Ceria Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441025 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Ceria Market Size

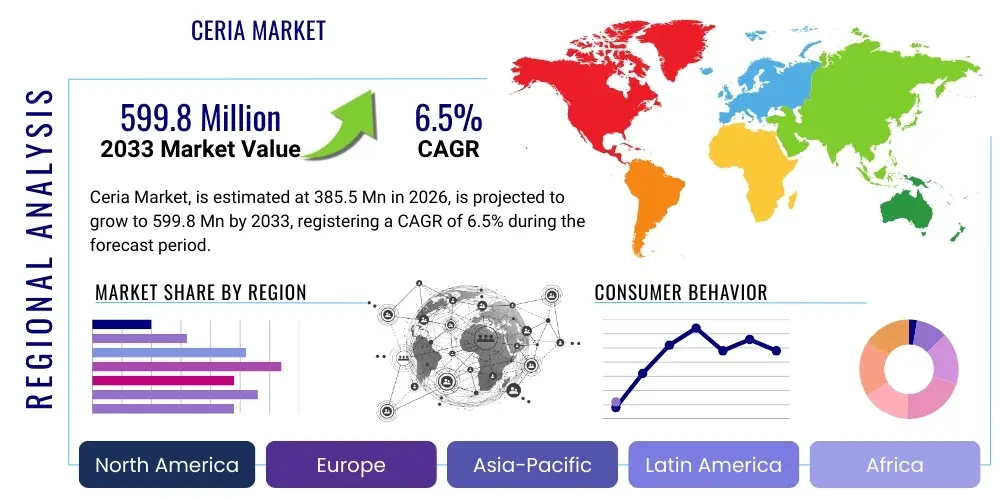

The Ceria Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $385.5 million in 2026 and is projected to reach $599.8 million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global regulatory environment mandating stricter emission controls, thereby boosting the necessity for advanced automotive catalytic converters. Furthermore, the persistent demand for high-precision polishing agents in the rapidly evolving electronics sector, particularly for Chemical Mechanical Planarization (CMP) in semiconductor fabrication and specialized glass polishing, contributes significantly to this positive market trajectory.

Market valuation growth reflects not only volume increase but also a shift towards higher-value, high-purity Ceria grades, especially those utilized in cutting-edge applications such as Solid Oxide Fuel Cells (SOFCs) and advanced UV-absorbing materials. The shift towards sustainable and efficient energy systems globally provides a robust underlying structural support for Ceria demand, given its critical role as an electrolyte or catalyst component in various green technologies. Investment in specialized refining capacity and the vertical integration efforts by major rare earth companies are key factors enabling this projected financial increase, ensuring a more stable and high-quality supply chain moving forward.

Ceria Market introduction

Ceria, or Cerium Oxide (), is the most commercially important oxide of the rare earth element cerium. It is a pale yellow to white powder known for its exceptional chemical stability, high oxygen storage capacity, and superior mechanical properties. These unique characteristics make it indispensable across a multitude of high-technology sectors. The market encompasses the production, processing, distribution, and utilization of Ceria in various purity grades, ranging from standard polishing compounds to high-purity materials required for advanced electronics and energy applications.

The product is fundamentally crucial as a polishing agent, exhibiting high removal rates and excellent surface finishes, making it the material of choice for glass polishing (e.g., precision optics, flat panel displays, and automotive windshields) and increasingly vital for CMP processes in semiconductor manufacturing. Its major functional application, however, lies in catalysis. Ceria’s ability to readily cycle between the +3 and +4 oxidation states () provides it with a high oxygen storage capacity (OSC), which is essential for stabilizing platinum group metals and ensuring efficient conversion of noxious emissions in automotive catalytic converters. This catalytic role is a primary market driver, intrinsically linked to global vehicular sales and stringent environmental regulations.

Key benefits derived from Ceria include improved environmental performance through efficient pollution control, enhanced product quality in manufacturing (especially ultra-smooth surfaces in electronics), and increased energy efficiency in solid oxide fuel cells (SOFCs) where it functions as a critical electrolyte or electrode material. Driving factors include the sustained global demand for sophisticated consumer electronics requiring ultra-flat substrates, the rapid implementation of Euro 7 and equivalent international emission standards, and significant governmental investment into hydrogen and fuel cell technologies, which heavily rely on advanced cerium oxide derivatives for improved performance and longevity. The versatility and irreplaceable nature of Ceria in these specific applications solidify its strong market position.

Ceria Market Executive Summary

The Ceria Market is undergoing a rapid transition characterized by strong demand growth, technological diversification, and notable supply chain consolidation efforts. Business trends indicate a marked shift towards high-purity and nano-grade Ceria products, moving away from bulk, lower-value polishing compounds. Manufacturers are heavily investing in specialized refining technologies to meet the stringent purity requirements of the semiconductor and SOFC industries, necessitating significant capital expenditure in separation and preparation infrastructure. This push is concurrently driving mergers and acquisitions among rare earth processors aimed at securing stable, long-term supply agreements and optimizing processing efficiencies. Furthermore, the imperative for supply chain resilience, particularly in Western markets, is promoting investment in non-Chinese rare earth sources, diversifying geopolitical risk associated with Ceria procurement.

Regionally, Asia Pacific (APAC) currently dominates the consumption and production landscape, primarily due to the concentration of major rare earth processing facilities in China and the expansive growth of the electronics and automotive manufacturing sectors across East Asia. However, North America and Europe are exhibiting the fastest growth rates in terms of value, driven by aggressive regulatory actions on vehicle emissions and substantial public and private investment into next-generation energy technologies, such as fuel cells and advanced catalytic systems. The European Union's focus on achieving carbon neutrality and diversifying its critical raw materials supply is particularly fueling regional expansion and technological innovation in Ceria application development.

Segment trends reveal that the Catalysis application segment, overwhelmingly dominated by automotive catalysts, remains the largest revenue generator, benefiting from the mandated replacement cycles and increasing vehicle penetration in developing economies. Nonetheless, the Solid Oxide Fuel Cell (SOFC) segment is anticipated to display the highest CAGR during the forecast period, reflecting global efforts to deploy stationary and mobile power generation solutions that utilize cleaner fuels. Within the product type segmentation, High Purity Ceria (>99.9%) is outpacing Standard Purity Ceria, indicative of the premiumization occurring in end-use sectors where material quality directly impacts performance metrics like electronic device yield or fuel cell efficiency.

AI Impact Analysis on Ceria Market

User inquiries concerning the influence of Artificial Intelligence (AI) on the Ceria market frequently center around three primary themes: how AI can optimize the complex extraction and separation processes of rare earths, the potential for AI-driven materials discovery to identify novel Ceria alternatives or superior derivatives, and the role of AI in improving the efficiency and lifespan of Ceria-based end products like catalysts and fuel cells. Users are particularly concerned with whether machine learning (ML) algorithms can mitigate the inherent volatility and geopolitical risk associated with rare earth supply chains by predicting market fluctuations, optimizing inventory management, and enhancing the efficiency of resource utilization during refinement. The overarching expectation is that AI will introduce significant cost savings, accelerate innovation, and contribute to greater transparency and sustainability within the critical materials sector.

AI is beginning to revolutionize the R&D and manufacturing stages of Ceria production and application. In research, sophisticated algorithms are employed to simulate crystallographic structures, predict catalytic activity based on surface chemistry modifications (e.g., doping with other rare earths), and accelerate the formulation of high-performance Ceria slurries used in precision polishing. This predictive modeling dramatically reduces the need for costly and time-consuming physical experimentation. In production, AI-powered process control systems analyze real-time sensor data from separation columns and calcination furnaces, enabling instantaneous adjustments to temperature, pH, and flow rates. This optimization leads to higher yields of desired purity grades and significantly lower energy consumption per unit of Ceria produced, addressing long-standing industry challenges related to efficiency and environmental footprint.

The influence of AI extends into the application phase, particularly in optimizing catalytic performance. ML models are being trained on vast datasets of engine operating conditions, pollutant levels, and catalyst composition to dynamically manage the oxygen storage capacity of Ceria components within vehicle emission systems. Furthermore, predictive maintenance frameworks utilize AI to monitor the degradation rate of Ceria-based electrolytes in SOFC stacks, allowing operators to preempt failures, maximize operational lifespan, and reduce total cost of ownership. These advancements position AI as a critical enabling technology, driving higher performance standards and operational efficiencies throughout the Ceria value chain, consequently increasing demand for specialized, traceable, and consistent high-purity Ceria input materials.

- AI optimizes rare earth separation processes, leading to higher Ceria purity yields and reduced operational costs.

- Machine learning accelerates the discovery and testing of novel Ceria dopants and nano-structures for enhanced catalytic performance.

- Predictive analytics improves supply chain resilience by forecasting price volatility and managing strategic stockpiles of rare earth feedstocks.

- AI-driven monitoring enhances the durability and efficiency of Ceria-based components in solid oxide fuel cells (SOFCs) and advanced sensors.

- Robotic process automation (RPA) integrated with AI enhances quality control and precision during the manufacturing of Ceria polishing slurries for CMP applications.

DRO & Impact Forces Of Ceria Market

The Ceria market is shaped by a complex interplay of fundamental market drivers, structural restraints, strategic opportunities, and powerful external impact forces. The primary driving factor is the global trend toward rigorous environmental protection, specifically mandated through increasingly stringent regulations on vehicular emissions worldwide, which necessitates the widespread use of Ceria-containing catalytic converters for efficient pollution reduction. This demand is further amplified by the parallel technological driver of high-definition electronics, where Ceria remains the benchmark for precision polishing in semiconductor and display manufacturing. Restraints, conversely, center on the geopolitical concentration of rare earth mining and processing, leading to significant supply chain volatility and price instability, alongside increasing public and regulatory scrutiny regarding the environmental costs associated with rare earth extraction and waste disposal.

Opportunities for market expansion are primarily found in niche, high-value applications, particularly the burgeoning field of Solid Oxide Fuel Cells (SOFCs), where doped Ceria serves as a crucial, performance-defining electrolyte, aligning with global decarbonization goals. Furthermore, the development of specialized nano-ceria particles is opening up new avenues in biomedical applications (e.g., antioxidants, drug delivery systems) and advanced UV protection materials. External impact forces, such as government policies related to critical raw materials security and trade tariffs, exert immense pressure on supply stability. Technological breakthroughs in substitute materials, while currently limited, pose a long-term risk, whereas rapid advancements in Ceria doping techniques continuously enhance its performance, solidifying its competitive advantage across multiple high-tech domains.

The sustained demand from the automotive sector, coupled with innovations in SOFC technology, ensures a healthy growth outlook, despite recurring challenges related to raw material sourcing. Market participants are actively mitigating restraints through geographic diversification of sourcing and investment in closed-loop recycling technologies, turning previously perceived liabilities into long-term strategic opportunities. The convergence of these factors dictates a market trajectory characterized by moderate volume growth but significant value accretion, driven by the increasing need for ultra-high purity materials capable of meeting next-generation performance thresholds.

Segmentation Analysis

The Ceria market is comprehensively segmented based on its Purity Type, key Application areas, and the final End-Use Industry it serves, providing a multi-dimensional view of market dynamics and value distribution. Purity differentiation is crucial as it directly correlates with the material's performance in sensitive applications like electronics and catalysis, dictating price and market accessibility. Application segmentation highlights the functional use of Ceria, differentiating between large-volume uses (like automotive catalysts and glass polishing) and high-growth, specialized uses (like SOFCs and advanced pigments). The end-use industry analysis frames the demand from a macro-economic perspective, linking Ceria consumption to major industrial sectors such as automotive manufacturing, consumer electronics, and renewable energy infrastructure development.

Understanding these segments allows stakeholders to pinpoint specific growth vectors. For instance, the demand for High Purity Ceria is intrinsically linked to the investment cycle within the semiconductor fabrication industry, requiring highly stable and contamination-free polishing agents (CMP). Conversely, the volume requirement for standard purity Ceria remains tied to the traditional glass and jewelry polishing sectors. The segmentation by application clearly demonstrates the market’s reliance on environmental technology (catalysis), which accounts for the lion's share of volume, while simultaneously indicating the future direction of growth through high-tech energy and electronic applications. These segments do not operate in isolation but exhibit cross-dependencies, where innovation in one area (e.g., nano-Ceria production) can quickly transform consumption patterns across multiple end-use industries (e.g., healthcare and cosmetics).

- By Type:

- High Purity Ceria (99.9% and above)

- Standard Purity Ceria (99% - 99.9%)

- By Application:

- Catalysis

- Automotive Catalysts

- Chemical Catalysts

- Polishing

- Chemical Mechanical Planarization (CMP)

- Glass Polishing (e.g., Optics, Displays)

- Solid Oxide Fuel Cells (SOFCs)

- UV Absorbers/Sunscreen

- Pigments/Additives

- Electronics and Displays (e.g., Phosphors, Sensor Materials)

- By End-Use Industry:

- Automotive

- Electronics & Semiconductors

- Energy & Environment

- Glass & Ceramics

- Healthcare & Cosmetics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Ceria Market

The Ceria market value chain commences with the upstream extraction and concentration of rare earth ores, primarily bastnaesite and monazite, often sourced from specialized mines globally. This raw material is then subjected to complex separation and refining processes to isolate Cerium Oxide from other rare earth elements. Upstream activities are characterized by high capital intensity, significant environmental regulation adherence requirements, and geopolitical risk due to the concentration of efficient processing capabilities in specific regions, particularly East Asia. Ensuring a consistent, high-quality rare earth concentrate feed is paramount for maintaining competitive pricing and product purity downstream, making raw material security a key strategic focus for major market participants.

Midstream activities involve the conversion of purified cerium compounds into specific Ceria products, such as polishing powders, high-psurface area catalysts, or nano-structured materials, tailored to precise customer specifications regarding particle size distribution, morphology, and purity level. These processes often involve calcination, precipitation, and complex milling techniques. The distribution channel plays a vital role here, facilitating the flow from refiners to application-specific manufacturers. Direct distribution is common for high-volume, proprietary products (e.g., Ceria sold directly to major catalytic converter manufacturers under long-term contracts), ensuring quality control and technical support. Indirect distribution, leveraging specialized chemical distributors and agents, handles smaller, more standardized polishing grade volumes, reaching a wider array of glass and ceramics customers globally.

Downstream analysis focuses on the final consumption within end-use industries. Automotive manufacturers integrate Ceria into catalytic washcoats; semiconductor companies utilize Ceria slurries for CMP; and energy firms incorporate it into SOFC stacks. The value accretion at this stage is high, as the Ceria enables crucial functionality in complex systems. This consumption pattern is heavily influenced by regulatory cycles (e.g., emissions standards) and technological advancements (e.g., smaller node sizes in semiconductors). The efficiency and stability of Ceria in these final applications determine the material's market value, linking successful downstream performance directly back to the quality and consistency achieved during upstream rare earth separation and refinement.

Ceria Market Potential Customers

The primary consumers and potential buyers of Ceria are concentrated in highly regulated, technology-intensive industries where material performance is critical to the final product's functionality and regulatory compliance. Automotive catalyst manufacturers represent the largest volume purchasers, relying on Ceria's oxygen storage capacity to meet stringent governmental emission mandates (e.g., EPA, Euro standards). These companies typically engage in long-term supply contracts with Ceria producers to guarantee material consistency and quantity, making them foundational to the market’s stability and growth trajectory. The transition towards hybrid and advanced internal combustion engines continues to sustain this demand, even as electric vehicle adoption increases.

A rapidly growing segment of potential customers includes semiconductor fabrication plants (fabs) and specialized chemical companies serving the electronics supply chain. These entities procure ultra-high purity Ceria slurries for Chemical Mechanical Planarization (CMP), a process essential for creating the microscopically flat surfaces required for advanced integrated circuits. As feature sizes shrink (e.g., 5nm, 3nm nodes), the demand for increasingly finer and purer Ceria particles escalates, positioning these customers at the premium end of the market. Supplier relationships here are often characterized by intense collaboration on technical specifications and rigorous quality auditing, highlighting the technical barrier to entry for new suppliers in this segment.

Furthermore, energy and environmental technology developers form another critical customer base. This includes manufacturers of Solid Oxide Fuel Cells (SOFCs) utilizing Ceria-based electrolytes and developers of advanced ceramic materials for high-temperature applications. Biomedical and cosmetics companies are emerging buyers, particularly interested in nano-ceria for its unique properties as an antioxidant and effective, non-toxic UV absorber. These diverse customer bases underscore Ceria's role not just as a commodity chemical, but as a performance-enabling specialty material critical to achieving efficiency and compliance across the industrial landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $385.5 Million |

| Market Forecast in 2033 | $599.8 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alkane Resources Ltd., Lynas Rare Earths Ltd., Neo Performance Materials Inc., Solvay S.A., Treibacher Industrie AG, Shin-Etsu Chemical Co., Ltd., Merck KGaA, Universal Display Corporation, Rennie & Co. (Rare Earths), China Northern Rare Earth (Group) High-Tech Co., Ltd., Ganzhou Rare Earth Association, Inner Mongolia Baotou Steel Rare-Earth Hi-Tech Co., Ltd., HEFA Rare Earths, Sichuan Guangsheng Non-ferrous Metals Co., Ltd., Guangdong Rare Earth Industry Group Co., Ltd., Jiangxi Copper Co., Ltd., Showa Denko K.K., Mitsubishi Chemical Corporation, Nippon Yttrium Co., Ltd., Sumitomo Metal Mining Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceria Market Key Technology Landscape

The technological landscape of the Ceria market is characterized by innovations focused on two main areas: optimizing the purity and morphology of the material itself, and enhancing its integration and performance in sophisticated end applications. Upstream, the separation technology employed for cerium extraction from rare earth concentrates continues to evolve, with solvent extraction methods being refined for higher efficiency and lower environmental impact, crucial for meeting the increasing demand for ultra-high purity grades (>99.99%). Novel co-precipitation and controlled crystallization techniques are being developed to precisely control the particle size and surface area of Ceria powders, a critical factor for maximizing catalytic activity and optimizing polishing slurry performance in CMP applications for advanced semiconductors.

A significant area of technological focus is the development of nano-ceria. By synthesizing Cerium Oxide particles in the nanometer range, researchers can dramatically enhance the material's catalytic efficiency and introduce entirely new functionalities, such as specific redox activity for biomedical therapies or superior UV blocking capabilities for cosmetic formulations. This nanotechnology segment relies heavily on advanced manufacturing processes like hydrothermal synthesis and microemulsion techniques. Furthermore, in the energy sector, significant R&D is directed toward doping Ceria (e.g., using Samarium or Gadolinium, yielding SDC or GDC) to improve ionic conductivity for use as an electrolyte in intermediate-temperature Solid Oxide Fuel Cells (IT-SOFCs), pushing the boundaries of clean energy efficiency and device durability.

Digital technologies, as highlighted in the AI analysis, are increasingly integrated into the material science workflow. High-throughput screening and computational materials modeling allow researchers to rapidly test and optimize Ceria compositions and structures before physical synthesis, drastically cutting down development timelines. Continuous process monitoring using advanced sensors (e.g., spectroscopic and thermal analysis) is also a key technology, ensuring the production consistency required by demanding customers in the electronics and automotive industries. The convergence of advanced chemical synthesis, nanotechnology, and digital modeling defines the leading edge of Ceria market technology, shifting the focus from bulk material supply to high-performance, tailored specialty chemical provision.

Regional Highlights

Global Ceria consumption and production demonstrate significant regional variations, primarily influenced by industrial maturity, regulatory frameworks, and geological resource distribution. Asia Pacific (APAC) stands as the undisputed leader in both production capacity and consumption volume. China’s dominance in rare earth separation and refining provides it with a structural advantage, making it the central hub for Ceria supply globally. Furthermore, the massive manufacturing footprint in countries like South Korea, Japan, and Taiwan (especially in electronics and display production, which heavily rely on Ceria for polishing) ensures substantial regional demand. Growth in APAC is further fueled by the rapidly expanding automotive sectors in India and Southeast Asia, requiring increased volumes of catalytic converters.

- Asia Pacific (APAC): Dominates global production due to concentrated rare earth processing capabilities. High consumption driven by massive semiconductor, display, and automotive manufacturing bases in China, Japan, and South Korea. Projected to maintain the largest market share throughout the forecast period due to robust industrial expansion and infrastructure investment.

- North America: Characterized by high-value consumption, particularly in the advanced semiconductor CMP segment and high-performance catalytic applications driven by strict EPA standards. Focus is shifting towards diversifying supply chains away from reliance on APAC, spurring investment in domestic rare earth processing and recycling technologies. Strong governmental push for SOFC and hydrogen technology deployment accelerates high-purity Ceria demand.

- Europe: Exhibits one of the fastest growth rates in terms of value, primarily driven by stringent Euro 7 emission regulations which elevate the Ceria content required in catalytic systems. Strong emphasis on sustainable and circular economy practices, leading to significant investment in rare earth recycling (Urban Mining) and research into advanced Ceria applications for energy storage and fuel cell infrastructure mandated by the European Green Deal.

- Latin America: A growing market, largely driven by the expansion of the automotive sector, requiring standard-grade Ceria for local vehicle production and compliance. Market development is intrinsically linked to economic stability and infrastructural investments in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Primarily a net importer of Ceria, with demand tied to infrastructural projects, localized automotive assembly, and oil and gas sector investments requiring specific chemical catalysts. Regional growth opportunities exist through strategic partnerships focused on establishing local value-added processing capabilities to secure critical materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceria Market.- Alkane Resources Ltd.

- Lynas Rare Earths Ltd.

- Neo Performance Materials Inc.

- Solvay S.A.

- Treibacher Industrie AG

- Shin-Etsu Chemical Co., Ltd.

- Merck KGaA

- Universal Display Corporation

- Rennie & Co. (Rare Earths)

- China Northern Rare Earth (Group) High-Tech Co., Ltd.

- Ganzhou Rare Earth Association

- Inner Mongolia Baotou Steel Rare-Earth Hi-Tech Co., Ltd.

- HEFA Rare Earths

- Sichuan Guangsheng Non-ferrous Metals Co., Ltd.

- Guangdong Rare Earth Industry Group Co., Ltd.

- Jiangxi Copper Co., Ltd.

- Showa Denko K.K.

- Mitsubishi Chemical Corporation

- Nippon Yttrium Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ceria market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the current demand for Ceria?

The primary demand drivers for Ceria are its indispensable role in automotive catalytic converters (due to its high oxygen storage capacity) for pollution control, and its superior performance as a precision polishing agent (CMP slurry) used extensively in the manufacturing of semiconductors and high-definition flat panel displays.

How does the volatility in rare earth supply affect the Ceria market?

Since Cerium is derived from rare earth ores, supply volatility, often linked to geopolitical shifts and concentration of refining capacity, directly impacts Ceria raw material costs and availability. This forces market participants to prioritize supply chain resilience, often leading to price fluctuations in specialty Ceria grades.

What is the significance of High Purity Ceria (HPC) versus Standard Purity Ceria?

HPC, defined as 99.9% purity or higher, commands a significant price premium and is critical for high-tech applications like Solid Oxide Fuel Cells (SOFCs) and semiconductor CMP, where impurities severely degrade performance. Standard Purity Ceria is typically used for traditional bulk glass polishing and less sensitive chemical applications.

How are environmental regulations influencing the future of Ceria consumption?

Environmental regulations are positively driving the Ceria market by mandating stricter emission standards globally, which increases the required volume and complexity of Ceria washcoats in catalytic converters. Simultaneously, regulations on mining waste are pushing the industry toward more sustainable sourcing and recycling methods, increasing operational costs but fostering innovation.

Which geographical region exhibits the fastest growth potential for Ceria?

While the Asia Pacific region currently holds the largest market share, Europe and North America are projected to exhibit the fastest growth in value terms. This acceleration is fueled by aggressive regulatory push toward zero-emission technologies (SOFCs) and significant strategic investments in securing diversified, high-purity rare earth supply chains outside of traditional Asian sources.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- White Ceria Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- White Ceria Market Size Report By Type (Purer), By Application (.), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Chemical Polishing Slurry Market Statistics 2025 Analysis By Application (Silicon Wafers, Optical Substrate, Disk Drive Components), By Type (Alumina Slurry, Colloidal Silica Slurry, Ceria Slurries), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Nano CMP Slurry Market Statistics 2025 Analysis By Application (Wafers, Optical Substrate, Disk Drive Components), By Type (Colloidal Silica Slurries, Ceria Slurries), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Ceria Slurries Market Statistics 2025 Analysis By Application (Wafers, Optical Substrate, Disk Drive Components), By Type (Conventional, High Purity), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager