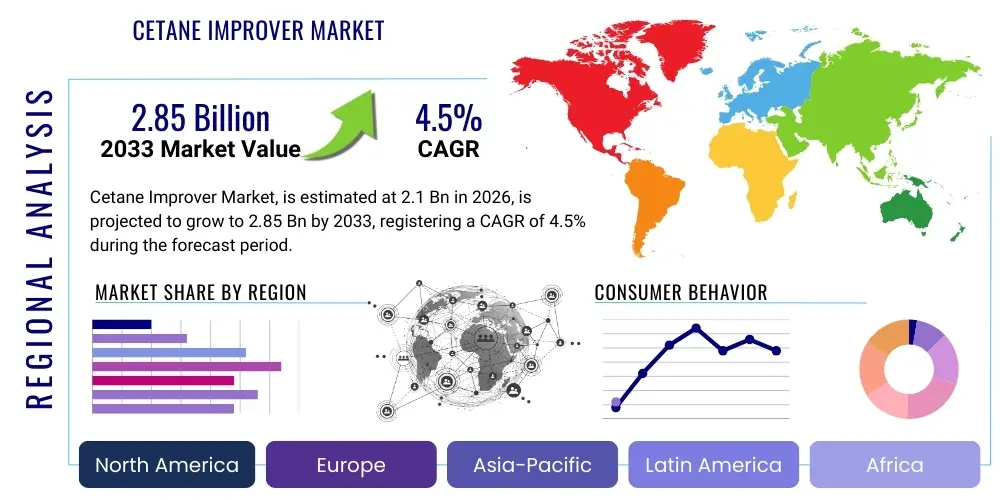

Cetane Improver Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442580 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Cetane Improver Market Size

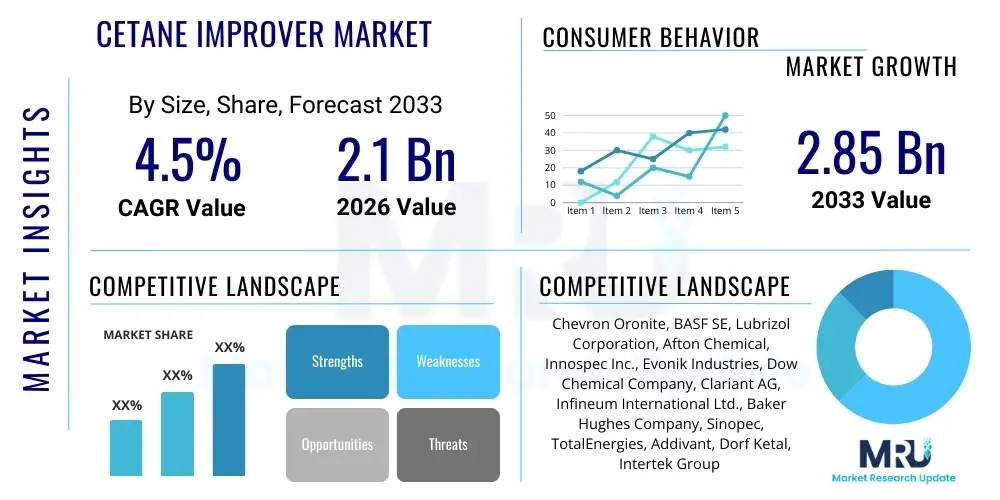

The Cetane Improver Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $2.85 Billion by the end of the forecast period in 2033.

Cetane Improver Market introduction

The Cetane Improver Market encompasses specialized chemical additives utilized primarily in the refining and fuel distribution sectors to enhance the ignition quality of diesel fuel. Cetane number is a critical metric defining the combustion characteristics of diesel, representing the time delay between fuel injection and the start of combustion. Low cetane numbers lead to rougher engine operation, increased noise, higher emissions, and reduced fuel efficiency. Cetane improvers, predominantly nitrate esters like 2-Ethylhexyl Nitrate (2-EHN), function by reducing this ignition delay, ensuring smoother, cleaner, and more complete combustion in modern diesel engines, particularly those operating under stringent regulatory environments.

The primary applications of these improvers span across automotive diesel, marine fuels, power generation units, and off-road machinery. The benefits derived from incorporating optimal cetane levels include better cold start performance, substantial reductions in regulated pollutants such as Nitrogen Oxides (NOx) and Particulate Matter (PM), and improved overall engine durability. Furthermore, the increasing global requirement for ultra-low sulfur diesel (ULSD) necessitates the use of cetane improvers, as the refining processes designed to remove sulfur often inadvertently degrade the natural cetane quality of the base fuel stream. Thus, improvers become essential tools for refiners to meet mandated fuel quality specifications efficiently and economically.

Driving factors for sustained market growth include escalating global diesel demand, especially in the logistics and heavy transportation sectors, coupled with increasingly severe worldwide environmental regulations (e.g., Euro 6/7 standards and equivalent EPA requirements) pushing for lower tailpipe emissions. The trend toward using biodiesel blends (B5, B20, etc.) also supports market expansion, as biodiesel often exhibits lower oxidation stability and may require cetane stabilization to maintain performance parity with conventional fuels. Investment in advanced engine technologies, such as High-Pressure Common Rail (HPCR) systems, which are highly sensitive to fuel quality, further amplifies the need for high-performance cetane enhancing solutions globally.

Cetane Improver Market Executive Summary

The Cetane Improver Market is characterized by robust growth driven by stringent global fuel quality standards and the widespread adoption of advanced diesel engine technologies that demand superior fuel performance. Business trends indicate a strong focus on developing multi-functional additive packages that combine cetane improvement with lubricity, detergency, and cold flow characteristics, catering to the complex needs of modern low-sulfur diesel and biodiesel blends. Strategic partnerships between major chemical manufacturers and global refinery operators are central to securing long-term supply agreements and optimizing logistics. Furthermore, the market is experiencing moderate consolidation, with leading players leveraging backward integration into raw material production and forward integration into advanced formulation services to maintain competitive advantage and pricing power in a market defined by technical expertise and regulatory compliance.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, primarily due to rapid industrialization, burgeoning transportation fleets, and the gradual adoption of higher quality fuel standards in developing economies like China and India, which are transitioning from Euro 4/5 equivalent norms to Euro 6. North America and Europe remain mature but vital markets, characterized by high regulatory pressure and continuous demand for premium, high-cetane fuels necessary for sophisticated automotive fleets. These regions are focused on sustainable solutions, increasing the demand for cetane improvers compatible with bio-derived fuels and demonstrating verifiable emission reduction benefits. Investment in infrastructure upgrades in Latin America and the Middle East & Africa (MEA) is also stimulating demand as these regions modernize their diesel specifications to attract international investment and participate in global supply chains.

Segment trends underscore the dominance of 2-Ethylhexyl Nitrate (2-EHN) as the primary chemical type, owing to its cost-effectiveness, proven efficacy, and ease of handling. However, there is growing research into non-nitrate based chemistries that offer comparable performance with potentially lower toxicity profiles, albeit currently at a higher cost. By end-use, the Automotive segment retains the largest market share due to sheer volume and the immediate impact of fuel quality on consumer satisfaction and regulatory compliance. The Marine segment is exhibiting accelerated growth, driven by the IMO 2020 sulfur cap regulation, which has increased the complexity of marine fuel blending, often requiring cetane stabilization for compliant low-sulfur residual and distillate fuels used in international shipping.

AI Impact Analysis on Cetane Improver Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cetane Improver Market primarily revolve around optimizing blending economics, predicting fuel quality variability, and accelerating the discovery of novel additive chemistries. Users frequently ask how machine learning algorithms can manage the complexity of refinery streams to determine the minimum effective dosage of cetane improvers needed to meet dynamic market specifications, thereby minimizing operating costs. Another key concern is the use of predictive AI models to analyze real-time engine data and refinery operational metrics, allowing for proactive adjustments in additive dosage based on feedstock quality fluctuations and changing environmental conditions. These inquiries underscore a high expectation that AI will transition cetane improvement from a standardized chemical treatment into a precise, data-driven optimization process, enhancing supply chain efficiency and product consistency.

The application of AI and machine learning (ML) is rapidly becoming integral to modern refinery operations and fuel formulation science. AI algorithms can process vast datasets related to crude oil assay data, catalytic cracking unit performance, and specific cetane requirement norms across various global markets. This predictive capability allows fuel blenders to model millions of potential scenarios, identifying the most cost-effective blendstock recipes that simultaneously achieve the target cetane number and meet other critical specifications (e.g., density, viscosity, distillation points). This data-driven approach significantly reduces the over-treatment risk of diesel fuel, optimizing the inventory and consumption of cetane improvers, which are commodity chemicals sensitive to price fluctuations.

Furthermore, AI is being leveraged in the research and development pipeline for next-generation cetane improvers. Computational chemistry and ML models can simulate the interaction of various chemical structures with different fuel matrices, drastically reducing the time and cost associated with traditional laboratory synthesis and engine testing. This capability accelerates the discovery of more environmentally benign, highly potent, and cost-efficient alternatives to existing nitrate-based solutions, particularly those suitable for complex synthetic fuels or emerging biofuel blends. The integration of AI also enables smart monitoring of additive effectiveness in remote applications, providing real-time feedback on combustion quality and allowing for dynamic dosing adjustments to maintain peak engine efficiency under diverse operating loads and environmental conditions.

- AI optimizes blending decisions, reducing chemical usage by 5-15%.

- Machine learning models predict feedstock quality fluctuations, ensuring proactive dosage adjustments.

- Computational chemistry accelerates the discovery of non-nitrate, high-performance improvers.

- Real-time monitoring systems use AI to dynamically adjust additive injection for sustained peak performance.

- AI improves supply chain efficiency by forecasting regional demand based on economic indicators and regulatory cycles.

DRO & Impact Forces Of Cetane Improver Market

The Cetane Improver Market is primarily driven by the intensification of global emission regulations and the subsequent mandatory requirement for higher quality diesel fuels. Regulatory bodies across North America, Europe, and Asia Pacific are continually tightening limits on pollutants like NOx and PM, pushing refiners to achieve higher cetane numbers (typically 51 or above) to ensure complete and clean combustion. A major restraint on the market, however, is the significant volatility in the price of raw materials, such as nitric acid and specific alcohols used in the production of 2-EHN, which impacts the profitability and overall cost of cetane improvers for end-users. Furthermore, the increasing global push towards electrification in the automotive sector, while currently minimal in heavy-duty commercial transport, presents a long-term existential threat that could eventually cap market expansion, particularly in passenger vehicles.

Significant opportunities exist in the penetration of underdeveloped or transitioning economies, where infrastructure modernization and new regulatory mandates are creating immense demand for fuel standardization. Markets in Southeast Asia, Africa, and parts of Latin America are upgrading their fuel specifications from older, lower-quality standards to globally accepted equivalents, thereby opening substantial new sales channels for cetane improver manufacturers. Another robust opportunity lies in the biofuel sector; as blending mandates increase globally, the inherent stability and cetane challenges of bio-components (like FAME) necessitate increased usage of specialized improvers and stabilizing additives to ensure long-term performance and compliance with engine warranties.

The impact forces within this market are predominantly regulatory and technological. Regulatory forces dictate the minimum quality requirements for diesel fuels, directly translating into volume demand for improvers. Technological impact forces include the continuous advancement of diesel engine design (e.g., use of Exhaust Gas Recirculation (EGR), Selective Catalytic Reduction (SCR)), which increases engine sensitivity to fuel quality and necessitates fuels with precise combustion characteristics. Economic impact forces, centered on the fluctuating price of crude oil and refinery margins, influence a refiner's willingness to invest in cetane improvement versus other upgrading processes. Overall, the powerful global momentum toward cleaner air and reduced carbon emissions remains the paramount force sustaining and expanding the consumption of cetane improvers, positioning them as non-negotiable chemical tools for compliance.

Segmentation Analysis

The Cetane Improver Market is comprehensively segmented based on the chemical type, which dictates the performance characteristics and cost structure, and by the end-use application, reflecting diverse operational demands across various sectors. The chemical type segmentation primarily distinguishes between nitrate-based compounds, which dominate due to their efficacy and affordability, and non-nitrate alternatives. The end-use analysis provides crucial insights into the consumption patterns, differentiating between the high-volume automotive sector, the performance-critical marine sector, and the specialized demand from industrial and power generation units. Understanding these segments is vital for manufacturers to tailor product development, compliance documentation, and targeted regional distribution strategies.

Within the chemical type segmentation, 2-Ethylhexyl Nitrate (2-EHN) stands out as the incumbent market leader, characterized by its reliable performance and established manufacturing processes. Its high effectiveness at low treatment rates makes it the preferred choice for standard diesel quality upgrades. However, environmental and health concerns associated with nitrate derivatives are fueling research into non-nitrate chemistries, such as certain peroxides or proprietary formulations, offering opportunities for premium pricing and market differentiation, especially in environmentally conscious regions like Western Europe. The market structure thus reflects a large volume base supplied by 2-EHN and a smaller, high-growth niche driven by advanced, high-specification chemistries that may also offer multi-functional benefits beyond cetane boosting.

By end-use, the dominance of the Automotive segment (covering commercial vehicles, heavy-duty trucks, and passenger cars) stems from the sheer volume of diesel consumed globally and the direct link between cetane number and engine performance metrics relevant to consumers and fleet operators. Meanwhile, the Power Generation segment, while smaller in volume, demands extremely consistent fuel quality for uninterrupted operation, particularly for standby or peak-shaving generators. The Marine industry segment is experiencing a transformative phase, necessitated by the shift to Very Low Sulfur Fuel Oil (VLSFO) and other low-sulfur blends. These new marine fuel oil (MFO) compositions often require significant cetane uplift to ensure stable ignition and efficient operation in large, medium-speed marine diesel engines, making the marine segment a crucial growth vector for specialized, high-dosage improvers.

- By Type:

- 2-Ethylhexyl Nitrate (2-EHN)

- Non-Nitrate based

- Others (Peroxides, Specialty Esters)

- By Application/End-Use:

- Automotive (On-road Transportation)

- Marine

- Power Generation & Industrial

- Oil & Gas (Mining, Off-road Equipment)

- Agriculture

Value Chain Analysis For Cetane Improver Market

The value chain for the Cetane Improver Market begins with the upstream sourcing and manufacturing of key raw materials, primarily nitric acid, and specific high-purity alcohols (such as 2-ethylhexanol) required for synthesizing 2-EHN. Manufacturers in this segment, often large petrochemical or specialized chemical companies, invest heavily in process optimization and safety protocols due to the handling of hazardous materials. Backward integration, where cetane improver producers secure their own supply of key chemical precursors, is a common strategy employed by market leaders to stabilize production costs and ensure continuity of supply, mitigating risks associated with commodity price volatility and supply chain disruptions.

The midstream component involves the synthesis, formulation, and quality control of the final cetane improver product. This stage is crucial as it involves blending the active ingredient with suitable solvents and stabilizers to create concentrated, safe-to-handle commercial formulations. Distribution channels are highly specialized, relying heavily on third-party logistics (3PL) providers capable of transporting bulk liquid chemicals, often requiring specialized chemical storage and handling equipment. Direct distribution is common for large-volume customers like major international refineries and national oil companies (NOCs), ensuring direct technical support and customized supply schedules, while indirect channels leverage regional distributors and agents to serve smaller blending facilities, fuel terminals, and wholesale distributors in geographically dispersed markets.

The downstream stage centers on the product application, primarily at refineries, bulk fuel terminals, and sometimes directly at large fleet operations. End-users receive technical guidance from the improver manufacturers regarding optimal dosage rates, testing procedures, and compliance documentation. The ultimate end-users—automotive fleets, shipping companies, and power plants—drive the demand through their need for fuel that meets regulatory and performance requirements. The integrity of the supply chain is heavily audited by regulatory bodies, ensuring that the additive products are compliant with global chemical registration standards and local environmental requirements before being introduced into the final fuel matrix.

Cetane Improver Market Potential Customers

The primary consumers and end-users of cetane improvers are global and national oil companies (NOCs) that own and operate crude oil refineries and large blending facilities. These entities are mandated to produce diesel fuel meeting strict governmental quality standards, making cetane improvers an essential chemical input for ensuring product marketability and legal compliance. Refineries typically procure improvers in bulk volumes and integrate the dosing process directly into their finished product streams or blending pools to consistently meet varying regional specifications for cetane number (e.g., 45, 48, 51, or 55 minimums).

A secondary, rapidly growing customer base includes independent fuel terminal operators and bulk distributors. These entities often purchase already-refined base fuels but may need to "spike" the fuel with cetane improvers to meet specific market demands, such as premium diesel grades or specialized fuel required by high-performance fleets. This flexibility allows distributors to tailor standardized fuels to niche markets, capturing value through differentiated product offerings. Furthermore, dedicated blenders focused on marine fuels or specialty applications, particularly following the IMO 2020 low-sulfur mandate, represent significant potential customers seeking high-concentration, specialized cetane solutions to manage the complexity of VLSFO blends.

The third major customer segment consists of large industrial consumers and fleet operators, including multinational mining companies, railway operators, and major logistics firms (trucking and shipping). While often served indirectly through fuel distributors, some large operators, especially those using non-conventional fuel sources or proprietary engine systems, may install their own injection systems to control fuel quality precisely. These customers prioritize operational reliability, reduced maintenance, and verifiable emissions reductions, viewing cetane improvers as a critical component of their fuel management strategy to maximize asset longevity and comply with local operational emissions rules.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $2.85 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chevron Oronite, BASF SE, Lubrizol Corporation, Afton Chemical, Innospec Inc., Evonik Industries, Dow Chemical Company, Clariant AG, Infineum International Ltd., Baker Hughes Company, Sinopec, TotalEnergies, Addivant, Dorf Ketal, Intertek Group plc, Croda International Plc, Valtris Specialty Chemicals, NALCO Water (Ecolab), Hengyi Petrochemical Co. Ltd., Shaoxing Shangyu Jiefu Chemical Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cetane Improver Market Key Technology Landscape

The technological landscape of the Cetane Improver Market is defined by continuous innovation aimed at optimizing the chemical composition for high efficacy, stability, and compatibility with modern fuel standards, particularly Ultra-Low Sulfur Diesel (ULSD) and high-ratio biodiesel blends (B20+). The dominant technology remains the synthesis of alkyl nitrates, primarily 2-Ethylhexyl Nitrate (2-EHN), which functions by rapidly decomposing under compression ignition conditions to release free radicals that initiate combustion, effectively shortening the ignition delay period. Advancements in this area focus on manufacturing processes that minimize impurities and enhance the thermal and storage stability of the improver concentrate, ensuring effectiveness even after long-duration storage in various climate conditions.

A crucial technological trend involves the development of multi-functional additive platforms. Instead of standalone cetane improvers, refiners increasingly demand integrated additive packages that simultaneously address multiple fuel quality challenges inherent in modern fuels, such as poor lubricity, injector fouling, foam formation, and cold flow issues. These advanced additive packages require sophisticated formulation technology that ensures chemical compatibility between the cetane booster component and other performance additives (e.g., detergents, lubricity enhancers, demulsifiers) without compromising the effectiveness of any single component. Manufacturers utilize complex solvent systems and stabilizing agents to create homogeneous, highly potent blendstocks capable of delivering comprehensive fuel performance enhancements.

Furthermore, technology is rapidly evolving in the non-nitrate space, driven by the desire for less hazardous or more sustainable alternatives. Research is exploring oxygenated compounds, certain specialized peroxides, and novel organometallic complexes as potential cetane boosters. While these alternatives currently face hurdles regarding cost-effectiveness and treat rate efficacy compared to 2-EHN, they represent the future direction of the market, particularly if regulatory pressure on nitrate-based chemicals increases. The application technology also utilizes advanced inline injection systems, often integrated with AI and sensor technology, allowing for real-time monitoring of base fuel quality and precise, variable-rate dosing directly proportional to the required cetane uplift, ensuring optimal chemical consumption and quality assurance throughout the fuel distribution network.

Regional Highlights

- Asia Pacific (APAC): This region is poised for the highest growth due to rapid infrastructure development, surging heavy-duty vehicle sales, and the phased adoption of stringent emission standards (e.g., China’s National VI and India’s Bharat Stage VI norms). The need to upgrade low-quality indigenous fuels to meet these new standards makes cetane improvers essential for refinery operations across the region. China and India are the primary volume drivers.

- Europe: A mature market characterized by extremely high fuel quality mandates (e.g., minimum Cetane Number 51) and a strong regulatory emphasis on renewable fuel integration. Europe drives demand for highly specialized, stable cetane improvers compatible with high-percentage biodiesel blends (B7, B10, and higher), focusing on performance and long-term storage stability.

- North America: Demand is stable and driven by fleet performance and severe temperature operation. The high uptake of diesel in the trucking, rail, and construction sectors necessitates consistent high-quality fuel. While ULSD requirements are well-established, the market focuses on premium diesel grades and additives that offer superior cold start capabilities and injector cleanliness alongside cetane improvement.

- Middle East & Africa (MEA): Emerging market undergoing significant modernization of its refining capacity and internal fuel specifications. Countries in the Gulf Cooperation Council (GCC) are upgrading quality standards to align with European and Asian benchmarks to enhance their domestic vehicle fleets and attract international trade, leading to substantial new demand, particularly in Saudi Arabia and the UAE.

- Latin America: Growth is steady, fuelled by economic recovery and increased industrial and mining activity, particularly in Brazil, Mexico, and Argentina. Regulatory implementation, while sometimes delayed, is trending towards higher quality standards, pushing refiners to adopt cetane improvers to meet mandated local fuel specifications and improve engine efficiency in demanding operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cetane Improver Market.- Chevron Oronite

- BASF SE

- Lubrizol Corporation

- Afton Chemical

- Innospec Inc.

- Evonik Industries

- Dow Chemical Company

- Clariant AG

- Infineum International Ltd.

- Baker Hughes Company

- Sinopec

- TotalEnergies

- Addivant

- Dorf Ketal

- Intertek Group plc

- Croda International Plc

- Valtris Specialty Chemicals

- NALCO Water (Ecolab)

- Hengyi Petrochemical Co. Ltd.

- Shaoxing Shangyu Jiefu Chemical Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Cetane Improver market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary chemical used in most commercial cetane improvers?

The predominant chemical used globally is 2-Ethylhexyl Nitrate (2-EHN). It is highly favored for its cost-effectiveness, high potency, and proven ability to reliably increase the cetane number of diesel fuel by initiating combustion more effectively.

How do stringent emission regulations affect the demand for cetane improvers?

Stringent emission regulations, such as Euro 6/7 and EPA standards, require cleaner combustion to minimize pollutants like NOx and PM. Higher cetane numbers facilitate quicker, more complete combustion, making cetane improvers crucial for refiners to comply with increasingly strict environmental mandates.

Is the Cetane Improver market being impacted by the rise of electric vehicles?

While the long-term threat of vehicle electrification exists, its immediate impact is primarily limited to the passenger vehicle segment. The heavy-duty commercial, marine, and power generation sectors, which are the largest consumers of diesel and cetane improvers, are projected to rely on advanced diesel technologies and fuels for the foreseeable future, ensuring sustained market demand.

Why is 2-EHN necessary for Ultra-Low Sulfur Diesel (ULSD)?

ULSD production often involves hydrotreating processes that remove sulfur but also strip the diesel fuel of its natural cetane components. Refiners must therefore use 2-EHN to restore the cetane number to mandated levels, ensuring the ULSD meets minimum ignition quality standards required by modern, sensitive diesel engines.

Which geographical region is expected to show the fastest market growth?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is forecast to exhibit the fastest growth. This is driven by large-scale infrastructure projects, rapid expansion of transportation fleets, and the ongoing implementation of cleaner, higher-quality national fuel standards.

What is the difference between direct and indirect distribution in this market?

Direct distribution involves manufacturers selling bulk product and providing technical support directly to large refineries and national oil companies (NOCs). Indirect distribution utilizes regional distributors and chemical agents to service smaller fuel terminals, independent blenders, and commercial fleet customers in diverse geographical locations, optimizing localized inventory management.

How is the volatility of crude oil prices linked to the cetane improver market?

Volatile crude prices affect refining margins. When margins are tight, refiners seek the most cost-effective methods to upgrade their fuel streams. Cetane improvers are often the most economical tool for meeting quality specifications compared to investing in expensive refinery unit upgrades, stabilizing demand but exposing manufacturers to raw material price fluctuations.

What are the key technical challenges facing new cetane improver development?

The main challenges include achieving high efficacy at low treat rates comparable to 2-EHN, ensuring chemical stability and compatibility with diverse modern fuel components (especially biofuels), and meeting stringent environmental standards regarding toxicity and handling without significantly increasing the final cost of the additive.

What role does the Marine industry play in cetane improver demand following IMO 2020?

The IMO 2020 sulfur cap increased demand because the resulting Very Low Sulfur Fuel Oil (VLSFO) blends often have poor inherent quality. Cetane improvers are crucial for these new marine fuels to ensure stable ignition and prevent operational issues in large marine diesel engines, accelerating growth in the marine segment.

Can cetane improvers be used to mitigate issues associated with high biodiesel blends?

Yes, biodiesel (FAME) often suffers from lower oxidation stability and sometimes lower cetane numbers than conventional diesel. Cetane improvers are frequently used in biodiesel blends (B20 and above) to maintain optimal ignition quality, ensure engine performance, and comply with fuel specification requirements.

What are non-nitrate based cetane improvers and why are they being researched?

Non-nitrate based improvers are alternative chemistries, such as certain peroxides or proprietary oxygenated compounds, developed to potentially offer equivalent performance without the handling and regulatory complexities associated with nitrate compounds like 2-EHN. Research focuses on sustainability and reduced toxicity profiles.

What is the significance of the Base Year 2025 in the market report?

2025 serves as the latest reliable point of data collection and market analysis before the start of the defined forecast period (2026-2033). It provides the reference point for assessing current market dynamics, technological adoption, and the baseline value for calculating future growth projections.

How do High-Pressure Common Rail (HPCR) systems influence additive demand?

HPCR systems operate at extremely high pressures and tight tolerances, making them highly sensitive to fuel quality. Low cetane fuel can cause combustion shock and damage. This increased sensitivity mandates the use of reliable cetane improvers to protect engine components and ensure optimal performance and longevity.

Are Cetane Improvers considered multi-functional or typically standalone additives?

While the active chemical (e.g., 2-EHN) is standalone, market trends favor multi-functional packages. Manufacturers increasingly blend cetane improvers with detergents, anti-wear agents, and corrosion inhibitors into a single, comprehensive additive solution to address multiple fuel quality issues efficiently.

What is the primary constraint related to the production of 2-Ethylhexyl Nitrate?

The primary constraint is the fluctuating cost and reliable sourcing of precursor chemicals, specifically 2-ethylhexanol and nitric acid. Their procurement is subject to the volatility of the global petrochemical and industrial chemical commodity markets, directly affecting the final product cost.

How does AI contribute to refinery profitability in terms of cetane improvisation?

AI utilizes complex data analytics to model the minimum effective dosage of cetane improvers required for specific blendstocks to meet regulatory minimums. This optimization prevents costly over-treatment, directly enhancing refinery efficiency and minimizing the variable operating expenditure related to additive consumption.

Which end-use segment holds the largest share in the Cetane Improver Market?

The Automotive (On-road Transportation) segment holds the largest market share. This is attributed to the vast volume of diesel consumed globally by commercial vehicles, passenger cars, and heavy-duty trucks, all of which require consistent, high-quality fuel to meet performance and emissions standards.

What is 'upstream analysis' in the context of the cetane improver value chain?

Upstream analysis focuses on the initial stages of the value chain, specifically the sourcing, synthesis, and procurement of basic raw materials like nitric acid and 2-ethylhexanol. It evaluates supply security, price stability, and manufacturing processes of the key chemical precursors.

Why are agricultural and mining sectors important potential customers?

These sectors rely heavily on high-performance, off-road diesel equipment operating in demanding conditions. Consistent fuel quality, ensured by cetane improvers, is critical for minimizing engine downtime, improving cold start capabilities, and ensuring compliance with non-road mobile machinery (NRMM) emission standards.

What is the projected Compound Annual Growth Rate (CAGR) for the market?

The Cetane Improver Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period from 2026 to 2033, driven by continuous global fuel quality mandates and fleet modernization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager