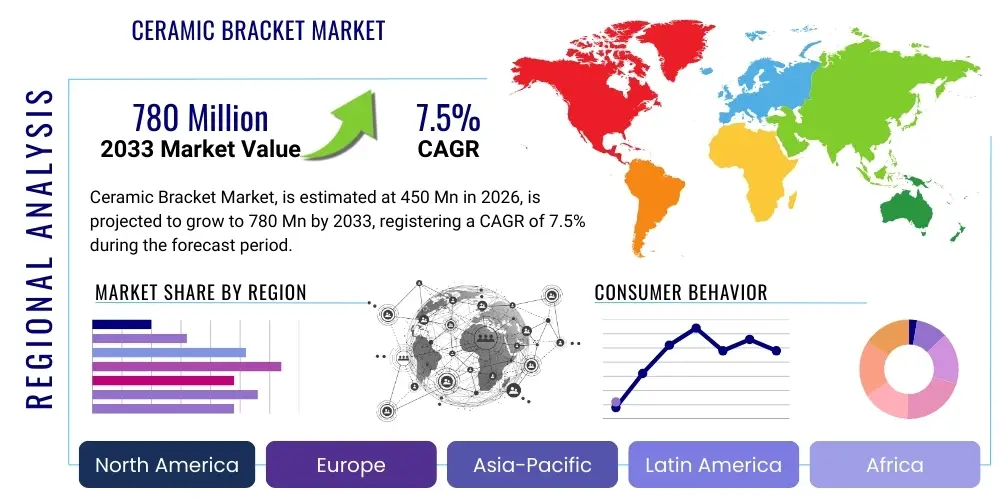

Ceramic Bracket Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442236 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Ceramic Bracket Market Size

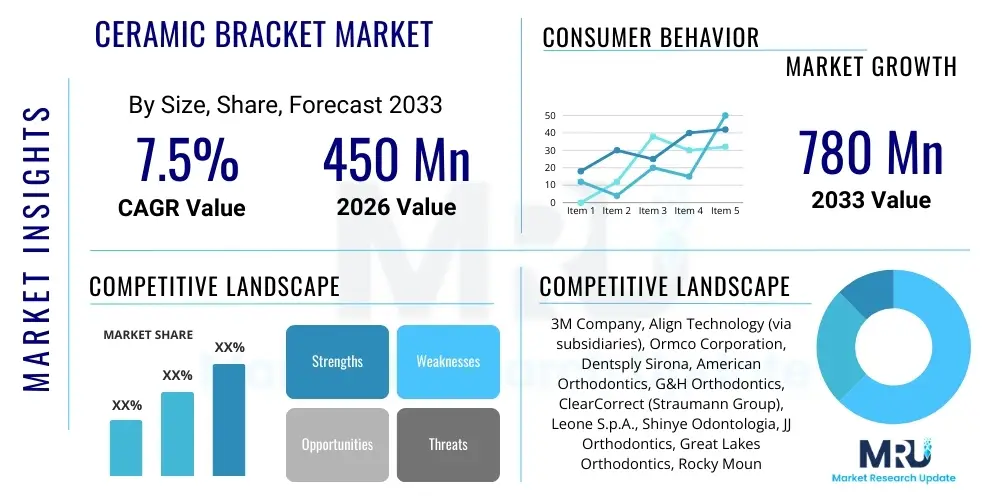

The Ceramic Bracket Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 780 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for aesthetic orthodontic solutions, particularly among adult patients who prioritize inconspicuous treatment options over traditional metal alternatives. Technological advancements in material science, leading to higher fracture resistance and improved bonding strength in ceramic compounds, further solidify the market's trajectory.

The valuation reflects robust investment in research and development aimed at enhancing the translucency and stain resistance of ceramic materials. Key market players are increasingly focusing on developing sophisticated self-ligating ceramic systems, which not only shorten treatment times but also improve patient comfort and oral hygiene maintenance throughout the corrective phase. The high growth rate anticipated in the latter half of the forecast period is attributed to the penetration of these advanced ceramic systems into developing economies, where disposable income and aesthetic awareness are rapidly improving, thereby broadening the patient base eligible for premium orthodontic care.

Ceramic Bracket Market introduction

The Ceramic Bracket Market encompasses the production and distribution of orthodontic appliances used for teeth alignment and correction, distinguished by their construction from tooth-colored or transparent ceramic materials, primarily alumina. These brackets serve as an aesthetic alternative to conventional stainless steel brackets, addressing the strong patient preference for nearly invisible orthodontic treatment. The primary product description includes both polycrystalline ceramic brackets, which offer good strength and appearance, and monocrystalline ceramic brackets (often referred to as sapphire brackets), which provide superior transparency and aesthetic appeal due to their single-crystal structure. These brackets are essential components in fixed orthodontic systems, utilizing archwires and ligatures to apply controlled mechanical forces for malocclusion correction.

Major applications for ceramic brackets span general orthodontics, complex corrective procedures, and specialized treatments for adult patients, where aesthetic concerns are paramount. These systems are widely utilized across private dental clinics, specialized orthodontic centers, and hospital dental departments globally. The inherent benefits of ceramic brackets include superior aesthetics, high chemical stability, and minimal visibility, significantly boosting patient confidence during the treatment period. Furthermore, modern ceramic formulations are designed to minimize irritation to surrounding oral tissues, enhancing overall comfort compared to traditional options.

The market’s expansion is robustly driven by several key factors, including the increasing global prevalence of malocclusion requiring orthodontic intervention, coupled with rising consumer willingness to invest in premium healthcare services. Urbanization and the growing influence of media promoting ideal aesthetics contribute significantly to the high adoption rates, particularly in mature markets like North America and Western Europe. Additionally, continuous material science improvements, which mitigate traditional drawbacks such as excessive friction or bracket breakage, solidify ceramic brackets as a viable and highly sought-after treatment modality for a diverse patient demographic, ensuring sustained market growth throughout the forecast timeframe.

Ceramic Bracket Market Executive Summary

The Ceramic Bracket Market is experiencing dynamic shifts, characterized by strong business trends centered on material innovation and strategic market penetration into high-growth regions. Key business trends indicate a focused move towards integrating CAD/CAM technology for highly customized bracket manufacturing, improving fit and efficiency, and minimizing chair time. Competitive strategies emphasize the development of low-friction ceramic options, notably self-ligating ceramic brackets, which represent a significant value-added proposition for both practitioners and patients. The market is witnessing consolidation among smaller specialized manufacturers and major dental supply corporations aiming to secure a broader intellectual property base and distribution network globally. Investment in automated production lines is also a defining trend, aiming to reduce manufacturing costs and increase scalability to meet burgeoning demand from emerging markets.

Regionally, North America maintains market dominance due to high healthcare expenditure, established orthodontic infrastructure, and high consumer awareness regarding aesthetic dental solutions. However, the Asia Pacific (APAC) region exhibits the highest projected growth rate, driven by a burgeoning middle class in countries like China and India, increased dental tourism, and improved access to advanced orthodontic care in metropolitan areas. European markets continue stable growth, focusing heavily on premium, high-translucency sapphire options. Regional trends also show manufacturers adapting product offerings to specific regional regulatory environments and clinician preferences, such as customizing bracket sizes and materials for diverse ethnic demographics.

Segmentation trends reveal polycrystalline ceramic brackets holding a larger volume share due to their cost-effectiveness, while the monocrystalline (sapphire) segment commands a premium price and is expected to grow rapidly due to its unparalleled aesthetic qualities. The end-user segment is dominated by specialized dental clinics and private practices, reflecting the elective nature of cosmetic orthodontics. Furthermore, the increasing adoption of ceramic brackets for complex treatments previously reserved for metal systems signals a maturing and evolving preference within the clinical application segment. The move towards specialized distribution channels focusing solely on high-end orthodontic equipment further streamlines the supply chain and enhances service quality for professional end-users.

AI Impact Analysis on Ceramic Bracket Market

Common user questions regarding AI's impact on the Ceramic Bracket Market frequently revolve around how artificial intelligence can enhance diagnostic accuracy, streamline treatment planning, and contribute to the manufacturing efficiency of customized brackets. Users are keenly interested in whether AI-driven simulation tools can predict treatment outcomes more accurately, thereby reducing the duration of ceramic bracket use and optimizing patient satisfaction. Concerns often touch upon the initial cost of integrating AI systems into existing orthodontic practices and the potential need for significant retraining of dental professionals. Expectations are high concerning AI's role in personalizing treatment, identifying subtle malocclusions invisible to the human eye, and automating repetitive tasks associated with bracket placement and adjustment schedules.

The application of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly revolutionizing the orthodontic treatment lifecycle, fundamentally impacting the ceramic bracket market from diagnosis to execution. AI algorithms are increasingly being deployed in analyzing advanced imaging data, such as CBCT scans and intraoral photographs, to provide highly precise diagnostic assessments and identify optimal treatment vectors. This precision allows orthodontists to select the most appropriate ceramic bracket type, size, and positioning for individual patient needs, ensuring maximum biomechanical efficiency. By improving case selection and planning accuracy, AI reduces treatment complexity and the associated risks of bracket failure or treatment delays, making ceramic options more reliable.

Furthermore, AI significantly enhances the manufacturing pipeline through its integration with CAD/CAM systems. Predictive modeling and generative design algorithms can optimize the complex geometry of self-ligating ceramic brackets, maximizing their strength while maintaining minimum dimensions and superior aesthetics. AI assists in automated quality control, identifying microfractures or inconsistencies in the ceramic material that would compromise performance. This automation not only accelerates production speed but also ensures the consistent quality necessary for premium ceramic products, thereby solidifying the competitive positioning of manufacturers who embrace these sophisticated digital tools in their supply chain.

- AI integration in automated diagnostic imaging and malocclusion assessment.

- Enhanced treatment planning using ML models to predict ceramic bracket stress and optimal placement.

- Optimization of bracket design and custom manufacturing via Generative Design and CAD/CAM interfacing.

- Automated quality control systems for detecting flaws in ceramic material and structure.

- Improved inventory management and demand forecasting for specialized ceramic product lines.

- Personalized patient monitoring and adjustment scheduling driven by AI analytics, reducing chair time.

DRO & Impact Forces Of Ceramic Bracket Market

The Ceramic Bracket Market is shaped by powerful synergistic forces encapsulated by Drivers, Restraints, and Opportunities (DRO), which collectively dictate market velocity and strategic focus. The primary drivers include the global prioritization of aesthetic dentistry, especially among the rising adult demographic seeking discreet orthodontic treatment, and significant advancements in ceramic material technology resulting in enhanced durability and reduced friction. Restraints largely involve the higher manufacturing and retail cost of ceramic systems compared to traditional metal brackets, creating price sensitivity in budget-conscious markets, alongside the technical challenges related to bracket debonding and potential enamel fracture risks if not handled correctly. Opportunities are plentiful, centered on the untapped potential in emerging economies, the innovation cycle focusing on self-ligating ceramic systems, and the expanding scope of teledentistry and digital orthodontics facilitating remote consultations and treatment tracking.

The impact forces driving the market are dominated by socio-economic factors, notably rising disposable income globally and the increasing aesthetic standards propagated by social media and cultural trends. Technological impact forces, particularly the integration of 3D printing and advanced sintering techniques, are crucial for lowering production costs while maintaining high quality, thereby making premium ceramic options accessible to a wider population base. Competitive intensity remains high, primarily focused on aesthetic differentiation and the development of proprietary ceramic composites that offer superior translucency and stain resistance over generic alternatives. Regulatory landscapes, while stringent, primarily ensure patient safety and material biocompatibility, pushing manufacturers towards continuous adherence to international standards like ISO 13485.

The balance of these forces creates a dynamic investment environment where companies must strategically balance R&D expenditure on innovation (to capture high-value opportunities like self-ligation) against manufacturing efficiency improvements (to mitigate cost restraints). The long-term trajectory suggests that as technological advancements continue to address the cost and fragility restraints, the aesthetic drivers will exert greater influence, inevitably pushing the ceramic bracket segment to capture a larger share of the overall fixed orthodontics market. The crucial success factor lies in demonstrating clinical superiority and tangible patient benefits over cheaper alternatives, justifying the premium pricing structure inherent in aesthetic orthodontic solutions.

Segmentation Analysis

The Ceramic Bracket Market is comprehensively segmented primarily based on the Type of material used, the Application/Treatment type, and the End-User setting, providing granular insights into market dynamics and consumption patterns. Analyzing these segments helps stakeholders tailor product development and marketing strategies to specific patient needs and clinical environments. The segmentation by type is crucial as it differentiates between the performance characteristics and aesthetic levels offered, directly correlating with pricing strategies and target demographics. Segmentation by application allows manufacturers to focus on general vs. specialized orthodontic procedures, while the end-user segmentation clearly distinguishes between high-volume private clinics and structured institutional settings like large hospitals or university dental departments.

The Type segment typically divides the market into Polycrystalline Ceramic Brackets and Monocrystalline Ceramic Brackets (Sapphire Brackets). Polycrystalline brackets are widely adopted due to their balance of aesthetics and strength at a moderate price point, making them the workhorse of the aesthetic segment. Monocrystalline or Sapphire brackets, offering superior transparency, cater exclusively to the high-end, premium aesthetic market where cost is secondary to visibility. Application segmentation includes traditional fixed orthodontics, comprehensive malocclusion treatment, and minor cosmetic alignment procedures, with the comprehensive treatment segment being the largest consumer of these brackets due to the complexity and duration of such treatments.

End-user analysis demonstrates that specialized Orthodontic Clinics and Dental Practices dominate consumption, given their focused expertise and high volume of elective cosmetic procedures. Hospitals and Academic Institutions also represent a significant, though smaller, segment, often handling complex or surgical-orthodontic cases. Understanding these segment dynamics is vital for supply chain planning and regional sales strategies, ensuring that specialized components and large inventory volumes are appropriately distributed to the areas of highest demand and clinical specialization, maintaining optimized product accessibility across the global market landscape.

- By Type:

- Polycrystalline Ceramic Brackets

- Monocrystalline Ceramic Brackets (Sapphire)

- By Application:

- Fixed Orthodontics

- Complex Malocclusion Treatment

- Cosmetic Alignment Procedures

- By End-User:

- Orthodontic Clinics

- Hospitals and Academic Institutions

- General Dental Practices

Value Chain Analysis For Ceramic Bracket Market

The value chain of the Ceramic Bracket Market is characterized by highly specialized upstream material procurement, complex precision manufacturing, and a targeted downstream distribution model focusing on specialized dental professionals. Upstream analysis begins with the sourcing of high-purity raw materials, primarily medical-grade alumina (aluminum oxide) powder, which determines the final product's translucency and mechanical strength. Suppliers of these highly refined ceramic powders are often specialized chemical companies, requiring strict quality control and certification processes. This initial phase is capital-intensive due to the need for advanced material processing techniques like injection molding and high-temperature sintering to form the dense, durable bracket body. The proprietary nature of material compositions often dictates competitive advantages early in the chain.

Manufacturing constitutes the core transformative stage, involving sophisticated processes such as CAD/CAM design, high-precision machining, and rigorous quality assurance testing for adhesion strength and fracture resistance. Direct distribution channels, where major manufacturers engage in direct sales and professional consultation with large orthodontic practices and hospital groups, account for a significant portion of high-volume sales, ensuring clinical support and rapid feedback loops. Indirect distribution involves specialized medical device distributors and regional orthodontic suppliers who possess deep market penetration in localized geographical areas, particularly crucial for reaching smaller, independent dental clinics. The efficiency and reliability of these distribution channels are paramount, given the need for precise inventory management of highly specialized orthodontic kits.

Downstream activities focus on the final delivery and clinical application. Education and training provided by manufacturers to orthodontists are integral to the value proposition, ensuring correct bonding and de-bonding techniques to maximize product effectiveness and minimize patient risk. The value chain concludes with the end-user (orthodontist) utilizing the brackets, driven by patient demand for premium aesthetics. Optimization of the value chain is increasingly focusing on digitalization, utilizing centralized ordering platforms and real-time inventory tracking to reduce lead times and associated logistics costs. The high perceived value of the product supports a robust margin structure throughout the chain, compensating for the specialized R&D and manufacturing complexity inherent in ceramic bracket production.

Ceramic Bracket Market Potential Customers

The primary potential customers and end-users of ceramic brackets are specialized professionals within the dental and medical fields who directly prescribe and apply these corrective devices. This group fundamentally comprises Orthodontists working in private practices and specialized clinics, as they represent the highest volume users, focusing intensely on comprehensive treatments and demanding high-quality aesthetic solutions for their patient base. These clinicians possess the necessary training and infrastructure to correctly diagnose complex malocclusion and implement treatment plans utilizing advanced ceramic systems. Their purchasing decisions are heavily influenced by clinical efficacy, material reliability, manufacturer support, and patient demand for visually discreet options.

Secondary, yet significant, customer segments include General Dentists who offer basic or minor cosmetic orthodontic treatments, particularly in regions where specialist availability is limited. Furthermore, large Hospital Dental Departments and University Teaching Clinics are key customers, often requiring bulk purchases for patient care and educational purposes. These institutional buyers prioritize durability, regulatory compliance, and cost-efficiency for standardized care, although they are increasingly pressured by patient preference to adopt premium aesthetic alternatives like ceramic brackets over standard metal options. The demographic profile of the ultimate buyer—the patient—is typically the aesthetic-conscious adult or the parent of an adolescent, both with sufficient disposable income to afford the premium associated with ceramic materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 780 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Align Technology (via subsidiaries), Ormco Corporation, Dentsply Sirona, American Orthodontics, G&H Orthodontics, ClearCorrect (Straumann Group), Leone S.p.A., Shinye Odontologia, JJ Orthodontics, Great Lakes Orthodontics, Rocky Mountain Orthodontics (RMO), TP Orthodontics, Adenta GmbH, Forestadent, DynaFlex, Ortho Technology, Modern Arch, Hangzhou Yamei Dental Equipment, Dentaurum GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic Bracket Market Key Technology Landscape

The technological landscape of the Ceramic Bracket Market is characterized by a relentless pursuit of superior aesthetics, mechanical strength, and enhanced clinical performance through advanced material science and digital manufacturing processes. A core technology is the refinement of Alumina (Aluminum Oxide) ceramics, utilized in both polycrystalline and monocrystalline forms. Advanced sintering techniques, particularly pressureless sintering and hot isostatic pressing (HIP), are crucial for achieving ultra-high density and transparency in the ceramic body, minimizing porosity which can lead to staining or fracture. Continuous R&D focuses on incorporating surface treatments or protective coatings to further resist discoloration from dietary pigments, maintaining the bracket’s aesthetic appeal throughout the typically long treatment duration.

The integration of digital technology, specifically Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM), is transformative. This allows for the precise, custom manufacturing of bracket bases designed to conform perfectly to individual tooth morphology, enhancing bonding strength and reducing the likelihood of bracket failure. Furthermore, injection molding ceramic (CIM) and 3D printing of molds are streamlining production, enabling complex geometries required for low-profile and self-ligating ceramic systems. Self-ligating mechanisms represent a key innovation, where a specialized clip or gate replaces traditional elastic ligatures, reducing friction, accelerating treatment, and significantly improving oral hygiene for the patient. The engineering of these minute ceramic clips requires extreme precision in both design and material processing to ensure consistent opening and closing functionality over years of use.

Another area of intense technological focus is the development of optimized adhesive systems tailored specifically for ceramic surfaces. The debonding process of ceramic brackets poses a historical clinical challenge, risking enamel damage due to the strong mechanical interlock between the bracket and the tooth surface. Recent technological solutions involve the incorporation of stress-releasing or thermal-responsive adhesives, and specialized debonding instruments designed to induce controlled failure at the bracket/adhesive interface rather than the adhesive/enamel interface. This commitment to safer debonding practices is crucial for overcoming one of the primary historical restraints associated with ceramic bracket use, thereby encouraging wider adoption among conservative practitioners and solidifying the market's long-term technological viability.

Regional Highlights

The global Ceramic Bracket Market exhibits distinct regional consumption and growth patterns, heavily influenced by local economic factors, healthcare infrastructure, and cultural aesthetic preferences.

- North America: This region holds the largest market share, driven by high per capita healthcare spending, extensive insurance coverage for orthodontic procedures, and a strong cultural emphasis on aesthetic perfection. The U.S. and Canada are early adopters of premium, high-cost technologies like self-ligating ceramic systems and sapphire brackets. Market maturity necessitates continuous innovation, particularly in digital orthodontic integration and customized treatment protocols.

- Europe: Characterized by stable growth, European countries, particularly those in Western Europe (Germany, UK, France), show high demand for quality aesthetic treatments. Stringent regulatory standards ensure high product quality, favoring manufacturers with robust research portfolios. The focus here is balanced between polycrystalline and high-translucency monocrystalline options, catering to an affluent patient base prioritizing longevity and discretion.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This acceleration is fueled by increasing disposable incomes, rapid urbanization, rising dental awareness, and the expansion of modern orthodontic infrastructure in highly populated countries like China, India, and South Korea. While price sensitivity exists, the rapidly expanding middle class is increasingly willing to invest in aesthetic solutions, driving massive volume growth, particularly in the polycrystalline segment.

- Latin America (LATAM): Growth in LATAM is moderate, influenced by fluctuating economic conditions, but shows high potential in countries like Brazil and Mexico, which have established dental tourism sectors and improving access to private dental care. Affordability remains a key determinant, positioning ceramic brackets as a premium offering in urban centers.

- Middle East and Africa (MEA): This region is an emerging market with specialized pockets of high growth in the Gulf Cooperation Council (GCC) countries. High oil revenues in the GCC support robust healthcare spending and demand for luxury aesthetic procedures, making it a viable target for high-end sapphire bracket sales. Infrastructure development and increasing awareness are prerequisites for sustained market penetration across the broader African continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Bracket Market, highlighting their strategic initiatives, product portfolios, and market positioning.- 3M Company

- Align Technology (via subsidiaries)

- Ormco Corporation

- Dentsply Sirona

- American Orthodontics

- G&H Orthodontics

- ClearCorrect (Straumann Group)

- Leone S.p.A.

- Shinye Odontologia

- JJ Orthodontics

- Great Lakes Orthodontics

- Rocky Mountain Orthodontics (RMO)

- TP Orthodontics

- Adenta GmbH

- Forestadent

- DynaFlex

- Ortho Technology

- Modern Arch

- Hangzhou Yamei Dental Equipment

- Dentaurum GmbH

Frequently Asked Questions

Analyze common user questions about the Ceramic Bracket market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between Polycrystalline and Monocrystalline ceramic brackets?

Polycrystalline brackets are slightly opaque and more economical, made from fine-grained ceramic powder. Monocrystalline (Sapphire) brackets are crafted from single-crystal alumina, offering superior, almost invisible transparency and commanding a higher price point due to their enhanced aesthetic qualities.

Is the Ceramic Bracket Market facing significant competition from clear aligners?

Yes, clear aligners pose a significant competitive threat, particularly for mild to moderate cases, due to their completely removable nature. However, ceramic brackets maintain a dominant position in complex or severe malocclusion cases where fixed appliance biomechanics are essential for effective correctional force delivery.

What is the primary driver for the growth of the Ceramic Bracket Market?

The central driver is the global increase in aesthetic consciousness, especially among adult patient populations, leading to a strong preference for subtle, tooth-colored orthodontic devices over traditional, visible metal brackets, supported by rising disposable incomes.

What technological advancements are currently defining the ceramic bracket industry?

Key technological advancements include the development of self-ligating ceramic systems that minimize friction and chair time, the use of advanced sintering processes for superior material strength, and the integration of CAD/CAM systems for highly customized bracket base designs.

Which geographical region shows the highest growth potential for ceramic brackets?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid economic growth, expanding healthcare infrastructure, and increasing accessibility and affordability of specialized aesthetic dental care across major emerging economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager