Central Vascular Access Device Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441591 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Central Vascular Access Device Market Size

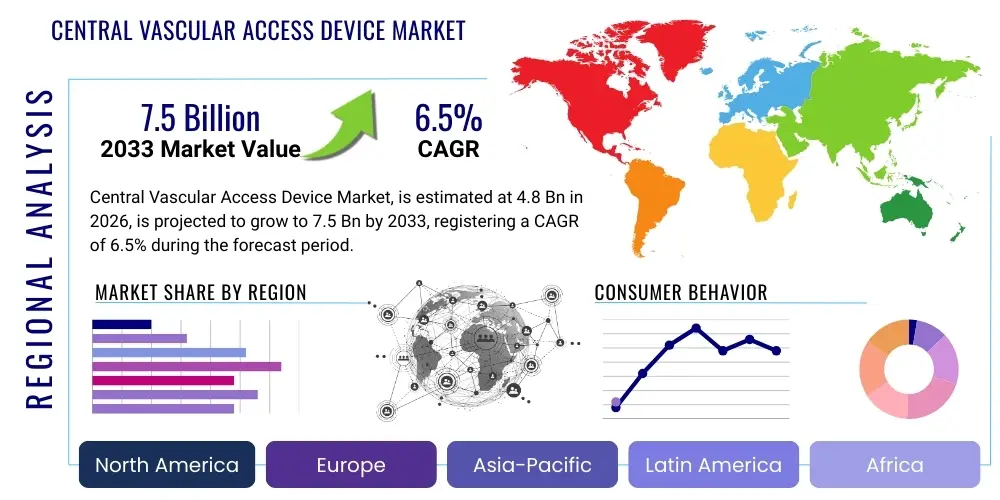

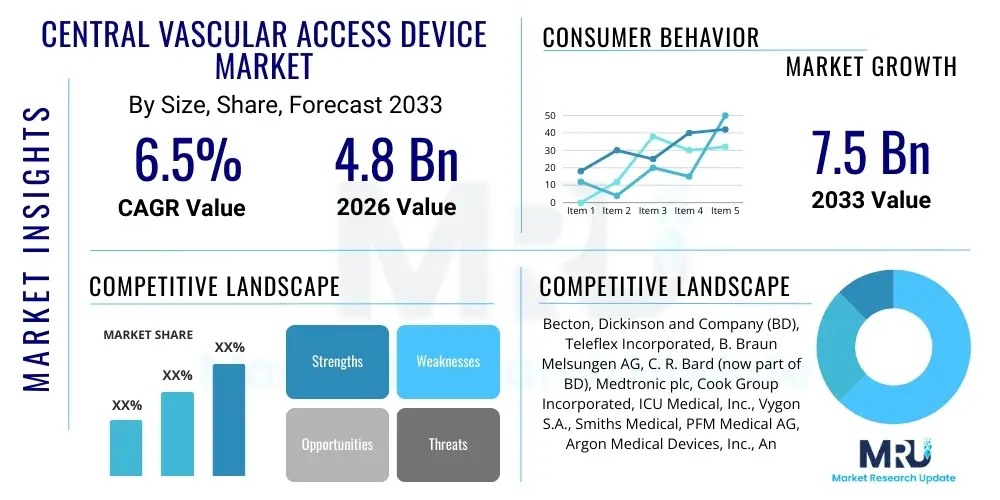

The Central Vascular Access Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Central Vascular Access Device Market introduction

The Central Vascular Access Device (CVAD) market encompasses specialized medical instruments used to administer medication, fluids, blood products, or nutritional solutions, or to monitor hemodynamic parameters directly into a large central vein, typically the superior or inferior vena cava. These devices are crucial for patients requiring long-term or intensive intravenous therapy, serving as essential tools in oncology, critical care, infectious disease treatment, and renal replacement therapy. CVADs are categorized broadly into Peripherally Inserted Central Catheters (PICCs), Non-Tunneled Central Venous Catheters (CVCs), Tunneled CVCs, and Implanted Ports, each designed for varying durations and complexities of vascular access needs.

The principal applications driving the adoption of CVADs include chemotherapy administration, prolonged antibiotic treatments, parenteral nutrition delivery, and repeated blood sampling in chronic disease management. These devices offer significant benefits over peripheral intravenous lines, such such as reduced risk of extravasation, minimized need for repeated venipuncture, and the capability to infuse high-osmolarity or caustic substances safely. The market expansion is intrinsically linked to the increasing global incidence of chronic diseases, particularly cancer and end-stage renal disease, alongside the growing elderly population which frequently requires long-term vascular access solutions.

Key driving factors supporting market growth involve continuous advancements in material science, focusing on enhanced biocompatibility and antimicrobial properties to reduce infection rates, which remain a major CVAD complication. Furthermore, the trend toward minimally invasive insertion techniques, guided by ultrasound and advanced imaging, improves procedural safety and efficacy. The expanding acceptance of home healthcare settings, where long-term CVADs facilitate outpatient treatment, also provides a substantial impetus to market growth, shifting demand towards user-friendly and reliable access systems.

Central Vascular Access Device Market Executive Summary

The Central Vascular Access Device (CVAD) market is characterized by robust innovation focusing primarily on minimizing device-related bloodstream infections (CRBSIs) and enhancing patient safety. Key business trends include the strategic consolidation of major players through mergers and acquisitions to leverage technological synergies, particularly in developing antimicrobial catheter materials and sophisticated insertion kits. There is a discernible market shift towards premium products offering specialized features, such as devices with power injection capabilities for CT scans and those integrated with specialized monitoring technologies, thereby commanding higher average selling prices and driving overall market valuation.

Regionally, North America maintains market dominance due to its highly developed healthcare infrastructure, rapid adoption of advanced medical technologies, and the presence of stringent regulatory guidelines that necessitate high-quality, complication-reducing devices. However, the Asia Pacific region is poised for the fastest growth, propelled by increasing healthcare expenditure, rising awareness regarding safe vascular access practices, and the expansion of critical care facilities in emerging economies like China and India. European countries demonstrate stable growth, driven by standardized clinical protocols and reimbursement policies favoring the use of advanced CVAD types, particularly PICCs, for cost-effective long-term treatment.

Segment trends indicate that Peripherally Inserted Central Catheters (PICCs) remain the most utilized product type, favored for their balance of ease of insertion and suitability for medium-to-long-term use, especially in oncology settings. Within end-user segments, hospitals and ambulatory surgical centers (ASCs) continue to represent the largest volume consumers, although the home healthcare segment is experiencing accelerated growth due to demographic shifts and the desire for decentralized patient care. Technological advancements in catheter design, including integrated valve technology and polyurethane/silicone material hybridizations, are driving incremental innovation across all major product categories.

AI Impact Analysis on Central Vascular Access Device Market

Common user questions regarding AI's influence on the CVAD market frequently revolve around its potential to mitigate insertion complications, predict catheter failure or infection risks, and optimize inventory management within large hospital systems. Users seek clarity on how machine learning algorithms can enhance procedural precision during catheter placement, particularly in challenging anatomical cases, thus reducing associated trauma and malpositioning. Concerns are also focused on the regulatory pathway for AI-integrated CVAD technologies and the data privacy implications of utilizing vast patient data sets to train predictive models for catheter care and maintenance. Furthermore, there is significant interest in AI's role in supporting less experienced healthcare personnel, offering real-time decision support during complex insertion or troubleshooting scenarios, ultimately aiming for improved patient outcomes and cost efficiencies.

AI algorithms are being developed to leverage real-time ultrasound and fluoroscopic imaging data, providing augmented reality guidance to clinicians during the catheterization procedure. This immediate feedback loop significantly improves the accuracy of tip placement and reduces the number of attempts, directly addressing the restraint of reliance on highly skilled operators. Beyond the insertion phase, AI models are being trained on electronic health record (EHR) data, vital signs, and laboratory results to construct personalized risk profiles for individual patients, enabling proactive intervention to prevent catheter-related bloodstream infections (CRBSIs) or thrombotic events. This predictive capability shifts the clinical paradigm from reactive troubleshooting to preventative maintenance, substantially enhancing the long-term safety and functionality of the devices.

Furthermore, AI is streamlining the operational aspects of CVAD management. In supply chain logistics, machine learning optimizes stock levels based on predictive consumption patterns related to hospital occupancy, seasonal disease prevalence, and surgical schedules, ensuring the availability of specialized devices while minimizing waste and carrying costs. In clinical documentation, Natural Language Processing (NLP) is automating the extraction and standardization of procedural data, improving compliance reporting and facilitating large-scale quality improvement studies related to CVAD efficacy and complication rates. This confluence of clinical precision, predictive maintenance, and operational efficiency positions AI as a transformative force in the CVAD ecosystem, driving both safety enhancements and economic benefits.

- AI-Enhanced Image Guidance: Provides real-time, augmented reality visual overlays for precise catheter tip placement during insertion.

- Predictive Risk Modeling: Analyzes patient data (EHR, labs) to forecast the probability of Catheter-Related Bloodstream Infections (CRBSIs) or occlusion.

- Automated Quality Control: Uses computer vision to assess catheter integrity and securement post-insertion, minimizing procedural errors.

- Optimized Inventory Management: Machine learning models forecast CVAD demand based on hospital census and procedural scheduling.

- Clinical Decision Support: Offers real-time alerts and recommendations for catheter maintenance, flushing protocols, and dressing changes.

- Robotic Assistance: Potential integration of AI for semi-autonomous or fully autonomous catheter insertion systems in the future.

DRO & Impact Forces Of Central Vascular Access Device Market

The dynamics of the Central Vascular Access Device market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces. The primary drivers include the escalating global prevalence of chronic illnesses such as cancer, cardiovascular diseases, and diabetes, necessitating long-term pharmacological treatments that rely on reliable vascular access. Concurrently, the increasing elderly demographic, which frequently requires complex and extended medical care, inherently expands the patient pool needing CVADs. These factors create sustained demand across acute care and outpatient settings, bolstering the foundational growth of the market.

Conversely, significant restraints hinder market growth and adoption rates. The most critical constraint is the inherent risk of severe complications associated with CVADs, notably Catheter-Related Bloodstream Infections (CRBSIs), deep vein thrombosis (DVT), and mechanical failure. The high morbidity and mortality rates linked to CRBSIs necessitate rigorous procedural training, imposing operational challenges and increasing healthcare costs, which pressures providers to seek alternatives or invest heavily in infection prevention technologies. Moreover, the scarcity of highly skilled healthcare professionals specialized in complex catheter insertion techniques, particularly in peripheral veins for PICCs, limits procedure throughput and broad accessibility in resource-constrained environments.

Despite these challenges, substantial opportunities are present, mainly revolving around innovation in product technology and evolving care settings. The development of next-generation CVADs incorporating antimicrobial coatings, integrated valve systems to prevent reflux, and advanced materials designed for superior thromboresistance represents a major growth avenue. Furthermore, the accelerating trend toward decentralized care, including home infusion therapy and use in ambulatory surgery centers (ASCs), expands the market reach outside traditional hospital walls. Strategic alliances between manufacturers and infection control bodies to standardize best practices also serve as a powerful force for market legitimization and growth.

Segmentation Analysis

The Central Vascular Access Device market is meticulously segmented across product type, insertion site, application, material, and end-user, reflecting the diverse clinical needs and technological complexity inherent in vascular access. Analyzing these segments provides a detailed understanding of market dynamics, identifying specific high-growth areas and dominant product categories. The segmentation by product type, encompassing PICCs, CVCs, and implanted ports, remains fundamental, dictating duration of use and insertion complexity. The application segmentation, which includes chemotherapy, fluid administration, and blood transfusion, highlights the principal therapeutic areas driving demand, with oncology consistently being the largest segment due to the intensive nature of cancer treatment protocols. Geographic analysis further refines the understanding, distinguishing established high-volume markets like North America from rapidly expanding, high-potential regions such as Asia Pacific.

The segmentation by insertion site—categorizing devices based on vein access points such as the cephalic, basilic, jugular, or subclavian veins—is critical for clinical practice and product design, influencing complication rates and patient comfort. Materials used in manufacturing, primarily polyurethane and silicone, also form a key segmentation, driven by considerations of biocompatibility, flexibility, and longevity. Polyurethane catheters often dominate acute care due to their rigidity and high flow rates, while silicone is preferred for long-term implanted devices due to its pliability and reduced potential for vein irritation. End-user segmentation, focusing on hospitals, ambulatory centers, and home healthcare, illustrates the evolving landscape of care delivery, demonstrating a significant shift toward outpatient settings facilitated by user-friendly devices and improved training protocols.

- Product Type:

- Peripherally Inserted Central Catheters (PICCs)

- Non-Tunneled Central Venous Catheters (CVCs)

- Tunneled Central Venous Catheters (CVCs)

- Implanted Ports

- Insertion Site:

- Upper Extremity Veins (Basilic, Cephalic)

- Internal Jugular Vein

- Subclavian Vein

- Femoral Vein

- Application:

- Chemotherapy

- IV Fluid and Nutrition Administration (Parenteral Nutrition)

- Antibiotic/Antiviral Administration

- Blood Transfusion and Sampling

- Dialysis and Apheresis

- Material:

- Polyurethane

- Silicone

- Others (e.g., Polyethylene, Teflon)

- End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs) and Specialty Clinics

- Home Healthcare Settings

- Geography:

- North America (U.S., Canada)

- Europe (Germany, U.K., France)

- Asia Pacific (China, Japan, India)

- Latin America (Brazil, Mexico)

- Middle East and Africa (MEA)

Value Chain Analysis For Central Vascular Access Device Market

The value chain for the Central Vascular Access Device market begins with the specialized sourcing and processing of high-grade raw materials, primarily medical-grade silicone and polyurethane, which must meet stringent biocompatibility and mechanical strength specifications. The upstream segment involves chemical and material suppliers who provide these polymers under tight quality control. Manufacturing processes are complex, requiring precision extrusion, molding, assembly of specialized components (like antimicrobial coatings and injection ports), and rigorous sterilization procedures, primarily carried out in highly controlled, specialized facilities. Quality assurance and regulatory compliance (such as FDA and CE Mark approvals) are paramount at this stage, significantly influencing production costs and time-to-market.

The middle segment focuses on distribution, which is bifurcated into direct and indirect channels. Direct distribution is often utilized by major market players for large institutional clients (major hospital chains or Government purchasers), allowing for better control over pricing and technical support, which is critical for complex medical devices. Indirect distribution relies heavily on regional distributors, wholesalers, and specialized medical device procurement agencies, particularly in geographically diverse or emerging markets, enabling broader market penetration and efficient inventory management across varied healthcare systems. Effective logistics, ensuring sterile delivery and proper handling, forms a crucial component of this segment.

The downstream segment involves the end-users—hospitals, ambulatory surgical centers, and home care providers—who utilize the devices. Service integration, including comprehensive clinical training for insertion and maintenance protocols, post-sale support, and infection surveillance systems, adds significant value at this stage. The ultimate consumers are the patients receiving therapy, and the successful application of the CVAD directly impacts their treatment outcomes. Continuous feedback loops from clinicians to manufacturers regarding product performance and complications drive iterative improvements in design and material science, reinforcing the value chain.

Central Vascular Access Device Market Potential Customers

The primary consumers and end-users of Central Vascular Access Devices are large institutional entities and specialized healthcare providers requiring reliable and long-term vascular access solutions for complex patient populations. Hospitals, particularly large tertiary care centers and university teaching hospitals, represent the largest customer base, driven by their high volume of critical care, surgical, and oncology patients who require immediate and prolonged central access. Within hospitals, intensive care units (ICUs), emergency departments, operating rooms, and oncology wards are the key points of consumption, demanding a wide range of CVAD types from non-tunneled CVCs for rapid, short-term use to PICCs and implanted ports for medium and long-term therapeutic needs.

Beyond traditional hospital settings, Ambulatory Surgical Centers (ASCs) and specialized infusion clinics focusing on oncology, pain management, and autoimmune disorders form a rapidly growing customer segment. These facilities favor devices that support outpatient infusion therapy, such as PICCs and implanted ports, offering lower overhead costs and increased patient comfort compared to inpatient hospital stays. The expanding home healthcare sector also constitutes a high-potential customer group, fueled by demographic trends and advancements in durable medical equipment, requiring CVADs that are secure, easy to manage, and minimize the risk of infection in non-clinical environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton, Dickinson and Company (BD), Teleflex Incorporated, B. Braun Melsungen AG, C. R. Bard (now part of BD), Medtronic plc, Cook Group Incorporated, ICU Medical, Inc., Vygon S.A., Smiths Medical, PFM Medical AG, Argon Medical Devices, Inc., AngioDynamics, Inc., Fresenius Medical Care, Nipro Corporation, Cardinal Health, Inc., Terumo Corporation, Edwards Lifescience, Kimal PLC, Merit Medical Systems, Inc., Promedon S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Central Vascular Access Device Market Key Technology Landscape

The Central Vascular Access Device market is characterized by intense technological evolution focused primarily on improving patient safety, increasing device longevity, and simplifying insertion procedures. A paramount technological trend is the development and commercialization of advanced materials, particularly those engineered with antimicrobial properties. These often include catheters infused or coated with silver, chlorhexidine, or specialized antibiotics designed to inhibit microbial colonization on the device surface, thereby drastically reducing the incidence of Catheter-Related Bloodstream Infections (CRBSIs). These sophisticated material science advancements are crucial in differentiating premium products and driving clinical adoption across high-risk patient populations, especially in critical care and long-term care environments.

Another significant technological driver is the integration of advanced visualization and guidance systems into the insertion process. The shift from traditional landmark-based methods to real-time ultrasound guidance, and increasingly, electromagnetic tip location (ETL) systems, has revolutionized the safety and efficacy of CVAD placement. ETL technologies confirm the accurate positioning of the catheter tip within the cavoatrial junction, minimizing the need for confirmatory chest X-rays, saving time and resources, and reducing radiation exposure. Furthermore, power injection compatible CVADs, identifiable by high-pressure tolerance markings, allow for rapid injection of contrast media necessary for CT and MRI scans, enhancing the utility and multipurpose function of the device.

Beyond insertion, advancements in valve technology, such as neutral displacement and positive pressure valves, are integrated into catheter hubs and implanted ports to minimize blood reflux into the catheter lumen, preventing occlusion and maintaining patency over extended periods. Future technological landscapes are rapidly moving toward "smart catheters" equipped with sensors capable of monitoring blood flow dynamics, detecting early signs of thrombosis, or signaling changes in inflammatory markers indicative of impending infection. The amalgamation of these sensor technologies with external monitoring platforms and AI-driven predictive analytics promises a paradigm shift in CVAD management, extending usage duration and improving overall clinical outcomes by enabling proactive, rather than reactive, device maintenance.

Regional Highlights

The Central Vascular Access Device Market exhibits distinct dynamics across key geographical regions, influenced by varying healthcare infrastructures, regulatory landscapes, and disease prevalence rates. North America, specifically the United States, commands the largest market share, driven by high per capita healthcare spending, widespread adoption of premium technologies (like antimicrobial PICCs and advanced tip location systems), and the presence of highly standardized clinical guidelines promoting safe CVAD usage. The region's robust reimbursement framework encourages the use of high-cost, high-performance devices aimed at infection reduction, creating a highly competitive environment focused on innovation and safety.

Europe represents the second-largest market, characterized by mature healthcare systems and centralized purchasing mechanisms, particularly within the NHS in the UK and centralized social security systems in Germany and France. Growth in Europe is stable, sustained by the high incidence of cancer and cardiovascular diseases, and adherence to European Union directives promoting patient safety and quality of care. The adoption of PICCs is particularly strong in Europe, recognized as a cost-effective alternative to traditional CVCs for medium-term therapy, while stringent medical device regulations (such as the Medical Device Regulation, MDR) influence market entry and product specifications, demanding extensive clinical evidence.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is attributed to massive population growth, improving access to healthcare, escalating government investments in modernizing hospital infrastructure, and increasing medical tourism. Countries like China and India, with their rising burden of chronic diseases and expanding middle class, are fueling demand. While price sensitivity remains a factor, the increasing awareness regarding the complications associated with poor vascular access is driving the adoption of safer, higher-quality CVADs, especially in metropolitan tertiary care centers, making APAC a critical growth frontier for global manufacturers.

- North America (U.S. and Canada): Market leader due to advanced infrastructure, high adoption of novel technologies (e.g., ETL), and favorable reimbursement policies for infection control measures.

- Europe (Germany, U.K., France): Second-largest market, driven by universal healthcare coverage, standardized protocols for CVAD maintenance, and strong clinical focus on reducing hospital-acquired infections (HAIs).

- Asia Pacific (China, India, Japan): Fastest-growing region, stimulated by massive investments in healthcare, expanding critical care capacity, rising prevalence of oncology cases, and increasing public awareness.

- Latin America (Brazil, Mexico): Emerging market characterized by fragmented healthcare systems; growth driven by increasing foreign direct investment in private healthcare and efforts to standardize clinical practice.

- Middle East and Africa (MEA): Growth concentrated in affluent GCC nations (UAE, Saudi Arabia) due to high infrastructure spending and medical specialization, particularly in high-volume cardiac and oncological centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Central Vascular Access Device Market.- Becton, Dickinson and Company (BD)

- Teleflex Incorporated

- B. Braun Melsungen AG

- Medtronic plc

- Cook Group Incorporated

- ICU Medical, Inc.

- Vygon S.A.

- Smiths Medical (a part of ICU Medical, Inc.)

- PFM Medical AG

- Argon Medical Devices, Inc.

- AngioDynamics, Inc.

- Fresenius Medical Care

- Nipro Corporation

- Cardinal Health, Inc.

- Terumo Corporation

- Edwards Lifescience

- Kimal PLC

- Merit Medical Systems, Inc.

- Promedon S.A.

- Baihe Medical

Frequently Asked Questions

Analyze common user questions about the Central Vascular Access Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Central Vascular Access Device (CVAD) Market?

The CVAD market growth is primarily driven by the rising global incidence of chronic diseases, notably cancer and renal failure, which necessitate long-term intravenous therapy. Furthermore, the increasing geriatric population, demanding prolonged and complex medical care, and technological advancements focusing on reducing device-related infections are key growth accelerators.

Which product segment holds the largest share in the CVAD Market?

Peripherally Inserted Central Catheters (PICCs) typically hold the largest market share by volume. PICCs are preferred for medium-term access (weeks to months) due to their relatively simple insertion procedure, suitability for various therapies including chemotherapy, and proven efficacy in minimizing patient discomfort and hospitalization time compared to surgical implantations.

What is the most significant restraint affecting the Central Vascular Access Device Market?

The most significant restraint is the high risk and incidence of Catheter-Related Bloodstream Infections (CRBSIs). These serious complications increase patient morbidity, mortality rates, and overall healthcare costs, compelling manufacturers to invest heavily in antimicrobial technology and demanding continuous procedural vigilance from healthcare providers.

How is technology impacting the safety and efficacy of CVAD insertion?

Technology is significantly enhancing safety through the adoption of real-time ultrasound guidance and Electromagnetic Tip Location (ETL) systems. These tools provide visual confirmation of vessel access and accurate catheter tip placement in the cavoatrial junction, substantially reducing malpositioning errors and the reliance on traditional confirmatory chest radiographs.

Which geographical region is anticipated to demonstrate the fastest market growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR. This accelerated growth is fueled by massive infrastructure development in healthcare, rising medical expenditure in developing nations like China and India, and increasing awareness and standardization of advanced critical care practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager