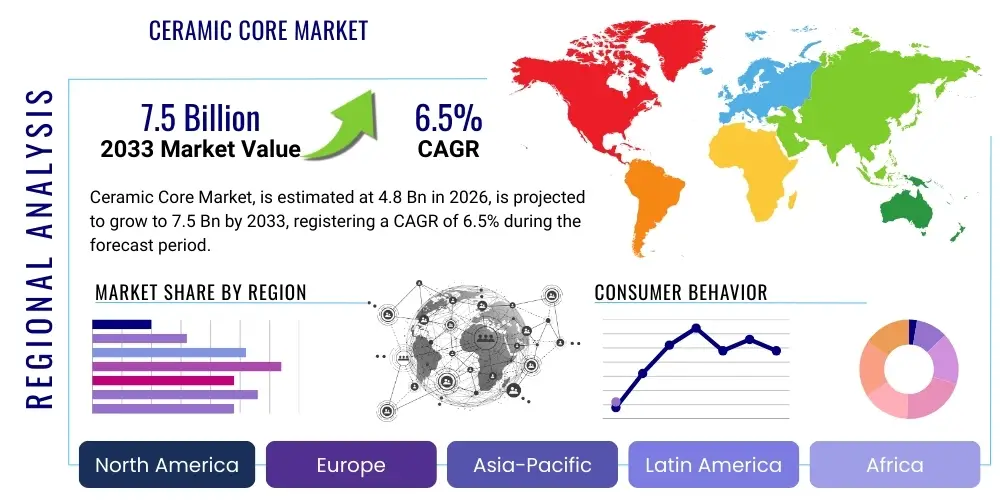

Ceramic Core Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442557 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Ceramic Core Market Size

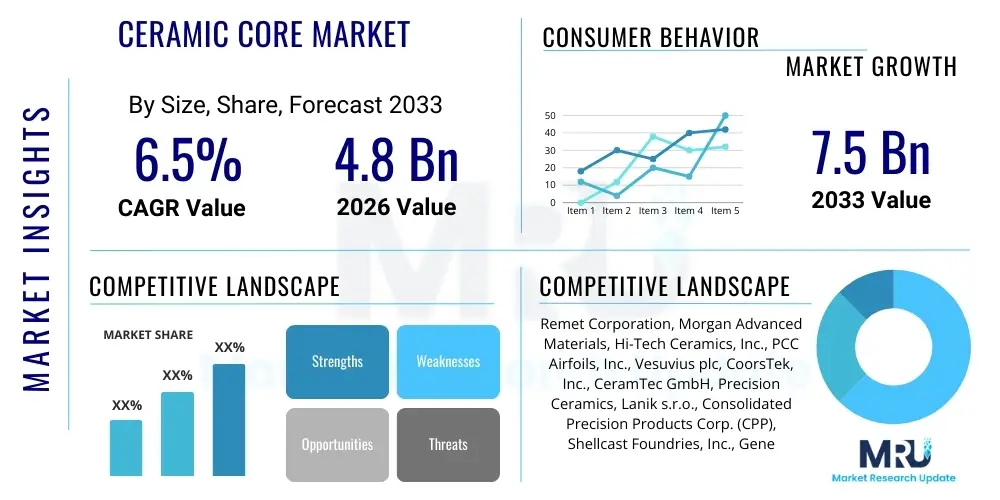

The Ceramic Core Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global demand for high-performance components capable of withstanding extreme thermal and mechanical stresses, particularly within the aerospace and industrial gas turbine sectors. The investment casting process, which relies heavily on precision ceramic cores to create intricate internal passages and cooling channels, is experiencing continuous innovation driven by stringent efficiency and performance requirements.

The market expansion is also catalyzed by technological advancements in ceramic materials science, enabling the production of cores with superior refractoriness, chemical stability, and dimensional accuracy. While traditional silica cores remain dominant in certain industrial applications, the accelerating adoption of advanced materials like alumina and zirconia in demanding environments—such as single-crystal turbine blades—is contributing significantly to the overall market valuation growth. Furthermore, the burgeoning maintenance, repair, and overhaul (MRO) sector, particularly in commercial aviation, provides a steady and essential demand stream for replacement parts that require highly reliable ceramic cores during their manufacture.

Ceramic Core Market introduction

The Ceramic Core Market encompasses the production and supply of refractory ceramic components utilized predominantly in the investment casting process to form internal geometries, passages, and features within precision metal parts. These cores act as sacrificial mandrels, defining the complex internal structure of components—such as airfoils for gas turbines or intricate medical implants—which are subsequently removed through chemical leaching after the metal solidifies. Key products include cores made from materials such as fused silica, alumina, and zirconia, each chosen based on the required melting temperature compatibility of the target alloy and the complexity of the core geometry. Major applications span high-stakes industries including aerospace, energy generation (industrial gas turbines), automotive turbochargers, and sophisticated medical devices. The primary benefits of using ceramic cores include enabling the creation of intricate, high-precision internal cooling networks essential for maximizing engine efficiency and durability, allowing manufacturers to cast complex designs that would be impossible or prohibitively expensive using conventional machining methods. Driving factors for this market include the relentless pursuit of fuel efficiency in aerospace, necessitating higher operating temperatures and complex cooling schemes, and substantial capital investment in next-generation power generation infrastructure.

Ceramic Core Market Executive Summary

The Ceramic Core Market is characterized by a strong convergence of mature manufacturing techniques and nascent high-precision technologies, driving moderate but stable growth underpinned by critical industrial applications. Business trends indicate a shift towards greater supply chain resilience, with key players investing in highly automated manufacturing facilities to ensure dimensional consistency and reduce defects, particularly as end-users demand tighter tolerances for advanced turbine components. Furthermore, strategic mergers and acquisitions focused on consolidating specialized material expertise and expanding geographic reach are shaping the competitive landscape. The integration of specialized robotics for handling fragile cores and implementing advanced quality control using non-destructive testing are pivotal in maintaining premium product integrity and market leadership. The focus on sustainability is also emerging as manufacturers explore environmentally friendly leaching processes and recycling methods for core materials, aligning with broader industrial corporate responsibility initiatives.

Regionally, the Asia Pacific (APAC) stands out as the highest-growth region, propelled by significant expansion in the aviation sector, rapid urbanization driving demand for energy infrastructure, and increasing domestic military expenditure, particularly in China and India. North America and Europe, while mature markets, maintain high market shares due to the presence of major aerospace OEMs and extensive MRO operations that require continuous supply of specialized cores for legacy and new engine programs. Segment trends highlight the dominance of the aerospace sector in terms of revenue, primarily driven by high-value cores made from zirconia and alumina used in hot section components. However, the energy segment is projected to exhibit robust growth, particularly concerning cores required for large-scale industrial gas turbines used for power generation, emphasizing larger, more complex silica cores. Investment casting remains the dominant application, though the emerging use of cores in ceramic matrix composite (CMC) manufacturing processes represents a strategic, high-growth niche segment moving forward.

AI Impact Analysis on Ceramic Core Market

User inquiries regarding AI's influence in the Ceramic Core market predominantly center on quality assurance, design optimization, and process efficiency. Key themes include how Artificial Intelligence can minimize costly casting defects, accelerate the design cycle for highly complex core geometries, and enhance predictive maintenance for high-value molding and firing equipment. Users frequently express interest in leveraging machine learning algorithms to correlate slurry composition and firing temperature profiles with final core integrity, seeking to transition from reactive defect analysis to predictive process control. There is also significant curiosity surrounding the use of AI in rapidly evaluating non-destructive testing (NDT) data, such as CT scans of cores, to automate flaw detection and classification, thereby ensuring only the highest quality cores proceed to the investment casting phase. This focus underscores the industry’s critical need for unparalleled precision and repeatability, where even minor variations in core structure can lead to component failure in mission-critical applications.

The integration of AI systems is fundamentally changing how material scientists approach core formulation and how manufacturing engineers manage production yield. By employing generative design algorithms, AI can propose optimal internal cooling passage layouts that maximize thermal efficiency while respecting the manufacturability constraints inherent to the ceramic injection molding process. This reduces the number of expensive, physical prototyping iterations traditionally required. Furthermore, AI-driven sensor fusion and data analytics applied to the entire production line—from slurry mixing to final firing—allow for instantaneous adjustments to process parameters, stabilizing the operation and significantly boosting overall throughput and product consistency, which is paramount in the production of high-value components like single-crystal turbine blades.

- AI-enhanced Quality Control: Machine vision and learning algorithms automate defect detection (cracks, voids, dimensional errors) in green and fired cores, drastically improving inspection speed and accuracy.

- Predictive Maintenance: AI models analyze vibration, temperature, and pressure data from injection molding machines and kilns to predict equipment failure, minimizing unplanned downtime.

- Material Formulation Optimization: Machine learning correlates variations in raw material purity and slurry rheology with final mechanical properties, optimizing mixture ratios for consistent performance.

- Generative Design: AI assists engineers in designing complex internal cooling geometries that optimize fluid dynamics while ensuring the ceramic core remains robust enough for handling and casting.

- Yield Improvement: Real-time data analysis and feedback loops adjust process variables (e.g., injection pressure, drying time) to maximize the percentage of successful cores produced per batch.

DRO & Impact Forces Of Ceramic Core Market

The Ceramic Core Market is primarily propelled by the stringent performance demands of the aerospace and energy sectors, counterbalanced by inherent manufacturing complexities and high production costs, while future growth is secured through technological convergence and novel material development. Drivers include the unrelenting requirement for lighter, more efficient gas turbine engines, which necessitates complex internal cooling structures achievable only through precision cores. Restraints largely involve the intrinsic brittleness of ceramic materials, leading to high scrap rates during handling and the challenging chemical leaching process, alongside the significant capital investment required for dedicated, high-precision manufacturing facilities. Opportunities are emerging through the commercialization of Additive Manufacturing (AM) for ceramic cores, allowing for unprecedented design complexity and rapid prototyping, particularly for low-volume, highly specialized parts. The convergence of these factors creates powerful impact forces, where the demand for higher temperatures components continuously pushes material science boundaries, requiring solutions that balance high refractoriness with superior mechanical stability at elevated temperatures.

Impact forces within the market are predominantly driven by regulatory standards concerning engine efficiency and emissions, forcing OEMs to continually innovate core designs to improve turbine performance. This pressure accelerates the adoption of advanced materials like Zirconia-based cores, despite their higher cost. The geopolitical landscape also acts as a powerful force, influencing defense spending and commercial aircraft orders, which directly correlates with core demand. Furthermore, the limited number of companies globally that possess the proprietary expertise in creating complex ceramic slurries and molds constitutes a significant barrier to entry, stabilizing pricing power for established market leaders. The development of next-generation engine platforms, such as those employing open rotor designs or focused on sustainable aviation fuels (SAF), requires corresponding core innovations, keeping R&D intensity high across the competitive landscape.

- Drivers: Growing demand for fuel-efficient aircraft engines; Increasing use of industrial gas turbines for power generation; Trend toward complex internal cooling passages; Expansion of MRO activities globally.

- Restraints: High material and manufacturing costs; Significant scrap rates due to material brittleness; Challenges associated with chemical removal (leaching) post-casting; Long R&D cycles for new core materials.

- Opportunities: Integration of Additive Manufacturing (3D Printing) for core creation; Development of superior refractory materials (e.g., rare-earth ceramics); Penetration into new applications like high-performance automotive and hydrogen energy systems; Focus on sustainable and reusable casting processes.

- Impact Forces: Intense technological competition in material science; Stringent aerospace qualification requirements; Global supply chain vulnerabilities affecting raw material costs (e.g., fused silica); Economic cycles influencing capital expenditure in aerospace and energy.

Segmentation Analysis

The Ceramic Core Market is systematically segmented primarily based on the chemical composition of the core material, the specific application or end-use industry, and the manufacturing methodology employed to produce the core geometry. Material segmentation is crucial as it determines the maximum casting temperature tolerance and chemical compatibility with the target metal alloy, ranging from lower-temperature fused silica cores to highly refractory zirconia cores. Application segmentation highlights the dominance of the aerospace and energy sectors, which utilize the most complex and high-value cores, compared to automotive or medical industries. Manufacturing process segmentation reflects the technological evolution of the industry, distinguishing between high-volume, cost-effective methods like ceramic injection molding (CIM) and emerging, high-complexity methods such as ceramic additive manufacturing.

Understanding these segmentations is critical for market participants, as specialization often dictates competitive advantage. For instance, companies dominating the Zirconia core segment possess highly specialized material handling and firing expertise, allowing them to serve the critical single-crystal turbine blade market with limited competition. Conversely, the fused silica segment is more volume-driven and competitive, serving general industrial and larger turbine component needs. The interplay between application complexity and material choice guides research and development efforts, with significant investment directed toward creating cores robust enough to withstand the demanding conditions of advanced superalloys while maintaining structural integrity for precise internal feature definition.

- By Material:

- Fused Silica Cores

- Alumina Cores

- Zirconia Cores

- Yttria Cores

- Other Advanced Ceramics

- By Application:

- Aerospace and Defense (Turbine Blades, Vanes, Nozzles)

- Energy (Industrial Gas Turbines, Land-based Power Generation)

- Automotive (Turbochargers, Engine Components)

- Medical and Dental (Implants, Prosthetics)

- General Industrial Components

- By Manufacturing Method:

- Ceramic Injection Molding (CIM)

- Gel Casting

- Additive Manufacturing (AM) / 3D Printing

- Extrusion and Traditional Pressing

Value Chain Analysis For Ceramic Core Market

The value chain for the Ceramic Core Market is highly specialized, beginning with the upstream sourcing and preparation of ultra-high-purity refractory raw materials, which is a critical determinant of final core performance. Upstream activities involve the mining, refining, and synthesis of materials like fused silica, fine alumina, and high-purity stabilized zirconia powder. Manufacturers often engage in strategic partnerships with specialized chemical suppliers to ensure material consistency and volume stability. This is followed by core manufacturing, where proprietary knowledge in slurry preparation (binder systems, dispersants, particle size distribution) and high-precision tooling (injection molds) is leveraged to produce complex geometries. The midstream involves quality control and firing processes, which are capital and expertise-intensive, converting the fragile green core into a robust, high-refractory component ready for shipment to the investment caster.

Downstream analysis focuses on the distribution channels, which are characterized by direct relationships between core manufacturers and large-scale investment casting foundries that serve the aerospace and energy original equipment manufacturers (OEMs). Direct distribution is the dominant model, necessitated by the highly technical specifications, bespoke nature of orders, and strict quality assurance requirements. Indirect channels, such as specialized material distributors or agents, are occasionally used for smaller foundries or general industrial cores. The final stage of the value chain is the end-user application (e.g., mounting the turbine blade into a gas engine), where the quality of the ceramic core directly impacts the performance and lifespan of the mission-critical component. Efficiency gains and cost reductions throughout the chain are highly valued, particularly in reducing material waste during the molding and firing phases, given the high cost of raw ceramic powders.

Ceramic Core Market Potential Customers

Potential customers in the Ceramic Core Market are sophisticated industrial entities that require precision metal components capable of operating under extreme conditions, where internal complexity is essential for functional performance. The primary buyers are large-scale investment casting foundries, both captive (owned by OEMs) and independent contract foundries, which specialize in high-temperature superalloys such as nickel-based and cobalt-based alloys. These foundries utilize the ceramic cores as sacrificial elements within their casting shells. End-users, who indirectly drive demand, include major global Aerospace OEMs (e.g., General Electric, Pratt & Whitney, Rolls-Royce) that manufacture commercial and military aircraft engines, where cores are vital for creating highly efficient turbine blades and vanes with intricate cooling channels. Similarly, the Energy sector, comprising manufacturers of Industrial Gas Turbines (IGTs) for power generation, represents a significant customer base, demanding large, robust cores for land-based turbine components.

Beyond these dominant sectors, specialized manufacturers in the high-performance automotive industry constitute an emerging customer group, particularly those producing advanced turbocharger rotors and exhaust system components that require optimized flow paths cast in high-temperature alloys. The medical device industry also relies on ceramic cores for investment casting complex, customized components like orthopedic implants (e.g., knee and hip joints) and surgical instruments where surface finish and geometric accuracy are paramount. These customers demand strict adherence to specifications, high repeatability, and robust intellectual property protection, leading core suppliers to maintain rigorous quality management systems and confidentiality agreements. Strategic partnership formation between core suppliers and key casting houses is common, ensuring proprietary core designs align perfectly with the metal casting process and yield optimal results for the final component.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Remet Corporation, Morgan Advanced Materials, Hi-Tech Ceramics, Inc., PCC Airfoils, Inc., Vesuvius plc, CoorsTek, Inc., CeramTec GmbH, Precision Ceramics, Lanik s.r.o., Consolidated Precision Products Corp. (CPP), Shellcast Foundries, Inc., General Pattern Co., Rauschert GmbH, Blasch Precision Ceramics, Inc., Zircoa, Inc., McDanel Advanced Ceramics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic Core Market Key Technology Landscape

The technological landscape of the Ceramic Core Market is dominated by advancements in Ceramic Injection Molding (CIM) and the emerging capabilities of Ceramic Additive Manufacturing (AM). CIM remains the benchmark for high-volume production, requiring highly sophisticated tooling made from specialty steels or nickel alloys to achieve extremely tight dimensional tolerances and intricate geometries. Continuous innovation in CIM focuses on optimizing binder systems—the temporary polymer or wax matrices that hold the ceramic powder together before firing—to minimize shrinkage variation and reduce the likelihood of defects suchs as cracks or warping during the high-temperature processing stages. Furthermore, automated systems for handling fragile green cores are being widely implemented, utilizing robotics and specialized gripping mechanisms to reduce manual errors and scrap rates associated with component fragility.

Additively Manufacturing of ceramic cores, particularly using techniques like stereolithography (SLA) or binder jetting, represents the most disruptive technological shift. AM overcomes the limitations of traditional tooling, allowing foundries to rapidly prototype cores with internal structures impossible to achieve with molding, such as complex lattices or variable wall thicknesses, directly improving the efficiency of next-generation turbine cooling. While still struggling with surface finish and production speed compared to CIM, AM excels in low-volume, high-value applications and bespoke component manufacturing. Other critical technology areas include advanced analytical techniques, such as X-ray computed tomography (CT scanning), used for non-destructive inspection of core internal features and density variation, ensuring conformance to the rigorous aerospace standards before they enter the expensive metal casting process, thereby mitigating costly casting failures.

Regional Highlights

- North America: Dominates the market value due to the presence of global aerospace and defense giants (e.g., Boeing, Lockheed Martin, major engine manufacturers) and substantial R&D investments. Demand is concentrated in high-performance Zirconia and Alumina cores for military and commercial aviation engine hot sections. The region benefits from stringent regulatory requirements that favor highly reliable, domestically sourced components.

- Europe: A mature and highly specialized market, particularly strong in industrial gas turbine manufacturing (Germany, Italy, UK) and luxury automotive turbocharger components. European demand focuses on optimizing core removal processes and investing in advanced ceramic material research, often driven by EU-wide efficiency targets and environmental regulations.

- Asia Pacific (APAC): Exhibits the highest growth rate, driven by rapid industrialization, burgeoning domestic aerospace industries (especially in China and India), and massive infrastructure projects requiring new power generation capabilities. The region is seeing significant expansion in local investment casting capabilities, increasingly demanding high-volume, cost-effective silica and alumina cores, alongside selective high-end core adoption for domestic engine programs.

- Latin America (LATAM): A smaller, but growing market primarily focused on MRO activities for existing aviation fleets and specialized industrial applications (e.g., mining and oil & gas equipment). Market growth is reliant on foreign direct investment and technology transfer from North American and European suppliers.

- Middle East and Africa (MEA): Growth is tied heavily to capital investment in the oil and gas sector (gas turbine power generation) and rapid expansion of commercial aviation hubs (e.g., UAE, Qatar). The region requires robust cores for maintaining imported high-value energy infrastructure and supporting new MRO centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Core Market.- Remet Corporation

- Morgan Advanced Materials

- Hi-Tech Ceramics, Inc.

- PCC Airfoils, Inc.

- Vesuvius plc

- CoorsTek, Inc.

- CeramTec GmbH

- Precision Ceramics

- Lanik s.r.o.

- Consolidated Precision Products Corp. (CPP)

- Shellcast Foundries, Inc.

- General Pattern Co.

- Rauschert GmbH

- Blasch Precision Ceramics, Inc.

- Zircoa, Inc.

- McDanel Advanced Ceramics

- Unifrax I LLC

- Applied Ceramics Inc.

- Inducer Technology Inc.

- Cotronics Corporation

Frequently Asked Questions

Analyze common user questions about the Ceramic Core market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a ceramic core in investment casting?

The primary function of a ceramic core is to act as a sacrificial mold to create intricate internal passages, such as cooling channels within turbine blades or complex internal flow geometries, which cannot be formed using traditional tooling methods. After the metal alloy solidifies, the ceramic core is chemically dissolved (leached) out, leaving a hollow, precision component.

Which ceramic materials are most commonly used for high-temperature turbine component cores?

For high-temperature applications, especially those involving superalloys used in gas turbine engines, Zirconia (ZrO2) and high-purity Alumina (Al2O3) cores are most commonly utilized. These materials offer superior refractoriness and chemical stability necessary to withstand the extremely high melting temperatures of nickel and cobalt-based superalloys.

How is the Ceramic Core Market impacted by Additive Manufacturing (3D Printing)?

Additive Manufacturing (AM) is transforming the market by enabling the rapid production of highly complex core geometries without the need for expensive, dedicated tooling. AM is particularly impactful for prototyping, low-volume production, and creating designs previously considered impossible via traditional Ceramic Injection Molding (CIM), driving innovation in thermal management designs.

What is the key driver of growth in the Ceramic Core Market?

The central driver of growth is the global demand from the aerospace and energy sectors for increased component efficiency. This necessitates the creation of hotter-running, lighter engines and turbines, which rely exclusively on ceramic cores to form the complex internal cooling schemes required to manage extreme thermal stresses and maximize performance.

What are the main risks associated with using ceramic cores in casting?

The primary risks include the inherent brittleness of the cores, leading to high scrap rates during handling and assembly, and the potential for residual core material remaining post-leaching, which can compromise the integrity of the final cast component. Ensuring dimensional accuracy and minimizing core-related defects are continuous manufacturing challenges.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Wire-Wound Surface Mount Inductor Market Size Report By Type (Ceramic Core Wire-Wound Surface Mount Inductor, Magnetic Core Wire-Wound Surface Mount Inductor), By Application (Automotive Electronics, Communications, Consumer Electronics, Computer, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Ceramic Core Market Statistics 2025 Analysis By Application (Aerospace & Space, Industrial Gas Turbine Blades, Automotive), By Type (Silica-based Ceramic Core, Zirconia-based Ceramic Core, Alumina-based Ceramic Core), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Wire-Wound Surface Mount Inductor Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ceramic Core Wire-Wound Surface Mount Inductor, Magnetic Core Wire-Wound Surface Mount Inductor), By Application (Automotive Electronics, Communications, Consumer Electronics, Computer), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager