Cosmetics industries are significant customers. They utilize CEAs to modify natural hydrocolloids, such as guar and cellulose derivatives, converting them into superior conditioning agents, thickeners, and emulsifiers for shampoos, creams, and lotions, driven by constant consumer demand for high-quality, stable personal hygiene products.

Other vital customer segments include textile finishing plants, where cationic agents enhance dye fixation and fabric handle, and water treatment municipalities and corporations, which use cationic flocculants for solids separation and clarification processes. Potential buyers range from multinational chemical conglomerates engaged in backward integration of raw material sourcing to small, specialized local formulators. Key buying criteria across all sectors remain price stability, guaranteed supply volume, technical support for application optimization, and increasingly, verifiable sustainability credentials, driving purchasing decisions toward suppliers capable of providing high-pquality, cost-effective, and environmentally compliant products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Chemical Company, SKC Co., Ltd., LOTTE Fine Chemical Co., Ltd., Chemigate Oy, Quzhou Baisheng Chemical Co., Ltd., Shandong Tianyi Chemical Co., Ltd., BCI, Sachem Inc., Samsung Fine Chemicals, ASHLAND GLOBAL HOLDINGS INC., Shanghai Fine Chemical Co., Ltd., Gujrat Alkalies and Chemicals Limited (GACL), Parchem fine & specialty chemicals, Yanzhou Tiancheng Chemical Co., Ltd., Zibo Wankai Chemical Co., Ltd., Solvay S.A., Kolb Distribution Ltd., Nouryon, BASF SE, Kemira Oyj. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cationic Etherification Agents Market Key Technology Landscape

The technological landscape surrounding the Cationic Etherification Agents market is dominated by advancements aimed at improving synthesis efficiency, enhancing product purity, and moving towards sustainable raw material sourcing. The traditional synthesis route for CHPTAC relies on the reaction between epichlorohydrin (EPI) and trimethylamine (TMA), which is a complex, multi-step process requiring meticulous control over reaction temperature and time to manage side reactions and maximize the degree of cationization. Current technological innovation is heavily focused on implementing continuous flow chemistry and micro-reactor technology, replacing conventional batch processes. These advanced manufacturing techniques allow for highly precise control over exothermic reactions, leading to significantly increased yield, improved product consistency, and a lower environmental footprint due to reduced energy consumption and hazardous waste generation compared to older plant designs. This shift is crucial for maintaining competitive pricing while adhering to tighter regulatory standards.

A parallel technological thrust involves the transition away from petrochemical-derived raw materials towards bio-based alternatives, often referred to as green chemistry initiatives. Specifically, the utilization of bio-glycerin, a byproduct of the biodiesel industry, as a feedstock for producing epichlorohydrin derivatives is gaining prominence. This technological shift, exemplified by the 'Epiclorohydrin from Glycerin' process, not only improves the overall sustainability profile of the resulting CEA but also potentially stabilizes the supply chain against crude oil price volatility. Furthermore, companies are investing heavily in catalyst research to identify novel, highly selective catalysts that can facilitate the cationization reaction under milder conditions, reducing the need for high-pressure systems and minimizing the formation of unwanted byproducts, ultimately yielding higher purity agents suitable for high-end cosmetic and pharmaceutical uses.

Finally, post-synthesis purification and formulation technologies are becoming increasingly sophisticated. The market demands highly concentrated solutions or even solid forms of CEAs to minimize shipping weight and reduce the inert water content, offering logistical advantages and greater handling ease for end-users. Technologies such as high-efficiency crystallization and advanced membrane filtration are employed to remove residual salts and unreacted intermediates, ensuring the final product meets the stringent quality requirements for applications such as specialized water treatment and personal care where impurity levels are critical. The integration of Process Analytical Technology (PAT) systems throughout the manufacturing cycle is also a key technological enabler, providing real-time quality assurance and immediate feedback loops for optimization, further solidifying the industry's move toward smart, autonomous chemical production facilities.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest market for Cationic Etherification Agents, driven by the colossal industrial base in China and India. The region dominates both production capacity, capitalizing on lower manufacturing costs and readily available raw materials, and consumption, fueled by explosive growth in the paper, packaging, and construction sectors. High levels of investment in infrastructure and the rapid expansion of the middle class driving personal care consumption further cement APAC’s leading role, necessitating massive imports of raw materials and fostering intense regional competition among local manufacturers focused on volume.

- North America: North America represents a mature, high-value market characterized by robust demand from the Oil & Gas sector, which utilizes CEAs extensively for hydraulic fracturing fluids and specialized drilling chemicals. The region also maintains significant consumption in the high-quality paper and pulp industry. Growth here is less volume-driven and more focused on specialized, high-performance CEA formulations and agents that comply with stringent environmental standards, particularly those promoted by regional agencies such as the EPA.

- Europe: The European market is defined by rigorous regulatory scrutiny, most notably the REACH framework, which heavily influences the types of CEAs that can be manufactured and imported. This constraint has spurred innovation, positioning Europe as a leader in the development and adoption of sustainable, bio-based cationic agents, moving away from epichlorohydrin reliance. Demand is steady in specialized paper grades and high-end cosmetic applications, valuing high purity and certified sustainable sourcing above bulk volume.

- Latin America (LATAM): LATAM is an emerging market showing promising growth, primarily linked to the expansion of regional paper and cellulose derivative producers, particularly in Brazil and Chile. Market growth is also supported by increasing localized personal care production. The market currently relies heavily on imports from APAC and North America but is seeing initial domestic capacity investments, driven by efforts to secure localized supply chains and reduce logistical costs.

- Middle East and Africa (MEA): The MEA region's demand is substantially influenced by its vast Oil & Gas operations, where CEAs are vital components of drilling and completion fluids. Additionally, construction chemical demand, supported by mega-infrastructure projects, drives consumption. While domestic production is minimal, high-volume imports are essential, making the region a critical consumer for global CEA suppliers specializing in energy-sector chemical solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cationic Etherification Agents Market.- Dow Chemical Company

- SKC Co., Ltd.

- LOTTE Fine Chemical Co., Ltd.

- Chemigate Oy

- Quzhou Baisheng Chemical Co., Ltd.

- Shandong Tianyi Chemical Co., Ltd.

- BCI

- Sachem Inc.

- Samsung Fine Chemicals

- ASHLAND GLOBAL HOLDINGS INC.

- Shanghai Fine Chemical Co., Ltd.

- Gujrat Alkalies and Chemicals Limited (GACL)

- Parchem fine & specialty chemicals

- Yanzhou Tiancheng Chemical Co., Ltd.

- Zibo Wankai Chemical Co., Ltd.

- Solvay S.A.

- Kolb Distribution Ltd.

- Nouryon

- BASF SE

- Kemira Oyj

Frequently Asked Questions

Analyze common user questions about the Cationic Etherification Agents market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Cationic Etherification Agents (CEAs) in industrial applications?

CEAs are specialty chemicals used to introduce a positive (cationic) charge onto substrates, primarily natural polymers like starch and cellulose. This modification enhances functional properties such as water solubility, binding affinity for anionic surfaces (flocculation), and viscosity, making them essential for high-performance paper, textile, and oilfield chemicals.

Which product type, CHPTAC or GTAC, dominates the Cationic Etherification Agents market?

3-Chloro-2-Hydroxypropyl Trimethyl Ammonium Chloride (CHPTAC) currently dominates the market by volume. It is favored for its cost-effectiveness and broad utility in bulk applications, such as starch modification for the paper industry. Glycidyl Trimethylammonium Chloride (GTAC), though more expensive, is gaining traction in high-purity, specialized segments like cosmetics due to its higher reactivity and lower salt content.

How is the Cationic Etherification Agents market addressing sustainability and environmental concerns?

The market is shifting towards green chemistry by developing bio-based CEAs, often utilizing glycerin derived from renewable sources instead of petrochemicals like epichlorohydrin. Manufacturers are also investing in cleaner production technologies, such as continuous flow chemistry, to minimize waste generation and energy consumption, aiming for compliance with regulations like REACH.

What role does the Asia Pacific region play in the global Cationic Etherification Agents market?

The Asia Pacific region, led by China and India, is the largest global consumer and producer of CEAs. Its dominance is driven by high-volume requirements from the booming paper, packaging, and textile manufacturing industries, coupled with competitive production costs and significant regional demand growth in the personal care sector.

In which end-use industry are Cationic Etherification Agents experiencing the fastest growth?

While the Paper & Pulp industry drives the highest overall volume, the Personal Care & Cosmetics industry and the specialized Oil & Gas sector are experiencing the fastest growth in terms of value. This growth is fueled by demand for high-performance conditioning agents (cosmetics) and specialized friction reducers (oilfield chemicals).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager