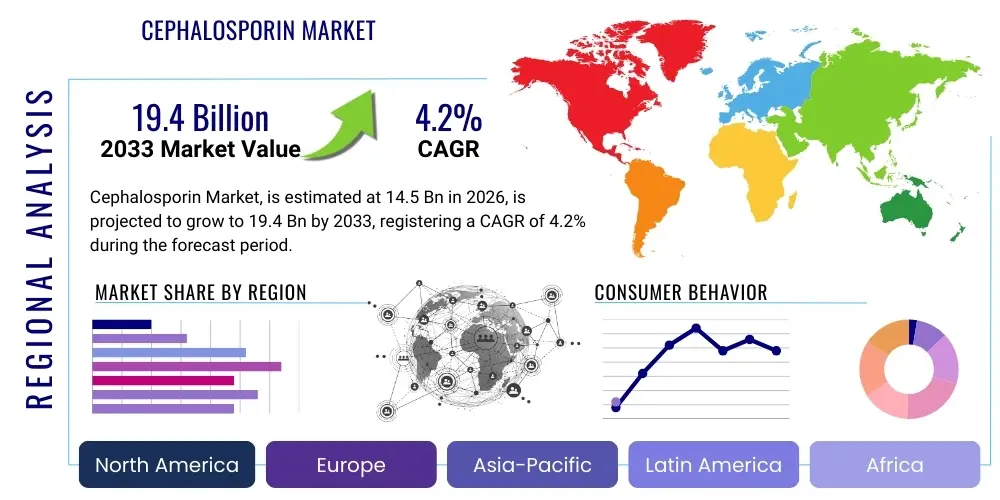

Cephalosporin Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442393 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Cephalosporin Market Size

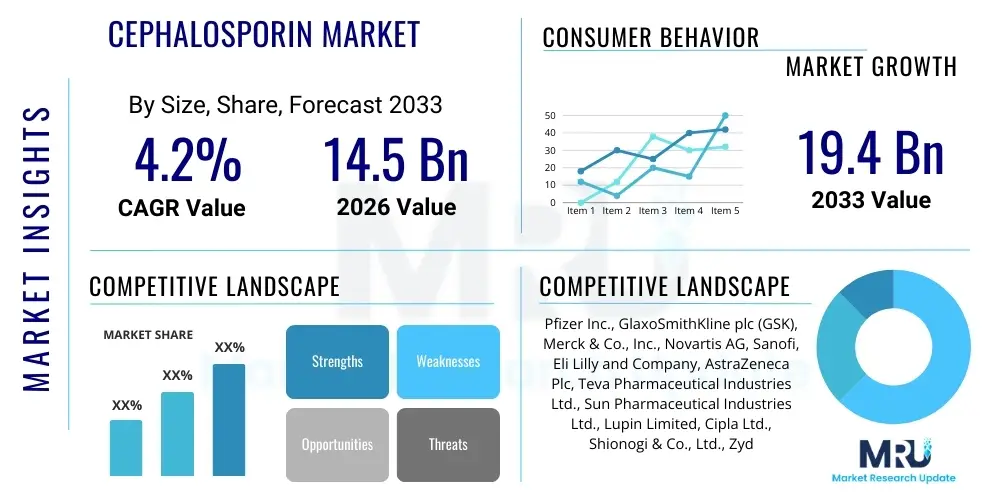

The Cephalosporin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 19.4 Billion by the end of the forecast period in 2033.

Cephalosporin Market introduction

The Cephalosporin Market encompasses a significant segment within the global pharmaceutical industry, focusing on a class of beta-lactam antibiotics derived originally from the fungus Acremonium (formerly known as Cephalosporium). These agents are crucial for treating a wide spectrum of bacterial infections, particularly those caused by Gram-positive and Gram-negative organisms. Cephalosporins are broadly classified into five generations, with increasing effectiveness against resistant strains and broader spectrum activity moving toward the fifth generation. Key applications span community-acquired pneumonia, complicated skin and soft tissue infections (cSSTIs), urinary tract infections (UTIs), and surgical prophylaxis. Their robust efficacy and relative safety profile compared to older antibiotics maintain their status as a cornerstone in both inpatient and outpatient antimicrobial therapy globally.

The product landscape is characterized by constant innovation driven by the accelerating global threat of Antimicrobial Resistance (AMR). Manufacturers are heavily investing in developing novel cephalosporin structures, often combined with beta-lactamase inhibitors, to restore activity against multi-drug resistant (MDR) pathogens. This shift in focus, particularly towards 3rd, 4th, and 5th generation compounds, is essential for maintaining clinical relevance. Furthermore, the market benefits from stable demand in emerging economies where infectious disease burdens remain high, coupled with standardized clinical guidelines that frequently recommend cephalosporins as first-line or empirical therapy across various clinical settings. The established nature of these drugs ensures predictable uptake, supported by comprehensive formulary listings in major healthcare systems worldwide.

Driving factors for sustained market growth include the rising prevalence of chronic diseases leading to immunocompromised states, which subsequently increase susceptibility to bacterial infections. Furthermore, increasing surgical volumes globally necessitate enhanced perioperative infection control, heavily relying on cephalosporins for prophylaxis. The inherent benefits of cephalosporins, such as low toxicity, predictable pharmacokinetics, and availability in multiple dosage forms (oral and parenteral), reinforce their utility. However, the market must continuously address the challenge of generic erosion for older generations and the high cost and regulatory complexity associated with introducing new, resistance-breaking products, particularly those targeting strains like Methicillin-resistant Staphylococcus aureus (MRSA) and Extended-spectrum beta-lactamase (ESBL)-producing organisms.

Cephalosporin Market Executive Summary

The Cephalosporin Market is undergoing a strategic evolution, transitioning from reliance on mature, off-patent compounds to prioritizing sophisticated, fifth-generation formulations designed to combat critical antimicrobial resistance (AMR) threats. Business trends indicate a focus on strategic partnerships between large pharmaceutical companies and smaller biotech firms specializing in novel anti-infective mechanisms, aimed at accelerating pipeline development and market penetration for new drugs like ceftolozane/tazobactam or ceftaroline fosamil. Pricing pressures persist across mature markets like North America and Europe due to robust generic competition for older cephalosporin generations, compelling key market players to optimize manufacturing efficiency and secure robust supply chains. Concurrently, increasing regulatory support, such as Qualified Infectious Disease Product (QIDP) designation in the US, provides critical market exclusivity incentives necessary to recoup the substantial investment required for anti-infective R&D, thereby bolstering the long-term sustainability of innovation in this therapeutic area.

Regional trends highlight the Asia Pacific (APAC) region as the primary engine of future growth, driven by rapid expansion of healthcare infrastructure, increasing awareness of proper antibiotic stewardship, and large, rapidly growing patient populations susceptible to infections. Specifically, countries like China and India are seeing substantial increases in cephalosporin consumption, though often characterized by a dominance of generic formulations. Conversely, established markets in North America and Europe demonstrate a preference for the latest generation cephalosporins, particularly in hospital settings where resistance rates are highest, thereby commanding premium pricing. Investment in R&D remains concentrated in Western markets, but clinical trial activities and manufacturing shifts are increasingly leaning towards APAC and Latin America, capitalizing on lower operational costs and diverse patient cohorts. Furthermore, public health initiatives globally are standardizing guidelines for cephalosporin use, which stabilizes demand but requires dynamic adaptation from manufacturers regarding formulation and distribution.

Segmentation trends reveal that the Third-Generation Cephalosporins (e.g., Ceftriaxone, Cefotaxime) retain the largest market share due to their broad spectrum and established efficacy across numerous common infections, despite heavy genericization. However, the Fifth-Generation segment, while currently smaller, is exhibiting the highest growth trajectory (CAGR), fueled by the critical clinical need to address MDR Gram-positive pathogens, notably MRSA. From an administrative perspective, the Parenteral route dominates revenue generation, reflecting the acute nature of the infections treated in hospital and critical care environments, although oral formulations maintain importance for outpatient treatment and transitioning patients from inpatient intravenous therapy. Application-wise, respiratory tract infections and complicated skin and soft tissue infections represent the most significant revenue drivers, underscoring the vital role cephalosporins play in managing severe community-acquired and nosocomial infections.

AI Impact Analysis on Cephalosporin Market

User interest regarding the application of Artificial Intelligence (AI) in the Cephalosporin market centers predominantly on three critical areas: accelerating the discovery of novel cephalosporin scaffolds that can evade current resistance mechanisms, optimizing clinical trial design to rapidly validate new drug combinations, and improving antibiotic stewardship programs within healthcare systems. Key concerns often revolve around whether AI can truly address the complexity of beta-lactamase variability and if it can predict long-term resistance evolution. Expectations are high for AI to significantly reduce the timeline and costs associated with anti-infective R&D, specifically through high-throughput screening simulations and the precise identification of patient subgroups that would benefit most from specific cephalosporin treatments, thereby maximizing efficacy and minimizing unnecessary usage that drives resistance. Furthermore, there is significant interest in AI-powered diagnostics that can quickly identify the exact pathogen and its resistance profile, guiding clinicians toward optimal cephalosporin selection in real-time.

AI's role extends beyond basic R&D into operational efficiencies within the market ecosystem. Machine learning algorithms are now being deployed by leading manufacturers to optimize complex fermentation and purification processes inherent in cephalosporin synthesis, leading to enhanced yields and reduced batch variation. In the supply chain, predictive analytics driven by AI models help forecast regional demand fluctuations, taking into account seasonal infection trends and local resistance patterns, thus preventing shortages or excess inventory of critical antibiotics. This technological integration ensures a more resilient and responsive supply chain, particularly vital for generics that are often prone to supply chain disruptions due to intense pricing competition and dependency on specific raw materials.

The implementation of AI-driven surveillance systems represents a paradigm shift in combating AMR, directly impacting the long-term utility of existing cephalosporins. By analyzing vast datasets of clinical microbiology results, AI can detect emerging resistance patterns earlier than traditional methods, allowing healthcare providers and public health agencies to issue timely warnings and adjust empirical treatment protocols, often favoring newer or more potent cephalosporin combinations. This enhanced vigilance helps preserve the effectiveness of the current therapeutic arsenal, extending the effective market life of critical drugs and influencing future R&D pipelines towards the most pressing resistance threats identified by these analytical tools.

- AI-driven drug discovery accelerates identification of novel cephalosporin structures effective against MDR pathogens.

- Machine learning optimizes clinical trial design, reducing timelines and costs for new anti-infectives.

- Predictive analytics enhance manufacturing efficiency and supply chain resilience for cephalosporin production.

- AI-powered diagnostic tools facilitate rapid identification of bacterial strains and resistance profiles, guiding treatment.

- Advanced surveillance systems use big data to monitor and predict the geographical spread of antimicrobial resistance (AMR).

- Algorithms support optimized antibiotic stewardship programs, ensuring appropriate prescribing practices and minimizing misuse.

DRO & Impact Forces Of Cephalosporin Market

The dynamics of the Cephalosporin Market are fundamentally shaped by the escalating global crisis of Antimicrobial Resistance (AMR), which acts as both the primary driver for innovation and the most critical restraint concerning the longevity of existing drugs. Drivers include the increasing global incidence of bacterial infections, rising rates of hospital-acquired infections (HAIs), and robust government funding programs aimed at incentivizing novel antibiotic development, such as the US QIDP designation. However, significant restraints impede growth, primarily the severe market failures associated with anti-infective development, characterized by high R&D costs, low financial returns due to short treatment courses, and strict regulatory hurdles imposed by agencies like the FDA and EMA. Opportunities reside chiefly in developing next-generation cephalosporins paired with novel beta-lactamase inhibitors (BLIs), addressing unmet needs in critical care settings, and penetrating vast, underserved emerging markets where infectious disease morbidity is high. The primary impact force remains the ever-evolving nature of bacterial resistance mechanisms, forcing continuous and costly drug reformulation and development cycles just to maintain current efficacy standards.

Analyzing the drivers in more detail reveals that the expansion of the elderly population globally and the corresponding increase in chronic diseases (e.g., diabetes, cancer) contribute significantly to higher infection rates requiring potent antibacterial therapy. Surgical advancements, including complex organ transplants and large-scale orthopedic procedures, mandate effective perioperative prophylaxis, largely fulfilled by first- and second-generation cephalosporins. Furthermore, substantial public health awareness campaigns and increased diagnostic testing capacity, particularly in developing regions, lead to earlier and more frequent identification of bacterial infections, consequently boosting demand for treatment. This convergence of demographic and clinical factors ensures a perpetually strong baseline demand for these foundational antibiotics, even amid competitive pressures from other antibiotic classes such as carbapenems and newer fluoroquinolones.

Conversely, the key restraints create a challenging commercial landscape. The "patent cliff" and subsequent generic erosion swiftly undermine revenue streams for older cephalosporin classes, necessitating pharmaceutical companies to generate increasingly specialized, high-cost formulations. Regulatory pathways for new antibiotics are stringent, demanding extensive clinical data demonstrating superiority or non-inferiority against existing therapies, often coupled with complex studies focusing specifically on resistant populations. The economic model is flawed; successful new antibiotics are often reserved as drugs of last resort (a necessary stewardship practice), limiting sales volume and hindering timely return on investment. This environment necessitates robust legislative and financial incentives—such as subscription models or market entry rewards—to sustain the crucial R&D necessary to keep pace with bacterial evolution. The opportunities, therefore, must be capitalized upon through strategic government partnerships and focusing R&D on fifth-generation compounds that secure premium pricing due to their unique efficacy against critical threat pathogens like MRSA and highly resistant Gram-negative bacteria.

Segmentation Analysis

The Cephalosporin market is segmented based on several key operational characteristics, reflecting therapeutic utility, chemical structure, and route of administration. The generational classification (First through Fifth Generation) forms the core segmentation, directly correlating with spectrum of activity and resistance profile, driving prescribing patterns in clinical practice. The Route of Administration (Parenteral and Oral) dictates usage settings, with parenteral formulations dominant in critical care and acute hospital settings, whereas oral versions are crucial for step-down therapy and outpatient management. Application segmentation provides insights into the primary disease areas driving demand, including Respiratory Tract Infections (RTIs), Urinary Tract Infections (UTIs), and Skin and Soft Tissue Infections (SSTIs), each demanding specific cephalosporin types based on common causative pathogens. Understanding these segments is vital for manufacturers optimizing their product portfolio and focusing R&D efforts on areas facing the most severe resistance threats.

Within the generational segments, the market dynamics show a clear shift: First and Second Generations (e.g., Cefazolin, Cefuroxime) maintain substantial volume due to their cost-effectiveness and high usage in surgical prophylaxis and less complicated community infections. However, their revenue contribution is diminishing due to generic competition. Third Generation (e.g., Ceftriaxone, Ceftazidime) remains the largest segment by revenue, serving as the workhorse for broad empirical coverage in hospitalized patients. The highest growth is concentrated in the Fourth (Cefepime) and particularly the Fifth Generation (e.g., Ceftaroline, Ceftolozane), which are strategically positioned to address multi-drug resistant Gram-positive organisms (MRSA) and complex Gram-negative infections requiring enhanced beta-lactamase stability. This trend underscores the market’s urgent response to evolving resistance epidemiology, demanding antibiotics with enhanced structural integrity and broader pharmacological action.

The market’s application segmentation highlights the persistent burden of common bacterial diseases. Respiratory tract infections, including community-acquired pneumonia and complicated bronchitis, account for the largest share, requiring robust third and fourth-generation coverage. Skin and soft tissue infections, particularly in diabetic or immunocompromised patients, necessitate antibiotics effective against both Staphylococci and Streptococci, driving demand for newer agents effective against MRSA. The segmentation by Route of Administration reflects the severity gradient of treated diseases; the dominance of parenteral products confirms that the highest value is derived from treating acute, serious infections requiring hospital admission and intensive intravenous therapy. Conversely, the oral segment supports adherence and cost-effective management in non-critical settings, crucial for preventing relapse and reducing healthcare costs.

- By Generation:

- First Generation (e.g., Cefazolin, Cephalexin)

- Second Generation (e.g., Cefuroxime, Cefoxitin)

- Third Generation (e.g., Ceftriaxone, Ceftazidime)

- Fourth Generation (e.g., Cefepime)

- Fifth Generation (e.g., Ceftaroline fosamil, Ceftolozane/Tazobactam)

- By Route of Administration:

- Parenteral (Intravenous, Intramuscular)

- Oral

- By Application:

- Respiratory Tract Infections (RTIs)

- Skin and Soft Tissue Infections (SSTIs)

- Urinary Tract Infections (UTIs)

- Septicemia and Bacteremia

- Gastrointestinal Infections

- Other Infections (e.g., Bone and Joint, Meningitis)

Value Chain Analysis For Cephalosporin Market

The cephalosporin value chain is complex, starting with the synthesis of the 7-aminocephalosporanic acid (7-ACA) core structure, derived from fermentation, and culminating in global distribution to end-users such as hospitals and retail pharmacies. The upstream segment involves the production of raw materials, primarily specialized fungal strains and chemical precursors necessary for the fermentation and subsequent chemical modification processes that yield various generations of the final API (Active Pharmaceutical Ingredient). Manufacturing is highly specialized, requiring stringent quality control and Good Manufacturing Practice (GMP) compliance, with significant production capacity concentrated in Asia (India, China) due to cost advantages. Supply chain resilience is a key differentiator, as dependence on a limited number of raw material suppliers can lead to vulnerability, especially for older, less profitable generics.

The midstream component encompasses formulation, packaging, and regulatory approval. Once the API is manufactured, it is formulated into finished dosage forms (e.g., sterile injectable powders or oral tablets). This stage is heavily influenced by quality assurance standards and regulatory filings required by different global markets. Distribution channels are segmented into direct and indirect routes. Direct distribution involves large pharmaceutical companies supplying major hospital systems and government procurement bodies, often managed through dedicated sales forces and specialized contracts. Indirect distribution relies heavily on wholesalers, distributors, and logistics partners to reach smaller hospitals, clinics, and retail pharmacy networks, ensuring broad geographic coverage and efficient stock management.

The downstream component involves prescribing and consumption. Key stakeholders here are prescribing physicians, hospital formularies, pharmacy benefit managers (PBMs), and the end consumer. Hospital formularies play a critical gatekeeping role, determining which cephalosporins are stocked and preferred, based on cost-effectiveness, local resistance patterns, and clinical guidelines. For newer, premium-priced fifth-generation agents, successful market adoption depends heavily on demonstrating superior clinical outcomes and securing favorable reimbursement terms. This competitive environment necessitates continuous education for healthcare professionals on appropriate antibiotic stewardship and the judicious use of cephalosporins to preserve their efficacy against evolving microbial threats.

Cephalosporin Market Potential Customers

The primary customers for cephalosporin products are institutions and organizations responsible for delivering healthcare and managing infectious diseases. Hospitals, particularly large academic medical centers and community hospitals with high volumes of surgical procedures and critical care admissions, represent the largest procurement channel, consuming vast quantities of both generic and patented parenteral cephalosporins for empirical therapy, surgical prophylaxis, and treatment of nosocomial infections. Clinics and outpatient treatment centers also constitute a significant customer base, primarily utilizing oral cephalosporin formulations for managing common community-acquired infections. Furthermore, government procurement agencies and public health bodies, especially in developing economies, are major buyers, purchasing bulk quantities of essential cephalosporins for national drug security and combating prevalent regional infectious diseases.

The purchasing decisions of these entities are influenced by a complex interplay of clinical necessity, cost-containment measures, and formulary restrictions. Hospital procurement departments seek value through competitive tendering processes, often favoring reliable suppliers of high-quality generics for high-volume, established cephalosporins. For newer, expensive agents targeting drug-resistant pathogens, clinicians (infectious disease specialists, critical care physicians) drive demand, supported by robust clinical trial data and guidelines. Pharmaceutical wholesalers and distributors act as crucial intermediaries, purchasing large volumes from manufacturers and ensuring efficient delivery to diverse smaller customers, including independent pharmacies and regional healthcare networks.

In addition to human health applications, the veterinary sector also represents a niche but important customer base, using certain cephalosporin compounds (such as Cefovecin) for treating bacterial infections in livestock and companion animals. While regulatory oversight is strict regarding antibiotic use in animals to mitigate resistance transfer to humans, this segment maintains steady demand. Ultimately, the market landscape is defined by the intense need for effective, broad-spectrum, and stable antimicrobial agents across various clinical settings, making any entity involved in diagnosing, treating, or preventing bacterial infection a potential buyer for cephalosporin products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 19.4 Billion |

| Growth Rate | 4.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pfizer Inc., GlaxoSmithKline plc (GSK), Merck & Co., Inc., Novartis AG, Sanofi, Eli Lilly and Company, AstraZeneca Plc, Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Lupin Limited, Cipla Ltd., Shionogi & Co., Ltd., Zydus Cadila, B. Braun Melsungen AG, Meiji Seika Pharma Co., Ltd., Hikma Pharmaceuticals PLC, Dr. Reddy’s Laboratories Ltd., Melinta Therapeutics, Alkem Laboratories Ltd., Bristol-Myers Squibb Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cephalosporin Market Key Technology Landscape

The technological landscape of the Cephalosporin market is defined by advancements in chemical synthesis, formulation science, and drug delivery systems aimed at overcoming the primary challenge of microbial resistance. In manufacturing, highly optimized enzymatic and semi-synthetic processes are replacing traditional chemical synthesis routes for the production of 7-ACA and its derivatives. Enzymatic processes offer higher purity, reduced environmental impact, and greater yield efficiency, crucial for maintaining cost competitiveness, especially for generic high-volume third-generation cephalosporins. Furthermore, manufacturers are increasingly adopting continuous flow chemistry, enabling more controlled reaction conditions and faster scaling up of novel API production, essential for rapidly bringing fifth-generation drugs to market following successful clinical trials.

A critical technological focus lies in conjugation and combination strategies. The development of Fixed-Dose Combinations (FDCs) pairing existing cephalosporins (e.g., Ceftazidime, Ceftolozane) with advanced Beta-Lactamase Inhibitors (BLIs) like Avibactam or Tazobactam represents the forefront of resistance management technology. These inhibitors protect the cephalosporin structure from hydrolysis by key bacterial enzymes, thereby extending the therapeutic spectrum against highly resistant Gram-negative bacteria such as carbapenem-resistant Enterobacteriaceae (CRE). The success of these FDCs relies on complex formulation stability and achieving optimal pharmacokinetic synchronization between the antibiotic and the inhibitor to maximize efficacy at the site of infection.

In drug delivery, research is exploring novel systems to improve bioavailability and target specific infection sites. Liposomal encapsulation and nanotechnology-based delivery systems are being investigated to enhance penetration into difficult-to-treat areas, such as bone, lung tissue, and biofilm structures, where traditional antibiotic concentrations often fail to reach therapeutic levels. These advanced delivery technologies aim to reduce systemic toxicity while concentrating the cephalosporin agent directly at the infection source. Furthermore, sophisticated lyophilization techniques are employed to ensure the long-term stability of parenteral formulations, particularly for combination products, crucial for global distribution and maintaining drug integrity across varied storage conditions in hospital pharmacies.

Regional Highlights

- North America: This region, particularly the United States, holds a significant market share characterized by the high adoption rate of premium-priced, newer-generation cephalosporins (4th and 5th generation) due to severe challenges posed by hospital-acquired MRSA and resistant Gram-negative infections. Market dynamics are shaped by stringent regulatory oversight (FDA), strong intellectual property rights, and robust government funding mechanisms (e.g., BARDA) that incentivize R&D in anti-infectives. High healthcare expenditure and sophisticated clinical guidelines promoting antibiotic stewardship ensure judicious yet sustained demand for innovative treatments.

- Europe: The European market displays varied dynamics, with Western Europe showing high adoption of both generic and patented cephalosporins, driven by established healthcare systems (NHS, Kassenärztliche Vereinigung). The market is heavily influenced by national pricing and reimbursement policies, which often favor cost-effective generics. Emphasis on surveillance (through networks like EARS-Net) and standardized stewardship programs dictates the slow but steady uptake of new agents. Eastern European nations show increasing demand as healthcare modernization progresses, focusing on securing affordable, high-quality third-generation generics.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive patient populations, rising prevalence of infectious diseases, and rapidly improving healthcare access and infrastructure, particularly in India and China. While generic cephalosporins dominate the volume market due to price sensitivity, the emergence of affluent middle classes and expansion of private hospitals are accelerating the adoption of branded, new-generation cephalosporins, especially in key metropolitan areas. Local manufacturing capabilities in this region are unparalleled, positioning it as a global supply hub for Active Pharmaceutical Ingredients (APIs) and finished dosage forms.

- Latin America (LATAM): This region exhibits moderate but steady growth, driven by public health programs aimed at combating high endemic infectious disease burdens. The market is primarily served by established international generics and imported branded products. Challenges include complex regulatory environments and economic volatility, impacting consistent drug procurement and distribution. Brazil and Mexico are the largest markets, focusing efforts on controlling resistance through updated national guidelines and centralized purchasing models.

- Middle East and Africa (MEA): The MEA market shows heterogeneous growth. The Gulf Cooperation Council (GCC) countries demonstrate high per capita spending and rapid adoption of advanced, often imported, cephalosporins due to high standards of care. In contrast, Africa faces significant challenges regarding drug affordability, distribution infrastructure, and the high burden of infectious diseases. Demand is heavily concentrated in essential, off-patent third-generation cephalosporins, often supported by global health organizations and charitable aid programs focused on essential medicines access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cephalosporin Market.- Pfizer Inc.

- GlaxoSmithKline plc (GSK)

- Merck & Co., Inc.

- Novartis AG

- Sanofi

- Eli Lilly and Company

- AstraZeneca Plc

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Lupin Limited

- Cipla Ltd.

- Shionogi & Co., Ltd.

- Zydus Cadila

- B. Braun Melsungen AG

- Meiji Seika Pharma Co., Ltd.

- Hikma Pharmaceuticals PLC

- Dr. Reddy’s Laboratories Ltd.

- Melinta Therapeutics

- Alkem Laboratories Ltd.

- Bristol-Myers Squibb Company

Frequently Asked Questions

Analyze common user questions about the Cephalosporin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the fifth-generation cephalosporin segment?

The central driver is the escalating global prevalence of multidrug-resistant (MDR) bacterial pathogens, particularly Methicillin-resistant Staphylococcus aureus (MRSA) and complex Gram-negative bacteria, which necessitates antibiotics with a broader spectrum of activity and resistance evasion capabilities.

How is the threat of antimicrobial resistance (AMR) impacting cephalosporin market profitability?

AMR simultaneously drives the need for costly R&D into novel agents (increasing investment risk) while rapidly eroding the efficacy and market life of older, generic cephalosporins, placing significant pressure on manufacturers to justify high pricing for new combination therapies.

Which generation of cephalosporins currently holds the largest market revenue share?

The Third Generation (e.g., Ceftriaxone, Cefotaxime) commands the largest market revenue share due to their established efficacy, broad spectrum against common bacterial pathogens, and widespread use as empirical therapy in inpatient settings globally.

What role does Artificial Intelligence (AI) play in the future development of cephalosporin antibiotics?

AI is increasingly employed to accelerate the identification of novel molecular scaffolds, optimize complex synthesis processes, and enhance clinical trial design, thereby shortening the R&D timeline and improving the hit rate for new anti-infective discoveries.

Which geographical region is projected to experience the fastest market growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, attributed to improving healthcare infrastructure, substantial increases in healthcare expenditure, and the high volume of infectious disease cases in populous nations like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager