Ceramic Dummy Wafer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441345 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Ceramic Dummy Wafer Market Size

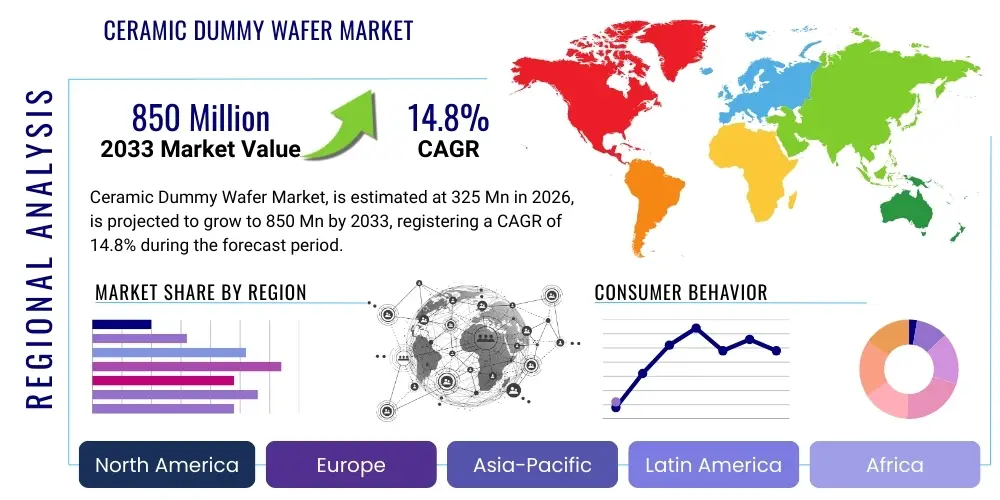

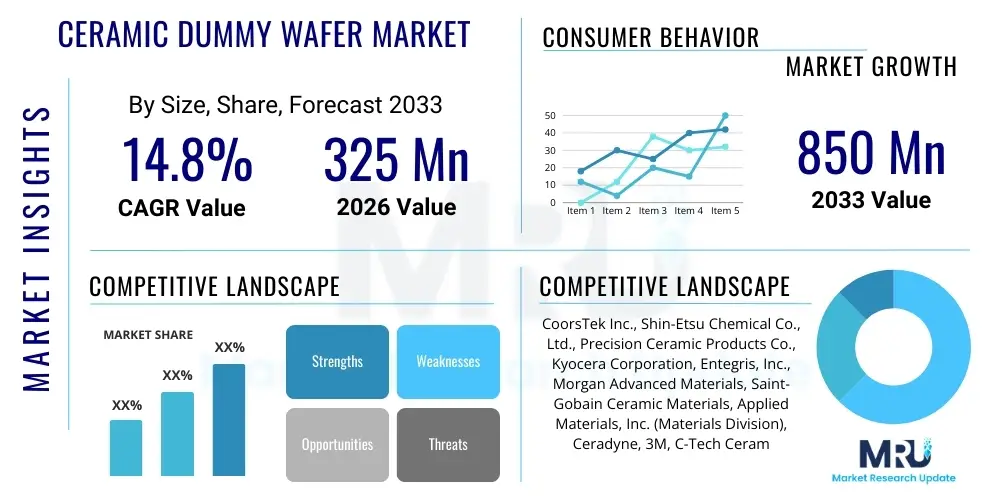

The Ceramic Dummy Wafer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2026 and 2033. The market is estimated at $325 Million in 2026 and is projected to reach $850 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the relentless scaling and complexity of semiconductor manufacturing processes, particularly the transition to smaller nodes and the increasing adoption of 300mm wafer technology globally. Ceramic dummy wafers, crucial for calibration and process stabilization in advanced fabrication facilities (fabs), are witnessing rising demand as manufacturers prioritize yield optimization and equipment precision.

Ceramic Dummy Wafer Market introduction

The Ceramic Dummy Wafer Market encompasses the production and supply of high-purity ceramic substrates utilized primarily within the semiconductor manufacturing industry. These wafers are non-functional surrogates, distinct from silicon or compound semiconductor production wafers, designed specifically for rigorous equipment calibration, process development, and routine cleaning cycles across various critical fabrication steps. They are essential tools for optimizing complex processes such as Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD), etching (plasma and dry), Chemical Mechanical Planarization (CMP), and metrology systems, ensuring the expensive production equipment maintains strict performance tolerances before actual product wafers are processed.

Ceramic dummy wafers are typically manufactured from materials like high-purity Alumina (Al₂O₃), Silicon Carbide (SiC), or various specialized refractory oxides, selected for their exceptional characteristics including superior thermal stability, high mechanical strength, chemical inertness, and precise control over surface finish and flatness. These properties are paramount as the wafers must withstand extreme thermal cycling, aggressive chemical exposure, and intensive mechanical stress within high-vacuum or high-temperature environments. Major applications span across integrated device manufacturers (IDMs), pure-play foundries, and semiconductor equipment manufacturers (SEMs) who rely on these tools to minimize defects, improve throughput, and validate new process recipes, especially those associated with advanced logic and memory chips.

The market's growth is fundamentally driven by several intertwined factors. The global increase in semiconductor capital expenditure (CapEx), particularly in Asia Pacific, fuels the demand for new fabs and subsequent equipment installation, where CDWs are mandatory for initial setup and qualification. Furthermore, the migration toward advanced manufacturing nodes (7nm, 5nm, and below) necessitates tighter process control and more frequent calibration, escalating the consumption rate of these high-precision ceramic substrates. Benefits derived from utilizing CDWs include significant reduction in costly production wafer wastage, improved equipment uptime, faster ramp-up times for new process lines, and enhanced overall manufacturing yield, making them indispensable components of the modern semiconductor ecosystem.

Ceramic Dummy Wafer Market Executive Summary

The Ceramic Dummy Wafer Market is characterized by robust growth, primarily propelled by global semiconductor industry expansion and the increasing complexity of manufacturing processes, demanding higher precision and lower defect rates. Business trends indicate a strong shift towards larger diameter CDWs, particularly 300mm, aligning with the industry standard for high-volume manufacturing, while the specialization in ultra-high-purity materials like advanced Silicon Carbide and specialized Alumina formulations is becoming critical for supporting extreme ultraviolet (EUV) lithography and advanced plasma etch applications. Key manufacturers are focusing on enhancing surface finish uniformity and material properties to meet the stringent requirements of sub-10nm process nodes, emphasizing collaborative research with equipment vendors to secure proprietary specifications for next-generation tools.

Regional trends clearly delineate the Asia Pacific (APAC) region as the undisputed epicenter of market demand and rapid expansion. Countries such as Taiwan, South Korea, China, and Japan house the vast majority of advanced semiconductor fabs, driving high consumption rates for both new equipment qualification and ongoing maintenance cycles. Significant government investments in domestic chip production capabilities, notably in China, are accelerating fab capacity additions, thereby creating immense downstream opportunities for CDW suppliers. North America and Europe remain key, albeit mature, markets, focused primarily on high-value, specialized applications and serving as central hubs for technology development and equipment manufacturing.

Segment trends reveal that the 300mm diameter segment dominates the market in terms of revenue, reflecting its status as the standard for volume production, although 200mm wafers maintain steady demand for legacy nodes, power electronics, and specialized sensor production. In terms of material, Alumina (Al₂O₃) ceramic remains a cornerstone due to its cost-effectiveness and excellent foundational properties, yet the high-performance Silicon Carbide (SiC) segment is exhibiting the fastest growth trajectory. SiC offers superior thermal conductivity and plasma resistance, making it essential for highly aggressive plasma etching and deposition processes critical in vertical NAND and complex logic fabrication, indicating a clear technological premiumization trend within the market.

AI Impact Analysis on Ceramic Dummy Wafer Market

Common user questions regarding AI's impact on the Ceramic Dummy Wafer Market often center on how digitalization and machine learning will influence wafer usage frequency, quality control, and the overall lifecycle management of these critical components. Users frequently inquire whether AI-driven predictive maintenance systems will reduce the necessity for scheduled, routine wafer cycling, thus potentially decreasing consumption volumes, or conversely, if increased process optimization demands will necessitate more complex, application-specific dummy wafers tracked by AI. Key concerns revolve around the integration challenges of high-resolution inspection data, generated during CDW usage, into existing AI yield management platforms, and the potential for AI to automate the specification generation for new generations of custom ceramic wafers tailored for specific equipment fingerprints.

The summary theme is that AI will not eliminate the need for ceramic dummy wafers; instead, it will elevate their importance as data collection instruments and process reference points. AI technologies, especially machine learning algorithms, are becoming instrumental in analyzing the vast datasets generated by metrology and inspection tools during CDW runs. This allows fabs to move from simple scheduled maintenance cycling to sophisticated, condition-based monitoring, optimizing the timing and frequency of necessary cleaning and calibration runs. This precision reduces overall operational variability, but simultaneously demands extremely high fidelity and repeatability from the ceramic wafers themselves, pushing suppliers toward tighter manufacturing tolerances and improved material homogeneity.

Furthermore, AI-driven process modeling and virtual fabrication environments utilize data collected from CDW cycles to refine process recipes before they are applied to expensive production wafers. This capability, focusing on identifying subtle equipment drifts or process non-uniformities that are invisible to traditional monitoring, ensures that CDWs become central to the digital twin strategy of advanced fabs. The implementation of AI for advanced defect detection and classification on CDWs is setting new standards for quality assurance, necessitating extremely pure ceramic compositions and near-atomic level surface precision to ensure that the monitored defects are attributable to the equipment and not the calibration substrate.

- AI-enhanced Predictive Maintenance: AI algorithms analyze CDW sensor data to forecast equipment drift, optimizing calibration cycles and minimizing unnecessary dummy wafer use while maximizing equipment uptime.

- Automated High-Fidelity Inspection: Machine learning facilitates rapid, ultra-precise classification of defects and particles detected on the CDW surface post-process, drastically improving quality control validation.

- Digital Twin Integration: CDW usage profiles contribute essential real-world data points to the digital twin of the fabrication line, enabling accurate simulation and optimization of future process recipes.

- Material and Design Optimization: AI assists in correlating process performance metrics with specific CDW material properties, guiding manufacturers in developing next-generation ceramics with enhanced thermal and chemical resistance for specific tool types.

- Yield Prediction Improvement: By establishing a precise baseline using calibrated CDWs, AI models can more accurately predict production yield fluctuations, mitigating costly operational errors.

DRO & Impact Forces Of Ceramic Dummy Wafer Market

The Ceramic Dummy Wafer Market is significantly influenced by a dynamic interplay of driving forces, inherent constraints, and strategic growth opportunities, all governed by the overarching demands of the global semiconductor industry. The primary drivers include the massive global capacity expansion in 300mm and emerging 450mm fabs, the necessity for ultra-high process precision in sub-10nm technology nodes, and the escalating reliance on complex, multi-step processes like High Aspect Ratio (HAR) etching that require frequent and detailed equipment calibration. These drivers establish the fundamental requirement for durable, highly reproducible reference substrates, reinforcing the indispensable role of CDWs in modern chip fabrication.

Restraints, however, pose challenges to market expansion and profitability. The high initial cost associated with manufacturing ultra-high-purity ceramic materials, coupled with the extremely demanding specifications for surface flatness (Total Thickness Variation, or TTV) and particle cleanliness, limits the number of qualified suppliers and often results in extended lead times. Furthermore, the reliance on specialized, proprietary ceramic formulations for specific equipment models (e.g., specific CVD or PVD reactors) creates vendor lock-in and high switching costs for end-users. The continuous obsolescence cycle, where new wafer sizes or materials are introduced for advanced nodes, necessitates constant R&D investment, posing a financial burden on smaller market participants.

Opportunities for growth are abundant, particularly in emerging areas such as advanced packaging (e.g., 2.5D/3D integration), where temporary bonding and handling wafers require specialized thermal and chemical properties. The long-term research into 450mm wafer production, while slow, represents a substantial future market shift that will necessitate entirely new generations of oversized ceramic dummy wafers. Furthermore, the expansion of compound semiconductor manufacturing (e.g., GaN, SiC power devices) also utilizes ceramic handling and carrier wafers, broadening the application base beyond traditional silicon logic and memory. Strategic partnerships between ceramic manufacturers, equipment vendors, and leading foundries are crucial for capturing these next-generation opportunities.

These forces collectively define the market landscape. The accelerating pace of Moore's Law and increasing CapEx act as powerful external drivers, demanding proportional increases in CDW quality and volume. Restraints related to materials science and cost enforce rigorous quality control and high barriers to entry. The opportunities in advanced node development and adjacent semiconductor markets provide long-term resilience and diversification potential, ensuring the market's sustained relevance and growth trajectory over the forecast period, contingent upon successful innovation in material purity and mechanical stability.

- Drivers:

- Escalation in global semiconductor fabrication capacity (300mm fab construction).

- Increasing process complexity at advanced nodes (e.g., FinFET, GAAFET, EUV lithography requirements).

- Mandatory compliance with stringent yield management standards and defect reduction targets.

- High frequency of equipment maintenance and calibration cycles (e.g., CMP conditioning, etch tuning).

- Restraints:

- High manufacturing cost and technical difficulty in achieving ultra-precise surface finish and purity.

- Material degradation and limited lifespan when exposed to aggressive plasma environments.

- Stringent qualification standards and lengthy approval cycles required by major IDMs and foundries.

- Supply chain vulnerability tied to specialized raw material sourcing (e.g., high-purity Alumina powder).

- Opportunity:

- Development of 450mm wafer processing technologies, requiring larger diameter CDWs.

- Increasing adoption in advanced packaging applications (fan-out, interposers, temporary carriers).

- Demand diversification into emerging compound semiconductor markets (SiC, GaN substrates).

- Integration of advanced sensing capabilities within dummy wafers for real-time process monitoring (Smart CDWs).

- Impact Forces:

- Technological substitution risk is low due to the indispensable nature of physical calibration references.

- Price sensitivity is moderate, as process reliability (yield protection) outweighs minor cost savings.

- Competitive rivalry is concentrated among a few highly qualified suppliers capable of meeting ultra-high purity standards.

Segmentation Analysis

The Ceramic Dummy Wafer Market is comprehensively segmented based on three primary dimensions: Wafer Diameter, Material Type, and Application. This segmentation provides clarity regarding the specific demands generated by different facets of semiconductor manufacturing and technological maturity. The Diameter segment is crucial as it directly correlates with production volume standards (300mm being the high-volume standard), while the Material segment dictates the technical suitability for various aggressive process steps, with Silicon Carbide addressing high-end etching needs and Alumina serving broader process development roles. Understanding these segments is key to strategic resource allocation for market participants.

The Application segment further differentiates demand based on the functional role of the wafer within the fab, ranging from the mechanical rigor of Chemical Mechanical Planarization (CMP) conditioning, which requires high abrasive resistance, to the precise contamination monitoring needed in deposition or metrology processes. The underlying driver for segmentation is the constant need for customization; unlike silicon wafers, ceramic dummy wafers are often tailored to specific equipment models and processes, meaning that a 300mm SiC wafer used for plasma etch tuning has fundamentally different specifications and value proposition compared to a 200mm Alumina wafer used for furnace loading practice. This high degree of specialization ensures that market players must maintain diverse product portfolios.

- By Wafer Diameter:

- 100mm (4-inch)

- 150mm (6-inch)

- 200mm (8-inch)

- 300mm (12-inch)

- 450mm (Under Development/Research)

- By Material Type:

- Alumina (Aluminum Oxide - Al₂O₃)

- Silicon Carbide (SiC)

- Quartz/Fused Silica

- Zirconia (Zirconium Dioxide)

- Specialized Refractory Oxides (e.g., Aluminum Nitride)

- By Application:

- Chemical Mechanical Planarization (CMP) Conditioning

- Physical Vapor Deposition (PVD) Equipment Calibration

- Chemical Vapor Deposition (CVD) Process Development

- Etching (Dry Etch and Wet Etch) Uniformity Testing

- Handling and Load Port Practice

- Metrology and Inspection System Calibration

Value Chain Analysis For Ceramic Dummy Wafer Market

The value chain for the Ceramic Dummy Wafer Market begins with the highly specialized upstream procurement of ultra-high-purity ceramic powders, such as sub-micron Alumina or reaction-bonded Silicon Carbide precursors. This upstream phase is crucial because the final wafer performance, particularly in terms of microstructural homogeneity and impurity levels, is directly dependent on the quality and purity of these raw materials. Suppliers in this phase are often chemical specialists who must meet semiconductor-grade purity levels (typically 99.999% or higher), maintaining stringent control over particle size distribution and trace element contamination, which dictates the performance capability in aggressive fab environments. Securing stable, long-term supply agreements for these specialty chemicals is a significant strategic consideration for CDW manufacturers.

The core manufacturing process involves complex steps including powder consolidation (e.g., pressing, casting, or slip casting), high-temperature sintering, and critically, precision machining and polishing. Sintering achieves the required density and mechanical strength, while the subsequent machining operations are highly proprietary, aimed at achieving nanometer-level control over surface roughness, parallelism, and Total Thickness Variation (TTV). Quality control and metrology at this stage are intensive, requiring specialized inspection equipment to certify the wafer meets the zero-defect standards required by foundries. The cost added at this stage is substantial, reflecting the high capital expenditure required for precision grinding and polishing tools, and the highly skilled labor necessary for manual final finishing and inspection.

The downstream distribution channel typically involves a mix of direct sales and specialized technical distributors. Due to the highly customized nature of many CDWs, direct engagement between the manufacturer and the end-user (foundry or equipment OEM) is common, especially for qualification of new process nodes or proprietary equipment lines. Indirect distribution utilizes technical sales representatives who often maintain inventory for high-turnover, standard-sized wafers (e.g., general-purpose 300mm handling wafers). The final end-users are primarily concentrated in the APAC region. Effective distribution requires specialized logistics to handle fragile, high-value components while maintaining ultra-cleanroom packaging standards (Class 1 or Class 10 clean bags and cassettes) to prevent contamination during transit, which is non-negotiable for semiconductor applications.

Ceramic Dummy Wafer Market Potential Customers

The primary consumers and buyers of ceramic dummy wafers are concentrated within the intricate ecosystem of the global semiconductor industry, specifically those entities involved in high-volume manufacturing and equipment development. Integrated Device Manufacturers (IDMs), which design and manufacture their own chips (e.g., Intel, Samsung), represent a large segment, utilizing CDWs across all their internal fabrication lines for quality assurance, calibration, and engineering studies. Similarly, pure-play foundries (e.g., TSMC, GlobalFoundries) are massive consumers, demanding high volumes of CDWs to support diverse customer recipes and maintain peak performance across their extensive, leading-edge fabrication facilities, where continuous uptime and yield are paramount financial metrics.

A second crucial segment includes Semiconductor Equipment Manufacturers (SEMs), such as Applied Materials, Lam Research, and KLA Corporation. These companies are vital early-stage customers, purchasing CDWs during the design, testing, and pre-shipping qualification phases of their multi-million dollar equipment (e.g., plasma etchers, CVD reactors, CMP tools). CDWs are required to prove the functionality, uniformity, and stability of new tools before delivery to the foundry or IDM. This segment often demands proprietary, highly specialized CDWs manufactured to custom specifications that match the unique geometry and process requirements of their specific chambers or modules, driving significant R&D collaboration within the value chain.

Finally, smaller but strategically important customers include specialized outsourced assembly and test (OSAT) companies involved in advanced packaging, as well as various research and development institutions, university cleanrooms, and government labs focused on material science and microelectronics. While their volumes are lower than those of major foundries, these entities often require the most technologically demanding and customized products for exploring novel materials, non-standard wafer sizes, or extreme processing conditions. Successful engagement with these potential customers requires suppliers to offer not just products, but detailed material science consultancy and technical support to navigate complex process integration challenges.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $325 Million |

| Market Forecast in 2033 | $850 Million |

| Growth Rate | CAGR 14.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CoorsTek Inc., Shin-Etsu Chemical Co., Ltd., Precision Ceramic Products Co., Kyocera Corporation, Entegris, Inc., Morgan Advanced Materials, Saint-Gobain Ceramic Materials, Applied Materials, Inc. (Materials Division), Ceradyne, 3M, C-Tech Ceramic, Beijing Kaide Ceramic, LPE S.p.A., Hitachi Chemical Co., Ltd., Rauschert GmbH, Technical Ceramics, Sumitomo Chemical Co., Ltd., Ferrotec Corporation, Wuxi South Semiconductor Co., Ltd., Denka Company Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic Dummy Wafer Market Key Technology Landscape

The technological landscape of the Ceramic Dummy Wafer Market is fundamentally defined by advancements in material science, precision machining, and metrology required to meet the escalating demands of sub-10nm semiconductor fabrication. A critical technological focus is the development of ultra-high-purity ceramic formulations, particularly refining the sintering process for materials like high-density Alumina and advanced reaction-bonded Silicon Carbide. Suppliers invest heavily in mitigating microstructural defects, ensuring consistent grain size, and minimizing trace metal contamination—impurities that can desorb in vacuum environments and compromise the delicate production wafers. The goal is to create a substrate that is chemically inert and mechanically robust, providing a stable reference plane under extreme thermal and plasma conditions.

Precision surface engineering constitutes the second pillar of technological advancement. Modern dummy wafers require surface finishes measured in angstroms, far exceeding general engineering requirements. Technologies such as Chemical Mechanical Polishing (CMP) optimized for hard ceramics, ultra-precision lapping, and specialized surface conditioning treatments are employed to achieve exceptional flatness (Total Thickness Variation, TTV, often less than 5 micrometers for 300mm wafers) and ultra-low surface roughness (Ra). Furthermore, technologies related to edge bevel and notch precision are critical for automated wafer handling systems (AMHS), ensuring seamless integration and preventing particle generation that could contaminate the equipment or the surrounding cleanroom environment.

Emerging technologies include the integration of "Smart" capabilities into ceramic dummy wafers. This involves embedding passive or active sensors (e.g., thermal, pressure, or RF sensors) directly into the ceramic body to capture real-time process data within highly constrained equipment chambers (such as plasma etch tools). These smart CDWs provide unparalleled insights into tool performance, enabling real-time feedback loops for process control and diagnostics, greatly enhancing AEO and GEO strategies for market analysis. The technical challenge lies in embedding these components without compromising the mechanical integrity, purity, or thermal properties of the ceramic substrate, necessitating specialized high-temperature bonding and encapsulation techniques.

Regional Highlights

The Asia Pacific (APAC) region fundamentally dominates the global Ceramic Dummy Wafer Market, driven by the concentration of the world’s leading semiconductor manufacturing capacity, particularly in Taiwan, South Korea, and China. Taiwan, home to major pure-play foundries, maintains the highest demand, constantly requiring CDWs for its vast network of 300mm fabs and aggressive transition to advanced nodes (5nm and 3nm). South Korea's robust memory chip sector (DRAM and NAND) drives significant consumption, particularly demanding high-durability SiC wafers for intense plasma etch processes critical to vertical architecture fabrication. China is experiencing explosive growth, propelled by significant national strategic investments aimed at achieving self-sufficiency in semiconductor production, leading to massive capital expenditures on new fab construction and subsequent mandatory CDW provisioning for equipment installation and qualification runs.

North America holds a strong position in the market, characterized by technological leadership and a concentration of semiconductor equipment manufacturers (SEMs) and leading-edge R&D activities. While the actual high-volume manufacturing (HVM) capacity is less than APAC, North American players are crucial buyers, as they utilize CDWs extensively for the design, testing, and qualification of new generations of semiconductor manufacturing equipment before shipping the tools globally. This region dictates the technical specifications and performance benchmarks for next-generation CDWs, especially those required for advanced lithography and novel materials processing. Investment in domestic fabrication capacity, spurred by initiatives like the CHIPS Act, is expected to increase regional consumption of standard CDWs over the latter half of the forecast period.

Europe represents a niche but highly specialized segment, primarily focused on automotive, industrial, and specialized power semiconductor manufacturing (often utilizing 200mm wafers for SiC and GaN devices). European R&D institutions and equipment manufacturers also contribute significantly to demand, particularly in areas requiring ultra-high precision ceramic components for highly sensitive metrology and inspection systems. While not a volume leader, the European market commands a premium for highly specialized, customized ceramic solutions. The Middle East and Africa (MEA) and Latin America currently represent nascent markets, with demand largely limited to smaller local assembly operations, specialized academic research, and the maintenance of older generation fabs or solar cell manufacturing facilities, relying heavily on imports from established suppliers in APAC and North America.

- Asia Pacific (APAC): Dominates the market due to the concentration of 300mm and advanced technology fabs in Taiwan, South Korea, and mainland China. Growth driven by governmental subsidies supporting domestic capacity expansion and aggressive scaling (sub-5nm nodes).

- North America: Key technology center; high demand from Semiconductor Equipment Manufacturers (SEMs) for new tool qualification and R&D. Demand expected to rise due to increased domestic fab construction investments (e.g., Arizona, New York).

- Europe: Focuses on specialized applications, including automotive electronics, industrial sensors, and compound semiconductor devices (SiC, GaN). Demand is stable for customized, high-specification ceramic products.

- Latin America & Middle East/Africa (LAMEA): Emerging markets with low current volume. Primary consumption is related to maintenance of existing, often older, fabrication or assembly facilities. Potential growth tied to future regional semiconductor investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Dummy Wafer Market.- CoorsTek Inc.

- Shin-Etsu Chemical Co., Ltd.

- Precision Ceramic Products Co.

- Kyocera Corporation

- Entegris, Inc.

- Morgan Advanced Materials

- Saint-Gobain Ceramic Materials

- Applied Materials, Inc. (Materials Division)

- Ceradyne (3M subsidiary)

- Denka Company Limited

- C-Tech Ceramic

- Beijing Kaide Ceramic

- LPE S.p.A.

- Hitachi Chemical Co., Ltd.

- Rauschert GmbH

- Technical Ceramics

- Sumitomo Chemical Co., Ltd.

- Ferrotec Corporation

- Wuxi South Semiconductor Co., Ltd.

- TOTO Ltd.

Frequently Asked Questions

Analyze common user questions about the Ceramic Dummy Wafer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a ceramic dummy wafer in semiconductor manufacturing?

The primary function of a ceramic dummy wafer (CDW) is to serve as a non-productive, high-precision substrate used for equipment calibration, process qualification, and routine maintenance (e.g., cleaning, conditioning) of critical fabrication tools, such as CMP systems, etchers, and deposition chambers, ensuring optimal yield before processing expensive production wafers.

Why are ceramic materials preferred over silicon for dummy wafers in certain applications?

Ceramic materials, particularly Alumina and Silicon Carbide, are preferred for their superior thermal stability, higher mechanical hardness, and enhanced resistance to aggressive plasma etching and corrosive cleaning chemicals, properties that exceed those of silicon and are necessary for simulating harsh production environments without degradation or contamination.

Which wafer diameter segment dominates the Ceramic Dummy Wafer Market?

The 300mm (12-inch) wafer diameter segment dominates the market in terms of revenue, reflecting its global adoption as the standard size for high-volume manufacturing (HVM) of advanced logic and memory semiconductors, necessitating large quantities of CDWs for calibration and throughput optimization.

How does the quality of the ceramic dummy wafer affect overall semiconductor yield?

The quality of the ceramic dummy wafer directly impacts yield by serving as the critical reference for detecting equipment non-uniformity or particle generation. If a CDW lacks precision in surface flatness (TTV) or contains impurities, it can provide false readings, leading to incorrect equipment adjustments that compromise subsequent production wafer uniformity and yield rates.

What are the fastest-growing material segments within the Ceramic Dummy Wafer Market?

Silicon Carbide (SiC) is the fastest-growing material segment, driven by its superior plasma erosion resistance and thermal conductivity, making it essential for advanced, aggressive dry etching processes required for manufacturing complex 3D NAND and next-generation logic devices at sub-7nm nodes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager