Ceiling Air Diffuser Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441175 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Ceiling Air Diffuser Market Size

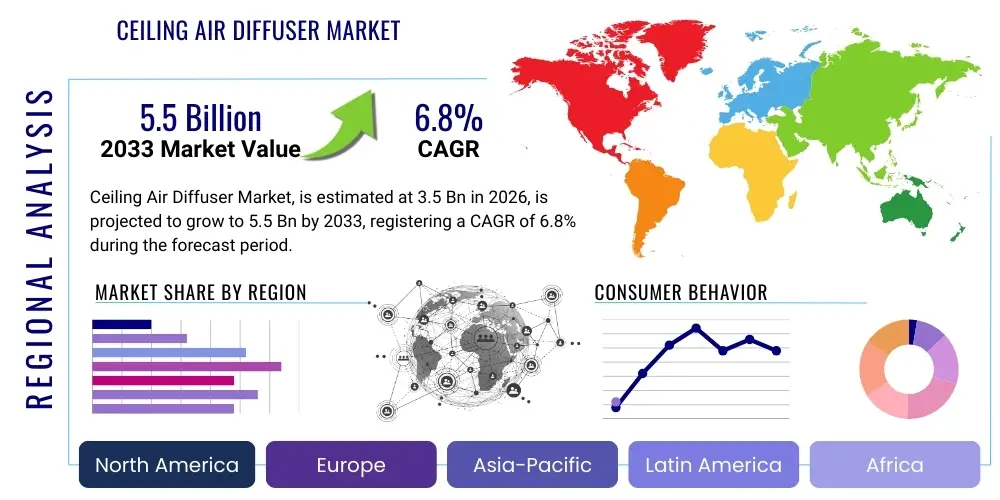

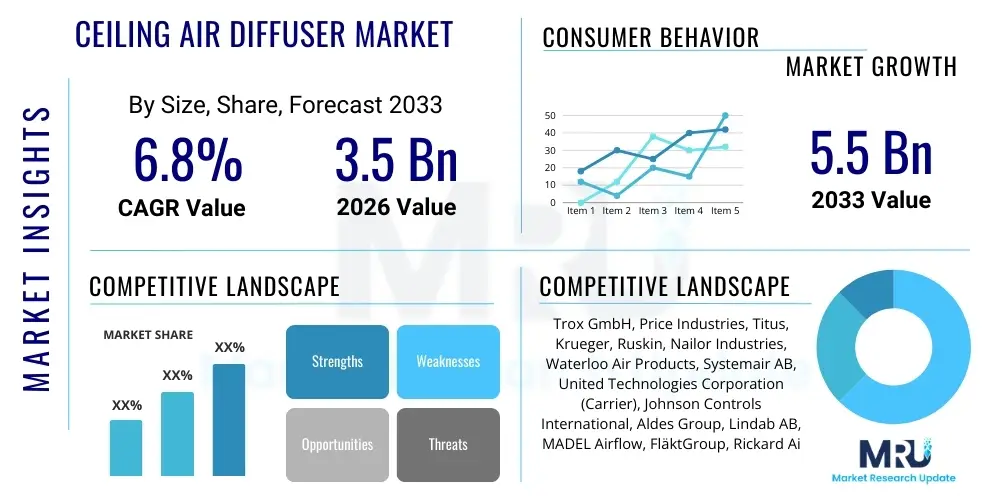

The Ceiling Air Diffuser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.5 Billion by the end of the forecast period in 2033.

Ceiling Air Diffuser Market introduction

The Ceiling Air Diffuser Market encompasses the manufacturing, distribution, and utilization of components essential for regulating and distributing conditioned air within enclosed spaces. Ceiling air diffusers are terminal units of Heating, Ventilation, and Air Conditioning (HVAC) systems designed to mix supply air with room air, ensuring optimal thermal comfort, acceptable indoor air quality (IAQ), and efficient climate control. These devices are pivotal in preventing drafts and stagnant air pockets, which are critical considerations for maintaining productivity and health in commercial and institutional environments. The performance characteristics, such as throw, aspiration, and noise level, dictate the suitability of a specific diffuser type for diverse architectural and application requirements. Modern diffusers often feature aesthetic integration and adjustable airflow patterns, enhancing their functionality in contemporary building designs. The growing global emphasis on energy efficiency in the building sector is driving innovation toward high-performance diffusers that minimize pressure drop and optimize air distribution uniformity.

Product descriptions within this market segment vary widely, including square, round, linear slot, and perforated panel diffusers, each catering to distinct aesthetic preferences and functional needs. Major applications span across commercial real estate, including office buildings, retail centers, hospitals, educational institutions, and residential complexes. The inherent benefits of utilizing high-quality ceiling air diffusers include improved occupant satisfaction through superior thermal regulation, reduced energy consumption by optimizing the HVAC system's operational efficiency, and adherence to stringent building codes concerning ventilation and air exchange rates. Furthermore, the integration of smart diffusers equipped with sensors and actuated dampers is becoming a key trend, allowing for dynamic adjustments to airflow based on occupancy and real-time environmental data, further cementing their role as critical components in advanced building management systems (BMS).

Key driving factors accelerating the market growth include rapid global urbanization, leading to extensive construction activity in both developing and developed economies, particularly the construction of high-density commercial and mixed-use buildings requiring sophisticated HVAC solutions. Government regulations mandating high energy efficiency standards (such as LEED and BREEAM certifications) necessitate the installation of optimized air distribution components. Additionally, heightened public awareness regarding indoor air quality, exacerbated by global health concerns, is pushing facility managers and developers to invest in superior ventilation equipment. The transition towards sustainable building practices, coupled with technological advancements like computational fluid dynamics (CFD) modeling for enhanced diffuser design, continues to underpin the positive trajectory of the Ceiling Air Diffuser Market.

Ceiling Air Diffuser Market Executive Summary

The global Ceiling Air Diffuser Market is currently undergoing a significant transformation driven by sustainability mandates and the proliferation of smart building technologies. Business trends indicate a strong move away from standardized, basic diffusers towards highly engineered products that offer adjustable patterns, reduced noise levels, and seamless integration with complex Building Management Systems (BMS). Manufacturers are focusing on lightweight, durable materials like aluminum and advanced plastics to improve installation efficiency and longevity. Mergers and acquisitions are common as large HVAC component providers seek to vertically integrate or acquire specialized expertise in smart ventilation technology. The competitive landscape is characterized by innovation in aesthetics and performance, aiming to meet the demands of architects and engineers for components that blend functionality with modern architectural design principles, particularly in luxury and high-performance commercial sectors. The trend towards modular and easily maintainable diffuser systems also reflects increasing operational cost considerations for end-users.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure investments in China, India, and Southeast Asian nations, alongside increasing adoption of international building standards. North America and Europe, characterized by stringent energy efficiency codes and a high penetration rate of retrofitting projects, represent mature markets where the demand centers around replacement, upgrade to smart systems, and compliance with strict IAQ regulations. The Middle East and Africa (MEA) region is exhibiting robust growth, propelled by large-scale commercial and hospitality construction projects, particularly in the UAE and Saudi Arabia, where climate control efficiency is paramount due to extreme ambient temperatures. Latin America shows steady growth, driven by commercial expansion and urbanization, though constrained by volatile economic conditions in certain countries. The market’s dynamism across regions is heavily influenced by local energy costs and government incentives for green building adoption.

Segmentation trends reveal a strong preference for linear slot diffusers in premium commercial spaces due to their aesthetic appeal and superior air distribution control over long distances, despite their higher initial cost. Square and rectangular ceiling diffusers remain dominant in general office and standard commercial applications due to their cost-effectiveness and versatility. By material, aluminum diffusers hold the largest share owing to their corrosion resistance, light weight, and suitability for various finishes. The commercial sector, including large office complexes, airports, and data centers, constitutes the primary end-user segment, demanding high-capacity, low-noise performance. However, the residential segment is also growing rapidly, driven by the increased construction of multi-family high-rise buildings and the adoption of centralized HVAC systems, requiring smaller, aesthetically pleasing diffuser solutions optimized for residential comfort.

AI Impact Analysis on Ceiling Air Diffuser Market

User inquiries regarding AI's influence on the Ceiling Air Diffuser Market typically revolve around predictive maintenance, optimizing system design, and the integration of autonomous airflow control within smart buildings. Common questions include how AI algorithms can predict diffuser failure or maintenance needs, whether AI can design optimal air throw patterns based on building parameters and occupancy data, and how intelligent control systems can use machine learning to dynamically adjust air velocity and temperature across zones, moving beyond simple static controls. Users are keenly interested in the potential for AI-driven HVAC systems to achieve significant energy savings and enhance personalized thermal comfort, thereby increasing the value proposition of advanced diffuser installations. The primary concern is the complexity and initial cost associated with implementing the required sensor networks and control software necessary for effective AI utilization in air distribution.

- AI enables predictive maintenance scheduling for HVAC systems, reducing unexpected downtime associated with dirty or malfunctioning diffusers.

- Generative design and computational fluid dynamics (CFD) enhanced by machine learning optimize diffuser shape and placement for maximum air quality and thermal homogeneity.

- AI-powered Building Management Systems (BMS) dynamically adjust diffuser damper settings in real-time based on occupancy sensing, external weather data, and energy demand forecasts.

- Enhanced quality control during the manufacturing phase through AI-driven visual inspection systems ensures high precision in aerodynamic component fabrication.

- Personalized environment control facilitated by AI learning individual occupant preferences, routing conditioned air more effectively through smart diffusers.

- Streamlined supply chain and inventory management for diffuser components using AI forecasting based on construction project timelines and material availability.

DRO & Impact Forces Of Ceiling Air Diffuser Market

The Ceiling Air Diffuser Market is shaped by powerful forces rooted in global construction trends, regulatory environment, and technological advancements in HVAC efficiency. Drivers largely center on stringent energy consumption mandates, the exponential growth of commercial infrastructure globally (especially in Asia), and increasing consumer demand for superior Indoor Air Quality (IAQ) and personalized thermal environments. The transition towards green building certifications (e.g., LEED, BREEAM) necessitates the use of high-efficiency air distribution components that minimize pressure loss and maximize air mixing, directly driving the demand for sophisticated ceiling diffusers. Furthermore, the imperative for noise reduction in modern workspaces and healthcare facilities is pushing innovation in acoustically optimized diffuser designs. These macro trends create a sustained positive demand environment for advanced air distribution technology.

Conversely, significant Restraints impede the market's trajectory, including volatility in raw material costs, particularly aluminum and steel, which directly impacts manufacturing profitability and final product pricing. The complexity and high initial installation costs of advanced, smart diffusers integrated with sensors and network controls present a barrier to entry, particularly in renovation projects or budget-constrained emerging markets. Moreover, the lack of standardization in smart HVAC communication protocols across different manufacturers can hinder seamless integration, causing reluctance among some facility managers. Economic slowdowns and geopolitical instability can momentarily halt major construction projects, creating short-term variability in market demand, although the long-term outlook remains strong due to fundamental urbanization trends.

Key Opportunities reside in the rapid expansion of the retrofitting market, where aging commercial buildings are updated to meet modern energy efficiency and IAQ standards, creating sustained replacement demand for high-performance diffusers. The development of next-generation materials, such as specialized polymers, offers potential for lighter, quieter, and more corrosion-resistant products. Furthermore, strategic partnerships between diffuser manufacturers and smart building technology providers open avenues for the proliferation of truly intelligent ventilation systems that offer granular control over airflow based on real-time data. These integrated solutions represent a significant potential for market differentiation and value creation. The Impact Forces—including technological innovation (AEO/GEO driven optimization), regulatory pressures, and architectural design trends—collectively push the market toward higher performance, greater aesthetic variability, and deeper system integration, making diffusers essential components rather than just passive vents.

Segmentation Analysis

The Ceiling Air Diffuser Market is segmented based on critical factors including the Product Type, Material utilized for manufacturing, and the End-Use Application sector. This segmentation allows for precise market analysis, identifying specific high-growth niches and understanding consumer preferences across diverse building environments. The dominance of a particular segment, such as the Square/Rectangular type or the Commercial End-Use, often reflects established architectural practices and infrastructure development patterns. However, emerging segments like linear slot diffusers and residential applications are demonstrating accelerated growth, propelled by modern design aesthetics and the centralization of residential HVAC systems. Analyzing these segments is crucial for strategic planning, enabling manufacturers to tailor product development, pricing strategies, and distribution channels to maximize penetration in targeted markets, ranging from large-scale industrial facilities to high-end residential towers.

- By Product Type:

- Square/Rectangular Diffusers

- Round Diffusers

- Linear Slot Diffusers

- Perforated Diffusers

- Swirl Diffusers

- By Material:

- Aluminum

- Steel

- Plastic/Polymer Composites

- Others (e.g., Stainless Steel, Wood)

- By End-Use Application:

- Commercial (Offices, Retail, Hospitality)

- Industrial (Factories, Warehouses, Data Centers)

- Residential (Single-family, Multi-family dwellings)

- Institutional (Hospitals, Schools, Government Buildings)

- By Operating Mechanism:

- Fixed Core

- Adjustable Core

- High-Induction

- By Sales Channel:

- Direct Sales (OEMs)

- Indirect Sales (Distributors, Wholesalers)

Value Chain Analysis For Ceiling Air Diffuser Market

The value chain for the Ceiling Air Diffuser Market begins with the Upstream Analysis, which involves the sourcing and processing of core raw materials such as aluminum billets, galvanized steel sheets, and specialized engineering plastics. Suppliers of these materials exert influence through pricing, quality consistency, and supply chain reliability. Efficient manufacturing processes, including stamping, extrusion, coating, and assembly, are critical mid-chain activities, where operational excellence determines product quality and cost competitiveness. Diffuser manufacturers must maintain strong relationships with metal processors and specialized component suppliers (e.g., damper actuators, sensors for smart models) to ensure a steady, high-quality input flow, especially given the strict aesthetic and performance standards required in construction projects. Optimization at this stage is essential for mitigating risks associated with material price fluctuations and ensuring compliance with sustainability metrics.

The Downstream Analysis focuses on the distribution and end-use installation phases. The primary distribution channels are robust and multifaceted, encompassing both Direct and Indirect sales models. Direct sales often involve relationships with large-scale Original Equipment Manufacturers (OEMs) of HVAC units or major national mechanical contractors managing extensive commercial projects. This channel demands customized solutions and stringent quality assurance. The indirect channel relies heavily on a network of specialized HVAC distributors, wholesalers, and mechanical supply houses, which provide inventory, logistics, and localized technical support to smaller contractors and maintenance firms. The effectiveness of the indirect network is critical for market penetration and servicing the aftermarket replacement demand, particularly in fragmented markets.

Installation typically falls under the purview of mechanical, electrical, and plumbing (MEP) contractors. The final links in the value chain involve facility management services responsible for system maintenance and eventual replacement. The increasing complexity of smart diffusers necessitates specialized training for installers and maintenance personnel, representing a shift in the skills required downstream. Value addition throughout the chain is achieved through efficiency gains, advanced aerodynamic design, aesthetic customization, and the provision of integrated digital control features, thereby transforming a simple component into a sophisticated part of the overall Building Management System ecosystem.

Ceiling Air Diffuser Market Potential Customers

Potential customers for ceiling air diffusers represent a wide array of entities involved in the construction, retrofitting, and maintenance of built environments where climate control is mandatory for human occupation or process stability. The primary end-users or Buyers of the product are typically the mechanical contractors (MEP firms) responsible for the installation of the HVAC system as part of a larger construction project specification set by architects and consulting engineers. These contractors purchase in bulk based on project specifications, focusing on product reliability, cost-effectiveness, and ease of installation. A second significant customer base includes building owners and facility managers who drive replacement and upgrade cycles, often prioritizing energy efficiency, indoor air quality improvements, and compatibility with existing smart building infrastructure. Institutional buyers, such as government agencies, hospital administrators, and university systems, form another crucial segment, prioritizing long-term durability, low maintenance, and adherence to specialized environmental control standards, such as those required for cleanrooms or operating theaters.

The residential market, specifically large-scale multi-family developers, represents a rapidly expanding customer segment, driven by the shift towards centralized HVAC systems in high-density urban areas. For this segment, aesthetics and low noise operation are often prioritized alongside performance. Data center operators and industrial facility managers constitute highly specialized customers, demanding diffusers capable of managing high heat loads and maintaining very specific temperature and humidity profiles, often favoring high-induction or specialized industrial-grade materials. Lastly, Original Equipment Manufacturers (OEMs) who assemble pre-packaged HVAC units (like rooftops or AHUs) are significant volume customers, integrating diffusers as a standard component of their complete systems. Understanding the distinct purchasing criteria and life-cycle requirements of each customer segment is paramount for successful market engagement and product strategy development across the value chain, ensuring that product offerings meet the diverse technical and commercial requirements of the ultimate consumer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trox GmbH, Price Industries, Titus, Krueger, Ruskin, Nailor Industries, Waterloo Air Products, Systemair AB, United Technologies Corporation (Carrier), Johnson Controls International, Aldes Group, Lindab AB, MADEL Airflow, FläktGroup, Rickard Air Diffusion, Enviro-Tec, Hart & Cooley, Daikin Industries, Barcol-Air, Camfil. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceiling Air Diffuser Market Key Technology Landscape

The technology landscape of the Ceiling Air Diffuser Market is characterized by a drive towards enhanced performance through advanced aerodynamics and sophisticated integration with digital control systems. A primary technological focus is the optimization of air patterns using Computational Fluid Dynamics (CFD) software, which allows manufacturers to simulate various airflow conditions, minimizing noise generation while maximizing air throw and induction rates. This engineering approach leads to the development of high-induction diffusers, such as swirl diffusers, which rapidly mix supply air with room air to eliminate temperature stratification and improve overall thermal comfort with minimal energy expenditure. Materials science innovations also play a crucial role, with the increased use of anti-microbial coatings and high-grade, fire-retardant polymer composites to meet hygienic standards, particularly in healthcare and food processing facilities, ensuring both safety and longevity.

The most transformative technology in this sector is the integration of smart sensors and actuators, creating "intelligent diffusers." These components incorporate motorized dampers, temperature sensors, and sometimes volatile organic compound (VOC) sensors, allowing for variable air volume (VAV) control at the terminal unit level. This digital integration facilitates highly granular zone control, enabling the diffusers to communicate directly with Building Management Systems (BMS) via protocols like BACnet or Modbus. This allows HVAC systems to respond dynamically to real-time changes in occupancy and load, moving beyond traditional constant volume systems. The adoption of wireless communication capabilities further simplifies installation and retrofitting processes, contributing significantly to the operational efficiency and flexibility of modern climate control infrastructure.

Furthermore, manufacturing technology itself is advancing, with precision tooling and automated assembly lines ensuring consistency and tight tolerances, which are essential for maintaining the quiet operation of high-performance linear slot diffusers. Design technology is also evolving to meet architectural demands for aesthetic subtlety; flush-mounted, invisible, or customizable linear diffusers that blend seamlessly into specialized ceiling structures (like plasterboard or metal ceilings) are becoming standard in high-end projects. The convergence of superior aerodynamic design, advanced materials, and digital control integration defines the competitive edge in the current Ceiling Air Diffuser Market, emphasizing total system performance and reduced lifecycle cost for the end-user.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the market growth trajectory, fueled by unprecedented rates of urbanization and massive government investments in infrastructure and smart city development across China, India, and Southeast Asia. The region’s need for energy-efficient solutions in densely populated commercial centers and rising standards of living necessitate the adoption of centralized, high-efficiency HVAC systems, driving demand for both standard and advanced air diffusers. Regulations in countries like Australia and Singapore, promoting green building practices, further accelerate the market.

- North America: A mature market characterized by high regulatory standards concerning IAQ and energy efficiency, particularly in the U.S. and Canada. Growth is predominantly driven by the replacement and modernization of existing commercial and institutional HVAC systems, emphasizing smart diffusers and VAV systems that offer data analytics and seamless integration with complex BMS protocols. The demand focuses heavily on premium, high-performance, and low-noise products.

- Europe: This region is strongly influenced by the European Union’s energy performance directives (EPBD), leading to consistent demand for highly insulated and energy-saving HVAC components. Germany, the UK, and France are key consumers, prioritizing sustainability and sophisticated airflow control. The focus is on precision-engineered diffusers that contribute optimally to achieving nearly Zero Energy Buildings (nZEB) standards, especially in the refurbishment sector.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar) due to major construction booms in hospitality, commercial offices, and mixed-use towers. The extreme climatic conditions necessitate robust, high-capacity diffusers capable of handling high air volumes efficiently, making climate control and energy consumption paramount drivers for market demand.

- Latin America (LATAM): Showing steady but constrained growth, market expansion is linked to commercial real estate development in major metropolitan areas such as Brazil and Mexico. The demand leans towards cost-effective, durable diffusers, with increasing interest in energy-saving models as local energy costs rise and regulatory compliance improves across the construction sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceiling Air Diffuser Market.- Trox GmbH

- Price Industries

- Titus

- Krueger

- Ruskin

- Nailor Industries

- Waterloo Air Products

- Systemair AB

- United Technologies Corporation (Carrier)

- Johnson Controls International

- Aldes Group

- Lindab AB

- MADEL Airflow

- FläktGroup

- Rickard Air Diffusion

- Enviro-Tec

- Hart & Cooley

- Daikin Industries

- Barcol-Air

- Camfil

Frequently Asked Questions

Analyze common user questions about the Ceiling Air Diffuser market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Ceiling Air Diffuser Market?

The Ceiling Air Diffuser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by infrastructure development and rising demand for energy-efficient HVAC solutions globally.

Which end-use segment dominates the demand for ceiling air diffusers?

The Commercial sector, encompassing office buildings, retail, and hospitality, currently dominates the demand for ceiling air diffusers, owing to strict building codes regarding thermal comfort and the sheer volume of commercial construction projects worldwide.

How do smart technologies impact the pricing and performance of ceiling air diffusers?

Smart diffusers, integrated with sensors and motorized dampers (actuators), offer superior real-time airflow control and energy optimization, justifying a higher initial cost. They significantly enhance HVAC performance by adjusting air patterns based on occupancy and load conditions.

What are the primary restraints affecting market growth in 2026-2033?

The primary restraints include the volatile costs of raw materials, particularly aluminum and steel, and the high complexity and initial investment required for the installation and integration of advanced, network-enabled smart diffuser systems across diverse building management platforms.

Which region presents the highest growth opportunities for air diffuser manufacturers?

Asia Pacific (APAC) represents the highest growth opportunities, driven by rapid urbanization, extensive new construction activities in commercial and residential sectors, and increasing adoption of modern, centralized HVAC technologies to meet higher indoor air quality standards.

What is the difference between linear slot and perforated diffusers in performance?

Linear slot diffusers offer highly adjustable, directional air patterns with superior aesthetic integration, ideal for precise zoning and high-end interiors. Perforated diffusers, conversely, provide a low-velocity, uniform, non-directional airflow suitable for spaces requiring low turbulence, such as cleanrooms or standard office environments.

How does Computational Fluid Dynamics (CFD) influence modern diffuser design?

CFD is crucial for modern diffuser design as it allows engineers to simulate and optimize complex airflow dynamics, ensuring maximum induction, minimum noise generation, and uniform temperature distribution before physical prototyping, leading to highly efficient and customized products.

What role does the retrofitting market play in the overall diffuser demand?

The retrofitting market is a critical growth driver, particularly in North America and Europe, as aging commercial buildings upgrade existing HVAC systems to comply with modern energy efficiency codes and enhance IAQ, generating consistent replacement demand for high-performance diffusers.

Are plastic or polymer composite diffusers gaining traction over traditional metal types?

Yes, plastic/polymer composite diffusers are gaining traction, especially in specialized applications, due to their light weight, corrosion resistance, and ability to incorporate anti-microbial properties, although aluminum remains the market leader due to its durability and aesthetic versatility.

What is the significance of the "Impact Forces" in analyzing the Ceiling Air Diffuser Market?

Impact Forces consolidate the influence of technological advances, regulatory changes (like nZEB standards), and evolving architectural demands, indicating that external pressures necessitate continuous product innovation towards higher efficiency, aesthetic customization, and deeper integration with building intelligence systems.

How do manufacturers ensure low noise levels in ceiling air diffusers?

Low noise levels are ensured through aerodynamic design optimization (often guided by CFD), utilizing high-tolerance manufacturing processes to eliminate vibration, and incorporating acoustic dampening materials, essential for maintaining occupant comfort in sensitive environments like libraries and hospitals.

What defines the upstream segment of the Ceiling Air Diffuser Market value chain?

The upstream segment is defined by the sourcing of raw materials—primarily aluminum, steel, and plastics—and their initial processing (extrusion, rolling). Supplier stability and raw material cost management are key factors in this phase.

Why is aluminum the preferred material for many high-performance diffusers?

Aluminum is preferred due to its excellent corrosion resistance, high strength-to-weight ratio, superior moldability for complex aerodynamic shapes, and compatibility with various aesthetic finishes, offering a blend of performance, durability, and visual appeal.

What specific challenges does the residential market pose for diffuser manufacturers?

The residential market, particularly multi-family dwellings, requires smaller, highly aesthetic, and extremely quiet diffusers, often requiring customized solutions that blend seamlessly into architectural features while maintaining cost-effectiveness for bulk deployment by developers.

How does AI contribute to the maintenance of HVAC systems involving ceiling diffusers?

AI facilitates predictive maintenance by analyzing performance data (airflow, temperature, pressure drop) from smart diffusers, identifying anomalies, and alerting facility managers to potential issues like filter blockage or damper malfunction before complete system failure occurs.

Which key technology facilitates variable air volume (VAV) control in modern diffusers?

Motorized actuators and integrated sensors facilitate VAV control in modern diffusers, allowing the damper position to be automatically adjusted in response to real-time input from the BMS, optimizing airflow to meet specific zone loads dynamically.

What are the consequences of poorly distributed air using inadequate diffusers?

Poor air distribution results in reduced thermal comfort (hot and cold spots), increased energy consumption due to the HVAC system overcompensating, and diminished Indoor Air Quality (IAQ) due to stagnant air and insufficient mixing.

How do green building certifications (e.g., LEED) influence diffuser procurement?

Green building certifications strongly influence procurement by requiring the use of high-efficiency components that contribute to overall energy savings and improved occupant well-being. Diffusers must demonstrate low pressure drop and optimized air throw to qualify for points under these standards.

What are the key differences between fixed core and adjustable core operating mechanisms?

Fixed core diffusers maintain a constant air pattern, ideal for stable loads. Adjustable core diffusers, conversely, allow facility managers or control systems to alter the air pattern (e.g., horizontal throw for cooling, vertical throw for heating) to optimize comfort seasonally or based on load changes.

In the regional breakdown, why is the Middle East a significant market for specialized diffusers?

The Middle East is significant due to extreme environmental conditions, necessitating highly robust, high-capacity diffusers with superior engineering to manage massive thermal loads while maintaining strict energy efficiency standards in large commercial and mixed-use projects.

What is the definition of throw and aspiration in diffuser performance metrics?

Throw refers to the horizontal or vertical distance the conditioned air jet travels before its velocity decreases to a specific terminal velocity. Aspiration, or induction, is the degree to which the supply air mixes with the ambient room air, crucial for eliminating stratification and drafts.

How do computational models help in reducing installation complexities?

Advanced computational models allow engineers to precisely calculate optimal diffuser placement and size, reducing trial-and-error during installation, minimizing system balancing requirements, and ensuring that the installed performance matches the design specification.

Which segment of the market is expected to grow fastest between 2026 and 2033?

The Linear Slot Diffusers segment, within Product Type, and the Institutional (Healthcare and Education) segment, within End-Use Application, are anticipated to exhibit the fastest growth, driven by aesthetic demand and critical IAQ requirements, respectively.

What risk does the lack of standardization pose in the smart diffuser sub-segment?

The lack of standardization in communication protocols (BMS integration) increases the risk of incompatibility between components from different vendors, leading to higher system integration costs and complexity, thereby slowing the adoption rate of certain smart systems.

Beyond aesthetics, why are perforated diffusers used in specialized environments?

Perforated diffusers are used in specialized environments like operating theaters or cleanrooms because they deliver air at very low velocities, resulting in non-aspirating, laminar flow, which is necessary to minimize particle disturbance and maintain critical cleanliness levels.

How do major industry players like Daikin and Johnson Controls participate in this market?

Major HVAC system conglomerates like Daikin and Johnson Controls participate by integrating diffusers as critical terminal components within their comprehensive, proprietary HVAC solutions, often focusing on advanced controls and system-wide efficiency optimization.

What is the significance of thermal comfort as a market driver?

Thermal comfort is a paramount market driver because it directly correlates with occupant productivity and well-being. Modern diffusers are designed to achieve precise temperature uniformity and minimal drafts, meeting the rising expectations for comfortable indoor environments in high-performance buildings.

Explain the role of the mechanical contractor in the downstream value chain.

The mechanical contractor is the primary installer and buyer, responsible for selecting and procuring diffusers based on the consulting engineer's specifications, ensuring correct installation, and performing system balancing to achieve specified airflow rates and acoustic criteria.

Why is the construction of data centers a niche market driver for ceiling air diffusers?

Data centers require specialized, high-capacity diffusers capable of managing enormous, concentrated heat loads while maintaining extremely tight temperature control tolerances to ensure reliable operation of sensitive IT equipment, driving demand for industrial-grade solutions.

What are the key material science advancements influencing the market?

Key material science advancements include the development of durable, recycled aluminum alloys, specialized polymer composites offering fire resistance and sound dampening properties, and the application of anti-microbial coatings to enhance hygiene standards in public spaces.

How do manufacturers leverage AEO and GEO practices in their product strategy?

Manufacturers leverage AEO/GEO by optimizing their product specifications and documentation online, ensuring that detailed performance data (e.g., noise levels, pressure drop, airflow diagrams) are easily accessible and directly answer technical questions posed by consulting engineers and facility managers through search engines.

What is the estimated market size for the Ceiling Air Diffuser Market by 2033?

The Ceiling Air Diffuser Market is projected to reach an estimated value of USD 5.5 Billion by the end of the forecast period in 2033, reflecting sustained global growth in both new construction and HVAC system modernization.

How does the emphasis on noise reduction influence diffuser design?

The emphasis on noise reduction requires designing aerodynamic passages within the diffuser that minimize air turbulence and vibration. This involves precise tooling, acoustic testing, and often larger neck sizes to reduce air velocity while maintaining necessary air volume delivery.

What distinguishes the institutional end-use segment from the commercial segment?

The institutional segment (hospitals, schools) has uniquely stringent requirements regarding hygiene (anti-microbial materials), IAQ, and low noise, often requiring specialized, high-filtration, or laminar flow diffusers that exceed typical commercial application specifications.

How do emerging economies impact the demand for basic versus premium diffusers?

Emerging economies initially drive high volume demand for basic, cost-effective diffusers for rapid infrastructure deployment. As standards of living and energy regulations mature, the demand shifts towards mid-range and premium, high-efficiency smart diffusers.

What is the primary function of a ceiling air diffuser within an HVAC system?

The primary function is to serve as the terminal unit responsible for ensuring effective mixing of conditioned supply air with the ambient room air, preventing drafts, eliminating temperature stratification, and maintaining acceptable air velocity in occupied zones.

How is the market addressing the need for aesthetically pleasing diffusers?

The market addresses aesthetic demands through the development of linear slot diffusers, plaster-in frames for seamless integration with drywall ceilings, and customizable finishes that allow the diffuser to blend discreetly into modern architectural elements.

What is the role of Direct Sales (OEMs) in the market segmentation by sales channel?

Direct Sales to OEMs involve supplying diffusers as integral components for packaged HVAC units (rooftops, AHUs), ensuring high volume orders and deep collaboration on technical specifications and manufacturing integration for standardized system components.

Define the concept of "Variable Air Volume" (VAV) in relation to diffusers.

VAV refers to HVAC systems that vary the volume of conditioned air delivered to a space based on the thermal load. VAV diffusers utilize motorized dampers to modulate airflow, maintaining precise temperature control in the zone while minimizing energy consumption compared to constant volume systems.

Why are logistics and distribution critical components of the value chain?

Logistics and distribution are critical because construction projects operate under tight deadlines. Efficient warehousing and timely delivery of the correct diffuser types and quantities via wholesalers and distributors are essential to avoid costly project delays and ensure contractor satisfaction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager