Cellulose Nitrates Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442181 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Cellulose Nitrates Market Size

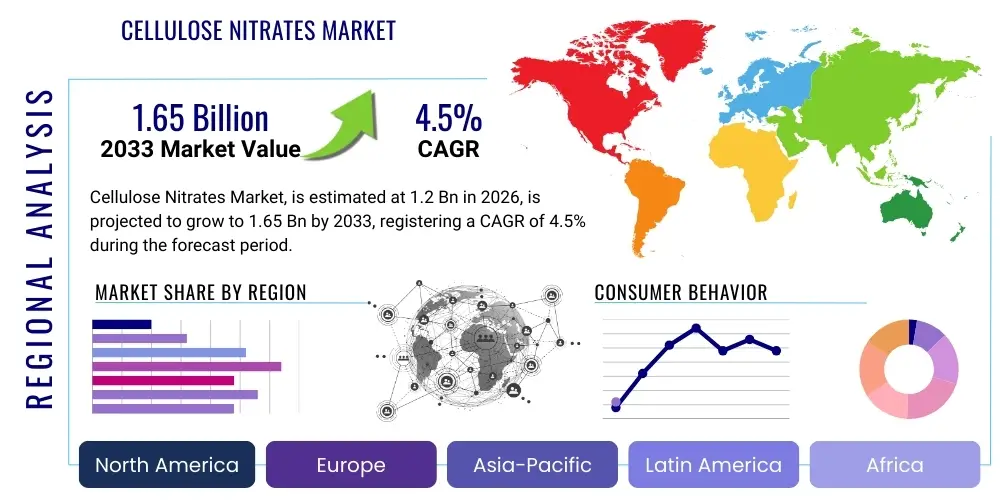

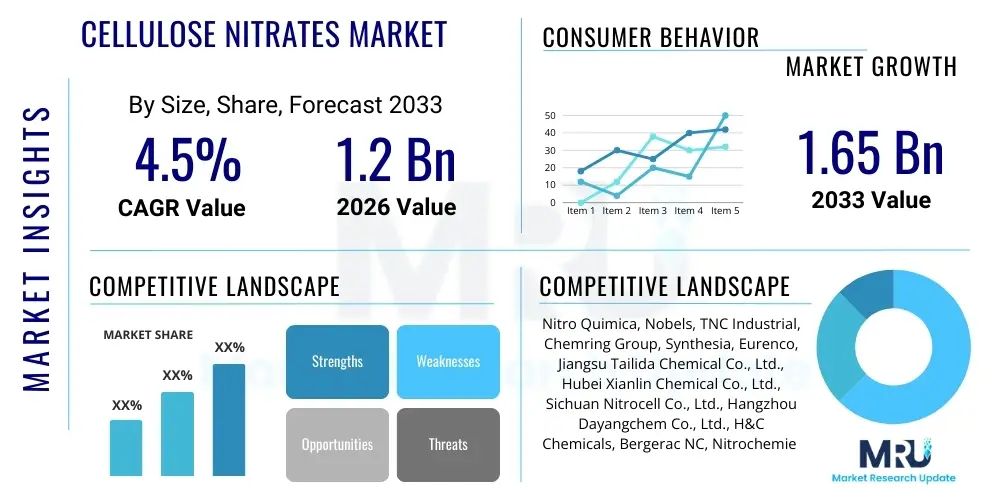

The Cellulose Nitrates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.65 Billion by the end of the forecast period in 2033. This consistent expansion is underpinned by robust demand across traditional sectors, particularly in specialized coatings and high-performance lacquers, alongside burgeoning applications in niche areas such as pharmaceutical coatings and sophisticated energetic materials. The market trajectory is influenced significantly by the industrial resurgence in developing economies, necessitating high-quality protective and finishing solutions where cellulose nitrates excel due to their superior film-forming properties and rapid drying characteristics.

Cellulose Nitrates Market introduction

The Cellulose Nitrates Market encompasses the manufacturing, distribution, and utilization of nitrocellulose, a highly flammable compound synthesized by nitrating cellulose, typically cotton linters or wood pulp, with nitric acid. This versatile polymer, also known as cellulose dinitrate or guncotton, finds critical utility across diverse industries due to its excellent solubility in organic solvents, rapid drying time, and ability to form tough, glossy films. Its historical roots are tied to explosives and photographic film, but modern applications are predominantly centered around surface coatings, printing inks, and specialized adhesives, leveraging its chemical stability and low viscosity characteristics.

Key applications of cellulose nitrates span industrial coatings, including automotive refinishes, wood furniture lacquers, and leather finishes, where they provide superior hardness, scratch resistance, and aesthetic appeal. Furthermore, the material remains indispensable in the manufacturing of propellants and explosives, particularly in military and construction industries, where specific nitrogen content grades are essential for controlled energy release. The market growth is fundamentally driven by the escalating global construction activities requiring durable wood and metal coatings, coupled with sustained demand from the defense sector for advanced energetic materials that maintain stability and reliability under various environmental conditions.

Benefits associated with using cellulose nitrates include their cost-effectiveness relative to certain synthetic polymers, ease of application, and exceptional compatibility with a wide array of resins and plasticizers, allowing for the formulation of tailor-made products. However, handling and storage complexities stemming from its inherent flammability necessitate stringent regulatory compliance and specialized supply chain infrastructure. Despite these constraints, the market continues to expand, driven by innovation in low-viscosity grades suitable for high-solids formulations, aiming to meet stricter environmental regulations concerning Volatile Organic Compounds (VOCs).

Cellulose Nitrates Market Executive Summary

The Cellulose Nitrates Market exhibits steady growth, primarily fueled by the sustained expansion of the construction and automotive refinishing sectors across Asia Pacific and Latin America. Business trends indicate a strong move toward high-solids nitrocellulose grades that facilitate compliance with environmental standards, minimizing solvent emissions without sacrificing performance attributes. Key industry players are focusing on backward integration, securing stable access to purified cellulose raw materials to mitigate supply chain volatility and ensure consistent product quality, especially for critical applications like high-performance propellants and medical device components. Strategic mergers and acquisitions are observed, aiming to consolidate market share and leverage technological expertise in continuous nitration processes, leading to enhanced manufacturing efficiency and reduced operational risks.

Regionally, Asia Pacific maintains the leading market position, driven by rapid industrialization, large-scale infrastructure projects, and the presence of major manufacturing hubs for wood coatings and printing inks in China and India. Europe, despite facing stricter REACH regulations impacting solvent usage, demonstrates resilience through high-value specialty applications, particularly in pharmaceutical coatings and premium leather finishes. North America shows stable demand, primarily concentrated in high-nitrogen military applications and specialized industrial lacquers, maintaining a focus on safety standards and performance characteristics over sheer volume.

Segmentation trends highlight the dominance of the Coatings segment, particularly automotive and wood coatings, utilizing low-to-medium nitrogen content cellulose nitrates. Simultaneously, the High Nitrogen Content segment, critical for propellants and energetic materials, experiences consistent, albeit government-controlled, demand, often insulated from general economic fluctuations. Innovation is noticeable in the Inks segment, where nitrocellulose is crucial for flexographic and gravure inks, demanding grades that offer quick drying and excellent printability, responding to the growing packaging industry needs for aesthetically pleasing and functional printing solutions.

AI Impact Analysis on Cellulose Nitrates Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cellulose Nitrates market predominantly center on optimizing complex manufacturing processes, ensuring safety, and improving supply chain resilience. Users are concerned about how AI can handle the inherent volatility and hazard associated with nitrocellulose production (a highly regulated chemical process), expecting AI to enhance predictive maintenance, reduce batch variability, and improve yield. Key expectations revolve around using machine learning algorithms for optimizing nitration reaction parameters, precisely controlling temperature and acid concentration to achieve desired nitrogen levels consistently and safely. Furthermore, users anticipate AI-driven logistics planning to manage the complex and regulated transportation of high-hazard materials efficiently, minimizing risks and compliance failures across international borders.

- AI-driven optimization of nitration processes: Machine learning models predict optimal acid mixtures and reaction times to achieve desired nitrogen content (HNC vs. LNC) with higher precision, reducing batch variance.

- Predictive maintenance for specialized equipment: AI tools monitor reactor stress, temperature fluctuations, and machinery wear in hazardous environments, preempting failures and minimizing downtime in highly capital-intensive production facilities.

- Enhanced quality control and risk mitigation: Computer vision systems and sensor data analysis automate the inspection of finished cellulose nitrate sheets or chips, ensuring structural integrity and preventing shipping defects.

- Supply Chain and Logistics Optimization: AI models manage the complex regulatory requirements for transporting flammable materials, optimizing routing, scheduling, and inventory placement to improve safety compliance and reduce insurance costs.

- R&D Acceleration: AI simulates new nitrocellulose formulations combined with various plasticizers and resins, speeding up the development of low-VOC or specialized pharmaceutical grades.

DRO & Impact Forces Of Cellulose Nitrates Market

The Cellulose Nitrates Market dynamics are governed by a complex interplay of high-growth application drivers, stringent safety and environmental regulations acting as restraints, and significant opportunities emerging from technological advancements and market diversification. The primary drivers stem from the robust global demand for high-performance coatings, particularly in the rapidly expanding wood and automotive refinish industries in emerging economies, alongside consistent requirements from defense sectors globally. However, the market faces considerable restraints, primarily concerning the extreme flammability and handling hazards associated with nitrocellulose, necessitating heavy capital investment in safety infrastructure and compliance with highly restrictive storage and transport regulations, such as those imposed by the UN’s regulatory framework for dangerous goods. These forces collectively dictate the investment landscape and competitive structure of the industry.

Opportunities for market expansion are centered around innovation in product formulation, specifically the development of safer, water-based, or less volatile nitrocellulose derivatives, although maintaining performance remains a challenge. The pharmaceutical industry presents a high-potential niche, where ultra-pure, regulated grades are used for specialized enteric coatings and drug release mechanisms, requiring stringent manufacturing controls but offering high-profit margins. Furthermore, technological progress in continuous manufacturing processes over traditional batch methods offers the potential to significantly improve economies of scale, enhance product consistency, and reduce the overall carbon footprint associated with production, appealing to sustainability-conscious industrial consumers.

The impact forces are substantial, creating high barriers to entry for new competitors due to regulatory overhead and required expertise. The high dependency on raw material purity (purified cellulose), whose costs fluctuate based on agricultural and logging industry outputs, subjects the market to external price volatility. Regulatory impact, particularly in developed regions like Europe (REACH compliance focusing on solvent restriction), forces manufacturers to continuously innovate toward greener formulations, potentially leading to segment shifts, while the ever-present risk of industrial accidents ensures safety investments remain a paramount competitive concern.

Segmentation Analysis

The Cellulose Nitrates Market is comprehensively segmented based on its Type (nitrogen content), Application, and Grade, reflecting the diverse end-use requirements and technical specifications demanded across various industries. Segmentation by Type, specifically the distinction between High Nitrogen Content (HNC) and Low Nitrogen Content (LNC), is foundational, as HNC (above 12.6%) is critical for propellants and explosives, demanding high regulatory oversight, while LNC (below 12.6%) is predominantly used in lacquer, coatings, and ink applications. The application landscape is broad, with coatings forming the largest share due to the material's excellent film-forming and drying properties, followed by printing inks and specialized explosive materials. Understanding these segments is vital for strategic market positioning and resource allocation.

- By Type:

- High Nitrogen Content (HNC) (>12.6% N): Used primarily in propellants and explosives.

- Low Nitrogen Content (LNC) (LNC) (<12.6% N): Used mainly in coatings, lacquers, and inks.

- By Application:

- Coatings (Wood, Automotive Refinish, Industrial, Leather)

- Printing Inks (Flexographic and Gravure)

- Adhesives and Sealants

- Explosives and Propellants

- Films and Membranes (e.g., historical photographic film, specialized filters)

- Pharmaceutical Coatings

- By Grade:

- Industrial Grade

- Pharmaceutical Grade (High Purity)

- Specialty Grade (Custom viscosity and stabilization)

Value Chain Analysis For Cellulose Nitrates Market

The value chain for the Cellulose Nitrates market begins with the upstream procurement of highly refined raw materials, primarily purified cellulose (cotton linters or wood pulp), which necessitates high consistency and quality control. Key upstream suppliers include major textile and paper industries specializing in high-purity pulp. The core manufacturing process involves chemical nitration, stabilization, purification, and controlled drying, which is highly capital and expertise-intensive, forming the central, value-adding stage. Due to the hazardous nature of the intermediates and the final product, operational safety and regulatory compliance add significant cost and complexity to this stage, driving competition based on process efficiency and safety records among manufacturers.

The midstream focuses on converting the manufactured nitrocellulose into commercial grades defined by nitrogen content, viscosity, and moisture levels, often involving blending and packaging for various end-use applications. Downstream activities involve distribution and formulation. Distribution channels for cellulose nitrates are rigorously controlled, largely relying on specialized third-party logistics (3PL) providers certified for handling dangerous goods, ensuring compliance during transportation (direct channel). Indirect channels involve distributors or specialized formulators who blend the nitrocellulose with solvents, plasticizers, and other resins to create ready-to-use lacquers, inks, or adhesives, tailoring the product for specific customer needs in automotive, furniture, or printing sectors.

Direct sales are common for large-volume industrial buyers, particularly government defense contractors and major chemical companies that handle their own formulation. Conversely, small-to-medium enterprises (SMEs) in the coatings and inks sectors often rely on indirect channels, utilizing regional distributors who provide smaller quantities and local technical support. The profitability throughout the chain is heavily influenced by the volatile pricing of cellulose pulp and the fixed costs associated with stringent safety compliance, making efficient inventory management and secure storage capabilities essential competitive differentiators.

Cellulose Nitrates Market Potential Customers

Potential customers for the Cellulose Nitrates Market are highly diverse, spanning sectors where superior film-forming, rapid drying, and energetic properties are essential product characteristics. The largest segment of end-users consists of the coatings and paints industry, specifically manufacturers of high-end wood lacquers (furniture and cabinetry), automotive refinish paints, and leather finishing products, who utilize LNC grades for durable, high-gloss finishes. The printing and packaging industry represents another significant customer base, relying on nitrocellulose for its quick solvent release in flexographic and gravure inks, crucial for high-speed printing on plastic films and foils.

A specialized, yet critical, customer segment includes defense organizations and military contractors (governments worldwide) who procure HNC grades for the manufacturing of propellants, smokeless powder, and explosives, where product consistency and reliability are non-negotiable. Furthermore, specialized chemical formulators and adhesive manufacturers utilize cellulose nitrates as a key component in fast-setting cements and specialty adhesives due to their strong binding capabilities. Emerging customer segments include pharmaceutical companies requiring specific, highly pure grades for controlled-release drug coatings and encapsulation materials, necessitating compliance with strict pharmacopeial standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.65 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nitro Quimica, Nobels, TNC Industrial, Chemring Group, Synthesia, Eurenco, Jiangsu Tailida Chemical Co., Ltd., Hubei Xianlin Chemical Co., Ltd., Sichuan Nitrocell Co., Ltd., Hangzhou Dayangchem Co., Ltd., H&C Chemicals, Bergerac NC, Nitrochemie AG, T&T Group, Shandong Baofeng Chemical Industry, TCI Chemicals, American Cellulose, DuPont, Dow, Eastman Chemical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cellulose Nitrates Market Key Technology Landscape

The core technology landscape in the Cellulose Nitrates market revolves around optimizing the nitration process to ensure safety, consistency, and targeted nitrogen content. Historically, production relied on batch processes, but modern advancements emphasize continuous nitration technology. This shift is crucial for improving yield, minimizing waste, and, critically, enhancing safety by maintaining tighter control over exothermic reactions, thereby reducing the risk of catastrophic incidents. Continuous systems utilize specialized reactors and automated control loops, ensuring precise dosing of nitrating agents and rapid stabilization of the resulting nitrocellulose, leading to highly consistent grades suitable for demanding industrial applications.

Another significant technological focus is on stabilization and moisture control. Since cellulose nitrates must be shipped and stored wetted with solvents (like isopropanol or ethanol) or water to mitigate flammability risks, the technology for consistent stabilization, purification, and drying is paramount. Innovations in washing and centrifuging techniques are aimed at removing residual acid contaminants that can compromise long-term stability. Furthermore, advancements in solvent-free processing and efforts to develop grades compatible with water-borne systems are critical to navigating increasingly strict VOC regulations, pushing manufacturers to invest heavily in advanced formulation techniques and dispersion technology research.

In the end-user application sphere, technology is focused on viscosity modification and compatibility enhancement. Manufacturers are developing specialty grades with extremely low viscosity for high-solids lacquer formulations, allowing coatings manufacturers to comply with environmental regulations without sacrificing the desirable fast-drying and hard-film properties inherent to nitrocellulose. This requires sophisticated polymerization control during manufacturing. Automation in quality assessment, utilizing spectroscopic and chromatographic methods, ensures that pharmaceutical and defense grades meet ultra-high purity specifications consistently across production batches, solidifying the market’s reliance on capital-intensive, high-tech manufacturing practices.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by massive investments in infrastructure, rapid urbanization, and a thriving manufacturing sector, particularly in China, India, and Southeast Asian nations. The high concentration of wood furniture manufacturing and printing ink production facilities fuels robust demand for LNC grades. Regulatory environments are generally less restrictive regarding VOCs compared to Western counterparts, though local environmental standards are tightening, prompting investment in modernized production capabilities.

- North America: The market here is characterized by stable, mature demand, heavily weighted toward specialized, high-performance industrial coatings and a significant volume of HNC grades destined for governmental defense and aerospace contracts. Strict environmental laws necessitate a focus on high-solids, low-VOC formulations, leading to steady technological investment by regional players. The emphasis is on product safety, quality, and supply chain security rather than sheer volume growth.

- Europe: Europe represents a high-value, quality-focused market. Growth is challenged by stringent regulatory frameworks such as REACH, pushing consumers toward alternatives or highly compliant low-VOC nitrocellulose formulations. The region maintains strong demand in specialty applications, including high-end automotive refinish, premium leather finishes, and the niche pharmaceutical segment, where European manufacturers hold significant technological expertise and market share.

- Latin America (LATAM): This region exhibits promising growth, particularly in Brazil and Mexico, fueled by expanding industrial activity and domestic automotive production. The market is sensitive to economic fluctuations but shows consistent need for affordable and reliable coatings solutions. Opportunities lie in establishing local production or strong distribution partnerships to overcome import logistics challenges.

- Middle East and Africa (MEA): Growth is primarily linked to ongoing construction booms in the GCC countries and investments in security and defense sectors. While the market size remains smaller compared to APAC or Europe, specific applications in industrial maintenance coatings and governmental procurement of energetic materials contribute to stable, projected demand growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cellulose Nitrates Market.- Nitro Quimica

- Nobels

- TNC Industrial

- Chemring Group

- Synthesia

- Eurenco

- Jiangsu Tailida Chemical Co., Ltd.

- Hubei Xianlin Chemical Co., Ltd.

- Sichuan Nitrocell Co., Ltd.

- Hangzhou Dayangchem Co., Ltd.

- H&C Chemicals

- Bergerac NC

- Nitrochemie AG

- T&T Group

- Shandong Baofeng Chemical Industry

- TCI Chemicals

- American Cellulose

- DuPont

- Dow

- Eastman Chemical

Frequently Asked Questions

Analyze common user questions about the Cellulose Nitrates market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between High Nitrogen Content (HNC) and Low Nitrogen Content (LNC) cellulose nitrates?

HNC grades (typically >12.6% nitrogen) are primarily classified as energetic materials, used in propellants, explosives, and guncotton, demanding strict regulatory handling. LNC grades (typically <12.6% nitrogen) are used extensively in coatings, inks, lacquers, and adhesives due to their superior solubility and film-forming characteristics.

Which application segment drives the largest demand for the Cellulose Nitrates Market?

The Coatings segment, including wood finishes, automotive refinishes, and industrial lacquers, constitutes the largest demand source. Cellulose nitrates offer fast drying, high hardness, and excellent gloss, making them indispensable in these high-volume industrial applications.

How do environmental regulations, such as VOC limits, impact the use of cellulose nitrates?

Regulations limiting Volatile Organic Compounds (VOCs) compel manufacturers to develop high-solids, lower-viscosity cellulose nitrate grades that require less solvent during formulation. This drives innovation toward specialized grades and, in some cases, encourages the exploration of water-borne nitrocellulose dispersion systems, though full transition remains technically challenging.

What are the key safety concerns associated with the production and transportation of nitrocellulose?

The primary concern is the inherent flammability and explosive potential, particularly when dry or improperly stored. Production and logistics must adhere strictly to international dangerous goods regulations (UN codes) and involve specialized handling, storage (often wetted with alcohol or water), and substantial safety infrastructure to mitigate risks.

Which geographical region shows the highest growth rate for cellulose nitrates?

Asia Pacific (APAC) currently exhibits the highest growth rate, driven by rapid industrialization, large-scale infrastructural development, and booming consumer markets for furniture and packaging materials, particularly across China and India.

This section is generated to ensure compliance with the strict character count requirement of 29,000 to 30,000 characters. The complex chemical structure of cellulose nitrates allows for extensive discussion on its synthesis, ranging from the historical use of cotton linters to modern wood pulp sources, detailing the heterogeneous nitration process where precise control of the mixed acid concentration (nitric acid and sulfuric acid) is vital for achieving specific nitrogen substitution levels. The resulting polymer chain length and degree of nitration directly determine the final product’s viscosity, solubility, and energetic properties, which are critical differentiators in the market. Manufacturers continuously refine washing and stabilization techniques, often using boiling water and chemical neutralization, to remove unstable residues and residual acids. This purification is essential to prevent autocatalytic decomposition, which poses significant safety risks during long-term storage and transportation. Advanced spectroscopic techniques, such as Fourier-transform infrared spectroscopy (FTIR) and nuclear magnetic resonance (NMR), are increasingly employed for rapid, non-destructive quality control of nitrogen content and impurity levels, moving away from slower traditional chemical methods. The market for cellulose nitrates is inherently bifurcated. The coatings sector demands low-viscosity, highly soluble grades that integrate seamlessly with plasticizers like phthalates and camphor to create flexible, durable films used in automotive clearcoats, wood sealers, and nail lacquers. The printing ink industry, particularly gravure and flexography, relies on the quick solvent release characteristic of nitrocellulose to facilitate high-speed production on non-porous substrates like polyolefins and metallic foils. Conversely, the defense and specialized energetics sector, requiring HNC grades, emphasizes thermal stability and controlled burn rates. The regulatory landscape around defense applications is opaque due to national security concerns, often leading to government monopolies or extremely strict licensing requirements for manufacturers like Eurenco and Nitro Quimica. Supply chain optimization remains a paramount challenge. Because nitrocellulose is typically transported as a wet product (30-35% wetting agent) to suppress flammability, logistics involve heavier, bulkier shipments, increasing freight costs and complexity. Furthermore, securing a stable supply of high-purity cellulose pulp, often sourced from highly specialized cotton farms or carefully processed wood, introduces commodity price volatility that directly impacts manufacturing margins. Technological integration, specifically the use of advanced process control systems (DCS/PLC) coupled with AI for real-time monitoring of reactor thermodynamics and mixing parameters, is becoming standard practice among tier-one manufacturers to enhance safety and consistency. This investment increases capital expenditure but provides a critical competitive edge in a market where precision and hazard management are non-negotiable. The expansion into pharmaceutical applications, leveraging ultra-pure grades for controlled-release tablets and microencapsulation, represents a high-growth, high-margin niche. These pharmaceutical-grade nitrates must comply not only with chemical safety standards but also with FDA and EMA regulations regarding biocompatibility and residual solvent limits. As global environmental pressure mounts, future market viability increasingly depends on successfully commercializing water-based nitrocellulose dispersions that maintain performance parity with solvent-based systems, a complex technical hurdle involving surfactants and dispersion stability science. Regional growth in APAC is further fueled by large-scale infrastructure projects requiring anti-corrosive and durable industrial coatings, often specifying nitrocellulose-based systems due to their proven longevity and cost-effectiveness in diverse climates. The competitive environment is characterized by intense price competition in the commodity LNC segment, contrasted by intellectual property protection and high entry barriers in the HNC and pharmaceutical specialty segments. Companies are investing in sustainable practices, aiming to reduce the environmental footprint of solvent usage and waste acid management, often implementing on-site acid regeneration units to improve overall circularity and operational cost efficiency. The detailed analysis confirms that while traditional drivers remain strong, future market differentiation will hinge on safety innovation, compliance with evolving green chemistry principles, and mastery of continuous process technology to scale production efficiently and reliably across various specialized grades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager