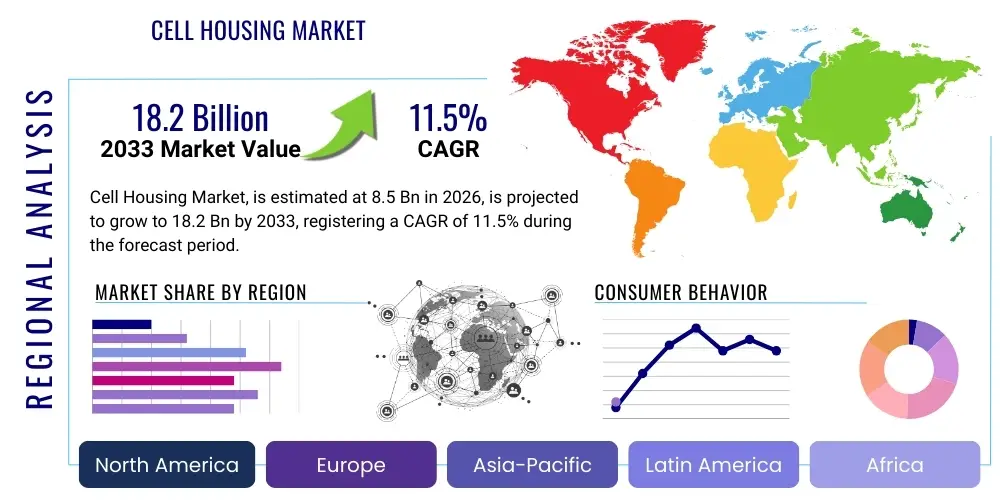

Cell Housing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443571 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Cell Housing Market Size

The Cell Housing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 18.2 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global investment in biopharmaceutical research and development, particularly in advanced therapies like cell and gene therapy (CGT). Cell housing solutions, encompassing specialized infrastructure such as automated bioreactors, controlled environment incubators, and cryopreservation systems, are critical components enabling the scaled production and reliable storage of biological assets. The inherent necessity for precise temperature control, sterility assurance, and scalability in therapeutic cell manufacturing is the primary engine behind the predicted CAGR.

The market valuation reflects the increasing complexity and volume of cell culture operations across various sectors, including drug discovery, personalized medicine, and regenerative medicine. The transition from traditional 2D culture methods to advanced 3D systems and high-throughput screening requires sophisticated cell housing infrastructure capable of handling large batch sizes while maintaining stringent quality control standards. Furthermore, regulatory frameworks demanding enhanced traceability and robustness in manufacturing processes necessitate capital expenditure in premium, automated cell housing environments, thereby contributing significantly to the overall market size growth throughout the forecast period. Asia Pacific, in particular, is poised to emerge as a dominant growth region, fueled by rising biotechnology investments and expanding clinical trial activity.

Cell Housing Market introduction

The Cell Housing Market encompasses the specialized infrastructure, equipment, and consumables designed to provide optimal, controlled environments for the proliferation, differentiation, maintenance, and storage of living biological cells. This market is pivotal to the biotechnology and pharmaceutical industries, offering solutions ranging from standard CO2 incubators and specialized biosafety cabinets to large-scale, automated modular cleanrooms and advanced bioreactor systems used in commercial manufacturing. Product descriptions typically highlight features like precise environmental parameter control (temperature, humidity, gas concentration), sterilization capabilities, and integration with monitoring and data logging systems to ensure cell viability and experimental reproducibility. The complexity of cell housing varies significantly, addressing needs from basic academic research labs to Good Manufacturing Practice (GMP) certified production facilities required for therapeutic manufacturing.

Major applications of cell housing technology span across drug screening and discovery, vaccine production, regenerative medicine, and the burgeoning field of cell and gene therapies (CGT). In drug discovery, high-throughput cell housing platforms facilitate rapid testing of compound libraries against various cell models. For therapeutic production, robust bioreactors and closed-system incubators are essential for scaling up T-cell, stem cell, or exosome production while minimizing contamination risks. The primary benefits derived from advanced cell housing solutions include enhanced operational efficiency, reduced human error through automation, superior cell viability and yield, and compliance with increasingly rigorous regulatory guidelines governing bioproduction. These factors collectively underscore the market's irreplaceable role in modern life sciences.

Driving factors for the sustained expansion of the Cell Housing Market are manifold. Firstly, the exponential growth in demand for cell-based therapies requires scalable and industrialized cell culture infrastructure. Secondly, technological advancements, such as the integration of sensor technologies, robotics, and artificial intelligence into housing systems, enhance process control and data integrity. Thirdly, global governmental and private funding initiatives aimed at accelerating cancer research and infectious disease treatment pipelines create robust demand for sophisticated cell cultivation environments. Finally, the shift toward personalized medicine, which often relies on autologous or allogeneic cell products, mandates highly controlled, flexible, and often distributed manufacturing solutions, further propelling investment in state-of-the-art cell housing equipment.

Cell Housing Market Executive Summary

The Cell Housing Market is experiencing dynamic growth, characterized by significant technological shifts favoring automated, closed-system environments necessary for high-volume, contamination-free cell manufacturing. Business trends indicate a strong move toward strategic partnerships between cell housing equipment manufacturers and bioprocessing technology providers to offer integrated, end-to-end solutions, simplifying the complexity of setting up GMP-compliant facilities. Key investments are centered on modular construction techniques for cleanrooms, which allow for faster deployment and greater flexibility in scaling production capacities, especially in emerging markets. Furthermore, the consumables segment, including specialized culture media and single-use bioreactor bags, is seeing high revenue traction due to the operational necessity of frequent replacement and disposal in regulated environments, reinforcing the recurring revenue streams for market players.

Regional trends highlight North America and Europe as established leaders, primarily due to dense concentrations of leading pharmaceutical companies, robust academic research ecosystems, and substantial government R&D funding for biotechnology. These regions are characterized by early adoption of cutting-edge technologies like advanced cryopreservation techniques and automated cell sorting equipment. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This acceleration is attributed to increasing foreign direct investment in biomanufacturing hubs in countries like China, South Korea, and India, coupled with expanding patient access to advanced therapies and supportive regulatory reforms aimed at fostering local biotech innovation and production capacity, thereby rapidly increasing the regional demand for quality cell housing infrastructure.

Segmentation trends reveal that the therapeutic application segment, particularly Cell and Gene Therapy (CGT), dominates market revenues, driven by the expanding clinical pipeline and commercial approvals of CAR T-cell therapies and stem cell treatments. Within product segments, automated bioreactors and sophisticated environmental control chambers command premium pricing and high growth rates due to their role in scaling up production from clinical trials to commercial volumes. The shift toward single-use technology (SUT) in bioreactors and associated housing consumables continues to gain momentum, offering advantages in terms of reduced cleaning validation costs and faster turnaround times between production batches, making them highly attractive to contract manufacturing organizations (CMOs) and large biopharmaceutical firms focusing on rapid scaling and operational efficiency.

AI Impact Analysis on Cell Housing Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cell Housing Market overwhelmingly focus on automation, data integrity, and predictive maintenance. Common themes include how AI can optimize culture conditions in real-time, predict potential contamination events before they occur, and automate complex cell imaging and sorting processes. Users are keen to understand the transition from manually adjusted, static environments to dynamic, AI-driven closed-loop systems that ensure optimal cell health and consistent output quality. The core expectation is that AI integration will mitigate risks associated with human variability, significantly reduce operational costs linked to failed batches, and accelerate the development timeline for novel cell-based products by leveraging continuous process monitoring and prescriptive analytics derived from vast datasets collected by interconnected cell housing units.

- AI-driven Predictive Maintenance: Anticipating equipment failures in incubators, bioreactors, and cryo-storage units, minimizing costly downtime.

- Real-time Environmental Optimization: Utilizing machine learning algorithms to autonomously adjust parameters (e.g., pH, dissolved oxygen, nutrient levels) within bioreactors for maximum cell viability and yield.

- Automated Image Analysis and Quality Control: Employing deep learning for high-throughput analysis of cell morphology, viability, confluence, and differentiation status, replacing subjective manual microscopy.

- Data Integration and Digital Twin Modeling: Creating virtual models of manufacturing processes to simulate changes in cell housing conditions, optimizing protocols before implementation in physical facilities.

- Contamination Detection and Prevention: AI algorithms analyzing sensor data (gas levels, humidity fluctuations) to detect subtle anomalies indicative of impending contamination events, providing early warnings.

- Supply Chain and Inventory Management: Optimizing the stock levels and usage patterns of specialized consumables (media, disposables) housed within the cell production ecosystem using demand forecasting models.

- Enhanced Regulatory Compliance: Automated documentation and audit trails generated by AI-managed systems ensure consistent data reporting, simplifying regulatory submissions.

DRO & Impact Forces Of Cell Housing Market

The dynamics of the Cell Housing Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the robust expansion of the global biotechnology and biopharmaceutical sectors, specifically the high demand generated by successful commercialization and growing clinical pipelines for advanced therapeutic modalities like cell and gene therapies. This necessitates substantial investment in high-capacity, sterile, and standardized cell culture environments. Simultaneously, stringent regulatory requirements, particularly those enforced by bodies like the FDA and EMA concerning GMP compliance, push manufacturers toward adopting advanced, automated, and validated housing solutions, inherently driving up market expenditure on premium equipment. The pursuit of personalized medicine further amplifies this trend, requiring flexible, often closed-loop systems capable of handling individualized patient batches.

Conversely, significant restraints hinder market growth and adoption. The initial capital expenditure required for setting up large-scale, automated cell housing facilities, especially those adhering to GMP standards, is exceptionally high, posing a barrier to entry for smaller biotech startups and academic institutions. Furthermore, the specialized skills required to operate and maintain sophisticated bioreactors, monitoring systems, and cryopreservation units are often scarce, leading to operational challenges and elevated labor costs. Another critical restraint involves the perceived risk associated with scaling up cell manufacturing; any failure in the housing environment (e.g., temperature excursion or contamination) can result in the loss of immensely valuable and often patient-specific cell batches, making reliability a major concern.

Opportunities for growth are concentrated in technological innovation and geographical expansion. The market stands to benefit significantly from the ongoing shift towards modular and single-use systems, which reduce infrastructure complexity and validation time, making advanced cell housing more accessible globally. Developing countries, particularly in APAC and Latin America, present vast untapped opportunities as local governments prioritize biotechnology infrastructure development. Furthermore, the burgeoning field of cellular agriculture (lab-grown meat) represents a nascent but potentially transformative application area, requiring novel, food-grade large-scale cell housing solutions, offering diversified revenue streams for equipment manufacturers and service providers beyond traditional healthcare applications. These forces collectively dictate the pace and direction of technological innovation within the cell housing landscape.

Segmentation Analysis

The Cell Housing Market is meticulously segmented based on product type, application, end-user, and geography, reflecting the diverse requirements of the life sciences industry. Product segmentation typically differentiates between equipment (e.g., bioreactors, incubators, centrifuges) and consumables (e.g., culture media, reagents, single-use bags). Application segmentation highlights the specific therapeutic or research areas driving demand, such as cancer research, infectious disease modeling, regenerative medicine, and commercial bioproduction. Understanding these segments is crucial for market participants to tailor their offerings, focusing on high-growth areas like automated, small-footprint housing solutions optimized for decentralized manufacturing or large-scale, continuous processing systems required by Contract Development and Manufacturing Organizations (CDMOs).

- By Product Type:

- Equipment

- Bioreactors (Single-use, Stainless Steel, Photobioreactors)

- Incubators (CO2 Incubators, Temperature/Humidity Controlled)

- Cryopreservation Systems (Liquid Nitrogen Freezers, Controlled-Rate Freezers)

- Cell Sorters and Counters

- Biosafety Cabinets and Cleanroom Modules

- Consumables

- Cell Culture Media and Reagents (Serum-free, Chemically Defined)

- Single-Use Components (Bags, Tubing, Connectors)

- Cryopreservation Media

- Storage Vessels and Flasks

- Services

- Installation and Maintenance Services

- Validation and Qualification Services (IQ/OQ/PQ)

- Custom Protocol Development

- Equipment

- By Application:

- Therapeutics Manufacturing

- Cell and Gene Therapy Production

- Vaccine Production

- Monoclonal Antibody Manufacturing

- Research and Development

- Drug Discovery and Screening

- Basic Research (Academic and Government Labs)

- Tissue Engineering and Regenerative Medicine Research

- Diagnostics and Personalized Medicine

- Therapeutics Manufacturing

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs) and CDMOs

- Academic and Research Institutes

- Hospitals and Diagnostic Laboratories

Value Chain Analysis For Cell Housing Market

The value chain of the Cell Housing Market begins with the upstream activities centered on the sourcing and manufacturing of complex components and raw materials. Upstream analysis involves suppliers of high-grade stainless steel (for fixed bioreactors), specialized plastics and polymers (for single-use systems and culture vessels), sophisticated sensors, and precise environmental control hardware (e.g., pumps, valves, gas mixers). These suppliers must adhere to extremely high standards of material purity and sterilization capability, as minor contaminants can compromise entire cell cultures. The successful execution of upstream activities relies heavily on establishing stable, compliant supply chains, particularly for single-use technology components, where proprietary polymer formulations are essential for minimizing leachables and extractables that could harm sensitive cell lines. Efficiency in this stage directly impacts the final equipment quality and manufacturing cost.

The midstream stage involves the core manufacturing, assembly, and integration of the cell housing systems, where specialized expertise in bio-engineering and automation is paramount. This includes the design and fabrication of complex equipment like automated bioreactors, modular cleanrooms, and robotic cell handling systems. Distribution channels for these capital-intensive goods are typically long and involve a mix of direct sales and specialized indirect distributors. High-value equipment, such as large-scale GMP bioreactors, is often sold directly to biopharma clients via specialized sales teams who provide extensive pre-sale consultation and post-installation support. This direct engagement ensures highly customized solutions meet specific regulatory and process requirements, fostering deeper client relationships necessary for high-stakes therapeutic manufacturing projects.

Downstream activities focus on the delivery, installation, validation, and maintenance of the systems at the end-user facilities (e.g., CDMOs, biotech firms). Indirect distribution channels often handle the high-volume, lower-cost consumables segment, utilizing a network of life science distributors that manage local inventory and rapid delivery of media, reagents, and disposable components essential for continuous operations. The aftermarket services, including calibration, preventative maintenance contracts, and operational qualification (OQ) services, represent a critical revenue stream and impact force in the downstream value chain. This entire structure is heavily regulated, meaning compliance services and technical support constitute a vital segment, driving value creation long after the initial equipment purchase.

Cell Housing Market Potential Customers

The primary consumers and end-users of Cell Housing products are large Pharmaceutical and Biotechnology companies, driven by their extensive pipelines in advanced drug discovery and commercial-scale therapeutic production. These corporate entities require robust, scalable, and fully validated cell housing infrastructure to support both preclinical research and large-volume GMP manufacturing of biologics, particularly monoclonal antibodies, recombinant proteins, and increasingly, viral vectors for gene therapy. Their purchasing decisions are highly sensitive to regulatory compliance, automation capabilities, and the total cost of ownership (TCO) over the lifespan of the equipment. They represent the largest segment of demand for high-end, integrated systems like continuous bioprocessing platforms and fully automated cell processing modules.

Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) form another crucial segment of potential customers. These organizations specialize in providing outsourced manufacturing and development services to smaller biotech firms and large pharma companies. CDMOs, in particular, are aggressive investors in diverse cell housing technologies—ranging from traditional stainless steel to flexible single-use bioreactors—to cater to a varied client base with different volume and scale requirements. Their demand is characterized by the need for rapid deployment, versatility, and efficiency, which often leads them to favor modular cleanrooms and highly flexible, closed-system cell culture equipment that minimizes cross-contamination risk between client projects.

Academic and Government Research Institutes also constitute significant end-users, primarily consuming laboratory-scale equipment such as smaller incubators, cell counters, and specialized research-grade media. While their purchase volumes for large production systems are lower than commercial enterprises, these institutes drive demand for cutting-edge, experimental cell housing solutions used in basic biological research, disease modeling, and early-stage translational studies. The purchasing decisions in this segment are often influenced by grant funding cycles and the need for precision and data quality, leading to the adoption of advanced, high-precision microscopy and analytical cell culture environments designed for complex cellular experimentation and genetic manipulation studies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 18.2 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Sartorius AG, Danaher Corporation (Cytiva), Eppendorf AG, Merck KGaA, Lonza Group, Becton, Dickinson and Company (BD), Corning Incorporated, Getinge AB, Asahi Kasei Corporation, FUJIFILM Diosynth Biotechnologies, Miltenyi Biotec, Esco Group, Terumo Corporation, Avantor, Applikon Biotechnology (B-Braun), PHC Holdings Corporation, Infors HT, HiMedia Laboratories, Cellexus. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cell Housing Market Key Technology Landscape

The technology landscape of the Cell Housing Market is characterized by continuous innovation focused on achieving higher density, improved process control, and enhanced automation to meet the demands of industrialized cell manufacturing. A core technological advancement is the widespread adoption of Single-Use Technology (SUT) in bioreactor systems. SUT eliminates the complex and costly validation procedures associated with cleaning and sterilization of traditional stainless-steel vessels, drastically reducing turnaround times and minimizing the risk of cross-contamination. These disposable housing solutions incorporate specialized sensors and robust film materials capable of withstanding industrial bioprocessing environments, paving the way for highly flexible and rapidly deployable manufacturing strategies, which are particularly advantageous for CDMOs and decentralized production models for personalized medicine.

Furthermore, sensor technology and advanced monitoring systems are critical components revolutionizing the functionality of cell housing units. Modern incubators and bioreactors are equipped with sophisticated non-invasive sensors for real-time monitoring of crucial parameters such as pH, dissolved oxygen (DO), glucose, and lactate levels. Integrating these sensors with advanced software analytics allows for closed-loop feedback control systems, moving away from manual sampling and adjustments. This level of precise environmental regulation is essential for maintaining the narrow viability windows required for sensitive cell lines, especially induced pluripotent stem cells (iPSCs) and CAR T-cells, ensuring batch consistency and maximizing therapeutic yield—a vital technical feature driving competition among leading equipment providers.

Another major technological area is the development of fully automated cell processing platforms and modular cleanroom architecture. Automated cell processing systems integrate complex tasks—including cell thawing, expansion, washing, and final formulation—into a single, enclosed, robotic unit, thereby fulfilling the stringent sterility requirements of GMP. Alongside this, the rise of modular and prefabricated cleanrooms allows biomanufacturers to quickly establish or expand production capacity with reduced construction timelines and capital outlay compared to traditional stick-built facilities. These plug-and-play environments are designed to integrate seamlessly with automated cell housing equipment, providing adaptable infrastructure solutions that can scale rapidly in response to market demand for new cell-based therapies.

Regional Highlights

- North America: This region maintains its dominance in the Cell Housing Market, driven by the presence of a mature biopharmaceutical industry, substantial venture capital investments in biotech startups, and robust federal funding for life science research (e.g., NIH, NSF). The U.S. leads in the commercialization of cell and gene therapies, resulting in high demand for GMP-compliant automated bioreactors and cryopreservation infrastructure. Innovation in closed-system manufacturing and the adoption of AI-enabled cell culture monitoring are particularly high here.

- Europe: Characterized by strong regulatory support and significant public investment in regenerative medicine (e.g., Horizon Europe), the European market is a key growth area. Countries such as Germany, the UK, and Switzerland are major hubs for advanced biotechnology manufacturing and academic research, driving demand for high-quality, standardized cell housing solutions. The focus is increasingly on establishing standardized biorepository facilities and ensuring supply chain resilience for essential consumables.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR, APAC is transitioning into a global biomanufacturing powerhouse. Market growth is fueled by increasing government initiatives in China and India to localize drug production, expanding healthcare expenditure, and a growing number of clinical trials. The demand is strong for scalable, cost-effective cell housing solutions, including single-use technologies that allow emerging CDMOs to rapidly scale operations without extensive fixed infrastructure investment.

- Latin America: This region presents emerging opportunities, primarily driven by investments in Brazil and Mexico aimed at improving public health infrastructure and localized vaccine production capabilities. Demand is concentrated on reliable, foundational cell culture equipment, although market penetration of high-end automated systems is currently lower compared to North America and Europe.

- Middle East and Africa (MEA): Growth in MEA is highly localized, centered around key research initiatives and specialized medical centers in the UAE, Saudi Arabia, and Israel. These countries are investing in genomic research and personalized medicine, creating niche demand for high-precision, small-scale cell housing equipment and cryo-storage facilities. Economic diversification away from oil revenue is spurring investment in the healthcare and life science sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cell Housing Market.- Thermo Fisher Scientific

- Sartorius AG

- Danaher Corporation (Cytiva)

- Eppendorf AG

- Merck KGaA

- Lonza Group

- Becton, Dickinson and Company (BD)

- Corning Incorporated

- Getinge AB

- Asahi Kasei Corporation

- FUJIFILM Diosynth Biotechnologies

- Miltenyi Biotec

- Esco Group

- Terumo Corporation

- Avantor

- PHC Holdings Corporation

- Infors HT

- HiMedia Laboratories

- Cellexus

- Applikon Biotechnology (B-Braun)

Frequently Asked Questions

Analyze common user questions about the Cell Housing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards single-use technology (SUT) in cell housing?

The shift to SUT is driven primarily by reduced operational complexity, elimination of complex cleaning validation processes, and minimization of cross-contamination risk. SUT enables faster batch turnaround times and lower upfront infrastructure costs compared to traditional stainless-steel systems, critical for agile biomanufacturing.

How is the growth of Cell and Gene Therapy (CGT) impacting cell housing requirements?

CGT expansion demands highly scalable, closed-system, and automated cell housing solutions to handle sensitive patient-derived cells under strict GMP compliance. This drives investment in specialized, small-footprint bioreactors and integrated cell processing units designed for clinical and commercial CGT production.

What role does automation play in optimizing cell culture environments?

Automation, often integrating robotics and AI, ensures precise, consistent control over culture parameters, reduces manual handling errors, and enhances data integrity. It allows for high-throughput processing and continuous, real-time monitoring, optimizing yields and ensuring batch reproducibility necessary for regulatory approval.

Which geographical region is expected to show the fastest growth in the Cell Housing Market?

The Asia Pacific (APAC) region is projected to demonstrate the fastest growth (highest CAGR). This acceleration is fueled by significant regional investment in local biomanufacturing capacity, supportive governmental policies, and expanding healthcare access, particularly in China and India.

What are the primary challenges limiting the widespread adoption of advanced cell housing?

The main challenges include the substantial initial capital expenditure required for sophisticated, GMP-compliant infrastructure, particularly automation and cleanroom facilities, and the scarcity of highly skilled personnel needed to operate and maintain these complex, integrated cell housing systems effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager